T&D Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T&D Holdings Bundle

T&D Holdings operates within a dynamic insurance landscape, where intense rivalry and the threat of substitutes significantly shape its market position. Understanding the nuanced interplay of these forces is crucial for strategic advantage.

The complete report reveals the real forces shaping T&D Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Specialized software and IT providers wield significant bargaining power over T&D Holdings. Life insurance operations are fundamentally dependent on advanced actuarial software, intricate data analytics platforms, and reliable IT infrastructure. The proprietary nature of these technologies, coupled with the substantial costs and complexities associated with switching providers, grants these suppliers considerable leverage. For instance, the global market for insurance software solutions was projected to reach approximately $20.5 billion in 2024, indicating a mature and specialized industry where established vendors often dictate terms.

Reinsurance companies play a vital role for T&D Holdings, enabling the transfer of underwriting risk, particularly for substantial policies or unforeseen events. This risk transfer helps to stabilize T&D Holdings' financial results.

The bargaining power of reinsurers can be considerable, especially when dealing with niche or unpredictable risks where the market is dominated by a limited number of global entities possessing specialized knowledge and financial capacity.

For instance, in 2024, the global reinsurance market continued to see robust demand, with major reinsurers like Swiss Re and Munich Re reporting strong premium growth, indicating their significant influence in pricing and terms for cedents like T&D Holdings.

Investment management service providers, such as external asset managers or investment banks that T&D Holdings might utilize, can wield significant bargaining power. This is especially true when T&D requires specialized expertise for niche markets or specific investment strategies. For instance, a top-performing hedge fund manager or an investment bank with unique market access could demand higher fees, impacting T&D's profitability.

The bargaining power of these suppliers is amplified by their specialized knowledge and proven track records. If T&D Holdings relies on these external entities to generate alpha or access opportunities unavailable internally, these suppliers become critical partners. In 2024, the competition for top-tier investment talent remained fierce, with many specialized managers commanding substantial performance-based fees, a trend likely to continue influencing T&D's sourcing decisions.

Human Capital and Actuarial Talent

The bargaining power of suppliers for T&D Holdings is significantly influenced by its need for specialized human capital, particularly actuaries, risk managers, and financial analysts. These professionals are absolutely essential for the company's operations in the financial services sector.

The limited supply of highly skilled individuals in these niche fields, coupled with robust demand from other financial institutions, grants these human capital suppliers substantial leverage. This power is evident in the competitive salary and benefits packages T&D Holdings must offer to attract and retain top talent.

- Scarcity of Expertise: The financial services industry, particularly in areas like actuarial science and complex risk management, faces a persistent shortage of qualified professionals.

- High Demand: Major financial firms are all vying for the same pool of talent, driving up compensation and benefits.

- Impact on Costs: This translates directly into higher labor costs for T&D Holdings, as they must match or exceed market rates to secure necessary expertise.

- Talent Retention Challenges: Retaining these key employees becomes a critical challenge, as competitors can easily poach them with more attractive offers.

Regulatory and Compliance Consultants

The bargaining power of regulatory and compliance consultants for T&D Holdings is substantial, primarily due to the intricate and ever-evolving regulatory environment of the Japanese insurance sector. These specialized firms hold unique knowledge of insurance laws, making them indispensable for T&D Holdings to maintain compliance. The potential financial and reputational repercussions of non-compliance are extremely high, amplifying the consultants' leverage.

In 2024, the Japanese Financial Services Agency (FSA) continued to emphasize stringent oversight, particularly concerning data privacy and solvency regulations for insurance companies. This heightened regulatory scrutiny means that T&D Holdings must rely on expert guidance to navigate these complexities, thereby increasing the bargaining power of consultants who possess this critical expertise. The cost of engaging these specialized services can be significant, reflecting their niche skills and the high demand driven by regulatory pressures.

- Specialized Expertise: Consultants offer in-depth knowledge of Japanese insurance law, a barrier to entry for many.

- High Switching Costs: The effort and time to onboard new consultants familiar with T&D's specific operations are considerable.

- Regulatory Dependence: T&D's need for compliant operations makes it reliant on expert advice, strengthening supplier power.

