Tootsie Roll Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tootsie Roll Industries Bundle

Tootsie Roll Industries navigates a confectionery landscape shaped by intense rivalry and the ever-present threat of substitutes. Understanding the bargaining power of buyers and suppliers is crucial for its sustained success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Tootsie Roll Industries’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The confectionery sector leans on essential inputs such as sugar, corn syrup, and cocoa, all susceptible to market price swings. Tootsie Roll Industries, like its peers, can encounter supplier leverage when particular, high-grade components are in short supply or are highly specialized. For example, cocoa bean prices experienced a notable surge in early 2024, with futures contracts reaching record highs, directly impacting manufacturing expenses throughout the sector.

While Tootsie Roll can likely find multiple suppliers for basic ingredients like sugar or corn syrup, the cost and complexity of switching increase significantly if they rely on specialized suppliers for proprietary flavorings or unique packaging materials. These specialized inputs, crucial for maintaining the brand's consistent taste and appearance, represent a higher switching cost.

Tootsie Roll's commitment to its iconic, long-standing recipes means that any disruption to taste or quality from a new supplier could be detrimental. This brand loyalty and focus on consistency inherently raise the barrier to switching, as the risk of product alteration is a major concern.

In 2024, many food manufacturers are actively exploring diversified sourcing to buffer against ingredient price volatility and ensure supply chain resilience. For Tootsie Roll, this might involve identifying and qualifying secondary suppliers for key components, even if it requires an initial investment in testing and integration.

The threat of forward integration by suppliers for Tootsie Roll Industries is generally low within the confectionery sector. Raw material suppliers venturing into candy manufacturing would face substantial capital outlays for production facilities and the considerable challenge of establishing a recognized brand, a hurdle most agricultural commodity producers are ill-equipped to overcome.

Suppliers of key ingredients like sugar, corn syrup, or cocoa typically operate with a focus on bulk production and distribution, lacking the specialized consumer market knowledge and extensive distribution networks essential for direct competition in the branded candy market. Their business model is rooted in providing raw materials, not in consumer-facing product development and marketing.

Importance of Volume to Suppliers

Tootsie Roll Industries' significant operational scale, particularly its widespread manufacturing and sales of confectionery products throughout North America, directly impacts its bargaining power with suppliers. The sheer volume of raw materials and packaging components required by a company of Tootsie Roll's magnitude grants it considerable leverage. This substantial purchasing power often translates into more favorable pricing and contract terms as suppliers seek to secure consistent, large-volume business.

Suppliers to Tootsie Roll Industries often depend on the consistent demand generated by the company's extensive product lines. For instance, in 2024, the confectionery market saw continued demand for established brands, benefiting large players like Tootsie Roll. This reliance means suppliers are often willing to negotiate better terms to maintain these valuable relationships.

- Volume Advantage: Tootsie Roll's large-scale operations necessitate significant raw material purchases, providing a strong negotiating position.

- Supplier Dependence: Many suppliers rely on the consistent orders from major confectionery manufacturers like Tootsie Roll for a substantial portion of their revenue.

- Favorable Terms: This dependence allows Tootsie Roll to secure more competitive pricing and favorable payment and delivery terms.

- Market Stability: The stable demand for Tootsie Roll's products in 2024 reinforces the suppliers' need to maintain a strong relationship, further enhancing Tootsie Roll's leverage.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier power for Tootsie Roll Industries. For common ingredients like sugar, the global market offers numerous suppliers, which naturally reduces the leverage any single supplier holds. This abundance of options means Tootsie Roll can often source these basic commodities from various producers, keeping prices competitive.

However, the situation changes for more specialized ingredients. If Tootsie Roll relies on specific types of cocoa beans or unique flavorings that are not widely available or have limited producers, those suppliers gain more bargaining power. The less accessible the substitute, the stronger the supplier's position becomes.

The confectionery industry, including companies like Tootsie Roll, is increasingly focused on ingredient innovation and sourcing. This is driven by factors such as fluctuating commodity prices and evolving consumer preferences towards healthier options. For instance, the exploration of alternative sweeteners or plant-based ingredients could introduce new supply chains and potentially mitigate the power of traditional suppliers.

