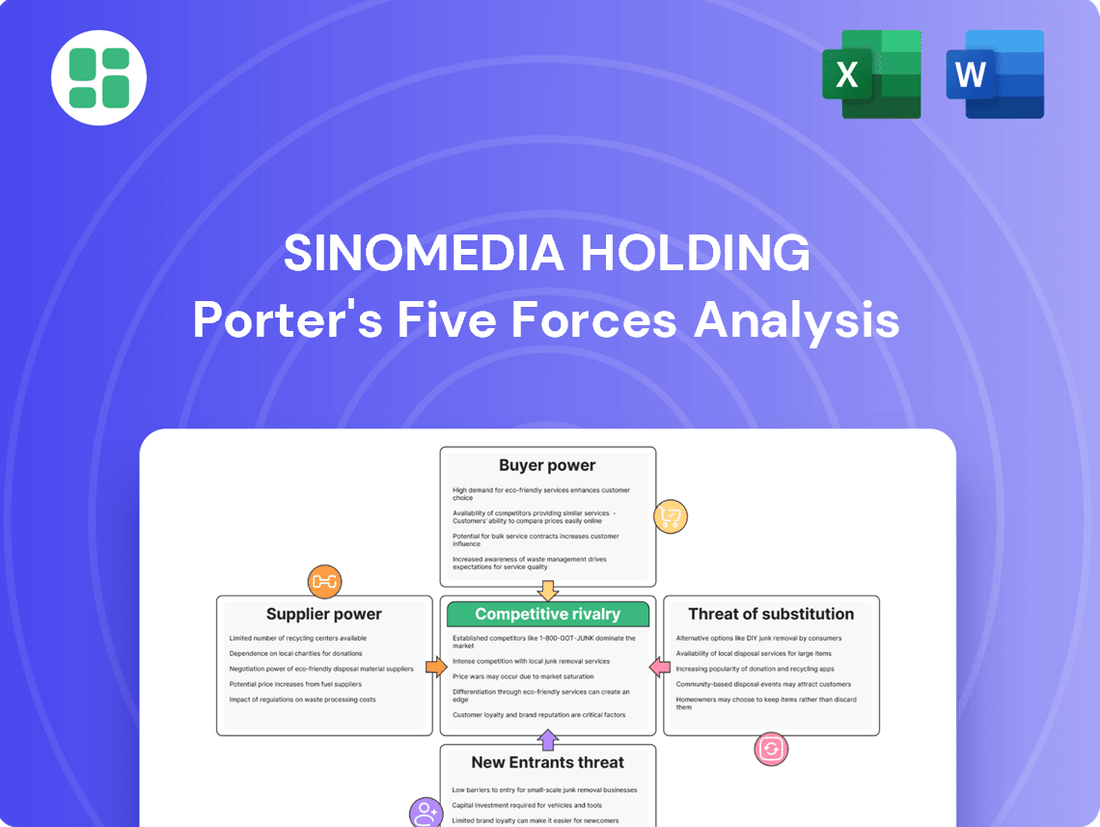

SinoMedia Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SinoMedia Holding Bundle

SinoMedia Holding navigates a complex media landscape shaped by intense rivalry and the ever-present threat of new digital entrants. Understanding the delicate balance of buyer power and supplier leverage is crucial for sustained success. This brief overview only scratches the surface of these critical competitive forces.

Unlock the full Porter's Five Forces Analysis to explore SinoMedia Holding’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the insights needed to make informed decisions.

Suppliers Bargaining Power

SinoMedia's reliance on a limited number of major media platforms, especially for crucial TV advertising, grants these platforms considerable bargaining power. For instance, their dependence on CCTV, a dominant force in Chinese television, means SinoMedia has less leverage in negotiations.

The unique reach and specific demographic targeting offered by these platforms can create high switching costs for SinoMedia. This makes it difficult and expensive to move advertising spend to alternative channels, thus strengthening the suppliers' position.

