South Indian Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

South Indian Bank Bundle

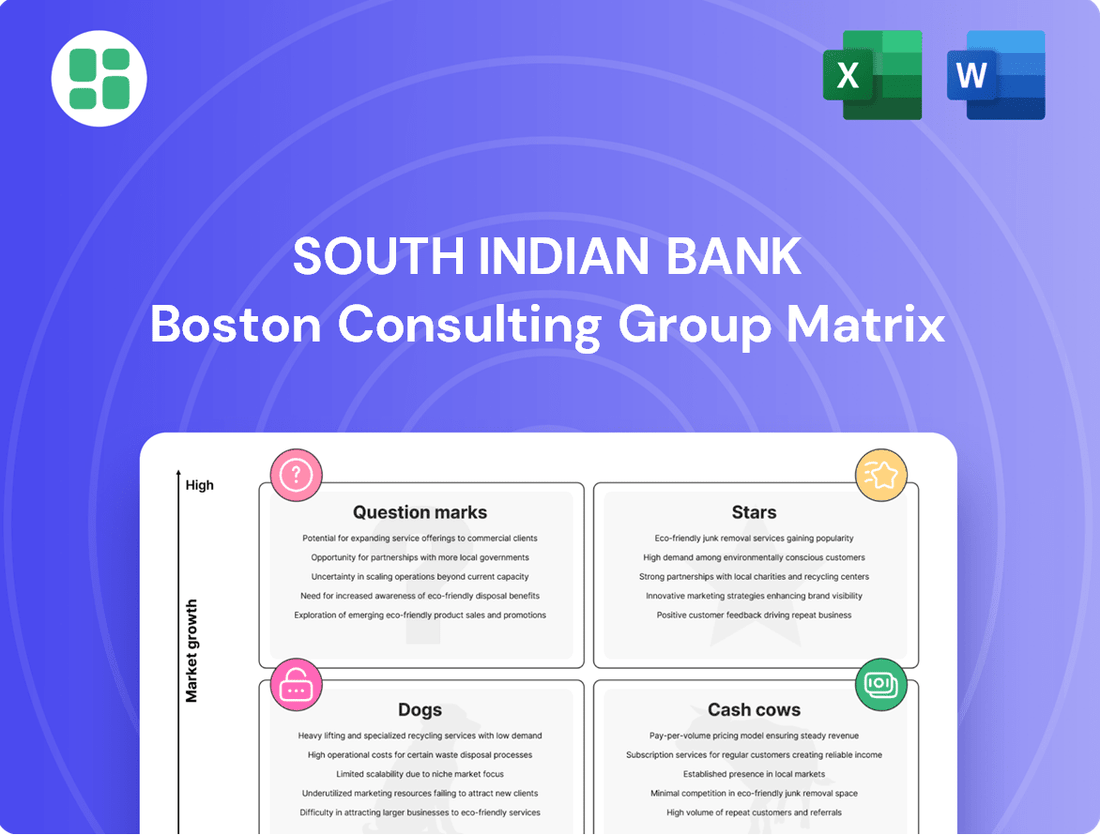

Curious about South Indian Bank's strategic positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a tantalizing preview of their product portfolio's market performance. To truly understand their competitive edge and unlock actionable insights for your own investment strategies, dive into the full report.

Gain a comprehensive understanding of South Indian Bank's product landscape with the complete BCG Matrix. Discover which offerings are driving growth, which require careful management, and where future opportunities lie, all presented with data-driven clarity. Purchase the full version to equip yourself with the strategic intelligence needed to make informed decisions.

Stars

South Indian Bank is aggressively expanding its digital lending portfolio with offerings like SIB Quick Personal Loans and SIB Digital Loan Against Mutual Funds. This strategic push addresses the increasing consumer preference for swift and accessible credit.

These digital products are designed for rapid processing and streamlined onboarding, tapping into the high-growth potential of the digital finance sector. In 2023, digital lending in India saw significant traction, with personal loans disbursed digitally growing substantially, reflecting a strong market appetite for such solutions.

By prioritizing these tech-driven lending avenues, South Indian Bank aims to capture a larger share of the evolving financial market, positioning itself for future growth and customer acquisition in a competitive landscape.

South Indian Bank's housing loans are a clear star in its BCG matrix. The portfolio saw a remarkable 66% year-on-year growth in Q1 FY26, showcasing robust market demand and the bank's successful strategic push into this segment. This impressive expansion positions housing loans as a key growth driver for the bank.

Vehicle loans represent a significant growth engine for South Indian Bank. In the first quarter of fiscal year 2026, this segment experienced a remarkable 27% year-on-year increase, underscoring its strong market demand and the bank's successful penetration.

