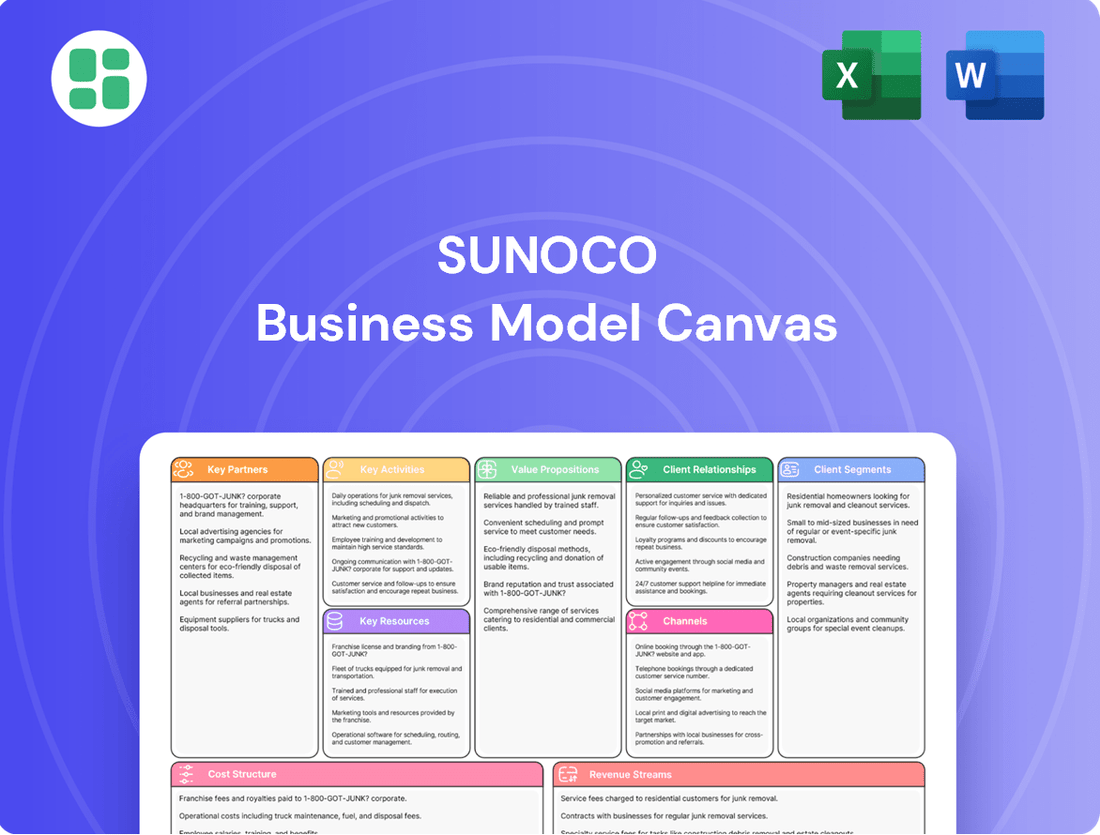

Sunoco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sunoco Bundle

Unlock the strategic blueprint of Sunoco's success with our comprehensive Business Model Canvas. This detailed analysis reveals how Sunoco effectively manages its customer relationships, key resources, and revenue streams to maintain its competitive edge in the energy sector. Discover the core components that drive their operations and market positioning.

Dive deeper into Sunoco's proven strategies by exploring the complete Business Model Canvas. This downloadable resource breaks down their value propositions, cost structures, and key partnerships, offering actionable insights for entrepreneurs and business strategists. Understand the framework that underpins their market dominance.

Want to dissect Sunoco's operational genius? Our full Business Model Canvas provides an in-depth, section-by-section breakdown of their business. Perfect for strategic planning or investor presentations, this editable document offers a clear roadmap to their success.

Partnerships

Sunoco LP's key partnerships with major refineries and fuel suppliers are critical for its operations. These relationships ensure a steady and varied supply of motor fuels, which is vital for managing the extensive inventory required across its broad distribution network.

In 2024, Sunoco's ability to secure diverse fuel sources directly impacts its competitive pricing and availability. The company's reach extends to over 40 U.S. states, Puerto Rico, Europe, and Mexico, highlighting the sheer volume of fuel sourcing needed to meet demand.

Sunoco LP collaborates with a network of independent dealers and franchisees who operate Sunoco-branded gas stations. This partnership strategy is crucial for expanding Sunoco's reach across diverse geographic areas, capitalizing on the local market knowledge and operational expertise of these business owners. In 2024, Sunoco LP continued to rely on this model to manage a significant portion of its retail fuel distribution network, demonstrating its effectiveness in scaling operations.

Sunoco LP relies heavily on third-party logistics providers, including trucking companies and potentially rail operators, to move its refined petroleum products. These partnerships are essential for cost-effective and secure transportation from their terminals to a wide array of customers, ranging from gas stations to industrial facilities.

In 2024, the efficiency of these logistics partnerships directly impacts Sunoco's ability to meet demand, especially given the fluctuating fuel prices and supply chain dynamics. For instance, optimizing delivery routes through these providers helps minimize fuel costs and delivery times, contributing to Sunoco's competitive pricing and customer satisfaction.

Convenience Store Operators

Sunoco LP's key partnerships include a wide array of convenience store operators, encompassing both major national chains and smaller regional businesses. These partnerships are crucial as they integrate fuel sales, a core offering for Sunoco, with the diverse retail merchandise and services provided by these convenience stores.

Sunoco LP acts as a vital wholesale fuel supplier to these operators. This relationship allows these convenience stores, whether branded as Sunoco or operating under different banners, to offer fuel to their customers. This significantly expands Sunoco's reach and customer base across the retail fuel market.

For instance, in 2024, Sunoco LP continued to be a significant fuel distributor to numerous convenience store locations, leveraging these relationships to maintain a strong presence in the fuel retail landscape. These partnerships are mutually beneficial, providing fuel suppliers with consistent demand and retailers with a reliable fuel source to drive traffic and sales.

