Sunoco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sunoco Bundle

Navigate the complex external forces shaping Sunoco's future with our comprehensive PESTLE Analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the energy sector. Gain actionable insights to refine your strategy and anticipate market changes. Download the full analysis now to unlock critical intelligence.

Political factors

Changes in federal and state regulations concerning fuel composition, emissions, and efficiency directly shape Sunoco LP's product development and operational strategies. For instance, the EPA's ongoing review of Renewable Fuel Standard volumes for 2024 and beyond, alongside California's Advanced Clean Cars II program mandating 100% zero-emission vehicle sales by 2035, creates a dynamic compliance landscape.

Adhering to these evolving environmental standards is paramount for Sunoco to maintain market access and sidestep potential fines, impacting its supply chain and product mix. Political shifts can introduce more rigorous or lenient environmental policies, influencing the entire petroleum distribution sector.

Government policies actively promoting renewable energy sources and electric vehicle adoption present a significant long-term challenge for Sunoco LP. For instance, the Inflation Reduction Act of 2022 in the United States offers substantial tax credits for renewable energy projects, accelerating the shift away from fossil fuels. This transition could directly impact demand for Sunoco's traditional motor fuels.

Subsidies and mandates aimed at increasing green energy adoption, such as federal tax credits for electric vehicle purchases, can directly reduce the consumption of gasoline and diesel. As of early 2024, these incentives have demonstrably boosted EV sales, indicating a growing market segment that bypasses traditional fuel infrastructure. Sunoco must strategize to adapt its business model or identify new revenue streams within this evolving energy landscape.

Furthermore, political support for various energy sources heavily influences where investments are directed and how infrastructure is developed. Decisions made by policymakers regarding the future of fossil fuels versus renewables directly shape the competitive environment and the long-term viability of Sunoco's core operations.

Global geopolitical events, such as the ongoing conflict in Ukraine and trade tensions between major economies, significantly impact crude oil supply and refined product pricing. These disruptions can lead to price volatility, directly affecting Sunoco LP's operational costs and revenue streams.

Sunoco LP, as a fuel distributor, is particularly sensitive to supply chain stability. Political instability in key oil-producing regions, for instance, can cause supply shortages and price spikes. In 2024, the Brent crude oil price has shown considerable fluctuation, at times exceeding $90 per barrel, directly linked to these geopolitical concerns, impacting Sunoco's ability to maintain consistent pricing and availability for its customers.

Government foreign policy and international trade relations are crucial for Sunoco. Sanctions or tariffs imposed on oil-producing nations can alter global supply dynamics. For example, shifts in U.S. foreign policy regarding energy exports or imports can influence the availability and cost of refined products distributed by Sunoco across its network.

Taxation and Fiscal Policies

Federal and state fuel taxes, alongside potential carbon taxes, directly impact Sunoco's operational costs and the retail price of fuel, influencing consumer purchasing behavior. For instance, the U.S. federal gasoline tax has remained at $0.184 per gallon since 1993, but many states have seen increases. In 2024, states like California and Pennsylvania have some of the highest state-level fuel taxes, adding significantly to the pump price.

Changes in these fiscal policies, such as an increase in federal fuel excise taxes or the implementation of a national carbon tax, could directly affect Sunoco LP's profit margins and sales volumes. For example, a hypothetical $0.10 per gallon carbon tax could reduce demand for gasoline by a measurable percentage, impacting Sunoco's distribution volumes.

- Federal Fuel Tax: Remains at $0.184 per gallon for gasoline, unchanged since 1993.

- State Fuel Taxes: Vary significantly, with states like California and Pennsylvania imposing some of the highest rates in 2024, impacting consumer costs.

- Carbon Tax Potential: The introduction of carbon pricing mechanisms could introduce new cost structures and influence fuel demand.

- Government Budget: Fiscal priorities can lead to adjustments in fuel taxation, directly affecting Sunoco's revenue streams and operational costs.

Infrastructure Spending and Development

Government investment in road infrastructure and transportation networks directly impacts Sunoco LP's distribution efficiency. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, allocates over $550 billion for transportation projects, including highway upgrades and bridge repairs, which can streamline Sunoco's fuel delivery routes. Improved logistics hubs also reduce transit times and operational costs, potentially boosting demand for motor fuels as travel becomes more convenient.

Political decisions regarding infrastructure development, such as the expansion of electric vehicle (EV) charging stations, will also shape future market conditions for fuel distributors like Sunoco. While increased EV adoption might impact traditional gasoline demand, investments in a robust and diversified energy infrastructure, including charging networks, could present new opportunities or require strategic adjustments for companies in the energy sector. The pace and focus of these infrastructure investments, often detailed in national and state-level transportation plans, will be a key indicator of evolving market dynamics.

Key infrastructure spending initiatives relevant to Sunoco's operations include:

- Federal Highway Administration (FHWA) funding: Significant portions of the Bipartisan Infrastructure Law are directed towards highway and bridge improvements, directly benefiting road-based logistics.

