South Indian Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

South Indian Bank Bundle

Navigate the intricate external forces shaping South Indian Bank's future with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that could impact its growth and stability. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full PESTLE analysis now and gain a significant competitive advantage.

Political factors

The Indian government's commitment to financial inclusion, exemplified by the Pradhan Mantri Jan Dhan Yojana (PMJDY), continues to expand banking access. As of late 2023, PMJDY accounts surpassed 51 crore, with a significant portion being zero-balance accounts, demonstrating broad reach.

These government policies directly benefit South Indian Bank by widening its potential customer base, particularly in rural and semi-urban areas. The emphasis on digital payments and direct benefit transfers under various social security schemes, such as the PM-KISAN scheme which disbursed over ₹2.24 lakh crore by early 2024, encourages account activity and deposit growth.

The Reserve Bank of India (RBI) significantly influences the banking sector through its monetary policies, such as adjusting the repo rate and managing liquidity. For instance, in the fiscal year 2023-24, the RBI maintained a stable repo rate at 6.50%, aiming to control inflation while supporting economic growth.

Recent policy actions, including liquidity infusions, have been designed to improve funding conditions and encourage lending. However, the RBI's stringent regulatory stance, as demonstrated by its actions regarding co-branded credit cards with entities like South Indian Bank, highlights a measured approach to managing risks in emerging business segments.

India's generally stable political landscape bolsters investor confidence, creating a more predictable environment for banks like South Indian Bank to operate and plan for the future. This stability is crucial for long-term financial growth and attracting foreign investment.

Government initiatives aimed at streamlining regulations and improving the ease of doing business, such as the Digital India program and reforms in financial services, directly benefit banks by reducing operational friction and lowering compliance costs. For instance, the simplification of Know Your Customer (KYC) norms has eased account opening processes.

However, specific policy shifts or regulatory interventions, though often aimed at strengthening the financial sector, can introduce short-term challenges. For example, changes in lending guidelines or capital adequacy requirements necessitate prompt adaptation by banks to maintain compliance and operational efficiency.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

South Indian Bank, like all Indian financial institutions, operates under rigorous Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These rules, primarily enforced by the Reserve Bank of India (RBI) and the Financial Intelligence Unit-India (FIU-IND), are crucial for preventing illicit financial flows and safeguarding the banking system's integrity. For instance, the Prevention of Money Laundering Act, 2002, provides the legal framework for these measures.

Adherence to these evolving norms necessitates continuous investment in advanced technology and skilled personnel. This includes implementing robust Know Your Customer (KYC) procedures, transaction monitoring systems, and suspicious activity reporting mechanisms. Failure to comply can result in significant penalties, reputational damage, and operational restrictions.

Key aspects of AML/CTF compliance for South Indian Bank include:

- Customer Due Diligence (CDD): Thoroughly verifying customer identities and assessing risks associated with their transactions.

- Transaction Monitoring: Analyzing transactions for unusual patterns or activities indicative of money laundering or terrorist financing.

- Suspicious Transaction Reporting (STR): Promptly reporting any suspected illicit activities to the FIU-IND.

- Record Keeping: Maintaining detailed records of transactions and customer information for a specified period.

Government Support for Digital Infrastructure

Government initiatives such as Digital India and the JAM Trinity (Jan Dhan-Aadhaar-Mobile) have significantly bolstered the digital banking landscape, providing a robust framework for expansion. This focus on digital infrastructure directly supports banks like South Indian Bank in reaching a wider customer base and enhancing service delivery.

The widespread adoption and promotion of the Unified Payments Interface (UPI) have been a game-changer, driving a surge in cashless transactions. In 2023 alone, UPI processed over 117 billion transactions, valued at approximately $2.4 trillion, demonstrating its critical role in financial inclusion and the digital economy. This trend directly benefits financial institutions that actively integrate and leverage these digital public infrastructure components.

- Digital India: A flagship program aimed at transforming India into a digitally empowered society and knowledge economy.

- JAM Trinity: Convergence of Jan Dhan (financial inclusion), Aadhaar (unique identification), and Mobile (connectivity) to deliver subsidies and services directly.

- UPI Growth: Unified Payments Interface has seen exponential growth, with transaction volumes consistently breaking records, facilitating seamless digital payments.

- Financial Inclusion: Government policies are actively promoting financial inclusion, which aligns with and supports the digital expansion strategies of banks.

