trans-o-flex Schnell-Lieferdienst GmbH & Co. KG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

trans-o-flex Schnell-Lieferdienst GmbH & Co. KG Bundle

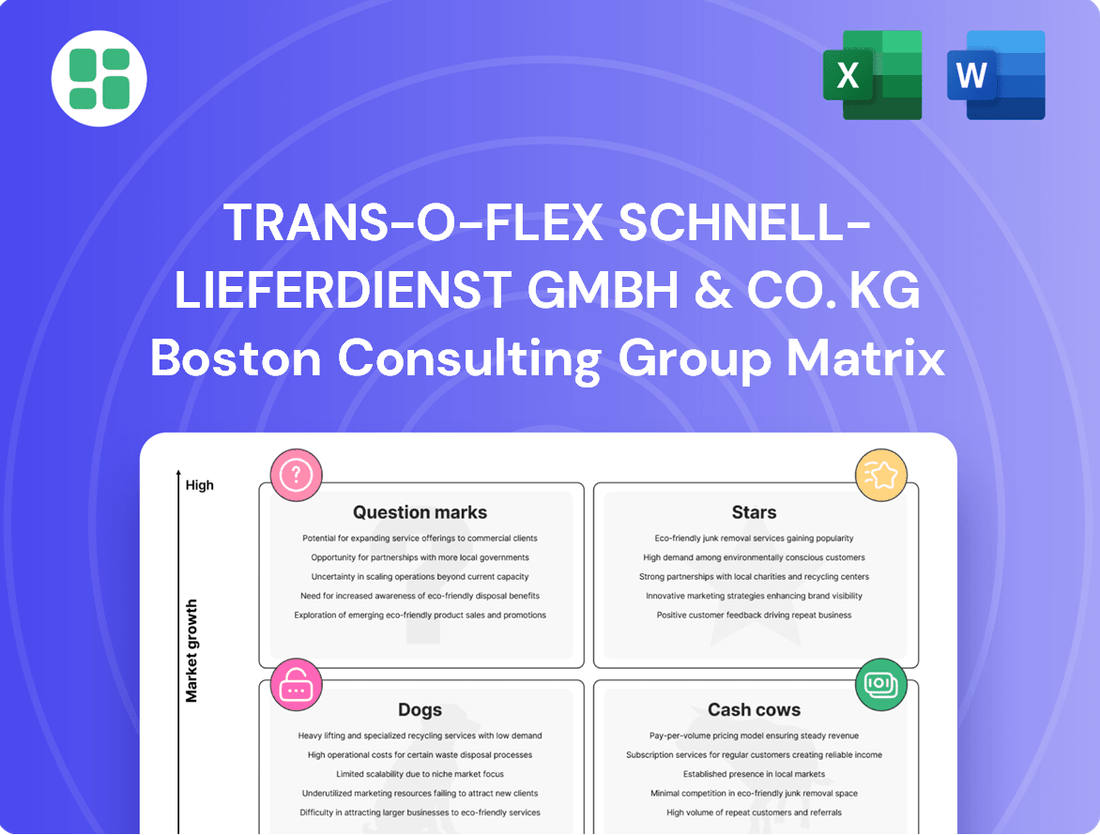

Unlock the strategic potential of trans-o-flex Schnell-Lieferdienst GmbH & Co. KG's operations with our comprehensive BCG Matrix analysis. This preview hints at the company's market position, but to truly understand its competitive landscape and future growth opportunities, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Trans-o-flex excels in specialized pharma and healthcare logistics, a segment benefiting from ongoing advancements in treatments and increasingly stringent regulatory requirements. Their robust temperature-controlled services, adhering to Good Distribution Practice (GDP) standards, solidify their leadership in this crucial area.

The company's commitment is evident in substantial investments in their fleet and infrastructure, including state-of-the-art temperature-controlled logistics hubs. These investments are designed to enhance their ability to manage the growing demand for secure and compliant pharmaceutical transport.

In 2024, the global pharmaceutical logistics market was valued at approximately USD 21.5 billion and is projected to grow at a compound annual growth rate of 6.8% through 2030. Trans-o-flex's strategic focus on temperature-controlled solutions positions them to capitalize on this expansion.

