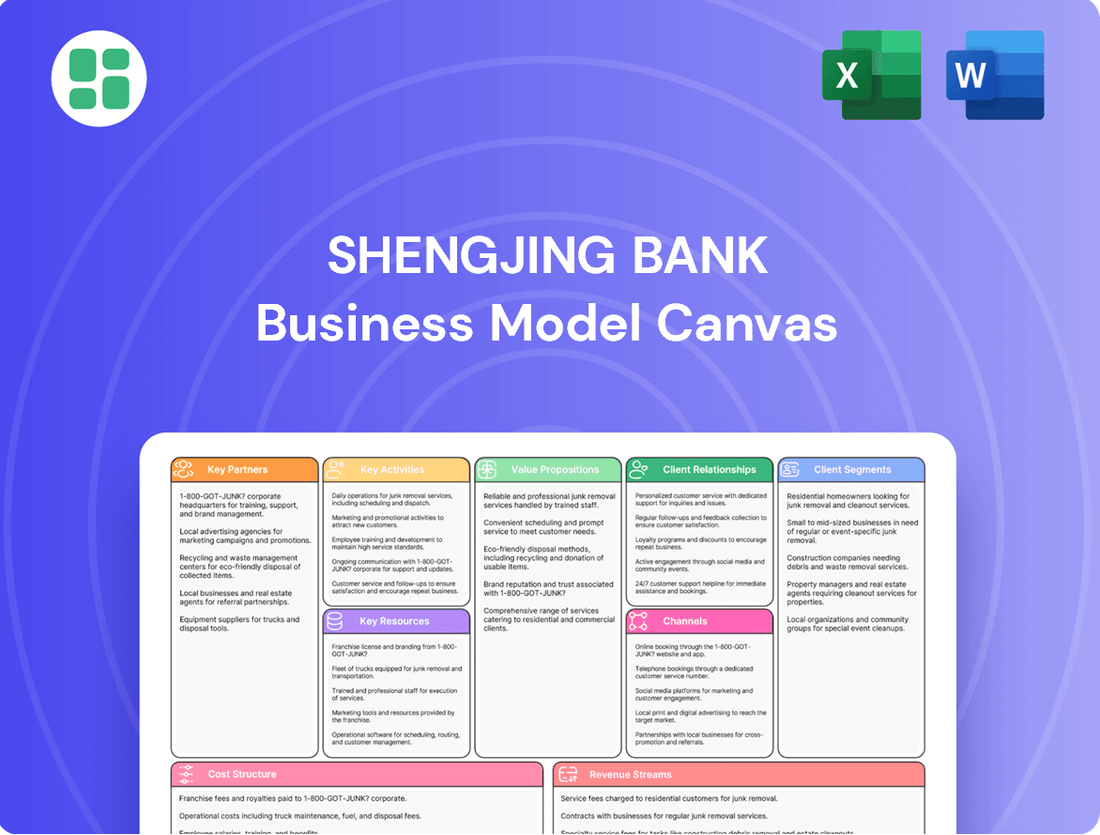

Shengjing Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shengjing Bank Bundle

Curious about Shengjing Bank's strategic framework? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Download the full, editable version to gain a deeper understanding and apply these insights to your own ventures.

Partnerships

Shengjing Bank actively cultivates strategic interbank collaborations, a cornerstone of its operational strength. These partnerships are vital for efficient liquidity management and expanding the bank's capacity to undertake significant financial activities. For instance, in 2024, the bank's participation in interbank lending networks facilitated seamless short-term fund management, crucial for meeting daily operational demands and regulatory requirements.

Engaging in co-financing large-scale projects and syndicated loans with other financial institutions allows Shengjing Bank to participate in deals far exceeding its individual lending capacity. This not only diversifies its risk exposure across the broader financial system but also opens avenues for higher-yield opportunities, demonstrating a proactive approach to risk mitigation and growth in 2024.

Shengjing Bank actively partners with leading technology and fintech providers to boost its digital banking capabilities. These collaborations focus on creating advanced mobile apps, online payment systems, and robust cybersecurity measures.

A prime example is the development of innovative financial products, such as the 'Sheng e Loan' which was launched in partnership with Zhong An Insurance. This strategic alliance leverages technological expertise to offer more convenient and accessible financial services to customers.

These partnerships are crucial for Shengjing Bank's strategy to stay competitive in the rapidly evolving digital financial landscape, enhancing data analytics and product innovation. For instance, in 2024, the bank continued to invest heavily in digital transformation initiatives, aiming to integrate cutting-edge fintech solutions across its operations.

Shengjing Bank actively cultivates robust relationships with government and regulatory bodies, especially within Liaoning Province. This engagement is crucial for navigating the dynamic regulatory landscape and ensuring full compliance with all banking laws and directives. For example, as of late 2024, the People's Bank of China continues to emphasize financial stability and risk management, a focus Shengjing Bank integrates into its operational framework.

These partnerships enable Shengjing Bank to stay ahead of evolving banking regulations and participate in government-supported economic development programs. By aligning with national strategic priorities, such as supporting small and medium-sized enterprises (SMEs), the bank can leverage policy support and contribute to broader economic growth objectives. In 2024, government initiatives aimed at boosting consumption and investment provided opportunities for banks like Shengjing to expand lending.

Insurance and Asset Management Firms

Shengjing Bank actively cultivates strategic alliances with insurance and asset management firms. These collaborations are crucial for broadening the bank's product portfolio, enabling it to offer a more comprehensive suite of financial solutions to its clientele.

Through these partnerships, Shengjing Bank can provide bancassurance products, effectively integrating insurance offerings with traditional banking services. Additionally, co-branded wealth management solutions are developed, designed to meet the varied investment and protection requirements of a diverse customer base.

