Tootsie Roll Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tootsie Roll Industries Bundle

Tootsie Roll Industries, a beloved confectionery icon, boasts a strong brand legacy and a loyal customer base, but faces challenges from evolving consumer tastes and intense competition. Understanding these internal strengths and weaknesses, alongside external opportunities and threats, is crucial for navigating the dynamic candy market.

Want the full story behind Tootsie Roll's enduring appeal and potential growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research into this iconic brand.

Strengths

Tootsie Roll Industries boasts a powerful brand recognition built on a heritage stretching back to 1896. Iconic products like Tootsie Rolls, Tootsie Pops, Junior Mints, and Charleston Chew are deeply ingrained in consumer memory, fostering significant brand loyalty and nostalgic appeal. This enduring legacy provides a distinct competitive edge in the confectionery landscape, attracting consumers across multiple generations.

Tootsie Roll Industries boasts a remarkably diverse and beloved product portfolio, featuring iconic brands like Tootsie Rolls, Tootsie Pops, Dots, Charleston Chew, Junior Mints, Sugar Daddy, and Andes.

This wide array of confectionery offerings appeals to a broad spectrum of tastes and preferences, effectively mitigating the company's dependence on any single product.

The extensive product variety ensures widespread consumer appeal and sustains consistent demand across various demographic segments, a key strength in the competitive candy market.

Tootsie Roll Industries boasts a robust distribution network, reaching consumers across the United States, Canada, and Mexico, and extending its presence to over 75 other nations. This expansive reach is a significant competitive advantage, ensuring broad product availability.

Their products are strategically placed in a wide array of retail environments, from major supermarkets and mass merchandisers to convenient corner stores and online platforms. This multi-channel approach maximizes accessibility for a diverse customer base.

The company’s success in securing and maintaining preferred shelf space within these retail channels is a testament to the strength of its distribution relationships and the consistent demand for its products. This visibility directly translates into sales volume.

Financial Resilience and Operational Efficiency

Tootsie Roll Industries has shown impressive financial resilience, even with recent revenue dips. For instance, in the first quarter of 2024, the company reported a 4.3% increase in net sales to $164.4 million, showcasing its ability to maintain and grow revenue streams. This resilience is underpinned by improved gross profit margins, which reached 35.8% in Q1 2024, up from 33.9% in the same period of 2023. This gain is attributed to better pricing strategies and enhanced manufacturing efficiencies.

The company's commitment to operational efficiency is a key strength. Tootsie Roll consistently focuses on optimizing its production processes and rigorously controlling expenses. This dedication allows them to maximize profit margins, ensuring that even with fluctuating top-line performance, profitability remains strong. For example, the company has been investing in its manufacturing operations and incorporating new technologies to further boost efficiency and maintain high product quality, a strategy that has paid off in their margin improvements.

Key aspects of their operational efficiency include:

- Improved Gross Profit Margins: Achieved 35.8% in Q1 2024, a notable increase from 33.9% in Q1 2023.

- Focus on Price Realization: Strategic pricing adjustments contribute to better financial performance.

- Manufacturing Investments: Ongoing capital expenditures in production facilities and technology enhance output and cost control.

- Expense Management: Diligent oversight of operational costs supports sustained profitability.

Consistent Dividend Payouts and Strong Liquidity

Tootsie Roll Industries boasts a remarkable track record of financial stability, evidenced by 55 consecutive years of consistent dividend payouts as of 2024. This unwavering commitment to shareholder returns underscores the company's robust financial health and operational consistency.

The company's strong liquidity is further highlighted by its healthy current ratio, which stood at 2.95 in the first quarter of 2024. This indicates a solid ability to meet its short-term obligations, providing a cushion for unexpected expenses and strategic investments.

- Consistent Dividend Payments: 55 consecutive years of dividends (as of 2024) demonstrate financial resilience.

- Strong Liquidity: A current ratio of 2.95 in Q1 2024 signifies excellent short-term financial health.

- Financial Flexibility: This liquidity enables reinvestment in brand promotion, product development, and potential acquisitions.

Tootsie Roll Industries maintains a dominant market position due to its iconic and widely recognized brands, fostering strong consumer loyalty across generations. This brand equity, built over decades, provides a significant competitive advantage in the confectionery sector.

The company's extensive product portfolio, including Tootsie Rolls, Tootsie Pops, and Junior Mints, appeals to a broad consumer base, reducing reliance on any single item. This diversity ensures consistent demand and market penetration.

