Shengjing Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shengjing Bank Bundle

Shengjing Bank operates within a dynamic environment shaped by political stability, economic growth, and evolving social trends in China. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves into these factors, offering actionable insights.

Gain a competitive edge by grasping the technological advancements and environmental regulations impacting Shengjing Bank. This ready-made PESTLE analysis provides expert-level intelligence, perfect for investors and strategic planners. Buy the full version to get the complete breakdown instantly.

Political factors

The stability of the Chinese government's financial policies and the broader political landscape are crucial for Shengjing Bank. For instance, in 2023, China's GDP grew by 5.2%, indicating a generally stable economic environment, which underpins the banking sector's operations. However, shifts in regulatory focus from bodies like the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA) can significantly alter lending conditions and liquidity, directly impacting Shengjing Bank.

The government's approach to managing financial risks, particularly those stemming from the property sector, is a key consideration. As of late 2024, ongoing efforts to stabilize the real estate market, including potential policy adjustments to support developers and homebuyers, will directly influence the non-performing loan ratios for banks like Shengjing. The government's commitment to supporting regional banks, as evidenced by past restructuring efforts, will also shape strategic decisions and risk appetite.

Shengjing Bank navigates a banking landscape where state influence is a constant. As of early 2024, the Chinese government, through various local entities, remains a significant shareholder in many domestic banks, potentially including Shengjing Bank, impacting its strategic decisions and asset management practices.

The regulatory framework is dynamic. For instance, in 2023, China continued to emphasize data security and anti-money laundering (AML) measures, with new regulations like the Personal Information Protection Law (PIPL) impacting how financial institutions handle customer data and report suspicious transactions, requiring ongoing compliance efforts from Shengjing Bank.

Shengjing Bank's operations are deeply intertwined with the economic landscape of Liaoning Province, making regional government support a significant factor. Policies enacted by the Liaoning provincial government and municipal authorities in areas like Shenyang directly impact the bank's operating environment. For instance, government initiatives aimed at revitalizing Northeast China's industrial base, where Liaoning plays a key role, could spur lending opportunities for Shengjing Bank.

Government interventions to manage regional financial risks or support struggling local enterprises can create both opportunities and challenges. In 2023, China's central government continued to emphasize financial stability, and regional governments often play a role in implementing these directives, which could involve restructuring or recapitalization efforts for local banks. Shengjing Bank, as a regional player, is subject to these localized policy shifts, which could influence its asset quality and risk profile.

Macroeconomic Control and Stimulus Measures

The Chinese government wields significant influence over the economy through active fiscal and monetary policy interventions. These measures are designed to manage inflation, control economic growth, and respond to market fluctuations. For instance, the People's Bank of China (PBOC) frequently adjusts benchmark interest rates and the Reserve Requirement Ratio (RRR) to manage liquidity within the banking system. In 2024, the PBOC continued its accommodative monetary stance, with a notable cut to the Reserve Requirement Ratio in early 2024, freeing up substantial liquidity for banks to lend. This directly impacts Shengjing Bank's net interest margins and its ability to extend credit.

Shengjing Bank's strategic planning must therefore be closely aligned with these macroeconomic objectives. The bank's profitability and lending capacity are directly influenced by the PBOC's actions. For example, lower interest rates can reduce the cost of funding but also compress lending yields. Conversely, targeted liquidity injections can bolster the bank's balance sheet and support its lending activities during periods of economic uncertainty. Shengjing Bank's success hinges on its ability to navigate and adapt to these government-driven economic controls and stimulus efforts.

Key policy actions and their implications for Shengjing Bank include:

- Interest Rate Adjustments: Changes to benchmark lending and deposit rates directly affect Shengjing Bank's core profitability. For example, a 25 basis point cut in the Loan Prime Rate (LPR) in early 2024 aimed to lower borrowing costs for businesses and individuals.

- Reserve Requirement Ratio (RRR) Changes: Reductions in the RRR, such as the 50 basis point cut implemented in January 2024, increase the funds available for lending, potentially boosting Shengjing Bank's loan origination volume.

- Liquidity Injections: The PBOC's use of tools like the Medium-term Lending Facility (MLF) provides targeted liquidity, helping to stabilize the financial system and support banks like Shengjing Bank in meeting their funding needs.

- Fiscal Stimulus Measures: Government spending on infrastructure or tax incentives can indirectly boost economic activity, leading to increased demand for banking services and loans from Shengjing Bank.

Geopolitical Risks and Trade Policies

Shengjing Bank, while focused domestically, feels the indirect impact of China's global standing. Geopolitical tensions and shifts in international trade policies can ripple through the economy, affecting the bank's corporate clients. For instance, a slowdown in global trade, as seen in the fluctuating export volumes of Chinese goods, can strain the finances of companies that rely on international markets. This, in turn, can lead to increased credit risk for Shengjing Bank.

