Grupo Televisa Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

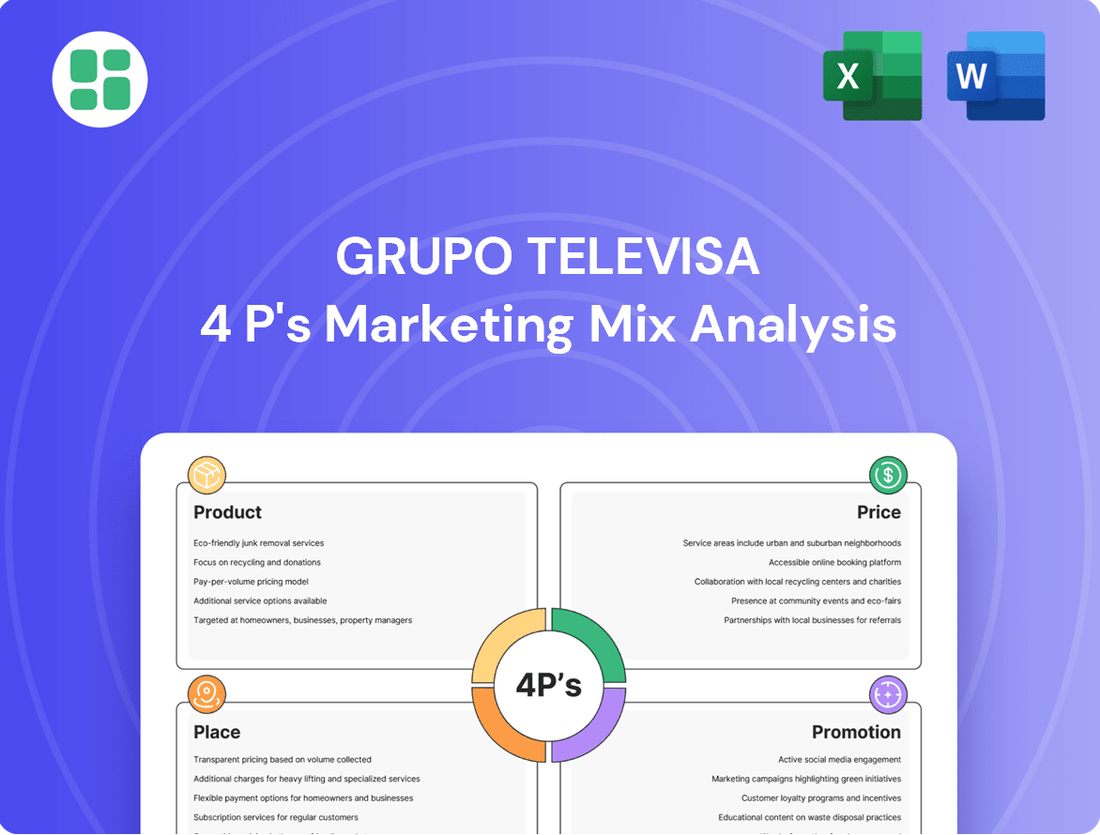

Grupo Televisa's marketing mix is a complex tapestry, weaving together diverse product offerings from media and telecommunications to its extensive content library. Understanding how they price these varied services, distribute them across multiple platforms, and promote them through integrated campaigns is key to grasping their market dominance.

Dive deeper into the strategic brilliance behind Grupo Televisa's success. Our comprehensive 4Ps Marketing Mix Analysis unpacks their product portfolio, pricing strategies, distribution channels, and promotional efforts, offering actionable insights for your own business planning.

Product

Grupo Televisa, primarily through TelevisaUnivision, is a powerhouse in Spanish-language content creation and distribution. They offer a wide spectrum of programming, from beloved telenovelas and gripping series to essential news and vibrant entertainment shows. This diverse content library is the heart of their appeal, meticulously crafted to connect with Hispanic audiences across numerous platforms.

The company's strategy involves significant investment in fresh programming and the continuation of popular, ongoing productions. This commitment to content innovation is balanced with a sharp focus on operational cost efficiency, ensuring they deliver value while expanding their reach. For instance, TelevisaUnivision reported a net loss of $100.5 million in the first quarter of 2024, but saw revenue grow 15% year-over-year to $1.3 billion, driven by strong performance in their content and distribution segments.

