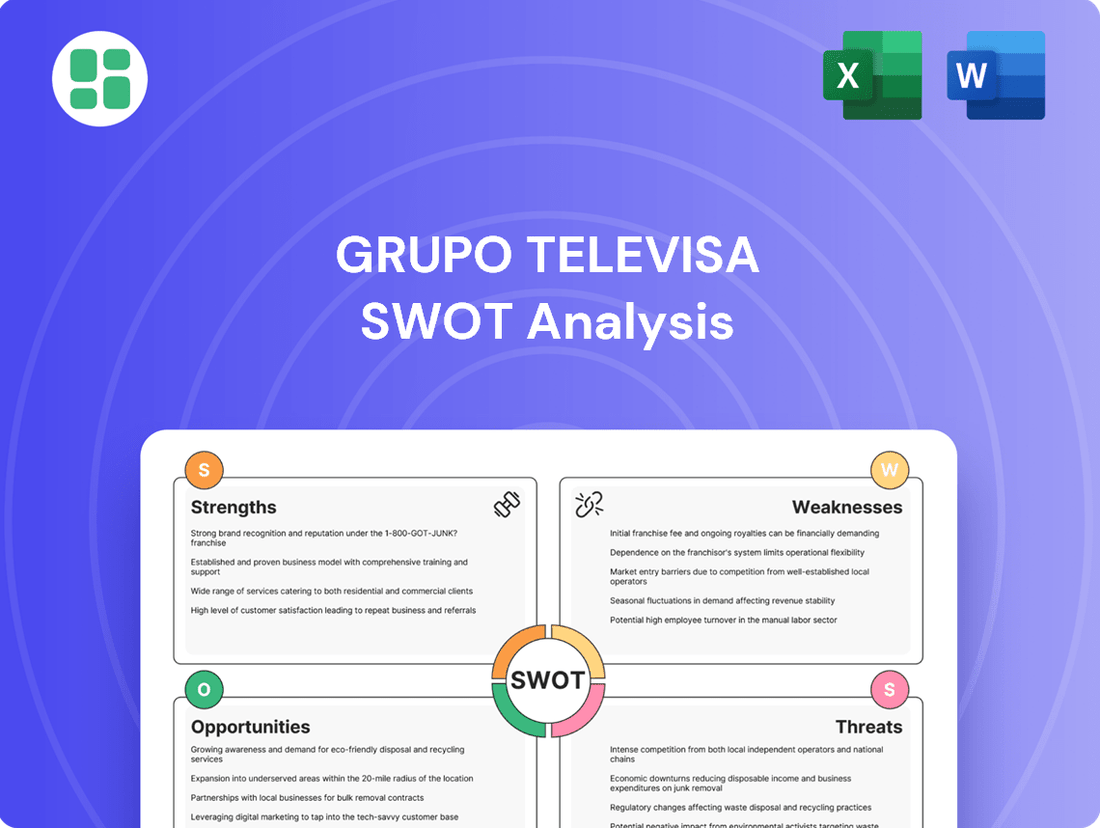

Grupo Televisa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

Grupo Televisa, a media giant, possesses significant strengths in its vast content library and extensive distribution networks across Latin America. However, it also faces considerable threats from digital disruption and evolving consumer viewing habits. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Televisa’s market position, its opportunities for expansion, and the challenges it must overcome? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Grupo Televisa commands an extensive market reach across Mexico, primarily through its dominant free-to-air television networks. This significant presence allows it to connect with a vast majority of the population, making it a powerful platform for advertising and content distribution.

The company's established brand recognition and deep-rooted loyalty among Mexican consumers provide a substantial competitive advantage. This brand equity translates into a strong position, not only in traditional media but also as it navigates the evolving landscape of digital and streaming services.

In 2024, Televisa's free-to-air networks continued to be a primary source of news and entertainment for millions, reinforcing its status as a cultural cornerstone. This broad accessibility is crucial for its advertising revenue streams, which remain a core component of its financial performance.

