Shengjing Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shengjing Bank Bundle

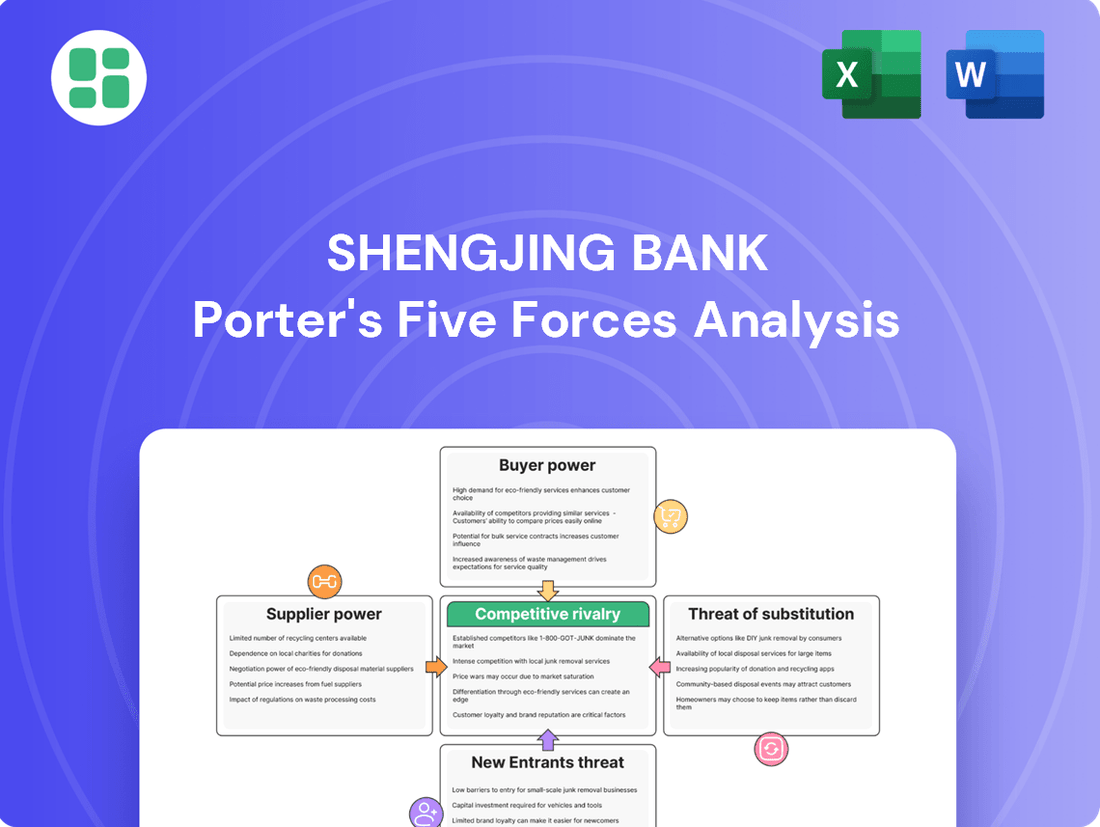

Shengjing Bank faces significant competitive pressures, with moderate threat from new entrants and intense rivalry among existing players. Understanding the nuances of buyer power and the availability of substitutes is crucial for navigating this landscape.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Shengjing Bank.

Suppliers Bargaining Power

Depositor sensitivity to interest rates significantly impacts Shengjing Bank's funding costs. In China's low-interest-rate environment, individual and corporate depositors, who are the bank's primary funders, have limited options for higher yields. While overall rates are subdued, competition for dependable deposits means larger or very loyal depositors can still exert some influence.

Shengjing Bank faces the challenge of offering competitive deposit rates to attract and retain funds without eroding its net interest margin. For instance, in 2023, China's benchmark one-year deposit rate hovered around 1.5%, a low figure that necessitates careful management of funding expenses to maintain profitability.

Shengjing Bank, like many regional financial institutions, faces a growing reliance on interbank funding. This dependence can shift leverage towards larger, more established banks that act as crucial liquidity providers. For instance, in 2024, the average overnight interbank lending rate fluctuated, but the overall trend for smaller banks was to secure funding from these larger entities, potentially increasing the latter's bargaining power.