Grupo Televisa's cable and telecommunications services, primarily under the Izzi brand, are a cornerstone of its operations in Mexico. Izzi provides a bundled offering of video, high-speed internet, and voice services to both homes and businesses. This integrated approach aims to capture a significant share of the Mexican telecommunications market.

Expanding its reach, Izzi also operates as a Mobile Virtual Network Operator (MVNO), offering mobile services. This allows the company to provide a more comprehensive suite of communication solutions to its customer base, further solidifying its market presence.

The company is actively restructuring this segment, notably by integrating Sky services, to boost profitability and enhance its fiber optic network. This strategic move is expected to improve operational efficiencies and expand its high-speed data capabilities, a critical component in today's digital landscape.

TelevisaUnivision's direct-to-consumer streaming product, ViX, serves as a cornerstone of its digital strategy, offering a vast library of Spanish-language content. This includes everything from popular movies and TV shows to exclusive original productions and live sports, catering directly to a significant and growing audience.

ViX has demonstrated impressive traction, with reported figures showing a substantial increase in monthly active users and a healthy expansion of its premium subscriber base. This growth underscores ViX's importance as a revenue generator and a key area for continued investment and development within TelevisaUnivision's portfolio.

Satellite Pay Television (Sky)

Sky, a major satellite pay television and broadband provider in Mexico and other Latin American countries, is a key asset of Grupo Televisa. Televisa's recent acquisition of full ownership of Sky positions it to leverage synergies by integrating this service with its existing Izzi operations. This strategic move aims to enhance its competitive standing in the dynamic telecommunications and media landscape.

Sky's product offering is centered on comprehensive pay-TV packages, distinguished by exclusive content that appeals to a broad subscriber base. In 2023, the Mexican pay-TV market saw continued growth, with satellite services like Sky playing a significant role. While specific subscriber numbers for Sky's integration with Izzi are still emerging in early 2024, the combined entity is expected to command a substantial market share, estimated to be over 15 million combined pay-TV and broadband subscribers in Mexico based on previous reports.

- Product: Sky offers a range of satellite pay-TV packages featuring exclusive sports, entertainment, and news channels, alongside broadband internet services.

- Content: Key to Sky's appeal are its exclusive rights to popular sporting events and premium entertainment content, differentiating it from competitors.

- Market Presence: Sky operates in Mexico, Central America, and the Dominican Republic, providing direct-to-home (DTH) satellite television and broadband services.

- Strategic Integration: Grupo Televisa's full acquisition and integration of Sky with Izzi is designed to create operational efficiencies and strengthen its overall market position.

Other Businesses (Publishing, Radio, Sports)

Grupo Televisa's "Other Businesses" segment encompasses magazine publishing and distribution, radio stations, and professional sports. These ventures, while not always the primary focus of financial reporting, play a role in Televisa's broader revenue generation and brand visibility. For instance, its publishing arm has historically managed a portfolio of popular magazines, contributing to diverse media consumption habits.

The radio segment operates various stations across Mexico, reaching a wide audience and offering advertising opportunities. While precise 2024 or 2025 financial data for these specific sub-segments within Televisa's "Other Businesses" is not readily available in public disclosures, their existence diversifies the company's media footprint. These operations are integral to Televisa's strategy of maintaining a comprehensive presence across multiple media platforms.

- Magazine Publishing: Historically a significant part of Televisa's diversified offerings, contributing to print media revenue.

- Radio Stations: Operates a network of radio stations, providing a platform for advertising and content distribution across Mexico.

- Sports Promotion: Involved in professional sports, further broadening its media and entertainment engagement.

- Revenue Diversification: These segments contribute to Televisa's overall financial performance by tapping into different market segments and revenue streams.

