trans-o-flex Schnell-Lieferdienst GmbH & Co. KG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

trans-o-flex Schnell-Lieferdienst GmbH & Co. KG Bundle

The trans-o-flex Schnell-Lieferdienst GmbH & Co. KG operates in a dynamic logistics landscape, where intense rivalry and evolving customer demands shape its competitive environment. Understanding the interplay of supplier power, buyer bargaining, and the threat of substitutes is crucial for strategic advantage.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore trans-o-flex Schnell-Lieferdienst GmbH & Co. KG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of specialized equipment like actively temperature-controlled vehicles and advanced monitoring systems wield significant bargaining power over trans-o-flex. This is due to the critical need for GDP compliance and precise temperature control in handling pharmaceuticals and other sensitive goods, which often requires proprietary technologies.

The premium for temperature-controlled shipping, which can range from 15% to 30% higher than dry freight, underscores the value and specialized nature of these assets, further strengthening supplier leverage.

Fuel suppliers generally hold low to moderate bargaining power because fuel is a commodity with many providers. However, events like geopolitical tensions or disruptions in global supply chains can cause significant price swings, directly affecting the operating expenses of logistics companies like trans-o-flex.

While a single fuel provider might not dictate global prices, the substantial volume of fuel consumed by a large logistics operation means that even small price changes can have a notable impact on profitability. For instance, the average price of diesel fuel in Germany, a key market for trans-o-flex, saw fluctuations throughout 2024, with prices ranging from approximately €1.70 to €1.90 per liter, highlighting the sensitivity of operating costs to these external factors.

The ongoing shortage of qualified drivers and logistics specialists significantly bolsters the bargaining power of skilled labor within the transport and logistics sector. This scarcity directly translates into upward pressure on wages and increased personnel costs, critical considerations for companies like trans-o-flex Schnell-Lieferdienst GmbH & Co. KG.

In 2024, the German transport and logistics industry continued to grapple with a substantial deficit of professional drivers. Reports from early 2024 indicated a shortfall of over 60,000 qualified drivers, a figure that has persisted and even worsened in certain regions. This situation necessitates competitive compensation packages and robust training programs to attract and retain the essential talent required for specialized delivery services.

IT and Software Providers

The bargaining power of IT and software providers for trans-o-flex is significant and growing. As the pharmaceutical logistics sector increasingly demands advanced digital solutions for real-time tracking, AI-powered analytics, and robust supply chain management, reliance on specialized software intensifies. This reliance grants these providers leverage, especially as the market for such sophisticated technology, crucial for operational efficiency and regulatory adherence, consolidates around a few key players.

The increasing digitalization within the pharmaceutical supply chain means that companies like trans-o-flex are heavily dependent on IT and software vendors for essential functionalities. This dependence can translate into higher costs and stricter terms for trans-o-flex if these providers are few and possess unique, indispensable technologies. For instance, the global supply chain management software market was projected to reach over $30 billion in 2024, indicating substantial investment and reliance on these solutions.

- Growing reliance on advanced IT: Real-time tracking and AI analytics are becoming non-negotiable for pharmaceutical logistics, increasing dependence on specialized software providers.

- Market concentration: A limited number of dominant vendors in specialized logistics technology can lead to increased bargaining power for these suppliers.

- Criticality for compliance: Sophisticated IT systems are vital for meeting stringent regulatory requirements in the pharmaceutical sector, further empowering IT providers.

Packaging Solution Providers

Suppliers of specialized packaging, especially for temperature-sensitive shipments, wield moderate bargaining power over trans-o-flex. The critical need to maintain precise temperature ranges for active and passive temperature control means that the quality and reliability of packaging directly impact the integrity of goods. For instance, in 2024, the global cold chain packaging market was valued at approximately USD 15.7 billion, with a projected compound annual growth rate (CAGR) of 7.2% through 2030, indicating a significant demand for these specialized solutions.

The increasing focus on innovation and sustainability within the logistics sector further influences this dynamic. Suppliers offering advanced features like real-time temperature monitoring or eco-friendly materials can command greater leverage. As of early 2025, there's a growing trend towards biodegradable and recyclable packaging materials, with many companies actively seeking to reduce their environmental footprint in their supply chains.

