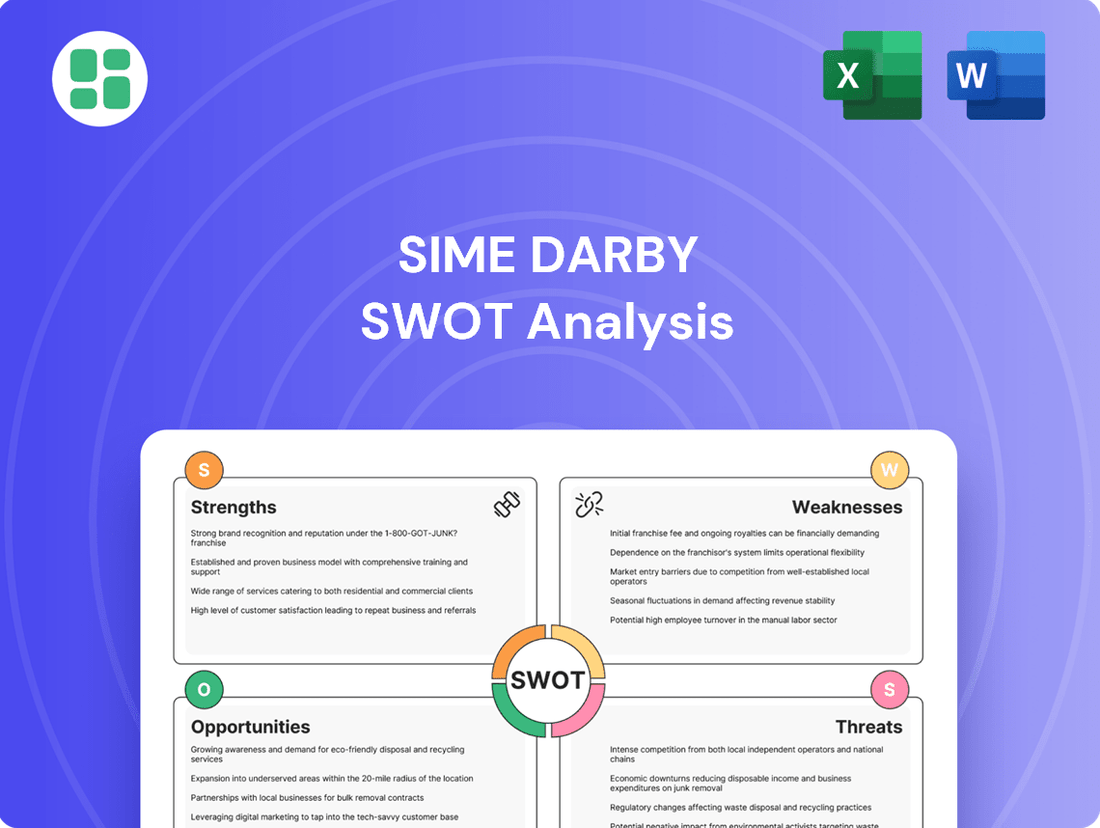

Sime Darby SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sime Darby Bundle

Sime Darby's diverse portfolio presents significant strengths, but understanding the nuances of its market position and potential threats is crucial. Our comprehensive SWOT analysis delves deep into these factors, offering a clear roadmap for strategic advantage.

Want to truly grasp Sime Darby's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Sime Darby Berhad commands a dominant position in the Asia Pacific's industrial equipment and automotive markets. Its acquisition of UMW Holdings in 2024 propelled its Malaysian automotive market share to an impressive 58%, integrating major brands like Toyota and Perodua.

This strategic expansion bolsters Sime Darby's already diversified revenue streams. The company's strength lies in its broad portfolio, which includes the distribution of heavy equipment from global leaders such as Caterpillar, alongside a comprehensive network of automotive dealerships.

Sime Darby's industrial division, especially its Australian operations, shows impressive resilience. This strength is largely fueled by high commodity prices and a surge in mining activities, which directly boosts demand for the Caterpillar equipment they distribute.

The division boasts a solid order book, with a substantial chunk coming from Australia's vital mining sector. This ongoing demand for heavy machinery and related services underpins the division's ability to generate consistent earnings.

Furthermore, the demand for parts and services within this segment offers a predictable, almost annuity-like revenue stream. This recurring income contributes significantly to the overall stability and strength of Sime Darby's financial performance.