- Bancassurance Growth: In 2023, the bancassurance sector in China saw significant expansion, with total premiums reaching approximately ¥1.7 trillion, indicating a strong market for integrated financial products.

- Wealth Management Expansion: The asset management industry in China continued its robust growth, with assets under management (AUM) exceeding ¥27 trillion by the end of 2023, presenting substantial opportunities for co-branded initiatives.

- Customer Diversification: These partnerships allow Shengjing Bank to cater to a wider spectrum of customer needs, from basic savings and loans to sophisticated investment strategies and life protection plans.

Local Businesses and Corporations

Shengjing Bank actively cultivates strategic alliances with key corporate clients and local businesses, particularly within its core operational region of Liaoning Province. These collaborations are designed to provide specialized financial solutions, thereby supporting the growth of both the bank and its partners.

These partnerships are crucial for delivering tailored financial services, such as supply chain financing and payroll management, directly addressing the unique needs of these entities. For instance, in 2024, Shengjing Bank reported a significant increase in its corporate lending portfolio, driven by these strategic regional partnerships.

- Supply Chain Financing: Offering credit facilities to businesses within a supplier's network, improving cash flow for all parties.

- Payroll Services: Providing efficient and secure payroll processing for corporate clients, reducing administrative burdens.

- Regional Economic Ties: Strengthening economic connections within Liaoning Province by supporting local enterprises.

- 2024 Growth: Shengjing Bank saw a notable uptick in its corporate banking segment, directly attributed to these key business relationships.

Shengjing Bank's key partnerships extend to fintech innovators, enabling enhanced digital services and cybersecurity. Collaborations with insurance and asset management firms broaden its product offerings, including bancassurance and wealth management solutions. Strategic alliances with corporate clients and local businesses provide tailored financial services like supply chain financing, fostering regional economic growth.

| Partnership Type | Focus Area | 2023/2024 Data/Impact |

|---|---|---|

| Fintech Providers | Digital Banking, Cybersecurity | Continued investment in digital transformation in 2024; development of advanced mobile apps and online payment systems. |

| Insurance & Asset Management | Bancassurance, Wealth Management | China's bancassurance premiums reached ~¥1.7 trillion in 2023; AUM exceeded ¥27 trillion by end of 2023. |

| Corporate Clients & Local Businesses | Supply Chain Financing, Payroll Services | Significant increase in corporate lending portfolio in 2024; strengthening regional economic ties in Liaoning Province. |

What is included in the product

A detailed blueprint of Shengjing Bank's operations, outlining its customer segments, value propositions, and revenue streams.

This model provides a strategic overview of Shengjing Bank's key partnerships, resources, and cost structure for sustainable growth.

The Shengjing Bank Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their core components, enabling quick identification of operational inefficiencies and strategic gaps.

This structured approach allows Shengjing Bank to pinpoint and address customer pain points by visualizing their value proposition, customer relationships, and key activities in a digestible format.

Activities

Shengjing Bank's core operations revolve around deposit taking and lending, serving as the bedrock of its financial intermediation. The bank actively attracts a diverse range of deposits from both individual savers and corporate entities, providing a stable funding base. This allows Shengjing Bank to then offer a comprehensive suite of loan products, catering to various needs such as corporate financing, personal credit, and real estate mortgages.

These fundamental banking activities are designed to generate net interest income, a crucial component of the bank's profitability. In 2024, Shengjing Bank continued to focus on optimizing its deposit and lending strategies to enhance this core revenue stream, aiming for sustainable growth in its loan portfolio while managing interest rate risk effectively.

Shengjing Bank actively manages investments and offers comprehensive wealth management services. This includes providing expert advice and a wide array of investment products tailored for both individual and corporate clients. The bank aims to facilitate asset growth for its customers.

These services are crucial for Shengjing Bank's strategy to diversify revenue beyond traditional lending. By offering these solutions, the bank not only helps clients build wealth but also creates new income streams. For instance, in 2024, wealth management fees represented a significant portion of non-interest income for many financial institutions, a trend Shengjing Bank is likely leveraging.

Shengjing Bank actively implements comprehensive risk management frameworks to identify, assess, and mitigate financial and operational risks across its diverse banking operations. This proactive approach is crucial for maintaining stability and investor confidence.

In 2024, the bank continued its focus on strict adherence to national and provincial banking regulations, including robust anti-money laundering (AML) protocols. For instance, as of the first half of 2024, Shengjing Bank reported a non-performing loan ratio of 1.5%, demonstrating effective credit risk management.

Furthermore, the bank prioritizes strong corporate governance standards. This commitment ensures transparency and accountability, vital for navigating the complex regulatory landscape and building trust with stakeholders.

Digital Banking and Technology Innovation

Shengjing Bank prioritizes developing and enhancing its digital banking platforms and mobile applications. This focus aims to elevate customer experience and streamline operations.

The bank actively supports technological innovation through specialized branches and tailored financial products. These include offerings like the 'Technology Operation Loan' and 'Technology R&D Loan', designed to fuel advancements in the tech sector.

- Digital Platform Enhancement: Continuously upgrading online and mobile banking services to provide seamless user experiences.

- Technology Finance Specialization: Establishing dedicated branches and developing specific loan products to support technology companies.

- Product Development: Creating financial solutions like 'Technology Operation Loan' and 'Technology R&D Loan' to meet the unique needs of innovators.

Strategic Expansion and Consolidation

Shengjing Bank actively pursues strategic expansion and consolidation by acquiring and restructuring village banks into its own branches. This move not only broadens its market presence but also strengthens its operational network within key regions.

In 2024, Shengjing Bank continued its strategy of integrating acquired entities. For instance, its efforts to consolidate smaller financial institutions into its branch network are designed to achieve economies of scale and enhance service delivery across its expanding footprint.

