Takeda Pharmaceutical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Takeda Pharmaceutical Bundle

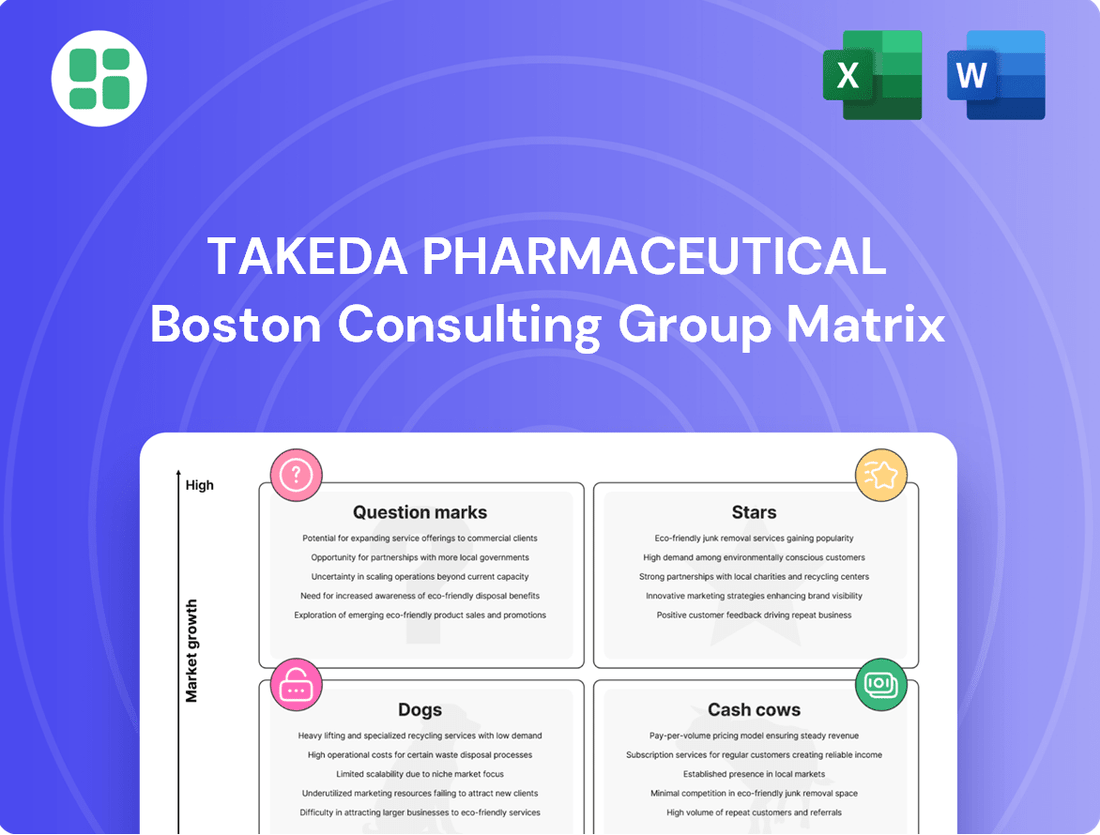

Curious about Takeda Pharmaceutical's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand which of Takeda's offerings are driving revenue and which require a closer look.

To truly unlock the strategic advantage, dive into the full Takeda Pharmaceutical BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to inform your investment and product development decisions.

Don't miss out on the complete picture. Purchase the full BCG Matrix report for Takeda Pharmaceutical and equip yourself with the detailed analysis and strategic recommendations needed to navigate the competitive landscape with confidence.

Stars

Oveporexton, an investigational oral orexin receptor 2 agonist for Narcolepsy Type 1, demonstrated positive Phase 3 results in July 2025, marking it as a potential first-in-class therapy. Takeda is targeting regulatory filings in fiscal year 2025, setting the stage for a significant market debut in a therapeutic area with substantial unmet need.

Analysts project that Oveporexton could achieve peak sales ranging from $2 billion to $3 billion, reflecting its strong potential in the narcolepsy market. This positions it as a key growth driver for Takeda, potentially becoming a star product in their portfolio.

