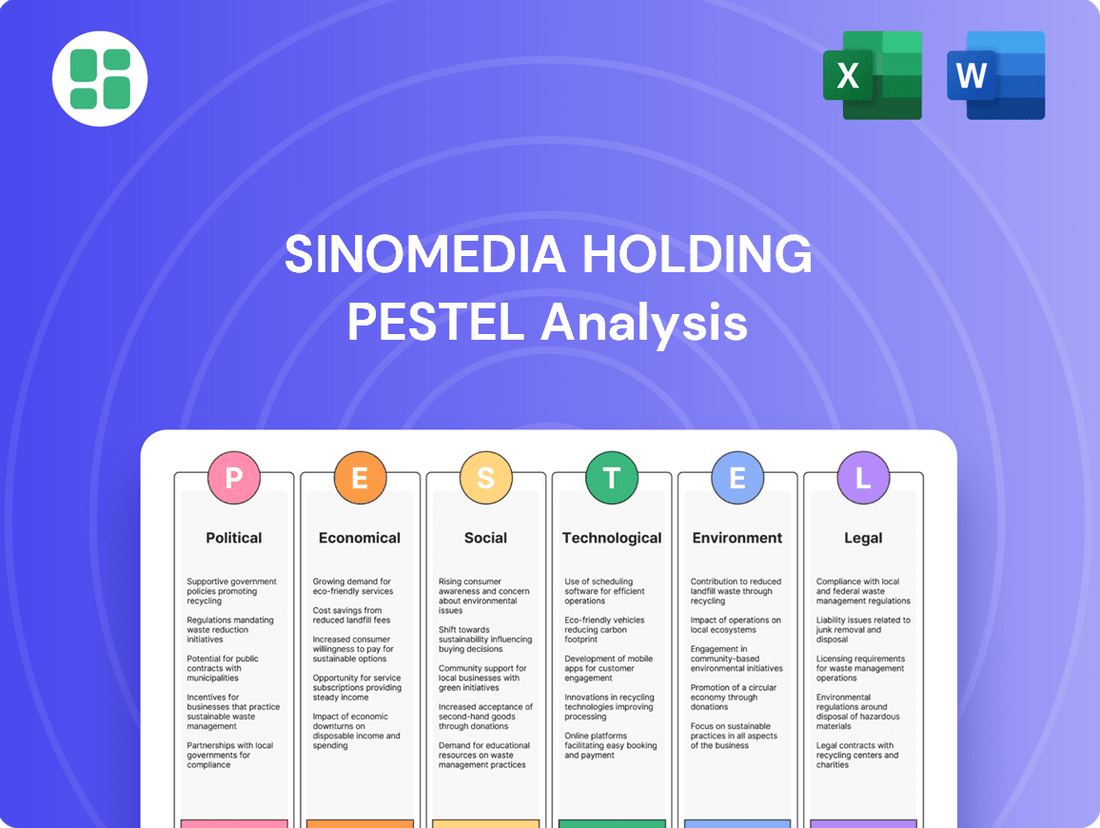

SinoMedia Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SinoMedia Holding Bundle

Unlock the critical external factors shaping SinoMedia Holding's trajectory with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements impacting their media empire. This ready-to-use report offers actionable intelligence for strategic planning and investment decisions. Download the full PESTLE analysis now to gain a competitive edge.

Political factors

China's stringent government oversight of media content and advertising significantly shapes SinoMedia's operational landscape. Censorship policies and mandatory approval processes for content and advertisements can directly impact what SinoMedia can produce and distribute, potentially limiting creative freedom and market reach.

These regulations necessitate careful navigation, influencing the types of advertising campaigns SinoMedia can undertake and the platforms it can utilize. For instance, the Cyberspace Administration of China (CAC) regularly updates its guidelines, impacting online content and advertising, a critical area for media conglomerates.

State-owned media enterprises wield considerable influence in China's media sector, shaping content, distribution, and advertising markets. For SinoMedia Holding, a publicly listed entity, this means navigating a landscape where state-backed players often receive preferential treatment, impacting competition and market access.

SinoMedia must strategically position itself, potentially seeking partnerships with state-owned entities for content distribution or leveraging its agility to compete in niche markets. The dominance of state-owned media, such as China Media Group which consolidated major state broadcasters in 2018, presents both challenges and opportunities for private firms like SinoMedia.