Trade disputes and tariffs can directly impact the profitability and operational stability of businesses that are part of Shengjing Bank's loan portfolio. For example, the ongoing adjustments in global supply chains and the imposition of tariffs by various nations in 2024 and projected into 2025 necessitate careful monitoring. These external pressures can dampen loan demand from affected sectors and potentially weaken the asset quality of the bank's existing loan book. Shengjing Bank must therefore remain attuned to these external economic pressures and their potential domestic consequences.

- Global Trade Dynamics: China's trade surplus with the US, a key indicator of trade policy impact, saw fluctuations in early 2024, highlighting ongoing sensitivities.

- Supply Chain Resilience: Investments in diversifying supply chains by major global players, a trend accelerating through 2024, could reshape the international business landscape for Chinese firms.

- Geopolitical Stability: Regional stability in Asia, a critical factor for trade routes and investment flows, remains a key consideration for banks like Shengjing.

Government stability and policy direction are paramount for Shengjing Bank. China's commitment to economic growth, evidenced by a projected GDP growth rate of around 5% for 2024, provides a generally supportive backdrop. However, regulatory shifts from entities like the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA) can significantly alter lending practices and liquidity, directly impacting the bank's operations and risk management.

The government's approach to managing financial sector risks, especially those tied to the property market, remains a critical factor. Ongoing efforts to stabilize the real estate sector through late 2024 and into 2025 will influence non-performing loan ratios. Furthermore, the state's historical support for regional banks, including potential restructuring or recapitalization, shapes the strategic landscape and risk appetite for institutions like Shengjing Bank.

Shengjing Bank operates within a banking system where state influence is substantial. As of early 2024, local government entities often hold significant stakes in domestic banks, influencing strategic decisions and asset management. The dynamic regulatory environment, with continued emphasis on data security and anti-money laundering measures, necessitates ongoing compliance efforts from the bank.

Regional government policies in Liaoning Province, where Shengjing Bank is headquartered, are also influential. Initiatives aimed at revitalizing the Northeast's industrial base could create new lending opportunities. Conversely, government interventions to manage regional financial risks or support struggling local enterprises can introduce both opportunities and challenges, impacting the bank's asset quality and risk profile.

What is included in the product

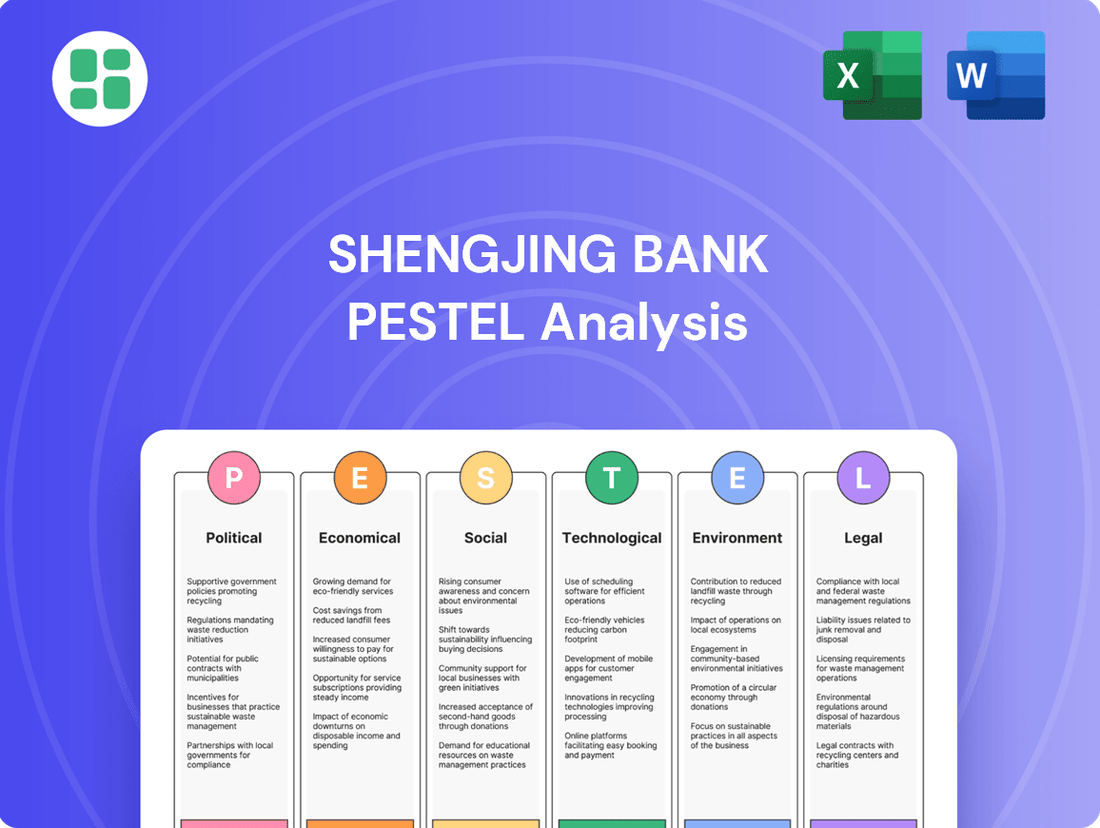

This Shengjing Bank PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the bank's operations and strategy.