Zasocitinib, Takeda's next-generation oral TYK2 inhibitor for psoriasis, is poised for significant market impact. Phase 3 results are anticipated in 2025, with Takeda projecting peak sales between $3 billion and $6 billion, underscoring its potential to disrupt current treatment paradigms with high efficacy.

This promising asset represents a substantial growth opportunity within the dermatology sector. Its development highlights Takeda's strategic focus on innovative therapies for chronic conditions, positioning Zasocitinib as a potential star product in their portfolio.

Rusfertide, an injectable hepcidin mimetic for polycythemia vera, showed a positive Phase 3 trial result in March 2025. Takeda anticipates regulatory submission for this indication in fiscal year 2025-2026, signaling a potential blockbuster drug.

The company's CEO expressed strong conviction that Rusfertide could significantly alter the treatment landscape for this rare chronic blood disorder, suggesting substantial market opportunity and a strong competitive position for Takeda.

ICLUSIG (Ph+ ALL)

ICLUSIG (ponatinib) is positioned as a potential star within Takeda Pharmaceutical's oncology portfolio, particularly for Philadelphia chromosome-positive acute lymphoblastic leukemia (Ph+ ALL).

Its recent U.S. FDA approval in March 2024 for newly diagnosed Ph+ ALL, when used alongside chemotherapy, is a significant development. This approval makes ICLUSIG the first and only targeted therapy available for frontline treatment of this specific condition in the United States. This breakthrough is expected to fuel substantial growth in the niche oncology market.

- Market Potential: The U.S. market for Ph+ ALL treatments is specialized, and ICLUSIG's unique position as a frontline targeted therapy offers considerable growth prospects.

- Competitive Advantage: As the first and only approved drug for this indication, ICLUSIG has a first-mover advantage, potentially capturing a significant market share.

- Revenue Growth: The expanded indication and its status as a novel treatment are anticipated to drive strong revenue generation for Takeda.

FRUZAQLA

Fruzaqla, a significant contributor to Takeda Pharmaceutical's fiscal year 2024 performance, is positioned as a Star in the BCG Matrix. Its robust market momentum and substantial revenue growth highlight its role as a key driver for the company.

The drug's continued success suggests it commands a high market share within a rapidly expanding therapeutic segment.

- Strong Revenue Contribution: Fruzaqla's performance in FY2024 was a notable factor in Takeda's overall financial results, underscoring its commercial success.

- Growing Market Segment: The drug operates in a market that is experiencing significant expansion, providing fertile ground for continued growth.

- High Market Share: Fruzaqla has successfully captured a substantial portion of its target market, indicating strong competitive positioning.

Fruzaqla and ICLUSIG are highlighted as Star products for Takeda Pharmaceutical. Fruzaqla demonstrated strong revenue contribution in fiscal year 2024 and operates in a growing market segment with a high market share. ICLUSIG received a significant U.S. FDA approval in March 2024 for frontline treatment of Philadelphia chromosome-positive acute lymphoblastic leukemia (Ph+ ALL), making it the first and only targeted therapy for this indication, which is expected to drive substantial growth.

| Product | Therapeutic Area | Key Development/Status | Market Position | Projected Impact |

| Fruzaqla | Oncology (CRC) | Strong FY2024 performance, high market share in expanding segment | Star | Key revenue driver, continued growth expected |

| ICLUSIG (ponatinib) | Oncology (Ph+ ALL) | First-in-class frontline therapy approval (March 2024) | Star | Significant growth potential in niche oncology market |

What is included in the product

This BCG Matrix overview analyzes Takeda's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic recommendations on investment, holding, or divestment for each category.

The Takeda Pharmaceutical BCG Matrix offers a clear, actionable overview of its portfolio, relieving the pain of strategic uncertainty.

Cash Cows

ENTYVIO stands as Takeda's flagship product, dominating the gastroenterology market for Crohn's disease and ulcerative colitis. Its substantial market share solidifies its position as a cash cow for the company.

Despite projected biosimilar competition around 2031, ENTYVIO remains a significant revenue driver. Takeda anticipates peak sales for the drug to range between $7.5 billion and $9 billion, underscoring its continued financial strength.

Takeda's Plasma-Derived Therapies, particularly its immunoglobulin products like HYQVIA, are strong cash cows. These therapies consistently generate substantial and stable revenue for the company. The recent FDA clearance in July 2025 for HyHub and HyHub Duo devices, designed to improve HYQVIA administration, solidifies its market dominance and operational efficiency.

