Terveystalo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Terveystalo Bundle

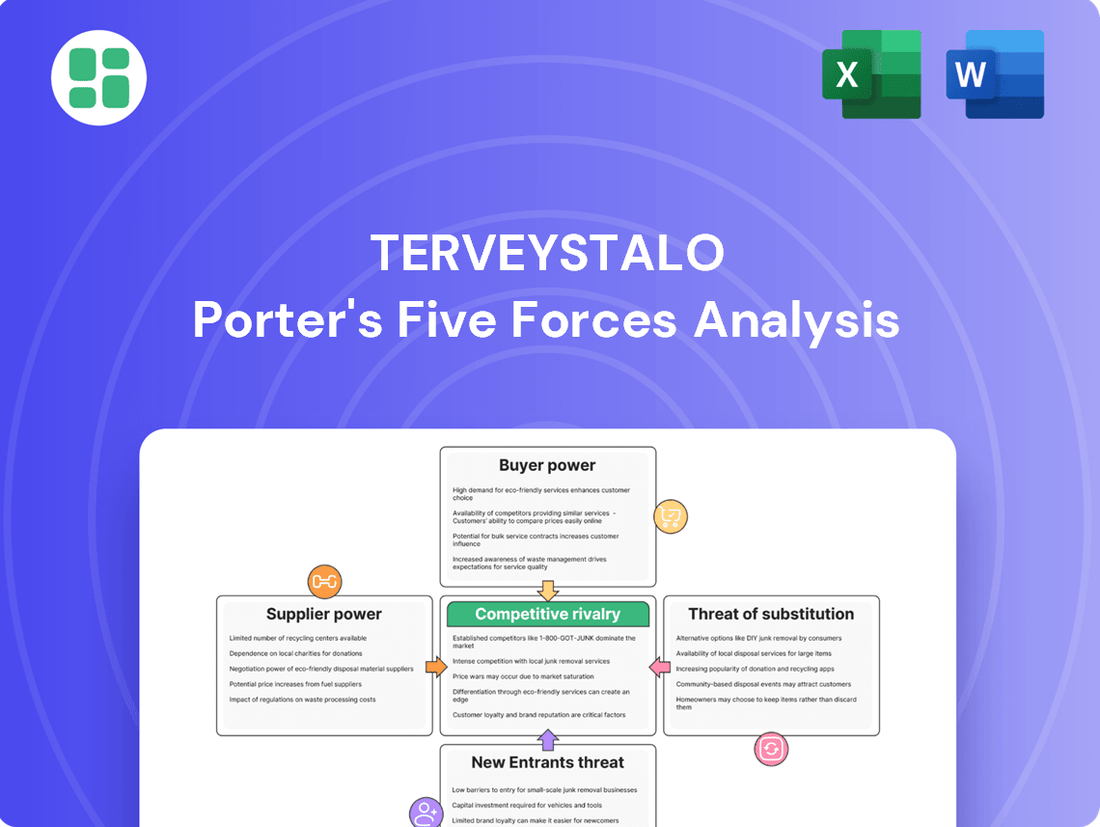

Terveystalo operates within a dynamic healthcare landscape, where understanding the interplay of competitive forces is crucial for strategic success. Our analysis reveals the significant impact of buyer power and the threat of substitutes on Terveystalo's market position.

The complete report reveals the real forces shaping Terveystalo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized medical equipment and unique pharmaceuticals wield considerable bargaining power. This is because these products are critical for patient care and often have limited alternatives. For instance, in 2024, the global medical devices market was valued at over $500 billion, with a significant portion driven by specialized, high-tech equipment where few suppliers exist.

Terveystalo, as a major healthcare provider, is dependent on these essential inputs. When viable alternatives are scarce, suppliers can dictate higher prices or less favorable contractual terms, directly impacting Terveystalo's operational costs and profitability. The proprietary nature of certain advanced medical technologies further solidifies this supplier leverage.

