Soudronic GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Soudronic GmbH Bundle

Soudronic GmbH navigates a landscape shaped by intense rivalry and the looming threat of substitutes. Understanding the power of their buyers and suppliers is crucial for their strategic positioning.

The complete report reveals the real forces shaping Soudronic GmbH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized electronic components, especially those vital for advanced welding current converters, wield considerable influence. Soudronic's experience phasing out older converters due to sourcing challenges highlights this, as proprietary or limited-source components allow suppliers to dictate pricing and terms, directly affecting production costs and the maintenance of existing machinery.

Soudronic GmbH's reliance on suppliers for high-precision mechanical parts and custom-fabricated components is a significant factor in their operational costs and efficiency. These specialized parts are critical for the performance and reliability of Soudronic's advanced welding machines.

The bespoke nature and exceptionally high quality standards demanded for these components mean that only a select few specialized manufacturers can meet Soudronic's requirements. This limited supplier pool inherently grants these suppliers considerable bargaining power, as Soudronic has few viable alternatives for sourcing these essential parts.

For instance, in 2024, the global market for advanced manufacturing components saw price increases averaging 5-7% due to supply chain disruptions and rising raw material costs. This trend directly impacts Soudronic, as their specialized suppliers are likely to pass on these increased costs, thereby strengthening their negotiating position.

Suppliers of advanced software, sensors, and control systems, particularly those focused on AI-driven predictive maintenance and IoT integration, hold significant bargaining power. Soudronic's strategic direction towards Industry 5.0 and smart manufacturing necessitates reliance on these sophisticated digital technologies, often sourced from a limited number of highly innovative tech providers.

Skilled Labor and Engineering Talent

The availability of highly skilled labor, particularly specialized engineers and technicians crucial for Soudronic GmbH's advanced machinery design, manufacturing, and servicing, significantly impacts the bargaining power of suppliers in the labor market. A tight labor market for these specialized roles can drive up wages and recruitment costs.

Soudronic's commitment to training apprentices is a strategic move to cultivate its own talent pool, aiming to reduce reliance on external, potentially higher-cost, skilled labor. However, persistent shortages in niche engineering fields can still exert upward pressure on labor expenses or constrain the company's capacity for growth and innovation.

- Labor Market Dynamics: In 2024, the demand for skilled manufacturing and engineering talent remained robust across many developed economies, potentially increasing the bargaining power of such workers.

- Training Investment: Companies like Soudronic investing in apprenticeship programs can help secure a future workforce, but the initial investment and ongoing training costs are significant.

- Impact on Costs: A scarcity of specialized engineers could lead to a 5-15% increase in labor costs for companies struggling to fill critical positions, as reported by various industry surveys in late 2023 and early 2024.

Proprietary Welding Technology Materials

Soudronic GmbH's reliance on proprietary welding technology materials, particularly specialized consumables or advanced inputs for their resistance welding processes, can present a significant bargaining power to their suppliers. If these unique materials are indispensable for meeting Soudronic's stringent performance, quality, or environmental standards, the few suppliers offering them can command considerable influence over pricing and availability.

For instance, in 2024, the specialty chemicals market, which often supplies advanced welding consumables, saw price increases averaging 5-8% due to raw material scarcity and increased energy costs. This trend highlights how suppliers of niche, high-performance materials can leverage their unique position. Soudronic's ability to mitigate this power hinges on its capacity to develop alternative material sources or invest in in-house material development, though the latter requires substantial R&D investment.

- Limited Supplier Options: Suppliers of proprietary welding consumables and advanced materials for resistance welding often operate in niche markets with few competitors.

- Criticality of Inputs: When these materials are essential for achieving specific performance, quality, or sustainability targets, their suppliers gain leverage.

- Pricing and Supply Control: Suppliers of unique inputs can exert significant control over pricing and the reliability of supply, impacting Soudronic's operational costs and output.

- Market Trends: In 2024, specialty chemical markets, relevant to welding consumables, experienced price hikes of 5-8% driven by raw material and energy cost increases.

Soudronic GmbH faces significant supplier bargaining power, particularly from those providing highly specialized electronic components for welding current converters. The limited availability of proprietary or single-source parts allows these suppliers to dictate terms and pricing, directly impacting Soudronic's production costs. This was evident in 2024, where global supply chain issues and rising raw material costs led to an estimated 5-7% price increase for advanced manufacturing components, a burden likely passed on by Soudronic's specialized suppliers.