Sky, now fully integrated with Izzi, offers a compelling pay-TV and broadband product, distinguished by exclusive content like premium sports and entertainment channels. This strategic union aims to create significant operational efficiencies and bolster Grupo Televisa's market dominance in Mexico and beyond. The combined entity is projected to serve over 15 million subscribers, solidifying its position as a major player in the telecommunications and media landscape.

| Product Aspect | Description | Key Differentiator | Strategic Goal |

|---|---|---|---|

| Pay-TV Packages | Comprehensive satellite TV offerings with exclusive channels. | Exclusive rights to popular sports and entertainment. | Enhance subscriber value and retention. |

| Broadband Internet | High-speed internet services bundled with TV. | Leveraging integrated network infrastructure. | Expand service offerings and market share. |

| Market Reach | Mexico, Central America, Dominican Republic. | Direct-to-home (DTH) satellite delivery. | Strengthen regional presence. |

| Integration Synergies | Combined operations with Izzi. | Operational efficiencies and cost savings. | Boost profitability and competitive advantage. |

What is included in the product

This analysis provides a comprehensive breakdown of Grupo Televisa's Product, Price, Place, and Promotion strategies, offering actionable insights into their marketing positioning and competitive landscape.

It's designed for professionals seeking a data-driven understanding of Televisa's approach, perfect for strategic planning, benchmarking, or developing market entry strategies.

Provides a clear, actionable framework for understanding Televisa's marketing strategy, alleviating the pain of complex analysis by summarizing their 4Ps.

Simplifies the identification of potential marketing gaps and opportunities within Televisa's 4Ps, offering a quick solution for strategic planning.

Place

Grupo Televisa leverages its extensive free-to-air broadcast television networks in Mexico, including flagship channels like Las Estrellas and Canal 5, as a core component of its marketing mix. These networks are crucial for content distribution, reaching an estimated 90% of the Mexican population, providing a massive platform for news, telenovelas, sports, and entertainment.

In 2024, Televisa's broadcast division continues to be a significant revenue generator, although viewership patterns are evolving with digital media. Despite increased competition, these networks remain vital for brand building and broad audience engagement, underpinning Televisa's market presence and advertising revenue streams.

Grupo Televisa's cable and telecommunications arm, Izzi, utilizes a robust network of copper and fiber-optic cables to serve customers in 31 Mexican states. This infrastructure is the backbone for delivering high-speed internet, phone services, and television to both homes and businesses.

The company is actively investing in expanding its fiber-to-the-home (FTTH) footprint. As of early 2024, Izzi reported passing over 15 million homes with its advanced fiber network, a significant increase from previous years, demonstrating a commitment to enhancing service quality and reach.

Sky, Televisa's direct-to-home satellite pay television service, is a cornerstone of its distribution strategy. This system bypasses traditional cable infrastructure, delivering a wide array of content directly to over 7.1 million subscribers as of the first quarter of 2024. Its reach extends across Mexico, Central America, and the Dominican Republic, ensuring broad accessibility, particularly in regions where terrestrial cable networks are less developed.

Streaming Platforms (ViX and Third-Party OTTs)

Grupo Televisa leverages its proprietary streaming service, ViX, to distribute content across free and premium tiers, directly reaching a significant audience. This platform is central to their content strategy in the digital age.

Further extending its market presence, TelevisaUnivision strategically licenses its extensive content library to various third-party Over-The-Top (OTT) platforms. This multi-channel approach ensures broader global accessibility and monetization of its intellectual property.

- ViX's Growth: As of early 2024, ViX reported over 30 million monthly active users, with a significant portion engaging with its premium offerings, demonstrating strong adoption of Televisa's direct-to-consumer strategy.

- Content Licensing Deals: TelevisaUnivision has secured partnerships with major global OTT players, allowing its popular telenovelas and sports content to reach new demographics and markets throughout 2024 and into 2025.

- Revenue Diversification: The dual approach of ViX and third-party licensing significantly diversifies revenue streams, reducing reliance on traditional broadcast models and capturing value in the rapidly expanding digital video market.

Retail and Digital Channels for Other Businesses

Grupo Televisa's publishing division leverages traditional retail, such as newsstands, alongside direct subscription models to reach its audience. This dual approach ensures broad availability while also fostering a loyal subscriber base.

Radio content distribution is a blend of over-the-air broadcasting, a long-standing method, and a growing emphasis on digital streaming platforms, expanding reach and accessibility in the modern media landscape.

For professional sports, distribution is multifaceted, encompassing broadcast television, pay-TV subscriptions, and the potential for live event attendance, creating multiple revenue streams and engagement points. In 2024, the sports media rights market continued to be a significant revenue driver for many media companies, with major leagues securing multi-billion dollar deals.

- Publishing: Newsstand sales and direct subscriptions are key distribution methods.

