Sunoco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sunoco Bundle

Sunoco, a prominent player in the energy sector, boasts strong brand recognition and a vast retail network as key strengths, positioning it well for market capture. However, the company faces significant threats from fluctuating fuel prices and increasing competition from alternative energy sources, demanding strategic adaptation.

Want the full story behind Sunoco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Sunoco LP boasts an impressive distribution network, spanning over 40 U.S. states, Puerto Rico, Europe, and Mexico. This vast infrastructure includes roughly 14,000 miles of pipeline and more than 100 terminals, ensuring dependable fuel delivery.

This extensive reach translates into strong brand recognition for Sunoco. With thousands of Sunoco and partner-branded locations, the company cultivates customer loyalty and a significant market presence.

Sunoco LP showcased exceptional financial strength in 2024, achieving record net income and adjusted EBITDA. This robust performance underscores the company's operational efficiency and market positioning.

Looking ahead to 2025, Sunoco's strategic direction points to continued growth, with a clear target of at least 5% distribution growth for unitholders. This forward-looking approach signals confidence in sustained profitability and value creation.

The company's consistent financial achievements and dedication to enhancing unitholder returns make Sunoco an appealing investment for those prioritizing income generation and stable financial growth.

Sunoco LP's strategic acquisition of NuStar Energy for approximately $7.3 billion in 2024 significantly bolsters its market share and diversifies its operations. This move is expected to drive substantial economies of scale, enhancing operational efficiencies across its refined products and crude oil logistics segments.

Focus on Fuel Supply and Logistics

Sunoco LP's strategic emphasis on fuel supply and logistics, rather than the complex and often volatile refining process, offers a significant competitive advantage. This focus allows the company to operate with a more predictable revenue stream, insulated from the sharp swings in crude oil refining margins that can impact integrated oil companies. For instance, in the first quarter of 2024, Sunoco LP reported that its logistics segment generated a substantial portion of its operating income, highlighting the stability of this business model.

The company's operational structure, centered around its extensive network of refined product terminals and its role as a distributor, provides a robust foundation for its logistics capabilities. This infrastructure is crucial for efficiently moving fuel to market. Sunoco's commitment to this core competency is reflected in its ongoing investments in terminal upgrades and expansion projects, aimed at enhancing throughput and service reliability for its customers.

Furthermore, Sunoco LP's reliance on fee-based commercial agreements provides a layer of revenue stability. These contracts often involve fixed fees for services rendered, such as terminaling and fuel distribution, which helps to mitigate the impact of fluctuating fuel prices on the company's earnings. This contractual framework is a key element in Sunoco's strategy to deliver consistent financial performance.

- Focus on Logistics: Sunoco LP operates primarily as a fuel distributor and terminal operator, avoiding the volatility of refining margins.

- Stable Revenue Streams: Fee-based commercial agreements contribute to predictable and consistent income.

- Infrastructure Advantage: The company possesses a significant network of refined product terminals, crucial for efficient fuel supply chain management.

- Market Position: This specialized focus allows Sunoco to be a key player in the midstream energy sector, facilitating fuel movement across various regions.

Robust Midstream Infrastructure

Sunoco's midstream operations, boasting an extensive pipeline network and terminal assets, form critical infrastructure for its fuel distribution business. This integrated system ensures the efficient storage and movement of petroleum products, directly supporting its wholesale and retail fuel segments. For instance, as of the first quarter of 2024, Sunoco's refined products pipeline system transported an average of 1.4 million barrels per day, highlighting the scale of its operations.

This robust portfolio of midstream assets provides Sunoco with a substantial operational advantage, enabling reliable and cost-effective product delivery. The partnership's commitment to maintaining and expanding this infrastructure, evidenced by ongoing capital expenditures in its midstream segment, underscores its strategic importance. In 2023, Sunoco invested approximately $300 million in its midstream infrastructure, focusing on reliability and growth projects.