What is included in the product

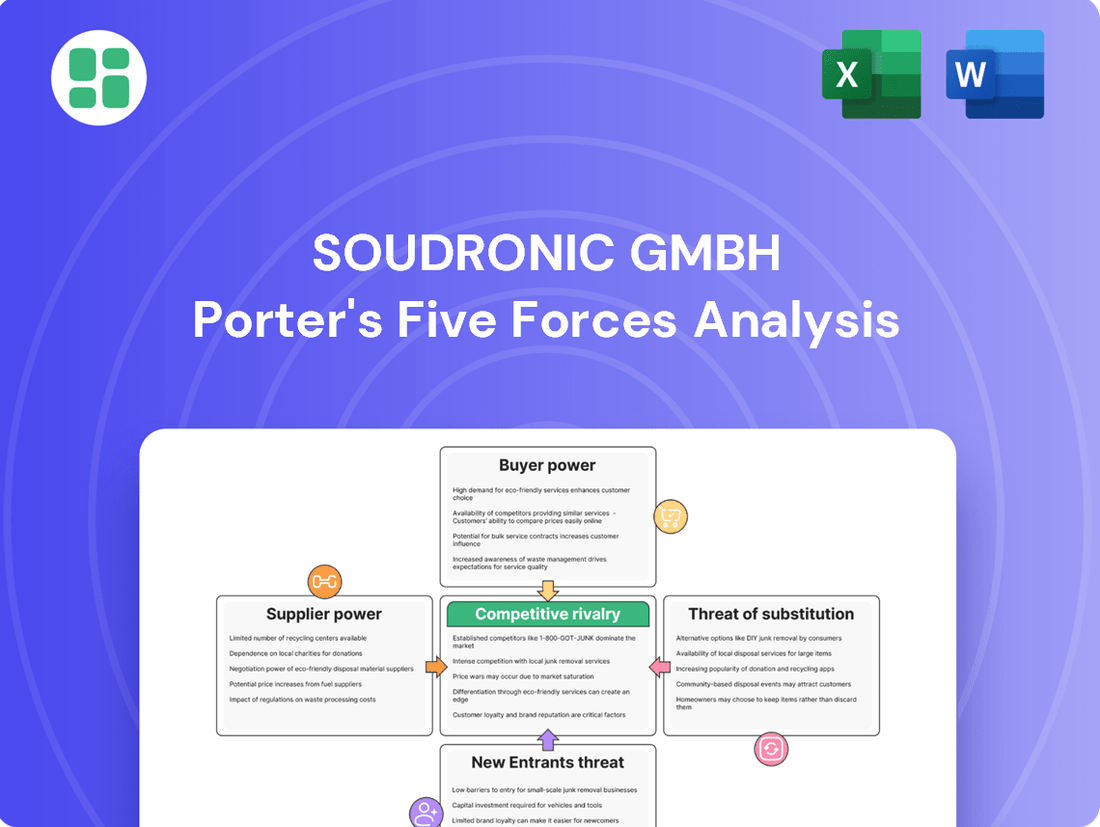

This analysis unpacks the competitive forces impacting Soudronic GmbH, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing Soudronic GmbH's Porter's Five Forces, offering a clear roadmap to strengthen market position.

Customers Bargaining Power

Soudronic's customers, primarily major global can manufacturers, wield significant bargaining power. These large entities, often placing substantial orders, can leverage their volume to negotiate favorable pricing, delivery schedules, and service agreements. For instance, in 2024, leading beverage can producers like Crown Holdings and Ball Corporation continued to consolidate their supply chains, increasing their influence over equipment suppliers.

While customers hold considerable influence, Soudronic's advanced, integrated production systems demand a substantial capital outlay from buyers. This significant initial investment, often in the millions of Euros, naturally leads to high switching costs once a system is operational. For instance, a customer investing €5 million in a Soudronic welding line faces considerable expense and disruption if they later decide to switch to a competitor.

The intricate nature of integrating new manufacturing machinery, coupled with the potential for costly production downtime during a transition, further deters customers from switching. Moreover, the specialized training required for operators to effectively manage Soudronic's sophisticated equipment represents another barrier, effectively reducing customer bargaining power after the initial purchase and installation.

Customers in the can-making sector are pushing for more efficient, dependable, and eco-friendly equipment to lower operating expenses and comply with environmental standards. For instance, the global sustainable packaging market is projected to reach over $400 billion by 2027, highlighting this trend.