This supplier power is reflected in financial results. SinoMedia's TV media resources management revenue saw a decrease, partly attributed to the settlement cycles and terms negotiated with these powerful media suppliers, highlighting the impact on their profitability.

The increasing fragmentation of media consumption, with a significant shift towards digital platforms, means SinoMedia Holding benefits from a wider array of digital advertising inventory suppliers. This diversification inherently dilutes the bargaining power of any single supplier.

While traditional television advertising still holds sway, the burgeoning growth of digital marketing channels, including social media and programmatic advertising, presents viable alternatives. This reduces the dependency on any one traditional broadcaster, thereby weakening their leverage over SinoMedia.

For instance, in 2024, digital advertising spending in China continued its upward trajectory, projected to reach over 70% of total ad expenditure, highlighting the expanding supplier base available to companies like SinoMedia.

For SinoMedia, the bargaining power of suppliers is significantly influenced by the specialized nature of their inputs, particularly in program production. Key talent and high-quality content creators hold substantial sway because their contributions directly shape the appeal and distinctiveness of SinoMedia's content library. In 2024, the demand for premium, original content continued to surge, placing these creative suppliers in a strong negotiating position.

The ability of these suppliers to command higher fees or more favorable terms stems from their direct impact on SinoMedia's revenue streams. Exceptional content drives viewership, which in turn attracts advertisers and boosts subscription numbers. For instance, a popular drama series produced with sought-after talent can become a flagship offering, making the cost associated with securing that talent a necessary investment for differentiation and market share.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge for companies like SinoMedia. This means that media platforms or content creators could potentially bypass intermediaries like SinoMedia by selling advertising directly to brands or distributing their content without third-party involvement. For instance, a popular content creator might establish their own ad sales team, cutting out the platform that previously facilitated these deals.

This potential shift compels SinoMedia to remain highly competitive. To retain its position, SinoMedia must continuously offer compelling value-added services and favorable terms to its clients. The ability of suppliers to integrate forward directly impacts SinoMedia's pricing power and the necessity of demonstrating unique value in its services. In 2024, the digital advertising market saw continued growth, with projections indicating a global spend of over $600 billion, highlighting the competitive landscape where such integration threats are most pronounced.

- Direct Sales Channels: Media platforms can establish in-house advertising sales teams, directly engaging with advertisers.

- Content Distribution Control: Creators can leverage their own websites or dedicated apps to distribute content and monetize it directly.

- Competitive Pressure: This integration threat forces SinoMedia to enhance its service offerings and pricing to remain attractive to both advertisers and content creators.

Switching Costs for SinoMedia

Switching costs for SinoMedia's core media partners and content production teams are a significant factor in supplier bargaining power. Renegotiating contracts, adapting existing systems, and the potential loss of established client relationships due to changes in media channels can represent substantial financial and operational hurdles.

These switching costs can deter media partners from easily moving to competitors, thus strengthening SinoMedia's position. For instance, if a major content provider has deeply integrated its workflow with SinoMedia's platform, the effort and expense to replicate that elsewhere would be considerable.

- High Integration Costs: The cost of integrating new systems and workflows can be a major deterrent.

- Client Relationship Disruption: Losing established client relationships built on specific media channels can be financially damaging.

- Contractual Obligations: Existing long-term contracts with media partners often include clauses that make early termination costly.

- Learning Curve and Training: New partners or production teams require time and resources for training and adaptation.

SinoMedia's reliance on key media platforms, particularly for television advertising, grants these suppliers significant leverage. The dependence on dominant players like CCTV means SinoMedia has limited negotiation power, impacting terms and pricing. This is further amplified by high switching costs, as adapting to new channels is both expensive and time-consuming, reinforcing the suppliers' strong position.

The bargaining power of suppliers for SinoMedia is also shaped by the specialized nature of inputs like key talent and high-quality content creators. In 2024, the demand for premium content surged, placing these creative suppliers in a strong negotiating position due to their direct impact on viewership and revenue generation.