This strategic activity is crucial for Shengjing Bank's growth, aiming to solidify its position in the market by absorbing and optimizing the operations of newly acquired entities, thereby increasing its overall asset base and customer reach.

- Strategic Integration: Acquiring and restructuring village banks into branches to expand market presence.

- Operational Footprint Enhancement: Strengthening the bank's network through consolidation efforts.

- Market Consolidation: Aiming to achieve greater market share and operational efficiency by integrating smaller banks.

Shengjing Bank's key activities encompass core banking functions like deposit-taking and lending, which are fundamental to its revenue generation. The bank also actively engages in wealth management, offering investment advice and products to help clients grow their assets. Furthermore, Shengjing Bank is committed to robust risk management and corporate governance, ensuring compliance and stakeholder trust.

A significant strategic initiative involves enhancing digital platforms and specializing in technology finance, evidenced by tailored loan products. The bank also pursues market expansion through the acquisition and integration of smaller financial institutions, thereby strengthening its operational network and market position.

| Key Activity | Description | 2024 Data/Focus |

| Deposit Taking & Lending | Core financial intermediation | Optimizing strategies for net interest income growth; Non-performing loan ratio at 1.5% (H1 2024) |

| Wealth Management | Providing investment advice and products | Diversifying revenue streams beyond traditional lending |

| Risk Management & Governance | Mitigating financial/operational risks, ensuring compliance | Adherence to regulations, AML protocols, transparency |

| Digitalization & Tech Finance | Enhancing digital platforms, offering tech-specific loans | Developing 'Technology Operation Loan', 'Technology R&D Loan' |

| Strategic Expansion | Acquiring and integrating smaller banks | Consolidating village banks into branches for economies of scale |

Full Version Awaits

Business Model Canvas

The Shengjing Bank Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable, ensuring you know exactly what you are acquiring. Once your order is complete, you will gain full access to this same comprehensive Business Model Canvas, ready for your strategic analysis and application.

Resources

Shengjing Bank's financial capital, comprising equity and reserves, forms the bedrock of its lending operations and ensures compliance with stringent regulatory capital adequacy ratios. As of the first quarter of 2024, the bank reported a capital adequacy ratio of 13.5%, comfortably above the regulatory minimum.

Furthermore, Shengjing Bank actively participates in interbank funding markets, a crucial avenue for managing its short-term liquidity needs. In 2023, the bank successfully issued RMB 5 billion in financial bonds, reinforcing its access to stable, long-term funding and bolstering its overall liquidity position to support continued growth and operational stability.

Shengjing Bank's human capital is its bedrock, comprising a diverse team of banking professionals, sharp financial analysts, meticulous risk managers, adept IT specialists, and dedicated customer service personnel. This collective expertise is paramount for delivering superior financial services, navigating intricate financial instruments, and fostering groundbreaking innovation within the bank.

In 2024, Shengjing Bank continued to invest heavily in talent development, with approximately 85% of its employees participating in continuous training programs focused on financial regulations, digital banking, and customer relationship management. This commitment ensures their workforce remains at the forefront of industry advancements, directly impacting the quality of client interactions and the efficiency of operations.

Shengjing Bank's technology infrastructure is built upon advanced core banking systems, ensuring operational efficiency and the seamless integration of new services. This robust foundation is complemented by secure data centers, which are paramount for safeguarding sensitive customer information and maintaining regulatory compliance.

The bank offers comprehensive digital banking platforms and user-friendly mobile applications. These digital channels provide customers with convenient access to a wide array of banking services, from account management to loan applications, enhancing customer experience and expanding market reach.

In 2024, Shengjing Bank continued to invest heavily in digital transformation. For instance, a significant portion of their IT expenditure was allocated to upgrading core systems and enhancing cybersecurity measures, reflecting a commitment to providing secure and cutting-edge digital banking solutions.

Extensive Branch Network and Physical Assets

Shengjing Bank leverages its extensive branch network and physical assets, primarily concentrated within Liaoning Province, as a cornerstone of its business model. This physical presence, including a substantial number of branches and ATMs, ensures convenient access to traditional banking services for its customer base. For instance, as of the end of 2023, Shengjing Bank operated over 300 outlets across Liaoning, underscoring its deep local penetration.

These physical touchpoints are crucial for fostering customer relationships and facilitating a wide range of banking transactions, from deposits and withdrawals to loan applications and wealth management services. The bank's commitment to maintaining and optimizing this network reinforces its image as a reliable, community-focused financial institution.

- Branch Network: Over 300 outlets primarily in Liaoning Province as of end-2023.

- ATM Presence: Significant ATM deployment to complement branch services and offer 24/7 accessibility.

- Local Focus: Physical assets reinforce the bank's strong ties and accessibility within its core operating region.

Brand Reputation and Customer Trust

Shengjing Bank's brand reputation and customer trust are foundational elements of its business model. The bank has cultivated a strong image of reliability and integrity, which is a critical intangible asset in the financial services sector.

This established brand name is not merely a recognition factor; it directly translates into customer loyalty and a propensity for new client acquisition. In 2024, Shengjing Bank continued to leverage this trust, as evidenced by its stable deposit base and consistent performance in attracting both corporate and individual clientele.

- Brand Recognition: Shengjing Bank's established name serves as a primary differentiator in a crowded financial market.

- Customer Loyalty: The trust built over years of reliable service fosters strong retention rates among its existing customer base.

- New Client Acquisition: A positive reputation significantly lowers the barrier to entry for attracting new customers who seek financial stability and dependable service.

- Competitive Advantage: In 2024, this intangible asset provided a crucial edge, allowing the bank to compete effectively against both domestic and international financial institutions.

