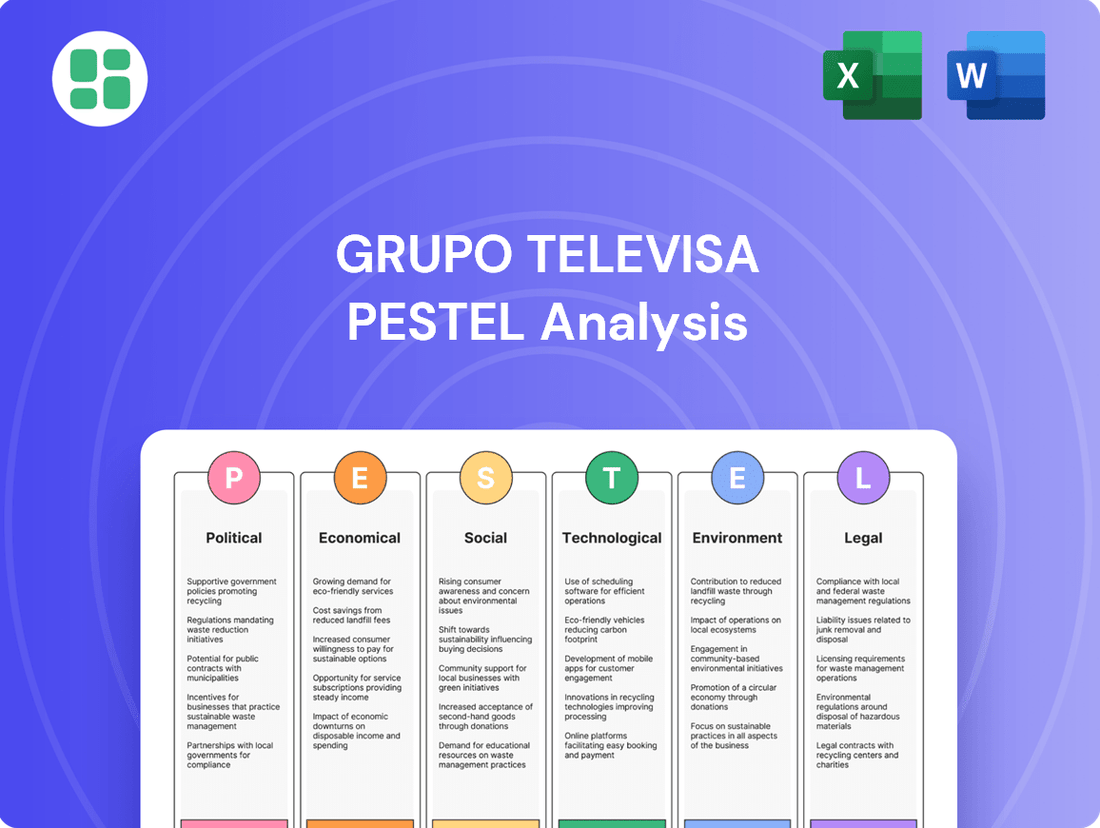

Grupo Televisa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

Grupo Televisa operates within a dynamic landscape shaped by political shifts, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for strategic planning and identifying growth opportunities. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable insights.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis of Grupo Televisa. Discover how political stability, economic growth, technological advancements, environmental concerns, and legal frameworks are impacting its operations and future trajectory. Download the full version now to unlock strategic intelligence and make informed decisions.

Political factors

Grupo Televisa navigates a complex regulatory framework in Mexico, primarily shaped by the Federal Telecommunications Institute (IFT). This oversight directly influences its operations and market position.

A key development in June 2024 saw the IFT revoke Grupo Televisa's designation as having substantial market power in restricted television and audio services. This shift offers Televisa greater operational latitude and potentially alters its competitive dynamics.

Despite this change, the IFT continues to enforce restrictions, notably prohibiting Televisa from securing exclusive broadcasting rights for major sporting events like Mexican football league matches, the FIFA World Cup, and the Olympic Games, thereby ensuring broader public access to popular content.

The political landscape in Mexico, especially around electoral cycles, directly impacts advertising revenues, with government spending being a notable component. A new administration, like the one led by President Claudia Sheinbaum since June 2024, often brings evolving regulatory priorities that can significantly shape the media and telecommunications sectors.

These shifts can alter how companies like Grupo Televisa operate and make future investment choices. For instance, changes in media ownership rules or content regulations stemming from a new government's agenda could necessitate strategic adjustments for Televisa's diverse business units.