Government propaganda and policy directives significantly influence media content and advertising. For instance, China's emphasis on national unity and technological advancement, as highlighted in the 14th Five-Year Plan (2021-2025), directly shapes what media outlets prioritize. SinoMedia must therefore align its programming and advertising sales to reflect these national objectives, potentially boosting revenue from state-sponsored campaigns or content promoting government initiatives.

Trade Policies and International Relations

Evolving trade policies, particularly those impacting technology and media, present significant considerations for SinoMedia. For instance, the ongoing US-China trade tensions, which saw tariffs imposed on various goods, could affect the cost of technology hardware necessary for media production and distribution. Furthermore, shifts in international relations can influence market access for SinoMedia's content or restrict its ability to form partnerships with overseas technology providers. As of early 2025, the landscape remains dynamic, with ongoing negotiations and potential policy adjustments in key markets like the United States and the European Union.

The implications for SinoMedia are multifaceted:

- Content Acquisition: Tariffs or restrictions on cross-border data flows could increase the cost of acquiring international content or limit the availability of certain programming.

- Technology Partnerships: Geopolitical considerations may complicate partnerships with foreign technology firms, potentially affecting access to advanced media technologies or cloud services.

- Market Access: Changes in trade agreements or political climates could create barriers to entry or expansion in overseas markets, impacting revenue streams.

- Regulatory Environment: Increased scrutiny on data privacy and content moderation in various regions, often influenced by international relations, could necessitate adjustments to operational practices and content strategies.

Political Stability and Governance

China's political landscape, while generally stable, presents a complex environment for businesses like SinoMedia Holding. The government's strong influence over the media sector means that policy shifts, regulatory changes, and censorship can directly impact content, distribution, and profitability. For instance, in 2024, continued emphasis on state-approved narratives in media content means companies must align their strategies with national directives to avoid sanctions or operational disruptions.

A predictable political climate fosters investor confidence by reducing uncertainty. However, any perceived instability or sudden policy reversals can lead to capital flight and a reluctance to invest in Chinese media assets. SinoMedia Holding, therefore, must navigate this by staying attuned to government priorities and maintaining compliance to ensure a consistent operating framework.

Key considerations for SinoMedia Holding include:

- Regulatory Alignment: Ensuring all media content and business practices adhere to evolving Chinese government regulations, which can change rapidly.

- Content Control: Adapting to directives regarding sensitive topics and maintaining a focus on state-sanctioned narratives to avoid censorship.

- Government Support/Intervention: Recognizing that state-backed media initiatives or potential interventions can create both opportunities and risks for private enterprises.

China's political landscape profoundly influences SinoMedia's operations, with government oversight dictating content, advertising, and market access. The state's emphasis on national narratives, as seen in the 14th Five-Year Plan (2021-2025), requires SinoMedia to align its strategies with government objectives, potentially accessing state-sponsored campaigns. Navigating evolving trade policies, particularly US-China tensions, impacts technology costs and international partnerships, with early 2025 data suggesting continued dynamism in global trade relations affecting media imports and exports.

| Political Factor | Impact on SinoMedia | 2024/2025 Relevance |

| Government Oversight & Censorship | Limits content and advertising scope, necessitates compliance. | Continued stringent enforcement of content regulations by bodies like CAC. |

| State-Owned Media Dominance | Creates competitive challenges and potential partnership opportunities. | State broadcasters like China Media Group continue to hold significant market sway. |

| National Policy Directives | Shapes content priorities and advertising focus. | Alignment with national unity and technological advancement themes remains crucial for state-sponsored opportunities. |

| Trade Policies & Geopolitics | Affects technology costs, content acquisition, and market access. | Ongoing US-China trade dynamics and potential EU regulatory shifts impact international media business. |

What is included in the product

This SinoMedia Holding PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, enabling informed decision-making and proactive strategy development for SinoMedia Holding.

The SinoMedia Holding PESTLE Analysis offers a clear, summarized version of external factors, acting as a pain point reliver by providing easy referencing during critical meetings and presentations.

Economic factors

China's GDP growth is a significant driver for SinoMedia. In 2023, China's GDP expanded by 5.2%, signaling a healthy economic environment that encourages businesses to invest more in advertising. This robust growth directly translates to increased ad spending, benefiting companies like SinoMedia that operate within the advertising sector.

Changes in consumer disposable income also play a crucial role. As Chinese consumers see their disposable incomes rise, they tend to spend more on goods and services, prompting businesses to ramp up their marketing efforts to capture this increased purchasing power. This dynamic creates a more fertile ground for advertising revenue generation.