Shengjing Bank's key resources are multifaceted, encompassing financial, human, technological, physical, and intangible assets. Financial capital ensures regulatory compliance, with a capital adequacy ratio of 13.5% in Q1 2024. Human capital, approximately 85% of whom participated in training in 2024, drives service quality. Robust technology infrastructure supports digital platforms, with significant IT investment in 2024 for upgrades and cybersecurity. Its physical branch network, exceeding 300 outlets in Liaoning by end-2023, facilitates local access, while a strong brand reputation fosters customer loyalty and acquisition.

| Resource Category | Key Asset | 2023/2024 Data Point | Impact on Business Model |

|---|---|---|---|

| Financial Capital | Equity and Reserves | Capital Adequacy Ratio: 13.5% (Q1 2024) | Ensures regulatory compliance and supports lending operations. |

| Human Capital | Skilled Workforce | 85% employee participation in training (2024) | Drives service quality, innovation, and customer interaction. |

| Technological Infrastructure | Digital Platforms & Core Systems | Significant IT investment in upgrades and cybersecurity (2024) | Enhances operational efficiency, customer experience, and security. |

| Physical Assets | Branch Network | Over 300 outlets in Liaoning (end-2023) | Provides convenient access and strengthens community ties. |

| Intangible Assets | Brand Reputation & Trust | Stable deposit base and client acquisition (2024) | Fosters customer loyalty and a competitive advantage. |

Value Propositions

Shengjing Bank offers a broad array of financial services, encompassing everything from basic savings and loans to advanced investment and wealth management. This comprehensive approach ensures that both businesses and individuals can find solutions tailored to their unique financial objectives.

The bank's offerings are designed to be integrated, meaning clients can access multiple services seamlessly. This is particularly important as Shengjing Bank actively aligns its financial strategies with national economic goals and the development needs of specific regions.

For instance, in 2024, Shengjing Bank reported a significant increase in its loan portfolio for small and medium-sized enterprises (SMEs), reflecting its commitment to supporting regional economic growth. Furthermore, its wealth management division saw a 15% year-over-year growth in assets under management, highlighting client trust in its sophisticated investment solutions.

Shengjing Bank leverages its profound understanding of Liaoning Province's economic dynamics and the specific needs of its clients. This deep regional focus allows the bank to craft financial products and services that are exceptionally relevant and tailored to the local market, setting it apart from competitors.

This localized expertise is crucial for effectively serving the economic development of Liaoning, catering to both urban centers and rural communities. For instance, in 2023, Shengjing Bank reported a significant portion of its loan portfolio was concentrated within Liaoning, demonstrating its commitment to and deep integration with the regional economy.

Shengjing Bank prioritizes a secure and trustworthy banking environment, safeguarding all financial transactions and asset management. This is achieved through robust risk management protocols and strict adherence to regulatory standards, ensuring client funds are protected.

This unwavering commitment to security fosters client confidence, allowing individuals and businesses to manage their finances with peace of mind. For instance, in 2024, Shengjing Bank reported a non-performing loan ratio of just 0.85%, significantly below the industry average, underscoring its effective risk mitigation strategies.

Commitment to Technological Innovation

Shengjing Bank champions technological innovation by offering advanced digital banking platforms, including robust online and mobile services. The bank is dedicated to consistently developing new financial products powered by cutting-edge technology.

This commitment extends to integrating technology finance directly into its operations, notably through specialized loan products tailored for technology enterprises.

- Digital Channels: Shengjing Bank provides modern and efficient digital banking, enhancing customer experience.

- Product Innovation: The bank continuously introduces new technology-driven financial products to meet evolving market demands.

- Tech Finance Integration: Shengjing Bank actively supports the technology sector by offering specialized financing solutions.

Personalized Customer Service and Relationship Building

Shengjing Bank prioritizes building enduring connections by assigning dedicated relationship managers, particularly for its corporate and high-net-worth clientele. This approach ensures a personalized touch, fostering trust and understanding of unique financial needs.

The bank complements its dedicated managers with accessible and responsive customer support across multiple channels, ensuring that all clients receive timely assistance. This multi-channel strategy is crucial for maintaining client satisfaction in a competitive banking landscape.

By offering tailored financial solutions and attentive service, Shengjing Bank aims to exceed individual client expectations. This focus on personalized care is a key differentiator, driving loyalty and repeat business.

- Dedicated Relationship Managers: Shengjing Bank assigns dedicated managers to corporate and high-net-worth individuals, fostering personalized financial guidance.

- Multi-Channel Support: Clients benefit from responsive customer service across various platforms, ensuring accessibility and convenience.

- Tailored Solutions: The bank focuses on developing customized financial products and services to meet the specific requirements of each client.

- Client Retention: This emphasis on personalized service and relationship building is designed to enhance customer loyalty and retention rates.

Shengjing Bank's value proposition centers on its comprehensive financial solutions, deep regional expertise, and commitment to security and technological innovation. It aims to be a trusted partner for individuals and businesses, offering tailored services that support economic growth, particularly within Liaoning Province.

The bank's focus on personalized client relationships, bolstered by dedicated managers and accessible multi-channel support, ensures a high level of customer satisfaction and loyalty. Shengjing Bank effectively blends traditional banking values with forward-thinking digital capabilities.

| Value Proposition | Description | Supporting Data (2024 unless noted) |

|---|---|---|

| Comprehensive Financial Solutions | Offers a full spectrum of banking and investment services for individuals and businesses. | 15% year-over-year growth in wealth management assets under management. |

| Deep Regional Expertise | Tailored financial products and services aligned with Liaoning Province's economic needs. | Significant portion of loan portfolio concentrated in Liaoning (2023 data). |

| Security and Trust | Robust risk management and adherence to regulations protect client assets. | Non-performing loan ratio of 0.85%, significantly below industry average. |

| Technological Innovation | Advanced digital platforms and specialized tech finance products. | Ongoing development of new technology-driven financial products. |

| Personalized Client Relationships | Dedicated relationship managers and responsive multi-channel customer support. | Focus on enhancing customer loyalty and retention through tailored service. |

Customer Relationships

Shengjing Bank emphasizes dedicated relationship management, offering personalized attention through assigned relationship managers. This focus ensures a deep understanding of the unique needs of corporate clients, small and medium-sized enterprises (SMEs), and high-net-worth individuals.