The availability of highly skilled healthcare professionals, such as doctors and nurses, is absolutely crucial for Terveystalo's service delivery. These individuals are the core of their operations, and their expertise directly impacts the quality of care provided.

A significant factor influencing their bargaining power is the current Finnish healthcare landscape. Reports from 2023 and early 2024 indicate ongoing challenges with staffing levels in public healthcare, partly due to government spending decisions. This scarcity of qualified personnel can empower these professionals, potentially driving up recruitment costs and salary demands for Terveystalo.

To counter this, Terveystalo actively works to be an employer of choice. By offering competitive compensation, professional development opportunities, and a supportive work environment, they aim to attract and retain top talent, thereby mitigating the impact of a tight labor market on their operational costs and service continuity.

As Terveystalo deepens its reliance on digital healthcare solutions and a smart service platform, the bargaining power of IT and digital healthcare solution providers is on the rise. Companies offering advanced IT infrastructure, specialized software, and crucial cybersecurity services are becoming increasingly influential in Terveystalo's operations. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating a robust demand for these specialized services.

The complexity involved in integrating these sophisticated IT systems within a healthcare environment, coupled with the paramount need for stringent data security and patient privacy, creates substantial switching costs for Terveystalo. This high barrier to entry and the specialized nature of these solutions mean that Terveystalo may find it challenging and expensive to change providers, thereby strengthening the bargaining power of existing IT and digital healthcare solution suppliers.

Real Estate and Facility Owners

The bargaining power of real estate and facility owners is a significant factor for Terveystalo, given its widespread network of healthcare facilities across Finland. Landlords who control prime locations, especially in densely populated urban areas or strategically important regional hubs, can leverage their position. This is particularly true as Terveystalo continues its expansion and seeks to optimize its operational footprint. For instance, in 2023, Terveystalo's revenue reached €1,360.8 million, underscoring the scale of its operations and its need for suitable, well-located premises to serve its growing patient base.

The ability of these facility owners to negotiate lease terms, rent increases, and renewal conditions directly impacts Terveystalo's operating costs and expansion capabilities. The strategic importance of having accessible and well-equipped physical locations for delivering in-person healthcare services means Terveystalo is reliant on securing and maintaining these spaces. This reliance grants a degree of leverage to property owners who can offer or withhold access to desirable sites.

- Strategic Locations: Owners of premium real estate in key Finnish cities and towns hold considerable sway due to Terveystalo's need for accessible patient service points.

- Lease Terms and Rent: Favorable lease agreements and rental rates are critical for Terveystalo's cost management and profitability, giving landlords negotiation power.

- Expansion Needs: As Terveystalo grows, its demand for new or expanded facilities increases, enhancing the bargaining position of property owners with available suitable spaces.

- Operational Dependency: Terveystalo's commitment to in-person care makes its physical presence paramount, creating a dependency on facility owners for its core service delivery.

Support Service Providers (e.g., Cleaning, Security)

For standardized support services like cleaning and security, individual suppliers typically possess low bargaining power. This is largely due to the abundant availability of alternative providers in the market, making it difficult for any single supplier to exert significant influence over pricing or terms. Terveystalo, as a major healthcare provider, likely benefits from this competitive landscape.

However, the dynamic can shift when considering large-scale, integrated contracts. In such scenarios, suppliers capable of offering comprehensive solutions might gain some leverage. Despite this, Terveystalo's substantial operational scale often allows it to negotiate favorable bulk deals, effectively mitigating the suppliers' potential power.

- Low Supplier Power in Standardized Services: The market for basic cleaning and security services is fragmented, with numerous providers competing for business.

- Potential for Increased Leverage in Integrated Contracts: Suppliers offering bundled or specialized support services may command more negotiation power.

- Terveystalo's Scale Advantage: The company's size enables it to secure advantageous pricing through volume purchasing and long-term agreements.

- Industry Benchmarking: For context, in 2024, many large organizations in the healthcare sector reported achieving cost savings of 5-10% on outsourced support services through strategic vendor management and consolidation.