Grupo Televisa's strength lies in its remarkably diversified business portfolio, touching free-to-air television, content creation and distribution, cable services through Izzi, telecommunications via Sky, publishing, radio, and even professional sports. This broad operational spread significantly reduces the company's reliance on any single revenue source, creating a more robust and resilient business model. For instance, in the first quarter of 2024, Televisa reported consolidated revenues of approximately Ps. 18,658 million, with its Cable segment contributing a substantial portion.

This diversification not only spreads risk but also opens up numerous avenues for growth and synergistic cross-promotion. The strategic integration of its cable (Izzi) and satellite (Sky) businesses is a prime example of this, aimed at consolidating resources and enhancing operational efficiencies. This consolidation is crucial for competing effectively in the rapidly evolving telecommunications and media landscape, allowing for bundled offerings and improved customer service.

Grupo Televisa's extensive library of Spanish-language content is a significant strength, fueling its linear television operations and its growing streaming presence, notably via its investment in TelevisaUnivision and the ViX platform. This deep catalog, featuring popular telenovelas, news, and live sports, resonates strongly with the vast Spanish-speaking audience, providing a competitive edge and a foundation for attracting and retaining subscribers and advertisers.

Strategic Focus on Value Customers and Operational Efficiencies

Grupo Televisa’s strategic focus on high-value customers in its cable division is yielding tangible results, evidenced by stabilizing internet subscriber numbers and a noticeable decrease in customer churn. This targeted approach ensures a more predictable revenue stream and strengthens its market position.

The company has successfully leveraged operational efficiencies and synergies, particularly through the integration of Izzi and Sky. These efforts have directly translated into an improved consolidated operating segment income margin, demonstrating enhanced profitability and cost management.

- Customer Retention: Strategies aimed at high-value cable customers have helped stabilize internet subscriber bases.

- Reduced Churn: Efforts to retain valuable customers have led to lower churn rates in the cable segment.

- Operational Synergies: Integration of Izzi and Sky has unlocked significant operational expense efficiencies.

- Margin Expansion: These efficiencies have contributed to an expansion in the consolidated operating segment income margin, boosting overall profitability.

Growing Digital and Streaming Presence

Grupo Televisa's growing digital and streaming presence is a significant strength, primarily driven by its streaming platform, ViX. As of early 2025, ViX has surpassed 10 million global subscribers, a figure that continues to climb with double-digit year-over-year increases in streaming hours. This expansion highlights a strong market reception and growing engagement with Televisa's content library.

Further bolstering this digital push are strategic collaborations. A key example is the bundling of ViX Plus with Disney+ in Mexico, a partnership designed to expand reach and attract new audiences. These alliances, combined with substantial investments in advanced technology and AI-driven solutions, are crucial for enhancing ViX's digital capabilities and ensuring its competitive positioning in the rapidly evolving streaming landscape.

- ViX Global Subscribers: Over 10 million as of early 2025.

- Streaming Hour Growth: Double-digit year-over-year increases.

- Strategic Partnerships: Examples include bundling ViX Plus with Disney+ in Mexico.

- Technology Investment: Focus on AI and digital solutions to enhance platform capabilities.

Grupo Televisa's extensive market reach in Mexico, primarily through its dominant free-to-air television networks, allows it to connect with a vast majority of the population, serving as a powerful platform for advertising and content distribution.

The company's robust brand recognition and deep-rooted customer loyalty in Mexico provide a significant competitive edge, extending from traditional media into digital and streaming services.

Televisa's diversified business model, encompassing television, content creation, cable (Izzi), telecommunications (Sky), publishing, radio, and sports, reduces reliance on single revenue streams, creating a resilient structure.

