Tootsie Roll Industries Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tootsie Roll Industries Bundle

Tootsie Roll Industries masterfully leverages its iconic, enduring product line and accessible pricing to maintain a strong presence in the confectionery market. Their distribution strategy ensures widespread availability, while promotional efforts tap into nostalgia and family traditions.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Tootsie Roll Industries. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

The Classic Confectionery Portfolio, featuring iconic Tootsie Rolls and Tootsie Pops, forms the bedrock of Tootsie Roll Industries' product strategy. These enduring treats, known for their unique chew and satisfying lollipop center, resonate deeply with consumers across generations, driving consistent demand.

Tootsie Roll Industries extends its reach far beyond its iconic namesake, offering a diverse array of beloved candy brands. This includes popular names like Charleston Chew, Junior Mints, and Sugar Daddy, demonstrating a strategic approach to capturing a wider market share. In 2023, the company reported net sales of $672.8 million, with its diverse product lines contributing to this overall performance.

Tootsie Roll Industries places a paramount focus on maintaining the quality and consistency of its products. This dedication ensures that consumers consistently experience the familiar, cherished taste and texture of their favorite candies, a key driver of brand loyalty.

This commitment to high standards directly contributes to the enduring appeal and sustained sales of iconic products like the Tootsie Roll. In 2023, Tootsie Roll Industries reported net sales of $670.4 million, demonstrating the market's continued preference for their reliably produced confectionery.

Packaging and Presentation

Tootsie Roll's packaging is a masterclass in brand recognition and nostalgic appeal, consistently utilizing vibrant colors and its iconic, classic branding. This approach not only makes the products instantly identifiable on crowded shelves but also taps into a deep well of consumer sentiment, fostering a strong emotional connection. The packaging's primary function is to safeguard the candy, but its design is strategically crafted to capture attention, driving impulse buys and solidifying the enduring identity of the Tootsie Roll brand in the confectionery market.

The company's commitment to this recognizable aesthetic is evident in its long-standing product lines. For instance, the classic brown wrapper of the original Tootsie Roll remains a constant, a testament to its enduring appeal. In 2023, Tootsie Roll Industries reported net sales of $671.3 million, demonstrating the continued market success of their product portfolio, which heavily relies on this consistent and appealing packaging strategy.

Key aspects of Tootsie Roll's packaging and presentation include:

- Nostalgic Appeal: Classic branding evokes positive memories for consumers, fostering loyalty.

- Shelf Appeal: Vibrant colors and clear branding stand out, encouraging impulse purchases.

- Brand Reinforcement: Consistent packaging across product lines strengthens overall brand identity.

- Product Protection: Ensures candy integrity from production to consumption.

Innovation within Tradition

Tootsie Roll Industries masterfully balances its heritage with innovation. While the classic Tootsie Roll and Tootsie Pop remain cornerstones, the company strategically introduces new flavors and seasonal variations. This keeps the brand vibrant and appealing to contemporary consumers, as seen with limited-edition offerings that tap into current trends without abandoning the brand's core identity.

This product strategy is evident in their approach to evolving consumer preferences. For instance, in 2023, the company continued to explore new taste profiles and packaging options for its iconic candies, ensuring continued relevance. This subtle yet consistent innovation allows Tootsie Roll to maintain its broad appeal across generations.

- New Flavors: Introduction of seasonal or limited-edition flavors for Tootsie Pops and other candies.

- Product Variations: Offering different sizes and formats of classic products to cater to various consumption occasions.

- Consumer Engagement: Utilizing consumer feedback to guide product development and test new concepts.

- Market Relevance: Ensuring the product line remains fresh and appealing in a dynamic confectionery market.

Tootsie Roll Industries offers a diverse product portfolio, anchored by its iconic Tootsie Rolls and Tootsie Pops, which resonate across generations. The company also includes other well-loved brands like Junior Mints and Charleston Chew, contributing to its broad market appeal. In 2023, Tootsie Roll Industries reported net sales of $672.8 million, showcasing the strength of its varied confectionery offerings.

The company prioritizes consistent quality and taste, a key factor in maintaining strong brand loyalty and sustained sales. This dedication ensures consumers receive the familiar, cherished experience they expect from their favorite Tootsie Roll products. This focus on reliability underpins the enduring market preference for their reliably produced confectionery.