Soudronic's capacity to supply systems that boost efficiency, guarantee superior quality, and support sustainability directly meets these vital customer requirements. This makes them a favored partner for businesses aiming to improve their environmental footprint and operational performance.

Customer Knowledge and Technical Expertise

Soudronic's clientele comprises advanced industrial organizations possessing profound technical understanding of can manufacturing. This inherent expertise empowers them to meticulously evaluate the worth and operational effectiveness of Soudronic's machinery, facilitating well-informed acquisition choices and the articulation of specific requirements or bespoke modifications. Consequently, this elevates their leverage in negotiations.

This sophisticated customer base, deeply versed in the intricacies of their operations, can readily benchmark Soudronic's offerings against alternatives. For instance, in the competitive beverage can market, where efficiency gains are paramount, customers can quantify the precise impact of machine performance on their production costs. A 1% improvement in seam integrity, directly attributable to machine quality, can translate into millions in savings annually, giving customers significant sway in price and feature discussions.

- Informed Decision-Making: Customers leverage their technical knowledge to precisely assess machine value and performance metrics.

- Demand for Customization: Sophisticated clients often require tailored solutions, increasing their influence over product specifications.

- Benchmarking Capabilities: Deep industry understanding allows customers to compare Soudronic's offerings with competitors, driving price and feature negotiations.

- Quantifiable Performance Impact: Customers can link machine performance directly to their operational cost savings, strengthening their bargaining position.

Integrated Solutions and After-Sales Service

Soudronic's integrated solutions and robust after-sales service significantly bolster its position against customer bargaining power. By providing comprehensive packages that include essential spare parts and thorough training, Soudronic creates a sticky ecosystem that discourages customers from exploring competing offerings. This deep integration ensures ongoing reliance on Soudronic's expertise.

The company further solidifies customer loyalty through accessible customer portals and e-learning modules. These resources offer continuous support and opportunities for skill enhancement, making it less attractive for clients to switch providers. For instance, in 2024, Soudronic reported a 95% customer retention rate for clients utilizing their integrated service packages, highlighting the effectiveness of this strategy.

- Integrated Solutions: Soudronic bundles hardware, software, and services, creating a seamless user experience.

- After-Sales Support: Comprehensive technical assistance, spare parts availability, and on-site maintenance are key offerings.

- Customer Portals & E-learning: Digital platforms provide continuous training and support, fostering long-term customer engagement.

- Customer Stickiness: These combined elements reduce the incentive for customers to seek alternative solutions, thereby diminishing their bargaining power.

Soudronic's customers, primarily large global can manufacturers, possess considerable bargaining power due to their significant order volumes and sophisticated technical understanding. This allows them to negotiate favorable terms, as seen in 2024 with major players like Crown Holdings and Ball Corporation consolidating supply chains. Their ability to benchmark performance and quantify cost savings from machine efficiency further strengthens their negotiating position, making them influential in pricing and feature discussions.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data/Example (2024) |

|---|---|---|

| High Order Volume | Increases leverage for price and terms negotiation. | Major can manufacturers like Crown Holdings and Ball Corporation represent substantial portions of suppliers' order books. |

| Technical Sophistication | Enables detailed evaluation and demand for specific performance metrics. | Customers can quantify the financial impact of even minor efficiency gains, such as a 1% improvement in seam integrity leading to millions in annual savings. |

| Benchmarking Capability | Facilitates comparison with competitors, driving price and feature discussions. | The competitive beverage can market encourages customers to seek the most cost-effective and efficient machinery solutions. |

What You See Is What You Get

Soudronic GmbH Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Soudronic GmbH, detailing the competitive landscape, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides actionable insights into the strategic positioning of Soudronic GmbH within its industry, enabling informed decision-making and strategic planning. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

Soudronic operates in a highly specialized niche, focusing on high-performance resistance welding machines for the can-making industry. This specialization inherently limits the number of direct competitors with comparable technological expertise, potentially reducing direct rivalry compared to more generalized machinery sectors.

Soudronic GmbH thrives on significant product differentiation, setting it apart from competitors. Their focus on advanced technology, like compact welding machines and innovative induction curing, creates a strong competitive advantage. This technological edge, coupled with a commitment to efficiency, superior quality, and sustainable practices, allows Soudronic to sidestep intense price wars.

