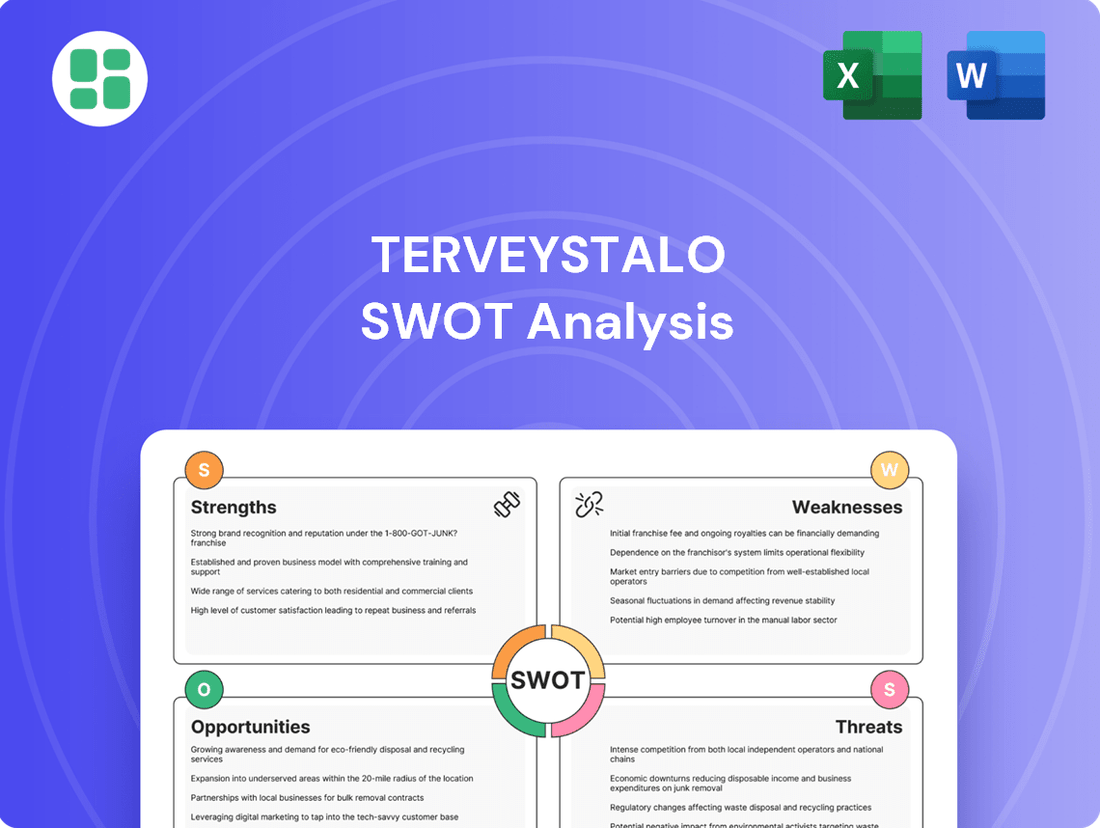

Terveystalo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terveystalo Bundle

Terveystalo's SWOT analysis reveals a strong market position and a growing demand for its healthcare services, but also highlights potential challenges in a competitive landscape. Understanding these dynamics is crucial for anyone looking to invest or strategize in the Finnish healthcare sector.

Want the full story behind Terveystalo's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Terveystalo's extensive network, comprising roughly 360 clinics and 18 hospitals throughout Finland, establishes it as the nation's largest private healthcare provider. This vast physical footprint, coupled with a substantial market share, grants a powerful competitive edge and ensures widespread patient accessibility.

The company's leadership extends to occupational health services in both Finland and Sweden, reinforcing its dominant market standing. This dual presence in key Nordic markets highlights Terveystalo's significant reach and influence within the healthcare sector.

Terveystalo's comprehensive service offering is a significant strength, covering medical, occupational health, and wellbeing services for individuals, corporations, and the public sector. This integrated approach facilitates seamless patient journeys across various specialties, from general practice to specialized care. In 2023, Terveystalo reported revenue of €1,218.7 million, demonstrating the market's demand for its broad service portfolio.