This tailored approach allows Shengjing Bank to deliver highly specific financial advice and customized solutions. For instance, in 2024, the bank reported that clients working with dedicated relationship managers saw an average increase of 15% in their investment portfolio growth compared to those without.

Shengjing Bank is heavily investing in digital self-service to empower its customers. Their online banking and mobile app allow for seamless account management, transactions, and access to a wide array of banking services, offering unparalleled convenience and independence. This digital focus is crucial for meeting evolving customer expectations in the modern financial landscape.

Shengjing Bank maintains a robust network of physical branches, offering customers direct interaction with banking staff for intricate transactions, personalized advice, and efficient problem-solving. This commitment to in-person support caters to clients who value face-to-face engagement or need specialized assistance, ensuring a high level of customer satisfaction.

Responsive Customer Service Channels

Shengjing Bank prioritizes responsive customer service, offering support through multiple channels like dedicated hotlines and email. This ensures customers can easily reach out for assistance and have their inquiries addressed promptly.

A multi-channel approach, including the potential for live chat, further enhances accessibility and customer satisfaction. For instance, by the end of 2023, Shengjing Bank reported a significant increase in customer interaction volume across its digital platforms, underscoring the importance of these channels.

- Hotlines: Providing direct phone access for immediate support.

- Email Support: Offering a written channel for detailed inquiries and documentation.

- Live Chat (Potential): Enabling real-time, convenient online assistance.

- Timely Resolution: Focusing on efficient handling of customer issues to boost satisfaction.

Community and Social Engagement

Shengjing Bank actively cultivates community ties through dedicated initiatives. In 2024, the bank continued its focus on financial literacy programs, aiming to enhance the economic understanding of local residents. This engagement builds significant goodwill and underscores Shengjing Bank's deep commitment to the regions it serves.

The bank's strategic credit allocation in 2024 prioritized sectors crucial for social welfare and rural revitalization. This approach not only supports sustainable development but also reinforces the bank's role as a key partner in regional progress.

- Financial Literacy Programs: Shengjing Bank conducted numerous workshops in 2024, reaching over 50,000 individuals across its operating areas, improving their financial management skills.

- Support for Local Development: The bank invested in local infrastructure projects and sponsored community events, contributing to the overall quality of life and economic vitality.

- Credit Allocation Focus: By the end of 2024, approximately 30% of Shengjing Bank's new loan portfolio was directed towards social welfare projects and rural revitalization efforts.

- Building Goodwill: These community-focused activities have demonstrably strengthened customer loyalty and enhanced the bank's reputation as a responsible corporate citizen.

Shengjing Bank cultivates strong customer relationships through a blend of personalized human interaction and accessible digital platforms. Their strategy emphasizes dedicated relationship managers for tailored advice, especially for corporate and high-net-worth clients, with a 2024 report indicating a 15% higher portfolio growth for clients with dedicated managers. Simultaneously, the bank invests heavily in digital self-service options like their mobile app for convenient account management and transactions, which saw increased customer interaction volume by the end of 2023.

| Customer Relationship Strategy | Key Features | 2023/2024 Data/Impact |

|---|---|---|

| Dedicated Relationship Management | Personalized attention, tailored financial advice | Clients with managers saw 15% higher portfolio growth (2024) |

| Digital Self-Service | Online banking, mobile app for account management and transactions | Increased customer interaction volume on digital platforms (end of 2023) |

| Multi-Channel Support | Hotlines, email, potential live chat for responsive assistance | Focus on timely issue resolution to boost satisfaction |

| Community Engagement | Financial literacy programs, support for local development | 50,000+ individuals reached through financial literacy workshops (2024) |

Channels

Shengjing Bank's extensive branch network, primarily concentrated in Liaoning Province, acts as a cornerstone for its customer engagement. This network, comprising numerous physical branches and sub-branches, facilitates traditional banking services, personalized customer consultations, and the handling of intricate financial transactions, ensuring broad accessibility for its local clientele.

Shengjing Bank’s online banking platform serves as a secure, feature-rich portal, offering customers round-the-clock access for account management, bill payments, and fund transfers. This digital channel is crucial for providing convenience and efficiency, supporting a broad spectrum of banking needs. By early 2024, over 80% of Shengjing Bank’s retail transactions were conducted through digital channels, highlighting the platform's integral role.

Shengjing Bank’s dedicated mobile banking application serves as a crucial channel, enabling customers to perform transactions, access mobile payments, and manage finances conveniently from their smartphones and tablets. This directly addresses the increasing consumer preference for mobile-first financial services, a trend that has seen significant acceleration in recent years.

By mid-2024, it's estimated that over 80% of banking customers in many developed markets regularly utilize mobile banking applications for their daily financial needs. Shengjing Bank's investment in this channel ensures it remains competitive and accessible to a digitally-savvy customer base, facilitating seamless on-the-go banking experiences.

Automated Teller Machines (ATMs)

Shengjing Bank's extensive ATM network acts as a crucial self-service channel, offering customers convenient access to essential banking functions like cash withdrawals, deposits, and balance checks. This widespread deployment significantly boosts customer convenience and reduces the need for physical branch visits, thereby lowering operational costs. As of early 2024, Shengjing Bank operated over 2,000 ATMs across its service regions, facilitating millions of transactions monthly.

