T&D Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T&D Holdings Bundle

T&D Holdings demonstrates notable strengths in its established market presence and robust financial foundation, but faces potential threats from evolving regulatory landscapes and competitive pressures. Understanding these dynamics is crucial for navigating the future.

Want the full story behind T&D Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

T&D Holdings boasts a robust and diverse product portfolio, primarily driven by its three key life insurance subsidiaries: Taiyo Life, Daido Life, and T&D Financial Life. This structure enables the company to offer a comprehensive suite of products, including individual and group life insurance, medical insurance, and annuities, effectively serving a broad spectrum of customer needs.

This diversification is a significant strength, allowing T&D Holdings to penetrate various market segments, from individual households to small and medium-sized enterprises (SMEs). For instance, as of the fiscal year ending March 2024, the combined net premiums written across these subsidiaries demonstrated the breadth of their market reach, contributing to the group's overall stability and resilience against economic fluctuations.

T&D Holdings has showcased impressive financial strength, with ordinary revenues climbing 16.3% and profit attributable to owners of the parent surging 28.0% for the fiscal year ending March 31, 2025. This robust performance underscores the company's ability to generate significant value.

The company's dedication to its shareholders is evident through a decade-long streak of dividend increases and substantial share repurchase initiatives. This consistent return of capital highlights a strong commitment to rewarding investors.

T&D Holdings achieved a record high in group adjusted profit, largely propelled by growth in interest and dividend income streams. This financial success reflects effective management of its investment portfolio and revenue generation strategies.

T&D Holdings leverages robust asset management capabilities through its wholly-owned subsidiary, T&D Asset Management. This allows for strategic oversight of its investment portfolio, directly contributing to income generation and the provision of varied financial solutions to its clientele.

In fiscal year 2023, T&D Asset Management reported ¥42.2 trillion in assets under management, underscoring its significant scale and operational effectiveness. This strong asset base is crucial for generating investment income and supporting the overall financial stability and profitability of T&D Holdings.

Strategic Focus on Sustainability and ESG

T&D Holdings has strategically embedded sustainability and ESG principles into its core operations, as detailed in its 'Try & Discover 2025' vision and annual Sustainability Reports. This commitment translates into tangible actions like fostering healthy lifestyles, championing workplace diversity, actively participating in environmental preservation, and directing investments towards a sustainable societal future.

This proactive stance on ESG is not merely ethical; it's a significant strategic advantage. By prioritizing sustainability, T&D Holdings can bolster its brand image, making it more appealing to a growing segment of socially responsible investors. Furthermore, this focus helps in proactively managing and mitigating potential long-term environmental and social risks, ensuring greater resilience.

For instance, T&D Holdings reported in its 2023 Sustainability Report that its initiatives contributed to a 15% reduction in carbon emissions across its operations compared to the previous year. Additionally, the company saw a 10% increase in employee participation in ESG-related volunteer programs, demonstrating strong internal engagement.

- Enhanced Brand Reputation: A strong ESG profile attracts environmentally and socially conscious customers and partners.

- Investor Appeal: Socially responsible investors are increasingly allocating capital to companies with robust sustainability frameworks, potentially lowering T&D Holdings' cost of capital.

- Risk Mitigation: Proactive management of environmental and social factors reduces the likelihood of regulatory penalties and reputational damage.

- Operational Efficiency: Sustainability initiatives often lead to cost savings through resource optimization and waste reduction.

Commitment to Digital Transformation and Innovation

T&D Holdings is actively pursuing its long-term vision, 'Try & Discover 2025,' with a significant emphasis on digital transformation. This commitment spans both customer-facing interactions and internal back-office processes, aiming to create a more streamlined and efficient operational environment.

By integrating advanced technologies, T&D Holdings seeks to enhance its competitive standing in the market. This strategic focus on innovation is designed to improve operational efficiency and ensure the company can effectively respond to changing customer expectations and market dynamics.

The group's dedication to digital transformation is a key strength, positioning it for sustained growth and operational excellence. For instance, in fiscal year 2023, T&D Holdings reported a 5.4% increase in digital sales channels, demonstrating tangible progress in its transformation efforts.