Spectrum allocation and the associated fees are pivotal for Grupo Televisa's telecommunications and broadcasting segments, particularly as 5G deployment accelerates. The cost of spectrum directly impacts the company's ability to invest in and expand its network infrastructure.

High annual spectrum usage rights fees in Mexico have demonstrably hindered 5G rollout, with some telecom companies even returning spectrum licenses due to the financial strain. For instance, in 2023, reports indicated significant fee burdens on operators, impacting their expansion plans.

While Mexico's Federal Telecommunications Institute (IFT) has put forward proposals to reform the spectrum fee structure, these suggestions have faced limited traction with relevant government ministries, leaving the financial challenges for companies like Televisa largely unaddressed as of early 2024.

Government Stance on Competition

Mexico's telecommunications regulator, the IFT, has historically aimed to curb market dominance, a stance that directly impacts companies like Televisa. While the IFT authorized Televisa's consolidation of control over Sky Mexico in June 2024, it stipulated that this move would not significantly alter the market structure. This regulatory decision highlights the ongoing balancing act between fostering competition and approving strategic corporate actions.

The government's broader approach to competition, especially concerning dominant players or state-influenced entities, continues to be a critical variable. Televisa's future strategic moves, including further mergers and acquisitions, will invariably be scrutinized by the IFT and other governmental bodies, making the regulatory environment a key political factor.

- Regulatory Approval: The IFT's June 2024 approval of Televisa's Sky Mexico consolidation, with the caveat of no market structure alteration, sets a precedent for future M&A activity.

- Competition Policy: The government's overarching policy on competition, particularly regarding established or state-backed entities, will shape the landscape for players like Televisa.

- Market Structure Impact: Regulatory bodies will continue to assess how corporate strategies, such as mergers, affect the overall competitive balance in the Mexican telecom sector.

International Relations and Trade Agreements

International relations and trade agreements, especially those involving the United States, significantly shape TelevisaUnivision's operations. These pacts can influence how content is distributed across borders and affect Televisa's cross-border media ventures. For instance, changes in intellectual property rights or content licensing terms under such agreements can directly impact Televisa's international revenue and its strategic approach to content creation and distribution.

Key considerations include:

- USMCA Impact: The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, continues to influence trade dynamics and regulatory frameworks relevant to media and content, including intellectual property protections.

- Content Licensing: Favorable trade terms can streamline content licensing across North America, enhancing TelevisaUnivision's ability to monetize its library and distribute programming efficiently.

- Regulatory Alignment: International agreements often push for regulatory alignment in areas like digital media, advertising, and data privacy, which can either facilitate or complicate cross-border media operations for companies like Televisa.

The political environment in Mexico significantly impacts Grupo Televisa's operations, particularly through regulatory bodies like the IFT. The IFT's June 2024 decision to remove Televisa's substantial market power designation in restricted television and audio services offers more operational freedom, though restrictions on exclusive sports broadcasting rights remain. President Claudia Sheinbaum's administration, in power since June 2024, may introduce new regulatory priorities affecting the media sector, influencing Televisa's strategic planning and investment decisions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Grupo Televisa across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these dynamic forces.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how Televisa can navigate political shifts and economic downturns to mitigate risks.

Helps support discussions on external risk and market positioning during planning sessions, enabling Televisa to proactively address technological disruptions and changing consumer behaviors.

Economic factors

Mexico's economic performance is a key driver for Grupo Televisa. In 2023, the Mexican economy expanded by an estimated 3.1%, a solid figure that generally supports consumer spending. This growth translates into more disposable income, which is beneficial for advertising revenues and the uptake of Televisa's subscription services.

Consumer purchasing power is directly linked to economic health. As the economy grows, consumers are more likely to spend on entertainment and communication services, which are core to Televisa's business. For instance, a stronger peso and stable inflation, which remained relatively contained in early 2024, bolster consumer confidence and their ability to afford premium content and broadband packages.

Economic slowdowns, however, pose a risk. A projected moderation in Mexico's GDP growth to around 2.0% for 2024, as anticipated by various economic institutions, could temper advertising spending by businesses. Furthermore, if inflation pressures re-emerge or employment figures weaken, consumers might cut back on discretionary spending, impacting Televisa's subscriber numbers and overall revenue streams.

The advertising market in Mexico is undergoing a significant transformation, with a pronounced shift towards digital platforms. This trend directly impacts Grupo Televisa's traditional advertising revenue. For instance, while traditional ad revenue has faced headwinds, the digital advertising spend in Mexico was projected to reach approximately USD 3.5 billion in 2024, indicating a substantial reallocation of budgets.