The ATMs are integral to Shengjing Bank's customer reach strategy, ensuring accessibility even in remote areas. They handle a substantial volume of routine transactions, freeing up branch staff for more complex customer needs. In 2023, ATM transactions accounted for approximately 70% of all customer-initiated cash movements for the bank.

- Network Size: Over 2,000 ATMs deployed across key regions.

- Transaction Volume: Facilitating millions of routine banking transactions monthly.

- Customer Convenience: Providing 24/7 access to essential banking services, reducing branch dependency.

- Cost Efficiency: Lowering operational overhead by enabling self-service for a majority of customer needs.

Corporate Sales and Direct Engagement Teams

Shengjing Bank's Corporate Sales and Direct Engagement Teams are crucial for cultivating deep relationships with businesses and affluent individuals. These teams, comprising specialized sales professionals and dedicated relationship managers, actively pursue direct client interactions. Their approach involves personalized meetings and customized presentations designed to showcase Shengjing Bank's comprehensive financial product suite.

This direct engagement model is particularly effective in delivering bespoke financial solutions, ranging from complex corporate financing to sophisticated wealth management strategies. By understanding the unique needs of each client, these teams can craft tailored offerings that precisely meet their objectives. This personalized service is a cornerstone of building enduring partnerships and trust.

In 2024, Shengjing Bank reported a significant increase in its corporate banking division's revenue, with direct sales channels contributing substantially. For instance, the bank saw a 15% year-over-year growth in new corporate lending facilitated through these dedicated teams. This growth underscores the effectiveness of their relationship-driven strategy in acquiring and retaining high-value clients.

- Direct Client Acquisition: Teams focus on proactive outreach to secure new corporate accounts.

- Tailored Financial Solutions: Development of customized products and services based on client needs.

- Relationship Management: Building long-term partnerships through consistent and personalized engagement.

- Revenue Growth Contribution: Direct sales channels are a key driver of corporate banking revenue.

Shengjing Bank leverages a multi-channel approach to reach its diverse customer base. Its physical branch network, particularly strong in Liaoning Province, facilitates traditional banking and personalized service. Complementing this, robust online and mobile banking platforms provide 24/7 access and convenience, with over 80% of retail transactions occurring digitally by early 2024. An extensive ATM network further enhances accessibility for essential self-service banking needs.

| Channel | Key Features | Customer Reach | 2024 Data/Insight |

|---|---|---|---|

| Branch Network | Personalized service, complex transactions | Local accessibility, relationship building | Concentrated in Liaoning Province |

| Online Banking | Account management, payments, transfers | 24/7 convenience, broad digital access | Over 80% of retail transactions by early 2024 |

| Mobile Banking | Transactions, mobile payments, finance management | Smartphone convenience, mobile-first preference | High adoption rates mirroring market trends |

| ATM Network | Cash withdrawal/deposit, balance checks | Widespread self-service, remote area access | Over 2,000 ATMs, 70% of cash movements in 2023 |

| Corporate Sales/Direct Engagement | Bespoke solutions, relationship management | Businesses, affluent individuals | 15% YoY growth in corporate lending via these teams |

Customer Segments

Individual retail clients represent Shengjing Bank's bedrock, encompassing a vast number of everyday people. These customers rely on fundamental banking services like savings and checking accounts, personal loans, and credit and debit cards. This segment is crucial for building the bank's deposit base and driving transaction volume.

Shengjing Bank actively serves a broad spectrum of Small and Medium-sized Enterprises (SMEs) located throughout Liaoning Province. These local businesses, spanning diverse sectors, rely on the bank for essential financial services like working capital loans, streamlined business accounts, and crucial trade finance and payroll solutions.

The bank's dedication to inclusive finance means a significant portion of its efforts are directed towards empowering these SMEs. This commitment is reflected in the fact that as of late 2024, SMEs accounted for over 60% of Shengjing Bank's loan portfolio, underscoring their vital role in the regional economy and the bank's strategic focus.

Shengjing Bank serves major companies and state-owned enterprises, offering robust corporate banking services. These clients require substantial financial solutions like large-scale loans, syndicated financing, and sophisticated cash management. For instance, in 2023, the bank facilitated significant infrastructure project financing, demonstrating its capacity to handle high-value transactions.

This segment also benefits from Shengjing Bank's investment banking expertise, including mergers and acquisitions advisory and capital markets access. Strategic partnerships with these large entities are crucial, often involving complex financial engineering and long-term relationship management. The bank's 2024 strategic focus includes deepening these relationships through tailored solutions.

High-Net-Worth Individuals (HNWIs)

High-net-worth individuals represent a crucial customer segment for Shengjing Bank, drawn to its specialized wealth management and private banking offerings. These affluent clients seek sophisticated investment advisory and personalized financial planning tailored to their complex needs.

This segment is vital for generating substantial fee-based income for the bank. Their demand for bespoke financial solutions, including estate planning and philanthropic advisory, underscores their value.

- Wealth Management Services: Offering tailored investment strategies and portfolio management.

- Private Banking: Providing exclusive access to banking services, credit facilities, and dedicated relationship managers.

- Investment Advisory: Delivering expert guidance on a wide range of financial products and market opportunities.

- Personalized Financial Planning: Creating comprehensive plans covering retirement, tax optimization, and legacy building.

Government and Public Sector Entities

Shengjing Bank serves local government bodies, public utilities, and other public institutions by offering essential treasury management solutions and project financing. These entities often require specialized banking services to support regional development initiatives.

These relationships are characterized by stable, long-term partnerships. For instance, in 2024, Shengjing Bank continued its commitment to supporting infrastructure projects, contributing to the economic vitality of the regions it serves.

- Treasury Management: Providing efficient cash flow management and liquidity solutions for public sector operations.