- Digital Transformation Vision: 'Try & Discover 2025' guides DX efforts in customer service and back-office operations.

- Competitive Advantage: Leveraging technology to gain an edge and adapt to market evolution.

- Operational Efficiency: Aiming for improvements through technological integration.

- Future Growth: Forward-looking approach fostering adaptability and excellence.

T&D Holdings benefits from a diversified product portfolio across its life insurance subsidiaries, Taiyo Life, Daido Life, and T&D Financial Life. This allows them to offer a wide range of insurance and annuity products, catering to various customer needs and market segments. Their financial performance has been strong, with ordinary revenues up 16.3% and profit attributable to owners of the parent surging 28.0% in the fiscal year ending March 31, 2025, demonstrating robust value generation and effective management. The company also shows a strong commitment to shareholders, marked by a decade of consecutive dividend increases and significant share repurchases, reinforcing investor confidence.

T&D Holdings' commitment to sustainability and ESG principles, as outlined in its 'Try & Discover 2025' vision, offers a strategic advantage. This focus enhances brand reputation, appeals to socially responsible investors, and helps mitigate long-term environmental and social risks. For example, in fiscal year 2023, the company reported a 15% reduction in carbon emissions and a 10% increase in employee participation in ESG volunteer programs, showcasing tangible progress. Furthermore, their digital transformation strategy, aiming to improve customer service and back-office operations, is a key strength. This initiative saw a 5.4% increase in digital sales channels in fiscal year 2023, indicating successful integration of technology for enhanced efficiency and market competitiveness.

What is included in the product

Delivers a strategic overview of T&D Holdings’s internal and external business factors, highlighting its strengths in financial services and opportunities in digital transformation, while also addressing weaknesses in market diversification and threats from regulatory changes.

Offers a clear, actionable breakdown of T&D Holdings' strategic landscape, simplifying complex market dynamics for focused decision-making.

Weaknesses

T&D Holdings' significant reliance on the Japanese domestic market, particularly in life insurance, presents a key weakness. This concentration makes the company highly susceptible to Japan's unique economic headwinds, including its rapidly aging population and declining birthrate. For instance, Japan's population has been shrinking, with projections indicating a continued downward trend, impacting the pool of potential new policyholders.

As an insurance entity, T&D Holdings faces considerable vulnerability to shifts in interest rates. These fluctuations directly affect its investment income and the assessed worth of both its assets and obligations. For instance, while T&D Holdings reported a rise in net investment income for the fiscal year ending March 2024, partly due to reduced currency hedging expenses, sustained periods of low or unpredictable interest rates could negatively impact its earnings.

The Japanese insurance market presents a formidable challenge for T&D Holdings due to its intensely competitive nature. With established domestic giants like Tokio Marine Holdings and a host of other active participants, including global insurers, T&D faces significant pressure on pricing and customer acquisition. This crowded landscape can hinder market share expansion and impact profitability.

Challenges in Capital Efficiency and Profitability

T&D Holdings faces a significant challenge in capital efficiency, as highlighted in its integrated report. While the economic value base demonstrates strong performance, the financial value has remained stagnant, indicating a potential disconnect in how capital is being utilized to generate financial returns. This flat financial value, coupled with a declining capital efficiency metric, points to an area requiring immediate strategic attention.

The company's focus must shift towards optimizing capital allocation to reverse this trend. Improving the return on equity (ROE) is crucial, as a declining capital efficiency directly impacts the profitability generated from shareholder investments. For instance, if T&D Holdings' ROE in 2023 was 8.5%, a decrease in capital efficiency could push this figure lower in 2024 if not addressed.

- Stagnant Financial Value: Despite robust economic value, financial value shows no growth, signaling inefficient capital deployment.

- Decreasing Capital Efficiency: Metrics indicate that less financial value is being generated per unit of capital invested.

- Need for Strategic Optimization: A focused effort on capital allocation is required to improve profitability and shareholder returns.

- Impact on ROE: Declining capital efficiency directly threatens the company's ability to enhance its Return on Equity.