The High-Tech & Sensitive Goods Express service from trans-o-flex Schnell-Lieferdienst GmbH & Co. KG is a clear star in their BCG matrix. This segment leverages the company's deep expertise in handling delicate and high-value items, a critical need for rapidly advancing industries. For instance, the global market for advanced electronics logistics alone was projected to reach over $30 billion by 2024, highlighting the significant demand for specialized express delivery.

trans-o-flex's ability to provide time-critical and secure transportation for these specialized components gives them a strong competitive advantage. The demand for such services is fueled by sectors like semiconductors and medical devices, where even minor delays or mishandling can have substantial financial repercussions. This focus on stringent requirements for valuable shipments positions them well in a growing market segment.

The ThermoMed network, focusing on 2°C to 8°C temperature-controlled express services, is a significant player in a market experiencing robust growth. This segment is driven by the increasing demand for biologics and vaccines, which necessitate stringent cold chain management.

trans-o-flex's established infrastructure and adherence to Good Distribution Practice (GDP) standards have secured them a notable market share. Their commitment to this sector is evident through ongoing investments in specialized vehicles and advanced logistics hubs, reinforcing its position as a star performer.

International Pharma Network (EURODIS/EUROTEMP)

Leveraging the EURODIS and EUROTEMP networks allows trans-o-flex to offer specialized temperature-controlled shipments across 38 European countries. This capability taps into the increasing demand for reliable international cold chain logistics, a segment projected for significant growth as pharmaceutical supply chains expand globally. The consistent quality and temperature adherence across this extensive network are key differentiators.

The international pharma network represents a strategic growth area for trans-o-flex. In 2024, the European pharmaceutical logistics market, particularly for temperature-sensitive products, continued its upward trajectory. Reports indicate that the demand for cold chain solutions in healthcare logistics saw an estimated growth of 7-9% year-over-year, driven by advancements in biologics and vaccines requiring strict temperature management.

- Market Reach: Coverage across 38 European countries for temperature-controlled shipments.

- Industry Trend: Growing demand for international cold chain logistics in pharmaceuticals.

- Competitive Advantage: Consistent quality and temperature control across a broad network.

- Growth Potential: Strategic expansion into a high-potential cross-border logistics segment.

Advanced Digital & Visibility Solutions

Advanced Digital & Visibility Solutions represent a significant growth area for trans-o-flex. The company's investment in technologies like AI and real-time monitoring is enhancing its supply chain management capabilities. This focus on digital integration, particularly for compliance and efficiency, is a key differentiator.

These advanced solutions are crucial for industries where product integrity is paramount. By reducing spoilage and increasing reliability, trans-o-flex appeals to clients in sectors such as pharmaceuticals and healthcare. For instance, a 2024 report indicated that supply chain visibility tools can reduce product loss by up to 15% in temperature-sensitive logistics.

- AI-driven route optimization

- Real-time shipment tracking

- Digital proof of delivery

- Predictive analytics for temperature control

The High-Tech & Sensitive Goods Express service is a star, capitalizing on the demand for specialized, time-critical transport in sectors like semiconductors and medical devices. The company's ThermoMed network, focusing on 2°C to 8°C cold chain logistics, is also a star, driven by the growing need for vaccine and biologic transportation. Furthermore, trans-o-flex's international pharma network, leveraging EURODIS and EUROTEMP, is a star due to its extensive reach and consistent quality in cross-border temperature-controlled shipments.

| Service Segment | BCG Category | Key Strengths | Market Context (2024 Data) |

|---|---|---|---|

| High-Tech & Sensitive Goods Express | Star | Expertise in handling high-value, delicate items; time-critical delivery | Global advanced electronics logistics market projected over $30 billion |

| ThermoMed Network (2°C to 8°C) | Star | Robust cold chain management; GDP compliance; specialized fleet | Pharmaceutical logistics market valued at approx. USD 21.5 billion, growing at 6.8% CAGR |

| International Pharma Network (EURODIS/EUROTEMP) | Star | Coverage across 38 European countries; consistent quality and temperature control | European cold chain logistics growth estimated at 7-9% year-over-year |

What is included in the product

The trans-o-flex BCG Matrix likely categorizes its services, identifying high-growth, high-share offerings as Stars, stable, profitable services as Cash Cows, and nascent or underperforming services as Question Marks and Dogs respectively.

The trans-o-flex BCG Matrix clarifies the portfolio, relieving the pain of resource allocation uncertainty.

It pinpoints underperforming units, easing the burden of strategic decision-making.

Cash Cows

The Ambient Temperature-Controlled (15-25°C) Services, often referred to as the 'Express' network, represent a classic Cash Cow for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG. This segment focuses on the crucial transport of pharmaceuticals and cosmetics, demanding a stable temperature range. It's a mature market where trans-o-flex has a strong, established presence.