ADCETRIS, a key oncology product for Takeda, remains a significant cash generator within their portfolio. Its recent European Commission approval in July 2025 for advanced Hodgkin lymphoma, when used with chemotherapy, underscores its continued market strength and potential for further revenue generation.

Established Gastroenterology Portfolio

Takeda's established gastroenterology portfolio, beyond its growth driver ENTYVIO, represents a significant cash cow. These mature products, benefiting from Takeda's deep-rooted expertise in the field, consistently generate substantial revenue. In fiscal year 2023, Takeda reported that its established products in the Gastroenterology and Inflammation segment continued to be strong contributors to overall revenue.

These established products are vital for Takeda's financial stability, providing a reliable income stream that can fund innovation and other strategic initiatives. Their consistent performance underscores Takeda's enduring market presence and the loyalty of healthcare providers and patients to its offerings.

- Consistent Revenue Generation: These products consistently contribute to Takeda's top line, providing a stable financial foundation.

- Leveraging Market Leadership: Takeda's long-standing presence in gastroenterology allows these established products to maintain strong market positions.

- Funding for Innovation: The cash flow generated by these established products supports investment in research and development for future growth drivers.

- Portfolio Stability: They offer a crucial element of stability within Takeda's broader therapeutic area portfolios.

Mature Rare Disease Portfolio

Takeda Pharmaceutical's dedication to rare diseases has cultivated a robust portfolio of established treatments that serve as significant cash cows. These products are characterized by their high value and consistent revenue generation, underpinning the company's financial stability.

These rare disease treatments often benefit from niche market positioning and substantial barriers to entry, such as complex regulatory pathways and specialized manufacturing. This allows Takeda to maintain strong market share and profitability for these mature assets.

- High Profitability: Mature rare disease drugs, like Takeda's established therapies, often command premium pricing due to unmet medical needs and limited competition.

- Stable Cash Flow: These products provide a predictable and reliable stream of income, essential for funding research and development in other areas.

- Market Dominance: In many rare disease indications, Takeda holds a dominant or sole market position, ensuring sustained revenue.

- Limited R&D Needs: As mature products, their ongoing research and development costs are typically lower compared to newer pipeline assets.

Takeda's established gastroenterology products, beyond ENTYVIO, are significant cash cows, consistently generating substantial revenue. These mature therapies benefit from Takeda's deep expertise and strong market presence in the field. In fiscal year 2023, this segment continued to be a robust contributor to Takeda's overall financial performance, providing a stable income stream to fund innovation.

| Product Category | Key Products | BCG Matrix Status | Revenue Contribution | Notes |

| Gastroenterology (Established) | Various mature therapies | Cash Cow | Significant and stable | Leverages long-standing market leadership and expertise. |

| Plasma-Derived Therapies | HYQVIA, Immunoglobulin products | Cash Cow | Substantial and consistent | Recent device clearances (July 2025) enhance administration and market position. |

| Oncology | ADCETRIS | Cash Cow | Key revenue generator | Recent European approval (July 2025) strengthens market position. |

| Rare Diseases | Established therapies | Cash Cow | High value and consistent | Benefit from niche markets, high barriers to entry, and strong pricing power. |

What You’re Viewing Is Included

Takeda Pharmaceutical BCG Matrix

The Takeda Pharmaceutical BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis is ready for immediate strategic application, offering a clear and professional breakdown of Takeda's product portfolio without any demo content or hidden surprises.

Dogs

Vyvanse, a key product for Takeda Pharmaceutical, has faced considerable generic competition. This has significantly impacted Takeda's revenue, particularly in fiscal years 2024 and 2025, as exclusivity waned.

The market for Vyvanse is now characterized by low growth and intense competition, which has led to a noticeable decline in its market share for Takeda.

Azilva, or azilsartan, has experienced a significant decline, positioning it as a Dog within Takeda Pharmaceutical's BCG Matrix. This downturn is largely attributable to its patent cliff, which directly impacted Takeda's domestic earnings in Japan, leading to sluggish performance.