Suppliers' ability to integrate forward, such as content creators selling advertising directly, poses a threat by bypassing intermediaries like SinoMedia. This compels SinoMedia to offer greater value and competitive terms to retain its market standing, especially given the global digital ad spend exceeding $600 billion in 2024.

| Supplier Type | Bargaining Power Factor | Impact on SinoMedia | 2024 Context |

|---|---|---|---|

| Major Media Platforms (e.g., CCTV) | Limited alternatives, high switching costs | Reduced negotiation leverage, potentially higher media buying costs | Continued dominance of traditional media in certain demographics |

| Key Talent & Content Creators | Uniqueness of input, direct revenue impact | Higher fees for premium content, potential for talent retention challenges | Surging demand for original, high-quality content |

| Digital Advertising Inventory Providers | Diversification of options, lower switching costs | Increased negotiation power for SinoMedia, greater flexibility in ad placement | Digital ad spend projected to exceed 70% of total ad expenditure in China |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to SinoMedia Holding's media and advertising landscape.

Instantly identify competitive threats and opportunities by visualizing SinoMedia Holding's Porter's Five Forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

SinoMedia's customer base is broad, encompassing advertisers from key industries like consumer goods, tourism, and automotive. This diversity generally dilutes individual customer power.

However, the bargaining power of customers can increase significantly if a few large advertisers or agencies consistently allocate substantial portions of their advertising budgets through SinoMedia. For instance, if the top 10 clients represent over 30% of SinoMedia's revenue, these major players could demand more favorable pricing or terms, impacting SinoMedia's profit margins.

Advertisers possess significant leverage due to the abundance of alternative advertising channels available. They can easily switch to other advertising agencies, engage directly with popular digital platforms like Douyin and Xiaohongshu, or even develop their own in-house marketing capabilities. This wide array of choices directly enhances their bargaining power.

The proliferation of new media formats further amplifies customer power. Influencer marketing and the rise of social commerce offer advertisers diverse avenues to reach consumers, reducing their reliance on traditional advertising services like those offered by SinoMedia. For instance, by 2024, the global influencer marketing market was projected to reach over $21 billion, showcasing the significant shift in advertising spend towards these alternative channels.

In 2024, with a generally cautious economic outlook and subdued market expectations, advertisers are becoming notably more conservative with their marketing expenditures. This heightened price sensitivity directly translates into increased pressure on companies like SinoMedia to offer competitive pricing structures and adaptable service packages to attract and retain clients.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge for SinoMedia. Large brands and advertising agencies, especially in the digital realm where tools are readily available, could establish their own in-house media buying operations or content creation departments. This would directly diminish their need for SinoMedia's services.

For instance, a major consumer goods company with a substantial advertising budget might invest in developing internal expertise and technology for programmatic advertising or video production. This allows them greater control over campaigns and potentially lower costs.

The accessibility of digital advertising platforms and content creation software in 2024 amplifies this risk. Companies can now more easily bypass traditional intermediaries.

- Customer Control: Customers may seek to gain more direct control over their advertising spend and creative output by bringing these functions in-house.

- Cost Efficiency: Developing internal capabilities can be perceived as more cost-effective in the long run, especially for high-volume advertisers.

- Digital Tool Accessibility: The proliferation of user-friendly digital advertising and content creation tools in 2024 lowers the barrier to entry for in-house operations.

- Reduced Reliance: Successful backward integration by key clients directly reduces SinoMedia's revenue streams and market share.

Information Availability to Customers

Customers today have an unprecedented amount of information at their fingertips, significantly shifting the balance of power in their favor. They can easily access extensive market data, compare pricing across numerous advertising channels, and scrutinize performance metrics. This transparency allows them to make informed decisions and negotiate more effectively with service providers like SinoMedia Holding.

Digital advertising platforms are a prime example of this information availability. These platforms provide detailed analytics on campaign performance, reach, and cost-effectiveness. For instance, in 2024, the digital advertising market continued its robust growth, with global ad spending projected to reach over $600 billion, according to various industry reports. This vast dataset empowers advertisers to benchmark providers and demand better value.