- Diverse Operator Network Sunoco partners with both large national convenience store chains and smaller regional operators.

- Wholesale Fuel Provision Sunoco LP supplies fuel to these partners, enabling them to offer gasoline and diesel to consumers.

- Brand Flexibility The convenience stores can operate under the Sunoco brand or their own proprietary branding, broadening Sunoco's market penetration.

Energy Transfer LP (General Partner)

Energy Transfer LP's ownership of Sunoco LP's general partner and its incentive distribution rights creates a deep strategic alignment. This structure ensures Sunoco LP benefits from Energy Transfer's extensive energy infrastructure network, fostering potential for significant operational synergies and shared growth opportunities across the midstream sector.

This partnership is crucial for Sunoco LP's operational efficiency and market positioning. For instance, in 2023, Energy Transfer LP reported substantial growth in its distributable cash flow, a portion of which indirectly supports the strategic initiatives and financial stability of its controlled entities like Sunoco LP.

- Strategic Alignment: Energy Transfer LP's role as the general partner provides direct oversight and strategic direction for Sunoco LP.

- Synergistic Opportunities: The relationship facilitates integration and optimization of assets and operations within the broader Energy Transfer portfolio.

- Financial Support: As of early 2024, Energy Transfer LP's robust financial performance indicates a stable foundation for its subsidiaries, including Sunoco LP.

Sunoco LP's strategic alliances with convenience store operators are fundamental to its business model, acting as the primary interface for fuel sales to end consumers. These partnerships allow Sunoco to leverage the retail footprint and customer traffic of these stores, thereby expanding its market reach without direct ownership of all retail locations.

In 2024, Sunoco LP continued to solidify its position as a key fuel supplier to a vast network of convenience stores, both branded and unbranded. This approach diversifies Sunoco's customer base and revenue streams, ensuring consistent demand for its fuel products. For example, Sunoco's distribution network serves thousands of retail sites across the United States.

These collaborations are vital for Sunoco's operational strategy. By supplying fuel, Sunoco enables these convenience store partners to offer a core product that drives customer visits, which in turn benefits Sunoco through increased fuel volume. This symbiotic relationship is crucial for maintaining Sunoco's competitive edge in the fuel distribution market.

| Key Partnership Type | Description | 2024 Relevance |

|---|---|---|

| Convenience Store Operators | Supplying fuel to branded and unbranded convenience stores. | Drives retail fuel sales volume and broad market penetration. |

| Independent Dealers & Franchisees | Partnering with operators who run Sunoco-branded stations. | Expands geographic reach and leverages local market expertise. |

| Logistics Providers | Utilizing third-party trucking and potentially rail services. | Ensures cost-effective and efficient fuel transportation. |

| Energy Transfer LP | General partner relationship with extensive infrastructure access. | Provides strategic direction, operational synergies, and financial stability. |

What is included in the product

A comprehensive, pre-written business model tailored to Sunoco's strategy, covering customer segments, channels, and value propositions in detail.

Reflects Sunoco's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Sunoco's Business Model Canvas provides a clear, one-page snapshot that simplifies complex operational details, reducing the pain of information overload for stakeholders.

It streamlines strategic planning by offering a structured framework for understanding Sunoco's value proposition and customer relationships, alleviating the difficulty of ad-hoc strategy development.

Activities

Sunoco's core activity in wholesale fuel distribution and sales centers on procuring motor fuels in large quantities and then efficiently distributing them to a diverse customer base. This includes a broad network of retail service stations, independent fuel dealers, and various commercial enterprises that rely on a steady fuel supply.

This operational facet involves meticulous inventory management, optimizing complex logistics, and precisely scheduling deliveries. The goal is to guarantee a dependable and uninterrupted flow of fuel, which is critical for their customers' operations and Sunoco's market presence.

In 2024, the U.S. gasoline demand was projected to be around 8.7 million barrels per day, highlighting the substantial market Sunoco operates within. Efficient distribution networks are therefore paramount to capturing a significant share of this demand.

Sunoco LP's refined product terminal operations are a cornerstone of its business, managing over 100 terminals critical for storing, blending, and distributing gasoline and diesel. These facilities are essential for maintaining supply chain efficiency and ensuring product availability across the United States. In 2024, Sunoco's extensive terminal network plays a pivotal role in its ability to reliably serve its customer base.

Sunoco's logistics and supply chain management are critical for efficiently moving refined petroleum products. This involves optimizing pipelines, trucking, and rail transportation to ensure timely delivery to terminals and end-users. In 2024, Sunoco continued to leverage its extensive network, aiming to reduce transit times and fuel costs.

The company's strategy focuses on maintaining lean inventory levels while ensuring product availability across its distribution footprint. This careful balance helps manage storage expenses and reduces the risk of product obsolescence or spoilage. Effective inventory management is key to meeting fluctuating market demand.

Sunoco's operational efficiency is directly tied to its supply chain's performance. By meticulously planning delivery schedules and monitoring transportation assets, the company aims to minimize downtime and maximize throughput. This focus on operational excellence supports their commitment to reliable product distribution.

Acquisitions and Strategic Investments

Sunoco LP strategically grows its operations through acquisitions, aiming to bolster its energy infrastructure and fuel distribution network. A prime example is the 2023 acquisition of Parkland Corporation's U.S. retail assets, a move that significantly expanded its footprint. This growth strategy is designed to increase market share and enhance overall throughput volumes.

These key activities are crucial for Sunoco's expansion and market positioning. By integrating acquired assets, the company aims to achieve greater operational efficiencies and unlock new growth avenues. The focus remains on strengthening its competitive advantage in the fuel distribution sector.

- Acquisition of Parkland's U.S. Retail Assets: Completed in 2023, this acquisition added approximately 1,400 retail sites, significantly boosting Sunoco's presence.

