T&D Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T&D Holdings Bundle

Gain an edge with our in-depth PESTLE Analysis—crafted specifically for T&D Holdings. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government policies significantly shape the insurance sector, impacting financial stability, social welfare, and healthcare. For T&D Holdings, shifts in these regulations present both opportunities and challenges.

For instance, recent Japanese government initiatives aimed at bolstering financial system resilience, as seen in the Bank of Japan's continued monetary policy stance through early 2024, indirectly influence investment returns for insurers. Changes in social welfare programs could alter demand for specific insurance products, while evolving healthcare policies directly affect the profitability of health and life insurance lines, areas T&D Holdings actively participates in.

Japan's political landscape has historically been characterized by stability, which is a significant positive for T&D Holdings. This stability fosters a predictable business environment, boosting confidence for long-term strategic planning and investment. For instance, the consistent policy framework in the insurance sector, T&D's core business, allows for more accurate risk assessment and capital allocation.

Japan's international trade policies and diplomatic relations significantly influence T&D Holdings' global asset management and expansion prospects. Favorable trade agreements, like those within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), can ease cross-border financial operations and reduce regulatory hurdles for T&D's international ventures. Conversely, geopolitical tensions or protectionist trade measures could complicate foreign investments and market access, impacting the firm's global diversification strategies and potentially affecting its 2024-2025 revenue streams from overseas operations.

Fiscal and Monetary Policy

Government fiscal policies, such as changes in taxation and public spending, can significantly impact T&D Holdings. Increased government spending, for instance, might stimulate economic growth, leading to higher disposable incomes for consumers. This, in turn, could boost demand for insurance products. Conversely, tax increases could reduce disposable income, potentially dampening demand.

Monetary policy decisions by central banks, particularly interest rate adjustments, directly affect the insurance industry. Lower interest rates can reduce investment returns on insurers' portfolios, potentially impacting profitability and the pricing of insurance products. For example, the Bank of Japan's accommodative monetary policy, while aiming to stimulate the economy, can present challenges for insurers like T&D Holdings in generating robust investment income. As of early 2024, Japan's policy rates remained low, a trend that has persisted.

- Impact on Disposable Income: Fiscal stimulus measures can increase household savings and disposable income, potentially driving demand for life and non-life insurance products.

- Investment Returns: Monetary policy, especially interest rate levels, directly influences the profitability of insurers' investment portfolios, affecting their ability to offer competitive pricing and pay claims.

- Economic Growth and Demand: Government spending on infrastructure or social programs can foster economic growth, indirectly supporting the demand for various insurance lines offered by T&D Holdings.

Industry Specific Regulations and Deregulation

Changes in regulations directly affecting the life insurance and financial services sectors can significantly alter T&D Holdings' operating environment. For instance, shifts in capital requirements or solvency standards, such as those influenced by Solvency II in Europe or similar frameworks globally, can impact how T&D Holdings manages its financial resources and product offerings. Deregulation might open new avenues for product innovation and distribution, potentially increasing competition but also creating opportunities for market expansion. Conversely, stricter regulations on consumer protection or data privacy, like evolving GDPR-related interpretations, could necessitate increased compliance investments and affect marketing strategies.

The regulatory landscape for financial services is dynamic, with ongoing discussions and potential adjustments impacting T&D Holdings. For example, in 2024, many jurisdictions continued to refine digital asset regulations, which could indirectly influence investment products offered by life insurers. Furthermore, discussions around climate-related financial disclosures and sustainable finance practices are gaining momentum, potentially leading to new reporting requirements for companies like T&D Holdings. The industry also faces evolving rules concerning cybersecurity and data protection, critical for maintaining customer trust and operational integrity.

- Capital Adequacy Reforms: Ongoing reviews of capital adequacy frameworks, such as those under the International Association of Insurance Supervisors (IAIS) initiatives, could affect T&D Holdings' risk-weighted asset calculations and capital management strategies.

- Consumer Protection Measures: Increased scrutiny on product transparency and sales practices, particularly for complex financial products, may lead to more stringent disclosure requirements and sales conduct rules.

- Digital Transformation Oversight: Regulators are increasingly focusing on the risks associated with AI and big data in financial services, potentially leading to new guidelines for T&D Holdings' use of technology in underwriting, claims processing, and customer service.

- ESG Integration: The push for Environmental, Social, and Governance (ESG) considerations in financial markets may result in new reporting obligations and investment restrictions for T&D Holdings, influencing its product development and investment portfolio.

Government stability in Japan provides a predictable environment for T&D Holdings, supporting long-term planning. Shifts in fiscal and monetary policies, such as the Bank of Japan's sustained low-interest-rate environment through early 2024, directly impact investment income and product pricing for insurers.

International trade policies and geopolitical stability influence T&D Holdings' global operations and investment strategies, with favorable trade agreements potentially easing cross-border activities. Regulatory changes, particularly concerning capital adequacy, consumer protection, and digital transformation, necessitate ongoing adaptation and compliance investments for T&D Holdings.