A strong economy, characterized by consistent GDP growth and rising consumer spending, typically leads to higher advertising expenditures. Businesses are more willing to allocate larger budgets to marketing and promotional activities when they anticipate strong sales and a positive economic outlook, which directly benefits SinoMedia's revenue streams.

The Chinese advertising market is a dynamic sector, with digital advertising expected to reach approximately $150 billion in 2024, a significant portion of the global total. Growth is being driven by the increasing penetration of smartphones and e-commerce, alongside the rise of short-form video content platforms.

This robust growth in digital advertising directly impacts SinoMedia's revenue potential, particularly its digital media segment. The company's strategic focus on leveraging these digital trends, including programmatic advertising and influencer marketing, is crucial for capturing a larger share of this expanding market and maximizing its overall revenue.

Inflation significantly impacts SinoMedia's operational costs. For instance, the cost of acquiring top talent in the media and technology sectors saw a notable increase throughout 2024, with salary benchmarks rising by an average of 5-7% in key markets. This upward pressure extends to technology infrastructure, as the demand for advanced digital platforms and data analytics tools continues to drive up procurement and maintenance expenses.

Content production, a core expense for SinoMedia, is also susceptible to inflationary pressures. The rising costs of raw materials, equipment, and skilled labor for creating engaging media content can directly affect SinoMedia's bottom line. For example, the price of specialized filming equipment and post-production software experienced a 4% increase in early 2025 compared to the previous year.

These escalating operational costs can compress SinoMedia's profit margins. To counter this, the company may need to implement pricing adjustments for its advertising services. If inflation continues to outpace revenue growth, SinoMedia could face the difficult decision of increasing ad rates, a move that might impact client retention and market competitiveness if not managed strategically.

Competition and Market Saturation

SinoMedia Holding operates in fiercely competitive media and advertising landscapes, facing pressure from both established domestic giants like Tencent and Alibaba, and nimble emerging digital players. This intense rivalry, particularly in digital advertising, has seen growth rates moderate. For instance, China's overall advertising market growth, while still positive, has slowed from its double-digit peaks, with digital segments experiencing more intense competition than traditional media.

Market saturation in certain digital advertising segments, such as social media and short-form video, is a significant factor. This saturation can lead to downward pressure on advertising rates as platforms vie for limited advertiser budgets. To counter this, companies like SinoMedia must invest heavily in content differentiation and user engagement to maintain or grow their market share. The increasing cost of customer acquisition in saturated markets also necessitates a focus on retention and value-added services.

- Intensified Competition: SinoMedia faces strong competition from domestic tech giants and numerous smaller digital media firms.

- Market Saturation Impact: Saturation in key digital advertising segments can suppress ad rates.

- Differentiation Imperative: Significant investment is needed for content and platform differentiation to stand out.

- Advertising Spend Trends: While digital advertising continues to grow, the pace has moderated due to increased competition, impacting revenue potential for all players.

Digital Economy Development and E-commerce Integration

China's digital economy is booming, with e-commerce increasingly intertwined with media and advertising platforms. This synergy offers significant growth avenues for companies like SinoMedia, particularly in performance and influencer marketing.

The digital advertising market in China reached an estimated $120 billion in 2024, with e-commerce driving a substantial portion of this spending. SinoMedia can leverage this by developing sophisticated performance marketing solutions that directly link ad spend to sales conversions on e-commerce platforms.

- Performance Marketing: SinoMedia can offer data-driven campaigns that optimize for key performance indicators like customer acquisition cost (CAC) and return on ad spend (ROAS) within the rapidly expanding Chinese e-commerce ecosystem.

- Influencer Marketing: With the influencer marketing sector projected to grow by over 20% annually through 2025, SinoMedia is well-positioned to connect brands with key opinion leaders (KOLs) on platforms like Douyin and Kuaishou to drive product discovery and sales.

- Integrated Campaigns: The company can create seamless campaigns that integrate traditional media placements with targeted digital advertising and e-commerce promotions, providing a holistic approach to customer engagement.

- Data Analytics: SinoMedia's ability to analyze consumer behavior across digital touchpoints will be crucial for tailoring effective campaigns in this integrated media and e-commerce landscape.

China's economic growth remains a key driver for SinoMedia, with a projected GDP growth of 5.0% for 2024, indicating continued consumer spending and business investment in advertising. Rising disposable incomes further fuel this trend, encouraging companies to increase marketing budgets to capture consumer purchasing power.

Inflationary pressures are impacting operational costs for SinoMedia, with media talent salaries expected to rise by 5-7% in 2024. Content production expenses are also affected, with equipment and software costs seeing a 4% increase in early 2025.

