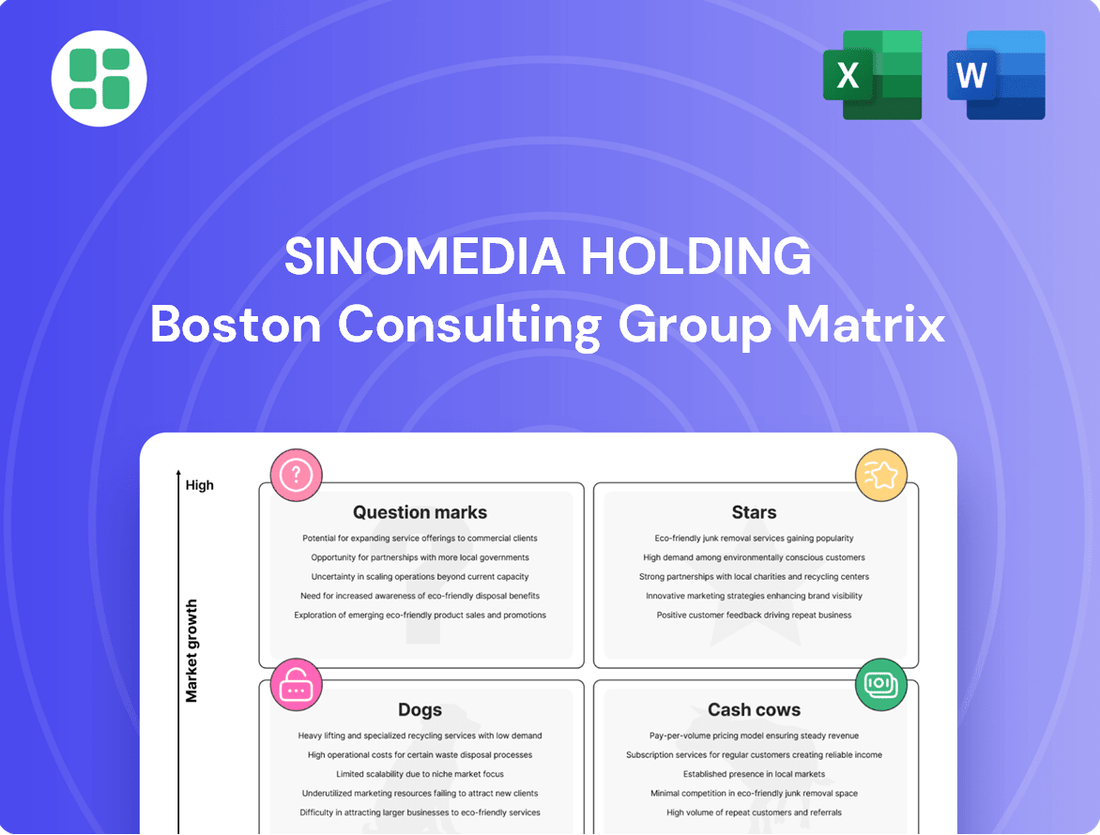

SinoMedia Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SinoMedia Holding Bundle

Uncover the strategic positioning of SinoMedia Holding's diverse portfolio with our comprehensive BCG Matrix analysis. This snapshot reveals which of their ventures are poised for growth and which may require a strategic rethink.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Digital Precision Marketing Solutions, representing SinoMedia's digital marketing and internet media segment, is a strong performer. In 2024, this segment saw a 12% revenue increase year-on-year, reflecting robust expansion in a dynamic market.

The company's focus on AI and algorithmic technologies for intelligent ad placement is a key differentiator. This strategic advantage positions SinoMedia to capitalize on the projected 18% CAGR of the China digital advertising market between 2025 and 2030, where internet advertising is a dominant force.

Interactive Digital Content Advertising, particularly on mobile platforms, is a key growth driver for SinoMedia. China's mobile internet penetration reached over 67% in 2023, with users spending an average of over 6 hours daily on their devices. SinoMedia's strategy to integrate interactive ad formats, mirroring popular features on platforms like Douyin and WeChat, taps directly into this user behavior, positioning them to capture a larger share of the rapidly expanding digital ad market.