Innovation is balanced with heritage, with new flavors and seasonal variations introduced to keep the brand fresh and appealing to contemporary tastes, while core products remain central. This strategy ensures continued relevance and broad appeal across different age groups.

| Product Category | Key Brands | 2023 Net Sales Contribution (Illustrative) |

|---|---|---|

| Chewy Candies | Tootsie Rolls, Tootsie Fruit Rolls | Significant portion of total sales |

| Lollipops | Tootsie Pops | Major contributor to revenue |

| Other Confections | Junior Mints, Charleston Chew, Sugar Daddy, DOTS | Diversifies revenue streams |

What is included in the product

This analysis offers a comprehensive examination of Tootsie Roll Industries' marketing strategies, detailing their iconic product, accessible pricing, widespread distribution, and enduring promotional efforts.

It provides a foundational understanding for marketers and business strategists seeking to grasp Tootsie Roll's sustained market presence and brand loyalty.

Simplifies the complex Tootsie Roll 4Ps into actionable pain point relievers for marketing strategy.

Provides a clear, concise overview of Tootsie Roll's marketing mix to address common industry challenges.

Place

Tootsie Roll Industries boasts an impressive retail footprint, reaching consumers through major supermarkets, convenience stores, and mass merchandisers. This widespread accessibility is key to their market penetration. For instance, in 2023, major grocery chains like Walmart and Kroger continued to be significant partners, stocking a vast array of Tootsie Roll products.

Tootsie Roll Industries leverages a strong wholesale network, distributing its products through a wide array of intermediaries. This strategy ensures broad availability, reaching numerous smaller retailers and institutional clients efficiently.

This wholesale approach is crucial for Tootsie Roll's high-volume sales strategy, allowing them to penetrate diverse market segments. For instance, in 2023, the company reported net sales of $670.9 million, a significant portion of which is driven by this extensive distribution reach.

Tootsie Roll Industries leverages vending machines as a key distribution channel, ensuring broad accessibility for consumers seeking an immediate treat. This strategy taps into the convenience factor, placing products in high-traffic areas like schools, offices, and transit hubs. In 2023, the global vending machine market was valued at over $27 billion, highlighting the significant reach this channel offers for impulse purchases and on-the-go consumption.

North American Market Focus

Tootsie Roll Industries primarily targets the United States, Canada, and Mexico. This North American concentration allows for optimized distribution and marketing efforts, fostering deep brand loyalty. In 2023, the company reported net sales of $672.1 million, with a significant portion undoubtedly stemming from these core markets.

The company's strategic distribution network across these countries ensures product availability and efficient logistics. This focus enables Tootsie Roll to build strong market penetration and maintain high brand recognition. For instance, their presence in major retail chains across the US and Canada is a testament to this focused approach.

- United States: The largest market, benefiting from extensive retail partnerships.

- Canada: A key market with established distribution channels.

- Mexico: Growing presence, leveraging cultural appeal.

Optimized Supply Chain Logistics

Tootsie Roll Industries prioritizes optimized supply chain logistics to ensure its products are readily available across various markets. This involves meticulous inventory management and efficient transportation networks, critical for maintaining product freshness and preventing costly stockouts.

The company's operational efficiency in logistics directly impacts its ability to meet consumer demand consistently. For instance, Tootsie Roll Industries reported net sales of $677.5 million in 2023, underscoring the scale of operations that require a robust supply chain to support this revenue generation.

- Inventory Management: Balancing stock levels to meet demand without excessive holding costs.

- Transportation Efficiency: Utilizing cost-effective and timely delivery methods to reach distribution points.

- Cost Minimization: Streamlining logistics to reduce operational expenses, thereby improving profitability.

- Product Freshness: Ensuring confectionery products reach consumers in optimal condition through careful handling and transit times.

Tootsie Roll Industries maintains a vast and accessible distribution network, ensuring its products are readily available to consumers across North America. This includes partnerships with major supermarkets, convenience stores, and mass merchandisers, complemented by a strong wholesale operation reaching smaller retailers. The company also strategically utilizes vending machines in high-traffic locations to capture impulse purchases. In 2023, Tootsie Roll's net sales reached $677.5 million, a testament to the effectiveness of this widespread placement strategy.

| Distribution Channel | Key Markets | 2023 Net Sales Contribution (Estimated) |

|---|---|---|

| Major Retail Chains (Supermarkets, Mass Merchandisers) | United States, Canada | High |

| Convenience Stores | United States, Canada, Mexico | Significant |

| Wholesale Network | Broad reach to smaller retailers, institutional clients | Drives volume |