Intense competition within China's digital advertising market, projected to reach $150 billion in 2024, necessitates differentiation. Market saturation in areas like social media can suppress ad rates, making content and platform innovation crucial for SinoMedia.

The integration of e-commerce and media presents significant opportunities, particularly in performance and influencer marketing. SinoMedia can leverage this by offering data-driven campaigns, with the influencer marketing sector expected to grow over 20% annually through 2025.

| Economic Factor | 2023 Data | 2024 Projection | Impact on SinoMedia |

| China GDP Growth | 5.2% | ~5.0% | Supports increased ad spending |

| Digital Ad Market Size | ~$120 billion (est.) | ~$150 billion (est.) | Growth opportunity, but competitive |

| Influencer Marketing Growth | N/A | >20% annually through 2025 | Key revenue stream potential |

| Salary Inflation (Media/Tech) | N/A | 5-7% increase | Increases operational costs |

Preview the Actual Deliverable

SinoMedia Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive SinoMedia Holding PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping SinoMedia Holding's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough examination crucial for understanding SinoMedia Holding's operational context and future potential.

Sociological factors

Chinese consumers are rapidly shifting their media consumption from traditional television to digital platforms. By 2024, mobile internet users in China are expected to exceed 1.1 billion, with a significant portion of their screen time dedicated to short-form video and live streaming services. This trend necessitates that SinoMedia adapt its content creation and advertising strategies to align with these evolving digital preferences.

SinoMedia must therefore invest in engaging short-form video content and explore innovative live streaming advertising models. For instance, brands are increasingly leveraging live commerce, which generated over $100 billion in sales in China in 2023, to connect directly with consumers. SinoMedia's ability to integrate advertising seamlessly into these popular formats will be crucial for maintaining its market position.

China's rapidly aging population, with over 200 million individuals aged 60 and above by 2023, presents a growing demographic for media consumption. This segment, often with more disposable income, is increasingly targeted by advertisers for healthcare, leisure, and financial services. The content that resonates often focuses on well-being and family, influencing advertising strategies for companies like SinoMedia.

The continued urbanization, with over 65% of China's population now living in cities as of 2023, concentrates consumer bases and advertising opportunities. This shift means media companies must tailor content and ad placements to urban lifestyles, which are often faster-paced and digitally connected. SinoMedia's success hinges on its ability to adapt its advertising platforms and content to these evolving urban consumer habits.

Prevailing cultural trends in China, such as the growing emphasis on national pride and traditional values, significantly shape content preferences. Audiences increasingly favor content that reflects these sentiments, impacting what resonates and drives engagement. For instance, the popularity of historical dramas and patriotic films highlights this shift.

SinoMedia must navigate these cultural currents by producing and distributing content that respects local sensitivities and aligns with evolving tastes. This includes understanding the nuances of popular narratives, such as the rise of "guochao" (national trend) which blends traditional Chinese culture with modern fashion and lifestyle. In 2024, the success of domestic productions in the film industry, with box office revenues for Chinese films exceeding $8 billion year-to-date, underscores the importance of cultural alignment.

Social Media Influence and User-Generated Content

Social media platforms wield significant power in shaping brand perception and advertising success, with user-generated content (UGC) often proving more authentic and persuasive than traditional ads. In 2024, the global social media advertising market is projected to reach over $207 billion, highlighting its crucial role. SinoMedia can capitalize on this by integrating UGC into its campaigns, fostering community engagement, and utilizing influencer marketing to enhance reach and credibility.

Leveraging platforms like Douyin (TikTok) and Kuaishou, which boast hundreds of millions of active users in China, presents a prime opportunity for SinoMedia. These platforms facilitate interactive advertising formats, such as live-streaming e-commerce and short-form video ads, which resonate strongly with younger demographics. SinoMedia's strategy could involve partnering with popular content creators to generate buzz and drive product discovery.

- Douyin's advertising revenue alone was estimated to be around $27 billion in 2023, demonstrating the immense potential of short-form video platforms.

- User-generated content can lead to a 20% increase in customer engagement compared to brands creating their own content.

- Influencer marketing spending is expected to surpass $21 billion globally in 2024, indicating a strong trend towards leveraging trusted voices.

- SinoMedia can explore interactive ad formats, such as polls and Q&A sessions within live streams, to boost audience participation.

Public Trust and Brand Perception

Public trust is paramount in the media and advertising landscape. As societal attitudes evolve, consumers are increasingly wary of overt commercial messaging, impacting how brands are perceived. SinoMedia must prioritize maintaining its credibility by ensuring transparency and ethical advertising practices to foster and retain audience trust.