The Indian government's proactive stance on financial inclusion, notably through schemes like Pradhan Mantri Jan Dhan Yojana (PMJDY), continues to expand banking access, with over 51 crore accounts by late 2023. This policy directly benefits South Indian Bank by broadening its customer reach, especially in underserved regions, and fostering deposit growth through digital payment initiatives and direct benefit transfers.

The Reserve Bank of India's monetary policy, including a stable repo rate of 6.50% in FY 2023-24, influences lending and liquidity conditions for banks. While regulatory actions, such as those concerning co-branded credit cards, underscore a cautious approach to risk management, the overall stable political environment in India fosters investor confidence and predictability for institutions like South Indian Bank.

Government drives like Digital India and the JAM Trinity have significantly enhanced digital banking infrastructure, aiding banks in expanding service delivery. The phenomenal growth of UPI, processing over 117 billion transactions in 2023, underscores the shift towards digital payments, which South Indian Bank can leverage for increased customer engagement and transaction volume.

What is included in the product

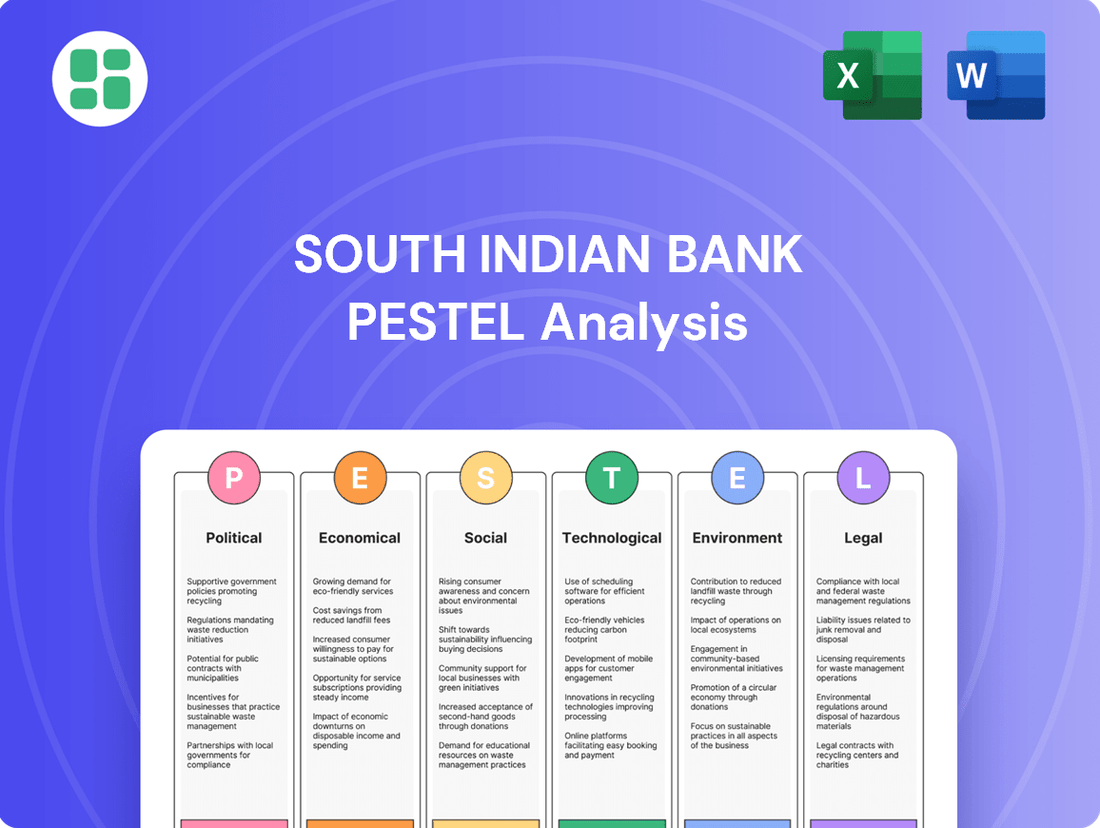

This PESTLE analysis dissects the external macro-environmental influences impacting South Indian Bank across Political, Economic, Social, Technological, Environmental, and Legal domains.

It offers a comprehensive understanding of how these factors present both challenges and strategic opportunities for the bank.

A concise PESTLE analysis for South Indian Bank acts as a pain point reliever by offering a clear, actionable overview of external factors, enabling faster strategic decision-making and risk mitigation.