- Radio: Traditional over-the-air broadcasts complement digital streaming.

- Sports: Broadcast, pay-TV, and live events form the distribution strategy.

Grupo Televisa's Place within its marketing mix is defined by its multi-channel distribution strategy, ensuring content reaches diverse audiences. This includes leveraging its extensive broadcast networks, a robust cable infrastructure via Izzi, and satellite services through Sky. Additionally, Televisa is aggressively expanding its digital presence with the streaming service ViX and content licensing to third-party platforms.

| Distribution Channel | Key Characteristics | 2024/2025 Data/Trends |

|---|---|---|

| Broadcast Television (Mexico) | Free-to-air networks (Las Estrellas, Canal 5) reaching ~90% of population. | Continues to be vital for brand building and advertising, despite evolving viewership. |

| Cable & Fiber (Izzi) | High-speed internet, phone, TV to homes/businesses in 31 states. | Expanding fiber-to-the-home (FTTH) footprint, passing over 15 million homes by early 2024. |

| Satellite (Sky) | Direct-to-home pay TV service. | Over 7.1 million subscribers in Q1 2024 across Mexico, Central America, Dominican Republic. |

| Streaming (ViX) | Proprietary free and premium OTT service. | Over 30 million monthly active users by early 2024; key to direct-to-consumer strategy. |

| Content Licensing | Licensing content library to third-party OTT platforms. | Strategic partnerships with global players to expand reach and monetize IP. |

Full Version Awaits

Grupo Televisa 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Grupo Televisa's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, providing full confidence in your purchase.

Promotion

Grupo Televisa leverages its extensive owned media channels, including free-to-air television networks and radio stations, for powerful cross-promotion. This strategy effectively showcases its diverse offerings, from new content and cable services to the burgeoning ViX streaming platform.

This internal cross-promotion is a cost-efficient way to tap into Televisa's massive existing audience. For instance, during the first quarter of 2024, Televisa’s media segment reported significant reach across its platforms, driving awareness for new programming and subscriber acquisition for its services.

Grupo Televisa strategically utilizes targeted digital and social media campaigns to promote its streaming services, most notably ViX. These efforts are specifically designed to capture the attention of distinct audience segments, aiming to build awareness, foster interest, and ultimately convert viewers into paying subscribers.

By leveraging sophisticated data analytics, Televisa personalizes its content delivery and advertising within these digital channels. This data-driven approach ensures that marketing messages resonate with the intended viewers, optimizing engagement and subscription rates for services like ViX.

In 2024, digital advertising spend in Latin America, where ViX has a significant presence, was projected to reach over $10 billion, highlighting the importance of these channels for companies like Televisa to connect with consumers and drive growth.

Grupo Televisa, through TelevisaUnivision, leverages its vast cultural platform and deep connection with the Hispanic market to attract advertisers. They offer comprehensive advertising solutions that span across their extensive network of television channels, popular streaming services, and radio stations, ensuring broad reach and engagement. In 2023, TelevisaUnivision reported significant advertising revenue growth, reaching over $2.5 billion, demonstrating the effectiveness of their integrated approach.

Strategic alliances, particularly in high-demand areas like sports broadcasting, are crucial for amplifying TelevisaUnivision's advertising and partnership opportunities. These collaborations allow them to present compelling packages to a wider demographic, enhancing the value proposition for advertisers seeking to tap into passionate fan bases. For instance, their partnerships for major soccer leagues in 2024 are expected to drive substantial advertising interest.

Public Relations and Content Slate Announcements

TelevisaUnivision actively uses public relations and content slate announcements as a key part of its promotion strategy. This includes hosting upfront presentations and issuing press releases to highlight new shows, talent acquisitions, and major company moves. These announcements are designed to capture media attention, building excitement for what's coming next for viewers and advertisers alike.

In 2024, TelevisaUnivision continued its robust engagement with upfront events, showcasing its 2024-2025 content slate. For instance, during its May 2024 upfront, the company emphasized its commitment to Spanish-language content across its broadcast, cable, and streaming platforms. This strategy aims to solidify its position as a leader in the Hispanic media market by generating significant buzz and securing advertising commitments.

- Upfront Presentations: TelevisaUnivision's upfront events are crucial for unveiling new programming and strategic directions to advertisers and media.