- TanQuid Acquisition: This earlier acquisition further solidified Sunoco's position in the fuel distribution market, adding valuable infrastructure.

- Growth Through Expansion: These strategic moves are designed to increase throughput volumes and enhance Sunoco's overall market penetration and revenue generation.

Financial Management and Investor Relations

Sunoco's key activities in financial management and investor relations are crucial for its operational health and growth. These include meticulously managing financial performance, which involves tracking revenue, expenses, and profitability to ensure efficient operations. Reporting results is another vital activity, encompassing the preparation of accurate quarterly and annual financial statements that adhere to regulatory standards.

Engaging with the investment community is paramount for maintaining investor confidence and attracting capital. This involves proactive communication strategies. For instance, Sunoco conducts regular earnings calls to discuss financial results and future outlook. In 2023, Sunoco reported total revenue of $18.9 billion. Transparency in communication is key to building trust and demonstrating the company's financial stability and strategic direction to shareholders and potential investors.

- Financial Performance Management

- Regulatory Reporting and Compliance

- Investor Communications and Engagement

- Capital Attraction and Stakeholder Relations

Sunoco's key activities revolve around the efficient distribution of motor fuels, managing over 100 refined product terminals, and optimizing complex logistics across pipelines, trucking, and rail. The company also strategically pursues growth through acquisitions, such as the significant 2023 purchase of Parkland's U.S. retail assets, to expand its market footprint and increase throughput volumes.

Financial management, including meticulous performance tracking and regulatory reporting, is also a core activity. Sunoco actively engages with investors through earnings calls and transparent communication, as evidenced by its 2023 revenue of $18.9 billion, to maintain confidence and secure capital for continued growth.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Wholesale Fuel Distribution | Procuring and delivering fuels to a wide customer base. | U.S. gasoline demand projected around 8.7 million bpd in 2024. |

| Terminal Operations | Managing over 100 terminals for storage, blending, and distribution. | Crucial for supply chain efficiency and product availability. |

| Logistics and Supply Chain | Optimizing transportation for timely deliveries. | Focus on reducing transit times and fuel costs in 2024. |

| Strategic Acquisitions | Expanding network through asset purchases. | 2023 acquisition of Parkland's U.S. retail assets added ~1,400 sites. |

| Financial Management & Investor Relations | Managing performance, reporting, and stakeholder engagement. | 2023 revenue of $18.9 billion reported; ongoing investor communication. |

Full Version Awaits

Business Model Canvas

The Sunoco Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured analysis, allowing you to immediately leverage its insights for your strategic planning.

Resources

Sunoco LP's extensive distribution infrastructure is a cornerstone of its business model. This network includes roughly 14,000 miles of pipelines and over 100 terminals strategically located across the United States, Puerto Rico, Europe, and Mexico. This vast physical footprint ensures efficient and widespread delivery of motor fuels to a broad customer base.

Sunoco's refined product terminals and storage facilities are a cornerstone of its operations, offering significant storage capacity and crucial control over product quality and blending. These assets are strategically positioned across its network, ensuring efficient supply chain management.

In 2024, Sunoco LP continued to leverage its extensive terminal network. The company's infrastructure plays a vital role in its distribution capabilities, facilitating the movement of refined products to market.

Sunoco's brand enjoys substantial historical recognition and a wide reach, operating at roughly 7,400 Sunoco and affiliated locations. This strong brand equity and extensive network are crucial for attracting and keeping independent dealers and commercial clients.

Supply Contracts and Customer Agreements

Sunoco LP's supply contracts and customer agreements are foundational to its business model, acting as critical intangible assets. These long-term relationships with fuel suppliers and a broad customer base are designed to ensure a steady supply of products and predictable revenue streams. For instance, in 2024, Sunoco continued to leverage its extensive network of approximately 10,000 customer locations, many of which are secured through multi-year agreements. These contracts provide a vital layer of stability, mitigating the volatility often seen in the energy sector.

The company's strategy relies heavily on these contractual frameworks to maintain operational efficiency and financial predictability. By securing these agreements, Sunoco can better manage its inventory and distribution, directly impacting its ability to generate consistent earnings. This focus on contractual stability is a key differentiator, allowing Sunoco to offer reliable service and product availability to its diverse clientele.

- Long-term supply agreements with major refiners ensure consistent access to fuel products.

- Diverse customer base, including independent dealers and commercial end-users, diversifies revenue sources.

- Contractual relationships are key intangible assets supporting revenue stability and predictability.

- Customer agreements often include volume commitments, bolstering revenue forecasts.

Skilled Workforce and Management Expertise

Sunoco's skilled workforce and management expertise are critical for its success in the fuel distribution sector. This includes professionals adept at logistics, ensuring efficient fuel delivery, and operations specialists who manage complex supply chains. In 2024, Sunoco continued to invest in training and development to maintain a high level of competency across its teams, recognizing that industry knowledge is paramount for navigating market fluctuations and regulatory changes.

The company's management team possesses deep experience in the energy industry, guiding strategic decisions for growth and profitability. This expertise is crucial for identifying new market opportunities and optimizing existing operations. For instance, their financial management capabilities are essential for managing capital expenditures and ensuring financial stability in a capital-intensive industry.

- Logistics and Supply Chain Professionals: Expertise in managing fuel transportation, storage, and delivery networks.

- Operations Management: Skilled individuals overseeing terminal operations, quality control, and regulatory compliance.

- Sales and Marketing Teams: Professionals driving customer acquisition and retention in competitive fuel markets.

- Financial and Administrative Experts: Ensuring sound financial planning, risk management, and corporate governance.