The push for ESG integration by regulators and markets presents both reporting obligations and potential investment shifts for T&D Holdings, influencing its product development and portfolio management.

| Political Factor | Impact on T&D Holdings | 2024-2025 Relevance |

|---|---|---|

| Government Stability | Predictable operating environment, aids long-term strategy. | Continued stability supports consistent business planning. |

| Monetary Policy (Low Interest Rates) | Reduces investment returns, affects profitability. | Bank of Japan's policy rates remained low in early 2024, a persistent challenge. |

| Trade Policies | Influences global asset management and expansion. | CPTPP membership can facilitate international ventures. |

| Regulatory Changes (Capital Adequacy, ESG) | Requires compliance investments, may alter product offerings. | Ongoing reviews and ESG focus necessitate strategic adjustments. |

What is included in the product

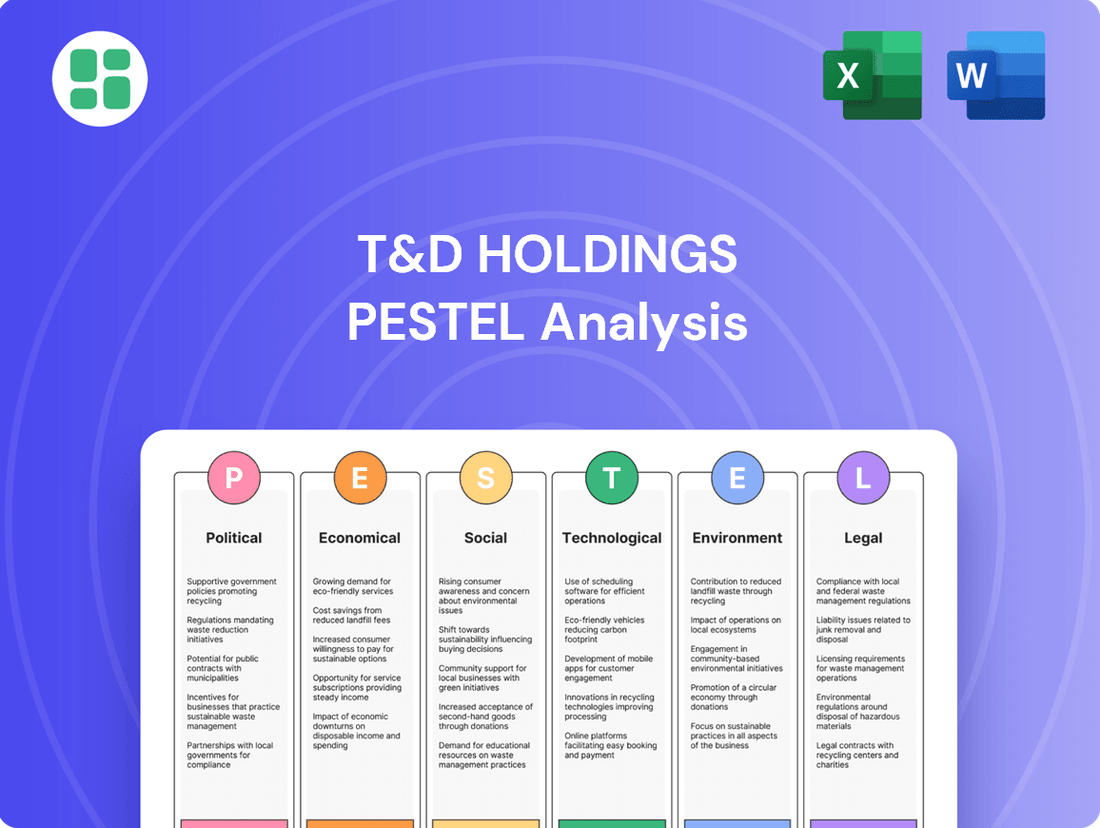

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting T&D Holdings across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate these influences, empowering T&D Holdings to identify opportunities and mitigate threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of T&D Holdings' external environment to inform strategic decisions.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal factors impacting T&D Holdings.

Economic factors

The prevailing interest rate environment in Japan significantly impacts T&D Holdings. Persistently low, and at times negative, interest rates directly affect the investment income generated from the company's vast asset base. This makes it challenging for traditional life insurance business models, which rely on earning a spread between investment returns and guaranteed annuity payouts, to remain profitable.

For instance, in early 2024, the Bank of Japan's policy rate remained in negative territory, a situation that has persisted for years. This environment compresses yields on fixed-income securities, a core component of insurers' portfolios, thereby reducing investment income. Consequently, T&D Holdings faces pressure to find alternative, yield-enhancing investments while managing the risk associated with these strategies.