- Press Releases: These are used to disseminate timely information about celebrity partnerships, new series launches, and significant business developments.

- Media Coverage: The goal is to generate positive media attention, increasing brand visibility and consumer interest.

- Strategic Initiatives: Announcements often highlight efforts to expand reach, enhance user experience, or integrate new technologies, such as advancements in streaming services.

Bundling and Loyalty Programs for Telecom Services

Grupo Televisa's telecommunications arm, primarily through Izzi and Sky, leverages promotional strategies centered on bundled offerings. These packages typically combine internet, television, and sometimes voice services, aiming to provide value and attract a broader customer base. For instance, in early 2024, Izzi was noted for aggressive pricing on its triple-play bundles, often undercutting competitors to gain market share.

Customer loyalty and retention are paramount in the competitive telecom landscape. Grupo Televisa implements loyalty programs designed to reward long-term subscribers and reduce churn. These programs can include exclusive discounts, early access to new services, or enhanced support, fostering a stronger customer relationship and encouraging continued subscription. As of late 2023, churn rates in the Mexican telecom market hovered around 2-3% monthly, making retention efforts critical.

- Bundled Services: Izzi and Sky offer integrated packages of internet, TV, and voice to attract and retain customers.

- Competitive Pricing: Bundles are strategically priced to be attractive in the market, with Izzi known for aggressive introductory offers.

- Loyalty Programs: Initiatives are in place to reward existing customers, aiming to decrease subscriber churn.

- Churn Reduction: Retention strategies are vital given industry churn rates, which can significantly impact revenue.

Grupo Televisa employs a multi-faceted promotion strategy, heavily reliant on its owned media assets for cross-promotion of its diverse content and services, notably the ViX streaming platform. This approach is cost-effective, leveraging existing audiences to build awareness and drive subscriptions. In Q1 2024, Televisa's media segment saw strong audience reach, supporting these promotional efforts.

Targeted digital and social media campaigns further amplify ViX's reach, utilizing data analytics for personalized messaging to boost engagement and conversion rates. With Latin American digital ad spend projected to exceed $10 billion in 2024, this digital focus is critical for growth.

TelevisaUnivision capitalizes on its cultural influence and Hispanic market connection to attract advertisers, offering integrated solutions across TV, streaming, and radio. The company reported over $2.5 billion in advertising revenue in 2023, reflecting the success of this broad approach.

Strategic alliances, especially in sports broadcasting, enhance promotional opportunities, creating compelling packages for advertisers targeting passionate fan bases. Partnerships for major soccer leagues in 2024 are anticipated to generate significant advertising interest.

Price

Grupo Televisa heavily relies on subscription-based models for its core offerings. This includes its cable television, Sky satellite service, and the ViX Premium streaming platform. Customers pay regular fees to access a variety of content and internet services.

The company employs tiered pricing strategies across these services. These tiers are designed to appeal to different customer needs and budgets, offering varying levels of content, features, and speeds. For instance, Sky's packages in Mexico can range from basic entertainment bundles to premium sports and international channel selections, with prices reflecting the included services.

As of early 2024, Televisa's consolidated revenue from its content and platforms segment, which includes these subscription services, saw significant growth. For example, in the first quarter of 2024, Televisa reported a substantial increase in its cable segment revenue, driven by subscriber additions and average revenue per user (ARPU) growth.

Advertising is a cornerstone of Grupo Televisa's revenue, particularly through its free-to-air television networks, radio stations, and the ad-supported tiers of its streaming service, ViX. In 2023, advertising revenue represented a substantial portion of Televisa's consolidated net revenues, underscoring its importance to the company's financial health.

Advertising rates are dynamic, directly correlating with audience reach and viewership numbers, especially during prime time slots. Market demand and the perceived effectiveness of reaching specific demographics through Televisa's platforms are key drivers of these rates, with the company continuously optimizing its advertising strategy to maximize impact and yield.

Grupo Televisa, through its Izzi brand, employs a tiered pricing strategy for its telecommunication bundles. These packages typically combine internet speeds, a selection of television channels, and landline telephony, designed to appeal to a broad customer base. For instance, in early 2024, Izzi offered plans starting with basic internet packages around 50 Mbps, scaling up to gigabit speeds, with pricing varying accordingly. This segmentation allows them to cater to both budget-conscious users and those requiring high-performance connectivity.