Tootsie Roll Industries benefits from a well-established and far-reaching distribution network, ensuring product availability in numerous retail channels across the U.S., Canada, Mexico, and over 75 other countries. This expansive reach is crucial for maximizing sales volume and market share.

The company demonstrates strong financial health, evidenced by a 4.3% increase in net sales to $164.4 million in Q1 2024 and improved gross profit margins of 35.8%. This financial resilience is further supported by 55 consecutive years of dividend payments as of 2024 and a healthy current ratio of 2.95 in Q1 2024, indicating robust liquidity and operational efficiency.

| Financial Metric | Q1 2024 Value | Q1 2023 Value | Significance |

|---|---|---|---|

| Net Sales | $164.4 million | $157.6 million | Indicates revenue growth and market demand. |

| Gross Profit Margin | 35.8% | 33.9% | Shows improved profitability through pricing and efficiency. |

| Current Ratio | 2.95 | N/A | Highlights strong short-term financial health and liquidity. |

| Consecutive Dividend Years | 55 (as of 2024) | 54 (as of 2023) | Demonstrates long-term financial stability and shareholder commitment. |

What is included in the product

Delivers a strategic overview of Tootsie Roll Industries’s internal and external business factors, highlighting its brand strength and market presence against competitive pressures and evolving consumer preferences.

A Tootsie Roll Industries SWOT analysis can alleviate the pain of unfocused marketing by highlighting opportunities to leverage their enduring brand loyalty and iconic product.

Weaknesses

Tootsie Roll Industries has faced a notable downturn in its financial performance, with net sales and revenue showing a decline in recent periods. For the full year 2024, the company reported a 6% decrease in net sales. This downward trend continued into the first quarter of 2025, where net product sales saw a 3.3% decline.

This persistent challenge in sales growth appears to be partly influenced by consumer resistance to price adjustments. The reduced sales volumes are particularly concerning because the company's fixed costs remain constant, meaning lower sales directly translate to a more significant impact on profitability.

Tootsie Roll Industries is particularly vulnerable to fluctuations in the cost of key ingredients like cocoa and sugar. Cocoa prices, for instance, saw a substantial increase in 2024, reaching record highs, and projections indicate they will likely remain elevated through 2025. This upward pressure on raw material expenses directly impacts the company's ability to maintain healthy profit margins.

The company's reliance on commodities such as corn syrup and edible oils also exposes it to price volatility. While Tootsie Roll has a strategy of implementing price adjustments to offset these rising input costs, there's an inherent limit to how much of these increases can be passed on to consumers without negatively affecting demand.

Tootsie Roll Industries' international market penetration remains a notable weakness. As of the first quarter of 2025, a significant 91% of the company's revenue is derived from the U.S. market, with only 9% coming from international sales, primarily in Canada and Mexico.

This heavy reliance on the domestic market indicates a substantial opportunity for growth that has yet to be fully capitalized upon. Expanding its reach beyond North America could diversify revenue streams and mitigate risks associated with over-dependence on a single market.

Dependence on Key Retailers

Tootsie Roll Industries faces a significant weakness due to its heavy reliance on a few major retail partners. This concentration means that a substantial portion of its revenue is tied to the performance and purchasing decisions of these large customers.

The company's dependence is highlighted by the fact that Walmart alone accounted for roughly 23.2% of its total net product sales in 2024. Such a high concentration with a single retailer can create vulnerabilities.

- Customer Concentration Risk: A significant portion of sales, like the 23.2% from Walmart in 2024, makes the company susceptible to changes in that retailer's strategies or financial health.

- Reduced Negotiating Power: Dependence on a few large buyers can weaken Tootsie Roll's ability to negotiate favorable terms, potentially impacting profit margins.

- Vulnerability to Retailer Challenges: If key retailers experience difficulties, such as declining sales or operational issues, it can directly and disproportionately affect Tootsie Roll's overall revenue and profitability.

Challenges in Product Innovation and Adaptation to Evolving Consumer Demands

Tootsie Roll Industries faces a significant challenge in adapting its primarily traditional candy product line to the rapidly evolving confectionery market. While the company has a strong legacy, its core offerings may not fully capture the growing consumer interest in healthier alternatives, such as organic, vegan, or sugar-free options. This potential lack of diversification could limit its appeal to a broader, more health-conscious demographic.

The company's investment in research and development (R&D) has been a point of discussion. For instance, in 2023, Tootsie Roll's R&D expenses represented a small fraction of its net sales, a figure that has historically remained modest. This limited R&D spending may impede the company's ability to innovate and introduce new products that align with shifting consumer preferences, potentially putting it at a disadvantage compared to competitors with more robust innovation pipelines.