Sunoco's key resources include its substantial distribution infrastructure, brand recognition, long-term supply and customer contracts, and a skilled workforce. These assets collectively enable efficient fuel delivery, market penetration, and stable revenue generation. In 2024, the company continued to optimize its vast network of approximately 14,000 miles of pipelines and over 100 terminals, reinforcing its operational capabilities and market position.

| Key Resource | Description | 2024 Relevance/Data |

| Distribution Infrastructure | Pipelines, terminals, and storage facilities | ~14,000 miles of pipelines, >100 terminals |

| Brand Recognition | Widely recognized Sunoco brand | ~7,400 Sunoco and affiliated locations |

| Supply & Customer Contracts | Long-term agreements with suppliers and customers | Secures steady supply and predictable revenue streams |

| Skilled Workforce & Management | Expertise in logistics, operations, and finance | Essential for navigating market dynamics and ensuring efficiency |

Value Propositions

Sunoco LP's commitment to reliable fuel supply is a cornerstone of its business. In 2024, the company continued to be a major distributor, ensuring that its extensive network of over 10,000 locations, including convenience stores and independent dealers, had consistent access to motor fuels. This dependability is crucial for their customers to meet the daily demands of consumers without interruption.

Sunoco LP's extensive distribution network ensures customers receive fuel efficiently and on time across a broad geographic footprint. This vast reach simplifies logistics for businesses, guaranteeing product availability precisely when and where it's needed.

In 2024, Sunoco LP's terminals and distribution infrastructure played a crucial role in serving its diverse customer base, which includes major fuel brands and independent retailers. The company's commitment to operational excellence in its distribution channels directly translates to enhanced reliability for its partners.

Sunoco LP provides optimized logistics and supply chain solutions, enabling partners to reduce fuel procurement and inventory expenses. This focus on efficiency helps customers streamline operations and cut costs, allowing them to concentrate on their primary business activities.

In 2024, Sunoco's extensive distribution network, comprising over 10,000 miles of pipelines and a large fleet of transport vehicles, facilitated the reliable delivery of approximately 14 billion gallons of fuel. This robust infrastructure is key to minimizing partner operational costs.

Flexible Branding and Partnership Opportunities

Sunoco offers adaptable branding and partnership structures, enabling independent dealers and convenience stores to either capitalize on the established Sunoco brand recognition or utilize Sunoco's wholesale distribution for their proprietary brands. This adaptability supports varied business objectives and market approaches.

This flexibility is crucial for businesses looking to optimize their market presence. For instance, in 2024, Sunoco continued to support a network of thousands of branded locations, demonstrating the ongoing demand for its brand association and supply chain capabilities.

- Brand Leverage: Dealers can operate under the well-known Sunoco banner, benefiting from national advertising and customer loyalty.

- Private Label Support: Sunoco's wholesale distribution allows businesses to maintain their own brand identity while ensuring reliable fuel supply.

- Partnership Models: The company provides various contractual arrangements to suit different dealer and operator needs, fostering strong relationships.

- Market Reach: This approach allows Sunoco to maintain a significant presence across diverse geographic markets and consumer segments.

Strategic Infrastructure and Terminal Access

Sunoco LP's strategic infrastructure and terminal access provides customers with a significant advantage. This includes access to a robust network of refined product terminals, enabling greater control over fuel supply chains. For instance, in 2024, Sunoco LP continued to optimize its terminal operations, enhancing efficiency for its partners.

This access to extensive midstream assets translates into tangible benefits for customers. They can potentially reduce transportation costs and ensure a more reliable flow of fuel. The stable and well-established distribution platform offered by Sunoco LP is a core component of its value proposition.

- Enhanced Supply Chain Control: Customers benefit from direct access to Sunoco's terminal network, allowing for more predictable fuel sourcing.

- Potential Cost Reductions: Leveraging Sunoco's infrastructure can lead to lower transportation expenses for fuel distribution.

- Operational Stability: The extensive and maintained midstream assets provide a reliable foundation for business operations.

- Market Reach: Access to a widespread terminal network facilitates broader market penetration for fuel products.

Sunoco LP's value proposition centers on providing reliable fuel distribution through an extensive network, ensuring consistent product availability for over 10,000 locations. Their optimized logistics and supply chain solutions help partners reduce costs and streamline operations. Furthermore, Sunoco offers flexible branding options, allowing businesses to leverage the Sunoco brand or their private labels while benefiting from robust infrastructure and terminal access for enhanced supply chain control.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Reliable Fuel Distribution | Ensuring consistent fuel supply across a vast network. | Served over 10,000 locations, distributing approximately 14 billion gallons. |

| Optimized Logistics & Cost Savings | Reducing fuel procurement and inventory expenses for partners. | Facilitated efficiency gains for independent dealers and convenience stores. |

| Flexible Branding & Partnership | Supporting both Sunoco brand and private label strategies. | Continued support for thousands of branded locations, demonstrating brand strength. |

| Infrastructure & Terminal Access | Providing access to terminals for enhanced supply chain control. | Optimized terminal operations to improve partner efficiency and reliability. |

Customer Relationships

Sunoco LP prioritizes robust relationships with its significant business-to-business clientele, including major commercial entities and independent fuel retailers, by assigning dedicated account managers. This tailored strategy guarantees that individual requirements are thoroughly addressed, contractual obligations are handled with maximum efficiency, and enduring alliances are cultivated.

Sunoco LP solidifies customer relationships through long-term supply agreements, often spanning multiple years. These contracts are crucial for providing stability and predictability, ensuring a consistent flow of fuel for their diverse customer base, which includes distributors and retail sites.

These multi-year fuel supply contracts act as a cornerstone for sustained business operations and foster mutual growth. For instance, in 2024, Sunoco LP continued to leverage these agreements to secure its market position and revenue streams, demonstrating the ongoing importance of these formalized relationships in their business model.

Sunoco LP offers dedicated wholesale customer support, ensuring fuel order, delivery, and billing inquiries are handled promptly. This commitment to responsive service is crucial for maintaining seamless operations for their business partners.

In 2024, Sunoco LP's focus on operational efficiency for its wholesale segment directly impacts its ability to secure and retain a significant customer base, contributing to its overall market position.