| Vending Machines | Schools, offices, transit hubs | Impulse purchases |

What You Preview Is What You Download

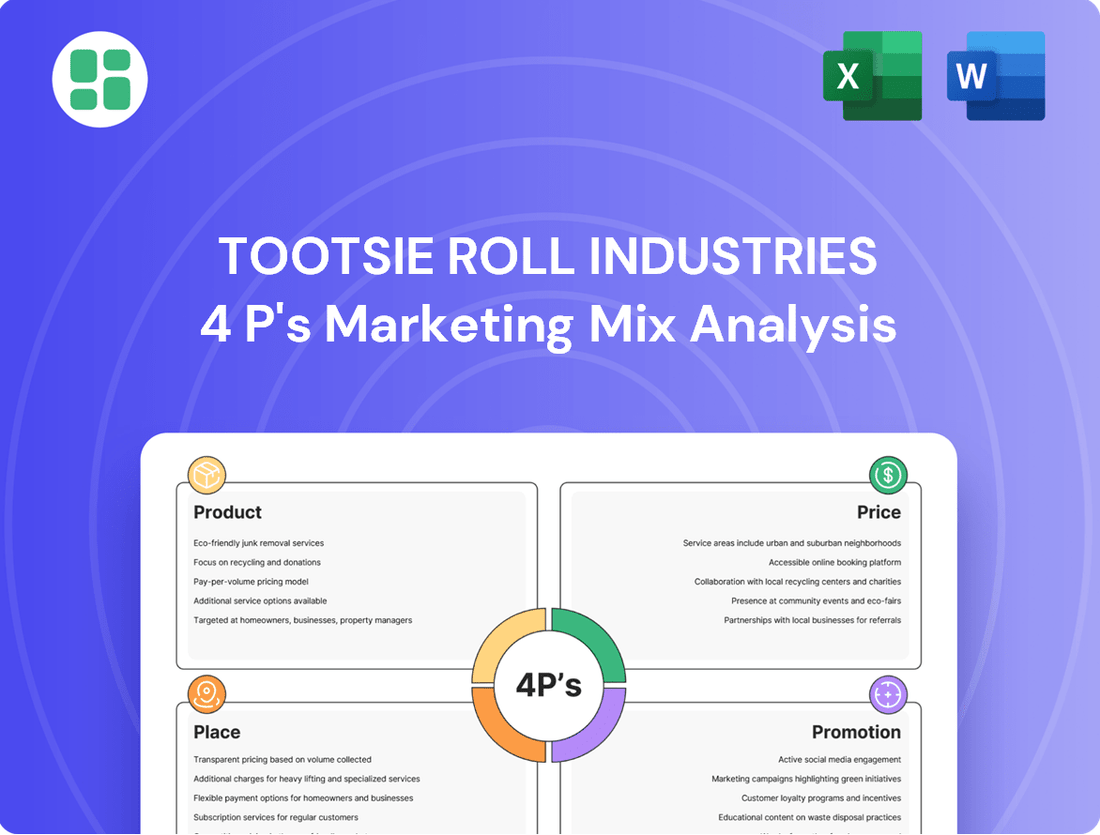

Tootsie Roll Industries 4P's Marketing Mix Analysis

The preview you see here is the actual, fully completed Tootsie Roll Industries 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This means no surprises, just the comprehensive information you need. You're viewing the exact version of the analysis you'll receive—fully complete and ready to use immediately.

Promotion

Tootsie Roll Industries leverages its iconic brand recognition as a cornerstone of its promotional strategy. The company's products evoke nostalgia, connecting with consumers across different age groups, which significantly lowers the cost of customer acquisition compared to brands needing to build awareness from scratch. This strong brand equity allows Tootsie Roll to focus on reinforcing positive associations and maintaining its presence in the market.

Tootsie Roll Industries leverages traditional advertising, including television spots and print ads, to maintain its strong brand presence. These channels are crucial for reinforcing awareness of their iconic products like the Tootsie Pop and Tootsie Roll, ensuring they remain top-of-mind for consumers. In 2023, the confectionery market saw significant ad spend, with major players investing heavily in these classic mediums to capture broad consumer attention.

Tootsie Roll Industries leverages seasonal and event-based promotions, particularly around major holidays. For instance, Halloween is a significant period for candy sales, and Tootsie Roll products are often featured in special packaging or multi-packs designed for trick-or-treaters. This strategy taps into the heightened consumer demand during these festive times.

Valentine's Day and Easter also present key opportunities. The company may offer heart-shaped or pastel-colored packaging for these occasions, aligning with the specific themes. These targeted campaigns not only boost immediate sales but also keep the Tootsie Roll brand top-of-mind during periods of high confectionery purchasing.

Point-of-Sale Marketing

Point-of-sale marketing is a vital component of Tootsie Roll Industries' promotional strategy, aiming to influence purchasing decisions directly at the retail level. Eye-catching displays and strategic shelf placement are employed to capture shopper attention, particularly for impulse buys. This in-store presence is key to driving immediate sales and brand visibility.