- National Electric Vehicle Infrastructure (NEVI) Formula Program: This program, part of the Bipartisan Infrastructure Law, aims to build out a national EV charging network, influencing the long-term demand for traditional fuels.

- State-level transportation improvement plans: Individual states continuously update their infrastructure priorities, often focusing on expanding capacity and improving the efficiency of their transportation networks, which directly impacts fuel distribution.

Government regulations on fuel standards and emissions, such as the EPA's Renewable Fuel Standard and California's Advanced Clean Cars II program, directly influence Sunoco's product offerings and compliance costs. Political support for renewable energy and electric vehicles, exemplified by the Inflation Reduction Act of 2022, presents a long-term challenge by potentially reducing demand for traditional motor fuels.

What is included in the product

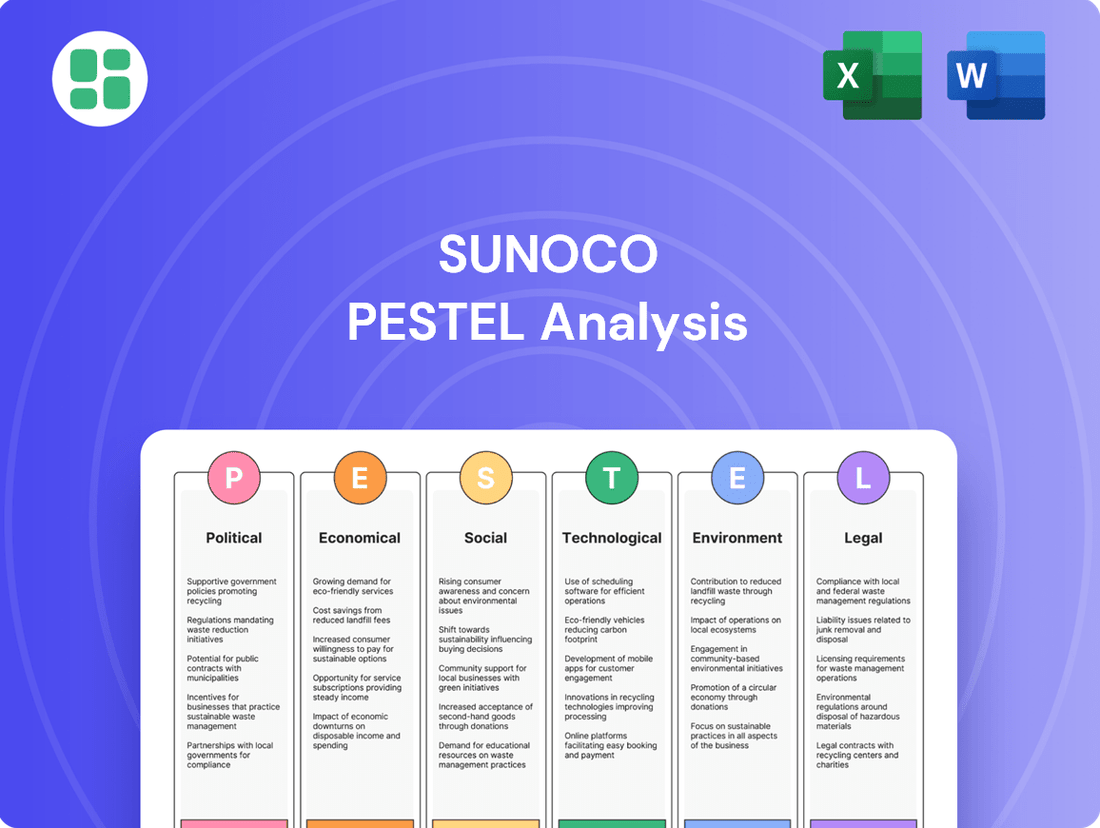

The Sunoco PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate these dynamics and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, allowing Sunoco to quickly identify and address external factors impacting its operations and strategic decisions.

Economic factors

Sunoco LP's profitability is heavily influenced by the volatile prices of crude oil and refined products. Fluctuations in global crude oil directly impact the wholesale cost of gasoline and diesel, affecting Sunoco's pricing strategies and profit margins. For instance, the average price of West Texas Intermediate (WTI) crude oil saw significant swings throughout 2024, impacting downstream product costs.

These price swings make financial forecasting and inventory valuation particularly challenging for Sunoco. Factors like geopolitical events, changes in global demand, and supply disruptions, such as those experienced in the Middle East or impacting OPEC+ production decisions, contribute to this inherent volatility. Speculative trading in oil futures also plays a role in exacerbating price movements.

Consumer spending is a major indicator of economic health, directly impacting fuel demand. In 2024, the U.S. personal savings rate hovered around 3.5%, a decrease from previous years, suggesting consumers are spending more of their disposable income. This trend generally supports higher fuel consumption as people engage in more travel and leisure activities.

Disposable income, the money left after taxes, is crucial for discretionary spending like travel. As of early 2025, projections indicate continued modest growth in real disposable personal income, which should sustain demand for motor fuels. However, persistent inflation could erode purchasing power, potentially dampening travel plans and, consequently, Sunoco's sales volumes.