Suppliers of specialized medical equipment and pharmaceuticals hold significant bargaining power due to the critical nature and limited alternatives of their products. For example, in 2024, the global medical devices market exceeded $500 billion, with specialized technology being a key driver, often supplied by a few dominant companies.

Terveystalo's dependence on these essential inputs, coupled with the proprietary nature of advanced medical technologies, allows suppliers to influence pricing and contract terms. This directly impacts Terveystalo's operational costs and profitability, especially when switching providers is complex and expensive.

The bargaining power of suppliers is amplified when Terveystalo requires highly specialized or unique inputs that lack readily available substitutes. This situation is common in advanced medical technology and specific pharmaceutical compounds, where innovation and patents restrict competition.

What is included in the product

This analysis unpacks the competitive intensity within the Finnish healthcare market for Terveystalo, examining supplier and buyer power, the threat of new entrants and substitutes, and the existing rivalry.

Quickly identify and address competitive threats, allowing Terveystalo to proactively manage its market position and customer acquisition costs.

Customers Bargaining Power

Private individuals, as consumers of healthcare, typically wield limited individual bargaining power. This is largely due to the essential nature of medical services and the strong trust consumers often place in established providers like Terveystalo, which can be built on perceived quality and brand recognition. For instance, in 2023, Terveystalo reported a revenue of €1.2 billion, indicating a significant market presence that can influence consumer choice.

However, the collective bargaining power of consumers can be amplified by external factors, such as government reimbursement policies. An example of this is the impact of Kela reimbursements in Finland, which can significantly lower out-of-pocket costs for private healthcare appointments. Increased reimbursements, like those seen in recent years, can make private care more affordable, thereby boosting demand and indirectly influencing provider pricing strategies.

Corporate clients, especially large employers, wield considerable bargaining power in the occupational health sector due to the sheer volume of services they procure for their workforce. Terveystalo's extensive reach, serving over 26,000 companies in Finland, underscores this dynamic. These clients can leverage their purchasing volume to negotiate favorable pricing, demand tailored service offerings that meet specific workforce needs, and expect consistently high standards of care and measurable health outcomes.

Public sector organizations, particularly Finland's Well-being Service Counties (WSCs), represent a significant customer segment for healthcare providers like Terveystalo. These WSCs are tasked with the crucial responsibility of organizing primary and secondary healthcare for their residents, making them substantial purchasers of healthcare services.

As large-scale buyers, the WSCs possess considerable bargaining power. This influence allows them to negotiate favorable contract terms, dictate pricing structures, and set stringent service standards. This is particularly relevant as many WSCs face financial deficits and are under pressure to control costs, further amplifying their ability to exert pressure on service providers.

Insurance Companies

The bargaining power of customers, particularly insurance companies, is a significant factor for Terveystalo. Finland's healthcare insurance market is experiencing robust growth, projected to be the fastest-expanding customer segment. This expansion inherently strengthens the negotiating position of insurers.

Insurance companies function as crucial intermediaries, guiding patient decisions and negotiating service prices with healthcare providers like Terveystalo. This intermediary role allows them to exert considerable influence over Terveystalo's revenue and the scope of its services. For instance, in 2024, the Finnish insurance market saw continued expansion, with health insurance products showing particularly strong uptake. This trend is expected to continue, further solidifying the bargaining power of these entities.

- Growing Healthcare Insurance Market: Finland's healthcare insurance sector is on a strong upward trajectory, anticipated to be the fastest-growing customer segment.

- Intermediary Role: Insurers influence patient choices and negotiate rates with healthcare providers, impacting Terveystalo's revenue and service offerings.

- Negotiating Power: The increasing market share of insurance companies translates directly into greater leverage when negotiating contracts and pricing with Terveystalo.

- Impact on Terveystalo: This heightened bargaining power can lead to pressure on Terveystalo's profit margins and necessitate adjustments in its service provision strategies.