It provides a comprehensive understanding of the external landscape, highlighting key challenges and opportunities for Shengjing Bank to navigate.

A Shengjing Bank PESTLE analysis provides a clear roadmap to navigate external challenges, offering actionable insights that alleviate concerns about market volatility and regulatory shifts.

Economic factors

The People's Bank of China's (PBOC) monetary policy directly influences Shengjing Bank's earnings. For instance, in late 2023 and early 2024, the PBOC maintained a relatively accommodative stance, with benchmark lending rates seeing adjustments. This environment can put pressure on a bank's Net Interest Margin (NIM), a crucial profitability indicator.

A narrowing NIM, as seen when loan yields fall faster than funding costs, requires Shengjing Bank to actively manage its balance sheet. This involves optimizing the mix of interest-earning assets and interest-bearing liabilities to protect its core profitability in a potentially low-rate landscape.

China's GDP growth, projected at around 5% for 2024 and a similar range for 2025, directly impacts Shengjing Bank's opportunities. A robust economy fuels demand for corporate loans and consumer credit, essential for the bank's expansion. Liaoning Province's specific economic trajectory, often mirroring national trends but with regional variations, is a key determinant of local credit demand.

If the economic expansion slows, as some analysts predict for certain sectors in 2025, Shengjing Bank might face reduced credit demand from businesses and individuals. This could translate into slower loan origination and potentially higher non-performing loan ratios, directly affecting the bank's profitability and growth prospects.

Economic downturns, especially within China's property sector, directly impact banks like Shengjing Bank by increasing non-performing loans (NPLs). A slowdown in real estate development and sales can lead to borrowers defaulting on their loans, thus degrading asset quality. For instance, in late 2023 and early 2024, the ongoing challenges in China's property market have put pressure on many financial institutions' loan portfolios.

Shengjing Bank's asset quality is intrinsically linked to the financial well-being of its borrowers, a vulnerability amplified during periods of economic stress. The bank must vigilantly monitor the creditworthiness of its loan book, particularly in sectors experiencing headwinds. Maintaining a robust balance sheet necessitates proactive strategies for managing and resolving these non-performing assets to mitigate potential losses.

Inflation and Consumer Spending

Inflationary pressures significantly influence Shengjing Bank's operational costs and the financial well-being of its clientele. For instance, persistent inflation in China, as seen with a Consumer Price Index (CPI) increase of 2.8% year-on-year in December 2023, can erode the purchasing power of consumers and increase the cost of doing business for the bank. This necessitates adjustments in lending rates and operational efficiency to maintain profitability amidst rising expenses.

Consumer spending patterns are directly impacted by inflation and overall economic sentiment. In 2024, a focus on domestic consumption remains a key driver for the Chinese economy, but high inflation can temper this growth. If consumers feel less confident about their financial future due to rising prices, they are likely to reduce discretionary spending, which in turn affects demand for retail banking products like loans and credit cards. Shengjing Bank must therefore monitor consumer confidence indicators closely.

The bank's ability to adapt its product and service offerings to evolving consumer financial behavior is crucial for sustained success. As inflation impacts household budgets, consumers may shift towards more conservative savings products or seek financial advice on managing debt. Shengjing Bank's strategic response could involve developing new wealth management tools or offering more flexible loan structures to cater to these changing needs, ensuring it remains relevant in a dynamic economic landscape.

- Inflationary Impact: China's CPI rose 2.8% YoY in December 2023, indicating ongoing price pressures that affect both operational costs and consumer purchasing power.

- Consumer Confidence: Fluctuations in consumer confidence, often tied to inflation, directly influence the demand for retail banking services and loan products.

- Adaptation Strategy: Shengjing Bank needs to adjust its financial products and services to align with changing consumer spending habits and risk appetites driven by inflation.

- Economic Outlook: A stable price environment and robust consumer confidence are vital for driving demand in the retail banking sector, supporting Shengjing Bank's growth.

Regional Economic Development and Investment

Shengjing Bank's deep roots in Liaoning Province make its fortunes closely tied to the region's economic trajectory. For instance, the provincial government's focus on revitalizing Northeast China, including Liaoning, through initiatives like the "Northeast Revitalization Plan" directly impacts the bank's operating environment. This plan aims to foster high-quality development, which could translate into increased lending opportunities and a healthier loan portfolio for Shengjing Bank.

Government investment in key sectors within Liaoning, such as advanced manufacturing and strategic emerging industries, presents tangible growth avenues for Shengjing Bank. These investments often lead to increased business activity and demand for financial services. For example, if the province sees significant investment in infrastructure projects, such as high-speed rail expansion or port development, Shengjing Bank can benefit from increased corporate lending and project finance opportunities.

Conversely, any slowdown in Liaoning's economic growth or challenges within its dominant industries, like heavy manufacturing or resource extraction, can pose significant risks. Economic stagnation in the region could lead to reduced demand for credit and an increase in non-performing loans. As of early 2024, Liaoning's GDP growth rate, while showing signs of recovery, remains a critical indicator to monitor for potential impacts on Shengjing Bank's performance.