Sunoco's core strength lies in its extensive and integrated logistics network, covering over 40 states and international markets. This robust infrastructure, including thousands of miles of pipeline and numerous terminals, ensures reliable fuel distribution and underpins its market presence. The company's strategic focus on fuel supply and logistics, rather than volatile refining, provides stable, fee-based revenue streams, insulated from market price swings.

The acquisition of NuStar Energy in 2024 for approximately $7.3 billion significantly enhanced Sunoco's market share and operational scale. This move is expected to generate substantial economies of scale, further solidifying its position in the midstream energy sector. Sunoco's consistent financial performance, highlighted by record net income and adjusted EBITDA in 2024, demonstrates its operational efficiency and commitment to unitholder value.

Sunoco's strategic direction for 2025 targets at least 5% distribution growth, signaling confidence in sustained profitability. The company's midstream assets, including pipelines and terminals, are critical for its operations, with significant investments made in 2023 to enhance reliability and growth. For instance, its refined products pipeline system transported an average of 1.4 million barrels per day in Q1 2024.

| Key Strength | Description | Supporting Data/Fact |

| Extensive Logistics Network | Vast pipeline and terminal infrastructure across the U.S. and internationally. | Operates ~14,000 miles of pipeline and over 100 terminals. |

| Stable Revenue Model | Focus on fee-based logistics services, avoiding refining volatility. | Logistics segment generated a substantial portion of operating income in Q1 2024. |

| Strategic Acquisitions | Acquisition of NuStar Energy in 2024 bolstered market share and scale. | Acquisition valued at approximately $7.3 billion. |

| Financial Performance | Consistent record of strong financial results and growth targets. | Achieved record net income and adjusted EBITDA in 2024; targeting 5% distribution growth in 2025. |

What is included in the product

Delivers a strategic overview of Sunoco’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis that simplifies complex market dynamics for Sunoco's leadership.

Weaknesses

Sunoco LP's financial structure is significantly impacted by its substantial long-term debt, which stood at approximately $7.5 billion as of December 31, 2024. This considerable leverage elevates the company's financial risk profile.

The high debt burden can restrict Sunoco's operational and strategic flexibility, potentially hindering its ability to pursue new growth opportunities or navigate economic downturns. Effective management of this leverage is paramount for ensuring the company's long-term financial stability and capacity for future investments.

Sunoco's core business, the distribution of motor fuels, creates a significant weakness due to its heavy reliance on fossil fuel demand. This dependence makes the company vulnerable to shifts in consumer behavior and technological advancements. For instance, the accelerating adoption of electric vehicles (EVs) in major markets like the United States, with EV sales projected to reach over 30% of new vehicle sales by 2025 according to some industry forecasts, directly threatens the long-term viability of traditional fuel distribution.

Sunoco LP's fuel distribution business is exposed to the volatility of commodity prices, specifically crude oil. While Sunoco doesn't refine, its profitability in fuel distribution is tied to fuel margins, which are the difference between the wholesale prices of gasoline and diesel, and the cost of crude oil. For instance, in 2024, the company experienced a decrease in its fuel margin per gallon, directly impacting its earnings in this segment.

Master Limited Partnership (MLP) Structure Risks

As a Master Limited Partnership (MLP), Sunoco LP faces inherent risks tied to its structure. Regulatory shifts and evolving tax policies, particularly those impacting corporate tax rates or Federal Energy Regulatory Commission (FERC) decisions on MLP tax treatment, could diminish the tax benefits MLPs typically offer. This could directly affect the cash distributions available to unitholders, potentially dampening investor interest.

For instance, changes in tax legislation could increase the partnership's tax burden, thereby reducing distributable cash flow. In 2024, the ongoing discussions around corporate tax reform continue to create uncertainty for MLPs. Furthermore, a significant portion of Sunoco's business involves regulated assets, making it susceptible to changes in FERC policies that could impact its cost structure and, consequently, its ability to generate stable cash flows for distribution.