Digital Service Users

For Terveystalo's digital service users, bargaining power is moderate. The convenience of digital health consultations is a significant draw, but the relatively low switching costs for basic services mean users can easily move to competitors if unsatisfied. This necessitates a strong focus on customer experience.

Terveystalo recognizes this dynamic, prioritizing an excellent Net Promoter Score (NPS) as a key metric. For instance, in 2024, Terveystalo reported an NPS of 45 for its digital services, indicating a high level of customer loyalty and satisfaction. This focus on integrated digital care paths aims to lock in users and reduce churn.

- Low Switching Costs: Users can readily switch between digital health platforms for routine consultations, granting them some leverage.

- Focus on NPS: Terveystalo's commitment to a strong NPS (45 in 2024) highlights its strategy to combat customer power through satisfaction.

- Integrated Digital Care Paths: These aim to enhance user experience and create stickiness, thereby mitigating individual user bargaining power.

The bargaining power of customers in the healthcare sector, particularly for Terveystalo, is multifaceted. While individual private patients have limited sway due to the necessity of care, large corporate clients and public sector entities like Finland's Well-being Service Counties (WSCs) exert significant influence through their substantial purchasing volumes. Furthermore, the rapidly expanding healthcare insurance market in Finland, projected as the fastest-growing customer segment, grants insurers considerable leverage in negotiating prices and service terms with providers like Terveystalo.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Terveystalo's Revenue Impact (Illustrative) |

|---|---|---|---|

| Private Individuals | Low | Essential nature of services, trust in providers | Direct patient payments, co-pays |

| Corporate Clients | High | Volume purchasing, demand for tailored services | Contracted occupational health services |

| Public Sector (WSCs) | High | Large-scale procurement, cost control pressures | Public tenders, service agreements |

| Insurance Companies | Increasingly High | Market growth, intermediary role, negotiation of rates | Reimbursement rates, service scope agreements |

Full Version Awaits

Terveystalo Porter's Five Forces Analysis

This preview showcases the complete Terveystalo Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape within the healthcare sector. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden elements. You can confidently expect this professionally formatted and ready-to-use analysis to be instantly accessible upon completing your transaction.

Rivalry Among Competitors

Terveystalo stands as the undisputed leader in Finland's private healthcare sector, boasting the highest revenue and the most extensive network. Its dominance extends to the Nordics as a premier occupational health provider. This significant market presence translates into substantial economies of scale, enabling Terveystalo to offer a broader spectrum of services and cultivate stronger brand recognition than its smaller competitors.

The Finnish private healthcare sector is experiencing significant consolidation, with major players like Terveystalo and Mehiläinen actively acquiring smaller clinics. This trend, as noted by the Finnish Competition and Consumer Authority, intensifies rivalry as these larger entities vie for increased market share through strategic mergers and acquisitions. For instance, Terveystalo's acquisition of Private Doctors in 2023, a deal valued at approximately €110 million, exemplifies this aggressive growth strategy.

Terveystalo's extensive service offering, encompassing medical, occupational health, and wellbeing, alongside its integrated care model, sets it apart. This breadth allows Terveystalo to serve a wider customer base, from individuals seeking routine check-ups to corporations requiring comprehensive employee health management. For instance, in 2023, Terveystalo reported strong revenue growth, partly driven by its ability to cross-sell services to its existing clientele, demonstrating the power of its integrated approach.

Digitalization and Innovation

The competitive landscape in healthcare is rapidly evolving, with digital advancements significantly intensifying rivalry. Terveystalo's proactive approach, marked by substantial investments in its smart service platform and digital tools, directly addresses this trend. These investments aim to boost efficiency, refine the customer journey, and expand the reach of remote healthcare services, thereby setting a higher technological benchmark for competitors.

This digital push creates pressure on rivals to similarly innovate and invest in their own technological infrastructure to remain competitive. Terveystalo's strategic focus on digitalization positions it to capture market share by offering superior convenience and accessibility, forcing other players to either adapt or risk falling behind.

