Takeda Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Takeda Pharmaceutical Bundle

Navigate the complex external forces shaping Takeda Pharmaceutical's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for this global biopharmaceutical leader. Gain the strategic foresight needed to make informed decisions and secure your competitive advantage.

Unlock critical insights into the social, technological, legal, and environmental factors impacting Takeda Pharmaceutical's operations and market position. This expertly crafted analysis provides actionable intelligence, perfect for investors, strategists, and anyone seeking to understand the dynamic landscape of the pharmaceutical industry. Download the full PESTLE analysis now to gain a deeper understanding and drive smarter business strategies.

Political factors

Government policies on drug pricing and reimbursement are critical for Takeda. For instance, in 2024, many European Union countries continued to implement stricter price negotiation frameworks, impacting the profitability of new drug launches.

Changes to national health insurance schemes, like potential adjustments to Medicare Part D in the US for 2025, directly influence Takeda's market access and sales volumes for its key therapies, particularly in oncology and rare diseases.

The global push for cost containment, evident in the UK's NICE evaluations, contrasts with emerging markets like India, where efforts to expand universal health coverage by 2025 could open new avenues for Takeda's innovative products, albeit with pricing considerations.

The regulatory landscape is a significant hurdle for Takeda, with agencies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan's Pharmaceuticals and Medical Devices Agency (PMDA) dictating market access. For instance, in 2024, the FDA continued to emphasize rigorous data requirements for new drug applications, impacting timelines. Delays in these approval processes directly affect Takeda's ability to generate revenue from its pipeline, a crucial factor for its financial performance.

The speed of drug approvals can offer a distinct competitive edge. Takeda's focus on rare diseases and plasma-derived therapies means that navigating these pathways, especially for innovative treatments, is paramount. In 2024 and projected into 2025, the trend of accelerated approval pathways for drugs addressing unmet medical needs will remain a key driver, potentially benefiting Takeda's portfolio.

Global regulatory harmonization, or lack thereof, adds another layer of complexity. Divergent standards across major markets increase the cost and time required for global drug launches. Takeda, operating internationally, must manage these varying requirements, which can influence market entry strategies and overall profitability in 2024-2025.

Takeda’s global operations are significantly influenced by international trade relations and geopolitical stability. For instance, ongoing trade discussions and potential tariff adjustments between major markets like the United States and China could impact the cost of raw materials and the accessibility of Takeda's products in key regions. In 2024, the World Trade Organization (WTO) continues to monitor trade policies, with approximately 30% of global trade still subject to some form of non-tariff barrier, a figure that can fluctuate based on geopolitical developments.

Geopolitical tensions, such as those observed in Eastern Europe or the Middle East, can disrupt Takeda's intricate supply chains, potentially affecting the timely delivery of essential medicines. A stable political environment fosters predictable market access and investment, which is vital for a company like Takeda that invests heavily in research and development and maintains manufacturing sites across multiple continents. For example, Takeda’s presence in Japan, the US, and Europe means that political stability in these regions is paramount for its consistent performance.

Political Stability and Governance

Takeda's global operations mean its investment and expansion plans are directly tied to the political stability of numerous countries. Unstable political climates can introduce significant risks, such as sudden policy changes, heightened corruption, or even the potential for asset seizure, which can severely impact long-term strategic decisions and profitability. For instance, in 2023, geopolitical tensions in certain regions continued to present challenges for multinational corporations, necessitating robust risk management strategies.

A strong governance framework and a predictable legal system are critical for Takeda's success. These elements are vital for safeguarding its valuable intellectual property, which is the bedrock of its research and development efforts, and for ensuring a level playing field in market competition. The World Bank's 2023 Worldwide Governance Indicators, for example, highlighted the ongoing importance of regulatory quality and rule of law for business environments.

- Political Stability: Takeda's reliance on stable political environments across its key markets, including the US, Japan, and Europe, underpins its operational continuity and investment confidence.

- Governance and Legal Frameworks: The strength of intellectual property protection and the predictability of regulatory landscapes in countries like Germany and the UK are crucial for Takeda's R&D pipeline and market access.

- Geopolitical Risks: Emerging market operations, particularly in regions experiencing political flux, require Takeda to actively manage risks associated with policy unpredictability and potential trade disruptions, as seen in some Latin American markets during 2024.

Public Health Initiatives and Pandemic Preparedness

Government initiatives like widespread vaccination drives directly impact pharmaceutical demand, a key area for Takeda. For instance, continued global efforts against polio, where Takeda is a significant contributor, demonstrate this link. The ongoing focus on strengthening pandemic preparedness, spurred by events like the COVID-19 pandemic, is expected to channel more public funds into infectious disease research and development, potentially boosting Takeda's pipeline in this segment. This heightened attention also translates to a greater need for agile vaccine production and distribution networks, areas where Takeda has been actively investing.

The World Health Organization (WHO) has highlighted the need for increased investment in pandemic preparedness, with estimates suggesting a global annual investment of $15 billion could significantly reduce the risk of future pandemics. Takeda's commitment to infectious disease research, including its work on neglected tropical diseases and its ongoing contributions to polio eradication through partnerships like the Global Polio Eradication Initiative, positions it to benefit from these public health priorities. The company's significant investments in R&D, which reached ¥438.9 billion (approximately $3.1 billion USD based on a 2024 exchange rate) in fiscal year 2023, underscore its alignment with these public health goals.