- Reputational Risk: Non-compliance carries severe penalties, making T&D hesitant to risk using less qualified consultants.

Suppliers of specialized software and IT infrastructure hold considerable sway over T&D Holdings due to the critical nature of these systems for life insurance operations. The proprietary nature of these technologies and the high costs associated with switching providers further enhance their bargaining power.

Reinsurers also exert significant influence, particularly when T&D Holdings seeks coverage for niche or high-risk policies. The concentration of specialized knowledge and financial capacity among a few global reinsurers allows them to dictate terms and pricing.

Providers of specialized human capital, such as actuaries and risk managers, possess strong bargaining power due to the scarcity of these skilled professionals in the market. T&D Holdings must offer competitive compensation to attract and retain this essential talent.

Regulatory and compliance consultants wield substantial power because of the complex and constantly changing legal landscape. T&D Holdings' dependence on their expertise to ensure compliance, coupled with the severe penalties for non-compliance, amplifies the consultants' leverage.

| Supplier Type | Key Factors Influencing Bargaining Power | Example Data/Trend (2024) |

|---|---|---|

| Specialized Software & IT | Proprietary technology, high switching costs | Global insurance software market projected at $20.5 billion |

| Reinsurers | Niche risk expertise, limited market players | Major reinsurers like Swiss Re and Munich Re reported strong premium growth |

| Specialized Human Capital | Scarcity of talent, high demand | Competitive salary and benefits packages required for actuaries |

| Regulatory Consultants | Complex regulations, high compliance stakes | Continued stringent oversight by Japanese FSA |

What is included in the product

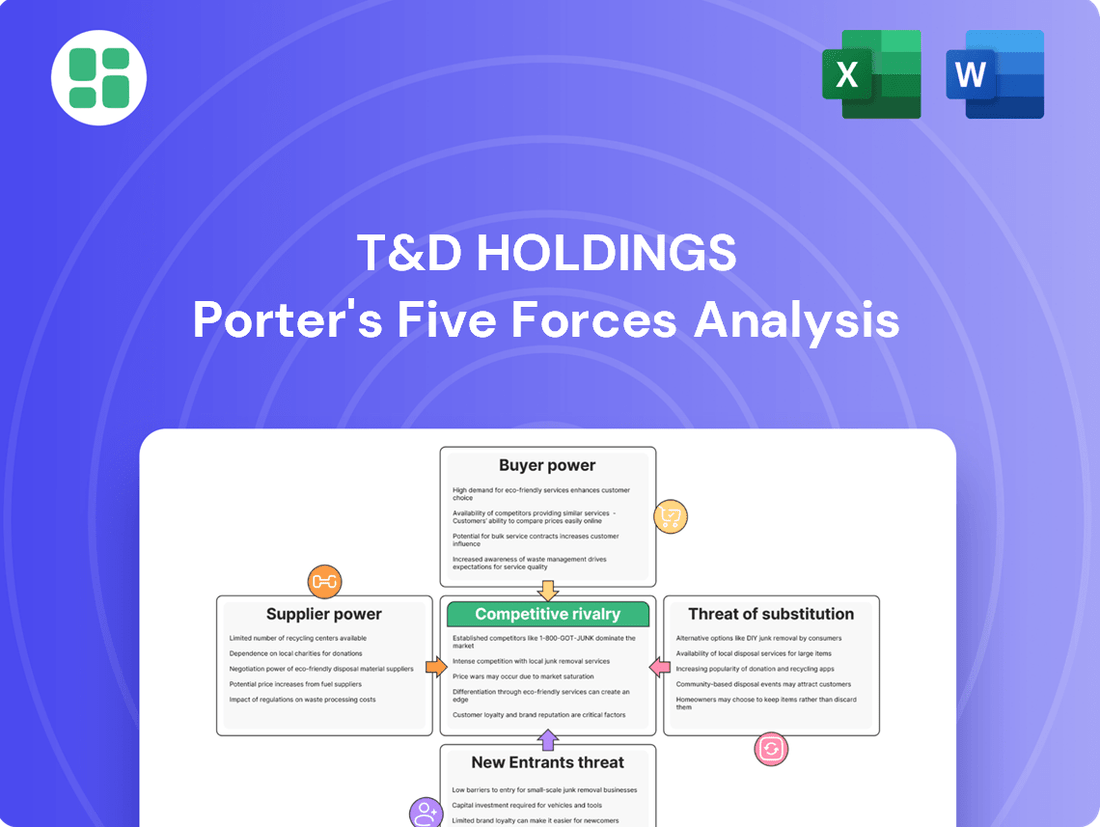

This analysis of T&D Holdings reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within its operating environment.