- Digital advancements are a key driver of competition in the healthcare sector.

- Terveystalo's significant investments in its smart service platform and digital tools are crucial for operational efficiency and customer experience.

- The company's focus on remote services puts pressure on competitors to match its technological capabilities.

Quality and Customer Satisfaction

In the healthcare sector, the intensity of competition often hinges on the quality of services provided and the resulting customer satisfaction. Terveystalo’s commitment to maintaining high medical standards and achieving positive patient outcomes directly impacts its competitive standing.

Customer satisfaction, frequently gauged by metrics like the Net Promoter Score (NPS), serves as a critical differentiator. Terveystalo's reported improvements in NPS scores, such as reaching 43.8 in 2023, underscore its success in fostering loyalty and attracting new patients.

- Quality of Care: Terveystalo emphasizes high medical quality, contributing to patient retention.

- Customer Satisfaction: Improved NPS scores, like the 43.8 recorded in 2023, indicate strong customer loyalty.

- Competitive Advantage: Positive patient outcomes and satisfaction are key battlegrounds in the healthcare industry.

- Market Impact: These factors help Terveystalo attract new customers and maintain its position against rivals.

Competitive rivalry in Finland's private healthcare is intense, with Terveystalo and Mehiläinen leading a consolidating market through acquisitions. Terveystalo's acquisition of Private Doctors for approximately €110 million in 2023 highlights this aggressive expansion. Digitalization is a key battleground, with Terveystalo's investment in its smart service platform and remote healthcare services pushing competitors to innovate to keep pace.

Terveystalo's strong customer satisfaction, reflected in its 2023 Net Promoter Score of 43.8, provides a significant competitive edge. This focus on quality care and positive patient outcomes is crucial for retaining existing patients and attracting new ones in a market where service excellence is a primary differentiator.

| Competitor | Market Position | Key Strategies |

|---|---|---|

| Terveystalo | Market Leader (Finland) | Acquisitions, Digitalization, Integrated Care |

| Mehiläinen | Major Competitor | Consolidation, Service Expansion |

| Smaller Clinics | Niche/Regional Players | Specialization, Local Focus |

SSubstitutes Threaten

The publicly funded healthcare system in Finland acts as a significant substitute for private healthcare providers like Terveystalo. This system offers comprehensive coverage to all residents, making it a powerful alternative, particularly for essential medical services.

Despite challenges such as extended waiting times and ongoing financial pressures within the public sector, its broad accessibility continues to make it a compelling choice for many. The Finnish government's commitment to managing public spending and enhancing healthcare access reinforces the public system's position as a formidable substitute.

Self-care and home remedies present a notable threat to Terveystalo, particularly for minor ailments and general wellbeing. Many individuals are increasingly turning to over-the-counter medications, dietary adjustments, or simple lifestyle changes as alternatives to professional medical consultations. This trend can directly reduce demand for Terveystalo's more routine or basic healthcare services.

For instance, the global market for over-the-counter (OTC) drugs was valued at approximately USD 150 billion in 2023 and is projected to grow, indicating a substantial consumer preference for self-treatment. While this impacts general practice, the effect on Terveystalo's specialized services like occupational health or advanced diagnostics is likely to be less pronounced, as these require professional expertise.

Alternative therapies like naturopathy and acupuncture, along with wellness services such as fitness coaching and dietary advice, present a threat of substitutes for Terveystalo. These options, while not direct medical replacements, vie for consumer spending on health and well-being. For instance, the global wellness market was valued at over $5.6 trillion in 2023, indicating significant consumer investment in non-traditional health solutions.

International Medical Tourism

For certain specialized or elective medical procedures, international medical tourism presents a viable substitute for Terveystalo’s services. Finnish patients with the financial means or private insurance may opt for treatments abroad if they can find shorter waiting periods or more competitive pricing in other nations. This trend, while currently representing a niche market, has the potential for growth, particularly as global healthcare accessibility improves.