- Government health programs drive demand for Takeda's vaccines and therapies, such as its contributions to polio eradication.

- Global pandemic preparedness is likely to increase public R&D funding for infectious diseases, benefiting companies like Takeda.

- Takeda's fiscal year 2023 R&D investment of ¥438.9 billion reflects its strategic focus on areas aligned with public health priorities.

Government pricing regulations and reimbursement policies remain a significant political factor for Takeda. In 2024, many European nations continued to refine their price negotiation frameworks, impacting the profitability of new drug launches. Changes to national health insurance schemes, such as potential adjustments to Medicare Part D in the US for 2025, directly influence market access and sales volumes for Takeda's key therapies.

The speed and nature of drug approvals by regulatory bodies like the FDA and EMA are critical. In 2024, the FDA maintained its emphasis on rigorous data requirements, potentially affecting Takeda's approval timelines. Accelerated approval pathways for drugs addressing unmet needs are expected to continue through 2025, offering potential benefits for Takeda's innovative treatments.

Geopolitical stability and international trade relations directly impact Takeda's global operations and supply chains. Trade discussions and potential tariff adjustments between major economies can affect raw material costs and product accessibility. Political instability in key markets can introduce risks such as sudden policy changes, impacting long-term investment and strategic decisions.

What is included in the product

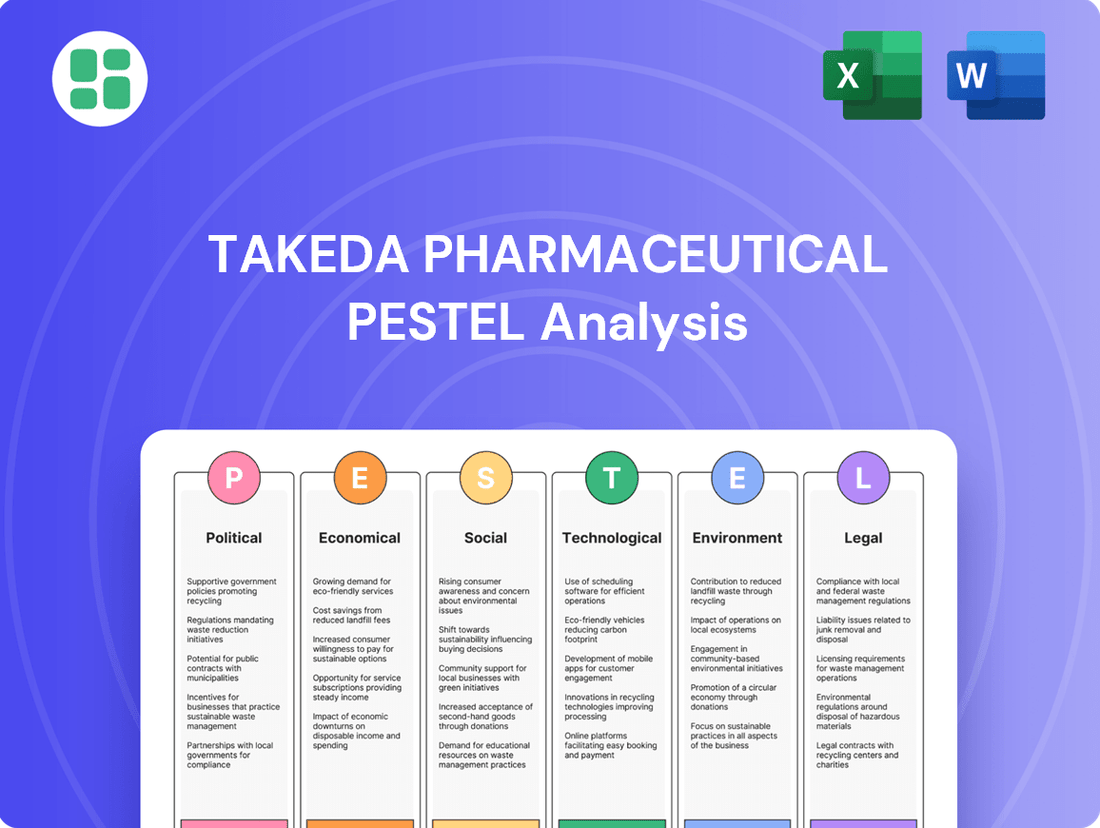

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces influencing Takeda Pharmaceutical, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and their potential impact on Takeda's operations and future growth.

Provides a concise version of Takeda's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, highlighting key external factors impacting the pharmaceutical giant.

Helps support discussions on external risk and market positioning for Takeda by offering a clear overview of political, economic, social, technological, environmental, and legal influences.

Economic factors

Global economic growth significantly impacts healthcare budgets. For instance, the International Monetary Fund projected global growth to be 3.2% in 2024, a slight increase from 3.0% in 2023, suggesting a potentially stable environment for increased healthcare investment.

In economic expansions, Takeda's focus on innovative and rare disease treatments could see higher demand as governments and insurers allocate more resources. This aligns with trends where advanced therapies often benefit from robust economic conditions.

However, economic slowdowns pose risks. During recessions, governments may implement austerity measures, leading to pressure on pharmaceutical pricing and potentially impacting Takeda's revenue streams for its specialized products.