T&D Holdings' Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick, informed decision-making.

Customers Bargaining Power

Individual policyholders, though many, possess limited individual bargaining power. This is largely due to the standardized nature of insurance products and the inherent complexity that makes direct price negotiation difficult for a single customer.

However, their collective strength is considerable. If a significant number of policyholders become dissatisfied with pricing, service quality, or product features, they can switch to competitors. This threat is amplified by growing market transparency and the proliferation of digital tools that make comparing insurance policies easier than ever before.

Small and medium-sized enterprises (SMEs) represent a significant customer segment for T&D Holdings in the insurance market. Their collective purchasing power for group life and medical insurance policies for employees grants them a degree of leverage over insurers.

SMEs actively shop around, comparing quotes from various providers and demanding customized policy features. This competitive landscape compels T&D Holdings to offer attractive pricing and adaptable insurance packages to win and keep these business clients. For instance, in 2024, the SME sector continued to be a key driver of growth in the group benefits market, with insurers reporting increased demand for flexible plan designs to meet diverse workforce needs.

Major corporations, particularly those seeking comprehensive group insurance and tailored financial services, wield considerable bargaining power over T&D Holdings. Their substantial employee numbers or asset bases give them leverage to demand better terms.

These large clients often initiate thorough bidding processes, seeking highly customized products and services. This necessitates T&D Holdings to be competitive on pricing, policy features, and service level agreements to secure and retain such business.

For instance, in 2024, large corporate clients accounted for a significant portion of the group insurance market, with many demanding price reductions of up to 5% in renewal negotiations, a trend T&D Holdings must actively manage.

Price Sensitivity and Transparency

Customers today are more aware of pricing than ever before. Economic pressures in 2024 have made many consumers more budget-conscious, actively seeking the best deals. This is amplified by the ease of comparing prices online, which significantly lowers the effort and cost for customers to switch providers if they find a better offer. For T&D Holdings, this means a constant need to ensure their pricing is competitive without sacrificing margins.

The increased transparency in the market in 2024 directly impacts T&D Holdings' ability to command premium pricing. With readily available information on competitor pricing, customers can easily identify discrepancies. This forces T&D Holdings to be more strategic with its pricing, potentially leading to price wars or a need to differentiate through value-added services rather than just price. For instance, a significant portion of consumers, estimated to be over 60% in many retail sectors in 2024, will abandon a purchase if they find a lower price elsewhere.

- Heightened Price Sensitivity: Economic conditions in 2024 have made a majority of consumers more focused on price.

- Online Transparency: Digital platforms allow for easy comparison of prices and offerings, reducing customer loyalty based on price alone.

- Reduced Switching Costs: The ease of finding alternatives online makes it less costly for customers to change providers.

- Pricing Strategy Pressure: T&D Holdings must balance competitive pricing with the need to maintain profitability and invest in its services.

Long-term Relationship Value

While customers typically have the freedom to switch insurance providers, the long-term commitments inherent in life insurance policies, such as those offered by T&D Holdings, naturally foster a degree of customer stickiness. Once a policy is in place and premiums are being paid, the administrative effort and potential loss of accumulated value can deter immediate switching.

T&D Holdings can effectively mitigate customer bargaining power by cultivating enduring relationships. This involves a strategic focus on enhancing customer loyalty through well-designed programs, ensuring exceptional service during the claims process, and maintaining consistent, valuable engagement with policyholders. These efforts aim to build trust and minimize the customer's incentive to seek alternatives.

For example, in 2023, T&D Holdings reported a significant portion of its revenue derived from its established life insurance segments, indicating the success of long-term customer retention strategies. By prioritizing customer satisfaction and demonstrating ongoing value, T&D Holdings can solidify its market position.