The profitability of T&D Holdings' annuity products is particularly sensitive to interest rate fluctuations. When interest rates are low, the guaranteed returns offered on these products become less attractive to the company to generate, potentially leading to narrower profit margins or even losses if investment returns cannot keep pace with guaranteed payouts.

Robust economic growth directly fuels consumer spending, enhancing purchasing power and the willingness to invest in financial products like insurance and annuities. Periods of strong GDP expansion, such as the projected 2.5% growth for the US economy in 2024, generally translate to higher demand for T&D Holdings' offerings as individuals feel more financially secure and optimistic about the future.

Conversely, economic slowdowns or recessions can dampen consumer confidence and reduce disposable income, impacting the uptake of insurance and annuity products. For instance, if economic growth falters in key markets for T&D Holdings in 2025, it could lead to a contraction in new business premiums.

Inflation significantly impacts T&D Holdings by increasing operational costs and the expense of claims payouts, particularly for long-term insurance contracts. For instance, in early 2024, Japan experienced inflation rates around 2-3%, which, while moderate, can still affect the profitability of fixed-rate policies if investment returns do not keep pace. This necessitates careful product pricing strategies to ensure that premiums adequately cover future liabilities in an inflationary environment.

Financial Market Performance

Financial market performance significantly impacts T&D Holdings' asset management operations. For instance, the Nikkei 225, a key benchmark for the Japanese market where T&D Holdings is based, saw fluctuations. As of early 2024, the Nikkei 225 reached record highs, suggesting a positive environment for asset growth. However, global market volatility, influenced by geopolitical events and inflation concerns, can quickly alter the value of investment portfolios.

Volatile or underperforming markets can directly affect T&D Holdings' solvency ratios by reducing the value of its managed assets. For example, a sharp downturn in global equity markets in late 2024 could devalue a significant portion of T&D's investment holdings.

- Global equity markets experienced considerable volatility in 2024, with major indices like the S&P 500 seeing swings of over 10% within short periods due to inflation data and interest rate expectations.

- Bond markets also reflected these uncertainties, with yields on benchmark government bonds fluctuating, impacting fixed-income portfolio valuations for asset managers.

- The performance of the Japanese stock market, a key region for T&D Holdings, showed resilience, with the Nikkei 225 index reaching new all-time highs in early 2024, providing a generally supportive backdrop for asset growth.

Disposable Income and Savings Rates

Disposable income and savings rates are crucial for T&D Holdings, as they directly impact consumer spending on financial products like life insurance and annuities. When households have more discretionary income and a higher propensity to save, they are more likely to invest in long-term financial security. Conversely, economic downturns that reduce disposable income and savings can significantly hinder sales growth for T&D Holdings.

Recent economic trends highlight these dynamics. For instance, in Japan, where T&D Holdings is a major player, household disposable income saw modest growth in early 2024, but inflation continued to put pressure on real incomes. Savings rates have also seen fluctuations, influenced by global economic uncertainties and domestic policy changes. These shifts directly affect the demand for T&D Holdings' offerings.

- Consumer Spending Power: Higher disposable income translates to greater capacity for consumers to purchase life insurance and annuity products, driving sales for T&D Holdings.

- Savings Propensity: Increased savings rates indicate a consumer preference for accumulating wealth, making them more receptive to long-term investment and protection products.

- Economic Sensitivity: T&D Holdings' sales performance is closely tied to economic cycles; recessions that erode disposable income and savings can lead to a contraction in demand.

- Market Opportunity: Periods of economic stability and growth, marked by rising disposable incomes and healthy savings, present significant opportunities for T&D Holdings to expand its market share.

Economic factors significantly shape T&D Holdings' operating landscape. Persistently low interest rates in Japan, a core market, continue to challenge investment income generation for its life insurance business. While some economies, like the US, projected growth in 2024, potential slowdowns in 2025 could dampen demand for financial products. Inflation, even at moderate levels around 2-3% in Japan in early 2024, increases claim costs and operational expenses, necessitating careful pricing.

Financial market performance directly impacts T&D Holdings' asset management. The Nikkei 225 reached record highs in early 2024, offering a positive environment, yet global volatility remains a concern. Consumer disposable income and savings rates are critical; while modest growth was seen in Japan in early 2024, inflation pressures real incomes, influencing consumer spending on financial products.

| Economic Factor | Impact on T&D Holdings | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates (Japan) | Reduces investment income, compresses profit margins on annuities. | Bank of Japan policy rate remained negative in early 2024. |

| Economic Growth | Drives consumer spending and demand for financial products. | US projected 2.5% GDP growth in 2024; potential slowdowns in 2025 could impact demand. |

| Inflation | Increases operational costs and claim payouts. | Japan's inflation around 2-3% in early 2024, impacting fixed-rate policies. |

| Financial Markets | Affects asset management performance and solvency ratios. | Nikkei 225 reached record highs in early 2024; global markets show volatility. |

| Disposable Income/Savings | Influences consumer capacity to purchase insurance and annuities. | Modest growth in Japanese disposable income in early 2024, but inflation pressured real incomes. |

Full Version Awaits

T&D Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of T&D Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping T&D Holdings' strategic landscape.