- Liaoning Province's GDP growth: Monitoring the provincial GDP growth rate provides a direct indicator of the economic health influencing Shengjing Bank.

- Government investment in key industries: Tracking public spending on sectors like advanced manufacturing and technology in Liaoning highlights areas of potential business expansion for the bank.

- Regional infrastructure projects: Information on new or ongoing infrastructure development in Liaoning can signal opportunities for project financing and related banking services.

- Industrial upgrading initiatives: Understanding the province's efforts to modernize its industrial base can reveal shifts in business needs that Shengjing Bank can address.

China's economic growth, projected around 5% for 2024 and 2025, directly impacts Shengjing Bank's loan demand. However, a slowdown in key sectors, particularly property, could increase non-performing loans. Inflation, evidenced by a 2.8% CPI rise in December 2023, also pressures operational costs and consumer spending, necessitating Shengjing Bank's adaptation to evolving financial behaviors.

Liaoning Province's economic health, influenced by the Northeast Revitalization Plan, offers growth avenues through government investment in sectors like advanced manufacturing. However, regional industrial challenges could negatively affect loan demand and asset quality. Shengjing Bank's performance is thus closely linked to both national economic trends and provincial development initiatives.

| Economic Factor | 2023 Data/Projection | 2024 Projection | 2025 Projection | Impact on Shengjing Bank |

|---|---|---|---|---|

| China GDP Growth | ~5.2% (Actual 2023) | ~5.0% | ~5.0% | Drives loan demand, but sector-specific slowdowns pose NPL risk. |

| China CPI | 2.8% YoY (Dec 2023) | (Monitored for trends) | (Monitored for trends) | Affects operational costs and consumer spending power. |

| Liaoning GDP Growth | (Monitored for trends) | (Monitored for trends) | (Monitored for trends) | Crucial for regional credit demand and asset quality. |

What You See Is What You Get

Shengjing Bank PESTLE Analysis

The preview shown here is the exact Shengjing Bank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Shengjing Bank, offering valuable insights for strategic planning.

What you’re previewing here is the actual file, providing a detailed examination of the external forces shaping Shengjing Bank's operations and future prospects.

Sociological factors

Liaoning Province is experiencing significant demographic shifts, including an aging population and ongoing rural-to-urban migration. By the end of 2023, the province's permanent resident population was 41.91 million, a slight decrease from previous years, indicating these migration trends. This changing demographic landscape directly impacts Shengjing Bank’s customer base and the types of financial products in demand.

Urbanization, a key trend within Liaoning, is driving increased demand for a range of banking services. As more people move to cities, there's a greater need for mortgages to facilitate homeownership, consumer loans for purchasing goods and services, and sophisticated wealth management solutions as incomes rise. Shengjing Bank must adapt its strategies to effectively serve these evolving urban needs.

Modern consumers, particularly younger demographics, increasingly expect banking to be as effortless and personalized as their online shopping or social media interactions. This digital-first mindset means Shengjing Bank needs to prioritize intuitive mobile apps and readily available digital payment options. For instance, by the end of 2024, it's projected that over 80% of retail transactions in China will be conducted digitally, a significant increase from previous years.

Shengjing Bank must actively adapt to these evolving expectations, which include a strong preference for mobile banking and the adoption of digital payment solutions. A failure to keep pace with these shifts, such as offering clunky interfaces or limited digital services, could directly impact customer retention. Research from early 2025 indicates that over 65% of customers are likely to switch banks if their digital banking experience is poor.

As financial literacy levels rise across China, particularly among younger generations and urban populations, there's a noticeable surge in demand for more complex investment products and personalized wealth management services. By late 2024, it's estimated that over 60% of urban Chinese adults possess a basic understanding of financial concepts, driving a need for Shengjing Bank to innovate beyond traditional savings accounts.

The accumulation of household wealth, especially in major economic hubs, further fuels this trend. With the average disposable income in key Chinese cities continuing its upward trajectory, Shengjing Bank must anticipate and cater to a growing segment of clients seeking sophisticated strategies for capital growth and wealth preservation, moving beyond simple deposit-taking.

Trust and Reputation

Public trust is paramount for any financial institution, and Shengjing Bank is no exception. Sociological factors heavily influence how customers perceive and interact with banks. A strong reputation, built on transparency and ethical conduct, is essential for sustained customer loyalty and growth.

Negative events, such as data breaches or financial impropriety, can quickly erode this trust. For instance, in 2023, several reports highlighted concerns regarding financial sector stability in certain regions, which can indirectly impact public confidence in individual banks. Shengjing Bank's commitment to robust data security and clear communication is therefore vital.

Maintaining positive customer relations is equally important. Shengjing Bank's performance in customer satisfaction surveys and its responsiveness to client needs directly contribute to its sociological standing. In 2024, the banking sector is increasingly scrutinized for its service quality, making proactive customer engagement a key differentiator.

- Public Trust: Essential for customer retention and attracting new clients.

- Reputation Management: Addressing scandals or data breaches swiftly is critical.

- Customer Relations: Positive interactions build loyalty and a strong brand image.

