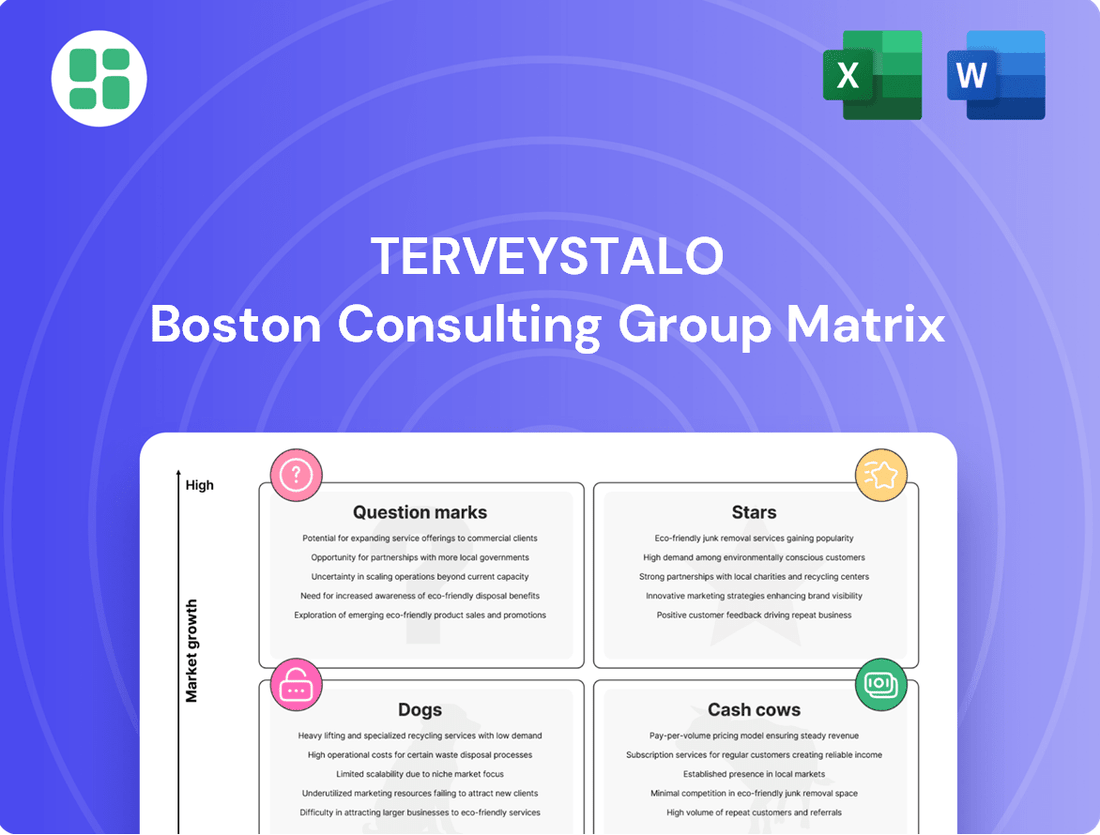

Terveystalo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terveystalo Bundle

Unlock the strategic potential of Terveystalo's product portfolio with this insightful BCG Matrix preview. See how their offerings stack up as potential Stars, Cash Cows, Dogs, or Question Marks. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your investment and product strategy.

Stars

Digital Healthcare Services represent a significant Star for Terveystalo. In 2024, the company solidified its position as Finland's digital health leader, a testament to its forward-thinking strategy in a booming market.

With an impressive user base exceeding 2.7 million registered individuals, Terveystalo's digital offerings, such as telemedicine and online appointment booking, are seeing substantial uptake. This high adoption rate fuels continuous investment into these platforms, enhancing patient accessibility and operational efficiency.

Terveystalo views Specialized Mental Health Services as a significant growth opportunity, aiming for profitable expansion in this high-demand area. Their acquisition of Recuror Oy in June 2025, a psychiatry specialist, highlights their strategic intent to capture market share. This move aligns with a broader societal emphasis on mental well-being, positioning these services for robust market growth.

Insurance-funded healthcare services represent a star in Terveystalo's BCG Matrix. This segment is experiencing robust growth, with projections indicating a 5-6% expansion annually between 2023 and 2029 in Finland. Terveystalo is strategically positioning itself to capitalize on this trend by forging new partnership models to expand its insurance business.

Advanced Diagnostic Services

Terveystalo's Advanced Diagnostic Services, particularly in radiology, are a key component of its growth strategy. In 2024, the company made significant moves by acquiring SRK Group Oy and Suomen Radiologikeskus Oy, solidifying its presence in this technologically advancing sector.