- Specialized Packaging Needs: Suppliers providing solutions for active and passive temperature control have moderate influence due to the critical nature of maintaining specific temperature ranges for sensitive cargo.

- Market Value: The global cold chain packaging market reached roughly USD 15.7 billion in 2024, underscoring the importance and demand for these specialized services.

- Innovation and Sustainability: Suppliers offering cutting-edge smart packaging or environmentally friendly options are gaining leverage, aligning with industry trends towards advanced and sustainable logistics.

The bargaining power of suppliers to trans-o-flex is a mixed bag, with specialization and market concentration being key drivers of supplier leverage. While commodity suppliers like fuel providers have less sway, those offering critical, specialized technologies and skilled labor can exert significant influence.

trans-o-flex's reliance on specialized temperature-controlled vehicles and advanced monitoring systems, essential for pharmaceutical logistics, grants significant power to their providers. Similarly, the scarcity of qualified drivers in 2024, with a reported shortfall exceeding 60,000 in Germany, means labor costs are likely to remain elevated, empowering skilled logistics personnel.

IT and software providers also hold considerable power, as sophisticated digital solutions are vital for tracking, analytics, and regulatory compliance in pharmaceutical transport. The global supply chain management software market's projected value of over $30 billion in 2024 highlights the critical nature of these services.

| Supplier Category | Bargaining Power Level | Key Drivers | 2024 Data/Context |

|---|---|---|---|

| Specialized Vehicle & Monitoring Tech | High | Proprietary technology, critical need for GDP compliance | Premium for temp-controlled shipping: 15-30% higher |

| Fuel | Low to Moderate | Commodity nature, many providers | German diesel price range: €1.70-€1.90/liter |

| Skilled Labor (Drivers) | High | Shortage of qualified professionals | Germany driver shortfall: >60,000 in early 2024 |

| IT & Software | High | Increasing digitalization, critical for compliance | Global SCM software market: projected >$30 billion in 2024 |

| Specialized Packaging | Moderate | Critical for temperature integrity, innovation | Global cold chain packaging market: ~$15.7 billion in 2024 |

What is included in the product

This analysis dissects the competitive forces impacting trans-o-flex Schnell-Lieferdienst GmbH & Co. KG, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the parcel and express delivery market.

Gain a strategic edge by quickly identifying and mitigating competitive threats within the parcel delivery market, simplifying complex industry dynamics for informed decision-making.

Customers Bargaining Power

Customers of trans-o-flex, especially those in the pharmaceutical and high-tech sectors, experience substantial switching costs. These costs stem from the specialized services required, the absolute necessity for Good Distribution Practice (GDP) compliance, and the deep integration of logistics into their vital supply chains. For instance, a pharmaceutical company's investment in a logistics partner that meets GDP standards, which includes rigorous temperature control and documentation, represents a significant sunk cost. Transitioning to a new provider would necessitate extensive re-auditing, complex system integrations, and a lengthy process to ensure new compliance with these demanding regulatory standards.

The effort involved in setting up new logistics partnerships, including thorough audits, system integration, and ensuring adherence to strict regulatory requirements like GDP for pharmaceuticals, significantly deters frequent provider changes. This robust integration and compliance framework effectively reduces the bargaining power of customers, as the cost and complexity of switching providers are prohibitively high.

The services trans-o-flex offers are absolutely vital for its clients. Think about it: they're moving pharmaceuticals, which are often high-value, need strict temperature control, and can even be life-saving medications.

When you're dealing with products like these, any hiccup in the delivery process, especially if the cold chain is broken, can be disastrous. This means huge financial losses from spoiled goods and serious damage to a company's reputation.

Because reliability and making sure everything is done by the book are so important, customers can't really push too hard on price. The need for a dependable service outweighs the desire for a lower cost.

Industry consolidation among trans-o-flex's customers, particularly in the pharmaceutical sector, is a notable factor influencing bargaining power. As mergers and acquisitions continue, larger, more integrated entities emerge. For instance, the pharmaceutical industry saw significant M&A activity in 2023 and early 2024, with major deals reshaping the competitive landscape. These consolidated giants often command greater shipping volumes, giving them substantial leverage to negotiate pricing and service terms with logistics providers like trans-o-flex.

Demand for Specialized and Tailored Solutions

Customers, particularly in sectors like pharmaceuticals and high-tech, are increasingly seeking logistics services that are precisely tailored to their unique needs. This includes stringent requirements for temperature control, guaranteed delivery times, and advanced tracking capabilities.