Economic downturns, marked by rising unemployment and falling disposable incomes, significantly reduce discretionary travel. For instance, during the 2008 recession, fuel consumption saw a noticeable dip. While the current economic outlook for 2024-2025 appears more stable, any unexpected economic shocks could quickly translate into lower demand for Sunoco's products.

High inflation in 2024 and early 2025 directly impacts Sunoco LP by elevating operational expenses. Costs for fuel, vehicle maintenance, and employee wages have seen upward pressure, potentially narrowing profit margins on fuel distribution. For instance, the Producer Price Index (PPI) for transportation and warehousing services saw a notable increase in late 2024, reflecting these rising costs.

The prevailing interest rate environment, particularly the Federal Reserve's policy decisions throughout 2024, presents a significant economic factor for Sunoco. An increase in interest rates raises the cost of capital for Sunoco's planned infrastructure upgrades and fleet modernization. This could lead to higher debt servicing expenses, affecting the company's financial flexibility for future investments and potentially impacting its debt-to-equity ratio.

Competition and Market Share Dynamics

Sunoco LP operates in a highly competitive fuel distribution market. Major rivals like Buckeye Partners and major oil company distribution arms, alongside numerous independent operators, constantly influence market share through aggressive pricing strategies. For instance, during periods of economic slowdown, this competition intensifies as companies fight for a shrinking customer base, directly impacting Sunoco's ability to maintain its pricing power.

Market concentration is a key consideration. While the fuel distribution sector has established players, the potential for new entrants, particularly those leveraging innovative logistics or alternative fuel sources, could disrupt existing market share dynamics. This dynamic is particularly relevant as the energy landscape evolves.

Sunoco's market share is directly tied to its ability to compete on price and service. In 2023, the U.S. gasoline market saw fluctuating demand, with retail gasoline prices averaging around $3.50 per gallon nationally, creating a challenging environment for distributors to maintain margins. The efficiency of Sunoco's distribution network and its strategic partnerships are crucial for retaining and growing its share against competitors who may have different cost structures or market access.

- Competitive Pricing: Major distributors and independent operators employ varied pricing models, impacting Sunoco's market share.

- Economic Impact: Economic downturns exacerbate competition, forcing companies to compete for a smaller pool of customers.

- Market Concentration: The presence of established players and the potential for new entrants shape the competitive landscape.

- 2023 Fuel Prices: National average gasoline prices around $3.50/gallon in 2023 highlight the pricing pressures distributors face.

Supply Chain Costs and Efficiency

Sunoco LP's distribution costs are heavily influenced by supply chain factors like freight expenses, labor availability, and energy prices. For instance, the average cost of shipping a container internationally saw significant fluctuations in 2024, impacting the overall cost of fuel logistics. Optimizing these operations is key for Sunoco to keep its pricing competitive.

Global economic shifts and unexpected events, such as geopolitical tensions or natural disasters, can create substantial volatility in logistics expenses. These disruptions can lead to increased freight rates and potential delays, directly affecting Sunoco's operational efficiency and profitability in 2024 and projections into 2025.

- Freight Costs: Fuel surcharges and trucking rates are sensitive to diesel prices, which have seen volatility in 2024.

- Labor Availability: Shortages in qualified truck drivers and warehouse personnel can drive up labor costs for Sunoco's logistics network.

- Energy Prices: Fluctuations in crude oil and refined product prices directly impact the cost of fuel for Sunoco's distribution fleet.

- Supply Chain Disruptions: Events like port congestion or extreme weather in 2024 highlighted the vulnerability of extended supply chains to efficiency impacts.

Sunoco LP's financial performance is intrinsically linked to the broader economic climate, with consumer spending and disposable income acting as key demand drivers. In 2024, a personal savings rate around 3.5% indicated increased consumer spending, generally supporting fuel demand. However, persistent inflation in early 2025 poses a risk, potentially eroding purchasing power and impacting sales volumes.

Interest rates significantly affect Sunoco's capital costs; for example, Federal Reserve policy throughout 2024 influenced borrowing expenses for infrastructure projects. Furthermore, competitive pricing pressures from rivals and market concentration dynamics, especially with evolving energy landscapes, directly impact Sunoco's market share and pricing power.

Operational costs for Sunoco are susceptible to inflation, with rising expenses in areas like transportation and warehousing services evident in late 2024. Supply chain factors, including freight expenses and labor availability, also contribute to cost volatility, as seen with fluctuating container shipping costs in 2024.

Full Version Awaits

Sunoco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Sunoco delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into the external forces shaping Sunoco's strategic landscape.

Sociological factors

Societal trends are increasingly favoring sustainability, with a noticeable rise in electric vehicle (EV) adoption. This shift directly influences the demand for traditional motor fuels, a core product for Sunoco LP. For instance, by the end of 2024, projections indicate that global EV sales could surpass 20 million units, a significant jump from previous years.