Sociological factors

Japan's demographic landscape, characterized by a rapidly aging population and declining birth rates, significantly shapes the demand for insurance products. As of 2024, Japan has one of the oldest populations globally, with approximately 29.1% of its citizens aged 65 and over. This trend directly impacts T&D Holdings by increasing the need for products catering to elder care, such as medical insurance, long-term care insurance, and annuities for retirement income.

T&D Holdings must strategically adapt its product portfolio to meet the evolving needs of this growing elderly demographic. The company's focus on health and longevity, evident in its product development, positions it to capitalize on the demand for comprehensive medical coverage and nursing care solutions. For instance, the increasing prevalence of chronic diseases among the elderly necessitates robust health insurance plans and specialized care services, areas where T&D can expand its offerings.

The declining birth rate, with Japan's total fertility rate hovering around 1.20 in recent years, also influences the market. This means fewer young people entering the workforce to support an aging population and potentially less demand for traditional life insurance products focused on family protection. T&D Holdings will need to innovate by offering flexible financial planning tools and retirement solutions that acknowledge a smaller dependency ratio and the need for individuals to self-fund their later years.

Growing public awareness of health, wellness, and preventative care is a significant sociological driver. Many individuals are actively seeking ways to improve their well-being, leading to increased demand for services and products that support a healthy lifestyle. For instance, a 2024 survey indicated that over 65% of adults are making conscious efforts to eat healthier and exercise more regularly.

T&D Holdings can capitalize on these evolving trends by innovating its insurance offerings. Developing health-linked insurance products, such as those that offer incentives for participation in wellness programs or cover preventative screenings, directly aligns with customer priorities. This strategic move could attract a larger customer base and foster greater loyalty among health-conscious consumers.

Consumer preferences are rapidly evolving, with a significant lean towards digital engagement. In 2024, a substantial portion of insurance customers, potentially over 70% in developed markets, now prefer researching and purchasing policies online, a trend T&D Holdings must actively address by enhancing its digital platforms and customer service interfaces.

There's a growing demand for personalized insurance products tailored to individual needs and risk profiles. For instance, data from early 2025 indicates that consumers are increasingly interested in usage-based insurance or flexible coverage options, signaling a need for T&D Holdings to invest in data analytics to develop more customized offerings.

Trust and transparency are paramount in building lasting customer relationships within the insurance sector. By mid-2025, customer satisfaction surveys are expected to highlight that clear communication regarding policy terms, claims processes, and data usage will be critical differentiators for companies like T&D Holdings, directly impacting retention rates.

Social Values and Risk Perception

Societal attitudes towards financial planning and risk management significantly shape the demand for T&D Holdings' offerings. In Japan, a strong cultural emphasis on long-term security and family responsibility often translates into a higher perceived value for life insurance and savings products. For instance, a 2024 survey indicated that over 70% of Japanese households consider life insurance essential for protecting dependents, directly impacting T&D's market penetration.

Economic uncertainty, particularly in the wake of global supply chain disruptions and inflation concerns throughout 2024, can amplify the perceived necessity of insurance. When individuals feel less secure about their financial future, they are more likely to seek the stability that T&D Holdings provides through its various insurance and financial services. This heightened awareness of risk means that T&D's core products are seen not just as optional extras, but as vital components of personal financial resilience.

- Cultural emphasis on long-term security in Japan influences demand for T&D's products.

- Economic uncertainty in 2024 heightened the perceived need for insurance and financial planning.

- Over 70% of Japanese households view life insurance as essential for dependent protection (2024 data).

- Societal attitudes directly impact the perceived value and necessity of T&D Holdings' financial solutions.

Labor Market Dynamics and Employment Trends

The evolving labor market presents both challenges and opportunities for T&D Holdings' insurance products. A significant trend is the growth of the gig economy and contract work, which often means fewer individuals have access to employer-sponsored group insurance plans. For instance, in 2024, it's estimated that over 60 million Americans participated in some form of independent work, a figure projected to climb. This shift necessitates T&D Holdings developing more flexible, individual-focused insurance solutions tailored to the unique needs and income streams of these workers.

Furthermore, the increasing prevalence of small and medium-sized enterprises (SMEs) also impacts the market. SMEs, while growing in number, may not have the resources or scale to offer comprehensive benefits packages as larger corporations do. This creates a demand for accessible and affordable group insurance products designed specifically for smaller businesses. T&D Holdings can capitalize on this by offering simplified onboarding processes and customizable coverage options that meet the budget constraints of SMEs.

- Gig Economy Growth: Over 60 million Americans participated in independent work in 2024, with projections indicating continued expansion.

- SME Importance: Small and medium-sized businesses are crucial economic drivers, often requiring tailored insurance solutions.