Terveystalo stands out as a frontrunner in Finland's digital healthcare landscape, providing round-the-clock digital services that seamlessly integrate with its physical clinics. This strong digital presence has been acknowledged through awards for digital competitiveness, particularly in e-commerce and customer relationship management.

These advanced digital tools are not just about convenience; they significantly improve patient access to care, optimize treatment journeys, and boost the company's overall operational efficiency. For instance, Terveystalo reported a substantial increase in digital service utilization throughout 2024, with over 70% of patient interactions being digitally enabled.

Robust Financial Performance and Profitability Improvement

Terveystalo has showcased impressive financial strength, with profitability on the rise. This improvement stems from better operational execution and a strategic shift towards higher-margin services, especially within its Healthcare Services division. The company's Q1 2025 adjusted operating profit saw a notable jump, and Q2 2025 earnings per share also exceeded expectations, demonstrating sustained financial momentum.

Key financial highlights include:

- Significant Profitability Growth: Terveystalo surpassed its profitability goals earlier than anticipated, signaling robust internal management and market positioning.

- Upgraded Financial Outlook: The company has revised its financial targets upwards, reflecting confidence in its strategy for continued profitable expansion.

- Strong Q1 2025 Performance: Adjusted operating profit increased substantially, driven by enhanced efficiency and a favorable service offering.

- Positive Q2 2025 Earnings: Earnings per share in the second quarter of 2025 showed considerable improvement, reinforcing the company's positive financial trajectory.

High Customer Satisfaction and Quality Focus

Terveystalo consistently earns high marks for customer satisfaction, reflected in robust Net Promoter Scores (NPS). For instance, in 2023, Terveystalo reported an NPS of 59 for appointments and 62 for hospitals, demonstrating strong patient loyalty and positive experiences.

The company's strategic direction is deeply rooted in delivering exceptional customer value. This is achieved through a commitment to integrated care pathways and a relentless pursuit of enhancing medical quality across its services.

This dedication to superior quality and positive patient outcomes directly translates into a powerful brand image and enduring customer loyalty. For example, Terveystalo’s focus on patient-centric care has been a key driver in its market position.

- High NPS Scores: Terveystalo achieved an NPS of 59 for appointments and 62 for hospitals in 2023, indicating strong customer approval.

- Integrated Care Strategy: The company prioritizes seamless, end-to-end patient journeys, enhancing overall care experience.

- Continuous Quality Improvement: Ongoing efforts to elevate medical standards and patient outcomes reinforce the brand's reputation.

- Customer Loyalty: A strong focus on quality and patient satisfaction fosters repeat business and positive word-of-mouth referrals.

Terveystalo's extensive network, with approximately 360 clinics and 18 hospitals across Finland, solidifies its position as the nation's largest private healthcare provider. This broad reach, combined with a significant market share, offers a distinct competitive advantage and ensures convenient access for patients. The company's leadership in occupational health services extends to Sweden, further underscoring its substantial influence in key Nordic markets.

| Strength | Description | Supporting Data |

|---|---|---|

| Market Leadership & Network Size | Finland's largest private healthcare provider with a vast network of clinics and hospitals. | ~360 clinics, 18 hospitals in Finland; leading occupational health services in Finland and Sweden. |

| Comprehensive Service Offering | Integrated medical, occupational health, and wellbeing services for diverse client segments. | 2023 Revenue: €1,218.7 million, reflecting strong demand for its broad portfolio. |

| Digital Healthcare Advancement | Frontrunner in digital healthcare with 24/7 services integrated with physical clinics. | Awarded for digital competitiveness; over 70% of patient interactions digitally enabled in 2024. |

| Financial Performance & Profitability | Demonstrated profitability growth driven by operational improvements and higher-margin services. | Upgraded financial outlook; strong Q1 2025 adjusted operating profit; positive Q2 2025 EPS. |

| Customer Satisfaction & Loyalty | Consistently high Net Promoter Scores (NPS) and a focus on patient-centric care. | 2023 NPS: 59 for appointments, 62 for hospitals; commitment to integrated care pathways. |

What is included in the product

Delivers a strategic overview of Terveystalo’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Terveystalo's strategic challenges, alleviating the pain of uncertainty.