This growing environmental consciousness, particularly among younger demographics, means Sunoco LP must consider strategies to adapt to evolving consumer preferences. The company's long-term success may hinge on its ability to diversify its offerings or enhance its retail presence with services catering to the growing EV market, such as charging infrastructure.

Urbanization continues to reshape how people move and consume fuel. As more people flock to cities, urban planning decisions play a big role. For instance, in the US, the percentage of people living in urban areas has steadily climbed, reaching over 83% by 2023, according to the World Bank. This shift often means more demand for public transportation, which could potentially reduce individual car usage and, consequently, fuel demand for personal vehicles.

The rise of remote and hybrid work models is another significant factor influencing commuting habits. By mid-2024, it's estimated that around 30% of the US workforce will be working remotely at least part-time. This trend directly impacts Sunoco LP's retail fuel volumes, as fewer daily commutes mean less gasoline and diesel sold at their stations.

Societal shifts towards better work-life balance also contribute to these changes. A greater emphasis on flexible work arrangements can lead to less predictable travel patterns and a potential decrease in overall vehicle miles traveled. This evolving landscape directly affects Sunoco's business, requiring adaptation to changing consumer behaviors and fuel consumption patterns across its retail and wholesale operations.

Societal awareness of climate change is increasing, leading to greater scrutiny of companies in the fossil fuel sector. This heightened public concern directly impacts Sunoco LP's brand image and its relationships with stakeholders, including investors and potential employees.

Negative public perception can translate into increased regulatory pressure and shifts in investment preferences away from fossil fuels. For instance, a 2024 survey indicated that over 60% of respondents believe companies should invest more in renewable energy, a trend that could affect Sunoco's long-term market position.

Health and Safety Concerns

Societal expectations for corporate responsibility in public health and safety are intensifying, particularly for companies like Sunoco LP involved in fuel handling and with the potential for environmental incidents. This heightened scrutiny means Sunoco must uphold stringent safety protocols throughout its terminal operations and retail locations to satisfy these demands and prevent damage to its reputation or legal entanglements.

Maintaining strong community relations is paramount for Sunoco. For instance, in 2024, Sunoco reported a total recordable incident rate (TRIR) of 0.69 for its employees, significantly below the industry average, demonstrating a commitment to safety that resonates with communities.

- Community Engagement: Proactive communication and collaboration with local communities regarding safety procedures and emergency preparedness are crucial.

- Environmental Stewardship: Adherence to and exceeding environmental regulations, especially concerning fuel storage and transportation, is a key societal expectation.

- Employee Safety: Investing in comprehensive safety training and equipment for all personnel directly impacts public perception and operational integrity.

Demographic Shifts and Vehicle Ownership

Demographic shifts significantly shape vehicle ownership and fuel consumption patterns. For example, the increasing urbanization trend, particularly among younger demographics, often leads to reduced personal vehicle ownership in favor of public transportation and ride-sharing services. This trend is evident in major metropolitan areas, where car ownership rates can be considerably lower than in suburban or rural settings.

An aging population can also influence vehicle usage. While older individuals may drive less frequently, their need for reliable transportation for appointments and daily life remains. Conversely, shifts in household structures, such as smaller family sizes, might correlate with a decrease in the number of vehicles per household. For Sunoco LP, understanding these evolving demographics is key to forecasting regional fuel demand and adapting its distribution strategies.

- Urbanization Impact: In 2023, over 57% of the global population resided in urban areas, a figure projected to reach 60% by 2030, potentially dampening per capita fuel demand in these regions.

- Aging Population Trends: The proportion of individuals aged 65 and over is expected to grow substantially, impacting driving frequency and vehicle type preferences.

- Household Size Changes: Average household sizes have been declining in many developed nations, potentially leading to fewer vehicles owned per household.

- Generational Preferences: Younger generations (Gen Z and Millennials) often prioritize experiences and sustainability, which can translate to less emphasis on personal car ownership.

Societal shifts toward sustainability and environmental consciousness are a significant factor for Sunoco LP. The increasing adoption of electric vehicles (EVs), with global sales projected to exceed 20 million units by the end of 2024, directly impacts demand for traditional motor fuels. This trend necessitates that Sunoco LP consider adapting its business model to cater to evolving consumer preferences, potentially through investments in EV charging infrastructure.

The growing awareness of climate change also leads to increased scrutiny of fossil fuel companies, affecting Sunoco's brand image and investor relations. A 2024 survey indicated that over 60% of respondents believe companies should invest more in renewable energy, signaling a potential shift in market sentiment away from traditional energy sources.