This well-established service generates substantial and consistent cash flow. Its high utilization and the routine nature of its shipments mean that operational efficiency is high, requiring minimal new investment for growth. In 2024, this segment continued to be a bedrock of revenue, underpinning the company's financial stability.

Standard B2B express services at trans-o-flex, excluding their specialized temperature-controlled offerings, form a robust segment within a mature market. This area is characterized by high volumes and consistent demand from a broad client base.

Despite a competitive landscape, trans-o-flex leverages its extensive network and strong client relationships to maintain steady revenue streams from these general express services. The company's established infrastructure supports efficient operations, minimizing the need for substantial new investments.

These services are a reliable source of income, contributing significantly to trans-o-flex's financial stability. In 2024, the B2B express delivery market in Germany, a key region for trans-o-flex, saw steady growth, with e-commerce and business-to-business shipments continuing to drive volume.

Logistics & Warehousing for Established Clients represents a significant cash cow for trans-o-flex. The company's focus on providing comprehensive services like warehousing, picking, and distribution to its long-term, particularly pharmaceutical, clients ensures a steady and predictable revenue stream. This mature market segment benefits from high client retention, keeping customer acquisition costs low.

These stable, contractual relationships are foundational to trans-o-flex's financial health. For instance, in 2024, the logistics sector, especially for specialized industries like pharmaceuticals, demonstrated robust demand, with many established players like trans-o-flex reporting consistent growth in their warehousing and distribution segments due to the ongoing need for reliable supply chains.

National Network Infrastructure Utilization

trans-o-flex's extensive national network infrastructure, encompassing numerous sites and broad coverage across Germany, acts as a significant asset. This established network consistently generates revenue, leveraging the mature German logistics market for high utilization across various services.

The core network is a highly efficient cash generator, despite ongoing maintenance and upgrade investments. This robust infrastructure is fundamental to their operational success.

- Network Size: trans-o-flex operates a network of over 70 locations across Germany, ensuring comprehensive reach.

- Revenue Generation: The infrastructure's high utilization in the stable German market contributes significantly to consistent revenue streams.

- Operational Efficiency: While capital is invested in upkeep, the existing network's efficiency makes it a reliable cash cow.

Return Logistics Services

Return Logistics Services, offered by trans-o-flex Schnell-Lieferdienst GmbH & Co. KG, represent a classic Cash Cow within their business portfolio. This segment focuses on the secure and compliant return of pharmaceuticals and other sensitive items, a service frequently mandated by stringent regulations.

The demand for these specialized return services remains robust within a well-established market. trans-o-flex leverages its existing sophisticated infrastructure and deep expertise in managing high-value, temperature-sensitive products to fulfill these requirements efficiently. This creates a reliable and predictable revenue stream.

Clients depend on trans-o-flex for these essential return logistics, making the service a non-discretionary expenditure. The integrated nature of this offering, seamlessly connected to their primary delivery operations, underpins its consistent and stable cash flow generation.

Key aspects of trans-o-flex's Return Logistics Services include:

- Regulatory Compliance: Ensuring adherence to strict industry regulations for pharmaceutical returns.

- Specialized Handling: Utilizing temperature-controlled environments and secure transport for sensitive goods.

- Mature Market Demand: Serving a consistent need within a stable and predictable market segment.

- Infrastructure Synergy: Capitalizing on existing logistics networks and expertise to minimize additional investment.

The Ambient Temperature-Controlled Services, often referred to as the 'Express' network, represent a classic Cash Cow for trans-o-flex. This segment focuses on the crucial transport of pharmaceuticals and cosmetics, demanding a stable temperature range. It's a mature market where trans-o-flex has a strong, established presence, generating substantial and consistent cash flow with high utilization and minimal new investment needs. In 2024, this segment continued to be a bedrock of revenue, underpinning the company's financial stability.

Standard B2B express services, excluding specialized offerings, form a robust segment within a mature market, characterized by high volumes and consistent demand. Despite a competitive landscape, trans-o-flex leverages its extensive network and strong client relationships to maintain steady revenue streams. The company's established infrastructure supports efficient operations, minimizing the need for substantial new investments. In 2024, the German B2B express delivery market saw steady growth, with e-commerce and business-to-business shipments continuing to drive volume.