Economic factors

India's economy is poised for continued strong performance, with projections indicating it will remain among the fastest-growing major economies worldwide. Forecasts for Gross Domestic Product (GDP) growth are generally in the range of 6.3% to 7.2% for both fiscal years 2024 and 2025.

This sustained economic expansion is a significant positive for the banking sector. Robust GDP growth typically fuels increased demand for credit, as businesses invest and individuals borrow. It also leads to higher disposable incomes, which can translate into greater savings and investment opportunities, expanding the potential customer base for financial institutions like South Indian Bank.

The banking sector itself is recognized as a crucial engine driving this economic growth. As credit flows more freely and financial services become more accessible, it supports business expansion, job creation, and overall economic development, creating a favorable environment for banks to thrive.

Inflation in India has generally stayed within the Reserve Bank of India's (RBI) target band, though occasional surges in food and energy costs require a watchful monetary stance. For instance, headline inflation averaged around 5.5% in FY24, demonstrating this trend.

The RBI's recent actions, including rate cuts and liquidity infusions, aim to lower borrowing expenses for banks like South Indian Bank. This could encourage more lending, although the full impact of these policy shifts on credit demand typically materializes over several quarters.

The Indian banking sector's asset quality has significantly improved, with gross non-performing assets (NPAs) reaching a 12-year low, signaling a more robust lending landscape and diminished risk for institutions like South Indian Bank. This positive trend suggests a healthier financial environment for credit expansion.

Robust credit growth, particularly in the retail and Micro, Small, and Medium Enterprises (MSME) sectors, offers substantial opportunities for banks to broaden their loan portfolios and enhance revenue streams. For instance, retail credit growth in India has been a key driver for many banks in recent years.

Disposable Income and Consumer Spending

Rising disposable incomes across India, particularly in southern states where South Indian Bank has a strong presence, are fueling increased consumer spending. This trend directly translates to higher demand for financial products like personal loans, vehicle financing, and credit cards. For instance, India's per capita disposable income saw a notable increase, contributing to a more robust consumer economy.

The proliferation of digital payment solutions and innovative credit facilities, such as Buy Now Pay Later (BNPL) services, is significantly reshaping consumer behavior. These platforms not only boost purchasing power by deferring payments but also simplify transaction processes, encouraging more frequent and larger purchases. This digital shift is a key driver for banks to expand their digital offerings and adapt their product strategies to meet evolving consumer preferences.

- Disposable income growth: India's per capita disposable income has been on an upward trajectory, indicating a greater capacity for consumer spending.

- Digital payment adoption: A significant percentage of retail transactions in India are now conducted digitally, reflecting the growing comfort and reliance on online payment methods.

- BNPL market expansion: The Buy Now Pay Later market in India is experiencing rapid growth, with projections indicating substantial expansion in the coming years, impacting credit uptake.

- Financial product demand: Increased consumer spending directly correlates with higher demand for banking products such as loans, credit cards, and investment services.

Competition in the Banking Sector

The Indian banking landscape is intensely competitive, featuring a mix of public sector banks, private players, and a growing number of fintech disruptors. This dynamic environment intensifies pressure on established institutions like South Indian Bank to innovate and maintain customer loyalty.

Digital-only banks and payment banks are particularly challenging traditional models by offering streamlined services and often more attractive rates. For instance, by the end of fiscal year 2024, India had over 200 million active UPI users, highlighting the rapid adoption of digital payments and the competitive threat from non-traditional players.

- Intensified Competition: Public sector banks, private banks, and fintech firms are all vying for market share.

- Digital Disruption: Fintechs and digital banks are pushing traditional banks to improve user experience and product offerings.

- Rate Pressure: Competition forces banks to offer competitive interest rates on deposits and loans.

- Innovation Imperative: Banks must continuously develop new financial products and services to stay relevant.

India's economy is projected for robust growth, with GDP expected to expand between 6.3% and 7.2% for fiscal years 2024 and 2025, creating a favorable environment for banking sector expansion. This growth fuels demand for credit and increases disposable incomes, directly benefiting institutions like South Indian Bank by broadening their customer base and investment opportunities. The banking sector itself is a key enabler of this economic expansion, facilitating business growth and job creation.

Inflation, while generally managed within the RBI's target, saw headline figures around 5.5% in FY24, necessitating a watchful monetary policy. The RBI's efforts to lower borrowing costs through rate adjustments and liquidity measures aim to stimulate lending, though the full impact on credit demand will unfold over time. Improvements in asset quality, with NPAs at a 12-year low, indicate a healthier lending landscape, reducing risks for banks.