- Broadly available commodities like sugar have many global sources, limiting supplier leverage for Tootsie Roll.

- Specialized ingredients, such as unique cocoa varieties or proprietary flavorings, may have fewer substitutes, increasing supplier bargaining power.

- The confectionery sector's ongoing research into alternative ingredients, driven by cost and health trends, could reshape supplier dynamics.

The bargaining power of suppliers for Tootsie Roll Industries is generally moderate, influenced by the type of input. For common ingredients like sugar and corn syrup, the market is competitive with numerous suppliers, limiting individual supplier leverage. However, for specialized ingredients or unique packaging, where fewer suppliers exist, their bargaining power increases.

Tootsie Roll's significant purchasing volume provides considerable leverage, especially for commodity ingredients. Suppliers often depend on the consistent demand from large manufacturers like Tootsie Roll, making them more amenable to favorable pricing and terms. For example, in 2024, the confectionery sector continued to see stable demand for established brands, reinforcing this dynamic.

| Ingredient Type | Supplier Bargaining Power | Factors Influencing Power |

|---|---|---|

| Commodity Ingredients (Sugar, Corn Syrup) | Low to Moderate | Numerous global suppliers, high substitutability, Tootsie Roll's large volume purchases. |

| Specialized Ingredients (Unique Flavors, Cocoa Varieties) | Moderate to High | Limited suppliers, higher switching costs, potential impact on product consistency. |

| Packaging Materials | Moderate | Depends on customization and supplier specialization; large order volumes offer some leverage. |

What is included in the product

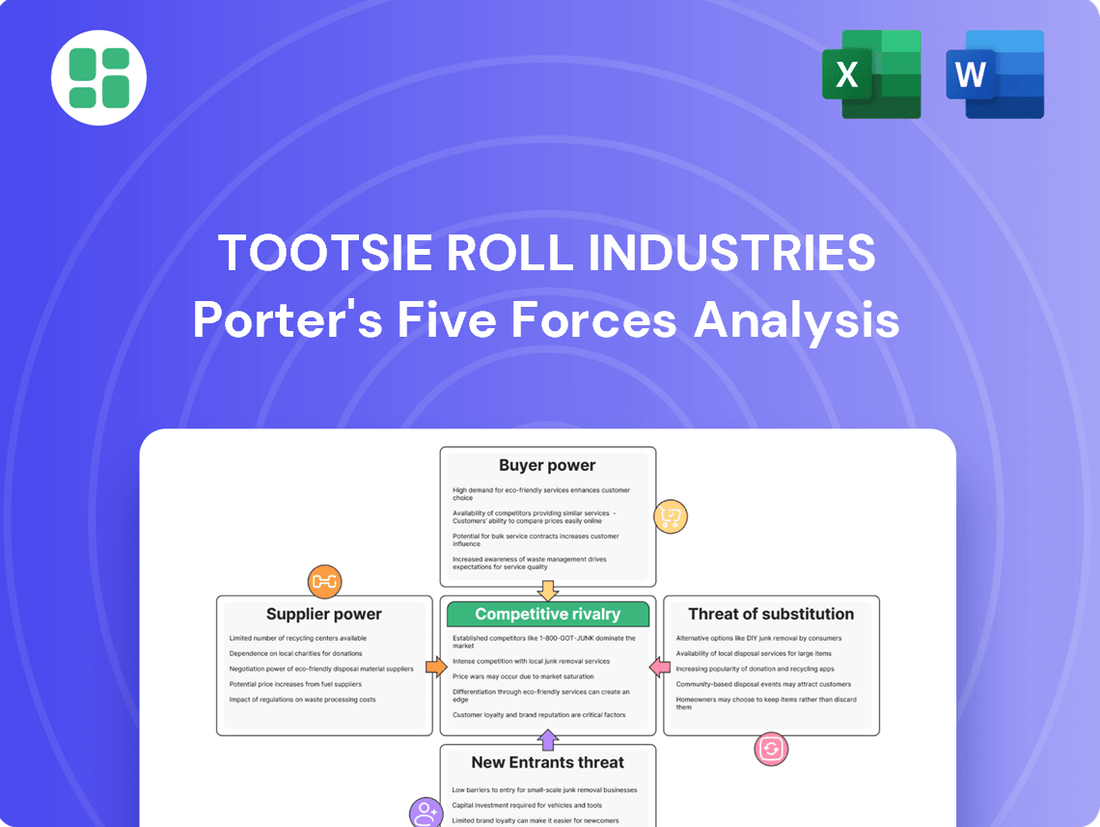

Analyzes the competitive forces impacting Tootsie Roll Industries, including the threat of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry within the confectionery market.