- Tax Law Vulnerability: Sunoco's MLP status exposes it to risks from changes in tax legislation that could reduce its tax advantages.

- Regulatory Impact: FERC policy changes can affect Sunoco's operating costs and cash flow generation, impacting distributions.

- Investor Appeal Sensitivity: A reduction in tax benefits or cash distributions could negatively affect Sunoco's attractiveness to investors.

Intense Competition in Retail and Wholesale Markets

Sunoco LP faces a challenging landscape due to intense competition in both retail and wholesale fuel markets. Major players like 7-Eleven, Circle K, and Speedway, alongside numerous independent stations, vie for market share. This crowded field directly impacts Sunoco's ability to maintain healthy fuel margins and its overall market presence, necessitating ongoing strategic adjustments.

The pressure from these competitors can erode profitability, forcing Sunoco to constantly innovate and optimize its operations. For instance, while specific 2024/2025 margin data is proprietary, the industry trend shows that gross profit per gallon for fuel is often in the low single digits, making volume and efficiency critical. Sunoco's strategy must account for this tight margin environment.

- Intense Rivalry: Sunoco competes with national brands and local operators, impacting its pricing power.

- Margin Pressure: Fierce competition can lead to reduced profitability on fuel sales, a core revenue stream.

- Market Share Defense: Maintaining and growing market share requires significant investment in branding, location, and customer loyalty programs.

- Operational Efficiency: To counter competitive pressures, Sunoco must excel in supply chain management and operational cost control.

Sunoco's significant debt load, around $7.5 billion as of year-end 2024, limits its financial flexibility for new ventures and economic downturns. Its core business, fuel distribution, is vulnerable to the rise of electric vehicles, with projections suggesting EVs could capture over 30% of new US vehicle sales by 2025, directly impacting long-term demand for gasoline and diesel.

The company's profitability is also subject to the volatility of crude oil prices, as fuel margins are directly tied to these fluctuations. Furthermore, as an MLP, Sunoco faces risks from potential changes in tax laws and FERC regulations that could reduce its tax advantages and impact cash distributions, potentially decreasing investor appeal.