The effectiveness of this tiered approach is evident in its market penetration. By offering distinct price points and feature sets, Izzi can capture different segments of the broadband market, from students needing basic connectivity to families requiring extensive entertainment options. This strategy directly addresses the 4Ps of marketing by defining the product (bundle) and its price, aiming to attract and retain customers across various economic strata. The company's focus on competitive pricing in key markets like Mexico City and Guadalajara has been a significant driver of its subscriber growth.

Content Licensing Fees

Content licensing is a significant revenue stream for TelevisaUnivision, leveraging its extensive library of Spanish-language content. The company generates income by providing access to its programming to various third-party platforms and international broadcasters, effectively monetizing its intellectual property.

These licensing agreements directly impact TelevisaUnivision's financial health, demonstrating the market's recognition of its valuable content catalog. For instance, in 2023, the company continued to secure deals that expanded its content's reach, contributing to its overall revenue diversification.

The value derived from these licensing fees is a testament to the enduring appeal and broad audience reach of TelevisaUnivision's productions. This strategy allows the company to capitalize on its content assets beyond its own distribution channels.

- Revenue Generation: Licensing fees from content libraries are a key income source.

- Market Value: Fees reflect the perceived value and demand for Spanish-language content.

- Strategic Importance: Licensing diversifies revenue and expands content's global footprint.

- Performance Indicator: Licensing revenue contributes to the company's overall financial performance.

Strategic Cost Optimization and Capex Management

Grupo Televisa is actively pursuing cost discipline and optimizing capital expenditures, especially within its cable and satellite operations. This focus aims to boost profitability and enhance free cash flow generation. For instance, in 2023, Televisa reported a significant reduction in its capital expenditures, contributing to improved financial health.

This strategic cost management indirectly supports competitive pricing strategies. By controlling expenses, Televisa can offer more attractive packages to customers while ensuring healthy profit margins. This allows them to maintain market share and attract new subscribers in a competitive landscape.

- Cost Discipline: Televisa's commitment to cost control is a cornerstone of its financial strategy for 2024 and beyond.

- Capex Rationalization: The company is strategically reducing capital spending, particularly in infrastructure-heavy segments like cable and satellite.

- Profitability Enhancement: These measures are directly linked to improving the company's bottom line and overall profitability.

- Competitive Pricing: Efficient cost structures enable Televisa to offer competitive pricing without sacrificing margins.

Grupo Televisa employs a dynamic pricing approach for its subscription services, like Sky and Izzi, with tiered packages catering to diverse consumer needs and budgets. These bundles, often including internet, TV, and phone, saw competitive pricing strategies in early 2024, with basic Izzi internet plans around $10-$15 USD monthly, scaling up significantly for higher speeds. This segmentation is crucial for market penetration, allowing them to capture a wide customer base.

Advertising revenue, a significant income stream, sees rates fluctuate based on viewership, particularly during prime time. In 2023, advertising was a substantial contributor to Televisa's overall revenue, reflecting its importance in monetizing content across free-to-air networks and ad-supported streaming tiers.

Content licensing agreements, a key revenue diversifier for TelevisaUnivision, leverage the market value of its extensive Spanish-language library. These deals in 2023 underscored the demand for their programming, directly impacting financial health and expanding global reach.

Cost discipline and optimized capital expenditures, evident in a reported reduction in capex during 2023, indirectly support competitive pricing by improving profit margins and enabling attractive package offerings.

| Service Segment | Pricing Strategy | Key 2024 Data Point |

|---|---|---|

| Cable/Satellite (Izzi, Sky) | Tiered Bundles (Internet, TV, Phone) | Basic Izzi plans ~$10-15/month (early 2024) |

| Streaming (ViX Premium) | Subscription-based | Growth driven by subscriber additions |

| Advertising | Dynamic, viewership-based | Substantial revenue contributor in 2023 |

| Content Licensing | Value-based | Monetizes extensive Spanish-language library |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Grupo Televisa is grounded in comprehensive data, including official financial reports, investor relations materials, and public disclosures. We also leverage insights from industry analyses, news archives, and competitive intelligence to capture their product offerings, pricing strategies, distribution channels, and promotional activities.