These diagnostic services cater to a market driven by continuous innovation and a steady need for accurate medical assessments. Terveystalo's strategic consolidation of these entities enhances its already substantial market share in a segment characterized by both technological evolution and consistent demand.

- Acquisitions in 2024: SRK Group Oy and Suomen Radiologikeskus Oy were integrated, strengthening Terveystalo's radiology network.

- Market Dynamics: The diagnostic services market benefits from ongoing technological advancements and sustained patient demand.

- Strategic Positioning: These moves reinforce Terveystalo's leading position in a technologically dynamic and expanding market segment.

Telemedicine and Remote Care Solutions

Telemedicine and remote care solutions represent a significant growth area within digital healthcare. In Finland, telemedicine already accounts for approximately 30% of all outpatient consultations, highlighting its widespread adoption and potential.

Terveystalo's commitment to its 24/7 digital services is a key driver of its success in this segment. These services are engineered to enhance patient access to healthcare and boost operational efficiency, firmly establishing Terveystalo as a frontrunner in this rapidly expanding market.

The company’s ongoing investments in advanced digital tools are crucial for maintaining and strengthening its star position in telemedicine and remote care.

- Market Share: Telemedicine accounts for 30% of outpatient consultations in Finland.

- Terveystalo's Role: 24/7 digital services improve access and efficiency.

- Growth Trajectory: Positioned as a market leader in a high-growth area.

- Investment Strategy: Continued investment in digital tools solidifies star status.

Terveystalo's Digital Healthcare Services are a clear Star, driven by strong market adoption and continuous innovation. The company’s user base of over 2.7 million individuals engaging with services like telemedicine and online booking demonstrates significant momentum. This high engagement fuels further investment, solidifying Terveystalo's leadership in a rapidly expanding digital health landscape.

Insurance-funded healthcare services also shine as a Star for Terveystalo, benefiting from a growing market in Finland. With projected annual growth of 5-6% between 2023 and 2029, Terveystalo's strategic partnerships are set to capture a larger share of this expanding segment. This focus on insurance collaborations positions the company for sustained profitability in a key growth area.

Advanced Diagnostic Services, particularly in radiology, represent another Star for Terveystalo. The 2024 acquisitions of SRK Group Oy and Suomen Radiologikeskus Oy significantly bolstered their capabilities in this technologically evolving field. These strategic moves enhance Terveystalo's market dominance in a sector characterized by consistent demand and ongoing technological advancements.

| Service Segment | BCG Category | Key Growth Drivers | Terveystalo's Strategic Actions | Market Data/Trends |

|---|---|---|---|---|

| Digital Healthcare Services | Star | High user adoption, telemedicine demand | 2.7M+ users, 24/7 digital services | Finland's digital health leader |

| Insurance-funded Healthcare | Star | Market growth, new partnerships | Expanding insurance business | 5-6% annual growth (2023-2029) |

| Advanced Diagnostic Services | Star | Technological innovation, patient need | Acquired SRK Group, Suomen Radiologikeskus | Strengthened radiology network |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

Terveystalo's BCG Matrix offers a clear, one-page overview of its business units, alleviating the pain of strategic confusion.

Cash Cows

Terveystalo's core occupational health services in Finland represent a significant cash cow. As the largest private healthcare provider in Finland and a major Nordic player, Terveystalo serves over 26,000 companies and 744,000 individuals in Finland. This established position, coupled with the mature Finnish occupational health market projected to grow 3-4% annually between 2023 and 2029, ensures a steady and predictable revenue stream.

The high margins and consistent cash flow generated by these services are a direct result of Terveystalo's dominant market share and deeply entrenched client relationships. This segment benefits from a stable demand, making it a reliable contributor to the company's overall financial health and a key element in its BCG Matrix.

Terveystalo's established primary healthcare services in Finland are a clear Cash Cow. As the country's largest private healthcare provider, this segment benefits from consistent, high-volume demand, ensuring a steady stream of revenue and profitability. In Q1 2025, this core business segment, which encompasses primary care, demonstrated its strength with a solid 4.7% revenue increase, underscoring its reliable cash-generating capabilities.

Terveystalo's extensive physical clinic and hospital network, boasting over 377 locations across Finland, represents a significant Cash Cow. This robust infrastructure provides broad market coverage and high patient accessibility, ensuring a consistent and substantial revenue stream from the mature physical healthcare sector.