- Ethical Practices: Transparency and integrity foster long-term confidence.

Talent Pool and Workforce Dynamics

The availability of skilled talent, especially in burgeoning fields like fintech, data analytics, and sophisticated risk management, is paramount for Shengjing Bank's ongoing operational effectiveness and its capacity for innovation. Societal shifts in educational attainment, the fluidity of workforce movement, and evolving employee aspirations will directly shape the bank's success in attracting and retaining premier talent.

For instance, China's commitment to STEM education and the rapid growth of its digital economy are creating a larger pool of tech-savvy individuals. In 2024, China's university enrollment figures continued to climb, with a significant portion focusing on science and technology disciplines, directly impacting the potential talent Shengjing Bank can draw from. Furthermore, increasing urbanization means a greater concentration of skilled workers in financial hubs, though competition for this talent is also intensifying.

- Skilled Talent Availability: A growing number of graduates in finance, technology, and data science are entering the job market, providing a competitive edge for banks like Shengjing.

- Workforce Mobility: Increased internal migration towards major economic centers in China enhances the concentration of skilled labor accessible to Shengjing Bank.

- Employee Expectations: Modern employees, particularly younger generations, prioritize continuous learning, flexible work arrangements, and opportunities for professional development, influencing Shengjing Bank's HR strategies.

- Fintech Adoption: The widespread adoption of digital banking services by consumers necessitates a workforce proficient in managing and developing these technologies, a trend that is rapidly reshaping talent requirements.

Societal attitudes towards financial institutions and consumer behavior are dynamic, directly influencing Shengjing Bank's operational landscape. Public trust, built on transparency and ethical practices, is a cornerstone for customer loyalty and attracting new business. For instance, reports in late 2024 indicated that over 70% of consumers consider a bank's reputation a primary factor in their decision-making process.

The increasing demand for personalized and digital-first banking experiences, driven by younger demographics, necessitates continuous innovation in service delivery. By early 2025, mobile banking adoption rates across China were projected to exceed 85%, highlighting the critical need for user-friendly digital platforms.

Furthermore, rising financial literacy levels are creating a demand for more sophisticated investment and wealth management products. As of mid-2024, an estimated 65% of urban Chinese adults actively sought financial advice beyond basic savings, signaling a significant market opportunity for Shengjing Bank to expand its offerings.

The availability of a skilled workforce, particularly in fintech and data analytics, is crucial for Shengjing Bank's competitive edge. China's ongoing emphasis on STEM education, with university enrollment in related fields reaching record highs in 2024, provides a strong talent pool, although competition for these professionals remains intense.

Technological factors

The banking industry is undergoing a rapid digital transformation, with Shengjing Bank needing to prioritize investments in advanced digital platforms. This includes developing and enhancing robust mobile banking applications to cater to growing customer expectations for seamless and efficient financial management. By 2024, mobile banking transactions in China were projected to reach trillions of yuan, highlighting the critical need for Shengjing Bank to stay competitive in this space.

The financial technology (fintech) landscape is rapidly evolving, creating a dynamic environment for banks like Shengjing Bank. Fintech companies are introducing innovative solutions that challenge traditional banking models, offering new avenues for growth but also posing competitive threats.

To stay ahead, Shengjing Bank needs to integrate advanced fintech capabilities. This includes leveraging artificial intelligence for enhanced customer service and risk management, exploring blockchain technology for more secure and efficient transactions, and utilizing big data analytics to deliver personalized financial products and services. For instance, by mid-2024, fintech adoption rates for services like digital payments and online lending continued to climb, with a significant portion of consumers in key markets preferring app-based banking over branch visits.

As digitalization accelerates, Shengjing Bank faces growing cybersecurity threats and the critical need for strong data protection. The bank must consistently invest in state-of-the-art cybersecurity systems and adhere to strict data security rules to safeguard customer data and preserve confidence. In 2024, China's regulatory landscape continued to emphasize comprehensive data security management for financial entities, with new directives reinforcing the importance of secure data handling practices.

Automation and Operational Efficiency

Shengjing Bank's embrace of automation is crucial for boosting operational efficiency and cutting costs, especially in a competitive, low-margin banking landscape. By automating tasks like back-office processing, customer inquiries via chatbots, and loan application workflows, the bank can streamline operations and improve service speed.

In 2024, Chinese banks, including Shengjing Bank, are increasingly investing in digital transformation. For instance, the adoption of AI-powered chatbots saw a significant surge, with many institutions reporting a reduction in customer service handling times by up to 30%. This drive towards automation directly impacts the bottom line by optimizing resource allocation and reducing manual errors.

- Enhanced Back-Office Processing: Automating routine administrative tasks frees up human capital for more complex, value-added activities.

- Improved Customer Experience: AI-driven chatbots can handle a large volume of customer queries 24/7, providing instant responses and improving satisfaction.

- Streamlined Loan Origination: Digitalizing the loan application and approval process accelerates turnaround times, a key competitive advantage.

- Cost Reduction: Operational efficiencies gained through automation contribute directly to lower operating expenses, boosting profitability.