The drug's current market position reflects a product in a low-growth sector. Its market share has been considerably eroded by generic competition, a common occurrence after patent expiration, further solidifying its status as a Dog.

Takeda Pharmaceutical's divestment of a portfolio of select non-core over-the-counter and prescription pharmaceutical products in Asia Pacific in 2020 is a prime example of shedding assets with low strategic value and market share. These products were likely situated in mature, low-growth markets, allowing Takeda to concentrate resources on its core therapeutic areas. In 2020, Takeda reported ¥3.7 trillion in total revenue, with a strategic focus on oncology, rare diseases, neuroscience, and gastroenterology, underscoring the shift away from less impactful segments.

Older Products Facing Generic Erosion

Takeda, like many established pharmaceutical giants, navigates the challenge of older products that have lost patent exclusivity. These drugs, once blockbusters, now contend with significant generic competition, leading to a predictable erosion of sales and market share. For instance, many of Takeda’s legacy products, while still contributing to revenue, operate in markets where pricing pressures are intense due to the availability of multiple generic alternatives. These mature products typically demand minimal ongoing investment in research and development, but their contribution to overall profitability is often modest.

The impact of genericization on these older products is substantial. For example, the introduction of generics for a major drug can lead to a price drop of 80-90% within a few years. This dynamic means that while these products might still represent a portion of Takeda's revenue stream, their growth potential is severely limited, and their margins are significantly compressed.

- Declining Market Share: Older drugs face intense competition from lower-cost generic versions once patents expire.

- Low Investment, Low Returns: These products generally require minimal R&D investment but yield diminishing returns.

- Price Erosion: Generic entry can cause rapid and substantial price reductions, impacting profitability.

- Cash Cows with Limited Growth: While still generating cash, their growth prospects are largely exhausted.

Legacy Products with Limited Growth

Takeda Pharmaceutical's portfolio includes legacy products that operate in mature, often commoditized markets. These offerings, while potentially stable, present limited avenues for significant expansion or innovation.

These products typically exhibit low market share and contribute minimally to Takeda's overall revenue growth. Consequently, they are often candidates for reduced investment or strategic divestment to reallocate resources towards more promising areas.

For instance, in 2024, Takeda's focus has increasingly shifted towards its pipeline of innovative therapies, particularly in oncology and rare diseases, where growth potential is substantially higher.

- Legacy products in mature markets show minimal revenue growth.

- Low market share limits their contribution to overall company expansion.

- Strategic review may lead to reduced support or divestiture of these assets.

- Takeda prioritizes investment in high-growth innovative therapy areas.

Takeda Pharmaceutical's portfolio includes products like Azilva, which have entered a low-growth phase due to patent expirations and subsequent generic competition. These legacy drugs, while still generating some revenue, are characterized by declining market share and limited future growth potential.

The company's strategic focus has shifted towards high-growth areas such as oncology and rare diseases, meaning investment in these mature products is likely to be minimal. This aligns with the typical management strategy for 'Dogs' in the BCG matrix, which often involves divestment or reduced resource allocation.

Takeda's 2024 financial reports indicate a continued emphasis on its innovative pipeline, underscoring the de-prioritization of older, less dynamic assets. This strategic reallocation aims to maximize returns by concentrating resources on products with higher market potential and innovation.

The divestment of non-core assets in 2020, which included products in mature markets, further illustrates Takeda's approach to managing its portfolio and shedding 'Dog' category assets.

| Product Category | Market Growth | Market Share | Takeda's Strategic Focus |

|---|---|---|---|

| Legacy Drugs (e.g., Azilva) | Low | Declining | Minimal investment, potential divestment |

| Innovative Therapies (Oncology, Rare Diseases) | High | Growing | Significant investment, strategic priority |

Question Marks

Mezagitamab, a promising late-stage candidate targeting immune thrombocytopenia (ITP) and immunoglobulin A nephropathy (IgAN), represents a potential future blockbuster for Takeda, with projected sales between $1 billion and $3 billion. Its market share is currently negligible as it navigates the regulatory pathway, with expected filings anticipated between fiscal years 2027 and 2029.

Fazirsiran, targeting alpha-1 antitrypsin related liver disease, represents a significant late-stage asset for Takeda. With projected filings between fiscal years 2027 and 2029, it's positioned for future growth. The drug is anticipated to achieve peak sales between $1 billion and $3 billion, indicating substantial market potential.