Rising inflation presents a significant challenge for Takeda, potentially increasing costs for research and development, manufacturing, and personnel. For instance, in early 2024, global inflation rates remained elevated in many key markets, impacting supply chain costs for pharmaceutical ingredients and logistics. If Takeda cannot effectively pass these increased costs onto consumers through price adjustments or achieve substantial efficiency improvements, its profit margins could be squeezed.

As a multinational corporation, Takeda's financial performance is also sensitive to fluctuations in exchange rates. When Takeda converts earnings from operations in countries like the United States or Europe back into its reporting currency, the Japanese Yen, unfavorable currency movements can reduce the reported value of those earnings. For example, a stronger Yen relative to the US Dollar in 2024 would negatively impact Takeda's reported revenue and profit figures derived from its substantial US-based sales.

The economic climate significantly influences Takeda's ability to fund critical research and development. For instance, in 2024, global pharmaceutical R&D spending was projected to reach over $250 billion, a figure heavily dependent on interest rates and the availability of investment capital. Economic downturns can tighten these funding channels, impacting Takeda's innovation pipeline.

Government support for biomedical research and tax incentives for innovation are vital economic factors. In the US, the National Institutes of Health (NIH) budget, a key source of early-stage research funding, saw an increase in its proposed budget for fiscal year 2025, aiming to foster advancements. Such governmental economic policies directly bolster the R&D ecosystem Takeda operates within.

Venture capital investment in the life sciences sector also reflects economic health and directly impacts Takeda's strategic partnerships and potential acquisitions. In 2024, venture funding for biotech startups remained robust, though sensitive to macroeconomic shifts, indicating a competitive environment for securing cutting-edge technologies.

Healthcare System Affordability and Payer Pressure

Global healthcare costs are escalating, placing significant pressure on payers like governments and private insurers to scrutinize the value of new pharmaceuticals. Takeda faces the challenge of justifying the cost-effectiveness of its treatments, particularly for its high-cost rare disease and oncology portfolios. For instance, the average annual cost of specialty drugs in the US reached an estimated $25,000 in 2023, a figure that continues to climb, forcing intense price negotiations.

The growing adoption of value-based healthcare models necessitates strong real-world evidence demonstrating improved patient outcomes. Payers are increasingly demanding data beyond clinical trials to prove that Takeda's therapies offer long-term benefits and cost savings within the broader healthcare system. This shift means Takeda must invest in robust post-market surveillance and health economics research to support its product valuations.

- Rising Healthcare Expenditure: Global healthcare spending is projected to reach $11.3 trillion by 2025, according to Deloitte, highlighting the financial strain on payers.

- Payer Negotiation Power: In 2024, many national health systems, such as the UK's NHS, continue to implement strict cost-effectiveness thresholds for drug approvals, often below $50,000 per Quality-Adjusted Life Year (QALY).

- Value-Based Care Emphasis: The US Centers for Medicare & Medicaid Services (CMS) is expanding its focus on outcomes-based reimbursement, impacting how innovative therapies are priced and paid for.

- Real-World Evidence Demand: Studies show that payers are more likely to reimburse therapies with strong real-world data, with over 70% of payers in a 2023 survey indicating it influences their decisions.

Competition and Market Dynamics

The economic climate significantly shapes competition in the biopharmaceutical industry, affecting Takeda's established products. For instance, the increasing prevalence of biosimilar competition for biologics, a trend expected to continue through 2024 and beyond, directly challenges revenue streams from mature Takeda assets.

Mergers and acquisitions (M&A) remain a key economic driver, with the global biopharma M&A market showing robust activity. In 2023, for example, the sector saw substantial deal-making, with major pharmaceutical companies leveraging strong balance sheets to acquire innovative pipelines, thereby altering the competitive landscape Takeda navigates.

To thrive, Takeda must actively manage its product portfolio, a strategy underscored by its divestment of non-core assets and strategic acquisitions. This approach aims to bolster its market share in key therapeutic areas and pivot towards emerging growth opportunities, ensuring long-term competitiveness.

- Biosimilar Entry: The market for biosimilars is projected to grow substantially, potentially impacting Takeda's revenue from biologics that have lost or are nearing patent exclusivity.

- M&A Trends: Economic conditions influence M&A activity; in 2023, the pharmaceutical sector witnessed significant deal value, with companies seeking pipeline expansion.

- Portfolio Management: Takeda's strategy involves optimizing its existing product portfolio and investing in new growth drivers to counter competitive pressures.

- Market Share Defense: Maintaining market share for key products requires continuous innovation and effective lifecycle management in the face of economic challenges.

Economic factors significantly shape Takeda's operating environment, influencing everything from R&D funding to market access for its innovative therapies. Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports increased healthcare spending, benefiting companies like Takeda. However, rising inflation, evident in elevated supply chain costs in early 2024, can squeeze profit margins if not effectively managed through pricing or efficiency gains.

Currency fluctuations also present a notable risk; a stronger Japanese Yen in 2024 would reduce the reported value of Takeda's substantial overseas earnings. Furthermore, the availability of investment capital for R&D, a sector projected to see over $250 billion in global spending in 2024, is directly tied to economic health and interest rates, impacting Takeda's innovation pipeline.