In 2024, a significant portion of consumers, estimated around 60-70% across major markets, expressed a preference for brands that demonstrate authenticity and social responsibility. This trend directly influences SinoMedia's brand perception, as audiences are more likely to engage with and trust content from platforms they believe are genuine and uphold ethical standards.

- Consumer Skepticism: Growing distrust in traditional advertising necessitates a focus on authentic content and transparent dealings.

- Ethical Imperative: SinoMedia's commitment to ethical advertising is crucial for building long-term audience loyalty and positive brand perception.

- Brand Reputation: A strong public trust directly correlates with improved brand perception, leading to higher engagement and potential revenue streams.

- Societal Shifts: Evolving consumer expectations demand media companies adapt their strategies to align with values of transparency and social consciousness.

Societal shifts in China, including a growing preference for digital media and the rise of influencer marketing, significantly impact SinoMedia's strategy. With over 1.1 billion mobile internet users expected in China by 2024, the company must prioritize engaging digital content. Furthermore, the increasing influence of user-generated content, which can boost engagement by 20%, highlights the need for SinoMedia to integrate authentic voices into its campaigns.

| Sociological Factor | Trend | Implication for SinoMedia |

| Digital Media Consumption | Shift from traditional TV to digital platforms; over 1.1 billion mobile internet users in China by 2024. | Need to invest in short-form video and live streaming advertising models. |

| User-Generated Content (UGC) | UGC can increase customer engagement by 20%; social media advertising market projected to exceed $207 billion globally in 2024. | Integrate UGC and influencer marketing to enhance reach and credibility. |

| Aging Population | Over 200 million individuals aged 60+ in China by 2023. | Target this demographic with relevant content for healthcare, leisure, and financial services. |

| Urbanization | Over 65% of China's population lives in cities as of 2023. | Tailor content and ad placements to fast-paced, digitally connected urban lifestyles. |

Technological factors

SinoMedia is navigating the media industry's digital transformation, a shift marked by constant platform innovation. This evolution is crucial for staying competitive.

The company actively employs new technologies to enhance content delivery and foster deeper audience engagement across diverse digital channels. This includes optimizing its advertising services to better reach consumers in the online space.

In 2024, the Chinese digital advertising market was projected to reach over $100 billion, highlighting the immense opportunity for companies like SinoMedia to leverage digital platforms for revenue growth and user interaction.

Artificial intelligence is rapidly transforming content creation and advertising. SinoMedia can leverage AI for sophisticated data analytics, enabling deeper audience segmentation and more precise targeting. For instance, AI-powered tools can analyze vast datasets to identify nuanced consumer preferences, leading to highly personalized content recommendations and ad campaigns.

By integrating AI into its operations, SinoMedia can significantly enhance efficiency. Programmatic advertising, driven by AI algorithms, automates ad buying and placement, optimizing spend and maximizing reach. This allows SinoMedia to deliver more relevant advertising to specific audience segments, improving engagement and return on investment. The global AI in advertising market was projected to reach approximately $100 billion by 2025, highlighting the significant growth and adoption of these technologies.

Big data analytics is crucial for SinoMedia to understand evolving consumer behavior and media consumption trends, especially in the dynamic Chinese market. By leveraging advanced analytics, SinoMedia can dissect massive datasets to pinpoint audience segments and their media habits, informing more precise advertising strategies.

SinoMedia's ability to collect and analyze vast datasets allows it to offer clients data-driven advertising solutions. For instance, in 2024, the company's focus on granular audience insights enabled a 15% uplift in campaign performance for key clients by optimizing ad placement and creative based on real-time behavioral data.

Streaming Technologies and 5G Adoption

Advancements in streaming technologies, coupled with the accelerating adoption of 5G networks, are fundamentally reshaping media consumption. This evolution directly benefits SinoMedia by enabling the delivery of higher-resolution content and a more seamless viewing experience for users. For instance, 5G's enhanced speed and lower latency facilitate the streaming of 4K and even 8K video, a significant upgrade from previous standards.

These technological shifts empower SinoMedia to offer faster content delivery, crucial for live events and on-demand services. Furthermore, the increased bandwidth and connectivity offered by 5G open doors for innovative, interactive advertising formats. These can include personalized video ads, augmented reality overlays, and real-time engagement features, all of which can enhance user experience and ad effectiveness. By mid-2024, 5G network coverage in key markets continues to expand, with many regions reporting over 50% population coverage, creating a fertile ground for these advanced media capabilities.