- Informed Negotiations: Customers can leverage readily available data on industry benchmarks and competitor pricing to negotiate more favorable terms with advertising service providers.

- Performance Scrutiny: Detailed analytics from digital platforms allow clients to rigorously assess the ROI of their advertising spend, pressuring providers to deliver measurable results.

- Channel Comparison: The ease of comparing various advertising channels and their associated costs and effectiveness gives customers greater leverage in allocating their marketing budgets.

SinoMedia's customers, primarily advertisers, wield considerable bargaining power due to the vast array of alternative advertising channels available. This includes direct engagement with digital platforms and the growing influencer marketing sector, which by 2024 was a multi-billion dollar industry. Advertisers can easily shift budgets, demanding more competitive pricing and flexible service packages from SinoMedia, especially given the cautious economic climate of 2024 which heightened price sensitivity.

The accessibility of digital tools also empowers customers to bring advertising functions in-house, reducing their reliance on intermediaries like SinoMedia. Furthermore, the wealth of data available through digital platforms allows advertisers to meticulously compare performance and costs, enabling them to negotiate more effectively for better value.

Preview Before You Purchase

SinoMedia Holding Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details SinoMedia Holding's competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry within the industry. This comprehensive assessment provides actionable insights into the strategic positioning and future prospects of SinoMedia Holding.

Rivalry Among Competitors

SinoMedia Holding operates within China's media and advertising sector, a landscape characterized by intense competition. This market features a wide array of participants, from established traditional media agencies to dominant digital platforms such as Tencent and ByteDance, alongside many specialized digital marketing firms.

The sheer number of companies vying for market share is significant. For instance, as of early 2024, China's digital advertising market alone was projected to reach over $100 billion, indicating a vast number of entities seeking to capture a portion of this substantial revenue stream.

This diversity extends to service offerings, with some companies providing comprehensive advertising solutions while others focus on specific niches within digital marketing, further intensifying rivalry for SinoMedia Holding.

The advertising market in China presents a mixed growth picture, directly impacting competitive rivalry. While the digital advertising sector is booming, with an estimated 17.9% growth in 2024, and internet advertising specifically seeing a 24% increase, SinoMedia's traditional TV media resource management segment has faced a decline. This divergence in growth rates intensifies competition in the more dynamic digital space while creating pressure for companies like SinoMedia to adapt to shifting market dynamics.

Competitive rivalry within SinoMedia Holding's advertising sector is high, largely due to the difficulty in truly differentiating its services. Many agencies offer comparable media buying and content creation, making it hard for clients to perceive significant differences.

The low switching costs for advertisers to change agencies or explore new platforms further fuel this intense competition. In 2023, reports indicated that the average client retention rate for digital advertising agencies hovered around 70%, highlighting the ease with which clients can move.

This environment necessitates constant innovation and a focus on unique value propositions to retain and attract clients, as a slight edge in service or results can be the deciding factor in a market where price and perceived quality are often very close.

High Exit Barriers

Significant investments in media resources, technology, and human capital create substantial exit barriers for companies operating within the media and advertising sector. These high upfront and ongoing costs make it financially challenging for businesses to divest or cease operations, even when facing declining profitability.

This situation can compel companies to remain active in the market, potentially exacerbating competitive pressures as they strive to recoup their investments. For instance, in 2024, many traditional media companies continued to invest heavily in digital transformation initiatives, creating a persistent need to compete for advertising revenue.

- High Capital Requirements: The cost of acquiring and maintaining advanced broadcasting equipment, production studios, and digital platforms represents a substantial sunk cost.

- Specialized Workforce: Training and retaining skilled personnel in areas like content creation, data analytics, and digital marketing require significant investment, making it difficult to redeploy or exit these specialized roles.

- Brand Reputation and Goodwill: Established media brands have built years of goodwill, which is a valuable asset that is difficult to liquidate upon exit.