The increasing cost of healthcare globally, with specialty drugs averaging $25,000 annually in the US by 2023, intensifies payer negotiations. Takeda must demonstrate the value of its high-cost treatments, especially in rare diseases and oncology, by providing robust real-world evidence to support reimbursement, a trend amplified by value-based care models.

| Economic Factor | Impact on Takeda | Data Point/Trend (2023-2025) |

| Global Economic Growth | Influences healthcare budgets and demand for innovative treatments. | Projected 3.2% global growth in 2024 (IMF). |

| Inflation | Increases R&D, manufacturing, and personnel costs. | Elevated inflation impacting supply chain costs in early 2024. |

| Exchange Rates | Affects reported revenue and profits from international operations. | A stronger Yen in 2024 would negatively impact Takeda's reported earnings from US sales. |

| R&D Investment Climate | Determines funding availability for innovation. | Global pharma R&D spending projected over $250 billion in 2024, sensitive to interest rates. |

| Healthcare Payer Pressures | Impacts pricing and market access for high-cost therapies. | Average US specialty drug cost ~ $25,000 annually (2023); payers demanding strong real-world evidence. |

Preview Before You Purchase

Takeda Pharmaceutical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Takeda Pharmaceutical covers all key external factors influencing its operations and strategy. You'll gain insights into the political, economic, social, technological, legal, and environmental landscape impacting this global biopharmaceutical leader.

Sociological factors

The world's population is getting older. By 2050, it's projected that nearly 1 in 6 people globally will be 65 or older, a significant jump from 1 in 11 in 2015. This demographic shift directly fuels demand for treatments for age-related diseases, a core area for Takeda, as conditions like cancer, cardiovascular disease, and neurological disorders become more common with age.

This aging trend means a larger patient pool for Takeda's key therapeutic areas. For instance, the global burden of cancer is substantial, with the World Health Organization reporting 19.3 million new cases in 2020. As populations age, this number is expected to rise, creating a sustained need for Takeda's oncology pipeline and existing treatments.

Understanding the unique healthcare needs of older adults is crucial for Takeda. This includes not only treating specific diseases but also addressing comorbidities and the potential for polypharmacy. For example, in 2024, the prevalence of diabetes, a common chronic condition often linked to aging, affects an estimated 541 million adults worldwide, highlighting the ongoing need for comprehensive disease management solutions.

Greater public access to health information, amplified by digital platforms, is significantly boosting health literacy. This empowers patients to actively participate in their healthcare, demanding greater transparency and involvement in treatment choices. For instance, a 2024 survey indicated that 78% of patients research their conditions and treatment options online before consulting a doctor.

This evolving patient landscape requires Takeda to foster direct engagement with patient advocacy groups and deliver clear, understandable information about its therapeutic offerings. Such engagement is crucial as patient-driven demand can sway prescribing habits and influence the market reception of new pharmaceuticals.

Modern lifestyles, characterized by sedentary habits and processed food consumption, are fueling a global surge in chronic diseases. For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely driven by lifestyle, accounted for an estimated 74% of all deaths worldwide. This societal shift directly translates into a growing demand for advanced, long-term therapeutic solutions, a need Takeda is well-positioned to address with its strong presence in gastroenterology and other chronic disease areas.

The increasing prevalence of conditions like type 2 diabetes and cardiovascular disease, often linked to diet and activity levels, presents a significant market opportunity for pharmaceutical companies. Public health initiatives promoting healthier living, while beneficial for overall well-being, can also influence the trajectory of disease management and the types of treatments required. Takeda's focus on innovative therapies for gastrointestinal disorders, a field often impacted by lifestyle factors, aligns with these evolving public health landscapes and patient needs.

Cultural Perceptions of Medicine and Healthcare Access

Cultural beliefs about health and medicine profoundly shape how patients engage with treatments. For instance, in some Asian cultures, there's a strong emphasis on traditional remedies, which can affect the adoption of Western pharmaceuticals. Takeda needs to understand these nuances to ensure its treatments are well-received globally, a challenge amplified by varying healthcare access. In 2024, a significant portion of the global population, particularly in low- and middle-income countries, still faces barriers to essential medicines, impacting Takeda's potential market reach.

These cultural perceptions directly influence patient adherence and the overall acceptance of pharmaceutical interventions. Takeda's strategy must therefore be adaptable, recognizing that a one-size-fits-all approach to communication and marketing simply won't work. Disparities in healthcare access, often tied to socioeconomic status or where someone lives, further complicate this. For example, in 2025, it's estimated that over 2 billion people will still lack access to essential medicines, a statistic that highlights the critical need for Takeda to consider equitable distribution and patient support programs.

- Cultural Beliefs: Varying regional acceptance of Western medicine versus traditional practices influences patient uptake of Takeda's products.

- Market Adaptation: Takeda must tailor communication and strategies to resonate with diverse cultural contexts to ensure treatment acceptance.

- Healthcare Access Disparities: Socioeconomic and geographic factors limit patient reach, impacting adherence and Takeda's market penetration.

- Global Health Statistics: In 2025, an estimated 2 billion people may still lack access to essential medicines, underscoring the importance of equitable healthcare solutions.

Ethical Considerations and Public Trust

Societal expectations for pharmaceutical companies like Takeda are intensifying, with a growing demand for ethical conduct, transparency in operations, and a clear commitment to corporate social responsibility. This heightened scrutiny means that public trust is a critical asset, easily damaged by concerns over drug pricing, perceived stagnation in innovation, or ethical lapses in research and marketing practices.