To capitalize on this upward trend, the bank has invested in a fully digital, end-to-end process for vehicle loan applications. This initiative features various onboarding methods and utilizes scorecard-based underwriting for swift and efficient decision-making, positioning vehicle loans as a key high-growth area.

Corporate Lending

South Indian Bank's corporate lending segment is a key growth driver, with its loan book expanding by a notable 13% in FY25. This expansion demonstrates the bank's effectiveness in securing high-quality corporate clients and assets.

The bank's strategy places a strong emphasis on corporate lending to achieve sustained profitability through judicious credit expansion. This focus is crucial for capturing market share as the Indian economy continues its upward trajectory.

- Corporate Loan Book Growth: South Indian Bank's corporate loan portfolio saw a 13% increase in FY25.

- Strategic Focus: The bank prioritizes corporate lending for profitable, quality credit growth.

- Market Opportunity: A growing Indian economy presents significant avenues for expanding market share in corporate banking.

- Revenue Potential: A robust corporate segment is vital for South Indian Bank's sustained revenue generation.

Upcoming Fully Digital Bank

South Indian Bank's upcoming fully digital bank, slated for launch in 2025, is positioned as a potential Star in its BCG Matrix. This venture aims to provide a seamless, end-to-end digital experience for services like account opening and loan processing, catering to the growing demand for digital financial solutions.

The bank is targeting a new generation of customers who are digital-native and expect efficient, online banking services. This strategic move is designed to capture a significant share of this high-growth market segment, aiming for substantial penetration in the rapidly evolving digital financial landscape.

- Market Opportunity: The digital banking market is experiencing rapid growth, with projections indicating continued expansion in the coming years. For instance, the global digital banking market size was valued at USD 22.79 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2024 to 2030.

- Strategic Alignment: This initiative aligns with the broader trend of financial institutions embracing digital transformation to enhance customer experience and operational efficiency.

- Competitive Edge: By offering a fully digital platform, South Indian Bank aims to differentiate itself and attract customers seeking convenience and speed in their banking transactions.

- Growth Potential: The success of this digital bank could significantly boost South Indian Bank's market share and profitability, solidifying its position as a key player in the digital banking space.

South Indian Bank's housing loans are a clear star in its BCG matrix. The portfolio saw a remarkable 66% year-on-year growth in Q1 FY26, showcasing robust market demand and the bank's successful strategic push into this segment. This impressive expansion positions housing loans as a key growth driver for the bank.

Vehicle loans represent a significant growth engine for South Indian Bank. In the first quarter of fiscal year 2026, this segment experienced a remarkable 27% year-on-year increase, underscoring its strong market demand and the bank's successful penetration.

South Indian Bank's upcoming fully digital bank, slated for launch in 2025, is positioned as a potential Star in its BCG Matrix. This venture aims to provide a seamless, end-to-end digital experience for services like account opening and loan processing, catering to the growing demand for digital financial solutions.

The bank is targeting a new generation of customers who are digital-native and expect efficient, online banking services. This strategic move is designed to capture a significant share of this high-growth market segment, aiming for substantial penetration in the rapidly evolving digital financial landscape.

| Segment | FY25 Growth | Q1 FY26 Growth | Strategic Importance |

| Housing Loans | N/A | 66% | Star |

| Vehicle Loans | N/A | 27% | Star |

| Digital Banking (New Venture) | N/A | N/A | Potential Star |

What is included in the product

This BCG Matrix analysis will identify South Indian Bank's Stars, Cash Cows, Question Marks, and Dogs.

It will highlight which business units to invest in, hold, or divest for optimal growth.

South Indian Bank's BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decisions.

Cash Cows

Traditional Fixed Deposits are South Indian Bank's Cash Cows. These deposits, a cornerstone of the bank's funding, offer stability and a reliable deposit base. Despite operating in a competitive, low-growth environment, their consistent inflow is crucial for liquidity. As of Q4 FY24, South Indian Bank reported total deposits of ₹1,08,871 crore, with a significant portion attributed to retail deposits, highlighting the enduring strength of this product.

Savings accounts represent a significant pillar of South Indian Bank's retail deposit base, acting as a reliable source of low-cost funding. As of the fiscal year ending March 31, 2024, the bank reported a substantial deposit base, with savings accounts playing a key role in this stability. Their consistent volume underpins the bank's ability to finance its lending operations and maintain robust liquidity.