Instantly identify competitive pressures with a visual breakdown of Tootsie Roll's industry landscape, streamlining strategic planning.

Customers Bargaining Power

Tootsie Roll Industries navigates a complex distribution landscape, relying on wholesale distributors, major supermarket chains, variety stores, dollar stores, and online retailers. This broad reach, while beneficial, also highlights a critical aspect of customer power.

The significant reliance on key accounts is evident, with Walmart alone representing about 23.2% of Tootsie Roll's net product sales in 2024. Such customer concentration inherently grants major retailers substantial bargaining power, allowing them to potentially negotiate more favorable terms, pricing, or promotional support.

Customers in the confectionery market, including those purchasing Tootsie Roll products, face an abundance of choices. The sheer volume of available substitutes means consumers can readily switch brands if Tootsie Roll's pricing or product offerings don't align with their expectations.

The United States confectionery market is notably saturated, with a multitude of competitors vying for consumer attention. This competitive landscape, featuring numerous brands and product types, significantly amplifies the bargaining power of customers.

For instance, in 2023, the US confectionery market generated approximately $48 billion in sales, highlighting the intense competition and the wide array of options available to consumers, which directly impacts Tootsie Roll's pricing power.

In 2024, consumers demonstrated heightened price sensitivity, a trend driven by persistent inflationary pressures. This meant that even for indulgent items like confectionery, shoppers actively sought out better value, influencing their purchasing decisions.

Retailers, grappling with their own squeezed profit margins, often translated this customer price sensitivity directly to their suppliers. Consequently, manufacturers like Tootsie Roll Industries faced increased pressure to offer competitive pricing to maintain shelf space and sales volume.

This dynamic also contributed to a shift in consumer shopping habits, with a noticeable increase in purchases from club stores and dollar stores, which are perceived as offering greater value for money, further intensifying the bargaining power of customers.

Switching Costs for Customers

For retailers and distributors, the ease of switching candy suppliers presents a significant factor in their bargaining power. Generally, the costs associated with changing from one confectionery manufacturer to another are quite low. This is because the market is populated by a vast number of alternative candy producers, making it simple for retailers to find substitutes.

Despite Tootsie Roll Industries' well-established brand recognition, retailers possess considerable leverage. They can readily incorporate competing candy products into their inventory, which naturally enhances their negotiating position. This accessibility to a wide array of alternatives means retailers are not heavily reliant on any single supplier.

Consumers also experience minimal friction when deciding between different candy brands. The low switching costs for end consumers mean that brand loyalty can be challenged by readily available alternatives, further empowering the customer segment in the confectionery market.

In 2024, the confectionery market continued to be highly competitive, with numerous brands vying for shelf space and consumer attention. For instance, the global confectionery market was projected to reach over $230 billion by 2024, indicating a vast landscape of options for both distributors and consumers.

- Low Switching Costs for Retailers: The ability to easily source from numerous alternative confectionery manufacturers minimizes the financial and operational burden of switching suppliers.

- Brand Recognition vs. Retailer Leverage: While Tootsie Roll benefits from strong brand awareness, retailers can easily dilute this by stocking a variety of competing brands, thereby increasing their bargaining power.

- Consumer Choice: Consumers face negligible costs when choosing between different candy products, allowing them to readily switch brands based on price, promotion, or availability.

- Market Competitiveness: The sheer volume of competitors in the confectionery sector, with a global market size exceeding $230 billion in 2024, underscores the significant bargaining power held by customers due to abundant choices.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Tootsie Roll Industries is a nuanced concern. While large retailers, like Walmart or Target, possess the scale to potentially develop their own private-label confectionery products, the intricate nature of candy manufacturing, coupled with the significant investment in brand building and stringent quality control, makes complete backward integration into complex, established product lines like Tootsie Roll's less frequent.