The sheer scale of Terveystalo's physical presence, encompassing numerous clinics and hospitals, allows for efficient service delivery and strong brand recognition. This established network is crucial for generating steady income, as evidenced by its role in Terveystalo's overall financial performance.

While the network is a mature asset, strategic investments are consistently made to maintain and enhance these facilities. These capital expenditures are focused on ensuring continued operational efficiency and the ability to meet evolving patient needs, thereby preserving its Cash Cow status.

Mature Well-being Services

Terveystalo's mature well-being services, primarily targeting corporate clients, represent a stable revenue stream. These established programs, focusing on preventive care and employee health, tap into a consistent demand. Their role as cash cows is further solidified by Terveystalo's strong existing relationships with businesses.

These services are distinct from emerging wellness trends, focusing instead on proven health management. For instance, corporate health check-ups and occupational health services are core components. In 2024, Terveystalo reported a significant portion of its revenue coming from corporate partnerships, underscoring the stability of these offerings.

- Stable Demand: Corporate clients consistently invest in employee health, ensuring a predictable revenue base for these mature services.

- Established Offerings: Services like occupational health and preventive screenings are well-understood and have a proven track record.

- Strong Client Relationships: Terveystalo's deep ties with businesses facilitate consistent service uptake and cash flow generation.

- Revenue Contribution: In 2023, corporate client services accounted for a substantial percentage of Terveystalo's overall turnover, highlighting their cash-generating power.

Dental Services

Dental services represent a cornerstone of Terveystalo's operations within Finland's healthcare landscape. As a mature and essential service, it likely commands a substantial market share, contributing steadily to the company's revenue.

- Stable Revenue: Dental care, being a recurring need, offers predictable income streams for Terveystalo.

- Market Position: Terveystalo's established presence positions it favorably in the Finnish dental market.

- Profitability Driver: This service segment is a key contributor to the overall financial health of Terveystalo's healthcare services.

- Customer Loyalty: Consistent, quality dental care fosters long-term patient relationships.

Terveystalo's occupational health services form a strong cash cow, leveraging its position as Finland's largest private healthcare provider. This segment benefits from a stable demand from over 26,000 corporate clients, generating predictable revenue. The Finnish occupational health market's projected 3-4% annual growth through 2029 further solidifies its cash-generating potential.

The company's extensive physical clinic and hospital network, with over 377 locations across Finland, also functions as a significant cash cow. This broad market coverage ensures consistent patient accessibility and a steady revenue stream from mature healthcare services, reinforcing its role as a reliable income generator.

Terveystalo's mature well-being services, particularly those aimed at corporate clients, are stable cash cows. These established programs, including health check-ups and preventive care, benefit from strong client relationships and consistent demand, contributing significantly to overall turnover, as seen in 2023.

Dental services are another key cash cow for Terveystalo, driven by the essential and recurring nature of dental care. This segment benefits from Terveystalo's established market position and fosters customer loyalty, making it a consistent contributor to the company's profitability.

| Service Segment | BCG Category | Key Strengths | Financial Impact (Illustrative) |

|---|---|---|---|

| Occupational Health | Cash Cow | Largest provider in Finland, stable corporate demand, market growth | Consistent, predictable revenue stream |

| Physical Clinics/Hospitals | Cash Cow | Extensive network, high patient accessibility, brand recognition | Steady income generation from mature services |

| Corporate Well-being | Cash Cow | Established programs, strong client relationships, consistent demand | Substantial contribution to overall turnover |

| Dental Services | Cash Cow | Essential & recurring need, established market position, customer loyalty | Key profitability driver, predictable income |

What You See Is What You Get

Terveystalo BCG Matrix

The Terveystalo BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready strategic tool for Terveystalo's business units. You can confidently use this preview to understand the depth of insight and clarity the final report will provide for your decision-making processes.

Dogs

Terveystalo's Portfolio Businesses, characterized by outsourcing operations, faced a substantial downturn. In the first quarter of 2025, this segment saw its revenue shrink by a significant 21.7%. This decline is primarily attributed to the strategic decision to end several outsourcing contracts that were not proving to be highly profitable, coupled with a generally sluggish market.

Looking ahead, Terveystalo anticipates an additional revenue reduction of EUR 25 to EUR 30 million for the full year 2025. This further decrease stems directly from the planned cessation of these specific outsourcing agreements. This move clearly signals a deliberate strategy to exit or downsize operations in segments that offer low growth potential and a minimal market share, thereby streamlining the overall business portfolio.