Current accounts, especially those maintained by businesses, act as a stable, non-interest-bearing funding source for South Indian Bank. While their growth might be moderate, these accounts consistently contribute to the bank's liquidity and transaction activity. As of the fiscal year ending March 31, 2024, South Indian Bank reported a CASA ratio of 51.74%, with current accounts playing a crucial role in this metric, bolstering profitability through low funding costs.

Gold Loans

South Indian Bank's gold loans represent a classic Cash Cow in its business portfolio. Despite a moderate 7% year-on-year growth in Q1 FY26, this segment is characterized by established demand, particularly in its core South Indian markets. The robust collateral backing gold loans ensures stable returns and relatively low risk for the bank.

This mature product line consistently generates predictable income, acting as a reliable source of cash flow. The bank's substantial gold loan portfolio underscores its importance as a stable contributor to overall financial performance.

- Mature Product: Gold loans exhibit steady demand, especially in South India.

- Stable Returns: Good collateral provides reliable income with lower risk.

- Consistent Contribution: The segment reliably generates predictable income for the bank.

- Q1 FY26 Growth: Recorded a 7% year-on-year growth in the first quarter of fiscal year 2026.

Established Retail Banking Network

South Indian Bank's established retail banking network, especially its strong presence in South India, continues to be a significant cash cow. This extensive branch infrastructure and the deep customer relationships it fosters generate consistent, reliable revenue from everyday banking transactions and services. As of the first quarter of 2024, South Indian Bank reported a net profit of ₹340 crore, demonstrating the ongoing profitability of its core banking operations.

Despite the increasing shift towards digital banking, the physical branches remain vital for a substantial portion of the customer base, particularly for traditional banking needs. This network's ability to attract and retain customers for basic services like savings accounts, fixed deposits, and loans provides a stable income stream. The bank's focus on enhancing customer experience within these branches further solidifies their role as revenue generators.

- Widespread Branch Network: South Indian Bank operates a significant number of branches, with a dominant presence in South India, catering to a large and loyal customer base.

- Consistent Revenue Generation: The network reliably generates income through traditional banking services, acting as a stable financial pillar for the bank.

- Customer Loyalty and Trust: The physical presence builds trust and facilitates strong customer relationships, leading to sustained business for core products.

- Support for Digital Initiatives: While digital channels are growing, the branch network provides a crucial touchpoint for customers who prefer or require in-person interaction, indirectly supporting the bank's overall service delivery.

South Indian Bank's traditional fixed deposits and savings accounts are its primary cash cows. These products, while operating in a low-growth environment, provide a stable and low-cost funding base essential for the bank's liquidity and lending operations. As of Q4 FY24, the bank's total deposits reached ₹1,08,871 crore, with retail deposits forming a significant portion, underscoring the consistent strength of these offerings.

Current accounts, particularly business accounts, also function as cash cows by offering a non-interest-bearing funding source. Their consistent contribution to liquidity and transaction activity, coupled with a CASA ratio of 51.74% as of FY24, highlights their profitability-boosting role through low funding costs.

Gold loans are another key cash cow, exhibiting stable demand and reliable returns due to robust collateral. Despite a moderate 7% year-on-year growth in Q1 FY26, this segment remains a predictable income generator for South Indian Bank.

The bank's extensive retail banking network, especially its strong South Indian presence, acts as a significant cash cow. This network generates consistent revenue from everyday banking transactions and fosters customer loyalty, contributing to the bank's net profit of ₹340 crore in Q1 2024.

| Product/Service | BCG Category | Key Characteristics | FY24 Data/Notes |

| Fixed Deposits | Cash Cow | Stable funding, reliable deposit base, low growth | Part of ₹1,08,871 crore total deposits (Q4 FY24) |

| Savings Accounts | Cash Cow | Low-cost funding, stable liquidity | Significant contributor to deposit base (FY24) |

| Current Accounts | Cash Cow | Non-interest bearing, stable liquidity, transaction activity | CASA ratio 51.74% (FY24) |

| Gold Loans | Cash Cow | Established demand, stable returns, low risk | 7% YoY growth (Q1 FY26) |

| Retail Banking Network | Cash Cow | Consistent revenue, customer loyalty, strong presence | Net profit ₹340 crore (Q1 2024) |

Preview = Final Product

South Indian Bank BCG Matrix

The South Indian Bank BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means you get the exact strategic analysis, including all data points and visual representations, without any watermarks or demo content. It's a professionally formatted report ready for immediate integration into your business planning and decision-making processes.

Dogs

Underperforming legacy branches, particularly those in areas with dwindling customer traffic or elevated operating expenses, that haven't embraced digital transformation, can be categorized as Dogs in South Indian Bank's BCG Matrix. These branches often represent a drain on resources, including rent, personnel, and upkeep, without yielding commensurate revenue or market growth.