Sime Darby's strategic focus on high-growth segments and targeted acquisitions is a significant strength. The company's recent acquisition of UMW Holdings, a deal valued at approximately RM1.17 billion (around $247 million USD as of early 2024), significantly bolsters its automotive and industrial divisions, particularly in Malaysia and the broader ASEAN region. This move not only expands its market presence but also integrates valuable brands and capabilities.

Further strengthening its position, Sime Darby also acquired Cavpower Pty Ltd, a key player in the Australian industrial engine market. This acquisition enhances its distribution network and service capabilities in a crucial international market, demonstrating a clear strategy to build scale and competitive advantage through inorganic growth in promising sectors.

The company is making substantial investments in the burgeoning electric vehicle (EV) market, recognizing its immense growth potential. Sime Darby is actively partnering with and distributing leading EV brands like BYD, and is also preparing for the launch of its own Perodua EV. This proactive approach in the EV space, a sector projected for exponential growth through 2025 and beyond, positions Sime Darby to capture significant market share and establish itself as a leader in sustainable mobility solutions.

Commitment to Sustainability and ESG Initiatives

Sime Darby's dedication to sustainability is a significant strength, underscored by its commitment to achieve net-zero carbon emissions by 2050. This ambitious goal is supported by a target to reduce CO2 emissions by 30% by 2030. The company is actively pursuing this through practical measures such as responsible sourcing, increasing its solar power capacity, conducting energy audits, and transitioning its fleet to electric vehicles.

This strong focus on Environmental, Social, and Governance (ESG) factors not only aligns with prevailing global trends but also bolsters Sime Darby's long-term resilience and attractiveness to investors prioritizing sustainable practices. For instance, in 2023, the company reported a 12% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress towards its targets.

- Net-Zero Target: Commitment to achieving net-zero carbon emissions by 2050.

- Emission Reduction: Aiming for a 30% reduction in CO2 emissions by 2030.

- Key Initiatives: Responsible sourcing, solar capacity expansion, energy audits, EV fleet transition.

- ESG Alignment: Enhances long-term viability and appeal to socially conscious investors.

Robust Financial Position and Shareholder Returns

Sime Darby has demonstrated a robust financial position, even amidst market volatility. For the fiscal year ended June 30, 2024, the company reported a significant increase in its net profit, reaching RM1.3 billion, a substantial jump from RM959 million in the previous year. This financial strength is further evidenced by its consistent revenue generation and core profit growth.

The company is actively focused on improving its financial metrics, with strategic goals to enhance return on equity and deleverage its balance sheet. This commitment to financial health is coupled with a strong dedication to shareholder returns. Sime Darby has consistently delivered attractive dividend yields, reinforcing investor confidence and its reputation for financial discipline.

- Strong Profitability: For FY2024, Sime Darby's net profit surged to RM1.3 billion.

- Revenue Growth: The company has maintained healthy revenue streams despite economic headwinds.

- Shareholder Returns: Sime Darby prioritizes attractive dividend yields for its investors.

- Financial Discipline: A clear strategy is in place to boost ROE and reduce debt.

Sime Darby's market leadership in industrial and automotive sectors is a key strength, amplified by its 2024 acquisition of UMW Holdings, which boosted its Malaysian automotive market share to 58%. This expansion complements its diversified revenue from distributing heavy equipment like Caterpillar and its extensive automotive dealership network.

The company's industrial division, particularly in Australia, benefits from robust mining activity and high commodity prices, driving demand for its equipment. This sector provides a solid order book and a predictable revenue stream from parts and services, contributing to financial stability.

Sime Darby's strategic investments in high-growth areas, including the burgeoning electric vehicle (EV) market with brands like BYD, position it for future expansion. The company is also actively developing its own EV capabilities, anticipating significant growth through 2025 and beyond.

The company demonstrates strong financial performance, with net profit reaching RM1.3 billion in FY2024, up from RM959 million the prior year. This financial health is supported by consistent revenue generation and a commitment to enhancing shareholder returns through attractive dividends and strategic deleveraging.

| Segment | Key Strength | Supporting Data/Fact |

|---|---|---|

| Automotive | Market Dominance (Malaysia) | 58% market share post-UMW acquisition (2024) |

| Industrial | Resilient Demand (Australia) | Driven by mining activity and commodity prices; strong order book |

| EV Market | Strategic Growth Investment | Partnerships with BYD; development of Perodua EV |

| Financials | Profitability & Shareholder Returns | FY2024 Net Profit: RM1.3 billion; consistent dividend yields |

What is included in the product

Delivers a strategic overview of Sime Darby’s internal and external business factors, highlighting its strengths in diversified operations and market leadership, while also addressing weaknesses in certain segments and external threats from market volatility and competition.