Strong credit growth, particularly in retail and MSME segments, presents significant revenue opportunities for banks. Rising disposable incomes, especially in South India, are driving demand for financial products like loans and credit cards, supported by a notable increase in per capita disposable income. The rapid adoption of digital payments and services like Buy Now Pay Later (BNPL) is also reshaping consumer behavior, pushing banks to enhance their digital offerings.

| Economic Indicator | Value/Projection | Impact on South Indian Bank |

| GDP Growth (FY24-25) | 6.3% - 7.2% | Increased credit demand, higher revenue potential |

| Headline Inflation (FY24 Avg.) | ~5.5% | Influences RBI monetary policy and borrowing costs |

| Gross NPAs (Banking Sector) | 12-year low | Improved asset quality, reduced lending risk |

| Per Capita Disposable Income | Upward trajectory | Higher consumer spending, increased demand for banking products |

| Digital Transactions | Significant growth | Opportunity for digital product expansion, competitive pressure |

Preview Before You Purchase

South Indian Bank PESTLE Analysis

The preview shown here is the exact South Indian Bank PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank, providing valuable insights for strategic planning. You can trust that the detailed analysis and structure you see are precisely what you will download immediately upon completing your purchase.

Sociological factors

Indian customers, especially the younger demographic, are rapidly migrating to digital banking platforms. They now expect user-friendly mobile applications and instant service, moving away from traditional branch interactions. This trend is evident with a significant portion of new account openings happening digitally.

South Indian Bank must adapt by enhancing its digital offerings, focusing on intuitive app design and faster processing for loans and services. For instance, by the end of FY24, digital transactions constituted a substantial percentage of the bank's overall transaction volume, underscoring this shift.

South Indian Bank recognizes the vital role of financial literacy in driving customer engagement and ensuring responsible financial behavior. Initiatives aimed at boosting awareness are essential for expanding financial inclusion across India.

The Reserve Bank of India's Financial Inclusion Index, which stood at 60.1 in March 2024, underscores the need for robust financial education. This index tracks access, usage, and quality of financial services, with education being a key pillar for safe and informed participation.

By empowering customers with knowledge, South Indian Bank can foster greater trust and facilitate more effective utilization of its diverse product and service offerings, ultimately contributing to a stronger financial ecosystem.

India's vast and varied population, with a median age of 28.7 years as of 2023, is undergoing rapid urbanization, with over 35% now residing in cities. This demographic trend fuels demand for financial services, creating a fertile ground for banks like South Indian Bank to expand their reach and offerings, particularly in mortgages and consumer loans.

The increasing digital penetration, with over 700 million internet users in India by early 2024, is a key factor. This digitally savvy population, even in Tier 2 and Tier 3 cities, is driving the adoption of mobile banking and digital payment solutions, pushing banks to innovate and enhance their online platforms to cater to these evolving customer preferences.

Cultural Acceptance of Digital Payments

The cultural acceptance of digital payments in India, particularly in South India, is exceptionally high, driven by user-friendly platforms like UPI. This is evident in the massive transaction volumes; as of March 2024, UPI processed over 12 billion transactions, valued at approximately INR 18.4 trillion. This widespread adoption directly encourages more individuals to open digital savings accounts and actively engage with online banking services, reducing the historical reliance on cash.

This shift has a tangible impact on financial institutions like South Indian Bank.

- UPI Dominance: UPI transactions in India have consistently grown, reaching an average of over 50 million transactions per day in early 2024.

- Digital Account Growth: The surge in digital payments correlates with an increase in new digital savings account openings across the banking sector.

- Reduced Cash Dependency: Cultural comfort with digital methods means fewer transactions are conducted using physical currency, especially in urban and semi-urban areas.

Trust and Brand Loyalty

Customer trust and brand loyalty are crucial, even as digital channels grow. South Indian Bank, with its established presence, benefits from this, but must continuously reinforce confidence. Balancing technological advancements with robust data security and personalized customer interactions is key to retaining this loyalty.

In 2024, a significant portion of banking customers, particularly older demographics, still prioritize human interaction and established trust over purely digital convenience. Surveys indicate that over 60% of retail banking customers in India consider trust in the bank's security measures as a primary factor when choosing a banking partner. This underscores the need for South Indian Bank to not only enhance its digital offerings but also to visibly demonstrate its commitment to safeguarding customer data and providing reliable, personalized service.