- Customer Retention: Life insurance policies often have long durations, making customers less likely to switch frequently.

- Loyalty Programs: Implementing rewards and benefits for long-term policyholders can further reduce switching incentives.

- Claims Service Excellence: A reputation for efficient and empathetic claims handling is crucial for maintaining customer satisfaction and loyalty.

- Continuous Engagement: Proactive communication and relevant policy updates keep customers connected and invested in their relationship with T&D Holdings.

The bargaining power of customers for T&D Holdings is a dynamic factor, influenced by individual policyholder behavior, the collective strength of SMEs, and the significant leverage of major corporations. In 2024, heightened price sensitivity and increased online transparency mean customers are more empowered than ever to seek better deals, putting pressure on T&D Holdings to maintain competitive pricing while focusing on service differentiation.

| Customer Segment | Bargaining Power Drivers | Impact on T&D Holdings (2024 Focus) |

|---|---|---|

| Individual Policyholders | Low individual power, high collective potential | Need for competitive pricing and clear value proposition; digital tools facilitate comparison. |

| Small & Medium Enterprises (SMEs) | Collective purchasing power for group benefits | Demand for customized policies and competitive pricing; key growth segment. |

| Major Corporations | Substantial employee base/assets, large contract values | Initiate bidding, demand tailored services and price concessions; significant revenue drivers. |

What You See Is What You Get

T&D Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for T&D Holdings, detailing the competitive landscape and strategic implications within the insurance and financial services sector. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The Japanese life insurance sector is a battleground dominated by established domestic giants like Nippon Life, Dai-ichi Life, Meiji Yasuda Life, and Sumitomo Life, with T&D Holdings being a significant player among them. This maturity fuels fierce competition, as these titans vie for market share through their vast sales networks, strong brand loyalty, and comprehensive product offerings.

Competitive intensity at T&D Holdings is significantly shaped by product differentiation, especially given Japan's aging population and shifting consumer demands. The company must continuously innovate its offerings, such as developing new medical insurance plans and advanced annuity products, to capture market share.

For instance, T&D Holdings’ focus on digital transformation, including enhancing online customer service and developing app-based solutions, aims to attract younger demographics and differentiate itself from competitors still relying on traditional sales channels. This innovation drive is crucial for retaining existing customers and appealing to new segments seeking modern financial services.

Competition among insurance providers like T&D Holdings is fierce when it comes to distribution channels. This includes how they reach customers through tied agents, independent financial advisors, bancassurance partnerships, and increasingly, direct online sales.

T&D Holdings actively invests in its sales force, focusing on training and development to ensure their agents are well-equipped to serve customers effectively. For instance, in fiscal year 2023, T&D Holdings reported a significant portion of its new business premiums were generated through its agency channels, highlighting the ongoing importance of this distribution method.

Expanding partnerships is also key, allowing companies to tap into new customer bases and offer products through various avenues. This multi-channel approach is crucial for staying competitive and efficiently reaching a broader market compared to rivals who might rely on fewer distribution methods.

Market Saturation and Growth Rates

The Japanese life insurance market is quite mature, making it tough for companies like T&D Holdings to achieve substantial organic growth. This maturity means that competition is fierce, as insurers battle for a shrinking pool of potential new customers. In 2023, the total premium income for Japanese life insurers saw a slight decrease, underscoring the challenge of expansion.

This intense rivalry often forces companies to adopt aggressive strategies. You'll see a lot of price competition, heavy spending on marketing to stand out, and a strong emphasis on keeping current policyholders happy. Customer retention is key when acquiring new ones is so difficult.

- Mature Market Dynamics: The Japanese life insurance sector faces limited organic growth opportunities, intensifying competition among existing players.

- Aggressive Strategies: Companies resort to price wars, extensive marketing, and customer retention initiatives to capture market share.

- 2023 Premium Data: Total premium income for Japanese life insurers experienced a slight contraction in 2023, reflecting the challenging growth environment.

Capital Strength and Financial Stability

In the insurance industry, a company's financial strength is a major battleground. T&D Holdings and its competitors constantly emphasize their strong capital reserves, healthy solvency ratios, and high credit ratings. This is because policyholders want to be sure their insurer is secure and can pay claims for years to come.