Dealer and Partner Programs

Sunoco's dealer and partner programs are crucial for maintaining its extensive network of branded stations. For independent dealers, these programs often include vital marketing assistance, such as co-op advertising funds and promotional materials, to help drive customer traffic. Operational guidance is also a key component, offering best practices for station management and customer service.

Access to industry insights and market trends empowers these partners to adapt and thrive. This support system is designed to bolster the success of each independent dealer, thereby strengthening the overall Sunoco brand and its market presence. For instance, in 2024, Sunoco continued its focus on supporting its dealer network through various initiatives aimed at enhancing brand visibility and operational efficiency.

- Marketing Support: Providing co-op advertising funds and promotional campaigns to increase brand awareness at the local level.

- Operational Guidance: Offering training and resources on best practices for station operations, safety, and customer service.

- Industry Insights: Sharing market data and trend analysis to help dealers make informed business decisions.

- Network Strength: These programs foster loyalty and drive collective success, reinforcing Sunoco's position in the fuel retail market.

Digital Platforms for Streamlined Interaction

Sunoco LP enhances customer relationships through robust digital platforms, offering seamless online portals for order placement and delivery tracking. This digital infrastructure significantly streamlines interactions, making it easier for clients to manage their business with Sunoco.

These systems not only improve convenience but also boost operational efficiency for both Sunoco and its customers by providing real-time updates and simplified invoicing processes. For instance, in 2023, Sunoco reported continued investment in its digital capabilities, aiming to further integrate its supply chain and customer service functions.

- Online Portals: Dedicated web portals allow customers to place orders, manage accounts, and access historical data.

- Delivery Tracking: Real-time tracking of fuel deliveries provides transparency and predictability for customer operations.

- Invoicing and Payments: Digital invoicing and payment options simplify financial transactions and reduce administrative overhead.

- Customer Support: Integrated digital channels facilitate efficient communication and support for customer inquiries.

Sunoco LP cultivates strong customer relationships through dedicated account management for its commercial clients and independent fuel retailers. This personalized approach ensures specific needs are met, fostering long-term partnerships and operational efficiency.

Long-term supply agreements, often multi-year, provide stability for Sunoco's diverse customer base, including distributors and retail sites. These contracts are vital for securing market position and revenue streams, as evidenced by continued reliance on these agreements throughout 2024.

Sunoco's dealer and partner programs are essential for its branded station network, offering marketing support like co-op advertising and operational guidance. In 2024, initiatives focused on enhancing dealer success and brand visibility were a priority.

Digital platforms, including online portals for ordering and real-time delivery tracking, streamline customer interactions and improve operational efficiency. Sunoco's continued investment in these digital capabilities, as seen in 2023, aims to further integrate its customer service functions.

| Customer Segment | Relationship Strategy | Key Support/Tools | 2024 Focus/Impact |

| Commercial Entities & Independent Retailers | Dedicated Account Management | Tailored solutions, efficient contract handling | Cultivating enduring alliances, addressing specific requirements |

| Wholesale Customers (Distributors, Retail Sites) | Long-Term Supply Agreements | Stability, predictability, consistent fuel flow | Securing market position and revenue streams |

| Independent Dealers | Dealer & Partner Programs | Marketing assistance (co-op ads), operational guidance, industry insights | Enhancing brand visibility and operational efficiency for network success |

| All Customers | Digital Platforms | Online portals, real-time delivery tracking, digital invoicing | Streamlining interactions, improving convenience and operational efficiency |

Channels

Sunoco LP's wholesale sales force is the backbone of its B2B strategy, directly engaging independent dealers, convenience store operators, and commercial clients to secure fuel supply agreements. This direct approach allows for personalized service and strengthens crucial business relationships.

In 2024, Sunoco continued to leverage this dedicated sales team to expand its market reach. The company's focus on building these direct partnerships is a key driver of its wholesale volume, which forms a significant portion of its overall revenue streams.

Sunoco's company-owned and operated terminals are crucial for moving refined products. These facilities are essentially major distribution points where large customers can directly pick up fuel, or where Sunoco loads its own trucks for delivery. This direct control over terminals ensures efficiency and reliability in getting products to market.

In 2024, Sunoco continued to leverage its extensive terminal network, which is a core asset for its fuel distribution business. These terminals are strategically located to serve key markets, enabling Sunoco to efficiently manage the flow of gasoline, diesel, and other refined products. This direct channel bypasses intermediaries, allowing for better cost management and service for high-volume buyers.

Sunoco LP relies on a network of third-party transportation and logistics providers to ensure the efficient delivery of fuel. This strategy allows Sunoco to leverage specialized fleets and expertise, reaching a broad customer base across its extensive operational footprint.

In 2024, Sunoco's commitment to third-party logistics was evident in its operational efficiency, with a significant portion of its fuel distribution managed by these external partners. This approach helps manage capital expenditures related to transportation assets while ensuring reliable supply to over 10,000 customer locations.

Sunoco-Branded Retail Outlets (Indirect)

Sunoco-branded retail outlets, though operated indirectly by independent dealers and partners, serve as the vital consumer-facing touchpoint for Sunoco LP's fuels. These thousands of locations across the United States are where the end-consumer purchases gasoline, directly influencing demand that flows back through Sunoco's wholesale distribution network.

These retail stations are critical for brand visibility and consumer preference. In 2024, Sunoco LP continued to leverage its strong brand recognition through these independent operators, ensuring its fuels are readily available at convenient locations for millions of drivers daily.

- Consumer Interface: The primary role of these outlets is to connect Sunoco's fuel products directly with the end-user.

- Demand Generation: Sales at these retail locations drive the volume requirements for Sunoco's wholesale fuel distribution.

- Brand Presence: They act as physical billboards, reinforcing the Sunoco brand in local communities.

- Indirect Operation: Sunoco LP benefits from these channels without direct ownership or operational management of the individual stations.