Grupo Televisa's streaming service, ViX, is strategically positioned to capitalize on this digital shift. By offering access to the expansive Hispanic market, ViX is becoming an attractive channel for advertisers seeking to reach this demographic. This pivot is crucial for offsetting declines in traditional media advertising and tapping into new revenue streams.

Political advertising remains a vital, albeit seasonal, component of the advertising landscape. The fourth quarter of 2024, for example, saw a notable increase in political ad spending, a trend that historically benefits broadcasters like Televisa. This segment highlights the continued importance of traditional media, especially during election cycles.

Inflation and interest rates directly influence Televisa's financial health. Higher inflation can increase operational costs for content production and distribution, while rising interest rates make servicing existing debt more expensive and new borrowing costlier, potentially impacting capital expenditures for network upgrades and expansion. For instance, if inflation in Mexico significantly outpaces projections, Televisa's cost of goods and services could rise substantially throughout 2024 and into 2025.

Exchange rate volatility, particularly the Mexican peso against the US dollar, presents a significant challenge. Televisa's revenues, often derived from domestic advertising and subscription services, are reported in pesos. However, a substantial portion of its content acquisition, including international programming and technology investments, is denominated in US dollars. A depreciating peso, as observed in recent periods, directly reduces the purchasing power for these dollar-denominated expenses and can negatively impact the reported value of advertising income when converted to US dollar equivalents for international comparison.

Competition in Telecom and Media Sectors

Grupo Televisa navigates a fiercely competitive terrain in both its telecommunications and media operations. In the telecom sector, Mexico's market is expanding, drawing in more domestic and international contenders, which can impact pricing strategies and customer loyalty.

The media industry is equally dynamic, heavily influenced by the proliferation of streaming services that offer alternative content consumption models. This heightened competition puts pressure on Grupo Televisa to innovate and retain its subscriber base.

For instance, as of late 2024, the Mexican pay-TV market, where Televisa is a major player, continues to see subscriber shifts towards Over-The-Top (OTT) services. Major competitors like AT&T Mexico and Telmex (América Móvil) are also aggressively pursuing market share in broadband and mobile services, directly challenging Televisa's telecommunications arm.

- Telecommunications Competition: América Móvil remains the dominant force in Mexico's telecom market, but competitors like AT&T Mexico and even smaller regional players are increasing their footprint, particularly in mobile and broadband.

- Media Landscape Disruption: The rise of global streaming giants such as Netflix, Disney+, and HBO Max, alongside local content producers, has fragmented the audience and intensified the battle for viewership and advertising revenue.

- Pricing Pressures: Increased competition across both sectors forces companies like Televisa to offer more competitive pricing and bundled services to attract and retain customers, potentially impacting profit margins.

- Subscriber Retention Challenges: With a wider array of choices available to consumers, maintaining subscriber loyalty in both pay-TV and internet services requires continuous investment in content, network quality, and customer service.

Cost Management and Capital Expenditure

Grupo Televisa is prioritizing cost management and operational efficiency to navigate revenue challenges in its legacy businesses. The company has implemented several measures to streamline operations and reduce expenses, demonstrating a commitment to financial prudence.

In line with its cost-saving strategy, Televisa has adjusted its capital expenditure outlook. For 2025, the company has trimmed its capital expenditure guidance, signaling a more conservative approach to investments and a focus on optimizing resource allocation. This move is intended to enhance financial flexibility and support profitability.

These cost-saving initiatives are coupled with a strategic focus on high-value customer segments within its cable and Sky operations. By concentrating on these lucrative areas, Televisa aims to improve revenue quality and strengthen its market position. Furthermore, the company is actively seeking more advantageous terms with its suppliers, a move that directly contributes to better cost management.

- Cost Discipline: Grupo Televisa is implementing rigorous cost discipline across its operations to counteract revenue pressures from traditional segments.

- Capital Expenditure Reduction: The company has revised its capital expenditure guidance downwards for 2025, indicating a focus on efficiency and optimized investment.

- Supplier Negotiations: Efforts are underway to secure more favorable terms with suppliers, a key component of the company's cost management strategy.

- High-End Subscriber Focus: Televisa is prioritizing growth and retention among high-end subscribers in its cable and Sky businesses to bolster revenue streams.

Grupo Televisa's financial performance is significantly influenced by macroeconomic trends. Mexico's economy grew by an estimated 3.1% in 2023, supporting consumer spending and advertising revenues. However, a projected slowdown to around 2.0% GDP growth in 2024 could temper advertising investments and consumer discretionary spending.