However, this dynamic is evolving. The growing consumer acceptance and preference for private-label chocolate products, as evidenced by market trends, signals an increasing potential threat for manufacturers. For instance, in 2023, private-label brands captured a notable share of the U.S. chocolate market, indicating a shift in consumer purchasing habits that could encourage retailers to explore further private-label expansion.

- Retailer Scale: Major retailers have the financial resources and distribution networks to launch private-label confectionery.

- Manufacturing Complexity: Developing and consistently producing high-quality, diverse candy lines requires specialized expertise and significant capital investment, acting as a barrier to full integration for many retailers.

- Brand Building: Tootsie Roll has cultivated a strong brand identity over decades, which is difficult and costly for retailers to replicate with private labels.

- Consumer Trends: A rising willingness among consumers to purchase private-label chocolate suggests a growing opportunity for retailers to leverage this trend, potentially increasing pressure on established brands.

Tootsie Roll Industries faces significant customer bargaining power due to the vast array of confectionery choices available and low switching costs for both consumers and retailers. The market's saturation, with the US confectionery market valued at approximately $48 billion in 2023, means customers can easily opt for competitors if prices or offerings are not appealing.

Retailers, who are key customers for Tootsie Roll, hold substantial leverage. This is amplified by their ability to easily substitute suppliers and the growing consumer acceptance of private-label brands, which in 2023 captured a notable share of the U.S. chocolate market. The concentration of sales, with Walmart accounting for 23.2% of Tootsie Roll's 2024 net product sales, further empowers major retail accounts.

| Factor | Impact on Tootsie Roll | Supporting Data (2023/2024) |

| Consumer Choice & Substitutes | High bargaining power due to abundant alternatives | US Confectionery Market: ~$48 billion (2023) |

| Retailer Concentration | Major retailers (e.g., Walmart) wield significant negotiation power | Walmart sales share: 23.2% of net product sales (2024) |

| Switching Costs (Retailer) | Low, as sourcing from alternative manufacturers is easy | N/A (inherent market structure) |

| Private Label Growth | Potential threat as consumers increasingly accept private labels | Private labels gained notable share in US chocolate market (2023) |

Preview the Actual Deliverable

Tootsie Roll Industries Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Tootsie Roll Industries' Porter's Five Forces Analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the confectionery market. This comprehensive analysis provides actionable insights into the competitive landscape Tootsie Roll operates within.

Rivalry Among Competitors

The confectionery market is a crowded arena, with giants like Hershey's, Mars, Mondelez, and Ferrero holding significant sway. Tootsie Roll Industries navigates this intensely competitive environment, facing off against these global powerhouses as well as a multitude of smaller, specialized brands. This sheer volume of competitors fuels a constant battle for consumer attention and market share.

The global confectionery market is expected to expand at a compound annual growth rate of 5.4% between 2024 and 2029. In the United States, this market was valued at $83.54 billion in 2024, with a projected annual growth of 5.27% over the same period. This steady growth, while positive, isn't so rapid that it significantly dampens the rivalry among existing players.

Despite the expanding market size, companies within the confectionery sector continue to actively compete for market share. The growth rate, though healthy, is characteristic of a mature industry where innovation and strategic maneuvering are crucial for gaining an edge. This dynamic means that competitive pressures remain a significant factor for businesses like Tootsie Roll Industries.

Tootsie Roll Industries benefits from strong brand loyalty built around nostalgic products like Tootsie Rolls and Tootsie Pops. This emotional connection with consumers is a significant advantage. For example, Tootsie Roll’s net sales reached $674.5 million in 2023, demonstrating sustained consumer demand.

However, the competitive landscape is intense, with rivals actively differentiating through flavor variety, healthier alternatives, and premium offerings. Confectionery giants consistently invest in marketing and new product development, posing a constant challenge to Tootsie Roll's market share. This requires Tootsie Roll to remain agile and innovative to keep pace.