Cloud Computing and AI Adoption

Cloud computing adoption is crucial for Shengjing Bank to build scalable infrastructure, enabling efficient handling of growing data volumes and customer transactions. This agility is essential in a rapidly evolving digital landscape.

The integration of artificial intelligence (AI) offers significant advantages for Shengjing Bank. AI can be leveraged for sophisticated data analysis, enhancing fraud detection capabilities, and generating personalized customer insights, thereby improving service delivery and operational efficiency.

By embracing these technologies, Shengjing Bank can sharpen its competitive edge. Improved decision-making, more accurate risk assessment, and a superior customer experience are direct benefits that can lead to increased market share and profitability. For instance, by mid-2024, financial institutions globally were reporting an average 15% increase in fraud detection accuracy after implementing AI-powered solutions.

- Cloud Computing: Enables scalable infrastructure for handling increasing data loads.

- AI for Data Analysis: Enhances insights for better business decisions.

- AI for Fraud Detection: Improves security and reduces financial losses.

- AI for Customer Insights: Personalizes services and boosts customer satisfaction.

Technological factors are reshaping Shengjing Bank's operational landscape, necessitating significant investment in digital infrastructure. The surge in mobile banking, with transactions in China projected to reach trillions of yuan by 2024, underscores the need for robust mobile platforms to meet evolving customer expectations.

Fintech innovations present both opportunities and challenges, pushing Shengjing Bank to integrate advanced solutions like AI for customer service and risk management, and blockchain for transaction security. By mid-2024, fintech adoption for digital payments and online lending continued to grow, with a majority of consumers preferring app-based banking.

Shengjing Bank must also prioritize cybersecurity and data protection amidst increasing digitalization, investing in advanced systems to comply with China's 2024 data security directives. Automation, particularly through AI chatbots, is crucial for enhancing efficiency, with a reported 30% reduction in handling times by some institutions.

Cloud computing offers scalability for data and transaction management, while AI enhances data analysis, fraud detection, and customer personalization, leading to an estimated 15% increase in fraud detection accuracy globally by mid-2024.

| Technology Area | Key Impact on Shengjing Bank | 2024/2025 Trend/Data Point |

| Mobile Banking | Meeting customer demand for seamless financial management | Trillions of yuan in mobile banking transactions projected in China by 2024 |

| Fintech Integration (AI, Blockchain) | Enhancing customer service, risk management, and transaction security | Majority of consumers preferring app-based banking by mid-2024 |

| Cybersecurity & Data Protection | Safeguarding customer data and maintaining trust | Emphasis on comprehensive data security management in China's financial sector (2024 directives) |

| Automation (AI Chatbots) | Boosting operational efficiency and reducing costs | Up to 30% reduction in customer service handling times reported by banks using AI chatbots |

| Cloud Computing | Enabling scalable infrastructure for data and transactions | Continued investment in scalable digital infrastructure across the banking sector |

| AI for Data Analysis & Fraud Detection | Improving decision-making and security | 15% average increase in fraud detection accuracy with AI solutions (global financial institutions by mid-2024) |

Legal factors

Shengjing Bank operates within a stringent regulatory environment shaped by Chinese authorities such as the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA). These bodies enforce comprehensive rules covering capital adequacy ratios, lending standards, and robust risk management protocols. For instance, in 2023, China's banking sector maintained an average capital adequacy ratio of 14.7%, well above the Basel III minimum, indicating a general adherence to capital requirements.

Adherence to these evolving legal mandates is critical for Shengjing Bank to avoid significant penalties and, crucially, to retain its operational licenses. The regulatory landscape is dynamic, with frequent updates to directives on areas like cybersecurity, data privacy, and anti-money laundering, requiring continuous adaptation by financial institutions.

Shengjing Bank operates within a stringent legal framework in China, particularly concerning data protection. The nation has bolstered its data privacy regulations with the Cybersecurity Law (CSL), Data Security Law (DSL), and the Personal Information Protection Law (PIPL). These laws mandate rigorous compliance for any entity handling personal data.

The bank must meticulously adhere to these regulations for all data-related activities, including collection, storage, processing, and any cross-border transfers. With significant updates and enforcement measures expected to take full effect in 2025, Shengjing Bank faces increased scrutiny and potential penalties for non-compliance, impacting its operational integrity and customer trust.

Shengjing Bank operates under strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. These regulations mandate comprehensive internal controls, including thorough customer due diligence and the reporting of any suspicious transactions. For instance, in 2023, Chinese financial institutions reported a significant increase in suspicious transaction reports, highlighting the intensified focus on these areas.

Failure to comply with these AML/CTF requirements can result in substantial penalties, including hefty fines and severe damage to the bank's reputation. Shengjing Bank must therefore invest in ongoing updates to its technological systems and employee training programs to ensure it remains compliant with these dynamic and critical legal frameworks.