Strategic Stakes and Aggressiveness of Competitors

Competitors are pouring significant capital into cutting-edge technologies such as artificial intelligence, aiming to enhance user engagement and personalize content delivery. This strategic push is evident in the substantial investments seen across the digital media landscape, with many companies prioritizing AI development to gain a competitive edge.

Expansion into burgeoning sectors like social commerce and short-video platforms signifies a broader trend of aggressive market capture. Companies are vying for dominance in these high-growth areas, understanding their potential to reshape consumer behavior and advertising revenue streams. For instance, in 2024, several major platforms reported double-digit percentage increases in their investments in short-form video content and integrated social shopping features.

- Aggressive Investment in AI: Competitors are actively developing and deploying AI for content recommendation, ad targeting, and operational efficiency.

- Expansion into Social Commerce: Companies are integrating shopping functionalities directly into their platforms to capitalize on the growing social commerce market.

- Focus on Short-Video Platforms: Significant resources are being allocated to short-form video content creation and monetization strategies.

- Drive for Market Leadership: This strategic aggressiveness is fueled by a clear objective to secure and expand market share in a rapidly evolving digital ecosystem.

Competitive rivalry in SinoMedia Holding's market is intense due to numerous players offering similar services, making differentiation difficult. Low switching costs for advertisers exacerbate this, as seen with the average client retention rate around 70% in 2023. Aggressive investments in AI and expansion into social commerce by competitors further intensify the battle for market share, with digital advertising in China projected to exceed $100 billion in 2024.

| Metric | 2023/Early 2024 Data Point | Implication for Rivalry |

|---|---|---|

| China Digital Ad Market Size | Projected > $100 billion (early 2024) | Attracts numerous competitors, increasing rivalry. |

| Digital Ad Growth Rate | Estimated 17.9% (2024) | Drives aggressive investment and competition for growth. |

| Internet Ad Growth Rate | Estimated 24% (2024) | Intensifies competition in the most dynamic segment. |

| Average Client Retention (Digital Agencies) | Around 70% (2023) | Indicates low switching costs, fueling client acquisition battles. |

SSubstitutes Threaten

Advertisers are increasingly bypassing traditional media agencies, opting to directly engage with a multitude of digital platforms, social media channels, and influencer networks. This shift allows for more targeted and cost-effective campaigns, directly impacting the revenue streams of companies like SinoMedia Holding that rely on agency partnerships.

The burgeoning trend of social commerce and livestreaming presents potent, direct pathways for brands to connect with consumers. For instance, by mid-2024, livestreaming e-commerce in China was projected to reach hundreds of billions of dollars, offering an alternative to traditional advertising slots that SinoMedia might provide.

Large corporations are increasingly building their own digital marketing departments, handling tasks like content creation and campaign management internally. This trend directly substitutes for the comprehensive services SinoMedia offers, as these companies no longer need to outsource as much. For instance, in 2024, many Fortune 500 companies have significantly expanded their internal digital marketing teams, a shift that directly impacts the demand for external agencies.

The media landscape is constantly shifting, with new formats like short-form videos, interactive games, and micro-dramas gaining significant traction. In 2024, platforms like TikTok continue to dominate user attention, with billions of active users globally, presenting a compelling alternative for brand engagement compared to traditional television or print advertising.

Furthermore, the rise of AI-generated content offers brands novel and potentially more budget-friendly avenues to connect with consumers. This technological advancement means businesses can explore highly personalized and dynamic content creation, directly challenging the established methods of reaching audiences through conventional media channels.

Consumer Behavior Shifts

Consumer behavior is rapidly evolving, with a significant migration towards digital platforms for content consumption. In 2024, mobile internet usage continues to dominate, and short-video platforms like Douyin (TikTok's Chinese counterpart) and social media channels are capturing substantial user attention, directly impacting traditional media's reach.