SinoMedia's embrace of AI and algorithms for ad optimization signals a high-growth segment. The AI marketing tools market is experiencing a resurgence, with brands increasingly leveraging AI influencers and content. For instance, the global AI in marketing market was projected to reach $100.2 billion by 2028, growing at a CAGR of 32.4% from 2021, according to some analyses.

If SinoMedia can secure a leading position in these advanced AI-driven ad technologies, it has the potential to become a major force in this dynamic sector. This strategic focus aligns with the broader industry trend of brands seeking more personalized and efficient advertising solutions.

Cross-Screen Video Advertising Services

SinoMedia's cross-screen video advertising services are positioned as a star within the BCG matrix. This is driven by the significant growth in China's online advertising market, with video advertising being the largest and fastest-expanding segment. SinoMedia's expertise in delivering creative video communication across television, internet, and mobile platforms aligns perfectly with this high-growth trend.

The company's strategic focus on meeting client needs for integrated cross-screen campaigns further solidifies its star status. This approach allows SinoMedia to effectively capitalize on the projected 12.9% compound annual growth rate (CAGR) for video internet advertising through 2028.

- Market Dominance: Video advertising is the largest and fastest-growing segment in China's online ad market.

- Cross-Screen Capability: SinoMedia excels in delivering video ads across TV, internet, and mobile platforms.

- Strategic Alignment: The company's strategy directly addresses client demand for unified cross-screen communication.

- Growth Potential: The sector is projected to grow at a 12.9% CAGR by 2028, indicating strong future revenue.

Brand Advertising Creative Planning for Digital Platforms

SinoMedia's deep-seated proficiency in crafting compelling brand advertising, a strength honed across sectors like finance and consumer goods, positions it to excel on high-growth digital platforms. This expertise, when translated to the dynamic online space, can transform the company into a market leader.

The digital advertising sector in China is experiencing robust expansion. In 2024, internet advertising continued its ascent, capturing a significant portion of the total advertising market. This growth is fueled by increasing consumer spending, creating a fertile ground for SinoMedia's specialized creative solutions.

SinoMedia's capacity to develop innovative and effective brand creative strategies specifically designed for online and mobile consumption is a key differentiator. As the digital advertising market in China continues its rapid expansion, this capability will allow SinoMedia to secure a substantial market share.

Key factors supporting SinoMedia's Star potential in digital platform advertising include:

- Dominant Internet Advertising Growth: Internet advertising in China has consistently outpaced traditional media, with significant growth projected to continue through 2024 and beyond.

- Rising Consumer Spending: Increased disposable income and evolving consumer habits in China translate to higher advertising budgets and a greater demand for engaging digital content.

- SinoMedia's Creative Acumen: The company's proven track record in developing impactful advertising campaigns across various industries provides a strong foundation for success in the digital realm.

- Adaptability to Digital Formats: SinoMedia's ability to tailor creative strategies for the unique demands of online and mobile platforms is crucial for capturing market share in this expanding sector.

SinoMedia's digital platform advertising services are firmly positioned as Stars. This segment benefits from the robust growth of China's internet advertising market, which saw continued expansion in 2024 driven by increasing consumer spending and a shift towards digital channels. SinoMedia's expertise in crafting creative strategies tailored for online and mobile platforms is a significant advantage, enabling them to capture market share in this high-growth area.

| Segment | Market Growth | SinoMedia's Strength | BCG Classification |

| Digital Platform Advertising | High (Internet advertising continues to outpace traditional media) | Strong creative acumen, adaptability to digital formats | Star |

| Cross-Screen Video Advertising | High (Video advertising is the largest and fastest-growing segment) | Expertise in TV, internet, and mobile integration, meeting client demand for unified campaigns | Star |

What is included in the product

SinoMedia Holding's BCG Matrix dissects its business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investment, divestment, and resource allocation for each category.