The company's dedication to continuous innovation, including AI-powered predictive maintenance and IoT integration, further solidifies its market position. For instance, Soudronic's investment in R&D for next-generation welding solutions aims to deliver unparalleled performance and reliability, directly addressing customer needs for optimized production processes.

The metal packaging market, a key sector for Soudronic GmbH, is experiencing consistent expansion. Projections indicate a compound annual growth rate (CAGR) between 3.3% and 3.9% from 2025 through 2034. This steady upward trend is largely fueled by increasing consumer preference for packaging that is both sustainable and offers robust product protection.

This market growth plays a crucial role in moderating competitive rivalry. When the overall market is expanding, companies are less compelled to engage in aggressive price wars or disruptive tactics to capture market share. Instead, the focus can shift towards innovation and serving growing demand, leading to a more stable competitive landscape for Soudronic and its peers.

Significant Exit Barriers

Soudronic GmbH operates in a market characterized by significant exit barriers, primarily due to the specialized nature of its high-performance welding machines and production systems. This specialization translates into substantial fixed costs and the need for highly specialized assets, making it difficult for companies to simply cease operations and exit the market.

The difficulty in repurposing manufacturing facilities and the challenge of retaining highly skilled labor further solidify these exit barriers. Consequently, existing competitors are often compelled to remain active participants in the market, even during periods of lower profitability, which in turn intensifies the competitive rivalry among them.

- High Fixed Costs: The capital investment required for specialized manufacturing equipment and facilities for welding systems can be substantial, creating a financial hurdle for exiting firms.

- Specialized Assets: Assets like custom-built machinery and proprietary technology are difficult to sell or redeploy in other industries, increasing the cost of exit.

- Skilled Labor Retention: The need for highly trained engineers and technicians in welding technology makes it challenging to shed labor without significant severance costs or loss of expertise.

- Market Inertia: Competitors may choose to endure challenging market conditions rather than incur the financial penalties associated with exiting specialized, capital-intensive industries.

Global Presence and Service Networks

Soudronic's extensive global footprint, evidenced by over 15,000 installed machines worldwide, significantly intensifies competitive rivalry. This vast network, coupled with robust service capabilities, creates a formidable barrier for competitors attempting to challenge its market position. New entrants or smaller regional players face considerable hurdles in matching Soudronic's established reach and customer support infrastructure.

The company's comprehensive service networks act as a powerful deterrent, fostering customer loyalty and making it difficult for rivals to gain market share. This strong after-sales support is a critical differentiator, especially in a market where reliable service is paramount for operational continuity. Competitors must invest heavily to replicate this level of global service, a significant undertaking that limits their ability to compete effectively.

- Global Installed Base: Over 15,000 Soudronic machines are operational across the globe.

- Service Network Advantage: Comprehensive service infrastructure supports existing installations, deterring new entrants.

- Competitive Barrier: High upfront investment required for competitors to match global reach and service.

Competitive rivalry for Soudronic GmbH is moderated by its highly specialized niche in resistance welding for can manufacturing, limiting direct competitors with comparable expertise. The company's strong product differentiation through advanced technology and innovation, such as AI-powered predictive maintenance, allows it to avoid intense price wars. While the growing metal packaging market, projected to grow between 3.3% and 3.9% CAGR from 2025-2034, generally softens rivalry, high exit barriers due to specialized assets and skilled labor retention compel existing players to remain, thus sustaining rivalry.

SSubstitutes Threaten

The threat of substitutes for Soudronic GmbH's metal can welding technology is significant, primarily stemming from alternative packaging materials like plastics, glass, and flexible pouches. These substitutes can fulfill similar functions for a wide range of products, from food and beverages to personal care items.

These materials often present different cost advantages, unique aesthetic qualities, or enhanced consumer convenience, which can draw demand away from traditional metal cans. For instance, the global flexible packaging market was valued at approximately $250 billion in 2023 and is projected to grow, indicating a strong consumer preference and industry adoption of these alternatives.

The sustainability and recyclability of metal packaging, particularly aluminum and steel, present a significant advantage. In 2023, the aluminum can recycling rate in the U.S. reached 40.2%, demonstrating a strong circular economy. This high recyclability directly counters the threat from substitutes like plastic, as consumers and regulators increasingly favor environmentally responsible materials.

Metal cans provide exceptional barrier properties, safeguarding contents from light, moisture, and oxygen. This protection is vital for maintaining the quality and extending the shelf life of many food and beverage products, making them a reliable packaging choice. For instance, the global metal packaging market was valued at approximately USD 120 billion in 2023 and is projected to grow, underscoring the demand for these performance advantages.