Digital Communication and Customer Portals

Sunoco LP leverages digital communication and customer portals as key channels to streamline interactions with its business partners. These online platforms provide essential self-service capabilities, allowing partners to manage orders, access real-time information, and track deliveries efficiently. This digital approach significantly enhances accessibility and operational efficiency.

These channels are crucial for maintaining strong relationships with Sunoco's diverse customer base, including distributors and commercial clients. For instance, in 2024, Sunoco continued to invest in its digital infrastructure, aiming to improve user experience and data transparency. This focus on digital tools supports Sunoco's commitment to providing reliable and convenient service.

- Customer Self-Service: Partners can access account information, view transaction history, and manage their profiles online.

- Order Management: The portals facilitate easy placement and tracking of fuel orders, reducing administrative overhead for both Sunoco and its partners.

- Information Access: Real-time data on fuel availability, pricing, and delivery schedules is readily available, empowering partners with timely insights.

- Enhanced Efficiency: Digital channels reduce the need for manual processes, leading to faster response times and improved operational flow.

Sunoco LP utilizes a multi-faceted channel strategy, blending direct sales, owned infrastructure, third-party logistics, and a vast retail network to reach its diverse customer base. This approach ensures efficient fuel distribution and strong brand presence across the United States.

In 2024, Sunoco's wholesale operations continued to be driven by its direct sales force, engaging with over 10,000 customer locations. The company's extensive terminal network, a critical asset for product movement, supported these sales by providing reliable supply points. Furthermore, a significant portion of its distribution relied on third-party logistics providers, underscoring a flexible and capital-efficient operational model.

The Sunoco-branded retail outlets, though operated by independent partners, remain a crucial consumer interface, driving demand and brand visibility. Complementing these physical channels, Sunoco has invested in digital platforms to enhance customer service and operational efficiency for its business partners.

| Channel Type | Description | 2024 Focus/Activity | Key Benefit |

|---|---|---|---|

| Direct Sales Force | Engaging independent dealers, convenience stores, and commercial clients. | Expanding market reach and securing fuel supply agreements. | Personalized service, strengthened relationships. |

| Company-Owned Terminals | Distribution points for refined products, direct pick-up or Sunoco truck loading. | Leveraging strategically located terminals for efficient product flow. | Cost management, reliability for high-volume buyers. |

| Third-Party Logistics | Utilizing external transportation and logistics providers. | Managing a significant portion of fuel distribution, ensuring reliable supply. | Capital expenditure management, broad customer reach. |

| Branded Retail Outlets | Consumer-facing touchpoints operated by independent dealers. | Leveraging brand recognition and convenient locations for consumers. | Brand visibility, demand generation. |

| Digital Platforms | Customer portals and online communication tools. | Enhancing user experience and data transparency for partners. | Streamlined interactions, self-service capabilities. |

Customer Segments

Independent Fuel Dealers are a cornerstone of Sunoco's distribution strategy. These are the folks who run individual gas stations or even small chains, buying their fuel directly from Sunoco LP. They might fly the Sunoco flag or operate as unbranded stations, but either way, they're crucial to getting Sunoco's products to consumers.

In 2024, Sunoco LP's extensive network relies heavily on these independent dealers. They represent a significant portion of Sunoco's wholesale fuel sales, directly contributing to the company's revenue. Their ability to manage local markets and customer relationships is key to Sunoco's overall market penetration and success.

Sunoco LP serves large and regional convenience store chains, which are crucial customers. These companies integrate fuel sales into their extensive retail operations, making them significant purchasers of fuel in bulk from Sunoco LP to stock their numerous locations.

For example, in 2024, convenience stores continued to be a dominant force in fuel retail. The National Association of Convenience Stores (NACS) reported that convenience stores sell approximately 80% of all motor fuel purchased in the United States. This highlights the immense volume and consistent demand Sunoco LP can expect from this segment.

Sunoco serves businesses with substantial fuel needs, including trucking companies, construction firms, and government agencies. These commercial and industrial customers rely on consistent, high-volume fuel for their fleets and equipment.

In 2024, the transportation sector, a major consumer of fuel, continued to be a significant driver for companies like Sunoco. For example, the American Trucking Associations reported that in 2023, trucks moved approximately 11.5 billion tons of freight, underscoring the immense fuel demand from this segment.

Other Wholesale Distributors

Sunoco LP also supplies refined fuel products to other wholesale distributors. These partners acquire fuel from Sunoco's terminals, leveraging Sunoco's infrastructure to serve their own customer bases and reach secondary markets. This segment allows Sunoco to extend its market presence indirectly.

This wholesale channel is crucial for Sunoco's distribution strategy, enabling broader market penetration without direct operational control in every region. In 2024, Sunoco LP reported significant volumes distributed through its wholesale channels, underscoring the importance of these partnerships.

- Wholesale Distribution Network: Sunoco LP acts as a supplier to independent fuel distributors.

- Market Reach: This segment allows Sunoco to access markets where it may not have a direct retail presence.

- Infrastructure Leverage: Other distributors utilize Sunoco's terminal network for their own supply chains.

Retail Consumers (End-Users)

While Sunoco LP primarily deals with business-to-business transactions, the ultimate drivers of its success are the millions of individual consumers who fill up their vehicles at Sunoco-branded stations. These end-users represent the foundational demand that fuels the entire Sunoco operation.

The purchasing decisions of these retail consumers directly impact the volume of fuel distributed through Sunoco's network. In 2024, the U.S. gasoline consumption remained robust, with millions of vehicles on the road daily, underscoring the persistent need for fuel at the consumer level.

- End-User Demand: The daily decisions of individual drivers to purchase gasoline and diesel at Sunoco-branded locations are the primary demand signal.

- Market Reach: Millions of retail consumers across various demographics rely on Sunoco-supplied fuel for their transportation needs.

- Economic Indicator: Consumer driving habits and fuel purchasing patterns serve as a key indicator for Sunoco's wholesale fuel distribution volumes.