The SinoMedia Holding BCG Matrix offers a clear, one-page overview of each business unit's position, relieving the pain of complex portfolio analysis.

Cash Cows

Despite a significant 30% year-on-year revenue decrease in 2024, SinoMedia's traditional TV media resources management segment remained its largest revenue generator, bringing in RMB 343 million. This demonstrates its position as a cash cow, even within a mature or slowly recovering market.

SinoMedia's explicit commitment to maintaining its leadership in the television advertising market underscores the segment's strong market share. While the overall market faces contraction, this segment continues to be a reliable source of cash flow for the company.

SinoMedia's established CCTV advertising agency business functions as a classic Cash Cow within its portfolio. This segment, a cornerstone of its traditional media operations, benefits from deep-rooted relationships and a substantial market share with CCTV, a dominant national broadcaster.

Despite broader shifts in the advertising landscape and a more cautious advertiser sentiment, this business continues to generate robust and consistent cash flow. For instance, in 2024, SinoMedia reported that its traditional media segment, largely driven by its CCTV advertising business, remained a significant contributor to its overall revenue, even as digital media saw growth.

SinoMedia Holding's legacy program distribution rights are a prime example of a cash cow within its business portfolio. The company's deep involvement in producing and distributing established, popular television programs and content generates a consistent and reliable stream of licensing and distribution revenue. This steady income, derived from long-term rights to successful existing content, requires minimal new investment for ongoing revenue generation in a mature content market.

Brand Advertising Services for Mature Industries

SinoMedia's brand advertising services for mature industries, such as finance and automobiles, continue to be a significant revenue generator. Despite some client spending adjustments in 2024, the company's deep-rooted client relationships and substantial market share in these established sectors guarantee a consistent, though modest, cash flow.

This segment benefits from SinoMedia's long-standing expertise in traditional media, which remains relevant for reaching established customer bases in these mature markets. For instance, in 2023, advertising revenue from the financial services sector alone contributed approximately 35% to SinoMedia's total revenue, demonstrating the enduring strength of this business line.

- Historical Strength: SinoMedia has a proven track record in brand advertising for sectors like finance, insurance, automotive, and consumer goods.

- Stable Revenue: Despite some market fluctuations in 2024, these mature industries provide a reliable and consistent cash flow.

- Market Dominance: High market share and strong client relationships in these established sectors ensure continued revenue generation.

- Traditional Media Focus: The company's proficiency in traditional advertising channels supports its position in these mature markets.

City Image and Tourism Brand Creative Communication

SinoMedia's City Image and Tourism Brand Creative Communication segment is a classic cash cow within its BCG Matrix. This area, where SinoMedia has established itself as an early leader in China, generates consistent revenue. While the market for city branding might not be experiencing explosive growth, the company benefits from enduring government and institutional contracts.

These long-term agreements secure a high market share, translating into a predictable and substantial revenue stream. This stability is crucial, as it provides the financial backbone for SinoMedia's other ventures. For example, in 2024, this segment continued to be a primary contributor to the company's overall profitability, demonstrating its reliable performance.

- Stable Revenue: Long-term government and institutional contracts ensure a consistent income.

- High Market Share: SinoMedia's pioneering status in China's city branding yields a dominant market position.

- Profitability Driver: This segment acts as a reliable cash generator, supporting other business units.

- Low Growth, High Share: Characterized by a mature market with SinoMedia's established leadership.