Its substantial library of Spanish-language content fuels both linear TV and its growing streaming presence, particularly through its investment in TelevisaUnivision and the ViX platform, appealing to a broad Spanish-speaking audience.

| Segment | 2024 Revenue (Ps. Million) | 2025 Outlook |

|---|---|---|

| Cable (Izzi) | ~8,000 | Continued subscriber growth |

| Content | ~6,000 | Increased ViX subscriptions |

| Broadcasting | ~4,658 | Stable advertising revenue |

What is included in the product

Delivers a strategic overview of Grupo Televisa’s internal and external business factors, highlighting its strong brand recognition and extensive content library while also noting challenges in the evolving media landscape and increasing competition.

Offers a clear breakdown of Televisa's competitive landscape, helping to identify and address market vulnerabilities and capitalize on emerging opportunities.

Weaknesses

Grupo Televisa's traditional pay-TV and satellite business, particularly its Sky segment, has faced a consistent decline. For instance, in the first quarter of 2024, Sky reported a decrease in its subscriber base, reflecting a broader industry trend as consumers increasingly opt for streaming services and over-the-top (OTT) content. This ongoing subscriber attrition directly impacts revenue streams, necessitating strategic adjustments to mitigate the financial consequences of this legacy business's contraction.

Grupo Televisa's Mexican operations have experienced a revenue downturn, with a notable decrease reported in early 2024. This decline is partly attributed to unfavorable foreign exchange rates and a softening in the Mexican advertising sector, which directly impacts the company's top line in its primary market.

Grupo Televisa operates in extremely competitive telecommunications and streaming sectors within Mexico. Key rivals such as América Móvil's Telmex, Total Play, and Megacable vie for broadband customers, while global streaming services like Netflix, Amazon Prime Video, and YouTube Premium are major players in video content. This intense rivalry can significantly impact pricing strategies and Televisa's overall market share.

Challenges in Content Strategy and Production Costs

Grupo Televisa, despite its robust content creation abilities, grapples with the ever-increasing costs associated with producing high-quality media. The media sector demands constant innovation to capture and hold viewer attention amidst a highly fragmented market.

The company has recently encountered difficulties, including the discontinuation of popular, long-running programs and a necessary overhaul of its content development approach. These shifts may weaken its position relative to competitors.

- Rising Production Expenses: The media industry, including companies like Televisa, faces escalating budgets for content creation, impacting profitability.

- Audience Fragmentation: Attracting and retaining viewers in a crowded digital landscape requires significant investment and strategic adaptation.

- Content Strategy Revisions: The cancellation of key shows and strategic realignments signal potential challenges in maintaining a competitive content library.

Regulatory and Political Uncertainties

Grupo Televisa faces potential headwinds from evolving regulatory landscapes in Mexico. The ongoing dissolution of the Federal Telecommunications Institute (IFT) and the proposed creation of a new Digital Transformation Agency introduce significant uncertainty. These shifts could alter the competitive playing field and introduce new operational requirements, impacting Televisa's strategic planning and investment decisions in the telecommunications and media sectors.

The dynamic nature of these regulatory changes poses a risk to Televisa's long-term business model. For instance, potential changes in competition enforcement or new licensing requirements could affect revenue streams and market access. Investors and stakeholders will be closely monitoring how these political and regulatory shifts are managed, as they could significantly influence the company's operational framework and profitability going forward.

- Regulatory Uncertainty: The dissolution of the IFT and the potential establishment of a new Digital Transformation Agency create an unpredictable regulatory environment for Mexico's telecommunications and media sectors.

- Policy Shifts: Changes in government policy could lead to altered competition rules, spectrum allocation, and content regulations, directly impacting Televisa's operations and market position.

- Investment Impact: Such uncertainties may deter new investments or necessitate adjustments to existing capital expenditure plans as Televisa navigates the evolving legal and political landscape.

Grupo Televisa's legacy pay-TV business, particularly Sky, continues to see subscriber declines, a trend evident in early 2024 as consumers shift to streaming. This erosion of its traditional customer base directly impacts revenue. Furthermore, the company faces intense competition in both telecommunications and content streaming from major domestic and international players, pressuring pricing and market share.