The attractiveness of medical tourism as a substitute is influenced by several factors:

- Cost Savings: Patients can sometimes find significant cost reductions for procedures like cosmetic surgery or certain dental treatments in countries such as Estonia or Turkey compared to Finland.

- Reduced Waiting Times: For non-emergency procedures, patients may bypass lengthy queues within the Finnish healthcare system by seeking care internationally.

- Access to Specialized Treatments: In some cases, specific advanced treatments or technologies might be more readily available or at an earlier stage of adoption in other countries.

Unregulated or Informal Healthcare Providers

The threat of unregulated or informal healthcare providers exists, particularly for individuals seeking basic advice or managing non-critical conditions. These alternatives can offer lower costs, bypassing the rigorous standards and associated expenses of established providers like Terveystalo. For instance, a 2024 survey indicated that a notable percentage of individuals might seek health information from online forums or unqualified sources, especially for minor ailments, underscoring the need for accessible and trusted professional guidance.

While Terveystalo's commitment to certified medical professionals and high-quality care significantly mitigates this threat, the availability of informal options remains a factor. These providers, often operating outside traditional regulatory frameworks, can attract price-sensitive consumers. This dynamic means that Terveystalo must continue to emphasize its value proposition, which includes patient safety, evidence-based treatments, and comprehensive care, to differentiate itself from less regulated alternatives.

- Low Cost Alternatives: Informal providers often have lower overheads, allowing them to offer services at a reduced price point compared to regulated entities.

- Accessibility for Minor Issues: For non-urgent or minor health concerns, individuals may opt for readily available, informal advice or services.

- Information Sources: Online platforms and non-professional advice networks can serve as substitutes for professional medical consultation in certain contexts.

- Consumer Perception: While quality is a concern, some consumers might perceive informal providers as a viable option if cost is the primary driver for non-critical health needs.

The publicly funded healthcare system in Finland remains a primary substitute, offering comprehensive care that can deter patients from seeking private services, especially for routine needs. Despite potential wait times, its universal accessibility and government backing make it a strong alternative. Furthermore, the growing trend of self-care, fueled by readily available over-the-counter medications and wellness advice, directly competes with Terveystalo’s less specialized services. The global OTC market, valued at approximately USD 150 billion in 2023, highlights this shift towards self-treatment. Alternative therapies and international medical tourism also present substitution threats, particularly for elective procedures where cost and wait times are key considerations.

| Substitute Category | Description | Impact on Terveystalo | Supporting Data/Trend |

|---|---|---|---|

| Public Healthcare System | Finland's universal healthcare system | High for routine and essential services; mitigates demand for basic private care. | Comprehensive coverage for all residents. |

| Self-Care & Home Remedies | Use of OTC drugs, lifestyle changes | Moderate to High for minor ailments and general wellness; reduces demand for primary care. | Global OTC market ~$150 billion (2023); growing consumer preference for self-treatment. |

| Alternative Therapies & Wellness | Naturopathy, acupuncture, fitness coaching | Moderate; competes for consumer spending on health and well-being. | Global wellness market >$5.6 trillion (2023). |

| International Medical Tourism | Seeking medical care abroad | Low to Moderate; niche market for specialized or elective procedures. | Driven by cost savings and reduced waiting times in certain countries. |

Entrants Threaten

Establishing a comprehensive healthcare service provider like Terveystalo, with its extensive network of clinics and hospitals and sophisticated digital infrastructure, demands significant upfront capital. For instance, building a new hospital or acquiring and upgrading existing facilities can easily run into tens or even hundreds of millions of Euros, creating a formidable barrier for aspiring competitors.

This high capital requirement discourages potential new entrants by necessitating massive financial commitments for infrastructure, technology, and skilled personnel. The sheer scale of investment needed to compete effectively in the Finnish healthcare market, especially with established players like Terveystalo, deters many smaller or less-capitalized companies from entering.