Takeda's ability to foster and retain public confidence hinges on its unwavering dedication to ethical principles and its demonstrable impact on societal health outcomes. For instance, in 2023, Takeda reported investing approximately $4.1 billion in research and development, aiming to address unmet medical needs, which directly speaks to its commitment to innovation and societal well-being.

- Ethical Conduct: Public perception of Takeda's adherence to ethical guidelines in clinical trials and marketing significantly influences trust.

- Transparency: Open communication regarding drug development, pricing strategies, and patient data handling is crucial for maintaining public confidence.

- Corporate Social Responsibility (CSR): Takeda's initiatives in areas like patient access programs and environmental sustainability contribute to its social license to operate.

- Innovation Perception: Demonstrating a consistent pipeline of novel therapies that address significant health challenges is vital to counter perceptions of a lack of innovation.

Societal expectations for pharmaceutical companies are evolving, with a strong emphasis on ethical practices and corporate social responsibility. Takeda's commitment to innovation, demonstrated by its substantial R&D investments, such as the $4.1 billion allocated in 2023, is key to maintaining public trust. Transparency in pricing and research, alongside impactful CSR initiatives, are vital for Takeda to navigate these shifting societal demands and ensure its social license to operate.

Technological factors

Technological leaps in genomics, proteomics, and bioinformatics are significantly speeding up Takeda's drug discovery. This allows for quicker identification of promising therapeutic targets and compounds, enhancing efficiency in R&D.

Takeda is leveraging advanced computational modeling and AI to refine lead optimization and preclinical testing. This technological integration is projected to shorten development cycles and lower research expenditures, supporting faster innovation in its key therapeutic areas.

Breakthroughs in biotechnology, such as cell and gene therapies, CRISPR gene editing, and RNA-based therapeutics, are revolutionizing disease treatment, particularly for rare genetic conditions. Takeda's strategic focus on Rare Diseases and Plasma-Derived Therapies places it in a prime position to leverage these advanced technologies.

The company's commitment to innovation is evident in its significant investments; for instance, Takeda's R&D expenditure was approximately ¥574.5 billion (around $3.9 billion USD at an average 2024 exchange rate) in fiscal year 2023, underscoring its dedication to developing novel treatments in these cutting-edge fields.

Digital health tools, including remote patient monitoring and telehealth, are reshaping how healthcare is delivered and how patient data is gathered. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, offering Takeda opportunities to improve patient engagement and data insights.

Artificial intelligence (AI) and machine learning (ML) are increasingly vital across the pharmaceutical sector, aiding in everything from predicting how well drugs will work to tailoring treatments for individuals and making clinical trials more efficient. By 2025, AI in drug discovery is expected to accelerate development timelines, a trend Takeda can capitalize on to streamline its R&D processes.

Takeda can harness these technological advancements to not only improve patient care and outcomes but also to boost its own operational efficiency. The company's investment in digital transformation initiatives, such as its collaboration with AI companies, positions it to leverage these trends for competitive advantage.

Advanced Manufacturing and Supply Chain Technologies

Technological advancements are reshaping pharmaceutical manufacturing, with innovations like continuous manufacturing and automation promising significant gains. These technologies are key to boosting production efficiency, tightening quality control, and ultimately lowering operational expenses. For instance, the pharmaceutical industry's adoption of advanced analytics is projected to drive substantial cost savings, with some estimates suggesting billions in potential efficiencies by 2025.

Supply chains are also seeing a revolution, particularly with technologies like blockchain. This is crucial for enhancing traceability and ensuring the integrity of pharmaceutical products, a vital step in safeguarding drug safety and combating the pervasive issue of counterfeit medications. The global pharmaceutical blockchain market is expected to grow considerably, reaching an estimated value of over $5.7 billion by 2027, underscoring its importance.

Takeda Pharmaceutical, with its extensive global footprint, stands to gain immensely from these technological shifts. Optimizing both production processes and distribution networks through these advanced solutions is paramount for maintaining a competitive edge and ensuring reliable access to its medicines worldwide.

- Continuous Manufacturing: Streamlines production, reducing batch times and improving consistency.

- Automation: Enhances precision in manufacturing and laboratory processes, minimizing human error.

- Advanced Analytics: Optimizes resource allocation, predictive maintenance, and quality assurance.

- Blockchain: Fortifies supply chain security, providing end-to-end visibility and authenticity verification.

Data Analytics and Real-World Evidence Generation

The sheer volume of healthcare data is growing exponentially. Advanced analytical tools are now enabling Takeda to leverage this data for generating real-world evidence (RWE). This RWE is crucial for understanding how Takeda's drugs perform and impact patients in everyday settings, going beyond traditional clinical trials. In 2024, the RWE market is projected to reach $4.5 billion, highlighting its growing importance.

This real-world evidence is becoming indispensable for proving the value of Takeda's treatments to healthcare payers and insurers, influencing clinical practice guidelines, and uncovering novel insights into disease mechanisms and potential new therapies. Companies investing in robust data infrastructure and sophisticated analytical capabilities, like Takeda, are positioning themselves for success in this evolving landscape.

Key technological drivers for Takeda include:

- Big Data Analytics: Utilizing advanced algorithms to process and interpret vast datasets from electronic health records, insurance claims, and patient registries.