This reliance means that the terms and availability of interbank loans directly impact Shengjing Bank's operational capacity and profitability. The ability of larger banks to dictate these terms becomes a significant factor in the competitive landscape. Shengjing Bank's strategic imperative, therefore, lies in its capacity to broaden its funding base beyond the interbank market to mitigate this supplier power.

As Shengjing Bank invests heavily in its digital transformation, providers of specialized technologies like artificial intelligence and advanced data management systems are seeing their bargaining power increase. The bank's reliance on these cutting-edge solutions for enhanced digital banking and robust data infrastructure makes it more dependent on these high-tech suppliers.

The demand for secure, efficient, and innovative digital banking platforms means Shengjing Bank must secure these specialized technological capabilities. This necessity can lead to a stronger negotiation position for technology and infrastructure providers, especially when their offerings are unique or when there are few alternative suppliers in specific niches.

Human Capital and Talent Pool

Skilled financial professionals, particularly those adept in fintech, risk management, and digital operations, are crucial talent suppliers for Shengjing Bank. Their expertise directly influences the bank's ability to innovate and manage complex financial landscapes.

In today's dynamic labor market, these highly sought-after individuals can negotiate for higher salaries and more comprehensive benefits. This elevated bargaining power directly translates into increased operational costs for Shengjing Bank, impacting its overall profitability and resource allocation for strategic initiatives.

Attracting and retaining top-tier talent is paramount for Shengjing Bank's sustained success. For instance, in 2024, the average salary for a senior fintech specialist in major Chinese financial hubs saw an increase of approximately 15-20% compared to the previous year, reflecting the intense competition for these roles.

- Talent as a Supplier: Skilled professionals in fintech, risk, and digital operations are key human capital suppliers.

- Impact of Bargaining Power: Increased wages and benefits for these professionals raise operational costs for Shengjing Bank.

- Competitive Landscape: The demand for specialized financial talent intensified in 2024, driving up compensation expectations.

- Strategic Importance: Retaining this talent is vital for Shengjing Bank's innovation and competitive edge.

Regulatory Compliance Services

The bargaining power of suppliers for regulatory compliance services is quite high for Shengjing Bank. China's financial sector is under increasing scrutiny, with regulations around data security, anti-money laundering, and capital adequacy becoming more complex. For instance, the People's Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC) consistently update guidelines, requiring specialized knowledge that many banks may not have in-house. This dependence on external expertise for navigating these intricate rules grants significant leverage to compliance service providers.

These external auditors and consultants are essential for Shengjing Bank to maintain its operating license and market reputation. Failure to comply with regulations, such as those introduced or strengthened in 2023 and early 2024, can result in substantial fines or even operational restrictions. Therefore, Shengjing Bank must engage with these suppliers, often at the suppliers' terms, to ensure ongoing adherence and avoid penalties.

The reliance on specialized knowledge translates into higher costs for Shengjing Bank. The market for these services is relatively concentrated, with a limited number of firms possessing the deep understanding of Chinese financial regulations. This limited competition among suppliers further amplifies their bargaining power, allowing them to command premium pricing for their indispensable services.

- Increased Regulatory Scrutiny: China's financial regulators, including the PBOC and CBIRC, have intensified oversight, demanding sophisticated compliance measures.

- Dependence on Expertise: Shengjing Bank requires external specialists to interpret and implement evolving regulatory frameworks, making these services critical.

- Risk of Penalties: Non-compliance can lead to significant financial penalties and reputational damage, underscoring the necessity of reliable compliance services.

- Limited Supplier Pool: The specialized nature of Chinese financial regulatory compliance creates a concentrated market for service providers, enhancing their bargaining power.

Shengjing Bank's bargaining power with its suppliers is influenced by several factors, including the concentration of suppliers, the uniqueness of their offerings, and the overall importance of the supplier's product or service to the bank's operations. For instance, the bank's reliance on specialized technology providers for its digital transformation efforts grants these suppliers significant leverage. Similarly, the need for expert regulatory compliance services, given China's evolving financial landscape, places considerable power in the hands of a few specialized firms.