Weaknesses

Terveystalo's significant reliance on the Finnish market presents a notable weakness. While it holds a dominant position domestically, this concentration means the company is highly susceptible to Finland's specific economic downturns, evolving healthcare regulations, and competitive pressures. This geographic focus limits its ability to offset potential regional challenges with broader international performance.

The company's limited international diversification is further underscored by its Swedish operations, which have experienced revenue declines and difficult market conditions. This situation highlights the challenges Terveystalo faces in expanding beyond its core Finnish market, making its overall financial health more vulnerable to Finnish market dynamics.

The Portfolio Businesses segment has faced considerable headwinds, with revenue declines stemming from the conclusion of outsourcing agreements and a strategic pruning of less profitable staffing service contracts. For instance, in the first half of 2024, this segment saw a notable drop in its contribution to Terveystalo's overall revenue. This underperformance, even with a robust performance in the core Healthcare Services, can negatively impact consolidated financial outcomes.

The healthcare industry, Terveystalo included, is grappling with a global trend of aging populations, which naturally increases demand for services. This demographic shift, coupled with potential shortages of skilled healthcare professionals in Finland, presents a significant challenge. For instance, the Finnish Ministry of Social Affairs and Health has highlighted concerns about the future availability of nurses and doctors, a trend expected to continue through 2025 and beyond.

While Terveystalo strives to be an employer of choice, a broad scarcity of healthcare workers could force the company to increase wages and benefits to attract and retain talent. This rise in personnel costs, a direct consequence of labor market dynamics, could squeeze profit margins. Furthermore, persistent staffing gaps might hinder Terveystalo's ability to deliver its services at optimal levels, potentially impacting patient care and overall operational efficiency.

Competition from Public Sector and Other Private Providers

Terveystalo faces significant competition in Finland's healthcare market. The public sector remains a dominant force, with approximately 70% of healthcare services historically provided by municipalities. This public provision, often at subsidized rates, presents a pricing challenge for private providers like Terveystalo.

Beyond public entities, Terveystalo also competes with other private healthcare companies and specialized clinics. These competitors may focus on specific service areas or patient demographics, creating niche markets. For instance, Mehiläinen is a prominent private healthcare provider in Finland, offering a similar range of services.

To maintain its competitive edge, Terveystalo must continuously innovate and differentiate its offerings. This includes focusing on service quality, patient experience, and potentially exploring new service models.

- Public Healthcare Dominance: Municipalities historically provided the majority of healthcare services in Finland, influencing patient access and cost perceptions.

- Private Sector Rivalry: Competitors like Mehiläinen offer a broad spectrum of services, directly challenging Terveystalo's market share.

- Differentiation Imperative: Terveystalo needs to emphasize unique value propositions, such as specialized treatments or advanced digital services, to stand out.

Dependency on Economic Conditions Affecting Private Spending

Terveystalo's reliance on private individuals and corporate clients makes its revenue streams vulnerable to shifts in the broader economy. For instance, during periods of economic uncertainty, like the ongoing global economic adjustments, consumers may postpone non-essential healthcare services, directly impacting Terveystalo's top line. Similarly, companies might scale back on corporate wellness programs as a cost-saving measure.

This sensitivity to economic cycles means that a downturn could lead to decreased demand for Terveystalo's services, potentially affecting its revenue and profitability. In 2023, while Terveystalo reported strong overall performance, the economic climate presents a persistent headwind. For example, discretionary spending by individuals can be significantly curtailed when inflation remains elevated or employment prospects dim, a scenario that analysts are closely monitoring for 2024 and 2025.

- Revenue Sensitivity: A significant portion of Terveystalo's income is tied to private consumer spending and corporate budgets, making it susceptible to economic downturns.

- Impact of Uncertainty: Economic uncertainty can lead individuals to defer healthcare appointments and companies to reduce spending on employee benefits and wellness initiatives.

- Pricing Pressure: In a weaker economic environment, Terveystalo might face pressure to lower prices or offer discounts to maintain patient volumes, impacting profit margins.