This shift means that advertising dollars are increasingly following eyeballs to these new digital ecosystems. Traditional media agencies, accustomed to the television advertising model, face a challenge in adapting to the fragmented and dynamic nature of digital content, potentially leading them to miss out on valuable advertising opportunities.

The threat of substitutes is amplified as consumers find new, often more engaging and personalized, ways to access information and entertainment. For instance, by mid-2024, it's projected that over 80% of internet traffic will be video, much of it on mobile devices, underscoring the decline in traditional TV's dominance.

- Mobile-First Consumption: Consumers, especially younger demographics, predominantly access content via smartphones, leading to a decline in traditional television viewership.

- Rise of Short-Form Video: Platforms like Douyin have seen exponential growth, becoming primary sources of entertainment and information for millions, diverting attention from longer-form traditional media.

- Social Media Integration: Social media platforms are increasingly becoming content hubs, offering diverse formats from live streams to user-generated videos, further fragmenting the media landscape.

- Advertising Diversification: Advertisers are reallocating budgets to digital channels that offer better targeting and measurable results, creating a substitute for traditional advertising placements.

Cost-Effectiveness and Performance of Substitutes

Many digital advertising substitutes offer highly measurable results and often lower entry costs for advertisers, making them attractive alternatives, especially for performance-based marketing. This pressure on return on investment (ROI) pushes advertisers towards more efficient substitute channels.

For instance, social media platforms and search engine marketing (SEM) campaigns in 2024 continue to demonstrate strong performance metrics. Many businesses report a cost per acquisition (CPA) significantly lower than traditional media. In 2023, for example, the average CPA for Google Ads campaigns across various industries hovered around $44, while social media platforms like Facebook and Instagram often yielded even lower figures, sometimes in the range of $20-$30 for certain campaign objectives.

- Measurable ROI: Digital substitutes provide granular data on ad spend versus customer acquisition, allowing for precise ROI calculations.

- Lower Entry Barriers: Many digital platforms allow for smaller initial ad spends compared to traditional advertising, making them accessible.

- Performance-Driven Focus: The emphasis on direct response and measurable outcomes in digital advertising makes substitutes highly competitive.

The threat of substitutes for SinoMedia Holding is significant, driven by the migration of consumer attention and advertising spend to digital channels. New media formats and direct brand-to-consumer engagement platforms offer compelling alternatives that bypass traditional advertising models.

By mid-2024, livestreaming e-commerce in China was projected to reach hundreds of billions of dollars, providing a direct sales and marketing channel that competes with traditional media. Furthermore, the rise of short-form video platforms, with billions of active users globally in 2024, captures audience attention, presenting a powerful substitute for traditional advertising placements.

Advertisers are increasingly prioritizing digital channels due to their measurability and often lower cost per acquisition. For instance, in 2023, the average cost per acquisition for Google Ads was around $44, while social media platforms frequently offered figures in the $20-$30 range, making them highly attractive substitutes.

| Substitute Channel | Key Characteristics | Impact on Traditional Media |

|---|---|---|

| Social Commerce & Livestreaming | Direct sales, influencer marketing, real-time engagement | Bypasses advertising slots, offers alternative revenue streams |

| Short-Form Video Platforms (e.g., Douyin) | High user engagement, viral potential, micro-content | Diverts audience attention, reduces demand for longer ad formats |

| In-house Digital Marketing Teams | Internal control, tailored campaigns, cost efficiency | Reduces outsourcing needs for traditional media services |

| Search Engine Marketing (SEM) | Targeted reach, performance-driven, measurable ROI | Offers measurable results and lower CPA compared to traditional ads |

Entrants Threaten

The traditional media landscape, encompassing advertising and program production, demands significant upfront capital. Companies like SinoMedia Holding need substantial investments in broadcast infrastructure, state-of-the-art studios, and advanced production technology. For instance, launching a new television channel or a major film production often requires hundreds of millions of dollars.

While digital advertising platforms present lower initial barriers, achieving true economies of scale for comprehensive, integrated services remains a hurdle. Companies that can leverage massive user bases and data analytics, like Meta or Google, can offer highly competitive pricing and reach, making it difficult for smaller players to compete effectively on cost and scope.