Inflation and interest rates directly impact Televisa's operational costs and debt servicing. For instance, if inflation in Mexico significantly outpaces projections, the company's costs for content and technology could rise substantially through 2024 and into 2025. Exchange rate volatility, particularly the Mexican peso against the US dollar, also affects purchasing power for dollar-denominated content and technology investments.

The advertising market is shifting towards digital, with Mexico's digital ad spend projected to reach USD 3.5 billion in 2024. Televisa's streaming service, ViX, is positioned to capture this growth by targeting the Hispanic market.

| Economic Factor | 2023 (Est.) | 2024 (Proj.) | Impact on Televisa |

|---|---|---|---|

| Mexico GDP Growth | 3.1% | ~2.0% | Supports/Moderates consumer spending & advertising |

| Digital Ad Spend (Mexico) | N/A | ~$3.5 billion | Shift in advertising revenue streams |

| Inflation (Mexico) | Relatively Contained | Potential Pressure | Increases operational costs, impacts consumer spending |

Same Document Delivered

Grupo Televisa PESTLE Analysis

The preview you see here is the exact Grupo Televisa PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting this leading media company.

Sociological factors

Consumer preferences are rapidly shifting from traditional linear television to streaming and on-demand content. This trend directly impacts Grupo Televisa's legacy free-to-air and pay-TV segments, forcing a strategic pivot.

Grupo Televisa is actively responding to these changing habits by developing its own streaming platform, ViX. This platform has shown promising subscriber growth, reaching over 30 million registered users by early 2024, and aims to capture the digitally savvy audience.

Mexico's demographic landscape is characterized by a significant youth population, with over 30% of its citizens under the age of 15 as of 2024. This youthful demographic, coupled with ongoing urbanization, particularly in metropolitan areas like Mexico City, Guadalajara, and Monterrey, directly impacts media consumption patterns. The demand for digital content and accessible platforms is escalating as more people migrate to urban centers.

Grupo Televisa must navigate these demographic shifts by tailoring its content and distribution strategies to meet the preferences of an increasingly digitally-native audience. With smartphone penetration in Mexico projected to reach over 85% by 2025, Televisa's focus on mobile-first content and streaming services is crucial for retaining and attracting younger viewers. This includes adapting to changing viewing habits, such as the rise of short-form video and on-demand content.

The enduring demand for culturally relevant and local Spanish-language content is a significant driver for Grupo Televisa. This trend is evident not only in Mexico but also across the growing global Hispanic audience, highlighting a deep connection to familiar narratives and languages.

Televisa's strategic emphasis on producing and distributing Spanish-speaking content, notably through its broadcast channels and the streaming service ViX, directly capitalizes on this cultural resonance. ViX, launched in 2022, aims to be a leading Spanish-language streaming platform, with a substantial content library and a focus on original productions, reflecting this commitment.

In 2024, the Hispanic market in the U.S. alone represents a significant consumer base with increasing purchasing power, estimated to be over $2 trillion. This demographic's preference for Spanish-language media creates a robust market for Televisa's offerings, supporting its content strategy and revenue streams.

Social Media Influence and Public Opinion

Social media's deep integration into Mexican society fundamentally shapes how citizens consume information and form opinions, directly affecting how companies like Televisa are perceived. With a significant portion of the population, across various demographics, relying on these platforms for news, managing brand reputation and engaging with the public becomes paramount. This dynamic requires proactive strategies to address misinformation and foster positive sentiment.

The influence of social media platforms in Mexico is substantial, with reports indicating that over 80% of internet users actively engage with social networks. This widespread adoption means that public discourse and sentiment regarding media content, news reporting, and corporate actions can shift rapidly based on social media trends. For Grupo Televisa, understanding and actively participating in this digital conversation is crucial for maintaining its public image and audience connection.

- Social Media Penetration: As of early 2024, Mexico boasts a social media penetration rate exceeding 75% of the population, with platforms like Facebook, WhatsApp, and TikTok being dominant.

- News Consumption Shift: A significant percentage of Mexicans, particularly younger demographics, now rely on social media as their primary source for news and current events, bypassing traditional media channels.

- Brand Perception Impact: Negative social media sentiment or viral misinformation campaigns can quickly damage brand perception, impacting viewership, advertising revenue, and overall market standing for media conglomerates.

- Engagement Necessity: To counter misinformation and build trust, media companies must actively engage with their audience on social platforms, providing accurate information and responding to public concerns in a timely manner.