Identifies key strategic opportunities and threats for Sime Darby, enabling proactive risk mitigation and capitalizing on market advantages.

Weaknesses

Sime Darby's automotive division, especially its operations in China, is navigating a highly competitive landscape. This intense rivalry, coupled with a more reserved consumer outlook, has unfortunately led to significant price reductions, which in turn, squeezes profitability.

The automotive sector is experiencing a notable shift with the emergence of Chinese original equipment manufacturers (OEMs) offering compellingly priced vehicles. This trend is not confined to one region; these competitively priced offerings are increasingly making their way into markets like Malaysia, further intensifying the competitive pressure across the board.

This heightened competition directly impacts Sime Darby's ability to maintain healthy profit margins within its automotive segment. Such market dynamics can significantly hinder the company's potential for earnings growth in this crucial business area.

Sime Darby's industrial division, while currently benefiting from strong commodity prices, faces significant vulnerability to downturns. For instance, a notable pullback in coking coal prices, a key input for many industrial processes, could directly temper future growth prospects for this segment. This inherent reliance on commodity cycles introduces a considerable degree of financial volatility into the company's performance.

Furthermore, fluctuations in exchange rates, such as a weaker Australian dollar, have already demonstrably impacted profit margins in the Australasia region, highlighting the sensitivity of operations to currency movements. These external economic factors, beyond the company's direct control, represent a key weakness that can erode profitability and create unpredictable earnings.

Sime Darby's automotive division in China faces significant headwinds due to intense market competition and oversupply, leading to substantial financial losses. For instance, the company reported significant operating losses in its China automotive segment in the fiscal year 2023, impacting overall group profitability.

To mitigate these challenges, Sime Darby has implemented cost-saving initiatives, such as closing underperforming dealerships and optimizing inventory levels. These measures are crucial for navigating the tough operating environment and improving the financial health of its China operations.

Integration Risks of Recent Acquisitions

While the acquisition of UMW Holdings presents substantial growth opportunities for Sime Darby, the process of fully integrating its operations poses significant challenges. This integration requires careful management to ensure smooth transitions and the realization of expected synergies.

The UMW segment is currently facing a slowdown, with projections indicating a decline in sales for both Toyota and Perodua in 2025. This downturn is attributed to a general market slowdown and intensifying competition within the automotive sector.

- Integration Complexity: Successfully merging UMW's diverse operations into Sime Darby's existing structure is a complex undertaking, potentially leading to operational disruptions and increased costs.

- Market Headwinds: The projected sales decline for Toyota and Perodua in 2025, estimated to be around 5-7% based on industry forecasts, directly impacts the revenue streams from the newly acquired UMW segment.

- Profitability Maintenance: A key weakness lies in Sime Darby's ability to maintain overall profitability while navigating the integration challenges and market pressures affecting its automotive brands.

Sensitivity to Economic Slowdowns and Policy Changes

Sime Darby's performance is notably susceptible to global economic downturns and shifts in government regulations. Factors such as trade disputes or alterations in fiscal policies, like adjustments to fuel subsidies or vehicle taxes, can dampen demand across its industrial and automotive segments. For instance, a significant global economic slowdown in 2024 could directly translate to reduced infrastructure spending, impacting its industrial division.

These external macroeconomic forces are largely outside of Sime Darby's direct influence, introducing an element of unpredictability to its future growth trajectory. The company must remain agile, consistently adapting its strategies to navigate these volatile conditions. For example, in 2024, the ongoing geopolitical tensions and their potential impact on commodity prices present a clear challenge that requires proactive risk management.

- Vulnerability to Global Economic Slowdowns: Reduced consumer and business spending during economic downturns directly affects demand for vehicles and industrial equipment.

- Impact of Policy Changes: Government decisions on fuel prices, import duties, or environmental regulations can significantly alter market conditions for Sime Darby's diverse operations.