- AI and Machine Learning: Employing these technologies to identify patterns, predict patient responses, and optimize treatment strategies based on RWE.

- Data Integration Platforms: Developing systems to seamlessly combine diverse data sources, ensuring data quality and accessibility for analysis.

- Cloud Computing: Leveraging scalable cloud infrastructure to manage and analyze large volumes of sensitive healthcare data efficiently.

Technological advancements are rapidly transforming pharmaceutical R&D, with AI and machine learning accelerating drug discovery and optimization. Takeda's investment in these areas, including its approximately ¥574.5 billion R&D expenditure in fiscal year 2023, positions it to capitalize on faster development cycles and reduced research costs.

Breakthroughs in biotechnology, such as cell and gene therapies, are revolutionizing treatment for rare diseases, a key focus for Takeda. The company's strategic alignment with these cutting-edge technologies, coupled with the growing digital health market (valued at $200 billion in 2023), offers significant opportunities for improved patient engagement and data insights.

Innovations in manufacturing, like continuous manufacturing and automation, promise to boost Takeda's production efficiency and quality control. Furthermore, technologies like blockchain are fortifying supply chain security, a critical factor given the global pharmaceutical blockchain market's projected growth to over $5.7 billion by 2027.

Takeda is leveraging big data analytics and AI to derive real-world evidence (RWE), enhancing its understanding of drug performance in patient populations. The RWE market's projected growth to $4.5 billion in 2024 underscores its increasing importance in demonstrating treatment value and informing clinical practice.

| Technology Area | Impact on Takeda | Supporting Data/Trend |

|---|---|---|

| AI & Machine Learning | Accelerated drug discovery, optimized clinical trials | AI in drug discovery expected to accelerate timelines by 2025 |

| Biotechnology (Cell/Gene Therapy) | Advancements in rare disease treatments | Takeda's focus on Rare Diseases |

| Digital Health | Enhanced patient engagement and data collection | Global digital health market valued at $200 billion in 2023 |

| Advanced Manufacturing | Increased production efficiency and quality | Pharmaceutical analytics projected to drive substantial cost savings |

| Blockchain | Improved supply chain security and traceability | Global pharmaceutical blockchain market projected over $5.7 billion by 2027 |

| Real-World Evidence (RWE) | Demonstrating treatment value, informing practice | RWE market projected to reach $4.5 billion in 2024 |

Legal factors

Takeda's reliance on innovation means strong intellectual property (IP) laws and robust patent protection are critical. These safeguards protect the substantial investments made in research and development, ensuring market exclusivity for its groundbreaking therapies. For instance, the patent life for key drugs directly dictates their revenue-generating potential before generic or biosimilar competition emerges.

The enforceability and duration of these patents are constant legal considerations. Takeda actively monitors and defends its patent portfolio against challenges. The potential for biosimilar entrants following patent expiry, as seen with other major pharmaceutical companies, presents an ongoing legal and commercial challenge that impacts long-term profitability.

Takeda navigates a complex web of legal requirements for drug approval, clinical trials, manufacturing, and marketing across its global operations. Adherence to standards set by bodies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan's Pharmaceuticals and Medical Devices Agency (PMDA) is paramount. Failure to comply can result in significant repercussions, including hefty fines, product recalls, and even market exclusion, impacting Takeda's revenue streams and reputation.

Takeda Pharmaceutical operates under a complex web of global data privacy and cybersecurity regulations. Laws like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States dictate how patient health information and clinical trial data can be collected, stored, and utilized. For instance, GDPR mandates strict consent requirements for data processing, impacting how Takeda engages with patients across the EU.

Ensuring robust cybersecurity measures is paramount for Takeda to safeguard sensitive patient data from breaches. Failure to comply can lead to severe legal penalties and significant reputational damage. In 2023, the average cost of a data breach in the healthcare sector reached an estimated $10.10 million, underscoring the financial risks involved.

The legal framework governing data is in a constant state of evolution, requiring Takeda to remain agile in its compliance strategies. New legislation and amendments are frequently introduced, necessitating continuous updates to internal policies and technological safeguards to maintain adherence.

Anti-Corruption and Anti-Bribery Laws

Takeda Pharmaceutical, as a global entity, must navigate a complex web of anti-corruption and anti-bribery legislation. Key among these are the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, which impose strict penalties for illegal payments or inducements. Failure to comply can lead to significant fines and reputational damage, especially in dealings with healthcare professionals and government entities.

Adherence to these regulations is not merely a best practice but a legal imperative. Takeda is therefore mandated to implement and maintain robust internal controls and comprehensive training programs. These measures are designed to proactively identify and mitigate the risks associated with corrupt business practices, ensuring ethical conduct across all operations.

- FCPA and UK Bribery Act Compliance: Takeda must adhere to stringent global anti-bribery laws.

- Risk Mitigation: Proactive measures are essential to prevent illegal payments to healthcare professionals and officials.

- Mandated Controls: Robust internal controls and employee training are legal requirements.

- Ethical Operations: Ensuring compliance safeguards Takeda's reputation and financial stability.