- Customer Retention: Banks with strong brand loyalty often experience higher customer retention rates, reducing acquisition costs.

- Digital Security Concerns: A significant percentage of users express concerns about data privacy and security in digital banking platforms.

- Personalized Service Value: Despite digital trends, many customers still value personalized advice and relationship management from their banks.

Societal shifts in India, particularly the rapid embrace of digital platforms, are reshaping banking expectations. Younger demographics, comprising a significant portion of India's median age of 28.7 years (2023), now demand seamless mobile experiences and instant service, moving away from traditional branch visits.

This trend is powerfully illustrated by the massive adoption of digital payment systems like UPI, which processed over 12 billion transactions in the first quarter of 2024, valued at approximately INR 18.4 trillion. This widespread cultural acceptance of digital transactions directly influences customer behavior, encouraging more engagement with online banking services.

While digital convenience is paramount for many, customer trust and the perception of security remain critical. Over 60% of Indian retail banking customers in 2024 still cite trust in a bank's security measures as a primary decision-making factor, highlighting the ongoing need for South Indian Bank to balance technological innovation with robust data protection and personalized customer relationships.

Technological factors

South Indian Bank is navigating a landscape rapidly reshaped by digital transformation, particularly in mobile banking. India's increasing smartphone usage, with over 700 million smartphone users projected by 2025, and expanding internet access are fundamentally altering how customers interact with financial institutions. This technological shift necessitates continuous investment in digital capabilities.

To remain competitive, South Indian Bank is prioritizing its digital transformation. This includes enhancing its mobile banking application to offer a wider array of services, streamlining online account opening processes, and ensuring a seamless digital onboarding experience. Meeting the evolving expectations of tech-savvy customers is paramount for sustained growth and customer retention in the current financial ecosystem.

South Indian Bank is increasingly leveraging Artificial Intelligence and Machine Learning to transform its customer interactions and operational efficiency. These technologies are key to offering hyper-personalized banking products and streamlining internal processes, directly impacting customer satisfaction and cost management.

The bank's adoption of AI-powered tools, such as chatbots for customer service and advanced credit scoring models, is crucial for enhancing both the speed and accuracy of its services. For instance, AI-driven credit assessment can significantly reduce loan processing times, a critical factor in a competitive market.

By integrating AI and ML, South Indian Bank aims to improve customer engagement through personalized recommendations and proactive support. This technological shift is essential for staying competitive in the evolving digital banking landscape, with many banks reporting significant gains in customer retention and operational cost savings through similar implementations in 2024 and early 2025.

South Indian Bank, like all financial institutions, faces escalating cybersecurity threats with the surge in digital banking. The volume of cyberattacks, including phishing and ransomware, has seen a significant uptick globally, directly impacting customer data protection and operational continuity.

Regulatory bodies mandate stringent data protection measures, including robust disaster recovery plans and the requirement for data storage within India. For instance, the Reserve Bank of India's (RBI) data localisation norms necessitate that all payment system data be stored exclusively in India, adding a layer of complexity and cost for banks.

To counter these threats, South Indian Bank must continue investing in advanced cybersecurity solutions. This includes implementing multi-factor authentication, advanced threat detection systems, and regular security audits. The ongoing migration to '.bank.in' domains, as encouraged by regulatory bodies, is also a crucial step in enhancing domain security and customer trust.

Fintech Collaborations and Open Finance

Fintech collaborations are reshaping the banking landscape, with initiatives like open finance encouraging traditional institutions to partner with agile fintech firms. This trend is particularly evident as digital-only banks gain traction, pushing established players to innovate. South Indian Bank, like others, is navigating this shift by exploring partnerships that leverage technology to enhance customer experience and product offerings.

The rise of Banking-as-a-Service (BaaS) models presents a significant technological factor. BaaS allows banks to provide their core functionalities as invisible infrastructure, enabling fintechs and other businesses to embed financial services directly into their platforms. This fosters a more integrated financial ecosystem. For instance, by Q1 2025, it's projected that BaaS will unlock new revenue streams for traditional banks, with an estimated market growth of 25-30% annually.

- Open Finance Mandates: Regulatory push towards open finance, seen in various global markets, necessitates banks to share data securely with third-party providers, fostering innovation and competition.

- BaaS Market Growth: The global BaaS market is anticipated to reach approximately $35 billion by 2026, indicating significant opportunities for banks to monetize their infrastructure.

- Fintech Investment: Global fintech investment remained robust in 2024, with a significant portion directed towards platforms enabling embedded finance and BaaS solutions.