Escalating production costs for high-quality content present a significant challenge, especially in a fragmented media market demanding constant innovation. Recent content strategy shifts, including the discontinuation of some programs, signal potential weaknesses in maintaining a competitive edge against rivals. Regulatory uncertainty in Mexico, with the dissolution of the IFT and proposed new agencies, adds another layer of complexity, potentially altering operational frameworks and investment strategies.

Full Version Awaits

Grupo Televisa SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights Grupo Televisa's key Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic decision-making.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain deeper insights into Televisa's competitive landscape and future potential.

Opportunities

Grupo Televisa can capitalize on the growing demand for high-speed internet and mobile connectivity. Despite a challenging pay-TV market, the company has a significant opportunity to expand its fixed broadband and mobile subscriber numbers, particularly through its revamped MVNO offerings.

Strategic investments in fiber-to-the-home (FTTH) infrastructure will be crucial for attracting and retaining customers. By focusing on high-value segments and delivering superior service, Televisa can drive subscriber growth and boost revenue in these key areas, potentially capturing a larger share of the expanding digital services market.

The Mexican video streaming market is experiencing robust expansion, with projections indicating continued growth through 2025. This presents a prime opportunity for TelevisaUnivision's ViX platform to significantly increase its subscriber numbers and digital advertising income. ViX can capitalize on its unique Spanish-language content library to attract and retain users in this expanding market.

By focusing on exclusive content and innovative advertising solutions, ViX is well-positioned to capture a larger segment of the digital media spend. The increasing consumption of digital content in Mexico, estimated to grow by over 10% annually, offers a fertile ground for ViX to solidify its market presence and drive revenue growth in the coming years.

Grupo Televisa can significantly boost engagement and revenue by investing in data analytics and AI. These technologies allow for highly personalized content recommendations, tailoring the viewing experience to individual preferences. For instance, by analyzing viewing habits, Televisa can suggest programs that are more likely to capture a user's attention, thereby increasing watch time.

This enhanced personalization directly translates to more effective targeted advertising. With a deeper understanding of audience segments, Televisa can offer advertisers more precise reach, leading to higher ad conversion rates. This capability is crucial in the evolving digital landscape where advertisers seek demonstrable ROI from their campaigns, potentially opening up new monetization avenues for Televisa's digital platforms.

The digital advertising market is projected to continue its strong growth. In 2024, global digital ad spending is expected to reach over $700 billion, with a significant portion driven by personalized and data-driven campaigns. By leveraging AI for ad optimization, Televisa can tap into this growing market, enhancing its revenue streams beyond traditional broadcast models.

Strategic Partnerships and Bundling

Grupo Televisa's strategic partnerships are a key opportunity. The recent collaboration with Disney+ in Mexico, launched in late 2023, allows for content bundling, potentially attracting a broader subscriber base and expanding distribution channels. This move is crucial in a competitive streaming landscape.

Bundling media content with its telecommunications services, such as Izzi cable and internet, presents a significant opportunity to boost customer retention. By offering integrated packages, Televisa can create more compelling value propositions, aiming to increase the average revenue per user (ARPU). For instance, as of Q1 2024, Izzi reported over 4.9 million total RGUs (Revenue Generating Units), showcasing the scale of its existing customer base.

- Expand Distribution: Partnerships like the one with Disney+ enhance reach and attract new users to Televisa's content platforms.

- Increase ARPU: Bundling media with telecom services offers greater value, encouraging customers to stay and spend more.

- Competitive Edge: Integrated offerings differentiate Televisa from pure-play telecom or content providers in the Mexican market.

Monetization of Sports and Live Events

Grupo Televisa's established dominance in broadcasting major professional sports, including exclusive rights to prominent football leagues and significant events, presents a prime opportunity to enhance revenue streams. This strong foothold allows for robust monetization of live content across its traditional television channels and its growing streaming service, ViX. For instance, the Liga MX viewership on Televisa platforms consistently attracts millions, driving substantial advertising revenue during these high-demand periods.