This growing demand for specialized, customized solutions gives customers significant bargaining power. They can effectively leverage their requirements to push logistics providers like trans-o-flex to invest in specific technologies and adapt their service models, effectively dictating terms.

The market for customized logistics is on an upward trajectory, with projections indicating substantial growth. For instance, the global cold chain logistics market, a key area for specialized pharmaceutical transport, was valued at approximately $17.5 billion in 2023 and is expected to expand significantly, further empowering customers who require these niche services.

- Demand for temperature-controlled shipments: Critical for pharmaceuticals and certain food products, requiring specialized fleets and monitoring.

- Need for time-critical deliveries: Essential for just-in-time manufacturing and urgent medical supplies, demanding reliable scheduling.

- Requirement for enhanced visibility and traceability: Customers want real-time tracking and detailed data on their shipments for compliance and inventory management.

Regulatory Compliance Requirements

Strict regulatory compliance, particularly within the pharmaceutical sector, significantly amplifies customer bargaining power. For instance, Good Distribution Practice (GDP) mandates rigorous standards for temperature control, tracking, and security in logistics. This means customers, especially those in healthcare, can demand and expect unwavering adherence to these protocols from providers like trans-o-flex. Failure to meet these stringent requirements can expose customers to substantial risks, including product spoilage and regulatory penalties, thus granting them considerable leverage to enforce compliance.

This heightened demand for compliance translates into a powerful negotiating position for customers. They can dictate terms and expect premium service levels, knowing that any lapse by trans-o-flex could have severe consequences for their own operations. The need for trans-o-flex to maintain its GDP certification, which is a critical selling point, means they must invest heavily to meet these customer expectations, effectively ceding some control over service standards and pricing to the buyer.

Consider the implications for a pharmaceutical company. If a logistics partner fails to maintain the cold chain for a temperature-sensitive drug, the financial and reputational damage can be immense. This risk incentivizes customers to scrutinize their logistics providers closely and to exert pressure for the highest standards. In 2024, the global pharmaceutical logistics market saw continued growth, with an increasing emphasis on specialized, compliant services, underscoring the importance of regulatory adherence in customer negotiations.

The bargaining power of customers is thus directly influenced by the regulatory landscape:

- Regulatory Mandates: Requirements like GDP empower customers by making compliance a non-negotiable aspect of service.

- Risk Aversion: Customers face significant penalties and reputational damage for non-compliance, increasing their leverage.

- Quality Expectations: Customers demand high levels of quality assurance, driving up service standards and provider costs.

- Supplier Dependence: Customers rely on logistics providers to uphold their own compliance, making them sensitive to service failures.

Customers, especially in the pharmaceutical sector, wield significant bargaining power due to high switching costs and the critical nature of logistics for their products. The need for specialized services like GDP compliance, coupled with the complexity of integrating new providers, makes it difficult and expensive for clients to change logistics partners. This reliance means customers can exert considerable influence over pricing and service terms.

The increasing demand for tailored logistics solutions, such as precise temperature control and enhanced traceability, further strengthens customer leverage. As the global cold chain logistics market, valued at approximately $17.5 billion in 2023, continues to grow, customers requiring these niche services are empowered to dictate terms to providers like trans-o-flex.