However, Fazirsiran currently has low market penetration, necessitating considerable investment to unlock its full value. This characteristic places it in a position where it requires ongoing support and development to move towards market leadership, aligning with the characteristics of a question mark in a BCG matrix.

Elritercept, currently in late-stage development for myelodysplastic syndromes (MDS), is positioned as a potential 'Question Mark' in Takeda Pharmaceutical's BCG Matrix. Its projected regulatory submissions between fiscal years 2027 and 2029 indicate a future market entry, aiming to tap into a high-growth potential segment.

With estimated peak sales ranging from $1 billion to $3 billion, Elritercept signifies substantial revenue opportunity. However, its current low market share, inherent in a product still under development, necessitates significant investment to capture market position and realize its full potential.

Early-Stage Oncology Pipeline Candidates

Takeda is heavily investing in its early-stage oncology pipeline, exploring promising modalities such as antibody-drug conjugates (ADCs), targeted small molecules, and advanced biologics. These innovative approaches are positioned in rapidly expanding segments of the oncology market, indicating significant future growth potential.

While these early-stage candidates represent high-growth opportunities, they also carry inherent risks due to their developmental stage. Takeda's commitment to these projects necessitates substantial research and development expenditures, with the potential for substantial future market penetration if successful.

- Focus on Novel Modalities: Takeda's early oncology pipeline emphasizes ADCs, small molecules, and complex biologics, targeting areas with high unmet needs.

- High R&D Investment: Significant capital is allocated to these nascent programs, reflecting their potential for disruptive innovation and market leadership.

- Uncertain but High Potential: While success is not guaranteed, the early-stage oncology candidates offer the possibility of capturing substantial market share in the future.

- Strategic Alignment: Takeda's investment aligns with its strategy to build a robust portfolio of next-generation cancer therapies.

New Licensing Deals and Collaborations

In fiscal year 2024, Takeda Pharmaceutical actively pursued new licensing deals and collaborations, signaling a strategic push into promising, high-growth therapeutic areas. These partnerships are designed to bolster Takeda's pipeline and expand its market reach. For instance, Takeda announced a significant licensing agreement in early 2024 for a novel oncology candidate, aiming to capture a larger share of the rapidly expanding cancer treatment market. The success of these ventures hinges on the future clinical development and market acceptance of these new assets.

These strategic alliances underscore Takeda's commitment to innovation and market expansion. By investing in external assets, Takeda aims to accelerate its growth trajectory and solidify its position in key therapeutic segments. The specific financial terms of many of these deals, while not always fully disclosed, represent substantial commitments to research and development, reflecting confidence in the partnered technologies. The ultimate market penetration and revenue generation from these collaborations remain a critical factor in their long-term success.

- Pipeline Expansion: Takeda secured licensing rights for several promising drug candidates in oncology and rare diseases during FY2024.

- Strategic Investments: These deals represent significant financial commitments, reflecting Takeda's focus on high-potential therapeutic areas.

- Market Penetration Goals: The collaborations are intended to establish or strengthen Takeda's presence in competitive, growing markets.

- Uncertainty of Success: The ultimate market adoption and revenue generation from these new partnerships are yet to be determined.

Question Marks in Takeda's portfolio are products with low market share but in high-growth markets, requiring significant investment to potentially become stars. Mezagitamab and Fazirsiran, both late-stage candidates with projected peak sales of $1-3 billion, currently have negligible market penetration. Similarly, Elritercept, targeting myelodysplastic syndromes, is in late-stage development with substantial revenue potential but low current market share. Takeda's early-stage oncology pipeline also fits this category, with significant R&D investment in novel modalities like ADCs, offering high growth potential but facing inherent developmental risks.

| Product/Pipeline Area | Market Growth | Market Share (Current) | Investment Need | Potential |

|---|---|---|---|---|

| Mezagitamab | High | Negligible | High | Star |

| Fazirsiran | High | Low | High | Star |

| Elritercept | High | Low | High | Star |

| Early-Stage Oncology Pipeline | High | Low | High | Star |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market data, internal sales figures, and therapeutic area growth projections to provide a comprehensive view of Takeda's portfolio.