The healthcare sector in Finland, where Terveystalo operates, is heavily regulated. New entrants face significant challenges due to the need for extensive licensing, certifications, and strict adherence to quality and safety standards. For instance, obtaining the necessary permits and approvals can be a lengthy and costly process, acting as a substantial barrier.

Terveystalo has cultivated a robust brand reputation and deep customer trust, reflected in its consistently high Net Promoter Scores, which often exceed industry averages. For example, in 2023, Terveystalo reported a strong Net Promoter Score, indicating high customer loyalty and satisfaction.

Newcomers face a substantial hurdle in replicating Terveystalo's established credibility. Building comparable trust and recognition among individual consumers, corporate partners, and government entities requires considerable time and substantial financial investment.

This brand equity acts as a significant barrier, as potential new entrants must not only offer competitive services but also overcome the ingrained preference and confidence that customers have in Terveystalo's established name and track record.

Access to Skilled Professionals

The existing shortage of healthcare professionals in Finland significantly hinders new entrants. It's difficult for them to recruit the necessary talent to staff their operations effectively. This scarcity of skilled individuals creates a substantial barrier to entry.

Terveystalo benefits from its established reputation as a preferred employer. This strong employer brand gives it a distinct advantage in attracting and retaining the highly skilled staff essential for success in the healthcare sector.

- Healthcare professional shortage in Finland: A persistent challenge impacting recruitment for new market players.

- Terveystalo's employer advantage: Established reputation aids in attracting and retaining key talent.

- Recruitment difficulties: New entrants face significant hurdles in staffing operations due to limited skilled professionals.

Economies of Scale and Network Effects

Terveystalo leverages significant economies of scale across its vast network of healthcare facilities and service providers. This scale allows for substantial cost efficiencies in areas like procurement of medical supplies, adoption of new technologies, and centralized administrative functions. For instance, in 2023, Terveystalo reported a revenue of €1.4 billion, underscoring its operational size and the potential for cost savings through bulk purchasing and streamlined operations.

Furthermore, Terveystalo benefits from powerful network effects. As its number of clinics and the breadth of its service offerings grow, it becomes more attractive to a wider customer base. This creates a virtuous cycle where more patients lead to greater brand recognition and loyalty, making it increasingly challenging for new, smaller competitors to match Terveystalo's cost structure or the convenience of its integrated service model.

- Economies of Scale: Terveystalo's large operational footprint enables cost advantages in procurement and administration.

- Network Effects: A broader network of clinics and services attracts more customers, enhancing Terveystalo's market position.

- Competitive Barrier: These factors create a significant barrier for new entrants aiming to compete on cost or convenience.

The threat of new entrants in the Finnish healthcare market, where Terveystalo operates, is generally low. Significant capital requirements for establishing facilities and technology create a substantial barrier.

High regulatory hurdles, including licensing and strict quality standards, further deter new players. Terveystalo's strong brand reputation and customer loyalty also make it difficult for newcomers to gain market share.

The existing shortage of healthcare professionals and Terveystalo's advantage in attracting talent also contribute to this low threat level.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for infrastructure, technology, and personnel. | Significant deterrent due to massive financial commitments needed. |

| Regulation & Licensing | Extensive permits, certifications, and adherence to safety standards. | Lengthy and costly processes create a substantial hurdle. |

| Brand Reputation & Loyalty | Established trust and customer preference for Terveystalo. | New entrants struggle to build comparable credibility and attract customers. |

| Talent Acquisition | Shortage of healthcare professionals and Terveystalo's employer brand advantage. | Newcomers face difficulties in recruiting and retaining skilled staff. |

| Economies of Scale | Terveystalo's operational size leads to cost efficiencies. | Makes it challenging for smaller new entrants to compete on price. |

Porter's Five Forces Analysis Data Sources

Our Terveystalo Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Terveystalo's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and analyses from reputable healthcare sector publications.