Same Document Delivered

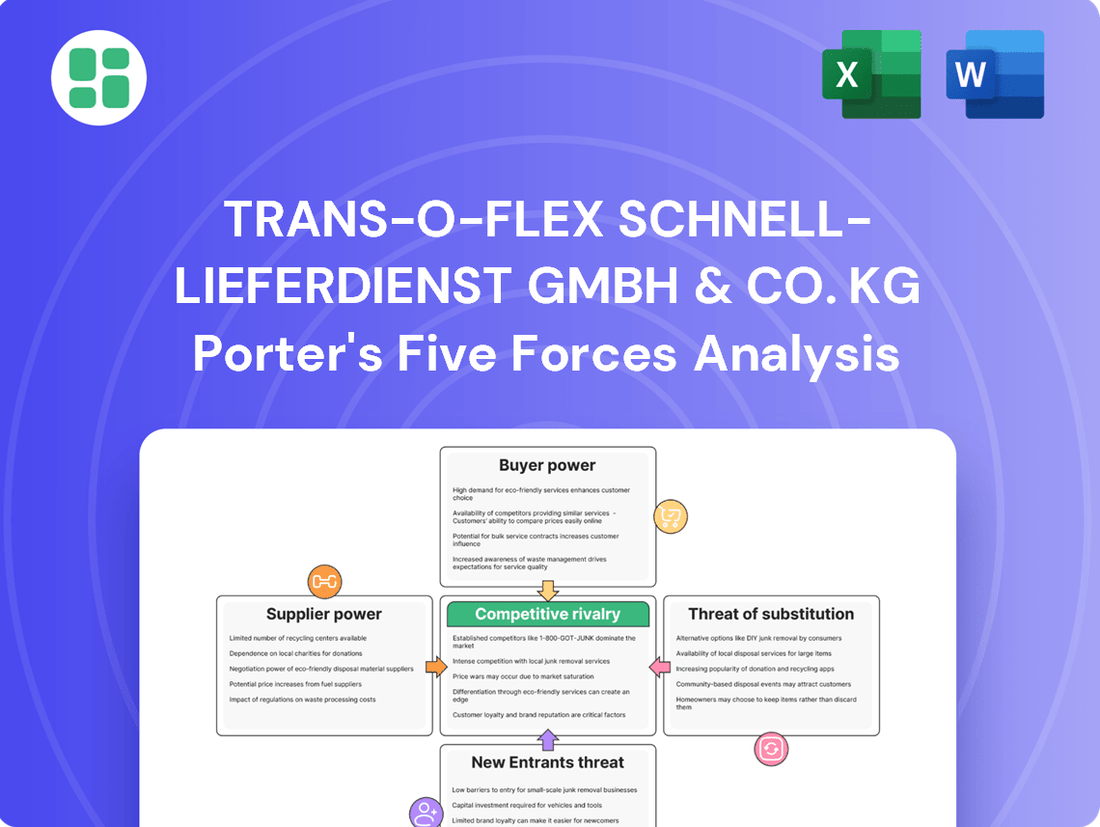

trans-o-flex Schnell-Lieferdienst GmbH & Co. KG Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors. The document you see here is exactly what you’ll be able to download after payment, offering a complete and ready-to-use strategic overview.

Rivalry Among Competitors

The cold chain logistics market in Germany and Europe presents a dynamic competitive landscape, featuring a wide array of participants from global behemoths to specialized niche operators. This fragmentation fuels intense rivalry as companies battle for dominance.

Despite the large number of players, a notable trend towards consolidation is evident, driven by mergers and acquisitions. For instance, the German cold chain logistics market was valued at USD 12.9 billion in 2024 and is anticipated to grow to USD 26.8 billion by 2033, indicating a fertile ground for strategic combinations.

The specialized nature of temperature-controlled logistics, demanding substantial investment in refrigerated infrastructure and compliant fleets, creates significant exit barriers for trans-o-flex. Companies in this sector must also navigate stringent regulatory landscapes, such as Good Distribution Practice (GDP) guidelines, making it costly and complex to divest assets or cease operations.

These high exit barriers mean that established players are compelled to remain active in the market, even during periods of lower profitability. This persistence intensifies competition as firms strive to maximize the utilization of their specialized, high-cost assets and extensive networks, leading to a more aggressive competitive environment.

Competitive rivalry for trans-o-flex is softened by its deep specialization in handling sensitive goods, especially pharmaceuticals, and its commitment to rigorous standards like Good Distribution Practice (GDP). This focused approach enables differentiation beyond mere cost, as a limited number of competitors can match its compliance and specialized knowledge. In 2024, the pharmaceutical logistics market continued to see demand for specialized temperature-controlled solutions, a segment where trans-o-flex excels.

This specialization creates a barrier to entry, as replicating the necessary infrastructure and regulatory adherence is costly and time-consuming. Consequently, trans-o-flex can command premium pricing and foster customer loyalty. For instance, the global cold chain logistics market, crucial for pharmaceuticals, was projected to reach over $600 billion by 2024, highlighting the value of specialized players.