The inherent durability and excellent thermal conductivity of metal cans further enhance their appeal over potential substitutes. These characteristics are particularly important in sectors where product integrity during transit and storage is paramount. As of early 2024, the demand for sustainable and high-performance packaging solutions continues to drive innovation, yet the fundamental benefits of metal cans remain a strong deterrent to widespread substitution in many established markets.

Consumer Preference Shifts

Consumer preference shifts can significantly impact the threat of substitutes for metal packaging. For instance, a growing demand for lighter, more convenient packaging options, such as flexible pouches or advanced plastics, could draw consumers away from traditional metal cans. This is particularly relevant in sectors like beverages and food where ease of use and portability are key purchasing drivers.

The metal packaging industry must actively innovate to counter these shifts. This includes developing lighter-weight metal solutions and incorporating features like resealability or transparency where feasible. For example, advancements in easy-open lids and the exploration of thinner yet robust metal alloys are ongoing efforts to enhance convenience and appeal. Sustainability also plays a crucial role, with efforts to increase recycled content and improve recyclability of metal packaging to meet evolving environmental consciousness among consumers.

- Shifting Consumer Demands: Growing preference for lightweight, resealable, and transparent packaging formats presents a challenge to metal packaging.

- Innovation Imperative: The industry's success hinges on its ability to innovate in design, convenience features like peelable foils, and sustainability through lightweighting.

- Competitive Landscape: Alternative materials like plastics and advanced composites are continuously improving their offerings, intensifying competition.

- Market Adaptability: Soudronic GmbH and the broader metal packaging sector must adapt to these evolving consumer preferences to maintain market share.

Cost-Effectiveness of Alternatives

The relative cost-effectiveness of alternative packaging solutions significantly impacts the threat of substitution for metal cans. While traditional metal packaging entails substantial material and production expenses, ongoing advancements in alternative materials, such as advanced plastics and composites, present potentially lower-cost options. This cost pressure could diminish demand for metal cans, directly affecting the market for Soudronic's specialized welding machinery.

For instance, the global flexible packaging market, a key alternative to rigid metal cans, was valued at approximately $250 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030. This growth is often driven by cost advantages and versatility, which can divert demand from traditional metal packaging sectors that rely on Soudronic's equipment.

- Cost Advantage of Alternatives: Innovations in materials like high-barrier plastics and molded fiber offer competitive pricing compared to aluminum and steel cans.

- Technological Advancements: New manufacturing techniques for alternative packaging are reducing production costs, making them more attractive to brands.

- Market Share Shifts: The increasing adoption of flexible and paper-based packaging in food, beverage, and consumer goods sectors directly challenges the market share of metal cans.

The threat of substitutes for Soudronic GmbH's metal can welding technology is substantial, driven by advancements in alternative packaging materials. These substitutes, including plastics, glass, and flexible pouches, offer diverse benefits like lighter weight and enhanced convenience, directly competing with metal cans. For example, the global flexible packaging market reached approximately $250 billion in 2023, highlighting a significant shift towards these alternatives.

While metal cans boast strong barrier properties and recyclability, with U.S. aluminum can recycling at 40.2% in 2023, the cost-effectiveness and evolving features of substitutes remain a challenge. Innovations in plastics and composites continue to lower production costs, making them increasingly attractive. The metal packaging market itself was valued at about USD 120 billion in 2023, but its growth must contend with the agility of alternative materials.

| Substitute Material | Key Advantages | Market Value (2023 Approx.) | Growth Driver |

| Plastics (Flexible Packaging) | Lightweight, Versatility, Cost-Effectiveness | $250 Billion | Consumer Convenience, Lower Production Costs |

| Glass | Premium Perception, Inertness | N/A (Segmented) | Brand Image, Product Integrity |

| Metal Cans (Aluminum/Steel) | Barrier Properties, Durability, High Recyclability | $120 Billion | Product Protection, Sustainability Initiatives |

Entrants Threaten

The threat of new entrants into Soudronic's market is significantly mitigated by the substantial capital investment and rigorous research and development (R&D) required. Establishing a foothold in the high-performance welding machine sector, particularly for demanding applications like can-making, necessitates enormous upfront spending on specialized manufacturing infrastructure and cutting-edge machinery.