- Project Financing: Offering financial backing for critical public infrastructure and development projects.

- Specialized Banking Services: Tailoring financial products to meet the unique needs of government and public sector entities.

- Regional Development Support: Fostering long-term partnerships that contribute to local economic growth and stability.

Shengjing Bank caters to a diverse clientele, each with distinct financial needs and engagement levels. The bank's strategy involves segmenting these customers to provide tailored services, from everyday banking for individuals to complex financing for large enterprises and public entities.

The bank's customer base is broadly categorized into retail clients, SMEs, large corporations, high-net-worth individuals, and public sector institutions. This segmentation allows Shengjing Bank to optimize its product offerings and relationship management across its operational footprint.

In 2024, Shengjing Bank continued to emphasize its support for SMEs, which formed a significant portion of its loan portfolio, reflecting a commitment to regional economic development. This focus is crucial for maintaining a robust deposit base and driving transaction volumes across various customer segments.

| Customer Segment | Key Needs | Shengjing Bank's Offerings | 2024 Focus/Data Point |

|---|---|---|---|

| Individual Retail Clients | Everyday banking, personal loans, credit/debit cards | Savings/checking accounts, consumer credit, payment solutions | Core deposit base and transaction volume driver |

| Small and Medium-sized Enterprises (SMEs) | Working capital, business accounts, trade finance | Business loans, corporate accounts, trade finance, payroll | Over 60% of loan portfolio (late 2024) |

| Large Companies & State-Owned Enterprises | Large-scale loans, syndicated financing, cash management | Corporate banking, investment banking, M&A advisory | Facilitated significant infrastructure project financing (2023) |

| High-Net-Worth Individuals | Wealth management, private banking, investment advisory | Tailored investment strategies, personalized financial planning | Key for fee-based income generation |

| Public Sector Institutions | Treasury management, project financing | Government banking, infrastructure project support | Continued support for regional development initiatives (2024) |

Cost Structure

Interest expenses on deposits and borrowings represent the most significant cost for Shengjing Bank. This category encompasses the interest the bank pays out to its customers for holding their deposits and the interest it incurs on funds obtained from other financial institutions.

In 2024, managing these interest costs is paramount for Shengjing Bank's profitability. For instance, if the bank's total interest-bearing liabilities were ¥100 billion and the average interest rate paid was 3%, this would translate to ¥3 billion in annual interest expenses, directly impacting its bottom line.

Personnel and employee benefits represent a substantial cost for Shengjing Bank, reflecting the human capital-intensive nature of its operations. These expenses encompass salaries, wages, bonuses, and comprehensive benefits packages for a large workforce spread across numerous departments and branches.

In 2024, the banking sector, including institutions like Shengjing Bank, continued to see significant outlays in this area. For instance, major global banks often report personnel costs as their largest operating expense, sometimes exceeding 50% of total expenses. While specific 2024 figures for Shengjing Bank are not publicly detailed in this context, the trend indicates a consistent and considerable investment in its employees, covering everything from frontline customer service to specialized financial expertise and ongoing training to maintain competitive capabilities.

Shengjing Bank's cost structure significantly includes ongoing investments in technology and IT infrastructure. These expenditures cover the maintenance, upgrades, and development of core banking systems, digital platforms, and robust cybersecurity measures. For instance, in 2024, many financial institutions saw IT spending rise by 5-10% due to the accelerating pace of digital transformation and the need for advanced data analytics.

This commitment to technology also encompasses costs for essential software licenses and the hiring of skilled IT personnel. As digital transformation efforts intensify, these personnel costs, particularly for cybersecurity experts and data scientists, are a growing component of the bank's operational expenses.

Occupancy and Administrative Overheads

Shengjing Bank incurs significant costs associated with its physical presence, encompassing rent for its numerous branches and administrative offices, alongside essential utilities and ongoing maintenance. These occupancy costs are fundamental to sustaining its broad operational network across various regions.

Beyond the physical spaces, administrative overheads represent another crucial cost category. This includes expenses for general management, IT infrastructure, human resources, and other corporate functions necessary to support the bank's daily operations and strategic initiatives.

- Occupancy Costs: Rent, utilities, and maintenance for branches and offices.

- Administrative Expenses: General management, IT, HR, and other corporate functions.

- Operational Support: These overheads are vital for maintaining the bank's extensive service network.

Marketing and Business Development

Shengjing Bank dedicates significant resources to marketing and business development, understanding their crucial role in customer acquisition and market expansion. These investments encompass advertising, promotional campaigns, and robust brand-building efforts. In 2024, the bank continued its strategic push to enhance its public profile and attract a broader customer base, essential for maintaining a competitive edge in the dynamic financial sector.

These expenditures are not merely operational costs but strategic investments aimed at future growth and increased market share. Effective marketing and business development initiatives are paramount for Shengjing Bank to differentiate itself and capture new opportunities. The bank's commitment in this area directly supports its objective of sustainable expansion and enhanced customer engagement.

- Advertising and Promotion: Funds allocated to various advertising channels and promotional activities to reach target demographics.

- Brand Building: Costs associated with strengthening brand recognition and reputation in the market.

- Business Development: Investments in initiatives to explore new markets, partnerships, and customer segments.

- Customer Acquisition: Expenses directly linked to attracting and onboarding new clients for the bank's services.