UPI and Digital Public Infrastructure

The Unified Payments Interface (UPI) has fundamentally reshaped India's transaction ecosystem, emerging as a significant disruptor in digital payments. This platform's widespread adoption is a testament to its efficiency and ease of use for consumers and businesses alike.

South Indian Bank can leverage India's strong digital public infrastructure, such as Aadhaar for identity verification and DigiLocker for document management, to streamline operations. This integration can significantly enhance customer acquisition processes by enabling faster and more accurate digital Know Your Customer (KYC) procedures.

Furthermore, by utilizing this digital backbone, the bank can gain deeper insights into customer behavior and preferences, paving the way for more personalized product offerings and improved customer engagement. This data-driven approach is crucial for staying competitive in the evolving financial services landscape.

- UPI Transaction Growth: UPI transactions in India reached an annualized run rate exceeding 100 billion in early 2024, demonstrating its massive scale and impact.

- Digital KYC Benefits: Banks adopting digital KYC through platforms like Aadhaar have reported reductions in onboarding time by up to 90%.

- Personalization Potential: Enhanced data access through digital infrastructure allows for tailored financial product recommendations, potentially increasing cross-selling by 15-20%.

- DigiLocker Adoption: Over 100 million documents have been issued and stored in DigiLocker, highlighting its growing utility for digital identity management.

South Indian Bank's technological strategy is heavily influenced by India's robust digital public infrastructure, including UPI and Aadhaar. These platforms streamline customer onboarding and data management, with UPI transactions exceeding 100 billion annualized in early 2024. Digital KYC processes, leveraging Aadhaar, have shown up to a 90% reduction in onboarding time.

The bank is also navigating the rise of Banking-as-a-Service (BaaS), a market projected for 25-30% annual growth, offering new revenue streams. Fintech collaborations and open finance mandates are pushing traditional banks to innovate, with global fintech investment remaining strong in 2024, particularly in BaaS solutions.

Furthermore, the bank's investment in AI and Machine Learning is crucial for personalized customer experiences and operational efficiency. AI-driven credit scoring, for example, can significantly reduce loan processing times, a key competitive advantage. Many banks reported gains in customer retention and cost savings through similar AI implementations in 2024 and early 2025.

| Technology Area | Impact on South Indian Bank | Key Data/Trends (2024-2025) |

|---|---|---|

| Digital Banking & Mobile Apps | Enhanced customer interaction, streamlined services | 700M+ Indian smartphone users by 2025; increased demand for seamless digital onboarding. |

| AI & Machine Learning | Personalized products, operational efficiency, improved customer service | AI-driven credit scoring reducing loan processing times; enhanced customer engagement. |

| Cybersecurity | Protecting customer data, ensuring operational continuity | Escalating cyber threats; RBI data localization norms adding complexity. |

| Fintech & Open Finance | Innovation, new partnerships, integrated financial ecosystems | BaaS market growth of 25-30% annually; strong fintech investment in BaaS. |

| Digital Public Infrastructure (UPI, Aadhaar) | Streamlined operations, faster KYC, data-driven insights | UPI transactions >100B annualized run rate (early 2024); Digital KYC reduces onboarding time by up to 90%. |

Legal factors

India's Digital Personal Data Protection Act (DPDPA), anticipated to be fully implemented soon, places substantial responsibilities on financial entities like South Indian Bank concerning data privacy, security, and overall management.

Banks are now mandated to strictly follow data privacy principles, which include securing explicit consent from individuals before collecting their data, clearly defining the purposes for which data will be used, and establishing compliant procedures for data retention and eventual deletion.

Compliance with the DPDPA will likely necessitate investments in enhanced cybersecurity measures and data governance frameworks, potentially impacting operational costs but also building greater customer trust.

The Reserve Bank of India (RBI) is the primary regulator for South Indian Bank, issuing extensive rules on everything from licensing and capital requirements to asset quality and customer care. Adherence to RBI's directives, like those concerning cybersecurity and liquidity management, is crucial for operational continuity.

For instance, the RBI's prudential framework mandates specific capital adequacy ratios, such as the Basel III norms, which South Indian Bank, like other Indian banks, must meet. Failure to comply can result in penalties and operational restrictions.

South Indian Bank, like all financial institutions, operates under the stringent Prevention of Money Laundering Act (PMLA) and Know Your Customer (KYC) norms. These legal mandates are fundamental to preventing financial crimes and ensuring the integrity of the banking system. Compliance with PMLA and KYC directly impacts customer onboarding processes, requiring robust identity verification and ongoing due diligence.