Furthermore, societal expectations for corporate responsibility in public health and safety are intensifying. Sunoco must maintain stringent safety protocols, as evidenced by its 2024 total recordable incident rate (TRIR) of 0.69, which is below the industry average, to uphold its reputation and community trust.

| Sociological Factor | Trend/Data Point | Impact on Sunoco LP |

|---|---|---|

| EV Adoption | Global EV sales projected to exceed 20 million units by end of 2024. | Reduced demand for traditional motor fuels; need for diversification. |

| Environmental Consciousness | 60%+ of respondents in a 2024 survey favor increased investment in renewables. | Potential negative impact on brand image and investor preference for fossil fuels. |

| Urbanization | Over 57% of the global population lived in urban areas in 2023, projected to reach 60% by 2030. | Potential decrease in per capita fuel demand in urban centers due to public transport and ride-sharing. |

| Remote Work | Estimated 30% of the US workforce working remotely at least part-time by mid-2024. | Direct impact on retail fuel volumes due to fewer daily commutes. |

| Safety Expectations | Sunoco's 2024 TRIR of 0.69 (below industry average). | Reinforces positive community relations and operational integrity. |

Technological factors

Technological advancements are rapidly reshaping the automotive landscape, with electric vehicles (EVs) at the forefront. Battery technology is seeing significant improvements, leading to increased energy density and faster charging times. For instance, by early 2025, some new EV models are expected to offer ranges exceeding 400 miles on a single charge, a substantial leap from just a few years ago.

This progress directly impacts traditional motor fuel providers like Sunoco LP. The expanding network of EV charging stations, supported by government incentives and private investment, presents a direct challenge to Sunoco's core business of distributing gasoline and diesel. By the end of 2024, the US is projected to have over 150,000 public charging ports, a number expected to grow significantly in 2025.

This technological shift necessitates a strategic re-evaluation for Sunoco, potentially requiring diversification into alternative energy solutions or services that complement the evolving transportation sector. Failure to adapt could lead to a diminished market share as consumer preference shifts towards EVs.

Ongoing technological advancements in internal combustion engine (ICE) design are consistently boosting fuel efficiency. For instance, by 2024, the average fuel economy for new passenger cars in the U.S. reached approximately 28.6 miles per gallon, a notable increase that directly impacts fuel demand per mile driven.

These incremental improvements, while not as drastic as the shift to electric vehicles, steadily reduce the overall consumption of gasoline and diesel over time. This trend directly affects Sunoco LP's wholesale fuel volumes, as fewer gallons are needed to cover the same distance.

Automakers are committed to continuous innovation in ICE technology, focusing on areas like advanced combustion strategies, lighter materials, and more efficient transmissions. This persistent development ensures that even traditional engines become more economical, further pressuring demand for traditional motor fuels.

Innovations in telematics and route optimization software are revolutionizing fuel distribution. For Sunoco LP, these technologies offer the potential to significantly cut operational costs by finding the most efficient delivery paths. For instance, advanced algorithms can consider real-time traffic data and fuel prices, leading to substantial savings.

Real-time inventory management systems are also a game-changer. By providing instant visibility into fuel levels at various locations, Sunoco can prevent stockouts and reduce unnecessary trips, directly impacting efficiency and customer satisfaction. This data-driven approach ensures resources are allocated optimally across the distribution network.

The advent of autonomous delivery vehicles presents a future opportunity for even greater efficiency and cost reduction in logistics. While still in development for widespread fuel transport, the potential for reduced labor costs and 24/7 operational capacity is immense, further strengthening Sunoco's competitive edge in the coming years.

Digitalization of Retail Operations and Payment Systems

Technological advancements are reshaping how customers interact with fuel stations and convenience stores. Upgraded point-of-sale (POS) systems and mobile payment options, like those seen with widespread adoption of contactless payments, can significantly enhance the customer experience at Sunoco LP's locations. For instance, in 2024, the global mobile payment market is projected to reach over $2.5 trillion, indicating a strong consumer preference for digital transactions.

Implementing secure and intuitive digital solutions is crucial for Sunoco to remain competitive and attract new customers. Loyalty programs, increasingly integrated with mobile apps, offer personalized discounts and rewards, fostering repeat business. By leveraging data analytics from these digital touchpoints, Sunoco can gain valuable insights into customer behavior, enabling more informed operational and marketing decisions.

- Enhanced Customer Experience: Modern POS and mobile payment systems streamline transactions, reducing wait times.

- Increased Customer Loyalty: Integrated digital loyalty programs incentivize repeat visits and purchases.

- Data-Driven Insights: Analytics from digital operations inform inventory management, marketing, and service improvements.

- Competitive Advantage: Adopting new technologies helps Sunoco stand out in a crowded retail fuel market.

Development of Alternative Fuels and Biofuels

The ongoing research and development in alternative fuels, including advanced biofuels and hydrogen, presents a dynamic landscape for Sunoco LP. While these technologies are still in their nascent stages for widespread automotive use, their eventual adoption could significantly influence the demand for traditional gasoline and diesel fuels.

For instance, the U.S. Department of Energy's Bioenergy Technologies Office (BETO) continues to invest in developing sustainable aviation fuels and advanced biofuels, aiming to reduce greenhouse gas emissions. In 2024, projected investments in bioenergy research and development are expected to support pathways that could eventually compete with fossil fuels in transportation sectors.