For instance, as of the first half of fiscal year 2024, T&D Holdings reported a consolidated solvency margin ratio of 865.1%, far exceeding the regulatory minimum. This financial muscle directly impacts competitive dynamics, as it allows insurers to weather economic downturns and invest in product innovation.

- Financial Strength as a Differentiator: Insurers leverage strong capital positions and high credit ratings (e.g., A+ from S&P for T&D Holdings) to build trust and attract customers.

- Impact on Solvency Ratios: Maintaining robust solvency margins, like T&D's 865.1% in H1 FY2024, signals stability and the ability to meet future obligations, a key factor in customer choice.

- Competitive Pressure on Capitalization: Rivals are compelled to maintain similar levels of financial health, leading to a continuous focus on capital management and risk assessment.

- Customer Confidence and Long-Term Security: Policyholders prioritize insurers demonstrating long-term financial stability, making capital strength a critical element of competitive rivalry.

The competitive rivalry within the Japanese life insurance market, where T&D Holdings operates, is characterized by intense competition among well-established domestic players. This rivalry is further amplified by the mature nature of the market, which limits organic growth opportunities and forces companies to focus on market share acquisition through aggressive strategies.

Companies like T&D Holdings engage in price competition, substantial marketing expenditures, and a strong emphasis on customer retention to stand out. This is evident in the slight contraction of total premium income for Japanese life insurers in 2023, underscoring the challenging environment for expansion and the need for differentiation.

Financial strength serves as a critical battleground, with insurers like T&D Holdings highlighting robust capital reserves and solvency ratios to build customer trust. For instance, T&D Holdings reported a consolidated solvency margin ratio of 865.1% in the first half of fiscal year 2024, demonstrating its financial stability and ability to meet obligations.

| Key Competitors | Market Share (Approx. 2023) | Key Competitive Tactics | Financial Strength Indicator (H1 FY2024) |

| Nippon Life | ~15-20% | Extensive agency network, brand loyalty, product innovation | Strong capital base |

| Dai-ichi Life | ~10-15% | Digital transformation, bancassurance partnerships, customer service | Robust solvency ratio |

| Meiji Yasuda Life | ~10-15% | Focus on medical and health insurance, agent training | Healthy capital adequacy |

| Sumitomo Life | ~10-15% | Global expansion, diverse product portfolio, strong brand recognition | High credit rating |

| T&D Holdings | ~5-10% | Digital services, multi-channel distribution, agent development | Solvency Margin Ratio: 865.1% |

SSubstitutes Threaten

The threat of substitutes for traditional life insurance is growing as individuals and some small to medium-sized enterprises (SMEs) increasingly opt for self-insurance strategies. By accumulating substantial savings or investing in diversified financial instruments such as stocks, bonds, or real estate, they can build a financial cushion that potentially negates the need for insurance policies. This approach offers greater flexibility and direct control over their funds.

Government social security programs in Japan, such as the National Pension System and National Health Insurance, offer a fundamental safety net. These systems provide a baseline of retirement income and healthcare coverage, acting as a partial substitute for private life and medical insurance products. For instance, the robust public pension system can lessen the perceived urgency for individuals to build substantial private retirement savings, potentially impacting demand for certain annuity products.

Emerging fintech and insurtech companies present a growing threat by offering innovative digital solutions that can serve as partial substitutes for traditional insurance products. These platforms, such as peer-to-peer lending or micro-insurance, cater to specific needs and can reduce an individual's reliance on comprehensive life insurance policies. For instance, the global fintech market was projected to reach over $1.7 trillion in 2024, indicating a significant shift towards digital financial services.

Alternative Risk Transfer Mechanisms

Larger corporations increasingly explore alternative risk transfer (ART) mechanisms, like captive insurance or risk securitization, as substitutes for traditional group insurance. These ART solutions, including corporate hedging, offer tailored risk management and greater control, potentially reducing reliance on standard insurance offerings.

For instance, the global market for insurance-linked securities (ILS), a form of risk securitization, experienced significant growth. In 2024, the ILS market capacity was estimated to be around $100 billion, demonstrating a substantial alternative for transferring catastrophic risks away from traditional insurers.