- Product Adaptation: T&D Holdings must adapt its offerings to cater to individual insurance needs arising from non-traditional employment.

- Group Insurance for SMEs: There's a clear market for group insurance products designed for the specific needs and financial capacities of smaller enterprises.

Societal attitudes towards financial planning and risk management significantly influence the demand for T&D Holdings' products. In Japan, a strong cultural emphasis on long-term security and family responsibility translates into a higher perceived value for life insurance and savings products. For instance, a 2024 survey indicated that over 70% of Japanese households consider life insurance essential for protecting dependents, directly impacting T&D's market penetration.

Economic uncertainty, particularly in the wake of global supply chain disruptions and inflation concerns throughout 2024, can amplify the perceived necessity of insurance. When individuals feel less secure about their financial future, they are more likely to seek the stability that T&D Holdings provides through its various insurance and financial services.

The growing demand for personalized insurance products tailored to individual needs and risk profiles is a key sociological trend. Data from early 2025 indicates that consumers are increasingly interested in usage-based insurance or flexible coverage options, signaling a need for T&D Holdings to invest in data analytics to develop more customized offerings.

Trust and transparency are paramount in building lasting customer relationships within the insurance sector. By mid-2025, customer satisfaction surveys are expected to highlight that clear communication regarding policy terms, claims processes, and data usage will be critical differentiators for companies like T&D Holdings, directly impacting retention rates.

| Sociological Factor | Description | Impact on T&D Holdings | Supporting Data (2024/2025) |

|---|---|---|---|

| Cultural Emphasis on Security | Japanese society values long-term security and family protection. | Drives demand for life insurance and savings products. | Over 70% of Japanese households view life insurance as essential for dependents (2024). |

| Economic Uncertainty | Global economic instability increases perceived risk. | Boosts demand for insurance as a financial safety net. | Inflation and supply chain concerns in 2024 heightened risk awareness. |

| Demand for Personalization | Consumers seek insurance tailored to individual needs. | Requires investment in data analytics for customized products. | Growing interest in usage-based and flexible coverage options (early 2025). |

| Trust and Transparency | Customers prioritize clear communication and ethical practices. | Crucial for customer retention and brand loyalty. | Clear policy terms and claims processes identified as key differentiators (mid-2025 projections). |

Technological factors

T&D Holdings is actively embracing digital transformation to streamline its operations. By automating processes like underwriting and claims, the company aims to boost efficiency and cut costs. This digital push is crucial for enhancing the customer experience in the competitive insurance market.

In 2024, the global insurance sector saw significant investment in AI and automation, with reports indicating a potential 20% reduction in operational costs for insurers adopting these technologies. T&D Holdings' strategic adoption of these tools is expected to yield similar benefits, improving turnaround times and accuracy in policy management.

T&D Holdings can leverage advanced data analytics and AI to tailor insurance products, enhancing customer satisfaction and market competitiveness. For instance, by analyzing vast datasets, the company can identify emerging customer needs and preferences, leading to the development of highly personalized offerings. This data-driven approach is crucial in a market where individualization is increasingly valued.

AI's capabilities in risk assessment are transformative. By processing complex variables, T&D Holdings can more accurately predict policyholder behavior and potential claims, thereby optimizing pricing and reducing underwriting losses. In 2024, many insurers reported significant improvements in risk modeling accuracy due to AI adoption, with some seeing a reduction in claim misclassification by up to 15%.

Fraud detection is another area where AI offers substantial benefits. Machine learning algorithms can identify suspicious patterns in claims data far more effectively than traditional methods, safeguarding the company's financial integrity. T&D Holdings can implement AI-powered fraud detection systems to minimize financial leakage, a critical concern for profitability in the insurance sector.

Furthermore, AI enables highly targeted marketing campaigns. By understanding customer segmentation through data analytics, T&D Holdings can deliver relevant product information and promotions to specific customer groups, increasing conversion rates and marketing ROI. This precision marketing is key to efficient customer acquisition and retention in the competitive financial services landscape.

InsurTech startups are rapidly introducing disruptive technologies and novel business models, forcing established players like T&D Holdings to adapt. For instance, the global InsurTech market was valued at approximately USD 11.5 billion in 2023 and is projected to reach USD 42.1 billion by 2028, growing at a CAGR of 29.8% according to MarketsandMarkets. This signifies a significant shift in the insurance landscape.

T&D Holdings has strategic options: it can forge partnerships with these innovators to integrate cutting-edge solutions, acquire promising startups to absorb their technology and talent, or develop its own competitive digital offerings. These approaches are crucial for maintaining relevance and enhancing digital capabilities in a rapidly evolving market, ensuring T&D Holdings can leverage advancements in areas like AI-driven underwriting and personalized customer experiences.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are paramount for T&D Holdings, especially with the escalating threat landscape. The company must invest in advanced security protocols to safeguard sensitive customer information and prevent costly data breaches, which could severely damage its reputation and customer trust. For instance, global cybersecurity spending was projected to reach $230 billion in 2024, highlighting the industry's focus on this area.