The labor market for skilled financial professionals, particularly in fintech and digital operations, also presents a challenge. High demand for these individuals in 2024 led to increased salary expectations, directly impacting Shengjing Bank's operational costs. This dynamic highlights how the availability and specialization of human capital can act as a significant supplier-side force.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Shengjing Bank |

|---|---|---|

| Technology Providers | Uniqueness of AI/Data Management Solutions, Demand for Digital Banking | Increased costs for specialized tech, potential dependence on few providers |

| Interbank Lenders | Concentration of larger banks, Shengjing Bank's reliance on interbank funding | Potential for higher borrowing costs, dependence on terms set by larger institutions |

| Skilled Financial Professionals | High demand for fintech/digital expertise, competitive labor market | Increased salary and benefit costs, challenges in talent retention |

| Regulatory Compliance Services | Complexity of Chinese financial regulations, limited number of specialized firms | Higher fees for essential compliance services, need to adhere to supplier terms |

What is included in the product

This analysis of Shengjing Bank's competitive environment reveals the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitute products.

Visualize competitive pressures with a dynamic, interactive dashboard, allowing Shengjing Bank to pinpoint and address market vulnerabilities effectively.

Customers Bargaining Power

Chinese consumers, both individuals and businesses, are increasingly comfortable with digital tools. In 2023, mobile banking penetration in China reached an impressive 86%, with users actively seeking intuitive and efficient online services. This widespread digital adoption means customers expect quick transactions, competitive pricing, and tailored financial solutions.

This high level of digital engagement translates directly into increased bargaining power for Shengjing Bank's customers. They can easily compare offerings across different financial institutions, switching providers if their expectations for speed, cost, or personalization aren't met. For instance, the average time for a customer to open a new bank account online in China dropped to under 5 minutes in 2023, setting a benchmark for service delivery.

Consequently, Shengjing Bank faces pressure to constantly enhance its digital platforms and product innovation. Failing to keep pace with evolving customer demands for faster service, lower fees, and personalized products could lead to customer attrition. The bank must invest in technology and data analytics to deliver the seamless, customized experiences that today's digitally savvy Chinese customers expect.

The Chinese government's strong push to support Small and Medium-sized Enterprises (SMEs) significantly boosts their bargaining power. Initiatives like higher loan limits and lower interest rates mean these businesses have more options and leverage when seeking financing.

For banks like Shengjing Bank, which serves corporate clients, this translates into pressure to offer more attractive loan terms and smoother application processes to retain and attract SME customers. In 2023, China's central bank, the People's Bank of China, continued to emphasize inclusive finance, with SME loan growth outperforming overall loan growth, indicating a favorable environment for these businesses.

Customers in China benefit from a vast banking landscape, including major state-owned banks, joint-stock entities, and numerous regional commercial banks. This extensive choice significantly lowers the cost for customers to switch providers.

With many banking alternatives available, customers gain leverage to negotiate for more favorable interest rates, superior service quality, and more adaptable account terms. This competitive environment pressures Shengjing Bank to actively innovate and distinguish its products and services to retain and attract clients.

Shift to Wealth Management Products

Customers are increasingly moving their money from basic savings accounts to wealth management products, seeking higher returns. This shift gives them more power because banks need these funds to operate. Shengjing Bank must offer attractive investment options to keep customer deposits.

In 2024, the demand for wealth management products continued to grow, with Chinese banks reporting significant increases in assets under management in these categories. For instance, many major banks saw their wealth management AUM grow by double digits year-over-year. This trend highlights a clear customer preference for products that offer potential for greater returns compared to traditional deposits.

This growing customer sophistication and demand for better yields directly enhance their bargaining power.

- Customer Demand for Yield: Customers are actively seeking higher returns, moving funds away from low-interest deposits.

- Increased Leverage: This migration to wealth products gives customers more leverage over banks reliant on traditional deposits.

- Competitive Pressure: Banks like Shengjing Bank face pressure to innovate and offer competitive wealth management solutions.

- Market Trends: In 2024, wealth management assets under management for Chinese banks saw substantial year-over-year growth, indicating this customer behavior.

Regulatory Push for Consumer Lending

Chinese regulators are actively pushing for increased consumer lending and credit card adoption to boost domestic consumption. This policy shift significantly bolsters the bargaining power of individual consumers. Banks are now more motivated to offer competitive rates and user-friendly credit products to attract this growing segment.