Sunoco LP's customer segments are diverse, ranging from independent fuel dealers and large convenience store chains to commercial enterprises and other wholesale distributors. Ultimately, the success of Sunoco's business model hinges on the consistent demand from millions of individual retail consumers who purchase fuel at Sunoco-branded locations.

In 2024, the company's extensive network relies on these varied customer groups to drive wholesale fuel sales and maintain market presence. The collective purchasing power of these segments directly translates into the significant volumes Sunoco LP distributes daily.

| Customer Segment | Description | 2024 Relevance |

|---|---|---|

| Independent Fuel Dealers | Operate individual gas stations or small chains, purchasing fuel directly from Sunoco LP. | Form a significant portion of wholesale sales, crucial for local market penetration. |

| Convenience Store Chains | Large and regional chains integrating fuel sales into extensive retail operations. | Represent immense volume purchasers, with convenience stores selling approximately 80% of U.S. motor fuel in 2024. |

| Commercial & Industrial Customers | Businesses like trucking companies, construction firms, and government agencies with substantial fuel needs. | Drive consistent, high-volume demand from sectors like transportation, which moved 11.5 billion tons of freight in 2023. |

| Wholesale Distributors | Partners who acquire fuel from Sunoco's terminals to serve their own customer bases. | Extend Sunoco's market reach indirectly, leveraging Sunoco's infrastructure. |

| Retail Consumers | Individual drivers purchasing fuel at Sunoco-branded stations. | The foundational demand driver, with U.S. gasoline consumption remaining robust in 2024. |

Cost Structure

Fuel procurement represents Sunoco LP's most significant and unpredictable expense. This involves the direct purchase of gasoline and diesel fuel from refiners and various suppliers, making it a substantial part of their operational outlay.

The price of these fuels is heavily tied to global crude oil prices, which can swing dramatically. Additionally, refining margins, the difference between the cost of crude oil and the selling price of refined products, also play a crucial role in determining Sunoco's fuel procurement costs.

For instance, in 2024, crude oil prices experienced considerable volatility, impacting the cost of fuel for Sunoco. The average price of West Texas Intermediate (WTI) crude oil fluctuated throughout the year, directly influencing the cost of gasoline and diesel Sunoco had to purchase to supply its network of stations.

Transportation and logistics represent a substantial cost for Sunoco, driven by the need to move vast quantities of fuel across its extensive distribution network. These expenses encompass trucking fees for last-mile delivery, significant pipeline tariffs for long-haul transport, and rail freight charges.

Beyond the direct transport costs, Sunoco also incurs expenses for the fuel used by its own transport fleet, which is crucial for operational efficiency. Furthermore, the wages and benefits for the dedicated drivers and logistics personnel who manage this complex operation form a significant portion of this cost category.

In 2024, the energy sector, including fuel transportation, continued to grapple with volatile fuel prices, directly impacting Sunoco's logistics expenses. While specific figures for Sunoco's transportation and logistics costs for 2024 are not publicly detailed, industry benchmarks suggest that such expenses can represent a considerable percentage of a fuel distributor's operating budget, often in the high single digits or low double digits of revenue.

Sunoco incurs significant expenses to keep its more than 100 refined product terminals running smoothly and in compliance with regulations. These costs cover essential utilities like electricity and water, ongoing property taxes for each location, and regular maintenance to keep equipment in good working order. For example, in 2024, utility costs alone can represent a substantial portion of operational expenses across this extensive network.

Furthermore, ensuring strict adherence to environmental regulations is a critical and often costly component of terminal operations. This includes investments in spill prevention, containment systems, and regular environmental monitoring to meet stringent governmental standards. These compliance measures are vital for avoiding penalties and maintaining the company's license to operate.

Operating Expenses and Administrative Overhead

Sunoco's operating expenses and administrative overhead encompass a range of essential business functions. These include compensation for non-operational personnel, investments in marketing and branding to maintain visibility, robust information technology infrastructure for seamless operations, and general corporate administrative activities. These costs are fundamental to the effective management and support of the partnership's diverse operations.

In 2024, Sunoco LP's selling, general and administrative (SG&A) expenses were approximately $1.05 billion. This figure reflects the ongoing investment in the infrastructure and personnel required to manage its extensive fuel distribution network.

- Salaries and Benefits: Covering executive, administrative, and support staff.

- Marketing and Advertising: Funds allocated for brand promotion and customer outreach.

- Information Technology: Costs associated with maintaining and upgrading IT systems and cybersecurity.

- Professional Services: Expenses for legal, accounting, and consulting services.

Capital Expenditures for Infrastructure

Sunoco LP's capital expenditures for infrastructure are substantial, reflecting its commitment to growth and operational excellence. In 2023, the company reported capital expenditures of approximately $574 million, with a significant portion allocated to enhancing its extensive terminal network and distribution capabilities.

These investments are vital for maintaining Sunoco's competitive edge and ensuring the efficient delivery of fuel products across its vast service area. The company actively pursues upgrades to existing terminals and strategically expands its pipeline and distribution network to meet growing market demand.

- Terminal Upgrades: Ongoing investments in modernizing and expanding terminal facilities to improve storage capacity and loading efficiency.

- Pipeline and Distribution Expansion: Strategic capital deployment to extend the reach and capacity of its distribution network, including new pipeline segments and transportation assets.

- Acquisitions: Funding for strategic acquisitions that bolster its infrastructure footprint and market presence.

Sunoco's cost structure is dominated by fuel procurement, which is directly tied to volatile global crude oil prices and refining margins. Transportation and logistics are also significant expenses, encompassing trucking, pipeline tariffs, and rail freight, alongside the costs of fuel for its own fleet and personnel wages.

Operational expenses include maintaining over 100 refined product terminals, covering utilities, property taxes, and essential maintenance, with a notable emphasis on costly environmental compliance measures. Furthermore, selling, general, and administrative (SG&A) costs, amounting to approximately $1.05 billion in 2024, support essential business functions like personnel, marketing, and IT infrastructure.