For instance, during the fiscal year 2023-24, South Indian Bank continued its strategic shift towards digital channels, with digital transactions forming a significant portion of its overall business. Branches lagging in adopting these digital models, and experiencing a consistent decline in physical transactions, would fall into this category.

Outdated manual processes are those banking operations still heavily reliant on paper-based or human-driven tasks rather than digital systems. These can include legacy account opening procedures or manual cheque processing, which are becoming increasingly rare as banks modernize.

These manual methods are inherently inefficient, often leading to delays and a higher chance of mistakes compared to automated workflows. For instance, a manual loan application review can take days, whereas a digital process might be completed in hours.

South Indian Bank is actively working to eliminate these, aiming for a future where nearly all transactions are digital. By investing in Straight-Through Processing (STP) systems, the bank is streamlining operations, reducing costs, and improving customer experience, moving away from the inefficiencies associated with manual intervention.

South Indian Bank has strategically reduced its reliance on high-cost bulk deposits. This move highlights a focus on improving profitability by shedding less efficient funding sources.

These high-cost deposits, while bolstering the deposit base, often erode net interest margins due to their significant interest payouts. For instance, in the fiscal year ending March 31, 2024, the bank has shown a deliberate shift away from such liabilities, aiming for a healthier cost of funds.

This shedding indicates that these deposits were not contributing optimally to the bank's overall financial performance, suggesting a proactive approach to capital efficiency and margin enhancement.

Stagnant Niche Investment Products

Stagnant niche investment products, characterized by low customer adoption and a misalignment with evolving market demands or the bank's digital roadmap, fall into this category. These offerings often necessitate continued expenditure on maintenance and regulatory adherence, yet yield minimal fee-based revenue or client acquisition. Their restricted market appeal and negligible market share diminish their overall contribution to the bank's strategic objectives.

South Indian Bank, like many financial institutions, may encounter products that struggle to gain traction. For instance, a bespoke structured product launched in 2022, designed for a very specific investor profile, might have only seen a handful of subscriptions by mid-2024. This limited uptake means the product contributes little to the bank's fee income, which for South Indian Bank, was around INR 1,350 crore for the fiscal year ending March 31, 2023, with wealth management being a component.

- Low Customer Uptake: Products with minimal client subscriptions, failing to meet initial adoption targets.

- Market Trend Misalignment: Offerings that do not resonate with current investor preferences or economic conditions.

- Digital Strategy Conflict: Products that are not integrated with or support the bank's digital transformation initiatives.

- Resource Drain: Continued costs for maintenance and compliance without commensurate revenue generation.

Legacy Non-Performing Assets (NPAs)

While South Indian Bank has made substantial progress in cleaning up its balance sheet, reducing its Gross Non-Performing Assets (NPA) ratio to 3.32% and Net NPA ratio to 0.90% as of March 31, 2024, any lingering legacy NPAs still represent a challenge.

These older, difficult-to-recover bad loans require ongoing management and provisioning, diverting capital and impacting the bank's overall profitability. Even with significant improvements, these remaining legacy NPAs can be considered Dogs in the BCG matrix context, as they tie up resources without generating significant returns.

- Legacy NPAs as a drag: Despite a notable reduction in NPA ratios, the remaining legacy bad loans continue to consume management attention and resources for recovery, hindering faster growth.

- Impact on profitability: Provisioning for these assets, even if reduced, still impacts the bank's bottom line, affecting its ability to reinvest in growth areas.

- Resource allocation: The effort and capital allocated to resolving these older NPAs could otherwise be directed towards more productive lending or strategic initiatives.

Dogs within South Indian Bank's BCG Matrix represent offerings or business segments with low market share and low growth potential, often requiring significant resources without generating substantial returns. These are typically products or services that have failed to gain traction or have become obsolete due to market shifts or technological advancements.

For instance, certain legacy IT systems that are costly to maintain but offer limited functionality and are not integrated into the bank's digital strategy would be classified as Dogs. Similarly, branches with consistently declining transaction volumes and a failure to adapt to digital banking trends also fall into this category, representing an inefficient use of capital.

South Indian Bank's focus on improving operational efficiency and digital adoption means that such underperforming assets are actively being managed or divested. For example, the bank's efforts to streamline its branch network and enhance digital services aim to move away from these low-return areas.

The bank's reported Net Interest Margin (NIM) for the fiscal year ending March 31, 2024, stood at 3.04%, indicating a healthy core banking operation. However, products or branches classified as Dogs would likely be dragging down overall profitability and efficiency metrics, necessitating strategic review.