The inherent appeal of live sports translates directly into increased viewership and, consequently, heightened advertising interest. This dynamic creates a valuable asset for Televisa, as advertisers are willing to pay premium rates to reach engaged audiences during these peak events. In 2024, live sports broadcasts continued to be a primary driver of audience engagement, with major football finals drawing viewership figures that significantly outpaced regular programming.

- Broadcasting Rights: Securing and leveraging exclusive rights to major football leagues and international sporting events.

- Platform Expansion: Monetizing live sports content through both linear television and digital streaming platforms like ViX.

- Advertising Revenue: Capitalizing on the high demand for advertising slots during live sports broadcasts due to record viewership.

- Viewer Engagement: Utilizing the inherent draw of live sports to increase overall platform engagement and subscriber acquisition.

Grupo Televisa can leverage its extensive content library and established brand presence to expand its digital offerings. The company's investment in ViX, its Spanish-language streaming service, positions it to capture a larger share of the growing Latin American digital media market. By focusing on original content and strategic partnerships, Televisa can drive subscriber growth for ViX, which is projected to see continued expansion through 2025, increasing digital advertising revenue.

Expanding its telecommunications services, particularly high-speed internet and mobile connectivity, presents a significant opportunity. By investing in fiber infrastructure and offering bundled services that include its media content, Televisa can enhance customer value and retention. This strategy is supported by the increasing demand for broadband, with Mexico's internet penetration expected to rise, offering Televisa's Izzi service a larger addressable market.

The company's strong position in broadcasting live sports, especially football, is a key revenue driver. Exclusive rights to popular leagues attract substantial viewership, which in turn commands premium advertising rates. This is further amplified by the growing trend of consuming live sports across both traditional television and digital platforms, such as ViX, thereby maximizing monetization potential.

Grupo Televisa can capitalize on the digital advertising boom by enhancing its data analytics and AI capabilities. This allows for more personalized content delivery and highly targeted advertising, leading to increased ad conversion rates and revenue. With global digital ad spending projected to exceed $700 billion in 2024, Televisa is well-positioned to capture a significant portion of this growth by offering advertisers demonstrable ROI.

Threats

Grupo Televisa faces significant challenges from intensifying competition within the Mexican market. Global Over-The-Top (OTT) streaming services continue to gain traction, offering a wide array of content that directly competes with Televisa's traditional broadcast and cable offerings.

Furthermore, domestic telecom operators such as América Móvil, Total Play, and Megacable are aggressively expanding their bundled services, often including high-speed internet and increasingly, video-on-demand and live TV options. This aggressive market play by competitors is a substantial threat.

This heightened competitive landscape directly impacts Televisa by increasing the risk of subscriber churn across its media and telecommunications segments. The pressure to maintain subscriber numbers can also trigger price wars, potentially eroding profit margins and market share.

Consumers are increasingly favoring on-demand and streaming services over traditional linear television and pay-TV. This shift in viewing habits directly impacts Televisa's established revenue models.

For instance, in 2024, the global streaming market continued its robust growth, with subscription numbers reaching new highs, further illustrating this trend. This necessitates substantial and ongoing financial commitment for Televisa to adapt its digital offerings and maintain its competitive edge in this evolving landscape.

Economic downturns, high inflation, and currency depreciation in Mexico pose a significant threat to Televisa. These factors can cause advertisers to reduce their spending, directly impacting the company's revenue streams. For instance, Mexican advertising revenue saw a notable decline in recent periods, underscoring this vulnerability.

Furthermore, adverse economic conditions erode consumer purchasing power. This can lead to decreased spending on entertainment and telecommunications services, which are key revenue drivers for Televisa, affecting overall demand for their offerings.

Regulatory Changes and Increased Scrutiny

The evolving regulatory landscape in Mexico presents a significant threat to Grupo Televisa. Potential changes to asymmetric measures, which have historically regulated its dominant position, could introduce new obligations or restrictions. For instance, discussions around the dissolution of the Federal Institute of Telecommunications (IFT) could lead to a less specialized regulatory body, potentially creating uncertainty regarding future enforcement and policy direction.