Same Document Delivered

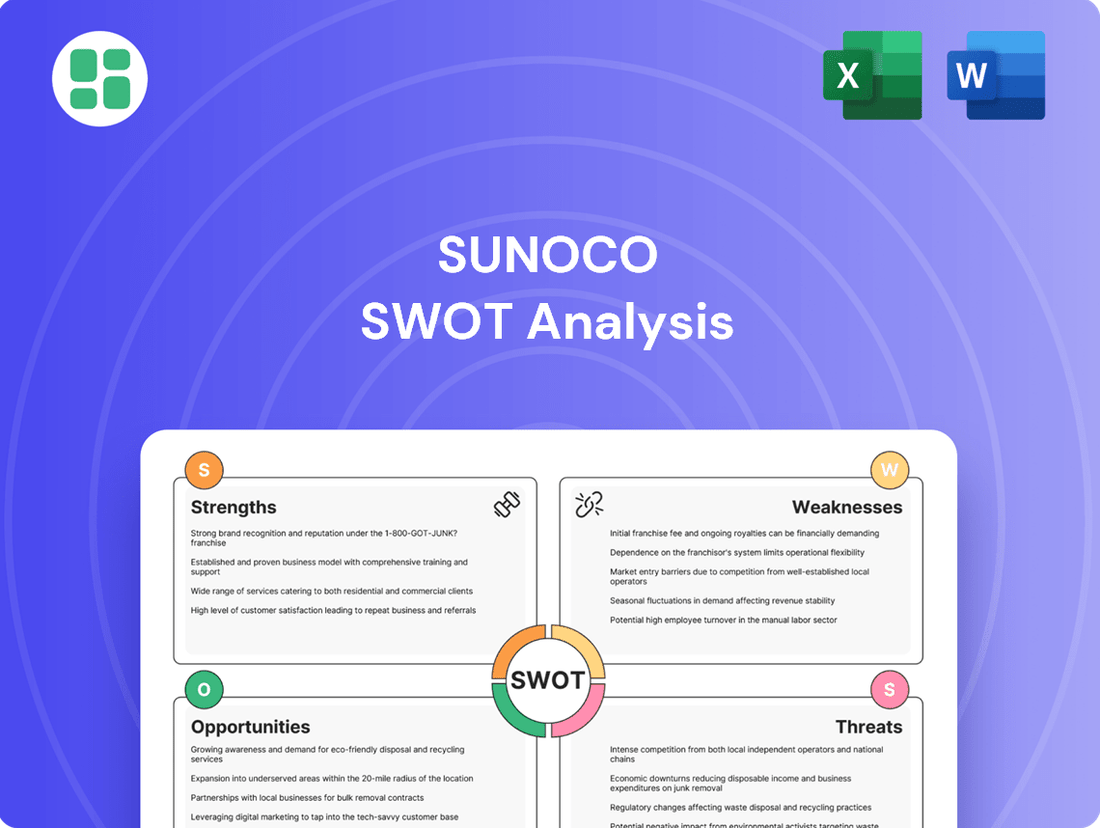

Sunoco SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights Sunoco's key Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview of their market position.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain deeper insights into Sunoco's strategic landscape and competitive advantages.

Opportunities

The global market for renewable fuels and EV charging is experiencing significant growth, with the EV charging market alone projected to reach $150 billion by 2030. Sunoco LP is well-positioned to capitalize on this trend by integrating EV charging stations into its extensive network of over 5,000 retail locations. This strategic move allows Sunoco to tap into a burgeoning customer base and diversify its revenue streams beyond traditional gasoline sales.

Furthermore, Sunoco can strategically invest in biodiesel and renewable diesel infrastructure, aligning with the increasing demand for cleaner energy alternatives. For instance, the U.S. renewable diesel market is expected to grow by over 10% annually in the coming years. By embracing these alternative fuels, Sunoco can proactively adapt to evolving energy demands and capture market share in a rapidly transforming industry.

Sunoco has a proven history of successful strategic acquisitions, and the company continues to identify promising targets within the fuel distribution and retail industries. This ongoing strategy allows for significant market expansion.

Recent acquisitions, such as the integration of Parkland Corporation's U.S. wholesale business and TanQuid, demonstrate Sunoco's ability to effectively absorb and leverage new assets. These moves have demonstrably broadened their geographic reach and bolstered operational efficiencies, contributing to their market position.

Sunoco LP's extensive network of terminals across the U.S. is a significant asset, particularly as demand for refined product storage and distribution continues. In 2023, Sunoco reported approximately $1.7 billion in revenue, showcasing the scale of its operations. This infrastructure allows them to efficiently manage a wide range of fuel products, positioning them to benefit from evolving market needs and potentially boost profitability.

The company's ability to handle diverse fuel types and adapt to market shifts is a key strength. By investing in terminal upgrades and expansions, Sunoco can further solidify its position. For instance, ongoing investments in their logistics and terminal capabilities are crucial for maintaining a competitive edge in the energy distribution sector, which saw significant volatility in 2024.

Optimizing Operational Efficiencies through Technology

Sunoco can unlock significant cost reductions and efficiency gains by embracing advanced technologies. This strategic move is particularly relevant given the current economic climate where optimizing every operational dollar is crucial. For instance, implementing automated inventory management systems can minimize waste and stockouts, while IoT-enabled fuel tracking offers real-time insights into consumption and potential inefficiencies.

The impact of these technological investments can be substantial. Consider the potential for improved logistics optimization, which directly affects fuel delivery routes and scheduling. By leveraging data analytics and AI, Sunoco can refine its supply chain, leading to fewer miles driven and reduced fuel expenses. These improvements are not just theoretical; many companies in the energy sector are reporting tangible benefits. For example, a study in late 2024 indicated that companies adopting advanced logistics software saw an average reduction of 8-12% in transportation costs.