Product Liability and Litigation

Takeda Pharmaceutical faces ongoing legal exposure stemming from product liability claims. These lawsuits can target the safety or effectiveness of its diverse drug portfolio, often initiated due to reported adverse events, insufficient warnings provided to patients and healthcare professionals, or alleged manufacturing defects. Such litigation frequently results in substantial financial burdens through settlements and legal fees, alongside significant damage to the company's reputation.

Mitigating these legal risks is paramount for Takeda. The company employs strategies focused on stringent quality control throughout its manufacturing processes, robust post-market surveillance to monitor drug performance and safety in real-world conditions, and meticulous attention to clear and comprehensive product labeling. These measures are critical for addressing potential claims and maintaining public trust.

In 2023, the pharmaceutical industry, including companies like Takeda, continued to navigate a complex legal landscape. While specific figures for Takeda's product liability expenses in 2024 are not yet fully reported, the general trend indicates persistent litigation. For instance, in 2023, major pharmaceutical companies collectively spent billions on litigation and settlements related to various product liability issues, underscoring the financial significance of this legal factor.

- Product Liability Claims: Takeda is susceptible to lawsuits alleging harm from its pharmaceutical products due to safety concerns, efficacy issues, inadequate warnings, or manufacturing flaws.

- Litigation Costs: These claims can lead to substantial expenses from legal defense, settlements, and potential court-ordered damages, impacting profitability.

- Reputational Impact: Adverse legal outcomes or prolonged litigation can erode public trust and damage Takeda's brand image, affecting market access and sales.

- Risk Mitigation Strategies: Takeda's focus on rigorous quality control, comprehensive post-market surveillance, and clear labeling aims to proactively reduce its exposure to product liability litigation.

Takeda's operations are heavily influenced by evolving healthcare regulations, including pricing controls and market access policies. For example, the Inflation Reduction Act in the U.S. introduced measures impacting drug pricing negotiations, which could affect Takeda's revenue streams for certain products. Compliance with these diverse national and international healthcare frameworks is essential for market participation and sustained growth.

The pharmaceutical industry is subject to stringent advertising and promotional regulations, ensuring that marketing claims are accurate and evidence-based. Takeda must adhere to guidelines set by regulatory bodies regarding how its products are presented to healthcare professionals and the public. Violations can lead to significant penalties and damage to the company's reputation.

Takeda must also navigate the legal landscape surrounding mergers, acquisitions, and partnerships. Antitrust laws and regulatory approvals are critical for strategic collaborations and expansion efforts. For instance, any significant acquisition would require scrutiny from competition authorities in relevant jurisdictions to ensure it does not stifle market competition.

Environmental factors

Global efforts to combat climate change are intensifying, with Takeda facing increasing pressure from regulations like carbon pricing and stricter emissions targets. These policies directly affect the company's manufacturing processes and extensive supply chain networks, necessitating a focus on reducing its carbon footprint across all global operations, including transportation.

Takeda's commitment to sustainability means investing in renewable energy sources and adopting more environmentally friendly manufacturing practices is no longer optional but a critical requirement. For instance, in 2023, Takeda announced its goal to achieve net-zero greenhouse gas emissions by 2040, a significant undertaking that will require substantial investment in green technologies and operational efficiencies across its diverse portfolio.

The pharmaceutical sector, including Takeda, grapples with diverse waste streams, from chemical byproducts and biological materials to extensive packaging. Effective waste management and stringent pollution control are paramount, as evidenced by the global pharmaceutical waste market projected to reach $11.5 billion by 2028, growing at a CAGR of 5.2%.

Takeda must navigate a complex web of environmental regulations governing waste disposal, wastewater treatment, and air emissions. Non-compliance can lead to significant fines and reputational damage. For instance, the US Environmental Protection Agency (EPA) enforces strict rules under the Resource Conservation and Recovery Act (RCRA) for hazardous pharmaceutical waste.

Embracing circular economy principles is increasingly critical for Takeda. This involves minimizing waste generation across the entire product lifecycle, from R&D and manufacturing to packaging and end-of-life product management. Companies are investing in sustainable packaging solutions and exploring innovative recycling technologies to reduce their environmental footprint.

Growing global concerns about resource scarcity, especially for water and specific raw materials vital for drug production, are pushing Takeda Pharmaceutical to enhance its sustainable sourcing strategies. This means a closer look at where ingredients and packaging come from, ensuring they are obtained ethically and with minimal environmental impact.

Takeda's commitment to responsible procurement extends to evaluating the environmental footprint of its suppliers. For instance, a 2024 report indicated that the pharmaceutical industry's water consumption is a significant environmental challenge, with some regions facing critical shortages, underscoring the need for Takeda to invest in water-efficient processes and resilient supply chains.

Furthermore, protecting biodiversity within its supply chain is becoming increasingly important. This involves working with suppliers who prioritize conservation efforts and minimize land-use changes, a trend that gained momentum throughout 2024 as more companies recognized the interconnectedness of ecological health and long-term business sustainability.

Environmental, Social, and Governance (ESG) Reporting

Takeda Pharmaceutical faces increasing pressure from investors and stakeholders to be transparent about its environmental, social, and governance (ESG) performance. This means providing detailed public reports on its environmental impact, such as carbon emissions and waste management. For instance, in its 2023 Integrated Report, Takeda disclosed its Scope 1 and 2 greenhouse gas emissions reduction targets, aiming for a 50% reduction by fiscal year 2030 compared to fiscal year 2019.