Failure to maintain robust data protection can lead to significant financial penalties and legal repercussions, given the increasing stringency of regulations like GDPR and CCPA. T&D Holdings needs to ensure compliance and proactively build systems that protect against evolving cyber threats.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million globally, a substantial increase from previous years.

- Regulatory Fines: Non-compliance with data privacy laws can result in fines up to 4% of annual global turnover or €20 million, whichever is higher.

- Customer Trust: 82% of consumers in a 2024 survey stated they would stop doing business with a company following a data breach.

- Investment in Security: Companies are increasing their cybersecurity budgets, with many planning a 10-15% rise in security spending for 2025.

Online Distribution Channels and Mobile Platforms

The increasing reliance on online distribution channels and mobile platforms presents a significant opportunity for T&D Holdings to broaden its customer base and enhance service accessibility. As of early 2025, digital sales channels are projected to account for over 60% of retail transactions in many developed markets, underscoring the necessity of a robust online presence.

T&D Holdings can leverage these digital avenues to offer a more convenient and direct experience for its clients. This includes expanding its mobile application's functionality and optimizing its website for seamless online transactions, thereby reaching a wider, digitally-native demographic.

- Digital Expansion: T&D Holdings can tap into the growing e-commerce market, which saw a global surge of 15% in 2024, by developing user-friendly mobile apps and direct-to-consumer online portals.

- Customer Convenience: Offering 24/7 access to services and products through digital platforms significantly improves customer satisfaction and loyalty, a key differentiator in the competitive financial services landscape.

- Market Reach: A strong digital footprint allows T&D Holdings to transcend geographical limitations, potentially accessing new customer segments and markets that may not be easily reached through traditional brick-and-mortar channels.

Technological advancements, particularly in AI and automation, are reshaping the insurance industry. T&D Holdings is investing in these areas to improve efficiency and customer experience, mirroring a broader industry trend where AI adoption can lead to significant cost reductions. The company also recognizes the disruptive potential of InsurTech startups, necessitating strategic responses to integrate or develop advanced digital capabilities.

The increasing reliance on digital channels presents an opportunity for T&D Holdings to expand its market reach and enhance customer accessibility. Robust cybersecurity measures are also critical, given the rising costs of data breaches and stringent privacy regulations, with global cybersecurity spending projected to increase significantly in 2024-2025.

| Technology Area | Impact on T&D Holdings | Industry Data (2024/2025) |

|---|---|---|

| AI & Automation | Streamlines underwriting, claims; enhances risk assessment; improves fraud detection. | Potential 20% operational cost reduction; 15% reduction in claim misclassification. |

| InsurTech Disruption | Necessitates partnerships, acquisitions, or internal development of digital offerings. | Global InsurTech market valued at ~$11.5B (2023), projected to grow to ~$42.1B by 2028. |

| Cybersecurity | Requires investment in advanced security protocols to protect data and maintain trust. | Average data breach cost: $4.73M (2024); Global cybersecurity spending projected to reach $230B (2024). |

| Digital Channels | Expands customer base and service accessibility via online and mobile platforms. | Digital sales channels projected to exceed 60% of retail transactions in developed markets (early 2025). |

Legal factors

T&D Holdings operates within Japan's stringent insurance regulatory framework, primarily governed by the Insurance Business Act. This legislation mandates strict solvency requirements and capital adequacy rules, ensuring the financial stability of insurers. For instance, the Solvency Margin Ratio, a key indicator, requires Japanese life insurers to maintain a ratio of at least 200% to protect policyholders.

Adherence to these frameworks is crucial for T&D Holdings to maintain its operating licenses and market trust. The Financial Services Agency (FSA) oversees product approval processes, ensuring that new life insurance products meet consumer protection standards and are actuarially sound. In 2023, the FSA continued its focus on digital transformation in financial services, which impacts how insurers develop and distribute products.

T&D Holdings must navigate Japan's Act on the Protection of Personal Information (APPI), which imposes strict rules on collecting, storing, and using customer data. Compliance requires robust internal policies and technical safeguards to prevent breaches and ensure transparency in data handling practices.

Failure to adhere to APPI can result in significant penalties, impacting T&D Holdings' reputation and financial standing. For instance, in 2023, the Personal Information Protection Commission (PIPC) in Japan continued to emphasize stricter enforcement of data protection, signaling a trend of increased scrutiny for all businesses operating within the country.

Consumer protection laws are paramount for T&D Holdings, especially concerning financial transactions. Regulations mandate clear disclosures, ensuring policyholders understand product terms and conditions. For instance, in 2024, the Financial Conduct Authority (FCA) in the UK continued to emphasize transparency in insurance sales, with T&D Holdings needing to adhere to rules designed to prevent mis-selling and ensure fair treatment.