This technological evolution necessitates that Sunoco LP closely monitor these trends. A future where hydrogen fuel cells or advanced biofuels become dominant could require substantial adjustments to Sunoco's existing product offerings and extensive distribution networks, potentially creating both challenges and new market opportunities.

- Monitoring R&D: Keeping a close watch on advancements in hydrogen fuel, synthetic fuels, and next-generation biofuels is crucial for strategic planning.

- Market Potential: While not yet mainstream, the long-term potential for these alternative fuels to disrupt the traditional fuel market is significant.

- Infrastructure Adaptation: Sunoco LP may need to consider how its current infrastructure could be adapted or expanded to accommodate new fuel types in the future.

Technological shifts towards electric vehicles (EVs) and improved internal combustion engine (ICE) efficiency are reducing demand for traditional fuels. For instance, by early 2025, some EVs are expected to exceed 400 miles range, while average new car fuel economy in the U.S. reached approximately 28.6 mpg in 2024.

Advancements in logistics, such as telematics and route optimization, offer Sunoco LP significant cost reduction opportunities in its distribution network. Real-time inventory management systems further enhance operational efficiency by preventing stockouts and minimizing unnecessary trips.

The evolving digital landscape impacts customer interaction, with mobile payments and loyalty apps becoming key for customer retention and data insights. By 2024, the global mobile payment market was projected to exceed $2.5 trillion, highlighting a strong consumer preference for digital transactions.

Research into alternative fuels like advanced biofuels and hydrogen is ongoing, with significant investment in bioenergy R&D in 2024. These developments could necessitate future adaptations in Sunoco's infrastructure and product offerings.

Legal factors

Sunoco LP operates under a complex web of environmental regulations, including the Clean Air Act and Clean Water Act, which dictate emissions and discharge standards. Failure to comply with these federal, state, and local laws, particularly at their extensive storage terminals and fuel handling facilities, can result in significant financial penalties and legal challenges.

For instance, environmental compliance costs can be substantial; in 2023, the Environmental Protection Agency (EPA) reported that industries spent billions on environmental compliance, a figure expected to continue as regulations evolve. Sunoco must therefore maintain robust internal policies and conduct frequent audits to ensure adherence, mitigating risks of fines and reputational harm.

Sunoco LP operates under stringent legal mandates concerning fuel quality and safety. These regulations, set by agencies like the Environmental Protection Agency (EPA) in the U.S., define acceptable levels for components such as sulfur content and octane ratings, directly impacting the products Sunoco distributes. For instance, the EPA's Tier 3 standards, implemented progressively from 2017, mandate significant reductions in vehicle emissions and require gasoline with lower sulfur content, a factor Sunoco must ensure in its supply chain.

Failure to adhere to these evolving legal requirements can result in severe consequences for Sunoco. Non-compliance can trigger costly product recalls, lead to substantial fines, and create significant liability issues, potentially damaging the company's reputation and eroding consumer confidence. The dynamic nature of these regulations means Sunoco must continuously monitor and adapt its operations to remain compliant.

Sunoco LP, like all employers in the United States, must navigate a complex web of labor laws. These include federal regulations such as the Fair Labor Standards Act, which dictates minimum wage and overtime pay, and the Occupational Safety and Health Act, setting workplace safety standards. For instance, in 2024, the U.S. Department of Labor continued to enforce wage and hour laws, with significant penalties for non-compliance. Additionally, anti-discrimination statutes like Title VII of the Civil Rights Act of 1964 remain critical, prohibiting bias in hiring and employment practices.

Adherence to these legal frameworks is not merely a matter of avoiding litigation; it's fundamental to effective workforce management and fostering a productive atmosphere. Failure to comply can lead to costly lawsuits and damage to Sunoco's reputation. For example, a significant settlement in 2023 involving a major retail employer for wage and hour violations underscored the financial risks associated with labor law breaches.

Furthermore, evolving labor legislation can directly influence Sunoco's operational expenditures. Proposed changes to minimum wage laws or new mandates for employee benefits, which were actively debated in various states throughout 2024, could necessitate adjustments to payroll and human resource budgets, impacting overall profitability.

Antitrust and Competition Laws

Sunoco LP operates within a highly competitive energy sector, necessitating strict adherence to antitrust and competition laws. These regulations are in place to prevent monopolistic practices, price collusion, and other unfair competitive behaviors that could harm consumers and the market. For instance, the Federal Trade Commission (FTC) actively monitors mergers and acquisitions to ensure they do not unduly concentrate market power. In 2023, the FTC reviewed thousands of transactions, a number expected to remain robust in 2024 and 2025, reflecting ongoing regulatory vigilance.

Sunoco's strategic decisions, including potential mergers, acquisitions, or significant market expansions, undergo rigorous legal review to confirm compliance with these antitrust statutes. Failure to comply can result in substantial fines and operational restrictions. For example, in 2022, a major energy company faced a significant penalty for anticompetitive practices related to fuel distribution. This underscores the critical importance of proactive legal counsel in navigating these complex regulations.