Specifically for Sunoco, these opportunities translate into tangible financial benefits:

- Reduced Labor Costs: Automation in areas like inventory tracking and site monitoring can decrease the need for manual oversight, potentially saving millions annually.

- Lower Fuel Expenses: Optimized delivery routes, driven by advanced logistics software, can cut down on fuel consumption and vehicle maintenance.

- Enhanced Inventory Accuracy: Real-time tracking minimizes losses due to spoilage or theft, improving the bottom line.

Geographical Expansion in International Markets

Sunoco LP's existing operations in Puerto Rico, Europe, and Mexico highlight a foundational international presence. Recent strategic moves, like the acquisition of TanQuid in Germany and Poland, underscore a commitment to expanding its European footprint. This international diversification offers significant potential for new revenue streams and reduced reliance on the U.S. market.

Further geographical expansion into key international markets presents a compelling opportunity for Sunoco. By leveraging its expertise in fuel distribution and retail, Sunoco can tap into growing demand in regions like Southeast Asia or South America. For instance, the European fuel market, while mature, continues to offer opportunities for consolidation and efficiency gains, as seen in the TanQuid acquisitions.

- International Diversification: Reduces exposure to U.S. market fluctuations.

- Acquisition Strategy: TanQuid acquisition in Germany and Poland shows a clear path for European growth.

- New Revenue Streams: Accessing growing demand in emerging markets can boost overall revenue.

Sunoco can leverage its extensive retail network to integrate EV charging stations, tapping into the rapidly expanding electric vehicle market projected to reach $150 billion by 2030. The company is also positioned to invest in renewable fuels like biodiesel, aligning with a U.S. market expected to grow over 10% annually. These moves allow Sunoco to diversify revenue and adapt to evolving energy demands.

Threats

The global energy landscape is undergoing a significant transformation, with a pronounced shift towards cleaner energy sources. This trend, coupled with the accelerating adoption of electric vehicles (EVs), presents a substantial long-term threat to the traditional fossil fuel market. As more consumers opt for EVs, the demand for gasoline and diesel is expected to decline steadily.

Analysts project a notable decrease in gasoline consumption in the coming years. For instance, the International Energy Agency (IEA) has forecast that global oil demand for road transport could peak around 2025-2026, indicating a sustained downward trajectory thereafter. This directly impacts Sunoco LP, whose core business revolves around the distribution of these very fuels.

The energy sector faces a constantly shifting landscape of environmental rules, like the EPA's Renewable Fuel Standard, which can significantly impact operations. Sunoco must navigate these evolving regulations, which often require substantial investments in new technologies and infrastructure to meet compliance standards.

Adhering to these stricter environmental mandates can directly translate into increased operational expenses and capital outlays for Sunoco LP. Failure to comply can also result in hefty fines, potentially affecting the company's bottom line and its ability to adapt its business strategies.

Sunoco LP operates in a highly competitive landscape, facing pressure from both large, established energy companies and smaller, agile newcomers in fuel distribution and retail. This intensified competition, particularly evident in 2024, often forces price adjustments that can squeeze profit margins.

The need to invest in modernizing infrastructure and enhancing customer experience, such as through loyalty programs and updated convenience store offerings, becomes crucial to stand out. For instance, in early 2025, industry reports indicated that retailers were channeling significant capital into store renovations and digital integration to combat market saturation.

Economic Downturns and Reduced Fuel Demand

Economic downturns pose a significant threat to Sunoco LP. Recessions typically curb consumer spending and business activity, directly translating to less demand for motor fuels. For Sunoco, a company heavily reliant on fuel distribution, this means lower sales volumes and, consequently, reduced revenue and profitability.

The impact of economic slowdowns on Sunoco's financial health is substantial. For instance, during periods of economic contraction, discretionary spending often decreases, leading consumers to drive less or opt for more fuel-efficient transportation. Businesses also scale back operations, further dampening fuel consumption across commercial sectors. This vulnerability was evident in past economic cycles where energy demand saw noticeable dips.