Switching Costs for Consumers

Consumer switching costs in the confectionery market are typically quite low. This means customers can easily move from one candy brand to another if they find a better deal, a new flavor they prefer, or if their usual choice isn't available. For companies like Tootsie Roll Industries, this low switching cost directly fuels intense competition among brands.

The ease with which consumers can switch brands forces confectionery companies to continuously innovate and offer attractive value propositions. This often involves competitive pricing strategies, exciting new product introductions, and effective marketing campaigns. For instance, in 2024, the confectionery market continued to see significant promotional activity, with brands leveraging digital channels and social media to highlight new offerings and engage consumers, further lowering the barrier to switching.

- Low Switching Costs: Consumers can readily opt for alternative candy brands based on price, taste, or accessibility.

- Intensified Rivalry: This ease of switching compels companies to constantly compete on product appeal and value.

- Influence of Promotions and Social Media: Marketing efforts, including discounts and viral product trends on platforms like TikTok, significantly sway consumer purchasing decisions in 2024.

Exit Barriers

Exit barriers in the confectionery sector, including for companies like Tootsie Roll Industries, are notably elevated. This is largely due to the substantial capital tied up in specialized manufacturing equipment and dedicated production facilities, which have limited alternative uses. For instance, a plant designed for specific candy production lines cannot easily be repurposed for other manufacturing processes without significant and costly modifications.

Furthermore, the established and often extensive distribution networks that confectionery companies build over years represent another significant exit barrier. Severing these relationships and liquidating these networks can incur substantial losses. In 2024, the confectionery market continued to see consolidation, but companies with deeply entrenched distribution channels, like those Tootsie Roll has cultivated, find it economically challenging to divest these assets without significant write-downs.

- Specialized Assets: High investment in candy-making machinery and production lines.

- Capital Investment: Significant upfront costs for plants and equipment.

- Distribution Networks: Established relationships with retailers and wholesalers are hard to exit.

- Fixed Costs: Ongoing costs associated with maintaining facilities and operations, even during a potential exit.

The competitive rivalry within the confectionery industry is fierce, with Tootsie Roll Industries facing off against major global players like Hershey's and Mars, alongside numerous smaller brands. This crowded market necessitates constant innovation and strategic marketing to capture consumer attention and maintain market share.

The global confectionery market is projected to grow at a CAGR of 5.4% from 2024 to 2029, with the U.S. market valued at $83.54 billion in 2024 and expected to grow at 5.27% annually. While this growth is positive, it occurs within a mature industry where competition remains intense, forcing companies to differentiate through new products and value propositions.

Tootsie Roll's strong brand loyalty, evidenced by $674.5 million in net sales in 2023, provides a buffer. However, rivals are actively introducing new flavors, healthier options, and premium products, supported by substantial marketing investments. This environment, coupled with low consumer switching costs, means companies must continually engage consumers through promotions and digital channels to retain their customer base.

| Competitor | Market Share (Approx. 2024) | Key Strengths |

|---|---|---|

| Hershey's | ~20% (US) | Brand recognition, diverse product portfolio, strong distribution |

| Mars | ~15% (US) | Global presence, iconic brands, innovation in product development |

| Mondelez | ~10% (US) | International reach, strong snack portfolio, strategic acquisitions |

| Tootsie Roll Industries | ~2-3% (US) | Nostalgic brands, loyal customer base, efficient operations |

SSubstitutes Threaten

The threat of substitutes for Tootsie Roll Industries' confectionery products is significant, stemming from a wide array of snack categories. Consumers are increasingly looking beyond traditional candy to options like healthier snacks, baked goods, and other indulgent treats that might offer perceived better value or functional benefits, such as high protein or plant-based ingredients.

The threat of substitutes for Tootsie Roll Industries is influenced by a significant shift in consumer preferences towards health and wellness. In 2024, a third of consumers worldwide reported increasing their intake of healthy snacks. This trend directly impacts traditional confectionery by making consumers more open to alternatives.

Consumers are increasingly seeking out options like vegan protein bars, organic fruit snacks, and other treats that offer reduced sugar or added nutritional benefits. This growing demand for healthier alternatives presents a tangible substitute for Tootsie Roll's core product offerings, potentially diverting sales from traditional candy.