- Enhanced Content Quality: 5G supports higher bandwidth, enabling seamless streaming of 4K and 8K video, improving viewer engagement.

- Faster Content Delivery: Reduced latency means quicker loading times and a more responsive experience for users accessing SinoMedia's platforms.

- New Advertising Opportunities: Interactive and personalized ad formats become feasible, potentially increasing revenue streams for SinoMedia.

- Increased User Engagement: Superior streaming quality and interactivity can lead to longer viewing sessions and greater user retention.

Cybersecurity and Data Privacy Technologies

The media and advertising industry, including companies like SinoMedia, faces a critical need for advanced cybersecurity and data privacy technologies. Protecting user data is paramount, not only for regulatory compliance but also for maintaining the trust essential in this data-driven sector. In 2024, the global cybersecurity market reached an estimated $271.7 billion, highlighting the significant investment required.

SinoMedia must prioritize investments in safeguarding its digital infrastructure and user information. This includes implementing sophisticated encryption, secure authentication protocols, and regular vulnerability assessments. Failure to do so risks severe financial penalties and reputational damage, especially as data privacy regulations become more stringent worldwide.

- Regulatory Compliance: SinoMedia must adhere to evolving data protection laws like GDPR and CCPA, which impose strict rules on data handling and privacy.

- User Trust: A strong data privacy posture is crucial for building and maintaining user confidence, a key differentiator in the competitive media landscape.

- Infrastructure Protection: Investing in robust cybersecurity measures protects SinoMedia's digital assets and operational continuity from cyber threats.

- Market Trends: The increasing sophistication of cyberattacks necessitates continuous adaptation and investment in cutting-edge security technologies.

Technological advancements are reshaping SinoMedia's operational landscape, particularly with the continued integration of artificial intelligence and big data analytics. These tools are vital for understanding evolving consumer behavior and optimizing advertising strategies in the dynamic Chinese market. For instance, in 2024, SinoMedia's data-driven approaches led to a notable 15% improvement in campaign performance for key clients by leveraging granular audience insights.

The expansion of 5G networks and streaming technologies directly benefits SinoMedia by enabling higher-quality content delivery and more engaging user experiences. This technological shift facilitates the adoption of interactive advertising formats, potentially boosting revenue. By mid-2024, 5G network coverage in major Chinese markets exceeded 50%, creating a robust environment for these innovations.

Cybersecurity and data privacy remain critical technological considerations for SinoMedia, especially given the increasing stringency of global data protection regulations. The company must invest in robust security measures to protect digital assets and maintain user trust, a factor underscored by the global cybersecurity market's estimated $271.7 billion valuation in 2024.

| Technological Factor | Description | Impact on SinoMedia | 2024/2025 Data Point |

| Artificial Intelligence & Big Data | Leveraging AI for analytics and data processing | Enhanced audience segmentation, personalized advertising, improved campaign ROI | Chinese digital advertising market projected >$100 billion in 2024 |

| 5G & Streaming Technologies | Faster, higher-quality content delivery | Improved user experience, new interactive ad opportunities | 5G population coverage in key markets >50% by mid-2024 |

| Cybersecurity & Data Privacy | Protecting digital infrastructure and user data | Ensuring regulatory compliance, maintaining user trust, mitigating risks | Global cybersecurity market estimated $271.7 billion in 2024 |

Legal factors

China's media landscape is tightly regulated, with specific laws governing content production, distribution, and licensing. SinoMedia must navigate these rules, which include obtaining permits for television programs and advertising services, ensuring all content adheres to national broadcasting standards and censorship requirements. Failure to comply can result in significant penalties, impacting operational continuity and market access.

China's advertising landscape is governed by stringent laws, including the Advertising Law of the People's Republic of China, which mandates truthfulness and prohibits misleading claims. Restrictions exist for certain sectors like pharmaceuticals and education, and consumer protection is a key focus, with significant penalties for violations. SinoMedia must navigate these regulations meticulously to avoid fines and reputational damage, ensuring all its campaigns align with current legal standards, which are continuously updated to reflect evolving market practices and consumer rights.

China's stringent data privacy and cybersecurity regulations, notably the Personal Information Protection Law (PIPL) enacted in November 2021 and the Cybersecurity Law, significantly impact digital media companies like SinoMedia. PIPL mandates strict consent requirements for data collection and processing, alongside rules for cross-border data transfers. Failure to comply can result in substantial fines, with PIPL penalties reaching up to 5% of annual turnover or RMB 50 million.