For Shengjing Bank, this means an opportunity to expand its retail footprint but also a challenge to differentiate itself in a more consumer-centric market. The bank needs to adapt its strategies to meet these regulatory objectives and capitalize on the enhanced consumer leverage.

- Regulatory Emphasis: China's central bank has signaled a strong intent to grow consumer credit, aiming for a more robust domestic demand-driven economy.

- Consumer Leverage: With more banks competing for retail customers, individuals gain greater power to negotiate terms and seek better deals on loans and credit cards.

- Shengjing Bank's Response: The bank must align its product development and marketing with this regulatory push, potentially offering more attractive credit limits and lower interest rates to capture market share.

Shengjing Bank's customers wield significant bargaining power due to widespread digital adoption and a vast banking landscape. Consumers' ability to easily compare offerings and switch providers pressures the bank to offer competitive pricing, efficient digital services, and personalized solutions. The increasing shift towards wealth management products further amplifies customer leverage, as banks compete for these more lucrative deposits.

| Factor | Impact on Shengjing Bank | Supporting Data (2023/2024) |

|---|---|---|

| Digital Savvy Customers | Increased demand for speed, low cost, and personalization. | 86% mobile banking penetration in China (2023); < 5 min online account opening (2023). |

| SME Support Initiatives | Pressure to offer attractive loan terms and streamlined processes. | SME loan growth outperforming overall loan growth (2023). |

| Abundant Banking Choices | Leverage to negotiate better rates and service. | Extensive network of state-owned, joint-stock, and regional banks. |

| Wealth Management Shift | Need to offer competitive investment products to retain deposits. | Double-digit AUM growth in wealth management for many Chinese banks (2024). |

What You See Is What You Get

Shengjing Bank Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Shengjing Bank Porter's Five Forces Analysis meticulously details the competitive landscape, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the banking sector. This comprehensive overview equips you with critical insights into the strategic positioning and potential challenges facing Shengjing Bank.

Rivalry Among Competitors

Shengjing Bank operates within a Chinese banking sector grappling with historically low and continuously narrowing net interest margins. This intense pressure on core profitability highlights fierce price competition for both deposits and loans.

For instance, in the first quarter of 2024, the average net interest margin for Chinese commercial banks hovered around 1.5% to 1.7%, a significant drop from previous years. This forces institutions like Shengjing Bank to aggressively seek operational efficiencies and explore revenue diversification beyond traditional lending.

Shengjing Bank's concentration within Liaoning Province places it directly against numerous regional banks and national bank branches vying for the same provincial customers. This intense local competition means Shengjing Bank must constantly innovate and offer competitive services to retain its market share. For instance, as of the first quarter of 2024, the banking sector in China, including regional players, saw a 10.5% year-on-year growth in total assets, highlighting the dynamic and competitive environment Shengjing Bank operates within.

The Chinese banking landscape is marked by significant consolidation, with smaller institutions frequently being restructured or absorbed. This trend means Shengjing Bank's own strategy of acquiring village banks to broaden its reach directly confronts this intensifying rivalry. By actively expanding its network, Shengjing Bank aims to capture a larger share of the market.

Deteriorating Profitability and Asset Quality Pressure

The Chinese banking sector is grappling with significant challenges, including sluggish credit expansion and persistent stress within the property market. These macroeconomic pressures are directly impacting profitability, forcing banks to contend with rising asset quality concerns. For instance, in 2023, the non-performing loan ratio for Chinese commercial banks edged up slightly, signaling a tougher operating landscape.

This environment fuels intense competition among financial institutions. Banks are increasingly competing for a limited supply of creditworthy borrowers and stable deposits, making it harder to preserve margins and maintain robust financial health. The pressure to find profitable lending opportunities intensifies rivalry, especially as economic growth moderates.

- Weak Credit Growth: China's overall credit growth slowed in 2023 compared to previous years, limiting lending opportunities.

- Property Sector Stress: Ongoing issues in real estate continue to weigh on asset quality and investor confidence.

- Rising Asset Risks: An increase in non-performing loans across the sector reflects the challenging economic climate.

- Profitability Squeeze: Banks are experiencing pressure on net interest margins due to these combined factors.