- Market Conditions: The company's performance is closely linked to consumer confidence and corporate financial health, which are key indicators to watch in the 2024-2025 economic outlook.

Terveystalo's concentrated reliance on the Finnish market is a significant weakness, making it highly vulnerable to domestic economic fluctuations and regulatory changes. Its limited international diversification, exemplified by challenges in Sweden, further amplifies this risk, leaving the company heavily exposed to Finnish market dynamics.

The Portfolio Businesses segment has experienced revenue declines due to the conclusion of outsourcing agreements and strategic pruning of less profitable contracts, impacting overall consolidated financial results even with strong core performance. Furthermore, the healthcare industry's struggle with an aging population and potential shortages of skilled professionals in Finland, a trend expected to persist through 2025, poses a direct challenge to Terveystalo's operational capacity and staffing costs.

Terveystalo faces intense competition from both dominant public healthcare providers, which historically deliver the majority of services, and other private entities like Mehiläinen. This necessitates continuous innovation and differentiation to maintain market share and avoid pricing pressure, especially as economic uncertainty in 2024-2025 could reduce private spending on healthcare services and corporate wellness programs.

Preview the Actual Deliverable

Terveystalo SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and allows you to assess the quality and depth of our Terveystalo SWOT analysis before committing.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing you with a comprehensive understanding of Terveystalo's strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, giving you immediate access to actionable insights for Terveystalo.

Opportunities

Terveystalo has a considerable opportunity to grow its digital health offerings, building on Finland's strong digital healthcare infrastructure. This includes enhancing remote consultation tools and digital care pathways.

Integrating more artificial intelligence (AI) and advanced analytics presents a chance to refine diagnostics, personalize patient care, and streamline operations. For instance, AI can analyze patient data to predict health risks, leading to proactive interventions.

By 2024, the global digital health market was valued at over $200 billion, with a projected compound annual growth rate (CAGR) of around 15-20% in the coming years, indicating substantial room for expansion.

Terveystalo, as a prominent occupational health provider, is well-positioned to benefit from the growing emphasis businesses place on employee well-being and proactive health measures. The company can leverage this trend by expanding its corporate contracts and developing specialized wellness solutions. This strategic focus on corporate wellness presents a consistent revenue stream and fosters enduring client relationships, with the Finnish occupational health market valued at over €1 billion annually.

Terveystalo can strengthen its position by acquiring smaller healthcare providers in Finland, allowing it to solidify its market leadership and enter niche areas like mental or dental health. For example, its acquisition strategy has already seen it integrate several smaller clinics, boosting its service portfolio.

Collaborating with tech firms or public sector organizations presents another avenue for growth, enabling Terveystalo to innovate service delivery and reach new customer segments. These partnerships can unlock opportunities for digital health solutions and integrated care models.

This approach to inorganic growth, through both acquisitions and partnerships, allows Terveystalo to quickly expand its market reach and diversify its service offerings, a strategy that has shown positive results in previous fiscal years.

Addressing the Aging Population and Care Gap

Finland's demographic landscape is shifting, with an increasing proportion of the population falling into older age brackets. This trend, evident in recent statistics, translates directly into a heightened demand for healthcare services, especially those focused on chronic condition management and long-term care. Terveystalo is well-positioned to capitalize on this by expanding its offerings in geriatrics and home-based care solutions, directly addressing a growing societal need.

The aging population represents a significant opportunity for Terveystalo. By 2025, it's projected that individuals aged 65 and over will constitute a substantial segment of the Finnish population, creating a consistent and expanding market for specialized healthcare.

- Growing Demand: Finland's aging population is increasing, driving demand for healthcare.

- Care Gap: There's a societal need for more long-term and specialized elderly care services.

- Market Opportunity: Terveystalo can develop tailored services for this demographic.

- Stable Revenue: The demographic shift ensures a stable and growing customer base.

Leveraging Data for Personalized and Preventive Healthcare

Terveystalo can harness its extensive health data by employing big data analytics and artificial intelligence to deliver highly personalized and proactive healthcare. This strategic use of data promises to enhance patient results, streamline treatment processes, and foster the creation of novel service offerings, aligning with the growing demand for data-informed health solutions observed in the 2024 market.