Question Marks

South Indian Bank is actively pursuing fintech partnerships, particularly in high-growth digital segments. These emerging ventures, while currently holding a small market share for the bank, are crucial for its digital transformation strategy.

For instance, in the first quarter of fiscal year 2024, South Indian Bank saw its digital channel advances grow by a significant 46.5%, reaching ₹3,560 crore. This growth underscores the bank's commitment to digital solutions and the potential of these nascent fintech collaborations.

These partnerships require substantial investment and careful strategic management. The bank is assessing whether these fintech initiatives will mature into 'Stars' within its product portfolio or if they will need to be divested based on performance and market dynamics.

South Indian Bank's strategic focus on digital transformation points toward an exciting future with AI-driven personalized banking. Imagine advanced analytics that truly understand your financial needs or AI assistants offering tailored advice. These are areas ripe for innovation, holding significant growth potential across the banking industry.

Currently, these advanced AI solutions represent a nascent market for South Indian Bank, with low penetration. This means there's a substantial opportunity to carve out a unique market position. However, realizing this vision requires considerable investment in research and development, along with robust implementation strategies to build a strong market presence.

South Indian Bank's international remittance services represent a potential 'Question Mark' within its BCG Matrix. While the bank benefits from a substantial NRI deposit base, the global money transfer market is characterized by high growth and intense competition.

Expanding these services, particularly through new digital channels, requires significant investment in technology and strategic global partnerships to capture a larger market share. This strategic move aims to leverage existing strengths in a dynamic and evolving financial landscape, with the potential for future growth if executed effectively.

NFC-based UPI Enhancements (Tap & Pay)

South Indian Bank's introduction of NFC-based UPI Tap & Pay aligns with India's booming digital payments landscape, a sector experiencing significant growth. While UPI as a whole is a high-potential area, these advanced features are still gaining traction.

To capitalize on this, aggressive marketing and user education are crucial for South Indian Bank to secure a substantial market share for its Tap & Pay service. The bank needs to highlight the convenience and speed of these transactions to drive adoption.

- NFC-based UPI adoption: While overall UPI transactions in India crossed 10 billion in FY24, specific data for NFC-based UPI adoption for South Indian Bank is still emerging.

- Market penetration strategy: The bank is focusing on increasing awareness and ease of use for its Tap & Pay feature to capture a larger segment of the digital payment market.

- Competitive landscape: Other banks are also enhancing their digital offerings, making user experience and targeted outreach key differentiators for South Indian Bank.

- Future growth potential: As contactless payments become more mainstream, NFC-based UPI is poised for significant expansion, presenting a strong opportunity for the bank.

Specialized MSME Digital Lending Modules

South Indian Bank is actively enhancing its digital lending capabilities for the Micro, Small, and Medium Enterprises (MSME) sector, a crucial engine for India's economic growth. The bank's strategic move includes implementing new digital Loan Origination Systems, specifically designed to streamline the process for MSMEs. This focus is evident in the revamp of products like 'Micro Power,' which targets micro and small businesses with tailored financial solutions.

While the MSME sector in India presents a significant growth opportunity, South Indian Bank's current penetration in these specialized digital lending modules might be modest when contrasted with larger financial institutions or agile fintech companies. The bank's investment in these advanced digital platforms and revamped product offerings is substantial, reflecting a commitment to scaling operations and capturing a more prominent market share in this competitive landscape.

- Digital Loan Origination Systems: South Indian Bank is investing in advanced digital platforms to expedite loan approvals for MSMEs.

- 'Micro Power' Product Revamp: The bank has updated its 'Micro Power' offering to better serve the needs of micro and small businesses.

- MSME Sector Growth: India's MSME sector is a high-potential market, with significant opportunities for digital lending.

- Investment for Market Share Gain: Achieving a dominant position requires considerable investment in technology and product development to compete effectively.

South Indian Bank's international remittance services are a prime example of a 'Question Mark.' While the bank leverages a strong NRI deposit base, the global money transfer market is highly competitive and rapidly evolving.

Significant investment in technology and strategic global partnerships is necessary to increase market share in this segment. The bank is actively exploring new digital channels to enhance these services, aiming to capture a larger portion of this dynamic market.

The bank's NFC-based UPI Tap & Pay feature is another 'Question Mark.' Despite the overall growth in UPI transactions across India, which surpassed 10 billion in FY24, the adoption of specific contactless features is still developing.

South Indian Bank is focusing on marketing and user education to drive adoption of its Tap & Pay service, recognizing the need to stand out in a competitive digital payments landscape. This strategic push aims to capitalize on the increasing mainstream acceptance of contactless payments.

BCG Matrix Data Sources

Our South Indian Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.