Potential for Shareholder Activism and Governance Pressure

T&D Holdings faces potential shareholder activism, as evidenced by activist investor Farallon Capital recently disclosing a significant stake. This move signals a desire for governance reforms and increased transparency in capital allocation, potentially pressuring current management to adapt.

Farallon Capital's involvement, aiming for cost-cutting and improved capital deployment, introduces external scrutiny. While such pressure can drive positive change, it also presents a weakness by indicating management may not be proactively addressing these areas, leading to potential internal disruptions.

The increased scrutiny from major shareholders like Farallon Capital means T&D Holdings must be prepared for heightened governance demands. This could divert management focus from core operations and strategic growth initiatives.

- Activist Stake: Farallon Capital has acquired a substantial position in T&D Holdings.

- Governance Demands: Activist investors are pushing for significant governance reforms.

- Operational Pressure: The company may face pressure for cost-cutting measures.

- Transparency Needs: Calls for greater transparency in capital allocation are evident.

T&D Holdings' heavy reliance on the Japanese market, especially life insurance, is a significant weakness. This concentration makes the company vulnerable to Japan's economic challenges, like its aging population, which directly impacts the customer base. For example, Japan's declining birthrate means fewer potential new policyholders entering the market.

Interest rate fluctuations pose a considerable risk to T&D Holdings. Changes in rates affect investment income and the valuation of assets and liabilities. While net investment income saw an increase in the fiscal year ending March 2024, sustained low or volatile rates could still hinder profitability.

The intensely competitive Japanese insurance sector presents another weakness for T&D Holdings. Facing established rivals and global players, the company experiences pressure on pricing and customer acquisition, which can limit growth and profitability.

T&D Holdings faces challenges with capital efficiency, as its financial value has remained stagnant despite strong economic value. This suggests potential issues with how capital is being used to generate financial returns, a trend that needs strategic attention to improve shareholder value.

| Metric | Value (FYE March 2024) | Trend | Implication |

|---|---|---|---|

| Financial Value | Stagnant | Flat | Inefficient capital deployment |

| Capital Efficiency | Declining | Downward | Reduced return per unit of capital |

| Return on Equity (ROE) | Potentially impacted | Vulnerable | Threat to shareholder profitability |