- Limited Diversification: Core product range heavily relies on traditional candies, potentially missing out on growth in healthier or specialty confectionery segments.

- Low R&D Investment: Historically modest R&D expenditure, as seen in 2023 where it was a small percentage of net sales, could hinder the development of innovative products catering to new consumer demands.

- Adaptation Lag: Difficulty in quickly introducing products that meet emerging trends like organic, vegan, or sugar-free options could slow market penetration in these growing areas.

Tootsie Roll Industries' reliance on a few major retail partners, such as Walmart which accounted for 23.2% of net product sales in 2024, presents a significant weakness. This concentration limits negotiating power and makes the company vulnerable to shifts in these key customers' strategies or financial health.

The company's product line, heavily focused on traditional candies, struggles to adapt to evolving consumer preferences for healthier options like organic or sugar-free products. This lack of diversification could hinder appeal to a growing health-conscious demographic.

Historically modest investment in research and development, exemplified by low R&D expenses as a percentage of net sales in 2023, may impede innovation. This could put Tootsie Roll at a disadvantage against competitors with more robust innovation pipelines.

Same Document Delivered

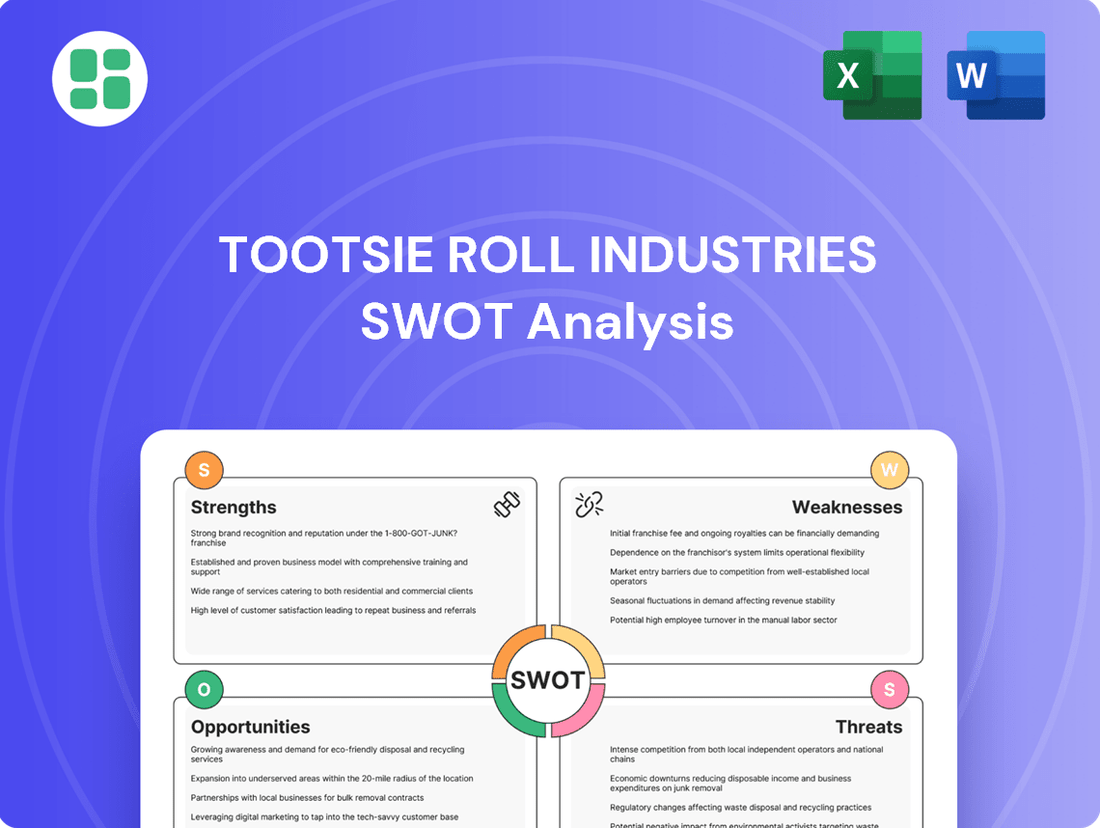

Tootsie Roll Industries SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing Tootsie Roll Industries' key Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document, showcasing the foundational elements of the Tootsie Roll Industries SWOT analysis. Once purchased, you’ll receive the full, editable version for comprehensive strategic planning.

You’re viewing a live preview of the actual SWOT analysis file for Tootsie Roll Industries. The complete version, offering a detailed breakdown of internal and external factors, becomes available after checkout.