Government Policies and Economic Stimulus

Government policies and economic stimulus significantly shape Shengjing Bank's competitive environment. Directives aimed at bolstering the real economy, such as support for small and medium-sized enterprises (SMEs) or initiatives to boost foreign trade, directly influence the demand for banking services and the types of lending opportunities available. For instance, China's efforts to stimulate domestic consumption and manufacturing in 2024, as evidenced by targeted fiscal measures and potential interest rate adjustments, create a dynamic where banks must adapt their product offerings and risk appetites.

These government interventions often lead to increased competition, not just on interest rates, but also on the accessibility and tailored nature of financial products. Banks like Shengjing Bank are compelled to align their lending strategies with these policy objectives, which can involve offering preferential terms for government-supported projects or sectors. This can create pressure to compete on factors beyond traditional pricing, such as speed of execution, advisory services, and the ability to navigate complex regulatory frameworks. The effectiveness of these stimulus packages, such as the People's Bank of China's reserve requirement ratio adjustments or targeted re-lending facilities, directly impacts the liquidity and lending capacity of the entire banking sector.

- Government Support for SMEs: Initiatives like tax breaks or subsidized loans for SMEs in 2024 encourage lending to this segment, intensifying competition among banks vying for this market share.

- Foreign Trade Incentives: Policies promoting exports and imports can boost demand for trade finance, creating opportunities but also increasing rivalry for banks with strong international capabilities.

- Economic Stimulus Impact: Broad economic stimulus measures, such as infrastructure spending or consumption vouchers, can indirectly increase overall credit demand, benefiting banks but also potentially drawing in new competitors or encouraging aggressive strategies from existing ones.

- Regulatory Alignment: Banks must adapt to evolving regulations tied to stimulus packages, influencing their operational strategies and competitive positioning.

Shengjing Bank faces intense rivalry within China's banking sector, characterized by narrowing net interest margins and aggressive competition for both deposits and loans. In the first quarter of 2024, Chinese commercial banks saw average net interest margins around 1.5% to 1.7%, pushing institutions like Shengjing to seek efficiency and diversification.

Operating primarily in Liaoning Province, Shengjing Bank contends with numerous regional and national banks for provincial customers, necessitating continuous innovation and competitive service offerings. The overall Chinese banking sector, with total assets growing 10.5% year-on-year by Q1 2024, reflects this dynamic and highly competitive environment.

Consolidation trends, where smaller banks are absorbed, also heighten rivalry as Shengjing Bank expands its network through acquisitions. This strategic move directly confronts the intensified competition for market share.

| Metric | 2023 (Approx.) | Q1 2024 (Approx.) | Trend |

| Avg. Net Interest Margin (Chinese Commercial Banks) | 1.6% - 1.8% | 1.5% - 1.7% | Decreasing |

| Total Banking Assets Growth (YoY) | ~9% | ~10.5% | Increasing |

| Non-Performing Loan Ratio (Chinese Commercial Banks) | ~1.6% | ~1.6% - 1.7% | Slightly Increasing |

SSubstitutes Threaten

The burgeoning fintech sector presents a substantial threat of substitutes for Shengjing Bank. Companies offering mobile payment solutions, online lending, and digital wealth management are increasingly capturing market share. For instance, by the end of 2023, China's mobile payment market, dominated by platforms like Alipay and WeChat Pay, processed trillions of dollars in transactions, directly impacting traditional banks' revenue streams and customer relationships.

The rise of shadow banking and less regulated financial channels presents a significant threat of substitutes for traditional banks like Shengjing Bank. These alternative avenues offer both borrowers and investors different options, often with less stringent requirements or unique risk-reward profiles. For instance, the global shadow banking sector was estimated to be worth around $230 trillion in 2023, providing a substantial pool of capital that might otherwise flow through regulated institutions.

While regulatory bodies are indeed increasing their oversight, these less regulated channels can still siphon off business by appealing to customers seeking flexibility or specialized financial products. This bypasses the traditional banking framework, impacting Shengjing Bank's ability to attract and retain both deposit and lending customers. The ongoing evolution of fintech and decentralized finance further exacerbates this threat, offering increasingly sophisticated alternatives.

For corporate clients, particularly larger enterprises and expanding SMEs, direct capital market financing offers a compelling alternative to conventional bank loans. This includes options like issuing bonds, raising equity, or securing venture capital, effectively lessening their dependence on commercial banks for essential funding needs.