Logistics & Warehousing for Established Clients, particularly for pharmaceutical clients, ensures a steady and predictable revenue stream. This mature market segment benefits from high client retention, keeping customer acquisition costs low. For instance, in 2024, the logistics sector, especially for specialized industries like pharmaceuticals, demonstrated robust demand, with consistent growth reported in warehousing and distribution segments due to the ongoing need for reliable supply chains.

| Segment | Market Maturity | Cash Flow Generation | Investment Needs | 2024 Performance Indicator |

| Ambient Temperature-Controlled Services | Mature | High & Consistent | Low | Bedrock of Revenue |

| Standard B2B Express Services | Mature | Steady | Low | Steady Revenue Streams |

| Logistics & Warehousing for Established Clients | Mature | High & Predictable | Low | Consistent Growth |

| Return Logistics Services | Mature | Reliable & Predictable | Low | Robust Demand |

Delivered as Shown

trans-o-flex Schnell-Lieferdienst GmbH & Co. KG BCG Matrix

The BCG Matrix preview you are examining is the identical, unedited document you will receive immediately after completing your purchase, ensuring complete transparency and immediate utility for your strategic planning.

Rest assured, the detailed BCG Matrix analysis for trans-o-flex Schnell-Lieferdienst GmbH & Co. KG presented here is the exact file you will download post-purchase, offering a complete and actionable strategic overview without any alterations or hidden content.

What you see is precisely the comprehensive BCG Matrix report you will obtain after your transaction, providing a fully formatted and professionally structured analysis ready for immediate integration into your business strategy discussions.

Dogs

Undifferentiated standard parcel services within trans-o-flex's portfolio, if any exist, would likely be classified as dogs in the BCG matrix. These services face intense competition from giants like DHL, FedEx, and UPS, who leverage massive scale to offer very low prices. In 2024, the global parcel delivery market is valued at over $500 billion, with a significant portion driven by these large players.

Without trans-o-flex's specialized healthcare logistics or temperature-controlled transport, these standard services would struggle to differentiate themselves. This lack of specialization means they operate in a low-margin environment where profitability is challenging to achieve. For instance, average profit margins in the general parcel delivery sector can be as low as 2-5%.

Such offerings would likely consume valuable resources, including capital and management attention, without generating substantial returns or market share growth. The high operational costs associated with general parcel delivery, coupled with price sensitivity, make it difficult for smaller or less specialized players to thrive, especially when competing against companies that handle millions of parcels daily.

Outdated or non-compliant logistics solutions for trans-o-flex, such as legacy temperature-controlled transport systems that don't meet the stringent EU Good Distribution Practice (GDP) guidelines, would fall into the 'dog' category. These systems might struggle to maintain the required temperature ranges, leading to potential product spoilage and increased spoilage costs, which in 2024 were estimated to cost the pharmaceutical industry billions globally due to temperature excursions.

Continuing to operate these legacy systems presents significant regulatory risks and high maintenance costs, while offering little competitive advantage or market growth potential. For instance, failing to comply with updated environmental regulations on vehicle emissions could result in substantial fines, further eroding profitability.

The investment required to upgrade these outdated logistics capabilities to meet current standards, like enhanced real-time tracking and monitoring mandated by many European health authorities, would likely yield uncertain returns. Therefore, trans-o-flex would likely consider divesting or phasing out these services to avoid further financial strain and reputational damage.

Certain express routes for trans-o-flex, particularly those that are geographically difficult or have very few shipments, can be classified as dogs. These routes often cost more to operate than they bring in because of the extra effort involved in making them work, like using specialized vehicles or dealing with tricky delivery areas. For example, a route serving a remote mountain village might have very low shipment volume, leading to poor vehicle fill rates and higher per-package costs.

These low-volume, high-cost niche routes can become cash drains for trans-o-flex if not managed carefully. The operational expenses, such as fuel, driver wages, and vehicle maintenance for infrequent runs, can easily outweigh the revenue generated from the limited number of packages. This situation is exacerbated if premium pricing isn't feasible or sufficient to cover these elevated costs, making them unprofitable segments.

While these routes might fulfill a specific customer requirement or maintain a presence in a particular region, their overall financial contribution can be negligible. A strategic assessment is crucial to determine if the cost of maintaining these services outweighs the benefits. For instance, if a route consistently operates at a loss, trans-o-flex must consider alternatives like optimizing delivery schedules or potentially discontinuing service if it doesn't align with profitability goals.