By prioritizing preventive care, Terveystalo has a significant opportunity to mitigate long-term healthcare expenditures for individuals and the broader system. For instance, predictive analytics could identify at-risk populations, enabling targeted interventions that reduce the incidence of chronic diseases, a key focus area for healthcare providers aiming for efficiency gains.

- Personalized treatment plans: Utilizing AI to analyze patient data for tailored health recommendations.

- Predictive health insights: Identifying individuals at high risk for certain conditions before symptoms manifest.

- Enhanced patient engagement: Offering proactive health monitoring and support through digital platforms.

- Optimized resource allocation: Directing healthcare resources more effectively based on population health trends.

Terveystalo can expand its digital health services, leveraging Finland's advanced digital infrastructure to enhance remote care and digital patient pathways. The global digital health market, exceeding $200 billion in 2024 and projected to grow at 15-20% annually, offers significant expansion potential.

The company is also poised to capitalize on the increasing corporate focus on employee well-being, a trend reflected in Finland's over €1 billion occupational health market. By developing specialized wellness solutions and expanding corporate contracts, Terveystalo can secure stable revenue and foster long-term client relationships.

Acquisitions of smaller healthcare providers, a strategy Terveystalo has successfully employed, allow for market consolidation and entry into specialized areas like mental or dental health, further diversifying its service portfolio and strengthening its market leadership.

Finland's aging population, with an increasing proportion of individuals over 65 by 2025, creates a growing demand for geriatric and long-term care services. Terveystalo can address this demographic shift by expanding its offerings in these specialized areas, ensuring a stable and growing customer base.

| Opportunity Area | Key Action | Market Context/Data |

|---|---|---|

| Digital Health Expansion | Enhance remote consultation and digital care pathways | Global digital health market >$200B (2024), CAGR 15-20% |

| Corporate Wellness | Expand occupational health services and wellness solutions | Finnish occupational health market >€1B annually |

| Strategic Acquisitions | Acquire smaller providers in niche health sectors | Proven strategy for market leadership and portfolio diversification |

| Aging Population Services | Develop specialized geriatric and home-based care | Growing demand due to increasing elderly population in Finland by 2025 |

Threats

While Terveystalo holds a strong position in the Finnish healthcare sector, the market is far from consolidated. Both public entities and other private players actively compete, creating a dynamic environment. For instance, in 2023, the Finnish Ministry of Social Affairs and Health continued to oversee significant public healthcare expenditures, which directly influences the private sector's operational landscape.

The Finnish care market has also attracted attention from international investors, signaling a potential influx of new competitors. This growing interest, observed through increased foreign direct investment in European healthcare services throughout 2024, could intensify market fragmentation. Such a scenario might exert downward pressure on service prices or necessitate Terveystalo to work harder to maintain its existing market share.

Changes in healthcare regulations and funding models present a significant threat. For example, Finland's projected reduction in the health budget for 2025 could directly impact Terveystalo's public sector contracts, potentially decreasing revenue streams.

Alterations in Kela reimbursement policies or broader social welfare reforms could also affect patient demand for private healthcare services, influencing Terveystalo's market position and profitability.

Furthermore, shifts in regulatory frameworks can create an uneven playing field or alter the demand for specific services, requiring Terveystalo to adapt its operational strategies and service offerings to remain competitive.

As a prominent digital healthcare provider, Terveystalo handles a vast amount of sensitive patient information, making it a prime target for cyberattacks. The increasing sophistication of cyber threats, coupled with the strict requirements of data privacy regulations like GDPR, presents a significant challenge. A successful data breach in 2024 could result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher.

Beyond financial repercussions, a cybersecurity incident would severely damage Terveystalo's reputation and erode the trust of its patients and partners. Maintaining customer confidence is paramount in the healthcare sector, and a breach could lead to a significant loss of business. Therefore, ongoing and substantial investment in advanced cybersecurity infrastructure and protocols is not just a recommendation but a critical necessity for Terveystalo's continued operation and growth.