In 2024, the global debt capital markets saw significant activity. For instance, corporate bond issuance reached trillions of dollars, providing companies with substantial avenues for direct funding outside traditional banking channels. This trend highlights the growing accessibility and attractiveness of these substitutes for businesses seeking capital.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer (P2P) lending platforms, though facing increased regulation, have presented a viable alternative to traditional bank loans for individuals and small businesses. This direct lending model, even with its fluctuating market presence, represents a persistent threat of substitution for Shengjing Bank.

While the P2P lending sector experienced significant growth in the past, its landscape has evolved. For example, by the end of 2023, the total outstanding loan balance in China's P2P lending market had significantly decreased from its peak, reflecting regulatory tightening and a shift towards more controlled online lending models. This evolution doesn't eliminate the threat entirely, as the underlying principle of disintermediation in credit provision persists.

The threat of substitutes from P2P lending platforms for Shengjing Bank can be understood through these points:

- Accessibility: P2P platforms historically offered faster and often less stringent application processes compared to traditional banks, appealing to borrowers seeking quick credit.

- Niche Markets: Some platforms have focused on specific borrower segments or loan types that traditional banks may find less profitable or more risky, creating specialized competitive niches.

- Technological Disruption: The underlying technology and operational models of P2P lending demonstrate the potential for fintech innovation to bypass traditional financial intermediaries, a constant pressure on established players like Shengjing Bank.

Internal Corporate Finance Departments

Large corporations increasingly possess robust internal finance departments, capable of managing treasury operations and even self-financing significant projects. This internal expertise can substitute for certain traditional banking services, such as syndicated loans or complex cash management solutions, particularly for companies with substantial liquidity and sophisticated financial planning capabilities.

For instance, in 2024, many large enterprises continued to leverage their strong balance sheets and internal treasury teams to manage foreign exchange exposures and optimize working capital, thereby reducing reliance on external financial intermediaries for these functions. This trend highlights a significant substitute threat for banks like Shengjing Bank, especially in its corporate banking segment.

- Internal Treasury Management: Corporations with advanced treasury functions can handle functions like cash pooling, intercompany lending, and foreign exchange hedging internally.

- Self-Financing Capabilities: Companies with strong cash flows or access to capital markets may opt to finance their growth and operations directly, bypassing traditional bank lending.

- Reduced Demand for Advisory Services: Sophisticated internal finance teams can perform financial analysis and strategic planning, diminishing the need for external financial advisory services offered by banks.

The threat of substitutes for Shengjing Bank is multifaceted, stemming from both technological innovation and evolving corporate financial strategies. Fintech solutions, shadow banking, direct capital market access, P2P lending, and robust internal corporate finance capabilities all offer alternatives to traditional banking services.

| Substitute Category | Key Offerings | Impact on Shengjing Bank | 2024 Data/Trend Example |

|---|---|---|---|

| Fintech Solutions | Mobile payments, online lending, digital wealth management | Reduced transaction fees, customer disintermediation | China's mobile payment market processed trillions in 2023, impacting traditional bank revenues. |

| Shadow Banking & Unregulated Channels | Alternative lending and investment avenues | Siphons capital, bypasses traditional oversight | Global shadow banking sector estimated around $230 trillion in 2023. |

| Direct Capital Markets | Corporate bonds, equity issuance, venture capital | Decreased reliance on bank loans for corporate funding | Trillions in global corporate bond issuance in 2024 provided direct funding alternatives. |

| P2P Lending | Direct lending between individuals/businesses | Offers alternative credit access, disintermediates banks | China's P2P market outstanding loans significantly decreased by end-2023 due to regulation. |

| Internal Corporate Finance | In-house treasury, self-financing | Reduced demand for syndicated loans, cash management | Large enterprises in 2024 managed FX and working capital internally, reducing reliance on banks. |

Entrants Threaten

The banking sector, including institutions like Shengjing Bank, faces significant threats from new entrants due to substantial capital requirements and complex regulatory landscapes. For instance, China's banking regulations mandate strict capital adequacy ratios, with the China Banking and Insurance Regulatory Commission (CBIRC) overseeing these requirements. These stringent rules, coupled with the need for extensive licensing and compliance infrastructure, create formidable barriers to entry for aspiring new banks.