Tootsie Roll leverages a variety of point-of-sale tactics to maximize impact. These include:

- Vibrant In-Store Displays: Utilizing colorful and engaging displays to stand out in busy retail environments.

- Prominent Shelf Placement: Securing prime locations on shelves, often at checkout counters or eye-level, to increase product visibility.

- Impulse Purchase Opportunities: Offering smaller, attractively priced items that encourage spontaneous buying decisions.

- Seasonal Promotions: Aligning point-of-sale materials with holidays and special events to boost relevance and sales.

In 2024, the confectionery market continued to see strong performance from established brands like Tootsie Roll, with effective in-store marketing playing a significant role. For instance, reports indicate that impulse purchases account for a substantial portion of candy sales, underscoring the importance of Tootsie Roll's point-of-sale efforts.

Digital and Social Media Engagement

Tootsie Roll Industries, while rooted in tradition, actively cultivates its connection with today's consumers through digital and social media. This approach ensures the brand remains vibrant and accessible, particularly to younger demographics, by maintaining an active online presence and engaging in targeted digital campaigns.

The company leverages platforms to interact directly with its audience, fostering a sense of community and reinforcing the enduring appeal of its products. This digital engagement is crucial for bridging the gap between its nostalgic heritage and the expectations of modern consumers.

In 2023, Tootsie Roll Industries reported net sales of $669.5 million, a slight increase from the previous year, indicating the continued relevance of its product offerings across various consumer segments. While specific digital marketing spend isn't detailed, the company's consistent sales performance suggests effective outreach strategies are in place.

- Digital Presence: Maintaining an active website and social media profiles to share brand history, product information, and engage with fans.

- Social Media Interaction: Responding to comments, running contests, and sharing user-generated content to build community.

- Campaigns: Implementing digital advertising and promotional campaigns to reach new audiences and re-engage existing customers.

- Relevance: Balancing classic brand messaging with modern digital communication to appeal to both long-time consumers and newer generations.

Tootsie Roll Industries utilizes a multi-faceted promotional strategy that blends traditional advertising with modern digital engagement. Its iconic status and nostalgic appeal significantly reduce the need for extensive awareness campaigns, allowing focus on reinforcing brand equity. The company effectively uses seasonal promotions and point-of-sale marketing to drive impulse purchases and maintain visibility during key consumption periods.

In 2023, Tootsie Roll Industries reported net sales of $669.5 million, demonstrating the enduring market presence of its products. While specific promotional budgets are not publicly itemized, the consistent sales performance, up from $667.5 million in 2022, suggests effective outreach across various channels, including digital platforms and traditional media.

| Promotional Channel | Key Tactics | Impact/Observation |

|---|---|---|

| Traditional Advertising | TV spots, print ads | Reinforces brand awareness for iconic products. |

| Seasonal Promotions | Holiday-themed packaging (Halloween, Valentine's Day, Easter) | Capitalizes on increased consumer demand during festive periods. |

| Point-of-Sale Marketing | In-store displays, shelf placement, impulse items | Drives immediate sales and brand visibility at retail. |

| Digital & Social Media | Website, social media interaction, online campaigns | Engages younger demographics and maintains brand relevance. |

Price

Tootsie Roll Industries maintains a highly affordable pricing strategy, ensuring its products are accessible to a wide range of consumers, regardless of income. This approach is key to their success, positioning the candies as everyday indulgences rather than premium goods.

This pricing directly fuels high sales volume, a core element of their market penetration. For instance, a standard 10-ounce bag of Tootsie Rolls often retails for around $2.50 to $3.50 in major US supermarkets as of early 2024, underscoring their commitment to affordability.

The low price point is a significant driver for impulse buys, making it easy for consumers to pick up a pack while shopping. This accessibility fosters consistent demand and broad market appeal, a testament to their effective pricing within the confectionery sector.

Tootsie Roll Industries employs a value-oriented pricing strategy, making sure customers feel they're getting their money's worth. This is evident in their consistent product quality and the substantial amount of candy offered at accessible price points. For instance, a standard 10.5 oz bag of Tootsie Rolls, often priced around $2.50-$3.00 in 2024, provides a significant quantity of product, reinforcing this value proposition.

Tootsie Roll Industries maintains a highly competitive pricing strategy within the confectionery market, often positioning its products at or slightly below those of comparable impulse candy items. This approach is crucial for attracting consumers in a crowded marketplace, ensuring Tootsie Rolls and similar products remain an appealing choice against direct rivals.