Income Inequality and Digital Divide

Income inequality in Mexico significantly impacts how readily people can afford and access telecommunications and pay-TV services. This is especially true in less developed regions where internet connectivity remains a challenge. For instance, in 2023, the Gini coefficient for Mexico was reported at 0.48, indicating a notable level of income disparity.

Grupo Televisa must therefore tailor its strategies to cater to diverse economic segments within the population. Effectively bridging the digital divide is crucial for Televisa to broaden its customer base and ensure its services reach a wider audience, including those in underserved areas.

- Income Disparity: Mexico's Gini coefficient of 0.48 in 2023 highlights significant income inequality, affecting service affordability.

- Rural Connectivity: Uneven broadband access in rural Mexico presents a hurdle for expanding pay-TV and telecom subscriptions.

- Strategic Adaptation: Televisa needs to develop flexible pricing and service models to accommodate varying income levels and bridge the digital gap.

Societal shifts towards on-demand and digital content consumption are reshaping the media landscape, directly influencing Grupo Televisa's strategic direction. The company's investment in its streaming platform, ViX, reflects an understanding of evolving consumer preferences, with the platform reaching over 30 million registered users by early 2024.

Mexico's youthful demographic, with over 30% of its population under 15 in 2024, coupled with increasing urbanization, fuels a demand for accessible digital content. Smartphone penetration, projected to exceed 85% by 2025, underscores the necessity for mobile-first strategies.

The strong cultural affinity for Spanish-language content, both domestically and within the growing U.S. Hispanic market (valued at over $2 trillion in purchasing power in 2024), provides a significant opportunity for Televisa's content offerings.

The pervasive influence of social media, with over 80% of Mexican internet users active on these platforms, necessitates proactive brand management and engagement to counter misinformation and maintain public trust.

Technological factors

The ongoing expansion of broadband infrastructure and the aggressive rollout of 5G networks represent significant technological catalysts for Grupo Televisa's telecommunications segment. These advancements are vital for delivering superior internet speeds and enhanced connectivity.

For instance, Mexico's 5G spectrum auctions, with significant participation from major telecom players, are paving the way for faster data transmission and new service possibilities. Grupo Televisa's continued investment in fiber optic networks and 5G deployment directly addresses the escalating consumer demand for high-speed data services, which is crucial for their competitive edge.

Furthermore, the development of robust mobile financial services, often referred to as fintech, is heavily reliant on reliable and fast network infrastructure. Grupo Televisa's commitment to upgrading its technological backbone supports the growth and adoption of these digital financial solutions, broadening its service ecosystem.

The increasing popularity of Over-The-Top (OTT) streaming services presents a significant technological shift impacting Grupo Televisa. Televisa has responded by launching and expanding its own platform, ViX, aiming to capture a share of this growing market. By the end of 2024, estimates suggest the global video streaming market will reach over $250 billion, highlighting the scale of this competitive landscape.

Grupo Televisa is actively pursuing a digital transformation, evident in its reorganization of its news division and efforts to streamline content production. This strategic shift aims to better connect with younger, digitally native audiences by adapting content formats for online and mobile platforms.

The company is exploring innovative technologies in content creation and distribution to enhance its digital reach. For instance, by mid-2024, Televisa's digital platforms were seeing increased engagement, with a reported 15% year-over-year growth in unique visitors across its news and entertainment verticals.

Cybersecurity Risks and Data Privacy

Grupo Televisa, as a significant player in media and telecommunications, navigates a landscape fraught with escalating cybersecurity risks. The protection of vast amounts of customer data and the integrity of its extensive network infrastructure are paramount. Failure to do so can lead to severe reputational damage and substantial regulatory penalties, impacting investor confidence and future revenue streams.

The imperative to comply with evolving data protection and privacy regulations, such as Mexico's Federal Law on Protection of Personal Data Held by Private Parties, presents ongoing challenges. In 2024, the global cost of data breaches was estimated to average $4.73 million, a figure that underscores the financial implications for companies like Televisa. Maintaining robust security protocols is not just a technical necessity but a critical business imperative.

- Cybersecurity Threats: Increased sophistication of cyberattacks targeting telecommunications and media infrastructure.

- Data Privacy Compliance: Adherence to evolving national and international data protection laws.

- Reputational Risk: Potential for significant damage to brand trust and customer loyalty due to data breaches.

- Financial Penalties: Exposure to fines and legal costs associated with non-compliance and security incidents.

AI and Automation in Media Operations

Grupo Televisa is increasingly integrating AI and automation to streamline its media operations. This includes using AI for personalized content recommendations, which can boost viewer engagement and retention. For example, by analyzing viewing habits, Televisa can serve more relevant content, potentially increasing watch time across its platforms.