These regulations necessitate rigorous transaction monitoring to detect and report suspicious activities. For South Indian Bank, this means investing in technology and training to ensure adherence, which can influence operational efficiency and customer experience. Failure to comply can result in significant penalties, underscoring the critical nature of these legal frameworks.

Cybersecurity and IT Act Amendments

The Indian IT Act, along with its subsequent amendments, forms the legal bedrock for cybersecurity in the financial sector. This legislation, coupled with SEBI's Cyber Security & Cyber Resilience Framework (CSCRF), imposes stringent requirements on financial institutions like South Indian Bank to safeguard digital assets and customer data.

These regulations necessitate the implementation of regular cybersecurity audits and comprehensive disaster recovery plans. Furthermore, the mandate for data localization, ensuring data is stored within India's borders, is a key compliance point. Failure to adhere to these legal stipulations can result in significant penalties, impacting operational continuity and financial standing.

- IT Act and Amendments: Provides the legal framework for digital security and data protection.

- SEBI CSCRF: Mandates specific cybersecurity and resilience practices for financial entities.

- Key Requirements: Frequent audits, robust disaster recovery, and data localization are crucial.

- Consequences of Non-compliance: Financial penalties and operational disruptions are potential outcomes.

Consumer Protection Laws and Grievance Redressal

South Indian Bank, like all financial institutions, operates under a stringent framework of consumer protection laws. These regulations are crucial for maintaining customer trust and ensuring fair practices. The bank must have robust mechanisms in place to handle customer grievances effectively. This includes clear, accessible channels for lodging complaints and timely resolution processes.

The Digital Personal Data Protection Act (DPDPA), enacted in India, significantly impacts how banks handle customer data. It grants individuals, or data principals, several rights concerning their personal information. These include the right to access, correct, and request the erasure of their data. Furthermore, the DPDPA mandates that data fiduciaries, such as South Indian Bank, must establish clear procedures for data principals to lodge complaints regarding data processing. This necessitates a proactive approach to data privacy and a transparent grievance redressal system.

- Customer Data Rights: The DPDPA empowers customers with rights like data access, rectification, and erasure.

- Grievance Redressal Channels: Banks must establish clear and accessible channels for addressing customer complaints.

- Compliance Burden: Adherence to data protection laws requires significant investment in compliance infrastructure and training.

- Reputational Risk: Failure to protect customer data or address grievances can lead to significant reputational damage and regulatory penalties.

The Digital Personal Data Protection Act (DPDPA) of 2023 imposes strict data handling obligations on South Indian Bank, requiring explicit consent for data collection and clear protocols for data usage and deletion. Adherence to RBI's prudential norms, such as maintaining adequate capital adequacy ratios under Basel III, is critical to avoid penalties and operational restrictions.

Compliance with the Prevention of Money Laundering Act (PMLA) and Know Your Customer (KYC) norms necessitates robust identity verification and transaction monitoring, impacting onboarding processes and operational efficiency. The IT Act and SEBI's Cyber Security & Cyber Resilience Framework (CSCRF) mandate strong cybersecurity measures, including regular audits, disaster recovery planning, and data localization, with non-compliance leading to significant penalties.

Consumer protection laws require South Indian Bank to establish effective grievance redressal mechanisms, ensuring fair practices and customer trust. The DPDPA further empowers customers with data access, rectification, and erasure rights, demanding transparent complaint handling procedures and investment in compliance infrastructure.

Environmental factors

South Indian Bank, like other Indian financial institutions, faces growing pressure to adhere to Environmental, Social, and Governance (ESG) compliance. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are actively shaping this landscape, with draft guidelines and frameworks emerging. These directives are pushing banks towards greater transparency and accountability in their operations.

A key development is the obligation for banks to prepare annual reports detailing their ESG performance. This aligns with international best practices and aims to standardize how environmental and social impacts are measured and disclosed. For South Indian Bank, this means a more rigorous approach to data collection and reporting on sustainability initiatives.

Furthermore, integrating climate-related financial risks into governance and risk management frameworks is becoming paramount. This involves identifying, assessing, and mitigating potential financial impacts stemming from climate change. By 2024, financial institutions are expected to demonstrate robust strategies for managing these evolving risks, a trend that will continue to intensify through 2025.