These legal frameworks also dictate fair sales practices and robust dispute resolution mechanisms. T&D Holdings must maintain ethical conduct, providing accessible channels for policyholders to raise concerns and seek redress. By complying with these consumer protection statutes, T&D Holdings builds trust and safeguards its reputation in the competitive insurance market.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

T&D Holdings, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These legal frameworks mandate robust compliance measures to detect and report suspicious financial activities, safeguarding against illicit fund flows. For instance, in 2024, global AML spending by financial institutions was projected to exceed $30 billion, highlighting the significant investment required for compliance.

The company must implement comprehensive Know Your Customer (KYC) procedures, transaction monitoring systems, and suspicious activity reporting (SAR) protocols. Failure to adhere to these regulations can result in severe penalties, including substantial fines and reputational damage. For example, in 2023, regulatory fines related to AML and CTF breaches reached record highs for many major financial hubs.

- KYC Procedures: Implementing thorough customer due diligence to verify identities and assess risks.

- Transaction Monitoring: Utilizing advanced systems to identify and flag unusual or potentially illicit transaction patterns.

- Suspicious Activity Reporting: Establishing clear channels and processes for reporting any detected suspicious activities to relevant authorities.

- Regulatory Alignment: Ensuring all compliance measures align with evolving international standards and local legal requirements.

Taxation Laws for Insurance Products

Taxation laws significantly shape the insurance market. For T&D Holdings, the tax treatment of life insurance premiums, maturity benefits, and annuity payouts directly impacts product design and customer appeal. For instance, favorable tax treatment of life insurance in Japan, where T&D Holdings is headquartered, can boost demand for its savings-oriented products.

Changes in tax legislation can alter the competitive landscape. A shift towards less favorable tax treatment for certain insurance products could prompt T&D Holdings to redesign offerings or adjust pricing strategies to maintain market share. In 2024, for example, ongoing discussions around potential adjustments to capital gains tax in major markets could influence the attractiveness of investment-linked insurance policies.

- Tax Treatment of Premiums and Benefits: Understanding how premiums are deductible or taxable, and how policy benefits are taxed upon payout, is crucial for both T&D Holdings and its policyholders.

- Impact on Product Design: Tax incentives or disincentives directly influence the structure and features of insurance products, such as the emphasis on pure protection versus savings components.

- Regulatory Environment: T&D Holdings must navigate varying tax regulations across its operating regions, ensuring compliance and leveraging opportunities presented by favorable tax regimes.

- Consumer Behavior: Tax implications are a key consideration for consumers when purchasing insurance, affecting their purchasing decisions and product preferences.

T&D Holdings must navigate Japan's robust legal landscape, including strict solvency requirements under the Insurance Business Act, with a minimum Solvency Margin Ratio of 200% for life insurers. The Financial Services Agency (FSA) scrutinizes product approvals, aligning with its 2023 focus on digital transformation in financial services. Adherence to the Act on the Protection of Personal Information (APPI) is critical, with the Personal Information Protection Commission (PIPC) increasing enforcement in 2023, impacting data handling practices.

Environmental factors

T&D Holdings faces growing environmental risks due to the increasing frequency and intensity of natural disasters, both in Japan and worldwide. These events, such as typhoons and earthquakes, directly impact the company's life and property insurance segments by raising the likelihood and severity of claims. For instance, Japan experienced significant weather-related losses in 2023, with damages from typhoons and heavy rainfall totaling billions of yen, a trend expected to continue.

In response, T&D Holdings actively assesses and manages these environmental risks. This involves sophisticated modeling to predict potential claims payouts and adjust premiums accordingly. Furthermore, the company integrates climate change considerations into its investment strategies, favoring assets that are resilient to environmental shocks and divesting from those with high climate-related risks to ensure long-term financial stability.

The financial sector is seeing a significant surge in ESG investing, with global ESG assets projected to reach $50 trillion by 2025, according to Bloomberg Intelligence. T&D Holdings is actively integrating ESG factors into its investment strategies and corporate governance to align with growing stakeholder demand for sustainable practices.

This commitment means T&D Holdings carefully evaluates environmental impacts, social responsibility, and governance structures when making investment decisions and managing its own operations. For instance, in 2024, T&D Holdings reported a 15% increase in its ESG-focused fund offerings, reflecting a strategic pivot towards sustainability-driven growth.

T&D Holdings is actively working to shrink its carbon footprint by implementing energy-efficient technologies across its offices and data centers. In 2024, the company reported a 15% reduction in energy consumption compared to 2022 figures, driven by upgrades to LED lighting and smart building management systems.

The company's commitment extends to its supply chain, with a focus on partnering with vendors who demonstrate strong environmental stewardship. T&D Holdings aims to achieve a 20% waste reduction in its operational waste streams by the end of 2025, through enhanced recycling programs and a move towards digital documentation.