SinoMedia must therefore invest in and maintain robust data handling practices, ensuring user consent mechanisms are clear and data minimization principles are followed. This includes implementing strong encryption and access controls to safeguard sensitive user information from breaches. Proactive compliance is crucial to avoid hefty legal penalties and maintain user trust in the evolving digital landscape.

Intellectual Property Rights and Copyright Laws

Intellectual property rights and copyright laws are critical for SinoMedia's operations, particularly in program production and content distribution. The company must navigate these regulations to protect its creative assets and ensure fair compensation for licensed material. Failure to do so can lead to significant financial and reputational damage.

SinoMedia actively manages its intellectual property by registering copyrights for its original productions and enforcing these rights against unauthorized use. The company also licenses content from other creators, requiring robust agreements that respect existing copyrights and define usage terms. Protecting against infringement is paramount to safeguarding revenue streams derived from content sales and distribution.

In 2023, China's National Copyright Administration reported a 15% increase in copyright infringement cases handled, highlighting the dynamic legal landscape SinoMedia operates within. The company’s investment in digital rights management technologies and legal teams reflects the growing importance of IP protection.

- IP Management: SinoMedia invests in copyright registration and monitoring for its original content, aiming to secure exclusive rights for its productions.

- Licensing Agreements: The company enters into complex licensing deals for third-party content, ensuring compliance with copyright laws and clear revenue-sharing models.

- Infringement Protection: SinoMedia employs legal strategies and technological solutions to detect and pursue copyright infringement, protecting its valuable content assets.

- Regulatory Landscape: Staying abreast of evolving copyright legislation, such as China's updated Copyright Law effective from June 1, 2021, is crucial for maintaining compliance and competitive advantage.

Anti-Monopoly and Competition Laws

China's anti-monopoly and competition laws are increasingly being applied to the media and technology sectors. In 2023, the State Administration for Market Regulation (SAMR) continued its focus on ensuring fair competition and preventing monopolistic practices. This regulatory environment directly impacts how companies like SinoMedia can operate and grow.

These regulations can significantly influence SinoMedia's market strategies by limiting exclusive content deals or imposing restrictions on platform dominance. For instance, SAMR's enforcement actions in 2023, which included fines for anti-competitive behavior in the digital economy, signal a stricter approach. This means SinoMedia must carefully consider its competitive practices and potential mergers or acquisitions to ensure compliance and avoid penalties, which could range from significant fines to operational limitations.

- Regulatory Scrutiny: China's anti-monopoly enforcement in the digital and media space intensified in 2023, with SAMR issuing fines and directives to ensure fair competition.

- Impact on M&A: Potential mergers and acquisitions for SinoMedia will face closer scrutiny to prevent market concentration and protect consumer interests.

- Market Conduct: SinoMedia must adapt its strategies to comply with regulations that prohibit monopolistic behaviors, such as predatory pricing or exclusive partnerships that stifle competition.

China's media sector operates under a comprehensive legal framework governing content, advertising, and digital operations. SinoMedia must adhere to strict regulations concerning censorship, advertising truthfulness, and data privacy, with significant penalties for non-compliance. For instance, the Personal Information Protection Law (PIPL) can impose fines up to 5% of annual turnover or RMB 50 million for data breaches, underscoring the need for robust compliance measures.

Environmental factors

The media industry, including SinoMedia, faces growing pressure to adopt sustainable production practices. This involves reducing the significant energy consumption associated with studios and post-production, minimizing waste from sets and equipment, and ensuring responsible sourcing of materials. For instance, the global entertainment industry's carbon footprint is a growing concern, with many productions now actively seeking ways to offset their environmental impact.

SinoMedia can enhance its corporate social responsibility and align with evolving global environmental standards by integrating greener practices. This could include investing in energy-efficient equipment, implementing robust recycling programs on set, and exploring virtual production techniques that can reduce travel and physical resource needs. By doing so, SinoMedia can not only mitigate its environmental impact but also appeal to an increasingly eco-conscious audience and investor base.

The digital infrastructure powering media and advertising, including data centers and network operations, consumes significant energy, contributing to environmental concerns. In 2024, global data center energy consumption was estimated to be around 1.5% of total electricity usage, a figure projected to rise. SinoMedia can mitigate this by investing in energy-efficient hardware and exploring renewable energy sources like solar and wind power for its operations, aiming to reduce its carbon footprint.

Public awareness of environmental issues in China has surged dramatically. Surveys in 2024 indicated that over 70% of urban Chinese consumers consider environmental impact when making purchasing decisions, a significant jump from previous years.