- Antitrust Compliance: Sunoco must ensure its operations and strategic moves, like potential acquisitions, do not violate regulations against monopolies or price fixing.

- Market Scrutiny: Regulatory bodies, such as the FTC, actively monitor the energy market for anticompetitive behaviors, with thousands of transactions reviewed annually.

- Legal Ramifications: Non-compliance can lead to severe penalties, including substantial fines and limitations on business activities, as seen in past industry cases.

- Fair Competition: Adherence to these laws is crucial for maintaining a fair and open marketplace, benefiting both consumers and other businesses in the sector.

Master Limited Partnership (MLP) Specific Regulations

As a Master Limited Partnership (MLP), Sunoco LP operates under a distinct set of tax and regulatory rules. A key requirement is generating a significant portion of its income from qualifying sources, typically related to natural resources. For instance, in 2024, the IRS continues to scrutinize MLP income streams to ensure compliance with these qualifying income tests.

Changes in tax laws, particularly those affecting pass-through entities or specific energy sectors, can directly influence Sunoco's financial health and investor attractiveness. For example, potential shifts in corporate tax rates or new deductions could alter the relative appeal of MLP structures compared to C-corporations.

Navigating these specialized regulations is essential for Sunoco's operational and financial strategy. This includes staying abreast of any updates to the definition of qualifying income or new reporting mandates that could affect its tax status and distribution capabilities.

- Qualifying Income Threshold: MLPs generally must derive at least 90% of their gross income from qualifying sources, often related to the transportation, storage, and processing of oil, natural gas, and refined products.

- Tax Treatment: MLP income is typically taxed at the individual partner level, avoiding double taxation common with C-corporations.

- Regulatory Scrutiny: Tax authorities, like the IRS, regularly review MLP structures to ensure ongoing compliance with MLP-specific tax provisions.

- Impact of Tax Reform: Legislative changes impacting pass-through entities or specific energy industry tax incentives can significantly alter an MLP's competitive positioning and investor returns.

Sunoco LP must adhere to a variety of legal frameworks governing its operations, from environmental protection to labor laws and antitrust regulations. Compliance with fuel quality and safety standards, such as the EPA's Tier 3 standards, is critical to avoid penalties and maintain consumer trust. Labor laws, including wage and hour regulations and workplace safety, are also paramount, with significant financial risks associated with non-compliance, as highlighted by substantial settlements in recent years.

The company's status as a Master Limited Partnership (MLP) subjects it to specific tax regulations, requiring a majority of income to be derived from qualifying sources, a factor under ongoing IRS scrutiny. Furthermore, Sunoco must navigate antitrust laws, ensuring its market activities do not constitute monopolistic practices, with regulatory bodies like the FTC actively monitoring the energy sector for such behaviors.

| Legal Area | Key Regulations/Considerations | Potential Impact/Consequences | Recent Data/Trends (2023-2025) |

| Environmental | Clean Air Act, Clean Water Act, EPA Standards | Fines, legal challenges, operational restrictions | Billions spent on environmental compliance by industries; evolving regulations |

| Fuel Quality & Safety | EPA Tier 3 Standards, sulfur content, octane ratings | Product recalls, fines, liability, reputational damage | Progressive implementation of stricter emission standards |

| Labor Law | FLSA, OSHA, Title VII | Lawsuits, fines, increased labor costs, reputational harm | Continued enforcement of wage/hour laws; debates on minimum wage increases |

| Antitrust | FTC oversight, anti-monopoly laws | Substantial fines, operational limitations, merger scrutiny | Thousands of transactions reviewed annually by FTC for market concentration |

| MLP Taxation | Qualifying income tests, IRS scrutiny | Tax status changes, impact on investor returns, regulatory adjustments | Ongoing IRS review of MLP income streams; potential shifts in pass-through entity taxation |

Environmental factors

The intensifying global and national emphasis on climate change is driving policies to curb carbon emissions, directly affecting the fossil fuel sector. Sunoco LP, as a significant player in fuel logistics, faces mounting pressure to address its carbon footprint across its operations. This necessitates potential investments in greener technologies and carbon offset programs to comply with evolving environmental regulations and stakeholder expectations.

The storage and distribution of petroleum products, a core part of Sunoco LP's operations, inherently involve the risk of spills and environmental contamination. These incidents can lead to significant ecological damage, requiring extensive and expensive cleanup efforts.

For Sunoco LP, a spill could translate into hefty regulatory fines and substantial reputational damage, impacting customer trust and investor confidence. For example, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce strict regulations on petroleum handling, with penalties for violations often reaching millions of dollars.

To counter these threats, Sunoco LP must maintain and continuously improve its environmental management systems. This includes investing in advanced containment technologies and rigorous employee training to minimize the likelihood of such events and ensure swift, effective responses if they occur.

Sunoco's operations, especially at terminals and during facility upkeep, face environmental scrutiny regarding water usage and potential contamination. Adherence to strict regulations for wastewater discharge and storm water management is crucial for maintaining water quality and promoting sustainability. For instance, in 2023, the EPA continued to enforce Clean Water Act regulations, with significant fines levied against companies for non-compliance in water discharge, underscoring the importance of robust management systems.