The confectionery market faces significant pressure from a wide array of substitutes. Healthy snack options, such as fruit bars, nuts, and yogurt, are readily available in the same retail environments where Tootsie Roll products are sold, including supermarkets and convenience stores. In 2024, the global healthy snacks market was valued at approximately $130 billion, demonstrating a substantial consumer shift towards healthier alternatives.

Differentiation of Substitutes

The threat of substitutes for Tootsie Roll Industries is growing as alternatives become more appealing. These substitutes are differentiating themselves not only on health aspects but also through exciting new flavors, varied textures, and eco-friendly packaging, all designed to capture changing consumer tastes. For instance, the global healthy snacks market, which includes many potential substitutes, was valued at approximately $115.1 billion in 2023 and is projected to grow significantly, indicating a strong competitive landscape.

Brands are actively focusing on key consumer demands like clean labels, which means fewer artificial ingredients, and ethical sourcing, ensuring products are made responsibly. This shift is creating compelling alternatives to traditional candy options. In 2024, consumer demand for transparency in food sourcing and ingredient lists continues to rise, with many shoppers actively seeking out products that align with their values.

- Evolving Consumer Preferences: Consumers are increasingly drawn to products offering health benefits, innovative flavors, and sustainable packaging, directly impacting traditional confectionery like Tootsie Rolls.

- Clean Labels and Ethical Sourcing: Brands emphasizing clean ingredient lists and responsible sourcing are gaining traction, presenting a significant alternative for health-conscious and ethically-minded consumers.

- Market Growth in Alternatives: The expanding healthy snacks market, projected for robust growth, highlights the increasing availability and consumer acceptance of substitutes for traditional candy.

- Product Innovation: Unique product formats and flavor profiles in the substitute market offer a dynamic competitive edge, challenging the established appeal of long-standing confectionery brands.

Impact of Health Trends and Regulations

The increasing consumer focus on health and wellness is a significant driver for the threat of substitutes in the confectionery market. This trend encourages consumers to seek out alternatives perceived as healthier, directly impacting demand for traditional candies like those produced by Tootsie Roll Industries.

Potential for stricter government regulations concerning sugar content, artificial ingredients, and clear labeling further amplifies this threat. Companies may face pressure to reformulate products or invest in healthier product lines to align with evolving consumer preferences and regulatory landscapes.

- Health-Conscious Consumers: A growing segment of the population actively seeks out snacks with lower sugar, natural ingredients, and functional health benefits, diverting spending from traditional confectionery.

- Regulatory Scrutiny: Anticipated or implemented regulations on sugar content and labeling can make existing products less appealing or require costly reformulation, increasing the attractiveness of compliant substitutes.

- Innovation in Alternatives: The market is seeing a rise in innovative snack options, including fruit-based snacks, protein bars, and sugar-free confectionery, all of which directly compete with traditional candy offerings.

The threat of substitutes for Tootsie Roll Industries' products is substantial, driven by evolving consumer preferences for healthier options and a broader snack market. In 2024, the global healthy snacks market reached an estimated $130 billion, showcasing a significant shift away from traditional confectionery.

Consumers are increasingly choosing alternatives like fruit snacks, nuts, and protein bars, which offer perceived health benefits and cater to dietary trends such as plant-based or low-sugar diets. This trend is further fueled by a demand for transparency in ingredients and ethical sourcing, making products with clean labels more appealing.

The competitive landscape is also shaped by innovation in product formats and flavors within the substitute category, directly challenging the established appeal of classic candies. Potential regulatory changes regarding sugar content and labeling could also increase the attractiveness of compliant alternative snacks.

| Substitute Category | Key Differentiators | Market Trend Relevance (2024) |

|---|---|---|

| Healthy Snacks (Fruit, Nuts, Bars) | Lower sugar, natural ingredients, functional benefits | Market valued at ~$130 billion globally |

| Baked Goods & Other Indulgences | New flavors, varied textures, perceived value | Growing consumer interest in premium and artisanal options |

| Plant-Based & Vegan Alternatives | Ethical sourcing, dietary alignment | Significant growth in vegan product adoption |

| Sugar-Free Confectionery | Reduced sugar content, dietary compliance | Increasing demand due to health awareness |

Entrants Threaten

The confectionery industry demands significant upfront capital for sophisticated manufacturing equipment, large-scale production facilities, and substantial raw material inventory. For example, establishing a modern, efficient candy production line can easily cost millions of dollars, a figure that deters many potential new players. Tootsie Roll Industries, with its decades of operational experience and existing infrastructure, possesses a considerable advantage due to these high capital requirements, creating a formidable barrier for emerging competitors seeking to enter the market at a comparable scale.