Capital expenditures, such as the $574 million reported in 2023, are crucial for infrastructure enhancements, including terminal upgrades and distribution network expansion, to maintain competitiveness and meet market demand.

| Cost Category | Description | 2024 Data/Impact |

|---|---|---|

| Fuel Procurement | Direct purchase of gasoline and diesel; influenced by crude oil prices and refining margins. | Significant volatility in crude oil prices in 2024 directly impacted procurement costs. |

| Transportation & Logistics | Moving fuel via trucking, pipelines, and rail; includes fleet fuel and personnel. | Industry benchmarks suggest these costs can be high single to low double digits of revenue; volatile fuel prices in 2024 amplified these expenses. |

| Terminal Operations | Maintaining refined product terminals, including utilities, taxes, and compliance. | Utility costs represent a substantial portion; environmental compliance is a critical and costly component. |

| SG&A Expenses | Salaries, marketing, IT, professional services. | Approximately $1.05 billion in 2024, reflecting investments in infrastructure and personnel management. |

| Capital Expenditures | Infrastructure upgrades, terminal expansion, network growth. | $574 million reported in 2023, with ongoing investments in terminals and distribution capabilities. |

Revenue Streams

Sunoco LP's main income comes from selling large amounts of gasoline and diesel. They sell to independent gas stations, convenience store owners, and businesses. This means their earnings depend on how much fuel they sell and the difference between what they buy it for and what they sell it at.

In 2024, Sunoco LP reported significant revenue from these wholesale fuel sales. For instance, their third-quarter 2024 earnings showed substantial contributions from this segment, reflecting the ongoing demand for transportation fuels across their vast distribution network.

Sunoco LP generates revenue beyond the base price of fuel by charging fees for its extensive distribution and logistics operations. These fees are crucial for covering the significant costs involved in transporting fuel, managing its handling, and ensuring timely and efficient delivery across its vast network. For instance, in 2023, Sunoco's fuel distribution segment reported substantial revenue, reflecting the volume and complexity of their logistical services.

Sunoco LP generates revenue from third parties using its refined product terminals for storage, blending, and throughput services. This strategy effectively monetizes its extensive midstream infrastructure, creating a stable and varied income stream.

In 2024, Sunoco LP's terminal network, a key component of its business model, continued to be a significant revenue driver. The company reported substantial volumes processed through these terminals, reflecting the ongoing demand for its midstream services.

Branding and Licensing Fees

Sunoco LP generates revenue by charging independent dealers and partners for the privilege of operating their fuel stations under the well-established Sunoco brand. This strategy leverages the strong recognition and consumer trust associated with the Sunoco name.

These fees are essentially a payment for the brand's equity and the marketing support Sunoco provides, allowing these partners to tap into an existing customer base and brand loyalty. For example, in 2024, Sunoco continued to expand its branded network, indicating the ongoing value proposition of its brand to downstream partners.

- Brand Value Monetization: Sunoco collects fees from third-party operators who utilize the Sunoco brand for their retail fuel locations.

- Marketing and Support: These fees also cover the marketing programs and operational support offered by Sunoco to its branded partners.

- Network Expansion: In 2024, Sunoco's strategy involved growing its branded footprint, demonstrating the continued appeal and revenue-generating potential of its brand licensing.

Acquisition-Related Revenue Growth

Sunoco LP's acquisition strategy is a key driver of revenue growth. Recent moves, like the acquisition of Parkland Corporation and TanQuid, are projected to boost future earnings by expanding their footprint and increasing fuel volumes. These strategic additions are anticipated to be accretive to distributable cash flow, enhancing shareholder value.

The integration of Parkland Corporation, a significant player in the North American fuel distribution market, is expected to add substantial revenue. TanQuid's operations further bolster Sunoco's reach and operational capacity. These acquisitions are not just about scale; they are about enhancing the overall financial health and cash-generating ability of the business.

- Parkland Corporation Acquisition: Expected to significantly increase Sunoco's market share and throughput volumes, contributing to revenue growth.

- TanQuid Acquisition: Further expands Sunoco's operational network and customer base, driving additional revenue streams.

- Accretive to Distributable Cash Flow: Both acquisitions are designed to enhance the company's ability to generate cash available for distribution to unitholders.

Sunoco LP's revenue streams are diversified, primarily driven by wholesale fuel distribution and the utilization of its extensive midstream infrastructure. The company also benefits from brand licensing and strategic acquisitions, all contributing to its financial performance.

In 2024, Sunoco LP's wholesale fuel sales remained a cornerstone, with significant volumes reported. Furthermore, the company's terminal services generated substantial income, reflecting the ongoing demand for its logistical capabilities. The brand licensing agreements also continued to provide a steady revenue stream, underscoring the value of the Sunoco brand.

| Revenue Stream | Description | 2024 Impact/Data Point |

|---|---|---|

| Wholesale Fuel Distribution | Sales of gasoline and diesel to independent stations and businesses. | Key driver of overall revenue; Q3 2024 earnings highlighted substantial contributions. |

| Logistics and Distribution Fees | Charges for transportation, handling, and delivery services. | Essential for covering operational costs and generating income from complex supply chains. |

| Terminal Services | Fees for storage, blending, and throughput at refined product terminals. | Monetizes midstream infrastructure; significant volumes processed in 2024. |

| Brand Licensing | Fees from third-party operators using the Sunoco brand. | Leverages brand equity and marketing support; network expansion in 2024 indicated ongoing appeal. |

| Acquisitions | Revenue growth from strategic acquisitions like Parkland and TanQuid. | Expected to increase market share, throughput, and distributable cash flow. |

Business Model Canvas Data Sources

The Sunoco Business Model Canvas is constructed using a combination of internal financial reports, extensive market research on fuel and convenience store industries, and competitive analysis of other energy retailers. These diverse data sources ensure a comprehensive and accurate representation of Sunoco's strategic positioning and operational realities.