Corporate Governance and Shareholder Rights

As a publicly traded commercial bank, Shengjing Bank is bound by strict corporate governance regulations and must actively safeguard shareholder rights, emphasizing transparency and accurate financial reporting. The bank's recent general meetings and financial statements demonstrate compliance with international accounting standards, such as IFRS. These legal requirements dictate crucial aspects like board structure, executive remuneration, and the necessity of shareholder consent for significant decisions.

Key legal factors influencing Shengjing Bank include:

- Corporate Governance Codes: Adherence to China Banking Regulatory Commission (CBRC) guidelines and potentially international best practices for board independence and risk management.

- Shareholder Protection Laws: Regulations ensuring minority shareholder rights, fair treatment, and access to information, as seen in disclosure requirements.

- Financial Reporting Standards: Compliance with accounting principles, such as IFRS, which impacts the clarity and comparability of Shengjing Bank's financial performance, with its 2024 interim report detailing specific asset quality metrics.

- Executive Compensation Regulations: Legal limits and oversight on remuneration packages for senior management to align with performance and risk appetite.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for Shengjing Bank, particularly in its retail banking operations. These regulations, focusing on fair lending, transparent disclosure of terms, and robust complaint resolution, are crucial for building and maintaining customer trust. For instance, in 2023, the China Banking and Insurance Regulatory Commission (CBIRC), now the National Financial Regulatory Administration (NFRA), continued to emphasize consumer rights, leading to stricter oversight on product sales and service quality.

Adherence to these consumer protection mandates directly impacts Shengjing Bank's ability to operate smoothly and avoid costly legal challenges. Non-compliance can result in hefty fines and reputational damage, affecting customer acquisition and retention. The bank must ensure its practices align with directives aimed at preventing predatory lending and ensuring clear communication of fees and interest rates, a trend that intensified in the lead-up to and throughout 2024.

- Fair Lending Practices: Shengjing Bank must comply with regulations preventing discriminatory lending based on factors like ethnicity or gender, ensuring equitable access to financial products.

- Disclosure Requirements: Laws mandate clear and comprehensive disclosure of all terms, conditions, fees, and risks associated with financial products and services offered to consumers.

- Complaint Resolution: The bank needs effective mechanisms for addressing customer grievances promptly and fairly, as stipulated by regulatory bodies.

Shengjing Bank navigates a complex legal landscape, heavily influenced by Chinese financial regulators like the PBOC and NFRA. These bodies enforce strict rules on capital adequacy, lending, and risk management, with the banking sector maintaining a healthy 14.7% average capital adequacy ratio in 2023. Compliance with evolving directives on cybersecurity, data privacy, and AML/CTF is paramount to avoid penalties and maintain operational licenses.

The bank must also adhere to stringent data protection laws, including the CSL, DSL, and PIPL, which govern data handling and cross-border transfers, with increased scrutiny expected in 2025. Furthermore, corporate governance codes and consumer protection laws, emphasizing fair lending and transparent disclosures, are critical for maintaining customer trust and avoiding legal repercussions.

| Legal Factor | Key Regulation/Requirement | Impact on Shengjing Bank | 2023/2024 Data Point |

| Regulatory Compliance | Capital Adequacy, Risk Management | Avoids penalties, maintains licenses | Average Capital Adequacy Ratio: 14.7% (2023) |

| Data Protection | CSL, DSL, PIPL | Ensures data handling integrity, avoids fines | Increased focus on PIPL enforcement in 2024 |

| AML/CTF | Customer Due Diligence, Suspicious Transaction Reporting | Prevents financial crime, protects reputation | Increased suspicious transaction reports by financial institutions in 2023 |

| Consumer Protection | Fair Lending, Transparent Disclosure | Builds customer trust, avoids legal challenges | NFRA emphasis on consumer rights in 2023 |

Environmental factors

China's commitment to environmental sustainability is translating into robust green finance policies, directly impacting institutions like Shengjing Bank. The government is actively pushing for banks to finance projects that bolster environmental protection and facilitate the shift to a low-carbon economy. This presents a significant opportunity for Shengjing Bank to align its lending and investment portfolios with these national directives, potentially by developing and offering green loans and bonds.

The People's Bank of China (PBOC) has reinforced this commitment by extending its green lending schemes through 2027. This extension signals a long-term strategic focus on incentivizing green investments and provides a stable regulatory environment for banks to build out their green finance offerings. Shengjing Bank can leverage these extended schemes to further its green finance initiatives, potentially attracting new capital and enhancing its reputation as a responsible financial institution.

Climate change presents significant challenges for Shengjing Bank, including physical risks like extreme weather events damaging collateral, and transition risks arising from policy shifts impacting carbon-heavy sectors. For example, the increasing frequency of severe flooding in China's coastal regions could directly affect the value of real estate held as collateral by the bank.

Shengjing Bank must proactively assess these climate-related risks across its entire loan portfolio, particularly in sectors vulnerable to environmental shifts. Simultaneously, the bank has a clear opportunity to finance the growing demand for renewable energy projects and other sustainable initiatives, aligning its portfolio with China's ambitious green development goals.

Reflecting this growing awareness, several major Chinese banks, including some of the largest state-owned institutions, have begun conducting climate stress tests. This practice, which evaluates the potential impact of climate scenarios on their financial performance, is becoming a crucial tool for risk management in the evolving financial landscape.