Tootsie Roll Industries, like many established confectionery manufacturers, benefits from substantial economies of scale. This means they can produce their iconic candies at a much lower cost per unit compared to a newcomer. For instance, their massive production volumes allow for bulk purchasing of raw materials like sugar and cocoa, securing better prices and reducing input costs.

A new company entering the candy market would face immense difficulty matching these cost efficiencies. They would likely have to purchase smaller quantities of ingredients at higher prices and invest heavily in production facilities without the immediate benefit of high-volume output. This initial cost disadvantage makes it harder for new entrants to compete on price with established players like Tootsie Roll.

Tootsie Roll Industries benefits from deeply ingrained brand loyalty, a significant barrier for potential new entrants. The company's iconic brands, like the Tootsie Roll itself, have been around for generations, fostering a strong emotional connection with consumers. This established trust means newcomers must invest heavily in marketing and product development to even begin to chip away at Tootsie Roll's market presence.

Access to Distribution Channels

Tootsie Roll Industries benefits from deeply entrenched distribution channels across wholesale, retail, and vending machine operators throughout the US, Canada, and Mexico. These established networks represent a substantial barrier to entry for any new confectionery company attempting to gain shelf space or market presence.

The cost and effort required to build comparable relationships with retailers and distributors are immense, making it difficult for newcomers to compete effectively. For instance, in 2023, Tootsie Roll's extensive product placement in over 400,000 retail locations underscored the scale of its distribution advantage.

- Established Networks: Tootsie Roll's long-standing relationships with thousands of distributors and retailers are a significant hurdle for new entrants.

- Vending Machine Dominance: The company's strong presence in vending machine operations, a key channel for impulse buys, is hard to replicate.

- Geographic Reach: Access to established channels in the US, Canada, and Mexico provides a broad market penetration that new companies would struggle to achieve quickly.

Regulatory Hurdles and Food Safety Standards

The confectionery sector, like much of food manufacturing, faces significant regulatory scrutiny. New companies must comply with extensive food safety regulations, rigorous quality control protocols, and detailed labeling mandates. For instance, the U.S. Food and Drug Administration (FDA) oversees many of these requirements, ensuring product safety and accurate consumer information.

Navigating this complex web of regulations presents a substantial barrier for potential new entrants. The costs associated with ensuring compliance, from product development to manufacturing processes and packaging, can be considerable. This adds a layer of difficulty and expense to market entry, potentially deterring smaller or less-resourced competitors.

- Regulatory Compliance Costs: Significant investment is required to meet FDA, USDA, and other relevant agency standards.

- Quality Control Investment: Implementing robust quality assurance systems is essential and costly.

- Labeling Requirements: Accurate ingredient lists, nutritional information, and allergen warnings add complexity and potential for error.

The threat of new entrants into the confectionery market, while present, is significantly mitigated by several factors for Tootsie Roll Industries. High capital requirements for manufacturing, established brand loyalty, and extensive distribution networks create substantial barriers. Additionally, navigating complex regulatory landscapes adds further cost and complexity for any aspiring competitor, making it challenging to challenge established players like Tootsie Roll.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Millions needed for production facilities and equipment. | Deters smaller or less-funded ventures. |

| Brand Loyalty | Generations of consumer trust in iconic brands. | Requires extensive marketing to build comparable recognition. |

| Distribution Channels | Access to over 400,000 retail locations (as of 2023). | Difficult and costly for newcomers to replicate extensive shelf space. |

| Regulatory Compliance | Adherence to food safety and labeling standards. | Increases operational costs and time-to-market. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tootsie Roll Industries is built upon a foundation of publicly available financial statements, annual reports (10-K filings), and industry-specific market research reports from reputable sources like IBISWorld and Statista.