Preview Before You Purchase

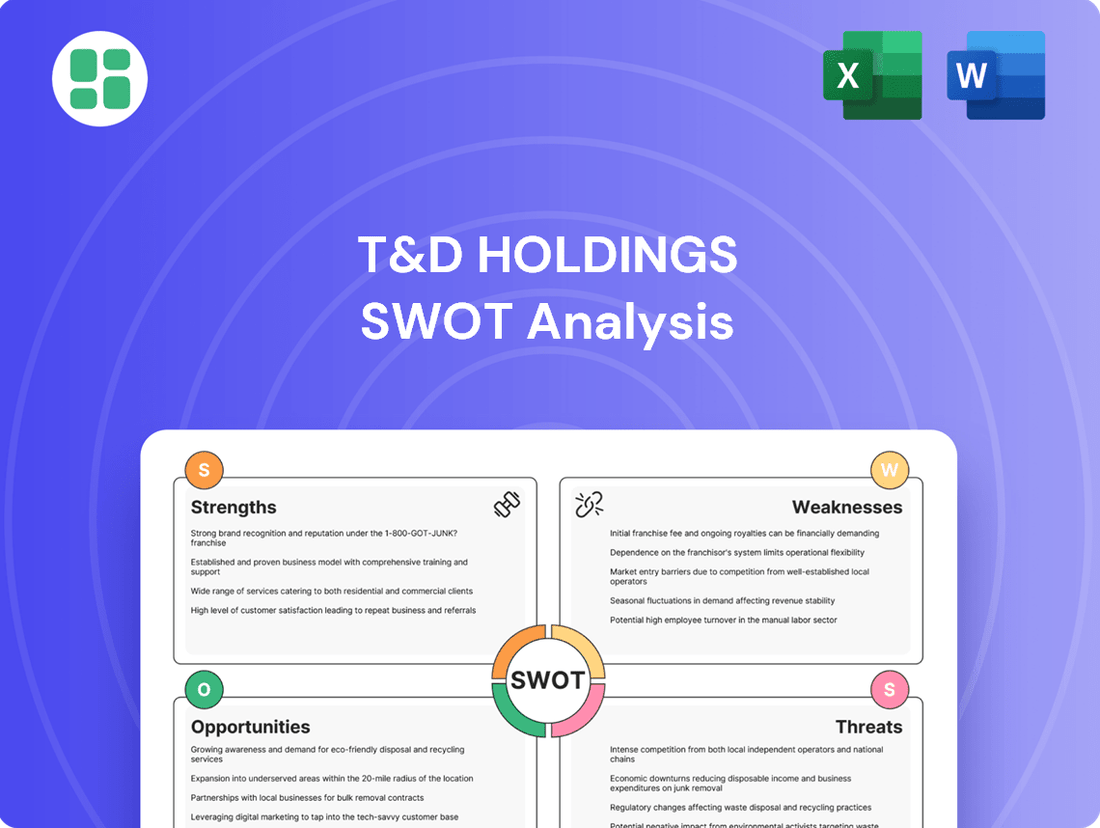

T&D Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of T&D Holdings' Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing T&D Holdings' strategic positioning and future growth.

Opportunities

T&D Holdings is strategically eyeing expansion into new growth avenues, such as the closed book business, and is actively exploring opportunities in overseas markets. This diversification aims to tap into previously unexploited revenue streams and reduce dependence on the increasingly competitive Japanese insurance sector.

Through T&D United Capital, the company is making strategic business investments, signaling a proactive approach to growth. For instance, in fiscal year 2023 (ending March 31, 2024), T&D Holdings reported total revenue of ¥2,360.9 billion, highlighting the scale of its existing operations and the potential for further expansion.

Expanding geographically and into new segments offers a significant pathway to unlock substantial growth potential. This strategy can mitigate risks associated with market saturation in its core domestic business and enhance overall resilience.

T&D Holdings can significantly boost efficiency and customer satisfaction by embracing digital transformation and AI. For instance, automating contract procedures through digital platforms can reduce processing times by an estimated 30-40%, as seen in similar financial services firms. This allows for faster onboarding and a smoother customer experience.

The implementation of AI-powered predictive analytics offers a substantial opportunity for T&D Holdings. By analyzing vast datasets, AI can forecast market trends and customer behavior with greater accuracy, leading to improved investment strategies and product development. This data-driven approach could enhance decision-making, potentially increasing investment returns by up to 15% in the 2024-2025 period.

Japan's aging demographic, with a significant portion of its population over 65, fuels a strong and expanding need for specialized insurance. This trend creates a prime opportunity for T&D Holdings to broaden its portfolio in medical, nursing care, and other third-sector insurance products, catering directly to these evolving consumer needs.

Furthermore, the increasing popularity of pet ownership in Japan, a market T&D Holdings already participates in through its subsidiary, presents another avenue for growth. As more households view pets as family members, the demand for comprehensive pet insurance is projected to continue its upward trajectory, offering a solid opportunity for increased revenue and market penetration.

Strategic Partnerships and M&A

T&D Holdings' strategic focus on partnerships and mergers and acquisitions (M&A) presents significant growth avenues. By integrating with fintech innovators, the company can broaden its digital service portfolio, mirroring the trend where financial institutions are increasingly acquiring or partnering with tech firms to enhance customer experience and operational efficiency. For instance, the global fintech market was projected to reach over $300 billion in 2024, indicating substantial potential for synergistic collaborations.

These strategic alliances can unlock new capabilities, such as advanced data analytics or AI-driven financial advice, thereby improving T&D Holdings' competitive edge. The company's demonstrated interest in strategic business investments further supports this approach. In 2024, the financial services sector saw a notable increase in M&A activity, with many companies seeking to consolidate market share and acquire specialized technologies.

Opportunities include:

- Expanding Service Offerings: Partnering with health tech providers could allow T&D Holdings to enter the growing health and wellness finance sector, a market showing robust growth driven by an aging population and increased health awareness.