The media landscape in China presents substantial regulatory hurdles and licensing demands, particularly for companies aiming to produce and broadcast content. These stringent requirements act as a significant barrier, making it difficult for new players to enter the market and compete effectively.

For instance, obtaining necessary permits and approvals from bodies like the National Radio and Television Administration (NRTA) can be a lengthy and complex process, often favoring established entities with existing relationships and expertise in navigating the system. In 2024, the Chinese government continued to emphasize content control and national security within the media sector, further solidifying these regulatory barriers.

SinoMedia's deep-rooted brand loyalty and over two decades of experience, serving more than 3,000 clients including prominent brands, present a formidable barrier. New entrants would need substantial time and investment to cultivate comparable trust and a robust client base.

Access to Distribution Channels and Resources

New entrants face significant hurdles in securing prime advertising real estate. For instance, gaining access to the most sought-after slots on major Chinese television networks or securing favorable partnerships with dominant digital platforms like Tencent, Alibaba, and ByteDance is exceedingly difficult for emerging media companies. SinoMedia's established relationships and existing access to these channels therefore represent a substantial competitive advantage, making it challenging for newcomers to compete effectively for audience attention and advertiser budgets.

SinoMedia's established position allows it to leverage its existing distribution channels, which are crucial for reaching a broad audience. This access is not easily replicated by new entrants.

- Dominant Digital Platforms: Partnerships with Tencent Video, iQIYI, and Youku are vital for digital reach.

- Traditional Media Access: Securing prime time slots on CCTV and provincial satellite TV remains a key differentiator.

- Advertising Revenue Share: In 2023, digital advertising spending in China was projected to reach over $90 billion, with a significant portion going to established platforms.

- Barriers to Entry: The cost and complexity of building equivalent distribution networks are prohibitive for most new players.

Talent Acquisition and Expertise

The media and advertising sector demands highly skilled professionals in areas like creative strategy, media purchasing, content creation, and digital campaigns. New companies entering this space face a significant hurdle in attracting and keeping this specialized talent, particularly when competing against established players for a limited pool of expertise.

For instance, in 2024, the global demand for digital marketing specialists continued to surge, with LinkedIn reporting a 25% year-over-year increase in job postings for these roles. This intense competition for qualified individuals can inflate recruitment costs and lengthen the time it takes for new entrants to build a capable team, thereby acting as a substantial barrier.

- Specialized Skill Sets: Creative directors, media planners, SEO analysts, and content producers are in high demand.

- High Recruitment Costs: Companies often invest heavily in headhunters and competitive compensation packages to secure top talent.

- Talent Retention Challenges: The fast-paced nature of the industry and the constant evolution of digital tools mean ongoing training and development are crucial, adding to operational expenses.

- Competitive Landscape: Established firms with strong employer branding and existing talent networks have an advantage over newcomers.

The threat of new entrants for SinoMedia Holding is moderate due to high capital requirements for traditional media and significant regulatory hurdles in China. While digital platforms offer lower initial costs, achieving scale and securing prime advertising real estate is challenging for newcomers. SinoMedia's established brand, client base, and distribution networks create substantial barriers, making it difficult for new players to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for broadcast infrastructure and production technology. | Significant barrier, especially for traditional media operations. |

| Regulatory Hurdles | Stringent licensing and content control from bodies like NRTA. | Complex and time-consuming process, favoring established players. |

| Brand Loyalty & Experience | Over two decades of service and established trust with 3,000+ clients. | New entrants need substantial time and investment to build comparable credibility. |

| Distribution Access | Established relationships with dominant digital platforms and traditional media. | Difficult for newcomers to replicate access to prime advertising slots and audience reach. |

Porter's Five Forces Analysis Data Sources

Our SinoMedia Holding Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the company and its peers. We supplement this with data from reputable industry research firms and market intelligence platforms to capture current market dynamics.