Established brand trust and customer loyalty represent a significant barrier for new entrants aiming to compete with banks like Shengjing Bank. Shengjing Bank, for instance, has cultivated deep relationships and a strong reputation over years of operation, particularly within its core regions. This existing trust means customers are less likely to switch to an unknown entity, even with potentially competitive offerings. For a new player, overcoming this ingrained loyalty requires immense marketing effort and a proven track record, which takes considerable time and financial resources to build.

Incumbent banks like Shengjing Bank enjoy significant advantages due to economies of scale. Their vast operational scale, sophisticated technology infrastructure, and extensive branch networks allow them to spread costs over a larger base, leading to lower per-unit costs. For instance, in 2023, major Chinese banks reported substantial operational efficiencies driven by their scale.

Furthermore, established banks benefit from powerful network effects. They possess extensive customer data, enabling them to offer highly personalized services and build strong customer loyalty. This deep well of data and established customer relationships makes it incredibly difficult for new entrants to gain traction, as they lack the critical mass and data insights to compete effectively on either cost or customer reach.

Government Support for Existing Banks

The Chinese government's historical commitment to its banking sector, particularly for larger, established institutions, presents a significant barrier to new entrants. This support, often manifested through implicit guarantees or direct capital injections, can create an uneven playing field.

For instance, in 2023, the People's Bank of China and other regulatory bodies continued to implement policies aimed at strengthening the stability of major state-owned banks, which can indirectly disadvantage smaller, newer players seeking to gain market share. This government backing can translate into lower funding costs and greater perceived stability for incumbents.

- Government backing reduces the perceived risk of established banks, making them more attractive to depositors and investors.

- Implicit guarantees allow incumbent banks to access capital more readily and at lower rates than new entrants.

- Regulatory favoritism, even if unintentional, can steer business opportunities or provide preferential treatment to existing, larger financial institutions.

Fintech-Enabled Niche Entrants

While the traditional banking industry presents significant barriers to entry, the burgeoning fintech sector has introduced a new dynamic. These agile, technology-driven firms are not necessarily aiming to become full-service banks but rather to carve out specific niches within the financial landscape. This allows them to bypass many of the regulatory and capital hurdles faced by traditional institutions.

Fintech-enabled niche entrants leverage advanced technology to offer highly specialized services, such as digital payments, peer-to-peer lending, or wealth management platforms. For instance, by mid-2024, the global fintech market size was estimated to be over $2.5 trillion, showcasing the significant investment and growth in this area. These specialized offerings can directly compete with and erode the market share of traditional banking products in those specific segments.

- Targeted Disruption Fintech firms focus on specific customer needs or product categories, offering streamlined and often cheaper alternatives to traditional banking services.

- Lower Overhead Costs Their digital-first approach generally results in lower operational costs compared to brick-and-mortar banks, enabling more competitive pricing.

- Agile Innovation Fintechs can adapt and innovate rapidly, responding to market changes and customer demands much faster than established banks.

- Data-Driven Personalization Advanced analytics allow fintechs to offer highly personalized customer experiences, a key differentiator in attracting and retaining users.

The threat of new entrants for Shengjing Bank is moderated by high capital requirements and stringent regulatory hurdles in China's banking sector. For example, as of early 2024, maintaining adequate capital ratios remains a cornerstone of regulatory compliance, making it costly for new players to establish themselves. These barriers, coupled with the need for extensive licensing, significantly deter many potential entrants from the traditional banking space.

Despite these traditional barriers, the rise of fintech presents a more dynamic threat. Fintech companies, often focusing on specific financial services like payments or lending, can enter the market with lower overhead and a more agile approach. By mid-2024, the global fintech market was valued in the trillions, indicating substantial investment and innovation in this area, allowing these niche players to challenge established banks like Shengjing Bank in specific product categories.

Porter's Five Forces Analysis Data Sources

Our Shengjing Bank Porter's Five Forces analysis leverages data from Shengjing Bank's annual reports, investor relations disclosures, and official company statements. We also incorporate industry-specific reports from financial analysis firms and regulatory filings from the China Banking and Insurance Regulatory Commission (CBIRC) to provide a comprehensive view.