Technological Advancements and Digitalization

The logistics sector is intensely competitive, with technological advancements like the Internet of Things (IoT) for real-time tracking and artificial intelligence (AI) for optimizing delivery routes becoming crucial differentiators. Companies are pouring significant capital into these innovations to boost operational efficiency and customer service. For instance, in 2024, many logistics providers reported substantial increases in their IT budgets, with some allocating over 15% of their operational expenditure to digital transformation initiatives. Failing to keep pace with these technological upgrades poses a serious risk, as it directly impacts a firm's ability to offer competitive pricing and reliable service.

This drive for digitalization creates a constant need for investment, as the benefits of technologies like AI-powered route optimization can lead to fuel savings of up to 10% and delivery time reductions of 5-15%. Blockchain technology is also gaining traction for its potential to enhance supply chain transparency and security, a feature increasingly demanded by clients. Those firms that embrace and effectively implement these advanced solutions are better positioned to attract and retain customers, thereby intensifying the pressure on competitors to do the same.

- IoT adoption for real-time monitoring is a key battleground.

- AI is crucial for optimizing delivery routes and improving efficiency.

- Blockchain enhances supply chain transparency and security.

- Companies failing to innovate risk falling behind in this competitive landscape.

Pricing Pressure and Cost Management

Despite trans-o-flex's specialization in pharmaceutical logistics, it still encounters pricing pressure from larger, more diversified logistics companies. These competitors can leverage economies of scale to offer lower prices on less specialized services, forcing trans-o-flex to carefully manage its own pricing strategies to remain competitive.

The logistics sector in 2024 continues to grapple with escalating operational costs. Labor expenses, fuel surcharges, and investment in fleet modernization are significant factors impacting profitability. For instance, the average hourly wage for truck drivers in Germany saw an increase in 2023, impacting overall operational expenditure.

- Rising Labor Costs: German logistics sector wages have been on an upward trend, impacting overheads.

- Fuel Price Volatility: Fluctuations in diesel prices directly affect transportation costs for companies like trans-o-flex.

- Investment in Technology: Upgrading fleets and implementing advanced tracking systems require substantial capital outlay.

- Competitive Pricing: The need to match or beat competitor pricing while covering increased costs creates a delicate balancing act.

Competitive rivalry for trans-o-flex is intense, driven by a fragmented market with numerous players, including large, diversified companies and specialized niche operators. While consolidation is occurring, the specialized nature of cold chain logistics, particularly for pharmaceuticals, creates high barriers to entry and exit, forcing established firms to remain competitive. Technological advancements like IoT and AI are crucial differentiators, demanding continuous investment to maintain efficiency and service levels.

| Metric | 2024 Value (USD) | Projected Growth Factor | Key Driver |

|---|---|---|---|

| German Cold Chain Logistics Market Value | 12.9 billion | 2.08x by 2033 | Increasing demand for temperature-controlled transport |

| Global Cold Chain Logistics Market Value | Over 600 billion | N/A | Pharmaceutical and food industry growth |

| AI Route Optimization Savings | Up to 10% fuel savings | N/A | Efficiency gains and cost reduction |

SSubstitutes Threaten

Large pharmaceutical and high-tech manufacturers, particularly those with substantial shipping volumes, may explore building or enhancing their internal logistics operations. This could involve significant upfront investment in specialized infrastructure and expertise, especially for temperature-sensitive goods requiring adherence to Good Distribution Practice (GDP) standards. For instance, in 2024, the global pharmaceutical logistics market was valued at approximately $270 billion, with a notable portion handled by in-house operations of major players.

Developing in-house capabilities offers greater control over the supply chain and potentially cost savings for very large shippers. However, the substantial capital expenditure, ongoing operational costs, and the intricate regulatory landscape surrounding pharmaceutical transport often make outsourcing to specialized providers like trans-o-flex a more pragmatic and cost-effective solution for many.

For less specialized logistics needs, such as general express services for cosmetics or high-tech items that don't require temperature control, trans-o-flex faces a significant threat from broader express and parcel delivery companies. These competitors often leverage extensive networks and economies of scale to offer more competitive pricing for non-specialized shipments. For instance, in 2024, the global express delivery market was valued at over $300 billion, with major players like DHL, FedEx, and UPS handling a vast volume of general parcels, representing a substantial alternative for a portion of trans-o-flex's customer base.