Economic Downturn Impacting Private and Corporate Spending

An economic downturn presents a significant threat to Terveystalo. Reduced disposable income for individuals could lead to decreased demand for private healthcare services, as consumers prioritize essential spending. For instance, if consumer confidence, as measured by the European Commission's Economic Sentiment Indicator, continues to decline in key markets like Finland, it directly correlates with lower discretionary spending on non-essential services.

Corporate clients may also scale back on occupational health and wellness programs to manage costs during economic instability. This could mean fewer contracts and lower revenue from Terveystalo's business segment. In 2023, many Finnish companies tightened their budgets, and this trend is expected to persist into 2024 and 2025, impacting corporate service uptake.

- Reduced private healthcare spending due to lower household incomes.

- Cuts in corporate occupational health and wellness budgets.

- Potential decrease in demand for elective procedures and preventative care.

- Increased price sensitivity among both individual and corporate customers.

Talent Shortage and Retention Challenges for Healthcare Professionals

The persistent global and national scarcity of healthcare professionals, encompassing doctors, nurses, and specialized practitioners, presents a considerable threat to Terveystalo. This deficit can escalate recruitment expenses and necessitate higher compensation, making it challenging to staff open roles and potentially capping service delivery capabilities.

For instance, in Finland, the demand for nurses is projected to grow significantly, with estimates suggesting a need for thousands more by 2030 to meet demographic shifts and increased healthcare needs. This intensifies competition for qualified staff, impacting operational efficiency.

In this competitive landscape, retaining experienced and skilled healthcare professionals becomes paramount. Terveystalo must focus on robust retention strategies to mitigate the impact of the talent shortage.

- Talent Scarcity: A widespread shortage of doctors, nurses, and specialists impacts Terveystalo's ability to operate at full capacity.

- Increased Costs: Recruitment expenses and wage demands are likely to rise due to intense competition for limited talent.

- Retention Imperative: Keeping existing skilled professionals is crucial to maintaining service quality and operational stability amidst the shortage.

Intensified competition from both public and private entities, including international players, poses a significant threat to Terveystalo's market share and pricing power. Changes in Finnish healthcare regulations and funding models, such as potential budget reductions for 2025, could directly impact revenue from public sector contracts.

The company faces substantial risks from sophisticated cyberattacks, given its handling of sensitive patient data. A data breach could lead to severe financial penalties under GDPR, potentially up to 4% of global annual revenue, and critically damage its reputation, eroding patient trust.

Economic downturns threaten Terveystalo by reducing disposable income, leading to lower demand for private healthcare services and corporate wellness programs. This is particularly relevant as consumer confidence indicators in key European markets, including Finland, have shown signs of weakening, impacting discretionary spending.

A critical threat stems from the ongoing scarcity of healthcare professionals, including doctors and nurses, in Finland and globally. This shortage drives up recruitment costs and compensation demands, potentially limiting service delivery capacity and impacting operational efficiency.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Context |

|---|---|---|---|

| Competition | Market fragmentation and new entrants | Reduced market share, pricing pressure | Continued foreign direct investment in European healthcare services in 2024. |

| Regulatory & Funding Changes | Shifts in public healthcare budgets and reimbursement policies | Decreased revenue from public contracts, altered patient demand | Finland's projected health budget review for 2025. |

| Cybersecurity Risks | Data breaches and sophisticated cyberattacks | Financial penalties (up to 4% of global revenue under GDPR), reputational damage, loss of patient trust | GDPR fines and increasing sophistication of cyber threats globally. |

| Economic Conditions | Economic downturns and reduced disposable income | Lower demand for private services, decreased corporate spending on wellness programs | Weakening consumer confidence indicators in key markets; Finnish companies tightened budgets in 2023. |

| Talent Shortage | Scarcity of healthcare professionals | Increased recruitment costs, higher wage demands, limited service capacity | Projected significant growth in demand for nurses in Finland by 2030. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of diverse data sources, including Terveystalo's official financial reports, comprehensive market research on the healthcare sector, and expert opinions from industry analysts to ensure a thorough and insightful assessment.