- Captive Insurance: Companies establish their own insurance subsidiaries to underwrite their risks, offering flexibility and cost savings.

- Securitization of Risks: This involves pooling specific risks and issuing securities backed by those risks, transferring them to capital markets.

- Corporate Hedging: Utilizing financial instruments like derivatives to offset potential losses from specific exposures, such as currency fluctuations or commodity price volatility.

Changing Societal Needs and Priorities

Shifting societal priorities, particularly a growing focus on immediate gratification and short-term financial objectives, can directly impact the demand for long-term insurance products offered by companies like T&D Holdings. This macro trend means individuals might choose to spend more on current needs rather than allocating disposable income to future security.

Evolving perceptions of personal risk and responsibility also play a crucial role. As societal attitudes change, the perceived necessity and value of traditional life insurance policies might decrease, making substitutes more attractive.

For instance, in 2024, a significant portion of consumers, especially younger demographics, are prioritizing experiences and immediate financial freedom over long-term commitments. This shift can be seen in consumer spending patterns, where discretionary spending on travel and entertainment often takes precedence.

- Changing Societal Needs: An increased emphasis on immediate consumption over long-term savings.

- Evolving Risk Perceptions: Altered views on personal responsibility may reduce the perceived need for traditional insurance.

- Impact on T&D Holdings: This trend could lead to reduced demand for life insurance products, increasing the threat of substitutes.

The threat of substitutes for T&D Holdings' life insurance products is significant and multifaceted. Individuals and businesses are increasingly turning to self-insurance, diversified investments, and alternative risk transfer mechanisms. Fintech innovations also offer competitive digital solutions, while evolving societal priorities favor immediate gratification over long-term security.

| Substitute Category | Examples | 2024 Market Data/Trend | Impact on T&D Holdings |

|---|---|---|---|

| Self-Insurance & Investments | Savings, Stocks, Bonds, Real Estate | Global wealth management market projected to grow significantly, indicating increased personal investment. | Reduced demand for traditional life insurance if personal financial cushions become robust enough. |

| Government Social Security | National Pension Systems, Public Healthcare | Japan's social security system provides a baseline, potentially lessening the perceived need for private retirement and health coverage. | Can dampen demand for certain annuity and medical insurance products. |

| Fintech & Insurtech | Peer-to-peer lending, Micro-insurance, Digital platforms | Global fintech market projected to exceed $1.7 trillion in 2024, showing a strong shift to digital financial services. | Offers alternative, often more agile, solutions that can fragment the insurance market. |

| Alternative Risk Transfer (ART) | Captive insurance, Risk securitization (ILS) | ILS market capacity estimated at $100 billion in 2024, highlighting a growing alternative for risk transfer. | Corporations may bypass traditional group insurance for tailored ART solutions. |

| Societal Shifts | Focus on immediate gratification, short-term goals | Increased discretionary spending on experiences, especially among younger demographics. | Decreased allocation of disposable income to long-term insurance products. |

Entrants Threaten

Establishing a life insurance company in Japan demands significant capital. This includes meeting stringent regulatory reserve requirements, building robust operational infrastructure, and funding initial marketing campaigns. For instance, in 2024, the minimum capital requirement for a life insurer in Japan is ¥1 billion, a substantial hurdle for many prospective companies.

These considerable financial barriers act as a strong deterrent to new entrants. The sheer scale of investment needed means only well-funded organizations or those with substantial financial backing can realistically consider entering the Japanese life insurance market, thereby limiting the threat of new competition.

The Japanese insurance sector, overseen by the Financial Services Agency (FSA), presents a formidable barrier to entry due to its rigorous licensing, solvency, and consumer protection mandates. This intricate regulatory framework necessitates substantial investment in legal and compliance resources, making it difficult for new players to establish a foothold.

Existing players like T&D Holdings leverage decades of brand recognition and established customer trust, crucial for a sector built on long-term financial commitments. For instance, T&D Holdings reported total assets of ¥71.8 trillion as of March 31, 2024, reflecting its substantial market presence and the deep trust it has cultivated.