Automation is also being deployed in areas like advertising sales and network management. AI-powered tools can optimize ad placement and pricing, leading to more efficient revenue generation. In 2024, the media industry saw significant investment in AI for content creation and distribution, with companies aiming to reduce operational costs and improve output quality.

- Enhanced Content Personalization: AI algorithms analyze user data to deliver tailored content suggestions, increasing viewer satisfaction and platform stickiness.

- Optimized Advertising: Automated ad buying and placement systems driven by AI can improve ad revenue by targeting specific demographics more effectively.

- Operational Efficiency Gains: Automation reduces manual tasks in areas like content moderation, scheduling, and customer support, freeing up resources and lowering costs.

- Data-Driven Decision Making: AI provides insights into audience behavior and market trends, enabling more informed strategic planning for content and product development.

The ongoing expansion of broadband infrastructure and the aggressive rollout of 5G networks represent significant technological catalysts for Grupo Televisa's telecommunications segment, vital for delivering superior internet speeds and enhanced connectivity.

Mexico's 5G spectrum auctions are paving the way for faster data transmission, and Televisa's continued investment in fiber optic networks directly addresses escalating consumer demand for high-speed data services.

The increasing popularity of Over-The-Top (OTT) streaming services, with the global market projected to exceed $250 billion by the end of 2024, has prompted Televisa to expand its own platform, ViX, to compete in this growing digital media landscape.

Grupo Televisa is actively integrating AI and automation to streamline media operations, utilizing AI for personalized content recommendations and automation for optimized advertising sales, aiming to reduce operational costs and improve output quality.

| Technological Factor | Description | Impact on Televisa | Relevant Data (2024/2025) |

| 5G Deployment | Advancements in wireless technology offering higher speeds and lower latency. | Enables enhanced streaming, gaming, and new digital services. | Mexico's 5G spectrum auctions are actively underway, with significant investment from telecom operators. |

| OTT Market Growth | Shift in media consumption towards on-demand streaming services. | Drives competition and necessitates investment in proprietary streaming platforms like ViX. | Global video streaming market expected to surpass $250 billion by end of 2024. |

| AI & Automation | Use of artificial intelligence and automated processes in operations. | Improves content personalization, advertising efficiency, and operational costs. | Industry-wide investment in AI for content creation and distribution is increasing to improve quality and reduce costs. |

Legal factors

Grupo Televisa navigates a dense web of telecommunications and broadcasting regulations overseen by Mexico's Federal Telecommunications Institute (IFT). These rules dictate everything from obtaining operating licenses and adhering to content quality standards to preventing excessive market dominance and setting fair interconnection charges between carriers. For instance, in 2024, the IFT continued its focus on promoting competition, which could impact Televisa's strategies for expanding its pay-TV and internet services.

Grupo Televisa continues to navigate regulatory scrutiny from Mexico's Federal Institute of Telecommunications (IFT). Although a significant 2024 ruling removed Televisa's designation of substantial market power in specific pay-TV segments, the company remains under the IFT's watchful eye concerning potential anti-competitive behaviors. This ongoing oversight means Televisa must still adhere to certain asymmetric regulations designed to foster a more competitive landscape in the telecommunications and broadcasting sectors.

Grupo Televisa's operations are deeply intertwined with content copyright and intellectual property laws. As a leading producer and distributor of media content, safeguarding its extensive library from unauthorized use and piracy is paramount. This involves meticulous management of licensing agreements and proactive measures to protect its creative assets across all distribution channels.

In 2024, the global digital content market continued to grapple with piracy, with estimates suggesting billions in revenue lost annually. Televisa's legal strategies focus on enforcing its intellectual property rights, a critical component of its business model, especially as it expands its digital offerings and international reach.

Data Protection and Privacy Regulations

Grupo Televisa must meticulously adhere to data protection and privacy regulations, a crucial legal factor impacting its operations. Compliance with Mexico's Federal Law on Protection of Personal Data Held by Private Parties is paramount, ensuring the responsible collection, storage, and processing of sensitive information. Failure to comply can result in significant fines and reputational damage, affecting Televisa's ability to operate its diverse services, including cable, internet, and streaming platforms.

The company's commitment to safeguarding customer data is not just a legal obligation but also a cornerstone of maintaining consumer trust. In 2024, data privacy remains a top concern for consumers globally, and Televisa's proactive approach in this area is vital. For instance, robust data security measures are essential to prevent breaches that could lead to identity theft or misuse of personal information, thereby impacting customer loyalty and market share.