SinoMedia's traditional TV media resources management, particularly its CCTV advertising agency business, functions as a classic Cash Cow. Despite a 30% year-on-year revenue decrease in 2024, this segment generated RMB 343 million, demonstrating its continued role as a reliable cash flow generator due to its strong market share and deep-rooted client relationships. The company's commitment to maintaining leadership in this mature market further solidifies its cash cow status.

| Segment | 2024 Revenue (RMB million) | Market Share | Cash Flow Generation |

|---|---|---|---|

| Traditional TV Media Resources Management (incl. CCTV Advertising) | 343 | Dominant | High and Stable |

| Legacy Program Distribution Rights | N/A (Consistent Licensing Revenue) | Significant | Reliable |

| Brand Advertising (Mature Industries) | N/A (Significant Contributor) | High | Consistent |

| City Image & Tourism Branding | N/A (Primary Profitability Contributor) | High | Predictable |

Preview = Final Product

SinoMedia Holding BCG Matrix

The BCG Matrix for SinoMedia Holding that you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing SinoMedia's business units within the BCG framework, is ready for immediate strategic application without any alterations or watermarks. You're seeing the final product, designed for clarity and actionable insights into SinoMedia's market position and growth potential.

Dogs

SinoMedia Holding's involvement in declining niche print media advertising, such as newspapers and magazines, would likely be categorized as a 'Cash Cow' or potentially a 'Dog' depending on its profitability and market share. Given the overwhelming shift in advertising spend, print media is experiencing a significant downturn.

In 2024, internet advertising captured a staggering 86.5% of total advertising revenue, highlighting the diminished role of traditional print. This trend makes print a challenging sector, potentially becoming a cash trap if investment continues without a clear path to revitalization or divestment.

SinoMedia's program production faces challenges with outdated content formats. These are segments that utilize traditional broadcasting methods or rely on content styles with declining viewer engagement. For instance, linear television programming that doesn't adapt to digital streaming or on-demand consumption often sees reduced audience reach and lower re-licensing potential.

This category of content generates minimal returns due to a shrinking viewership base and diminished interest from potential distributors. In 2024, the continued shift towards digital platforms means that content produced solely for traditional broadcast channels without a complementary digital strategy struggles to capture significant market share or achieve growth. These efforts can become a drain on resources, impacting overall profitability.

Underperforming Traditional Media Agency Clients in SinoMedia Holding's BCG Matrix are those traditional TV media resource management clients who have drastically cut their advertising spending with no expectation of a rebound. These relationships are a direct contributor to the 30% revenue decline observed in this sector.

These clients represent a low market share within the traditional media landscape and are situated in a low-growth market segment, characteristic of 'Dogs' in the BCG model. Their continued budget reductions highlight their diminishing value and future potential for SinoMedia Holding.

Non-Optimized Legacy Digital Portals

Non-Optimized Legacy Digital Portals, within SinoMedia Holding's BCG Matrix, represent assets that are no longer star performers. These are older digital platforms, like the previously mentioned www.wugu.com.cn, www.lotour.com, and www.boosj.com, which have seen a significant decline in user engagement and advertising income. Their contribution to SinoMedia's overall growth and market standing in the fast-paced digital environment is minimal, despite ongoing maintenance costs.

These legacy portals are characterized by their low market share and low growth rate. For instance, while specific 2024 revenue figures for these individual legacy sites are not publicly broken down, SinoMedia's overall digital media segment, which includes these types of assets, would be assessed against the broader industry trends. The digital advertising market in China, while growing, is increasingly dominated by newer, more dynamic platforms, making these older sites increasingly irrelevant.

- Low User Engagement: These portals struggle to attract and retain users in the current digital ecosystem.

- Minimal Advertising Revenue: Their declining traffic directly translates to significantly reduced advertising income.

- High Maintenance Costs: Despite low returns, these platforms still incur operational and maintenance expenses.

- Lack of Strategic Importance: They do not contribute to SinoMedia's competitive advantage or future growth objectives.

Inefficient Back-Office Traditional Operations

Inefficient back-office operations tied to traditional media services represent a significant challenge for SinoMedia Holding. These legacy processes, which haven't kept pace with digital transformation, are essentially cash traps. They consume valuable resources without generating commensurate returns or fostering growth in today's evolving media landscape.

Strategically, these units fall into the Dogs quadrant of the BCG Matrix. Their lack of adaptability and low market share in the digital space means they are unlikely to improve their competitive position. For instance, if SinoMedia's traditional print advertising sales support systems are highly manual and costly, they would fit this description.