Terveystalo's Swedish operations are currently in a difficult spot, fitting the 'Dog' category in the BCG Matrix. In the first quarter of 2025, revenue from Sweden saw a significant drop of 10.8%. This decline is largely due to a combination of reduced customer demand and the expiration of key contracts.

While Terveystalo has implemented cost-saving initiatives that have led to some improvements in profitability within Sweden, the ongoing revenue contraction paints a concerning picture. This suggests potential issues with market competitiveness or a weaker market position in certain service segments across Sweden.

The Swedish segment is a cash consumer, meaning it requires investment to operate but isn't generating substantial growth in return. This characteristic, coupled with the declining revenue, firmly places these operations in the 'Dog' quadrant, highlighting a need for strategic evaluation.

Terveystalo has strategically reduced its involvement in less profitable staffing service agreements within its Portfolio Businesses. This move focuses on exiting or minimizing exposure to contracts that offer low margins, indicating segments with poor profitability and potentially a low effective market share due to their unattractive nature. These services are being phased out rather than prioritized for growth.

Outdated Niche Physical Therapies

Certain specialized physical therapies, perhaps those rooted in older methodologies or catering to very specific, shrinking demographics, might be experiencing a slowdown in patient interest. If Terveystalo has a small footprint in these particular, less digitally integrated areas of physical care, they would be categorized as low-growth offerings that don't justify substantial new investment. These might just cover their costs or even see minor losses.

For instance, a niche therapy like traditional postural correction without incorporating modern biomechanical analysis or digital feedback tools could fall into this category. Such services might represent a minimal portion of Terveystalo's overall revenue, perhaps contributing less than 1% in 2024, and are unlikely to see significant expansion.

- Declining Demand: Specialized, non-digitally adapted therapies face reduced patient uptake.

- Minimal Market Share: Terveystalo's presence in these niche areas is small.

- Low Growth, Low Investment: These services offer little growth potential, thus requiring minimal capital allocation.

- Break-Even or Minor Losses: The financial performance of these outdated niches is typically neutral to slightly negative.

Non-strategic Divested Business Units

Terveystalo has strategically divested certain business units that were deemed non-core to its primary operations. These divestitures are often undertaken to streamline the company's portfolio and concentrate resources on areas with higher growth potential and stronger market positions. For instance, in 2023, Terveystalo completed the divestment of its occupational healthcare services in Sweden, a move aimed at sharpening its focus on the Finnish market.

These non-strategic units typically exhibit characteristics of low market share or slower growth compared to the company's core offerings. By exiting these segments, Terveystalo can reallocate capital and management attention towards more promising ventures, thereby enhancing overall profitability and competitive advantage. This strategic pruning is a common practice for companies seeking to optimize their business structure.

Examples of such divestitures might include smaller, specialized service lines that do not align with Terveystalo's long-term vision or market consolidation opportunities where divesting a unit makes financial sense. The company's M&A strategy, including divestments, is continuously evaluated to ensure it supports the overarching business objectives.

- Divestment Rationale: Focus on core Finnish market and high-growth areas.

- Asset Characteristics: Low market share or slower growth segments.

- Strategic Impact: Streamlining portfolio and reallocating resources for better returns.

- Example: Divestment of Swedish occupational healthcare services in 2023.

Terveystalo's Swedish operations, characterized by a 10.8% revenue drop in Q1 2025 due to lower demand and expiring contracts, fit the 'Dog' profile. These segments consume cash without generating substantial growth, indicating a weak market position and requiring strategic re-evaluation.

Similarly, certain niche physical therapies, representing less than 1% of 2024 revenue, are also 'Dogs'. These services face declining patient interest due to a lack of digital integration and minimal market share, leading to break-even or minor losses.

Divested units, such as the 2023 Swedish occupational healthcare services, also fall into the 'Dog' category. These non-core assets exhibit low growth and market share, prompting divestment to streamline the portfolio and focus on more profitable areas.

| Business Segment | BCG Category | Q1 2025 Revenue Change | Key Challenges | Strategic Action |

|---|---|---|---|---|

| Swedish Operations | Dog | -10.8% | Reduced demand, expiring contracts | Strategic evaluation |

| Niche Physical Therapies | Dog | Low/Declining | Lack of digital integration, minimal market share | Phased out/Minimal investment |

| Divested Units (e.g., Swedish OHC) | Dog | N/A (Divested) | Non-core, low growth/share | Divested |

Question Marks

Terveystalo is strategically channeling substantial investments into AI-driven data tools and software for medical devices, recognizing AI's potential to revolutionize healthcare delivery. These forward-thinking digital services represent an area of high growth potential, though Terveystalo's current market penetration in these advanced AI applications is still in its formative stages.