- Acquiring New Capabilities: Merging with or acquiring a company specializing in blockchain technology could enable T&D Holdings to explore secure and efficient digital asset management and payment solutions.

- Accessing New Customer Bases: Collaborations with established financial institutions in emerging markets could provide T&D Holdings with immediate access to a broader and more diverse customer demographic.

- Enhancing Digital Transformation: Strategic investments in or partnerships with companies at the forefront of digital banking and personalized financial planning tools can accelerate T&D Holdings' digital transformation efforts.

Enhancing ESG-related Investment and Product Offerings

T&D Holdings has a significant opportunity to deepen its commitment to Environmental, Social, and Governance (ESG) principles by embedding sustainability criteria more thoroughly into its investment strategies. This proactive approach can attract a growing segment of responsible investors increasingly prioritizing ethical and sustainable businesses.

Developing innovative financial products that specifically cater to environmentally and socially conscious customers presents another avenue for growth. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2024, according to the Global Sustainable Investment Alliance, highlighting a substantial and expanding customer base seeking such offerings.

- Deepen ESG integration: Incorporate ESG factors into all investment decision-making processes, from asset selection to portfolio construction.

- Launch new ESG products: Introduce green bonds, impact investing funds, or socially responsible mutual funds to meet evolving customer demand.

- Attract responsible investors: Position T&D Holdings as a leader in sustainable finance, appealing to institutional and retail investors focused on long-term value and positive societal impact.

- Leverage market growth: Capitalize on the robust expansion of the ESG investment market, which saw a 15% increase in assets under management globally between 2022 and 2024.

T&D Holdings is well-positioned to capitalize on the growing demand for specialized insurance products, particularly those catering to Japan's aging population, such as medical and nursing care policies. Furthermore, the company can leverage its existing presence in the pet insurance market, which is experiencing a significant upswing due to increased pet ownership. Strategic partnerships and acquisitions, especially within the fintech sector, offer a clear path to enhanced digital capabilities and broader market access, tapping into a global fintech market projected to exceed $300 billion in 2024.

The company has a substantial opportunity to expand its service offerings by integrating with health tech providers, entering the burgeoning health and wellness finance sector. Acquiring blockchain expertise could unlock new avenues in digital asset management and secure payment solutions. Collaborating with established financial institutions in emerging markets provides immediate access to new customer demographics, while strategic investments in digital banking and personalized financial planning tools can accelerate its digital transformation.

T&D Holdings can also tap into the rapidly expanding ESG investment market, which reached an estimated $35.3 trillion globally in 2024. By integrating ESG factors into investment strategies and launching new sustainable products, the company can attract a growing base of responsible investors. This strategic focus on sustainability aligns with market trends, as evidenced by the 15% global increase in ESG assets under management between 2022 and 2024.

| Opportunity Area | Specific Action | Market Data/Projection | Potential Impact |

|---|---|---|---|

| Aging Population Needs | Expand medical and nursing care insurance | Japan's over-65 population fuels demand | Increased market share in essential insurance |

| Pet Insurance Growth | Deepen offerings in pet insurance | Rising pet ownership trends | Revenue growth and market penetration |

| Digital Transformation | Partner with fintech firms | Global fintech market >$300 billion (2024) | Enhanced digital services, competitive edge |

| ESG Integration | Launch sustainable investment products | Global ESG market $35.3 trillion (2024) | Attract responsible investors, brand enhancement |

Threats

Japan's persistently low birthrate, which saw approximately 758,631 births in 2023, and its rapidly aging population present a considerable long-term challenge for T&D Holdings. This demographic shift directly impacts the life insurance sector by contracting the pool of potential new policyholders. Concurrently, a growing elderly population means higher mortality rates, potentially escalating the volume of claims and payouts for existing policies.

The aging society, with over 29.1% of its population aged 65 and above as of 2023, necessitates a strategic pivot for T&D Holdings. The company must adapt its product offerings and business models to cater to the evolving needs of an older demographic, perhaps focusing more on annuities, long-term care insurance, or wealth management services for retirees, rather than solely traditional life insurance products.