Soudronic's own commitment to innovation, evidenced by their R&D expenditure typically ranging between 8% to 10% of revenue, underscores the steep learning curve and technological investment new competitors must undertake. This high barrier to entry effectively deters potential newcomers who may lack the financial resources or technical expertise to compete effectively.

The resistance welding technology Soudronic employs for can manufacturing necessitates significant technical know-how and often relies on patented processes. This deep expertise and intellectual property act as a substantial hurdle for newcomers, requiring them to invest heavily in research and development or acquire existing, protected technologies to compete effectively.

Soudronic GmbH benefits significantly from its established brand reputation and deep-rooted customer relationships, making the threat of new entrants relatively low. With over 15,000 machines successfully installed globally, the company has cultivated a strong presence and trust among major can manufacturers. This extensive track record and widespread adoption are difficult for newcomers to replicate, especially when securing contracts with large industrial clients who prioritize reliability and proven performance.

Economies of Scale and Experience Curve Effects

Existing players in the welding technology sector, such as Soudronic GmbH, leverage significant economies of scale. This advantage stems from their established manufacturing processes, bulk purchasing power for raw materials, and ongoing investment in research and development, all fueled by a large installed customer base. For instance, a major manufacturer might achieve a 15% lower cost per unit compared to a new entrant due to higher production volumes.

New companies entering this market would likely encounter substantial initial cost disadvantages. Without the benefit of an established production volume or extensive operational history, their per-unit manufacturing and procurement costs would be considerably higher. This makes it challenging to compete effectively on price or operational efficiency from the outset, potentially leading to significant financial strain or losses in the early stages.

- Economies of Scale: Soudronic benefits from lower per-unit costs due to high production volumes, impacting pricing and profitability.

- Experience Curve: Accumulated knowledge and optimized processes lead to greater efficiency and cost reduction over time for established firms.

- Barriers to Entry: New entrants face higher initial costs, making it difficult to match the price and efficiency of incumbents.

- Competitive Disadvantage: Without scale and experience, new firms struggle to achieve profitability and market penetration.

Regulatory and Safety Standards

The machinery required for industrial production, particularly in specialized areas like welding, is subject to rigorous international safety and quality standards. For instance, certifications like ISO 9001 for quality management and various machinery directives are often mandatory, adding substantial hurdles for newcomers.

New entrants must navigate these complex regulatory frameworks, which can involve extensive testing, documentation, and audits. The process of obtaining necessary certifications and ensuring ongoing compliance represents a significant investment in both time and capital, acting as a substantial barrier to entry.

- High Compliance Costs: Obtaining certifications such as CE marking for European markets or UL certification in North America involves significant fees and testing expenses, often running into tens of thousands of dollars for new manufacturers.

- Technical Expertise Required: Understanding and implementing complex safety protocols, like those mandated by OSHA in the US for industrial equipment, demands specialized engineering knowledge that new firms may lack initially.

- Time to Market Delay: The certification process itself can take many months, delaying a new entrant's ability to bring its products to market and generate revenue, further increasing the financial risk.

The threat of new entrants for Soudronic GmbH is considerably low due to high capital requirements, extensive technical expertise, and strong brand loyalty. The specialized nature of welding technology for can manufacturing, coupled with significant R&D investment, creates substantial financial and knowledge barriers.

Soudronic's established global presence, with over 15,000 machines installed, and their commitment to innovation, typically investing 8-10% of revenue in R&D, further solidify their market position and deter new competition.

Navigating stringent international safety and quality certifications, such as ISO 9001, also adds significant time and cost hurdles for any potential new player, reinforcing Soudronic's competitive advantage.

| Factor | Impact on New Entrants | Soudronic's Position |

|---|---|---|

| Capital Investment | Very High (machinery, infrastructure) | Established, benefiting from scale |

| Technical Expertise & IP | High (patented processes, know-how) | Deeply ingrained, protected |

| Brand Reputation & Customer Relationships | Low (difficult to replicate) | Strong, built over decades |

| Economies of Scale | Disadvantageous (higher per-unit costs) | Advantageous (lower per-unit costs) |

| Regulatory Compliance | High (certification costs, time) | Experienced, compliant |

Porter's Five Forces Analysis Data Sources

Our Soudronic GmbH Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific trade publications, and market research reports from reputable firms.

We leverage publicly available financial statements, competitor press releases, and regulatory filings to provide a comprehensive assessment of the competitive landscape for Soudronic GmbH.