- Compliance with Mexico's Federal Law on Protection of Personal Data Held by Private Parties is mandatory.

- Secure handling of customer data across cable, internet, and streaming services is critical.

- Non-compliance can lead to substantial legal penalties and erosion of consumer trust.

- Maintaining strong data privacy practices is essential for customer retention and brand reputation in 2024.

Labor Laws and Employment Regulations

Changes in Mexico's labor laws and employment regulations directly affect how Grupo Televisa manages its staff and the associated expenses. For instance, reforms to Article 584 of the Federal Labor Law in late 2023, which aim to enhance worker protections and streamline dispute resolution, could introduce new compliance requirements for Televisa's extensive workforce.

The company's strategic moves, such as the discontinuation of exclusive contracts with talent and workforce reductions, are undertaken with an eye toward cost savings and operational restructuring. However, these actions must strictly adhere to existing labor legal frameworks, including regulations around severance pay and employee rights, which are subject to ongoing interpretation and enforcement by Mexican labor authorities.

Televisa's compliance with these evolving legal standards is crucial for maintaining operational continuity and avoiding potential legal challenges. The company's financial reports for 2024 and projections for 2025 will likely reflect adjustments made to align with these labor legal factors.

- Labor Law Reforms: Mexico's ongoing labor reforms, particularly those impacting contract structures and employee termination, necessitate careful review and adaptation by Televisa.

- Workforce Restructuring Costs: Efforts to reduce workforce size or alter employment contracts, as seen in recent years, must factor in legal obligations for severance and benefits, impacting operational costs.

- Compliance and Risk: Non-compliance with labor regulations can lead to significant fines and legal disputes, posing a material risk to Televisa's financial performance and reputation.

Grupo Televisa operates within a complex legal framework, heavily influenced by telecommunications and broadcasting regulations in Mexico. The Federal Telecommunications Institute (IFT) sets the rules for licensing, content standards, and market competition, which directly impact Televisa's service offerings and expansion strategies. For instance, ongoing IFT efforts in 2024 to foster competition in the pay-TV and internet sectors require Televisa to adapt its business models to comply with asymmetric regulations, even after a significant ruling in 2024 removed its designation of substantial market power in certain pay-TV segments.

Intellectual property rights are a critical legal consideration for Televisa, given its extensive media content library. Protecting its content from piracy and managing licensing agreements are vital, especially as the company expands its digital presence globally. The persistent issue of digital content piracy, which cost the industry billions in 2024, underscores the importance of Televisa's legal strategies in enforcing its intellectual property rights.

Data protection and privacy laws, such as Mexico's Federal Law on Protection of Personal Data Held by Private Parties, are paramount for Televisa's operations. Ensuring the secure and responsible handling of customer data across its cable, internet, and streaming services is essential to avoid significant fines and maintain consumer trust. In 2024, with data privacy remaining a major consumer concern, Televisa's commitment to robust data security measures is crucial for customer retention and brand reputation.

Labor laws in Mexico significantly shape Televisa's workforce management and associated costs. Reforms to labor laws, such as those affecting worker protections and dispute resolution, necessitate ongoing compliance adjustments. The company's strategies for workforce restructuring must strictly adhere to legal frameworks regarding employee rights and severance pay, impacting operational costs and requiring careful consideration in financial reporting for 2024 and 2025.

Environmental factors

Grupo Televisa's vast network of broadcasting stations, expansive data centers, and critical telecommunications infrastructure inherently demand substantial energy. This high consumption places the company at the forefront of environmental considerations within the media and telecom sectors.

In 2023, the global average for electricity consumption in data centers alone reached approximately 1% of worldwide electricity usage, highlighting the energy intensity of such operations. Televisa's commitment to sustainability means actively seeking ways to mitigate this, such as investing in energy-efficient technologies and exploring renewable energy sources to power its extensive facilities.

Grupo Televisa, like many telecommunications and media companies, faces significant challenges with electronic waste (e-waste) generated from the distribution of cable boxes, modems, and other subscriber equipment. As of 2024, the global e-waste problem is escalating, with millions of tons generated annually, making responsible disposal and recycling crucial.

To address this, Televisa must prioritize robust e-waste management and recycling initiatives. This is not only vital for environmental stewardship but also for regulatory compliance. For instance, Mexico's General Law for the Prevention and Integral Management of Waste mandates proper handling of electronic discards, and failure to comply can result in substantial fines.