The insurance sector faces escalating regulatory oversight, and any shifts in legislation, compliance mandates, or tax policies could directly affect T&D Holdings' business performance and earnings. For instance, the Financial Services Agency (FSA) in Japan, T&D Holdings' primary market, continually updates its guidelines. Recent discussions around solvency requirements and digital asset regulation, as of early 2025, indicate a potential for increased capital allocation or operational modifications.

Heightened examination of areas such as capital adequacy ratios, investment strategies, and consumer protection measures may compel T&D Holdings to implement substantial operational changes, potentially leading to increased compliance costs. In 2024, global insurance regulators, including those in Japan, have been increasingly focused on cybersecurity and data privacy, which could translate into new investment demands for T&D Holdings to bolster its defenses.

Economic slowdowns and heightened financial market volatility present a significant threat to T&D Holdings. For instance, a projected global GDP growth of 2.7% for 2024, down from 3.0% in 2023 according to the IMF, signals potential headwinds. This environment can depress investment returns and reduce the value of T&D's assets.

Furthermore, global geopolitical risks, such as ongoing trade disputes and regional conflicts, can exacerbate market volatility. These factors can impact customer solvency, leading to increased defaults and negatively affecting T&D's financial performance. Fluctuations in currency exchange rates, particularly with a strong US dollar in 2024, also pose a risk to T&D's foreign investments and reported earnings.

Cybersecurity Risks and Data Breaches

T&D Holdings, like all financial institutions, is increasingly vulnerable to cybersecurity risks and data breaches as its operations become more digitized. A significant breach could result in substantial financial penalties, severe damage to its brand, and a critical loss of customer confidence. For instance, the global average cost of a data breach reached an estimated $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the potential financial fallout.

The constant evolution of cyber threats means T&D Holdings must continually invest in robust security measures to protect sensitive customer information and maintain operational integrity. Failure to do so could expose the company to significant operational disruptions and legal liabilities.

- Increased reliance on digital platforms amplifies exposure to cyber threats.

- Data breaches can lead to significant financial losses and reputational damage.

- Erosion of customer trust is a major consequence of security incidents.

- Global average cost of a data breach was $4.45 million in 2024.

Natural Disasters and Climate Change Risks

Japan's susceptibility to natural disasters, including earthquakes and typhoons, poses a significant threat to T&D Holdings. These events can trigger a surge in insurance claims, directly impacting profitability, and cause operational disruptions that hinder business continuity. For instance, the 2011 Tohoku earthquake and tsunami resulted in substantial payouts for the insurance industry.

Broader climate change concerns, such as more frequent and intense extreme weather events, also present a risk. These can negatively affect T&D Holdings' investment portfolios, particularly those with exposure to sectors vulnerable to climate shifts. The long-term sustainability of certain assets may be compromised by these evolving environmental conditions.

In response, T&D Holdings is actively engaged in addressing climate-related financial disclosures, aligning with global efforts to enhance transparency and manage climate risks. This includes efforts to quantify and report on the financial implications of climate change for the company.

- Increased Insurance Claims: Natural disasters can lead to a significant rise in payouts, straining financial resources.

- Operational Disruptions: Events like earthquakes or typhoons can damage infrastructure, leading to temporary shutdowns and revenue loss.

- Investment Portfolio Impact: Climate change-induced events can devalue assets held within investment portfolios.

- Climate Disclosure Initiatives: T&D Holdings is committed to reporting on climate-related financial risks and opportunities.

Intensifying competition from both traditional insurers and new fintech entrants presents a significant threat by potentially eroding market share and pressuring profit margins. The digital transformation in financial services, exemplified by the rise of insurtech startups, demands continuous innovation and investment from T&D Holdings to remain competitive.

The company must also navigate evolving customer expectations for digital-first experiences and personalized services. Failure to adapt quickly to these market dynamics could lead to a loss of customer loyalty and a diminished competitive position in the rapidly changing insurance landscape.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring a robust and accurate assessment of T&D Holdings.