South Indian Bank, like many in India's financial sector, is navigating a significant shift towards green financing and sustainable lending. This trend is driven by a growing emphasis on environmental, social, and governance (ESG) principles. Financial institutions are increasingly incorporating ESG criteria into their lending policies, encouraging businesses to adopt these principles in their operations.

This focus translates into actively financing projects with clear environmental benefits, such as renewable energy initiatives and eco-friendly infrastructure. Furthermore, banks are developing innovative sustainable financial products designed to meet the evolving needs of both businesses and investors who prioritize environmental responsibility.

South Indian Bank, like other financial institutions, faces increasing pressure to integrate climate-related financial risks into its core operations. This includes assessing how physical risks, such as extreme weather events, and transition risks, like policy changes impacting carbon-intensive industries, could affect its loan book and overall financial stability. For instance, a significant portion of its lending might be exposed to sectors vulnerable to climate change, requiring proactive risk mitigation strategies.

Regulatory mandates are pushing banks to enhance their disclosures on climate risks, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). This means South Indian Bank needs to quantify and report on its exposure to climate change, demonstrating resilience and a clear strategy for managing these evolving environmental challenges. This is crucial for maintaining investor confidence and ensuring long-term business sustainability in a world increasingly focused on environmental, social, and governance (ESG) factors.

Carbon Footprint Reduction and Operational Sustainability

South Indian Bank is actively working to shrink its environmental impact by focusing on reducing its carbon footprint and boosting operational sustainability. This includes efforts to use energy more efficiently across its branches and to move towards digital platforms, thereby cutting down on paper consumption. The bank is also exploring investments in renewable energy sources to power its operations, aligning with broader sustainability goals.

These initiatives are crucial as the financial sector faces growing pressure to demonstrate environmental responsibility. For instance, by digitizing more services, the bank can significantly reduce the resources needed for physical operations. The bank's commitment to these areas reflects a growing trend in the banking industry towards integrating environmental, social, and governance (ESG) principles into their core strategies.

In 2023, the banking sector globally saw increased investment in green finance and sustainability-linked loans. While specific 2024/2025 data for South Indian Bank's carbon footprint reduction targets is still emerging, the industry trend suggests a strong push towards quantifiable environmental performance improvements. Key areas of focus for banks like South Indian Bank typically include:

- Energy Efficiency: Implementing smart energy management systems in branches and corporate offices.

- Digital Transformation: Reducing paper usage through enhanced online banking and digital document management.

- Renewable Energy Adoption: Exploring the use of solar power or other renewable sources for operational electricity needs.

Disclosure and Reporting Requirements

Regulatory bodies such as the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are increasingly mandating Environmental, Social, and Governance (ESG) disclosures for banks. South Indian Bank, like its peers, must now report on its environmental impact, social initiatives, and governance frameworks within its annual reports. For larger entities, this reporting is further strengthened by the requirement for mandatory third-party verification, ensuring greater transparency and accountability in 2024-2025.

These evolving disclosure requirements mean South Indian Bank needs robust systems for data collection and reporting across its operations. The focus is on providing clear, verifiable information regarding:

- Environmental Impact: Quantifiable data on carbon footprint, resource consumption, and waste management.

- Social Initiatives: Details on community engagement, employee welfare programs, and diversity metrics.

- Governance Practices: Information on board structure, ethical conduct, and risk management policies.

- Third-Party Verification: Assurance of the accuracy and completeness of reported ESG data, a growing expectation for financial institutions.

South Indian Bank is actively responding to environmental pressures by focusing on reducing its carbon footprint and enhancing operational sustainability, including energy efficiency in branches and digital transformation to cut paper usage.

The Reserve Bank of India and SEBI are driving increased ESG compliance, requiring banks like South Indian Bank to report on environmental performance, with a growing emphasis on climate-related financial risk assessment and management through 2025.

The bank is increasingly involved in green financing, directing capital towards environmentally beneficial projects such as renewable energy, reflecting a broader industry trend towards sustainable lending practices.

South Indian Bank's commitment to environmental responsibility is evident in its efforts to integrate ESG principles into core strategies, with a focus on quantifiable improvements in environmental performance expected to be a key trend through 2024-2025.

PESTLE Analysis Data Sources

Our PESTLE Analysis for South Indian Bank is grounded in data from official Indian government publications, Reserve Bank of India directives, and reputable financial news outlets. We incorporate economic indicators from national statistical agencies and reports from leading industry associations to ensure a comprehensive view.