Adhering to global ESG reporting frameworks, like those from the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB), and achieving strong ESG ratings are crucial. These factors directly impact investor confidence and Takeda's ability to secure capital. A good ESG score can signal lower risk and better long-term prospects, potentially lowering borrowing costs.

Demonstrating robust environmental stewardship is a fundamental aspect of Takeda's overall corporate responsibility. This commitment extends beyond mere compliance; it involves proactive measures to minimize ecological footprint throughout its value chain, from research and development to manufacturing and product distribution.

- Investor Scrutiny: Over 90% of institutional investors consider ESG factors when making investment decisions, according to a 2024 survey by PwC.

- Capital Access: Companies with high ESG ratings can see lower costs of capital, with some studies suggesting a reduction of up to 50 basis points.

- Environmental Targets: Takeda aims to achieve carbon neutrality by 2040, with interim targets for greenhouse gas emission reductions across its operations.

- Reporting Standards: Takeda aligns its reporting with international standards, enhancing comparability and credibility for global stakeholders.

Biodiversity and Ecosystem Protection

Takeda's global operations, which include manufacturing sites and research facilities, can interact with local environments, potentially impacting biodiversity. For instance, facilities situated near natural habitats must adhere to strict environmental impact assessments. In 2023, Takeda continued its efforts to integrate biodiversity considerations into its site management plans, aiming to minimize disruption to local flora and fauna.

Compliance with regulations safeguarding endangered species and protected habitats is a critical aspect of Takeda's environmental stewardship. The company actively monitors its sites for potential impacts and implements mitigation strategies. For example, Takeda's sustainability reports highlight ongoing projects focused on habitat restoration near key operational areas.

Takeda's commitment to reducing its ecological footprint encompasses the preservation of biodiversity and the support of ecosystem health. This includes initiatives that go beyond regulatory requirements, such as investing in local conservation projects. The company's 2024 sustainability targets emphasize an enhanced focus on ecosystem protection, aiming for a net positive impact where feasible.

- Regulatory Compliance: Takeda must navigate evolving environmental laws concerning biodiversity, such as those under the Convention on Biological Diversity.

- Operational Impact: Manufacturing processes and supply chains, especially those reliant on agricultural inputs, can affect local ecosystems.

- Conservation Initiatives: The company's sustainability strategy includes programs aimed at protecting and restoring natural habitats surrounding its facilities.

- Stakeholder Engagement: Collaborating with local communities and conservation groups is crucial for effective biodiversity management.

Takeda's environmental strategy is increasingly shaped by global climate action, pushing for reduced emissions and sustainable practices across its operations. The company has committed to achieving net-zero greenhouse gas emissions by 2040, a significant undertaking requiring substantial investment in green technologies and operational efficiencies. This aligns with a broader industry trend where sustainability is becoming a core business imperative, impacting everything from manufacturing to supply chain management.

Waste management and pollution control are critical environmental considerations for Takeda, given the diverse waste streams inherent in pharmaceutical production. The pharmaceutical waste market is substantial, projected to reach $11.5 billion by 2028, highlighting the economic and environmental importance of effective waste reduction and disposal strategies. Adherence to stringent regulations, such as those enforced by the EPA for hazardous waste, is non-negotiable to avoid penalties and reputational damage.

Resource scarcity, particularly water, and the need for sustainable sourcing are driving Takeda to enhance its procurement strategies. The company is evaluating the environmental footprint of its suppliers and investing in water-efficient processes to build resilient supply chains, recognizing the interconnectedness of ecological health and long-term business sustainability. This focus extends to protecting biodiversity, with initiatives to minimize disruption to local flora and fauna around its operational sites.

Investor scrutiny on environmental, social, and governance (ESG) performance is intensifying, with a significant majority of institutional investors considering these factors. Takeda's commitment to transparency through detailed reporting, such as its Scope 1 and 2 greenhouse gas emission reduction targets, is crucial for maintaining investor confidence and access to capital. Achieving strong ESG ratings signals lower risk and better long-term prospects, potentially reducing borrowing costs.

| Environmental Factor | Takeda's Focus/Action | Relevant Data/Target |

|---|---|---|

| Climate Change & Emissions | Reducing greenhouse gas emissions across operations and supply chain. | Net-zero emissions goal by 2040; 50% reduction in Scope 1 & 2 GHG emissions by FY2030 (vs. FY2019). |

| Waste Management | Implementing effective waste management and pollution control. | Global pharmaceutical waste market projected at $11.5 billion by 2028. |

| Resource Scarcity & Sourcing | Enhancing sustainable sourcing strategies and water efficiency. | Focus on ethical and environmentally minimal impact sourcing; addressing water consumption challenges in the pharmaceutical industry. |

| Biodiversity & Conservation | Minimizing operational impact on local ecosystems and supporting conservation. | Integrating biodiversity considerations into site management; aiming for net positive impact where feasible. |

| ESG Reporting & Investor Relations | Transparent reporting on environmental performance and ESG metrics. | Over 90% of institutional investors consider ESG factors (2024 PwC survey); strong ESG ratings can lower cost of capital. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Takeda Pharmaceutical draws from a comprehensive range of sources, including reports from the World Health Organization, governmental health agencies, and leading pharmaceutical industry associations. We also incorporate data from economic forecasting firms and reputable news outlets to ensure a holistic view.