New entrants must overcome significant hurdles to establish credibility and attract policyholders, necessitating extensive marketing campaigns and considerable time. This challenge is compounded by the need to match the perceived stability and reliability that established brands like T&D Holdings project to potential customers.

Extensive Distribution Networks

Incumbent insurers like T&D Holdings boast deeply entrenched distribution networks, comprising vast numbers of agents, physical branches, and strategic bancassurance alliances. In 2023, T&D reported a robust agency force contributing significantly to its sales volume.

Establishing a comparable reach and operational efficiency presents a substantial hurdle for new entrants. This requires immense capital outlay for sales infrastructure and the development of diverse distribution channels, making it difficult to compete effectively against established players.

The threat of new entrants is therefore moderated by the sheer scale and cost associated with replicating existing distribution capabilities. For instance, the cost of training and maintaining a large, qualified agent network can be prohibitive for startups.

Key factors contributing to this barrier include:

- Established Agent Networks: Insurers have cultivated long-term relationships with a large base of agents, offering them attractive commissions and support.

- Bancassurance Partnerships: Existing insurers often have exclusive or preferential agreements with banks, providing access to a broad customer base.

- Brand Recognition and Trust: Long-standing insurers benefit from established brand loyalty, making it easier to attract and retain customers through their existing channels.

Actuarial Expertise and Data Access

The life insurance sector, including companies like T&D Holdings, places immense value on deep actuarial expertise and access to vast datasets. Developing accurate pricing models and effectively managing long-term financial risks requires specialized talent and a significant historical data repository. New entrants face a substantial hurdle in replicating this foundational capability. For instance, in 2023, the global life insurance market was valued at over $3.3 trillion, underscoring the scale of investment needed to compete.

Acquiring the necessary actuarial talent and accumulating the extensive historical data crucial for robust risk assessment and product pricing presents a significant barrier. Without this, new players would struggle to develop proprietary models that accurately price life insurance products and manage the inherent long-term financial risks. This reliance on specialized knowledge and data acts as a formidable deterrent to potential new entrants.

- Actuarial Expertise: Life insurance pricing and risk management are heavily reliant on sophisticated actuarial science, demanding highly skilled professionals.

- Data Access and Analysis: A vast amount of historical mortality and morbidity data is essential for accurate underwriting and product development.

- Proprietary Modeling: Developing and maintaining advanced, proprietary actuarial models is a significant investment and a key competitive advantage.

- Talent Acquisition: The specialized nature of actuarial work means that attracting and retaining top talent is a challenge for newcomers.

The threat of new entrants into the Japanese life insurance market, where T&D Holdings operates, is significantly low. High capital requirements, such as the ¥1 billion minimum for life insurers in 2024, alongside stringent regulatory compliance and the need for substantial operational infrastructure, create formidable financial barriers.

Established players benefit from deep-rooted brand recognition and customer trust, cultivated over years of operation. T&D Holdings' total assets of ¥71.8 trillion as of March 31, 2024, exemplify this market entrenchment, making it difficult for newcomers to build comparable credibility and attract policyholders.

The sector's reliance on extensive actuarial expertise and vast historical data for risk assessment and pricing also poses a considerable challenge for new entrants. Acquiring specialized talent and accumulating the necessary data for proprietary modeling requires significant investment and time, further dampening the threat of new competition.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Minimum ¥1 billion capital for life insurers (2024). | High financial hurdle, limiting entry to well-funded entities. |

| Regulatory Compliance | Stringent licensing, solvency, and consumer protection mandates from FSA. | Requires significant investment in legal and compliance resources. |

| Brand Recognition & Trust | Decades of established customer loyalty and perceived stability. | New entrants struggle to build equivalent trust and attract customers. |

| Distribution Networks | Entrenched agent networks and bancassurance alliances. | Replicating reach requires immense capital and time for sales infrastructure. |

| Actuarial Expertise & Data | Need for specialized talent and historical data for pricing and risk. | Significant investment in talent acquisition and data accumulation needed. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for T&D Holdings is built upon a robust foundation of data, incorporating insights from T&D Holdings' annual reports, investor presentations, and official press releases. We also leverage industry-specific market research reports and financial news outlets to capture a comprehensive view of the competitive landscape.