For non-sensitive goods, alternative transport modes like standard freight rail or sea shipping can present a threat of substitution. These options are typically slower and lack the temperature control capabilities that are crucial for many of trans-o-flex's core offerings. However, for a segment of their business where these factors are less critical, the cost savings offered by these alternatives could be attractive, particularly if lead times are flexible.

Technological Advancements Enabling Self-Management

Technological advancements are increasingly enabling businesses to manage their supply chains more effectively in-house. Sophisticated software platforms now offer real-time tracking, inventory optimization, and dynamic route planning, potentially reducing the perceived necessity of full-service third-party logistics (3PL) providers like trans-o-flex Schnell-Lieferdienst GmbH & Co. KG.

This shift means some companies might choose to internalize logistics operations, thereby diminishing their reliance on external partners. For instance, the global market for supply chain management software was projected to reach over $30 billion by 2024, indicating a significant investment in these internal capabilities.

- Increased adoption of AI-powered logistics platforms.

- Growth in cloud-based SCM solutions accessible to SMEs.

- Development of proprietary tracking and optimization tools by larger corporations.

- Potential for reduced demand for traditional 3PL services in specific segments.

Direct-to-Patient Models and Decentralized Distribution

The burgeoning direct-to-patient (DTP) model in pharmaceuticals, fueled by personalized medicine, presents a significant threat of substitutes for traditional logistics. This shift could introduce alternative distribution networks that bypass conventional hubs.

While DTP models often still require specialized logistics, they may engage different service providers or adopt a more decentralized approach. For instance, by 2024, the global DTP logistics market was projected to reach over $20 billion, indicating substantial investment in these alternative pathways.

- DTP growth: The increasing demand for home healthcare and specialty drugs drives DTP adoption.

- Decentralized networks: These models may utilize local pharmacies or specialized couriers, offering alternatives to large-scale distribution centers.

- Service provider shift: New entrants or existing players adapting their services could offer competitive solutions.

- Potential cost efficiencies: Streamlined DTP routes might offer cost advantages for specific patient segments.

The threat of substitutes for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG primarily stems from companies developing their own logistics capabilities or utilizing broader, less specialized delivery services. For high-volume shippers, especially in pharmaceuticals, building in-house operations is a growing consideration, with the global pharmaceutical logistics market valued around $270 billion in 2024. However, the significant investment and regulatory hurdles often make outsourcing to specialists like trans-o-flex more viable. For non-temperature-controlled shipments, general express carriers, which operate in a market exceeding $300 billion in 2024, represent a substantial alternative due to their scale and pricing.

| Threat of Substitutes | Description | Market Size (2024 Estimate) | Key Factors |

|---|---|---|---|

| In-house Logistics | Large companies building or enhancing their own logistics operations. | N/A (Internal Investment) | Control, potential cost savings for very large volumes, but high capital expenditure and expertise required. |

| General Express/Parcel Delivery | Broader delivery companies handling non-specialized shipments. | >$300 billion (Global Express Delivery Market) | Economies of scale, extensive networks, competitive pricing for non-specialized goods. |

| Alternative Transport Modes | Slower, less specialized options like rail or sea for non-critical shipments. | N/A (Segment-specific) | Cost savings for flexible lead times and non-sensitive goods. |

| Supply Chain Management Software | Technological advancements enabling better in-house supply chain management. | >$30 billion (Global SCM Software Market) | Real-time tracking, optimization tools reducing reliance on 3PLs. |

| Direct-to-Patient (DTP) Logistics | Alternative distribution networks bypassing traditional hubs. | >$20 billion (Global DTP Logistics Market) | Decentralized networks, new service providers, potential cost efficiencies for specific segments. |

Entrants Threaten

The specialized nature of trans-o-flex's business, particularly in temperature-controlled and pharmaceutical logistics, necessitates significant capital outlay. This includes acquiring a dedicated fleet of temperature-controlled vehicles, establishing advanced warehousing facilities, and implementing sophisticated monitoring technologies.

For instance, a new refrigerated truck can cost upwards of €100,000, and a specialized pharmaceutical-grade warehouse can run into millions of euros in construction and equipment costs. These substantial upfront investments create a formidable barrier to entry for potential competitors aiming to replicate trans-o-flex's service offerings.