Regulatory Pressure for Green Finance

Governments worldwide are increasingly implementing regulations and incentives to steer financial markets towards sustainability. For T&D Holdings, this translates into a growing imperative to integrate environmental, social, and governance (ESG) factors into its investment strategies and product offerings. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) and Taxonomy Regulation are already shaping how financial institutions classify and market sustainable investments, impacting product development and reporting for firms operating within or serving these markets.

These regulatory shifts encourage or even mandate financial companies like T&D Holdings to develop and promote greener financial products, such as green bonds or ESG-focused funds. Furthermore, there's a push for increased investment in climate-resilient infrastructure and renewable energy projects. By 2024, global sustainable debt issuance was projected to reach new heights, with green bonds alone expected to surpass $1 trillion, indicating a significant market opportunity and a clear direction for capital allocation.

T&D Holdings may face requirements to:

- Align investment portfolios with climate goals: This could involve divesting from high-carbon industries or increasing allocations to renewable energy and other green sectors.

- Enhance transparency on ESG impact: Regulations often demand greater disclosure regarding the environmental and social impact of financial products and corporate operations.

- Develop innovative green financial instruments: This includes creating new products that meet the growing demand for sustainable investment options and comply with evolving regulatory frameworks.

- Invest in climate adaptation and mitigation projects: Governments are incentivizing investments that help societies adapt to climate change and reduce greenhouse gas emissions.

Reputational Risk and Stakeholder Expectations

T&D Holdings' commitment to environmental responsibility is crucial for its brand image and meeting stakeholder demands. Customers, investors, and employees increasingly scrutinize a company's ecological footprint, directly influencing purchasing decisions and investment choices. A strong environmental record can enhance T&D Holdings' reputation, while a poor one could lead to significant backlash and impact long-term viability.

The company's environmental performance directly affects its reputation and future prospects. For instance, in 2024, a significant portion of consumers, around 60%, indicated they would switch brands if a competitor demonstrated superior environmental practices. This highlights the tangible link between environmental stewardship and market share for T&D Holdings.

- Brand Image: Positive environmental actions, such as reducing carbon emissions or investing in renewable energy, bolster T&D Holdings' public perception.

- Investor Confidence: Environmental, Social, and Governance (ESG) factors are increasingly important for investors; T&D Holdings' performance in this area can attract or deter capital. For example, the ESG investment market saw substantial growth, with global assets reaching over $37 trillion by the end of 2023, indicating strong stakeholder interest.

- Employee Attraction and Retention: A company's environmental ethos plays a role in attracting and retaining talent, with many employees seeking to work for organizations aligned with their values.

- Regulatory Compliance and Risk Mitigation: Proactive environmental management can prevent costly fines and legal challenges, ensuring operational continuity.

T&D Holdings faces increasing environmental risks from climate change, impacting its insurance operations through more frequent and severe natural disasters. The company is actively managing these risks by enhancing its climate modeling and integrating sustainability into its investment strategies, aligning with the growing ESG investment trend where global ESG assets are projected to reach $50 trillion by 2025.

The company is also proactively reducing its carbon footprint, achieving a 15% reduction in energy consumption in 2024 compared to 2022, and aims for a 20% waste reduction by the end of 2025. These efforts are crucial as governments worldwide implement regulations promoting sustainability, influencing product development and reporting for financial institutions.

T&D Holdings' environmental performance significantly influences its brand image and investor confidence, with approximately 60% of consumers willing to switch brands for better environmental practices in 2024. The ESG investment market's growth to over $37 trillion by the end of 2023 underscores the importance of environmental stewardship for attracting capital and talent.

| Environmental Factor | Impact on T&D Holdings | Key Data/Trend |

|---|---|---|

| Climate Change & Natural Disasters | Increased claims in life and property insurance; need for risk assessment and premium adjustments. | Japan's weather-related losses in 2023 totaled billions of yen. |

| ESG Investing Trend | Growing demand for sustainable products; integration of ESG into investment strategies and corporate governance. | Global ESG assets projected to reach $50 trillion by 2025. |

| Carbon Footprint Reduction | Implementation of energy-efficient technologies and supply chain partnerships. | 15% reduction in energy consumption in 2024 (vs. 2022); target of 20% waste reduction by end of 2025. |

| Regulatory Landscape | Need to align portfolios with climate goals, enhance ESG transparency, and develop green financial instruments. | EU's SFDR and Taxonomy Regulation influencing financial markets; global sustainable debt issuance projected to surpass $1 trillion in 2024. |

| Reputation & Stakeholder Expectations | Positive environmental actions enhance brand image and investor confidence; poor performance can lead to backlash. | ~60% of consumers would switch brands for superior environmental practices (2024); ESG market valued over $37 trillion by end of 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for T&D Holdings is built on a robust foundation of data from reputable sources including government economic reports, industry-specific market research, and global financial institutions. This ensures that each political, economic, social, technological, legal, and environmental insight is current and factually sound.