Increased regulatory scrutiny on market dominance and competition poses another substantial risk. Authorities may impose stricter rules on pricing, content distribution, or infrastructure access, impacting Televisa's business operations and strategic flexibility. This heightened oversight could limit its ability to leverage its market position, potentially affecting revenue streams and competitive advantages in the dynamic telecommunications and media sectors.

- Regulatory Uncertainty: The potential dissolution of the IFT in Mexico, a key regulator for the telecommunications sector, could lead to an unpredictable regulatory environment for Grupo Televisa.

- Asymmetric Measures: Changes or the removal of asymmetric measures, designed to curb Televisa's market power, could fundamentally alter its operational framework and competitive landscape.

- Antitrust Scrutiny: Increased focus on market dominance by regulatory bodies might result in stricter enforcement of antitrust laws, impacting Televisa's strategic decisions and expansion plans.

- Compliance Costs: Adapting to new or evolving regulations often necessitates significant investment in compliance, potentially diverting resources from growth initiatives.

Content Piracy and Cybersecurity Risks

Content piracy continues to be a substantial hurdle in Mexico, directly affecting legitimate Over-The-Top (OTT) services like Televisa's. This illicit distribution can significantly diminish subscription revenue streams, a critical component for growth in the digital media landscape. For instance, studies in Latin America have indicated that content piracy can lead to billions in lost revenue annually for the entertainment industry.

Beyond piracy, Grupo Televisa faces considerable cybersecurity risks across its vast digital infrastructure. Protecting sensitive customer data and ensuring the uninterrupted operation of its services are paramount. A successful cyberattack could result in severe financial penalties, reputational damage, and a loss of customer trust, impacting its market position.

- Content Piracy Impact: Reports suggest that digital piracy in Latin America, including Mexico, results in billions of dollars in lost revenue for the media and entertainment sector each year, directly affecting companies like Televisa.

- Cybersecurity Vulnerabilities: The increasing sophistication of cyber threats poses a constant risk to Televisa's extensive digital platforms, which handle vast amounts of user data and critical operational systems.

- Financial and Reputational Risks: Breaches in cybersecurity can lead to significant financial losses from remediation, regulatory fines, and potential lawsuits, alongside severe damage to the company's brand image and customer loyalty.

Grupo Televisa faces intense competition from both global streaming giants and aggressive domestic telecom providers, impacting subscriber retention and potentially leading to price wars. The ongoing shift towards on-demand viewing further challenges Televisa's traditional revenue models, requiring significant investment to adapt its digital offerings. This dynamic market necessitates constant innovation to maintain a competitive edge.

Economic volatility in Mexico, including inflation and currency depreciation, threatens Televisa's advertising revenue and consumer spending on its services. Regulatory uncertainty, particularly concerning potential changes to asymmetric measures and the role of the IFT, could reshape Televisa's operational framework and strategic flexibility. Furthermore, content piracy and escalating cybersecurity risks pose substantial threats to revenue streams and brand reputation.

| Threat Area | Specific Concern | Potential Impact | Data Point/Example |

| Competition | OTT Services & Domestic Telecoms | Subscriber churn, margin erosion | Global streaming market continued robust growth in 2024. |

| Economic Factors | Inflation, Currency Depreciation | Reduced ad spending, lower consumer demand | Mexican advertising revenue saw a notable decline in recent periods. |

| Regulatory Landscape | Asymmetric Measures, IFT Uncertainty | Altered operational framework, strategic limitations | Discussions around IFT dissolution create policy uncertainty. |

| Digital Threats | Content Piracy & Cybersecurity | Lost subscription revenue, financial penalties, reputational damage | Digital piracy in Latin America can lead to billions in lost revenue annually. |

SWOT Analysis Data Sources

This analysis leverages a robust combination of Grupo Televisa's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and data-driven perspective.