Stringent regulatory requirements, such as Good Distribution Practice (GDP) for pharmaceuticals, act as a significant barrier to entry for new players in the logistics sector. New entrants must invest heavily in expertise and robust quality management systems to meet these standards. In 2024, the European Medicines Agency continued to emphasize strict compliance, making it challenging for smaller, less capitalized companies to enter and compete effectively within specialized segments like pharmaceutical logistics.

Trans-o-flex benefits from an established, comprehensive distribution network across Germany and Austria, specifically designed for sensitive and temperature-controlled shipments. This extensive infrastructure, built over years, represents a significant barrier to entry for newcomers.

The cost and time required to replicate trans-o-flex's existing network, complete with regional hubs and specialized, trained personnel, are substantial deterrents. New entrants would face immense capital investment and operational hurdles to achieve comparable reach and efficiency.

Brand Reputation and Customer Trust

For trans-o-flex, a strong brand reputation is a significant barrier to entry, especially when dealing with high-value and sensitive items like pharmaceuticals. Years of building trust in reliability and security mean new competitors face an uphill battle in gaining immediate credibility. Customers in this sector prioritize product integrity and compliance, making it difficult for newcomers to establish the necessary trust.

The logistics sector, particularly for specialized goods, relies heavily on established trust. In 2024, the pharmaceutical logistics market continued to demand stringent quality controls and a proven track record. New entrants would need substantial investment and time to replicate the brand equity trans-o-flex possesses, making direct competition challenging without a significant differentiator.

- Brand Reputation: Trans-o-flex has cultivated a strong reputation for reliability and security in pharmaceutical logistics.

- Customer Trust: This trust, built over years, is a critical asset that new entrants find difficult to quickly acquire.

- High-Value Goods: The handling of pharmaceuticals necessitates a high degree of confidence in the logistics provider.

- Barriers to Entry: The difficulty in establishing immediate credibility creates a substantial hurdle for new companies entering the market.

Access to Specialized Talent

The specialized logistics sector, particularly for services like those offered by trans-o-flex, demands a highly skilled workforce. This includes drivers proficient in handling sensitive or temperature-controlled goods, logistics planners with deep expertise in cold chain management, and compliance officers well-versed in regulatory frameworks. For instance, in 2024, the German logistics sector continued to grapple with a shortage of qualified drivers, with estimates suggesting a deficit of tens of thousands of drivers.

This scarcity of specialized talent, exacerbated by a general labor shortage within the logistics industry, presents a significant barrier for new entrants. Acquiring a sufficiently trained and experienced talent pool quickly is a considerable challenge, impacting operational readiness and service quality from the outset.

- Specialized Skills Required: Drivers trained for sensitive goods, cold chain logistics planners, compliance experts.

- Labor Shortage Impact: General logistics labor deficit makes acquiring specialized talent harder.

- New Entrant Challenge: Difficulty in rapidly building a qualified workforce.

- 2024 Data: Germany's logistics sector faced a significant shortage of qualified drivers.

The threat of new entrants for trans-o-flex is moderate, primarily due to the high capital requirements and specialized expertise needed in pharmaceutical and temperature-controlled logistics. While the market shows demand, replicating trans-o-flex's established network and brand trust is a significant hurdle for newcomers.

New entrants face substantial upfront costs for specialized fleets and compliant warehousing, estimated in the millions for advanced facilities. Furthermore, the ongoing emphasis on stringent regulations like GDP in 2024 by bodies such as the European Medicines Agency demands significant investment in quality systems and expertise, making market entry challenging for less capitalized firms.

The scarcity of skilled labor, particularly qualified drivers, further deters new entrants. In 2024, Germany's logistics sector experienced a notable shortage of tens of thousands of drivers, complicating the ability of new companies to quickly build an operational workforce capable of meeting trans-o-flex's service standards.

| Barrier Type | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | Specialized fleet and warehouse investment | High (e.g., €100k+ per refrigerated truck) |

| Regulatory Compliance | GDP for pharmaceuticals | High (EMA emphasis on strict compliance) |

| Network & Infrastructure | Established distribution network | High (costly and time-consuming to replicate) |

| Brand Reputation & Trust | Customer confidence in reliability | High (difficult for new entrants to build quickly) |

| Skilled Workforce | Specialized drivers and logistics planners | Moderate to High (labor shortages in Germany) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG is built upon a foundation of industry-specific market research reports, financial statements from publicly available sources, and insights from logistics and transportation trade publications.