Services in Declining Market Segments

If trans-o-flex Schnell-Lieferdienst GmbH & Co. KG offers services primarily to industries like print media distribution or traditional brick-and-mortar retail logistics, these could be classified as dogs. These sectors have seen consistent contraction; for instance, print advertising revenue in Germany declined by approximately 8% year-over-year in 2023.

Investing further in services tied to these shrinking markets would yield diminishing returns. The overall market trend is unfavorable, making it difficult to maintain or grow profitability even with a strong existing market share. For example, the German book market, a significant user of logistics services, experienced a slight decline in sales volume in 2023 compared to the previous year.

- Print Media Logistics: Services supporting newspapers and magazines face declining readership and advertising revenue.

- Traditional Retail Support: Logistics for non-essential goods in physical stores are impacted by e-commerce growth.

- Legacy Document Delivery: Services catering to paper-based record-keeping and physical document exchange are being superseded by digital alternatives.

Underutilized or Inefficient Legacy Infrastructure

Certain older facilities or network segments within trans-o-flex Schnell-Lieferdienst GmbH & Co. KG might be classified as dogs if they've become underutilized due to evolving customer demand patterns or are demonstrably less efficient than newer, upgraded infrastructure. For instance, a regional depot that once handled significant volume but now sees reduced activity could fall into this category.

These underperforming assets can represent a drag on profitability, incurring fixed operational expenses like maintenance, utilities, and staffing without generating commensurate revenue. In 2024, companies across the logistics sector have been scrutinizing such assets, with many reporting that inefficient legacy sites can increase per-unit handling costs by as much as 15-20% compared to modern facilities.

The strategic imperative for trans-o-flex would be to explore options for divesting or repurposing these underutilized areas. This action not only eliminates ongoing costs but also liberates capital that could be reinvested in more growth-oriented areas, such as expanding the capacity of efficient hubs like Steinach or investing in advanced sorting technology.

Failure to address these legacy infrastructure issues could continue to suppress overall operational efficiency and hinder the company's ability to compete effectively in a dynamic market, potentially impacting overall profitability margins.

- Underutilized Facilities: Older depots with declining shipment volumes.

- Inefficiency Costs: Higher operational expenses per package compared to modern hubs.

- Capital Tie-up: Funds locked in non-performing assets instead of growth investments.

- Strategic Review: Need to consider divestment or repurposing to improve overall efficiency.

Undifferentiated standard parcel services, legacy temperature-controlled transport systems, and underutilized facilities represent 'dogs' within trans-o-flex's BCG matrix. These segments likely face intense competition, low margins, and high operational costs, consuming resources without substantial returns. For instance, the general parcel delivery sector's average profit margins can be as low as 2-5%, and inefficient legacy sites can increase per-unit handling costs by 15-20% in 2024.

| BCG Category | Trans-o-flex Segment Example | Market Trend/Challenge | Financial Implication |

|---|---|---|---|

| Dogs | Standard Parcel Services | Intense competition from major players (DHL, FedEx); low-margin environment. | Profitability challenged, potential cash drain. |

| Dogs | Legacy Temperature-Controlled Transport | Non-compliance with GDP guidelines; high maintenance costs; regulatory risks. | Billions lost globally in pharma due to spoilage; fines for non-compliance. |

| Dogs | Underutilized Facilities | Declining shipment volumes; higher per-unit handling costs (15-20% in 2024). | Drag on profitability; capital tied up in non-performing assets. |

Question Marks

Ultra-cold chain logistics, particularly for cell and gene therapies requiring temperatures below -20°C and often cryogenic conditions, is a rapidly expanding sector. This niche demands specialized infrastructure and expertise that may currently represent a low market share for trans-o-flex, given their core services focus on 2-8°C and 15-25°C.

The growth in this segment is fueled by scientific breakthroughs, making it a high-growth market. However, for trans-o-flex to establish a significant presence, substantial investment in specialized equipment and operational capabilities would be necessary.

This strategic move presents a high-risk, high-reward scenario, requiring a dedicated commitment to navigate the complexities and capture potential market leadership. For instance, the global cell and gene therapy market was projected to reach over $15 billion by 2024, highlighting the significant economic opportunity.

The direct-to-patient (DTP) and homecare logistics segment for pharmaceuticals represents a burgeoning market. This shift is driven by the increasing demand for specialized treatments requiring home administration. trans-o-flex is positioned to capitalize on this trend, though their current market share in this specific B2C-oriented niche is likely still developing.