Furthermore, the increasing reality of water scarcity in various operational regions presents a potential challenge for Sunoco. As climate patterns shift, ensuring reliable access to water for essential processes, including equipment cleaning and fire suppression systems, will become a more prominent strategic consideration. Reports from the U.S. Drought Monitor in late 2024 indicated persistent drought conditions in several key Sunoco operating areas, highlighting the growing relevance of this environmental factor.

Waste Management and Recycling

Sunoco LP, like many in the energy sector, faces scrutiny regarding the environmental impact of waste generated from its extensive network of retail outlets and fuel terminals. Responsible waste management is crucial for maintaining regulatory compliance and minimizing ecological impact. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that the commercial and industrial sectors generated approximately 150 million tons of waste, highlighting the scale of the challenge.

The company's commitment to environmental stewardship involves adhering to stringent waste disposal regulations and actively seeking opportunities for waste reduction and recycling. This proactive approach not only helps in managing operational costs but also enhances Sunoco's corporate social responsibility profile. By implementing effective waste handling protocols, Sunoco aims to reduce its carbon footprint and contribute to a more sustainable future.

Key areas for improvement and focus include:

- Minimizing single-use materials at retail locations.

- Implementing robust recycling programs for operational waste, such as used oil filters and packaging.

- Exploring innovative waste-to-energy solutions for non-recyclable byproducts.

- Ensuring all waste disposal practices meet or exceed federal and state environmental standards.

Biodiversity and Land Use Impact

Sunoco LP's operations, particularly its fuel terminals and distribution networks, directly interact with the environment, raising concerns about biodiversity and land use. The company's physical footprint, from existing terminals to potential new developments, necessitates careful consideration of its impact on local ecosystems and wildlife habitats. For instance, the expansion of infrastructure could lead to habitat fragmentation or loss, affecting species diversity in the surrounding areas.

As environmental regulations and public awareness grow, Sunoco must integrate sustainable land management practices into its strategic planning. This includes minimizing land disturbance during construction, implementing effective erosion control measures, and considering the ecological value of the land it occupies or develops. The increasing emphasis on conservation and biodiversity protection means that responsible land use is not just an environmental consideration but also a critical factor for maintaining social license to operate and mitigating potential regulatory risks.

In 2023, Sunoco LP reported that its capital expenditures included investments in environmental compliance and improvements across its terminals, reflecting an ongoing commitment to managing its environmental footprint. While specific figures on biodiversity impact are not publicly detailed, the company's sustainability reports highlight efforts to reduce emissions and manage waste, which indirectly support healthier ecosystems. The trend towards greater transparency in environmental, social, and governance (ESG) reporting suggests that Sunoco will likely face increasing scrutiny regarding its land use and biodiversity management in the coming years.

Key considerations for Sunoco regarding biodiversity and land use include:

- Minimizing Habitat Disruption: Evaluating new site locations and expansion plans to avoid ecologically sensitive areas and critical wildlife corridors.

- Sustainable Site Management: Implementing practices that reduce soil erosion, manage stormwater runoff effectively, and promote native vegetation where appropriate.

- Regulatory Compliance: Adhering to all local, state, and federal regulations pertaining to land use, environmental protection, and endangered species.

- Stakeholder Engagement: Engaging with local communities and environmental groups to understand and address concerns related to land use and biodiversity.

The increasing focus on climate change and emissions reduction directly impacts Sunoco's fossil fuel logistics operations, requiring potential investments in greener technologies and carbon offsetting to meet evolving regulations. The company must also manage the inherent risks of spills, which can lead to substantial fines, with the EPA continuing strict enforcement in 2023, often imposing penalties in the millions for violations.

Sunoco's water management practices face scrutiny, necessitating adherence to Clean Water Act regulations, as highlighted by significant fines in 2023 for non-compliance. Furthermore, potential water scarcity in operational regions, evidenced by persistent drought conditions in late 2024 in several key areas, poses a growing strategic challenge for essential water access.

Responsible waste management is crucial, with the commercial and industrial sectors generating approximately 150 million tons of waste in 2023, according to EPA reports. Sunoco must adhere to stringent disposal regulations and explore waste reduction and recycling opportunities to enhance its corporate social responsibility and minimize its ecological impact.

Sunoco's physical footprint necessitates careful consideration of its impact on local ecosystems and biodiversity, with infrastructure expansion potentially leading to habitat fragmentation. The company reported capital expenditures in 2023 for environmental compliance and terminal improvements, indicating an ongoing commitment to managing its environmental footprint and adhering to ESG reporting standards.

PESTLE Analysis Data Sources

Our Sunoco PESTLE Analysis is constructed using a robust blend of official government reports, reputable financial news outlets, and leading industry publications. We meticulously gather data on energy policies, economic forecasts, and environmental regulations to ensure a comprehensive understanding of the macro-environment.