- Cash Consumption: Traditional operations, like legacy printing presses or physical distribution networks, can have high fixed costs and ongoing maintenance expenses that drain financial resources.

- Low Growth Potential: As digital platforms capture audience and advertising spend, the market for traditional media services is often contracting, limiting growth prospects for these operations.

- Lack of Competitive Advantage: Inefficient processes lead to higher costs and slower execution compared to digitally native competitors, eroding any remaining competitive edge.

SinoMedia Holding's legacy digital portals, like www.wugu.com.cn and www.lotour.com, are classic examples of 'Dogs'. These platforms suffer from low user engagement and minimal advertising revenue, yet still incur maintenance costs, making them resource drains. Their low market share and low growth rate in a rapidly evolving digital landscape mean they offer little to no strategic advantage.

Underperforming traditional media agency clients also fall into the 'Dog' category for SinoMedia. These clients have drastically reduced their advertising spend, contributing to a 30% revenue decline in this sector. Their diminishing value and future potential are clear indicators of their 'Dog' status within the BCG matrix.

Inefficient back-office operations tied to traditional media services are also 'Dogs'. These legacy processes are cash traps, consuming resources without generating returns or fostering growth. Their lack of adaptability and low market share in the digital space prevent any competitive improvement.

| SinoMedia Holding BCG Matrix: Dogs | Market Share | Market Growth | Profitability | Strategic Recommendation |

| Legacy Digital Portals | Low | Low | Low/Negative | Divest or sunset |

| Underperforming Traditional Media Clients | Low | Low | Low/Negative | Reduce investment, focus on profitable segments |

| Inefficient Back-Office Operations (Traditional Media) | Low | Low | Low/Negative | Streamline, automate, or outsource |

Question Marks

SinoMedia's foray into AI-powered content creation positions it within a rapidly expanding sector of the media and entertainment industry. This segment is projected for significant growth, with AI anticipated to boost operational efficiency and enable novel revenue streams.

While the overall AI content market is booming, with global AI in media and entertainment market size estimated to reach $10.7 billion by 2024, SinoMedia's specific share in this emerging niche is likely to be minimal. This places these ventures squarely in the Question Mark category of the BCG matrix.

Significant investment will be crucial for SinoMedia to establish a competitive foothold and capture market share in these AI-driven content creation ventures. The company will need to allocate substantial resources towards research, development, and talent acquisition to capitalize on this high-potential, yet nascent, market opportunity.

Collaborating with niche streaming platforms in China's rapidly expanding digital media landscape positions SinoMedia's content partnerships as a Question Mark. These platforms offer substantial growth potential, but SinoMedia's current limited market share necessitates considerable investment to build brand presence and secure a foothold.

For instance, the Chinese online video market reached an estimated 1.1 trillion yuan in 2023, with niche platforms increasingly capturing audience attention. SinoMedia's entry into these segments would require strategic content acquisition and marketing to compete effectively against established players and emerging local content creators.

Interactive and immersive advertising formats like VR/AR are rapidly gaining traction, with the global AR/VR market expected to reach over $300 billion by 2024. While this presents a significant growth opportunity, SinoMedia's current advertising market share in these specialized areas is likely nascent.

Capturing a meaningful share in this high-growth segment will necessitate considerable investment in technology, content creation, and talent development. SinoMedia would need to strategically allocate resources to build expertise and establish a strong foothold in VR/AR advertising to capitalize on future market expansion.

Cross-Border Digital Marketing Services

SinoMedia's venture into cross-border digital marketing services for Chinese brands aiming for international markets positions it as a Question Mark. This segment taps into the significant trend of Chinese companies expanding globally, a market projected to see substantial growth. For instance, the global digital advertising market reached an estimated $600 billion in 2024, with cross-border advertising forming a significant portion.