The company actively tracks market dynamics and competitor pricing to safeguard its market share. For instance, in early 2024, the average price for a standard 1.5-ounce Tootsie Roll remained consistently around $0.25-$0.35, a price point that has historically allowed them to compete effectively against brands like Reese's Peanut Butter Cups or Hershey's Kisses, which often carry a slightly higher price tag for similar single-serve units.

Tiered Pricing for Channels

Tootsie Roll Industries likely employs tiered pricing for its various distribution channels. This means wholesale prices are set for distributors and retailers, while a suggested retail price (SRP) guides what consumers pay. This structure ensures profitability at each stage of the supply chain and maintains consistent consumer pricing. For instance, in 2023, the average wholesale price for a case of Tootsie Rolls might differ significantly from the SRP of a single bag at a convenience store, reflecting the value added by each intermediary.

Discounts are also a key component of this tiered strategy. Tootsie Roll might offer volume discounts to large retailers or special pricing for exclusive channel partners. These incentives encourage larger orders and foster stronger relationships within the distribution network. Such practices are common in the confectionery industry, where maintaining shelf space and volume sales is crucial for brand visibility and overall revenue generation.

- Wholesale Pricing: Tailored prices for distributors and retailers, allowing for their profit margins.

- Suggested Retail Pricing (SRP): Guidance for consumer-facing prices to ensure market consistency.

- Channel Partner Incentives: Discounts and special offers for key distribution partners.

- Volume Discounts: Reduced per-unit costs for bulk purchases, encouraging larger orders.

Cost and Demand Considerations

Tootsie Roll Industries carefully considers production expenses, such as the cost of sugar, corn syrup, and cocoa, alongside manufacturing overhead when setting prices. These costs, which can fluctuate based on global commodity markets, directly impact the company's ability to maintain profitability. For instance, a 10% increase in sugar prices in early 2024 could necessitate price adjustments to maintain margins.

Market demand, consumer purchasing power, and competitive pricing strategies also play a crucial role in Tootsie Roll's pricing decisions. The company aims to strike a balance, offering value to consumers while ensuring its products remain attractive and competitive in the confectionery market. This often involves strategic pricing tiers for different product sizes and varieties.

- Production Cost Influence: Raw material costs, particularly for sugar and cocoa, are key drivers of Tootsie Roll's pricing.

- Demand Elasticity: The company analyzes how sensitive consumers are to price changes for its core products.

- Competitive Landscape: Tootsie Roll monitors the pricing of similar confectionery items from competitors to remain competitive.

- Economic Conditions: Inflationary pressures or changes in consumer disposable income can influence pricing flexibility.

Tootsie Roll Industries’ pricing strategy is fundamentally about accessibility and value, ensuring their iconic candy remains an affordable treat for a broad consumer base. This approach is a cornerstone of their market presence, positioning them as a go-to for everyday indulgence rather than a premium product. The company’s pricing directly supports high sales volumes, a critical factor in their sustained market penetration and consumer loyalty.

This value-driven pricing is evident in the consistent affordability of their products. For instance, in early 2024, a standard 10-ounce bag of Tootsie Rolls was typically priced between $2.50 and $3.50 in major U.S. grocery stores. This competitive pricing makes them a frequent choice for impulse purchases, contributing to consistent demand and broad appeal within the confectionery market.

The company maintains a competitive edge by aligning its prices with or slightly below those of comparable impulse candies, a strategy crucial for standing out in a crowded market. For example, a single 1.5-ounce Tootsie Roll in early 2024 often cost around $0.25-$0.35, a price point that allows them to effectively compete with single-serve units from brands like Hershey's or Mars, which can sometimes carry a slightly higher price tag.

Tootsie Roll Industries also utilizes tiered pricing across its distribution channels, with distinct wholesale prices for distributors and retailers, and suggested retail prices (SRPs) for consumers. This structure ensures profitability at each level and maintains price consistency. For example, while wholesale prices for a case in 2023 would vary, the SRP for a single bag at a convenience store would reflect the value added by intermediaries, ensuring a predictable consumer cost.

| Product Size | Estimated SRP (Early 2024) | Competitive Comparison (Approximate SRP) |

|---|---|---|

| 10 oz Bag | $2.50 - $3.50 | Similar sized bags from other value brands |

| 1.5 oz Single Roll | $0.25 - $0.35 | Hershey's Kiss (single), Reese's Peanut Butter Cup (mini) |

| Variety Bag (e.g., 15 oz) | $3.00 - $4.00 | Assorted candy bags from major manufacturers |

4P's Marketing Mix Analysis Data Sources

Our Tootsie Roll Industries 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.