SinoMedia can capitalize on this by integrating eco-conscious themes into its programming and advertising campaigns. This could involve showcasing sustainable brands or promoting green living tips, aligning with growing consumer demand for environmentally responsible content.

Green Advertising and CSR Initiatives

The increasing consumer and investor focus on environmental sustainability is driving a surge in green advertising and corporate social responsibility (CSR) initiatives. SinoMedia can capitalize on this trend by developing advertising campaigns that highlight environmental protection and partner with businesses committed to eco-friendly practices. For instance, in 2024, global spending on sustainable products was projected to reach over $150 billion, indicating a strong market for green messaging.

Integrating environmental themes into SinoMedia's advertising services can significantly enhance its brand image and attract environmentally conscious clients. The company could offer specialized packages for businesses promoting sustainable products or services, or create content that educates the public on environmental issues. By actively participating in CSR activities, such as sponsoring environmental clean-up drives or supporting conservation projects, SinoMedia can demonstrate its commitment to sustainability.

- Growing Demand for Green Marketing: Consumers are increasingly favoring brands with strong environmental credentials, with a significant portion willing to pay a premium for sustainable products.

- SinoMedia's Opportunity: The company can leverage its advertising platforms to promote eco-friendly messaging and partner with businesses that align with environmental values.

- CSR Integration: Participating in environmental CSR initiatives can bolster SinoMedia's reputation and attract talent and investment from stakeholders prioritizing sustainability.

- Market Trends: The global market for green advertising is expanding, with companies investing more in campaigns that emphasize their environmental responsibility.

Regulatory Pressure for Eco-Friendly Practices

China's commitment to environmental sustainability is intensifying, with potential for stricter regulations on media companies like SinoMedia. The government is increasingly focused on reducing carbon emissions and promoting green development across all sectors. For instance, by the end of 2023, China had set targets to increase the proportion of non-fossil fuel energy consumption to around 20% by 2025, a trend that will likely ripple into media production and distribution.

SinoMedia may face new compliance requirements related to energy efficiency in its data centers, waste management in its physical operations, and potentially even the carbon footprint of its digital content delivery. Adapting to these evolving environmental policies and standards will be crucial for maintaining operational continuity and avoiding penalties.

- Increased scrutiny on energy consumption for digital infrastructure.

- Potential mandates for sustainable sourcing of materials in physical media production.

- Government incentives for adopting renewable energy sources in operations.

- Focus on reducing e-waste generated from electronic devices used in media consumption.

Growing environmental awareness in China, with over 70% of urban consumers considering environmental impact in 2024, presents SinoMedia with a significant opportunity to integrate eco-conscious themes into its programming and advertising. This shift aligns with a global trend where green marketing spending is expanding, projected to exceed $150 billion globally in 2024, offering SinoMedia a chance to attract environmentally conscious clients and enhance its brand image through specialized advertising packages and CSR initiatives.

SinoMedia's operations, particularly its digital infrastructure, face increasing scrutiny regarding energy consumption, a challenge amplified by the projected rise in data center energy usage. By adopting energy-efficient hardware and exploring renewable energy sources, SinoMedia can reduce its carbon footprint and comply with China's intensifying commitment to environmental sustainability, which includes targets for non-fossil fuel energy consumption to reach around 20% by 2025.

| Environmental Factor | Impact on SinoMedia | Opportunity/Mitigation Strategy | Relevant Data/Trend (2024/2025) |

|---|---|---|---|

| Consumer Environmental Awareness | Increased demand for sustainable content and advertising. | Integrate eco-themes in programming; offer green advertising packages. | Over 70% of urban Chinese consumers consider environmental impact (2024). |

| Digital Infrastructure Energy Use | High energy consumption contributing to carbon footprint. | Invest in energy-efficient hardware; explore renewable energy sources. | Global data center energy consumption ~1.5% of total electricity (2024). |

| Government Environmental Policies | Potential for stricter regulations on energy efficiency and waste. | Adapt to compliance requirements; leverage incentives for green energy. | China aims for ~20% non-fossil fuel energy by 2025. |

| Green Marketing Growth | Expansion of market for environmentally responsible advertising. | Partner with eco-friendly businesses; develop campaigns promoting sustainability. | Global green advertising spending projected over $150 billion (2024). |

PESTLE Analysis Data Sources

Our SinoMedia Holding PESTLE Analysis is rigorously constructed using data from official Chinese government publications, reputable economic forecasting agencies, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.