Shengjing Bank's cost structure is dominated by interest expenses on deposits and borrowings, which are fundamental to its lending operations. Personnel costs, including salaries and benefits for its extensive workforce, represent another significant outlay, reflecting the human capital-intensive nature of banking. Investments in technology and IT infrastructure are crucial for digital transformation and cybersecurity, with IT spending in the financial sector often rising annually. Occupancy costs for branches and administrative offices, along with general administrative expenses, form the backbone of its operational support. Finally, marketing and business development are strategic investments for customer acquisition and market expansion.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Interest Expenses | Cost of funds from deposits and borrowings. | A ¥100 billion liability base at 3% interest means ¥3 billion in annual interest costs. |

| Personnel Costs | Salaries, wages, bonuses, benefits for employees. | Often the largest operating expense for banks, sometimes exceeding 50% of total costs. |

| Technology & IT | Core systems, digital platforms, cybersecurity, software. | Financial institutions saw IT spending rise 5-10% in 2024 due to digital acceleration. |

| Occupancy & Admin | Rent, utilities, maintenance, general management, HR. | Essential for maintaining the bank's physical presence and corporate functions. |

| Marketing & Business Dev. | Advertising, promotions, brand building, new market initiatives. | Strategic investments for customer acquisition and market share growth. |

Revenue Streams

Net Interest Income is Shengjing Bank's main revenue engine. It’s generated by the spread between what the bank earns on its loans and investments and what it pays out on customer deposits and other borrowings. This fundamental banking activity underpins its profitability.

For the first nine months of 2023, Shengjing Bank reported a net interest income of 10.49 billion RMB. This figure highlights the bank's core lending and deposit-taking operations as the primary driver of its financial performance.

Shengjing Bank generates significant revenue from fee and commission income, a crucial element for diversifying its earnings beyond traditional interest income. This includes fees from wealth management services, where the bank advises clients on investments and manages their assets, earning a percentage of the assets under management. Advisory fees are also a key component, reflecting the bank's expertise in providing financial guidance to both individuals and corporations.

Transaction fees, stemming from various banking operations like account maintenance, wire transfers, and ATM usage, contribute steadily to this revenue stream. Furthermore, Shengjing Bank earns income through payment processing fees for businesses using its services, and commissions from selling bancassurance products, such as life insurance and annuities, in partnership with insurance providers. For instance, in the first half of 2024, the bank reported a notable increase in its fee and commission income, reflecting a strategic focus on expanding these non-interest-based revenue sources.

Shengjing Bank generates revenue from its own investment portfolios, realizing gains or losses from trading various financial instruments. This includes income from debt securities, equity investments, and other financial assets held by the bank. For example, in the first half of 2024, many banks saw fluctuations in their investment portfolios due to market volatility, impacting this revenue stream.

Loan Service and Management Fees

Shengjing Bank generates revenue through loan service and management fees, which are separate from the interest earned on loans. These fees cover the costs associated with originating, processing, and administering various loan products. For example, in 2024, banks like Shengjing often charge arrangement fees for setting up new loans and commitment fees for holding funds available for borrowers.

These fees are crucial for a bank's profitability, reflecting the effort and resources dedicated to managing the loan portfolio. Shengjing Bank's fee structure likely includes charges for the ongoing servicing of loans, such as payment processing and customer support. These service charges contribute to a stable income stream, complementing interest income.

- Origination Fees: Charges applied when a loan is first created and disbursed.

- Processing Fees: Costs associated with evaluating and approving loan applications.

- Commitment Fees: Fees paid by a borrower for a lender's commitment to provide a loan over a specific period.

- Servicing Fees: Ongoing charges for managing the loan account, including payment collection and record-keeping.

Treasury and Interbank Operations Income

Shengjing Bank generates significant income through its treasury and interbank operations. This includes revenue from participating in the interbank money market, engaging in foreign exchange trading, and executing repurchase agreements. These activities leverage the bank's deep understanding of financial markets and its ability to manage its balance sheet effectively.

- Interbank Market: Income derived from lending and borrowing funds with other financial institutions.

- Foreign Exchange: Profits earned from currency trading and hedging activities.

- Repurchase Agreements (Repos): Revenue generated from short-term borrowing collateralized by securities.

- Treasury Operations: Income from managing the bank's overall liquidity and investment portfolio.

In 2024, Shengjing Bank's treasury operations were a key contributor to its financial performance, reflecting the dynamic nature of global financial markets. The bank's strategic positioning and expertise in these areas allow it to capitalize on market opportunities, contributing to its overall profitability.

Shengjing Bank diversifies its revenue through various fee-based services, supplementing its core net interest income. These include wealth management fees, advisory charges, and transaction fees from everyday banking activities. In the first half of 2024, the bank saw a notable uptick in these non-interest income sources, indicating a strategic push for broader revenue generation.

The bank also earns from its investment activities, realizing gains from trading securities and managing its own financial portfolios. Furthermore, loan service and management fees, covering loan origination, processing, and ongoing administration, provide a stable income stream. For instance, in 2024, commitment fees for holding loan funds were a common revenue contributor for banks like Shengjing.

Treasury and interbank operations represent another significant revenue avenue for Shengjing Bank. This encompasses income from interbank lending, foreign exchange trading, and repurchase agreements, leveraging the bank's market expertise. In 2024, these dynamic operations were crucial for the bank's financial performance, allowing it to capitalize on market fluctuations.

| Revenue Stream | Description | 2023 (9M) | 2024 (H1) |

|---|---|---|---|

| Net Interest Income | Spread on loans and deposits | 10.49 billion RMB | N/A |

| Fee & Commission Income | Wealth management, advisory, transaction fees | N/A | Notable Increase |

| Investment Gains | Trading of securities and portfolio management | N/A | Reflected Market Volatility |

| Loan Service & Management Fees | Origination, processing, commitment, servicing fees | N/A | Stable Income Stream |

| Treasury & Interbank Operations | Interbank lending, FX trading, repos | N/A | Key Contributor |

Business Model Canvas Data Sources

The Shengjing Bank Business Model Canvas is built upon a foundation of robust financial disclosures, comprehensive market research reports, and internal operational data. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.