Opportunities

Tootsie Roll Industries can capitalize on the growing global confectionery market, which is expected to reach over $200 billion by 2025, by expanding into new international territories. Emerging economies in Southeast Asia and Latin America, in particular, present significant opportunities for market penetration and sales growth.

By strategically entering these regions, Tootsie Roll can diversify its revenue streams and reduce reliance on its established North American base. The company's established brand equity, recognized by consumers worldwide, provides a strong foundation for successful international market entry and sustained growth.

Tootsie Roll Industries has a significant opportunity to diversify its product offerings. With a growing consumer demand for healthier alternatives, the company could explore developing organic, vegan, gluten-free, or sugar-free confectionery options. This aligns with market trends, as the global sugar-free confectionery market was valued at approximately $23.5 billion in 2023 and is projected to grow.

Strategic investment in research and development is key to this diversification. By creating new product lines or reformulating existing ones, Tootsie Roll can appeal to a wider, health-conscious demographic. This proactive approach could help offset potential declines in sales of traditional, sugar-heavy candies as dietary habits continue to shift.

The global e-commerce market for food and beverages is projected to reach over $1.7 trillion by 2027, indicating a substantial opportunity for Tootsie Roll Industries to bolster its online presence and direct-to-consumer (DTC) sales. By investing in enhanced digital platforms and streamlined DTC logistics, Tootsie Roll can tap into this expanding market, offering greater convenience to consumers and potentially improving its bottom line through reduced distribution costs.

Strategic Acquisitions and Partnerships

Tootsie Roll Industries can leverage its history of strategic growth by acquiring smaller, innovative confectionery brands or forging co-branding partnerships. This approach would allow them to diversify their product line and tap into new consumer segments. For instance, acquiring a brand with a strong online presence could bolster their digital sales channels, which saw a significant increase in demand during 2024.

Such moves could significantly expand their market share and geographical reach. Acquiring companies with unique flavor profiles or those popular in emerging markets could quickly complement Tootsie Roll's existing portfolio. This strategy aligns with their historical approach, aiming to accelerate growth in underserved areas or product categories.

- Acquisition Target: Focus on brands with strong digital engagement or unique product offerings.

- Partnership Potential: Explore co-branding with companies that have complementary distribution networks.

- Market Expansion: Target acquisitions in regions where Tootsie Roll has limited penetration.

Capitalizing on Nostalgia and Retro Trends

The enduring appeal of nostalgic and retro candy brands offers a prime opportunity for Tootsie Roll Industries. Given its rich history, the company is well-positioned to leverage this growing consumer interest. For instance, the global confectionery market, valued at approximately $230 billion in 2023, continues to see growth in segments that tap into consumer sentimentality.

To fully capitalize on this trend, Tootsie Roll can implement strategic marketing initiatives. These could include campaigns that emphasize the timeless quality and emotional connection associated with its classic products. Social media engagement and limited-edition promotions featuring vintage packaging or flavors can resonate strongly with both long-time fans and new consumers drawn to retro aesthetics. This approach can broaden its customer base by attracting younger demographics curious about heritage brands.

- Nostalgia Marketing: Campaigns focusing on the sentimental value of Tootsie Rolls can attract a broad demographic.

- Social Media Engagement: Leveraging platforms to share historical content and engage with consumers about their memories can boost brand loyalty.

- Limited Editions: Reintroducing classic packaging or special flavors can create buzz and drive sales, tapping into the retro trend.

- Market Growth: The global confectionery market's continued expansion, particularly in nostalgic segments, provides a favorable environment for such strategies.

Tootsie Roll Industries can expand its global footprint by targeting emerging markets, which are projected to drive significant growth in the confectionery sector. The company's strong brand recognition provides a solid foundation for entering new territories and diversifying revenue. By strategically entering regions like Southeast Asia and Latin America, Tootsie Roll can tap into growing consumer bases and increase its international sales.

The company has a clear opportunity to innovate its product line by introducing healthier options, such as sugar-free or organic confectionery. This aligns with the increasing consumer demand for wellness-focused products, a trend that saw the global sugar-free market reach approximately $23.5 billion in 2023. Investing in R&D for these alternatives can attract a broader, health-conscious demographic.

Leveraging the growing e-commerce landscape, Tootsie Roll can enhance its direct-to-consumer (DTC) sales channels. With the online food and beverage market expected to exceed $1.7 trillion by 2027, strengthening digital platforms and logistics can provide greater convenience and potentially improve profit margins. This digital push can also be complemented by strategic acquisitions of brands with strong online engagement.