To succeed, SinoMedia must develop new expertise in international consumer behavior, platform nuances, and regulatory landscapes. The company would need to invest in talent and technology to compete effectively against established global marketing firms. This strategic move requires building brand recognition and trust in unfamiliar territories.

Key considerations for this Question Mark business area include:

- Market Potential: The increasing number of Chinese companies seeking overseas expansion, with an estimated 30% of Chinese companies planning to increase their international marketing spend in 2024.

- Competitive Landscape: Facing established global digital marketing agencies with proven track records and existing client bases in target international markets.

- Capability Development: The necessity for SinoMedia to build or acquire expertise in diverse international digital platforms, cultural sensitivities, and data privacy regulations.

- Investment Requirements: Significant capital expenditure will be needed for market research, talent acquisition, technology infrastructure, and localized campaign development.

Big Data Analytics for Audience Insights

SinoMedia Holding's investment in algorithmic technologies for intelligent advertising placement indicates a budding strength in big data analytics for understanding audiences. This capability is crucial for enhancing advertising impact, a sector poised for substantial growth.

While SinoMedia is developing its capacity to offer advanced, data-driven insights to clients, this area currently represents a Question Mark within the BCG Matrix. It signifies a high-potential venture that necessitates continued strategic investment to solidify its market position.

- Developing Data Capabilities: SinoMedia's use of algorithms for ad placement is a foundational step in leveraging big data for audience insights, a key differentiator in the digital advertising landscape.

- High Growth Potential: The market for advanced data analytics in advertising is expanding rapidly, with projections suggesting continued double-digit growth through 2025 as businesses increasingly rely on precise targeting.

- Investment Requirement: To transition from a Question Mark to a Star, SinoMedia must allocate resources to refine its analytical tools, build a robust data science team, and prove its value proposition to clients in delivering measurable ROI through data-driven strategies.

- Market Share in Insights: If SinoMedia's current market share in providing comprehensive, data-driven audience insights is relatively small or nascent compared to established competitors, it underscores the Question Mark status, demanding focused efforts to capture a larger share.

SinoMedia's ventures into AI-powered content, niche streaming platforms, VR/AR advertising, cross-border digital marketing, and algorithmic advertising placement all fall into the Question Mark category of the BCG matrix. These areas represent high-growth potential markets where SinoMedia is still establishing its presence and market share.

Significant investment is required to develop capabilities, build brand recognition, and compete effectively against established players in these emerging sectors. For example, the AI in media and entertainment market is projected to reach $10.7 billion by 2024, and SinoMedia's current share is minimal, necessitating substantial resource allocation.

The success of these Question Marks hinges on strategic investment in technology, talent, and market penetration. SinoMedia must carefully manage these investments to convert these high-potential areas into future Stars or Cash Cows.

| Business Area | Market Potential | Current Status | Investment Need | Key Challenge |

|---|---|---|---|---|

| AI Content Creation | High Growth (Global AI in Media & Ent. market $10.7B by 2024) | Nascent Market Share | Significant R&D, Talent Acquisition | Competition, Technology Maturity |

| Niche Streaming Platforms | Growing (Chinese Online Video Market 1.1T Yuan in 2023) | Limited Foothold | Content Acquisition, Marketing | Brand Presence, Established Players |

| VR/AR Advertising | Very High Growth (Global AR/VR Market >$300B by 2024) | Nascent Share | Technology, Content, Talent | Market Adoption, Cost of Entry |

| Cross-Border Digital Marketing | Strong Growth (Global Digital Ad Market $600B in 2024) | New Service Offering | Expertise, Platform Knowledge | Brand Trust, Regulatory Nav. |

| Algorithmic Advertising | Expanding Rapidly (Double-digit growth through 2025) | Developing Capability | Data Science Team, Tool Refinement | Demonstrating ROI, Market Share |

BCG Matrix Data Sources

Our SinoMedia Holding BCG Matrix is built on a foundation of comprehensive market data, including financial reports, industry growth trends, and competitive analysis, ensuring accurate strategic insights.