- Reduced Consumer Spending: Economic slowdowns often lead to job losses and decreased disposable income, causing consumers to cut back on travel and fuel purchases.

- Lower Commercial Activity: Businesses facing economic hardship may reduce transportation needs, impacting demand for commercial fuel sales.

- Impact on Distribution Volumes: A decrease in overall fuel consumption directly translates to lower volumes distributed by Sunoco, affecting its fee-based income.

- Profitability Pressure: Lower sales volumes and potential price volatility during economic downturns can put significant pressure on Sunoco's profit margins.

Supply Chain Disruptions and Geopolitical Risks

Global geopolitical events, such as ongoing conflicts and trade tensions, continue to pose a significant threat to supply chains. For Sunoco LP, which operates primarily in fuel distribution, these disruptions can directly impact the availability of refined products and lead to price volatility. For instance, in early 2024, the ongoing conflict in Eastern Europe contributed to fluctuations in global crude oil prices, indirectly affecting the cost of gasoline and diesel that Sunoco distributes.

These external factors can significantly increase procurement costs for Sunoco and create challenges in maintaining consistent product flow. When crude oil production or transportation is interrupted, it can lead to shortages or increased shipping expenses, squeezing distribution margins. The company's reliance on a steady supply of fuel means that geopolitical risks, if left unmanaged, could directly impact its operational efficiency and profitability.

- Supply Chain Vulnerability: Geopolitical instability can disrupt the flow of refined fuels, impacting Sunoco's ability to meet demand.

- Price Volatility: Conflicts and production issues globally can cause sharp swings in fuel prices, affecting procurement costs and distribution margins.

- Increased Operating Costs: Higher transportation expenses and potential product scarcity due to geopolitical events can elevate Sunoco's operational expenditures.

- Margin Squeeze: The combination of rising costs and potential price controls or market pressures can compress Sunoco's profit margins on fuel distribution.

The accelerating shift towards electric vehicles (EVs) and cleaner energy sources presents a significant long-term threat to Sunoco's core fuel distribution business. Analysts anticipate global oil demand for road transport may peak around 2025-2026, signaling a sustained decline, which directly impacts Sunoco's sales volumes.

Stricter environmental regulations, such as the EPA's Renewable Fuel Standard, necessitate costly upgrades and can lead to fines for non-compliance, increasing operational expenses. Intense competition in 2024, with rivals investing heavily in store modernization and digital integration, pressures profit margins and requires continuous investment to remain competitive.

Economic downturns directly reduce consumer and commercial fuel demand, leading to lower sales volumes and profitability for Sunoco. Geopolitical events can disrupt supply chains and cause price volatility, increasing procurement costs and squeezing distribution margins, as seen with fluctuations in early 2024 due to global conflicts.

| Threat Category | Description | Potential Impact on Sunoco | Example/Data Point |

| Energy Transition | Shift to EVs and cleaner energy | Decreased demand for gasoline and diesel | IEA forecast: Global oil demand for road transport could peak around 2025-2026. |

| Regulatory Environment | Stricter environmental mandates | Increased operational costs, potential fines | Compliance with standards like EPA's Renewable Fuel Standard. |

| Competition | Intensified market competition | Pressure on profit margins, need for investment | Retailers investing in store renovations and digital integration (early 2025 reports). |

| Economic Conditions | Recessions and economic slowdowns | Reduced consumer and commercial fuel demand | Lower sales volumes and profitability during economic contractions. |

| Geopolitical Risks | Global conflicts and trade tensions | Supply chain disruptions, price volatility | Early 2024: Conflict in Eastern Europe impacting global crude oil prices. |

SWOT Analysis Data Sources

This Sunoco SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry forecasts. These sources provide a robust understanding of the company's internal capabilities and external market dynamics.