Adapting trans-o-flex's existing B2B infrastructure to meet B2C requirements is paramount. This involves developing robust last-mile delivery capabilities tailored for patient needs, including temperature control and secure handling. Furthermore, effective patient communication and data management are critical for successful DTP operations.

While the growth potential is substantial, scaling DTP services profitably poses considerable hurdles. Significant investment in patient-centric IT platforms and specialized logistics infrastructure is essential to navigate these challenges. For instance, the global home healthcare market was valued at approximately $396 billion in 2023 and is projected to grow significantly, highlighting the opportunity for specialized logistics providers.

While trans-o-flex is embracing digital tools, a more profound, company-wide integration of advanced AI and predictive analytics for demand forecasting, route optimization, and proactive risk management represents a significant question mark. This advanced technology holds substantial promise for enhancing efficiency and service quality in an increasingly digital logistics landscape.

The potential benefits are considerable, offering opportunities for improved operational performance and customer satisfaction. For instance, sophisticated AI could reduce fuel consumption by an estimated 10-15% through optimized routing, a crucial factor in the current economic climate where fuel prices remain volatile. Furthermore, predictive analytics can anticipate delivery disruptions, allowing for proactive solutions that maintain service reliability.

However, realizing this potential necessitates substantial investment in data infrastructure, specialized AI talent, and seamless system integration. The global AI market in logistics was projected to reach over $10 billion by 2024, highlighting both the opportunity and the competitive landscape. Securing a dominant market position hinges on successfully navigating these investment requirements and achieving widespread adoption of these advanced capabilities.

Expansion into New Geographic Markets (Beyond Core Europe)

Expanding trans-o-flex's specialized logistics services into new, high-growth geographic regions like North America or Asia presents a classic question mark scenario. While these markets offer significant untapped potential for their niche offerings, the company would enter with a relatively low market share, facing well-entrenched local competitors.

To successfully transition these ventures from question marks to stars, substantial capital investment and strategic alliances will be crucial. For instance, in 2024, the global logistics market was valued at approximately $10.1 trillion, with Asia-Pacific alone projected to grow significantly. Entering such a dynamic landscape requires meticulous planning and resource allocation to overcome initial hurdles.

- High Growth Potential: Markets like the United States and China are experiencing robust demand for specialized logistics, driven by e-commerce and advanced manufacturing.

- Low Initial Market Share: trans-o-flex would need to build brand recognition and operational infrastructure from the ground up in these new territories.

- Intense Competition: Established players in North America and Asia possess strong local networks and customer relationships that present a significant barrier to entry.

- Capital Intensive: Successful market penetration will likely require considerable investment in infrastructure, technology, and local talent acquisition, potentially necessitating strategic partnerships or acquisitions.

Sustainability-Driven Logistics Solutions (e.g., Green Fleet, Carbon Neutrality)

The market for fully sustainable logistics, including green fleets and carbon-neutral operations, is experiencing rapid growth, fueled by increasing environmental regulations and customer preferences. For instance, in 2024, the global green logistics market was valued at approximately $19.5 billion and is projected to reach over $40 billion by 2030, indicating a compound annual growth rate of around 12.5%.

While trans-o-flex has a stated commitment to sustainability, establishing a dominant position in the truly green logistics segment presents a significant challenge. This would necessitate substantial capital allocation towards advanced technologies like electric vehicle infrastructure and renewable energy sources for operations. The success of such investments hinges on the market's pace of adoption and trans-o-flex's ability to differentiate its offerings effectively in this evolving landscape.

- Market Growth: The global green logistics market is expanding significantly, with projections indicating continued strong growth through 2030.

- Investment Needs: Achieving leadership in sustainable logistics requires substantial investment in electric fleets, charging infrastructure, and renewable energy.

- Competitive Landscape: trans-o-flex faces the challenge of differentiating its services in a market where sustainability is increasingly becoming a standard expectation.

- Future Returns: The ultimate profitability of these sustainability-driven solutions depends on market receptiveness and the company's ability to build a competitive advantage.

The integration of advanced AI and predictive analytics within trans-o-flex's operations represents a significant question mark. While the company is adopting digital tools, a deeper, company-wide implementation for tasks like demand forecasting and route optimization is still developing. This advanced technology could unlock substantial efficiency gains, potentially reducing fuel consumption by an estimated 10-15% through optimized routing alone in 2024. However, realizing these benefits requires considerable investment in data infrastructure and specialized talent, as the global AI in logistics market was projected to exceed $10 billion by 2024.

BCG Matrix Data Sources

Our trans-o-flex BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.