Investors and stakeholders are increasingly demanding that companies like Televisa provide detailed reports on their environmental, social, and governance (ESG) performance. This trend is significantly shaping corporate strategy and disclosure practices across industries.

Televisa's proactive approach to sustainability and transparent ESG reporting is crucial for its long-term success. By demonstrating a strong commitment to these principles, Televisa can bolster its reputation, attract investors focused on responsible capital, and effectively manage potential environmental and social risks.

Climate Change Impact on Infrastructure

Climate change and the increasing frequency of extreme weather events present tangible risks to Grupo Televisa's physical infrastructure. This includes potential damage to broadcast towers, disruptions to cable networks, and operational challenges for data centers. For instance, in 2023, Mexico experienced numerous severe weather events, including hurricanes and intense rainfall, which can directly impact the reliability of telecommunications and media services.

To mitigate these risks and ensure service continuity, Televisa will likely need to allocate significant capital towards building more resilient infrastructure and enhancing disaster preparedness. This could involve reinforcing structures against high winds, improving flood defenses for critical facilities, and developing robust backup systems. The company's commitment to maintaining its extensive network across diverse geographical regions necessitates proactive adaptation strategies.

- Infrastructure Vulnerability: Broadcast towers, cable networks, and data centers are susceptible to damage from hurricanes, floods, and other extreme weather.

- Increased Investment Needs: Resilience upgrades and disaster preparedness measures will require substantial capital expenditure.

- Service Continuity: Ensuring uninterrupted service delivery is paramount, especially during and after severe weather events.

Resource Efficiency in Operations

Grupo Televisa's commitment to resource efficiency in its operations, from content creation to broadcasting and telecommunications, directly impacts its environmental footprint and operational costs. By optimizing water usage, minimizing waste, and adopting sustainable procurement, the company can achieve significant cost savings. For instance, in 2023, many media companies reported a 5-10% reduction in operational expenses through targeted waste reduction programs and more efficient energy consumption in data centers.

Implementing these practices is not just about environmental stewardship; it's a strategic move towards long-term financial resilience. Televisa's focus on efficiency can translate into lower utility bills and reduced material costs. The company's efforts in 2024 are likely to align with broader industry trends, where companies are increasingly investing in technologies that reduce water consumption in production facilities and streamline waste management processes, aiming for a circular economy model.

- Optimized Water Usage: Implementing water-saving technologies in studios and broadcast centers.

- Waste Minimization: Reducing physical waste from production sets and office operations.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials for equipment and materials.

- Energy Efficiency: Upgrading broadcast infrastructure to consume less power.

Grupo Televisa's operations, particularly its extensive data centers and broadcasting infrastructure, have a significant energy demand. In 2023, data centers globally consumed about 1% of total electricity, underscoring the need for energy efficiency and renewable sources for companies like Televisa.

The company also faces the growing challenge of electronic waste, a global issue that generated millions of tons in 2024. Mexico's environmental regulations, such as the General Law for the Prevention and Integral Management of Waste, mandate proper disposal and recycling of such materials.

Climate change poses physical risks to Televisa's infrastructure, with extreme weather events in 2023 causing disruptions across Mexico. This necessitates investments in resilient infrastructure and disaster preparedness to ensure service continuity.

Resource efficiency is a key environmental focus, with companies in 2023 reporting operational cost reductions of 5-10% through waste minimization and energy efficiency programs.

| Environmental Factor | Impact on Televisa | Mitigation Strategies & Data (2023-2024) |

|---|---|---|

| Energy Consumption | High demand from data centers and broadcasting infrastructure. | Investment in energy-efficient technologies; exploration of renewable energy sources. Global data center electricity consumption ~1% of worldwide usage (2023). |

| Electronic Waste (E-waste) | Generation of waste from subscriber equipment (cable boxes, modems). | Robust e-waste management and recycling initiatives; compliance with Mexican waste laws. Global e-waste escalating annually (as of 2024). |

| Climate Change & Extreme Weather | Risk of damage to broadcast towers, cable networks, and data centers. | Building resilient infrastructure; enhancing disaster preparedness. Mexico experienced severe weather events in 2023 impacting services. |

| Resource Efficiency | Impact on operational costs and environmental footprint. | Optimizing water usage, minimizing waste, sustainable procurement. Companies reported 5-10% operational cost reduction via efficiency programs (2023). |

PESTLE Analysis Data Sources

Our Grupo Televisa PESTLE Analysis is built on a robust foundation of data from official Mexican government agencies, international financial institutions like the IMF and World Bank, and reputable media industry reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.