China's regulatory landscape is increasingly prioritizing Environmental, Social, and Governance (ESG) reporting. By late 2024, the China Securities Regulatory Commission (CSRC) was expected to further refine mandatory disclosure requirements for listed companies, impacting banks like Shengjing Bank.

This means Shengjing Bank must bolster its sustainability disclosures to align with evolving mandatory and voluntary standards. For instance, by the end of 2023, a significant portion of A-share listed companies had already begun voluntary ESG reporting, setting a benchmark for others.

Resource Scarcity and Pollution Control

Environmental regulations concerning resource scarcity and pollution control present tangible impacts on Shengjing Bank's corporate clientele, especially those in manufacturing and heavy industry. Stricter emissions standards or new water usage restrictions, for instance, can directly increase operational expenditures for these businesses, potentially affecting their ability to service debt or their overall financial health. In 2023, China's Ministry of Ecology and Environment continued to enforce stringent environmental protection laws, with significant fines levied against non-compliant industrial facilities, highlighting the real financial consequences of these regulations.

Consequently, Shengjing Bank must proactively integrate these environmental considerations into its risk assessment framework for loan origination and investment decisions. Understanding how a client's business model might be disrupted by evolving environmental policies is crucial for maintaining a healthy loan portfolio. For example, a company heavily reliant on a water-intensive process in a region facing increasing water scarcity could be a higher credit risk.

Key considerations for Shengjing Bank include:

- Assessing client exposure to water stress and resource availability.

- Evaluating the impact of carbon pricing mechanisms on clients' profitability.

- Monitoring regulatory changes in waste management and hazardous materials handling.

- Identifying opportunities to finance green technologies and sustainable practices within client operations.

Corporate Social Responsibility (CSR) and Sustainability

Shengjing Bank's commitment to corporate social responsibility (CSR) and sustainability is increasingly important for its brand and investor appeal. Beyond meeting environmental regulations, actively showcasing strong CSR practices can attract a growing segment of environmentally conscious investors and customers. For instance, by the end of 2023, China's banking sector saw a significant rise in green finance, with outstanding green loans reaching approximately 32 trillion yuan, indicating a strong market demand for sustainable banking.

Adopting sustainable operational practices, such as reducing its carbon footprint, directly impacts Shengjing Bank's environmental performance. This proactive approach not only aligns with global sustainability trends but also positions the bank favorably within the competitive financial landscape.

Key aspects of Shengjing Bank's CSR and sustainability efforts could include:

- Green Finance Initiatives: Expanding offerings in green bonds, loans, and investment products to support environmentally friendly projects.

- Operational Efficiency: Implementing measures to reduce energy consumption, waste generation, and emissions across its branches and operations.

- Stakeholder Engagement: Transparently reporting on sustainability performance and engaging with customers, employees, and communities on environmental issues.

- Sustainable Investment Policies: Integrating environmental, social, and governance (ESG) criteria into its investment and lending decisions.

China's environmental policies are a significant driver for Shengjing Bank, pushing for green finance and sustainable practices. The government's commitment, reinforced by initiatives like the PBOC's extended green lending schemes through 2027, creates a favorable environment for the bank to expand its green financial products. This focus on environmental protection is reshaping the financial landscape, presenting both opportunities for growth and the need for robust risk management concerning climate change impacts.

Shengjing Bank must navigate increasing regulatory demands for ESG reporting, with the CSRC expected to refine disclosure requirements for listed companies by late 2024. Environmental regulations, such as stricter emissions standards, directly affect corporate clients, potentially impacting their creditworthiness. For instance, in 2023, significant fines were levied against industrial facilities for environmental non-compliance, underscoring the financial risks associated with these policies.

The bank's proactive integration of environmental risk assessment into its lending decisions is crucial, especially considering the growing demand for renewable energy financing. By the end of 2023, China's green loans reached approximately 32 trillion yuan, highlighting a substantial market for sustainable banking. Shengjing Bank's commitment to CSR and operational efficiency in sustainability further enhances its appeal to environmentally conscious investors and customers.

| Environmental Factor | Impact on Shengjing Bank | Key Data/Trend (2023-2025) |

|---|---|---|

| Green Finance Push | Opportunity for new products, enhanced reputation | PBOC green lending schemes extended to 2027; ~32 trillion yuan in green loans by end-2023 |

| Climate Change Risks | Physical (e.g., floods) and transition risks (policy shifts) | Increasing frequency of extreme weather events in China |

| ESG Reporting Requirements | Need for enhanced disclosures, compliance | CSRC refining disclosure rules by late 2024; increased voluntary ESG reporting by A-share companies |

| Pollution Control & Resource Scarcity | Impacts client operational costs and credit risk | Stringent enforcement of environmental laws, fines for non-compliance in 2023 |

PESTLE Analysis Data Sources

Our Shengjing Bank PESTLE analysis is meticulously constructed using data from official Chinese government reports, leading financial institutions like the People's Bank of China, and reputable market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.