Terveystalo is actively exploring and investing in emerging specialized treatment areas, signifying a strategic move beyond its core offerings. These nascent ventures represent high-growth medical fields where the company is building foundational expertise and market traction. For instance, in 2024, Terveystalo has been noted for its increased focus on areas like advanced mental health services and personalized medicine, which require significant upfront investment in technology and specialized personnel.

Terveystalo is making strides in digitizing and personalizing care, particularly for chronic illnesses like diabetes and hypertension. These innovative digital pathways, while promising, are currently in their nascent stages of adoption.

Significant investment in marketing and user engagement is crucial for these new digital offerings to capture substantial market share. The digital health sector is evolving at a rapid pace, demanding continuous innovation and outreach.

New Public Sector Partnership Models

Terveystalo is actively pursuing new partnership models to expand its reach within the public healthcare sector. This strategy includes offering staffing services and selling network capacity, aiming to tap into a market facing significant challenges but offering substantial growth opportunities.

The public healthcare market represents a large and attractive segment for Terveystalo, especially given the ongoing pressures within public healthcare systems. For instance, in 2024, the Finnish public healthcare expenditure was projected to be around €23 billion, highlighting the sheer scale of the opportunity.

These new partnership models are expected to begin with a low initial market share. Success will hinge on significant investment and skillful strategic negotiations to achieve scalability and build a strong presence.

- Staffing Services: Providing healthcare professionals to public sector entities.

- Network Capacity Sales: Offering access to Terveystalo's existing healthcare facilities and resources.

- Market Potential: Public healthcare expenditure in Finland reached approximately €22.5 billion in 2023.

- Growth Strategy: Focus on building market share through strategic partnerships and service offerings.

High-Potential Niche Expansions

Terveystalo’s strategy includes targeted investments in physical assets, such as new hospital and facility projects, and advanced equipment for healthcare professionals. This approach fuels organic growth by focusing on specific, high-potential niche markets or specialized healthcare facilities.

While these niche expansions are promising for future growth, they typically begin with a low market share. They are essentially strategic investments in expanding segments that demand substantial capital and a considerable timeframe to develop into market leaders, or 'Stars' in the BCG matrix framework.

For instance, Terveystalo's commitment to expanding its specialized diagnostics services, such as advanced genetic testing or personalized cancer treatment centers, exemplifies this strategy. These areas, while currently niche, are projected for significant market growth. In 2024, Terveystalo continued to invest in digital health solutions and specialized clinics, aiming to capture emerging patient needs and build a strong foundation for future market dominance in these growing healthcare segments.

- Selective physical asset investments support organic growth.

- Niche market expansions require significant capital and time.

- These are strategic bets on growing segments with initial low market share.

- Focus on specialized facilities and equipment for industry professionals.

Terveystalo's investments in AI-driven tools and specialized treatment areas, like advanced mental health and personalized medicine, represent potential high-growth areas. However, these ventures are currently in their early stages with limited market penetration. Significant marketing and user engagement are vital for these digital health initiatives to gain traction in a rapidly evolving sector.

The company's strategy to partner with the public healthcare sector, offering staffing and network capacity, taps into a large market. While public healthcare expenditure in Finland was around €22.5 billion in 2023, these new models are expected to start with a low market share, requiring substantial investment and strategic negotiation to scale.

Terveystalo's targeted investments in physical assets and specialized equipment for niche markets, such as advanced genetic testing or cancer treatment centers, are designed for organic growth. These expansions, while promising for future growth, begin with low market share and require considerable capital and time to develop into market leaders.

| BCG Category | Terveystalo's Initiatives | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Question Marks | AI-driven data tools, Specialized treatment areas (e.g., mental health, personalized medicine), Digital health solutions for chronic illnesses | High | Low | Investment in R&D, marketing, and user engagement to build market share. |

| Stars | (Not explicitly detailed in provided text, but likely areas with high growth and high market share, potentially existing core services if well-established and growing) | High | High | Maintain leadership, reinvest profits. |

| Cash Cows | (Not explicitly detailed in provided text, but likely established, profitable services with low growth) | Low | High | Milk for cash, fund other investments. |

| Dogs | (Not explicitly detailed in provided text, but likely low growth, low market share areas) | Low | Low | Divest or minimize investment. |

BCG Matrix Data Sources

Our Terveystalo BCG Matrix is constructed using comprehensive market data, including financial performance reports, patient demographic trends, and competitive service analysis.