The enduring appeal of nostalgic candy presents a significant opportunity for Tootsie Roll. By emphasizing its heritage through marketing campaigns and limited-edition retro products, the company can connect with consumers on an emotional level. This strategy can attract both loyal customers and new demographics interested in vintage products, capitalizing on the continued growth in nostalgic market segments within the broader confectionery industry.

Threats

The confectionery market is a crowded space, with giants like Mars and Hershey dominating, alongside a growing number of specialized brands. This fierce rivalry creates constant pressure on pricing and necessitates significant investment in marketing and promotions to stand out.

For Tootsie Roll Industries, this means navigating challenges in securing prime shelf space and fending off competitors who may have larger marketing budgets. In 2024, the global confectionery market was valued at approximately $230 billion, highlighting the scale of competition Tootsie Roll faces.

Growing consumer awareness around health and wellness, particularly a desire for reduced sugar and more natural ingredients, presents a considerable challenge for traditional candy makers like Tootsie Roll Industries. The confectionery market saw a 2.1% growth in 2023, reaching $43.7 billion in the US, but this growth is increasingly driven by healthier options.

If Tootsie Roll Industries fails to innovate and introduce products that align with these evolving consumer tastes, such as lower-sugar formulations or items featuring natural sweeteners and flavors, it risks alienating a significant portion of the market. This could directly impact sales volume and market share as consumers opt for perceived healthier alternatives.

Tootsie Roll Industries faces significant threats from the ongoing volatility in raw material costs. For instance, cocoa prices, a key ingredient, have seen substantial increases, with futures for delivery in late 2024 and early 2025 trading at historically high levels, impacting confectionery producers globally.

Supply chain disruptions remain a persistent concern. Factors like shipping container availability and port congestion, which were prominent in 2022-2023, continue to pose risks, potentially leading to shortages of essential ingredients or delays in getting finished products to market.

Economic Downturns and Reduced Discretionary Spending

Economic instability, including inflation and potential downturns, poses a significant threat to Tootsie Roll Industries. When the economy falters, consumers tend to cut back on non-essential purchases, and candy often falls into this category. This could directly impact Tootsie Roll's sales volumes and overall profitability.

The sensitivity of consumers to price increases was evident in 2024, with observed market resistance. This suggests that as inflation persists or economic conditions worsen, Tootsie Roll may struggle to pass on rising costs without alienating price-conscious buyers, further squeezing margins.

- Reduced Consumer Purchasing Power: Consumers may shift spending from confectionery to essential goods during economic hardship.

- Lower Sales Volumes: A decline in discretionary spending directly translates to fewer units of candy sold.

- Profitability Squeeze: The inability to fully offset increased production costs through higher prices can erode profit margins.

Regulatory Changes and Increased Scrutiny on Sugar Content

Potential shifts in food labeling laws and increased government focus on sugar content and marketing to children represent a significant threat. For instance, the U.S. Food and Drug Administration (FDA) continues to evaluate front-of-package nutrition labeling systems, which could highlight sugar content more prominently, impacting consumer perception of products like Tootsie Roll.

Governments worldwide are increasingly considering or implementing sugar taxes. The United Kingdom's sugar tax, introduced in 2018, has already led to reformulation efforts by many beverage companies, demonstrating the potential impact on the broader food industry. Such measures could increase Tootsie Roll Industries' operational costs and necessitate product adjustments.

Stricter advertising regulations, particularly those targeting marketing to children, could limit promotional activities and reach, a critical aspect for confectionery brands. For example, countries like Sweden have stringent rules on advertising directed at children, which could serve as a model for future regulations elsewhere.

- Heightened scrutiny on sugar content may lead to mandatory front-of-package labeling highlighting sugar levels.

- The potential for sugar taxes in key markets could increase production costs and affect pricing strategies.

- Stricter regulations on marketing to children could limit promotional reach and brand engagement with younger demographics.

- Product reformulation to reduce sugar content might be required, impacting taste profiles and consumer acceptance.

Tootsie Roll Industries faces intense competition from larger players with greater marketing resources, a challenge amplified in the $230 billion global confectionery market in 2024. Shifting consumer preferences towards healthier options, with the US market growing 2.1% in 2023 to $43.7 billion but favoring reduced sugar, presents a significant hurdle for traditional candy products.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including Tootsie Roll Industries' official financial statements, detailed market research reports, and insights from industry experts. These sources provide a robust understanding of the company's performance and its operating environment.