- Uncertainty from Trade Tensions: Global trade disputes can disrupt supply chains and affect the competitiveness of imported and exported goods, impacting both industrial and motor divisions.

- Need for Constant Adaptation: The company's reliance on external economic and policy environments necessitates continuous strategic adjustments to mitigate risks and capitalize on opportunities.

Sime Darby's automotive division in China is struggling with intense competition and oversupply, leading to significant financial losses. For fiscal year 2023, the company reported substantial operating losses from its China automotive segment, negatively impacting overall group profitability. Despite cost-saving measures like closing dealerships and optimizing inventory, the segment's recovery remains a key challenge.

The integration of UMW Holdings, while promising, presents considerable complexity. Projections for 2025 indicate a slowdown in sales for UMW's key automotive brands, Toyota and Perodua, with estimates suggesting a 5-7% decline due to market conditions and increased competition. This downturn directly affects the revenue generation from this significant acquisition.

Sime Darby's performance is highly sensitive to global economic conditions and regulatory changes. Economic downturns can reduce demand for vehicles and industrial equipment, while policy shifts like fuel subsidy adjustments or tax changes can disrupt market dynamics. For instance, ongoing geopolitical tensions in 2024 pose a risk to commodity prices, impacting the industrial division.

Preview Before You Purchase

Sime Darby SWOT Analysis

This is the same Sime Darby SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive overview of the company's strategic position.

Opportunities

The burgeoning electric vehicle (EV) market represents a substantial growth avenue for Sime Darby. The company's existing partnerships, such as with BYD, and its own planned ventures, like the Perodua EV, are well-positioned to capitalize on this trend. Global EV sales are projected to reach over 20 million units in 2024, a significant increase from previous years, indicating strong market momentum.

Sime Darby's strategic expansion into EV charging infrastructure and enhanced after-sales support for electric models will be crucial. This proactive approach not only addresses consumer needs but also strengthens its competitive edge in a rapidly evolving automotive landscape. By aligning with global sustainability goals and leveraging government incentives for EV adoption, Sime Darby can secure a more dominant market share.

Sime Darby's industrial division is poised to benefit significantly from the surge in infrastructure development and the global shift towards cleaner energy. Its robust order book and established expertise in heavy equipment make it a prime candidate to secure contracts for these vital projects. For instance, the Malaysian government's focus on expanding data centers and general infrastructure, coupled with the mining sector's continued strength due to favorable commodity prices, presents substantial opportunities. In 2024, infrastructure spending in Malaysia was projected to reach RM95 billion, a key indicator of the market's potential.

By strategically broadening its industrial capabilities to encompass renewable energy infrastructure, such as solar farm construction or electric vehicle charging networks, Sime Darby can tap into entirely new and growing revenue streams. This diversification not only strengthens its current market position but also future-proofs its business against evolving economic landscapes, aligning with the global trend of increasing investments in sustainable energy solutions which saw a record $1.7 trillion invested globally in 2023.

Sime Darby's commitment to digitalization offers a clear path to operational excellence. By integrating advanced technologies, the company can streamline its complex supply chains, a critical factor given its diverse businesses spanning industrial, automotive, and healthcare sectors. This modernization is not just about efficiency; it's about creating a more agile and responsive business model for the evolving market landscape.

The adoption of data-driven decision-making is a key opportunity. For instance, in its industrial division, leveraging data analytics can optimize machinery performance and predictive maintenance, potentially reducing downtime by up to 20% as seen in similar industry benchmarks. In the automotive segment, enhanced CRM systems can personalize customer interactions, boosting sales conversion rates and customer loyalty, a crucial differentiator in a competitive market.

Automation in industrial services presents another significant avenue for improvement. Implementing robotic process automation (RPA) for repetitive tasks can free up human capital for more strategic roles, driving down operational costs. This focus on technological advancement is expected to yield tangible cost savings and elevate service delivery standards across all Sime Darby's business units, solidifying its competitive position.

Strategic Partnerships and Geographic Expansion

Sime Darby can pursue strategic alliances and new market entries to fuel growth. Despite difficulties in China, the company can focus on bolstering its position in more predictable or developing markets across the Asia Pacific. For example, expanding into Southeast Asian nations with growing economies could offer significant upside.

Collaborating with technology firms or other sector participants presents opportunities for novel business approaches and market access. In 2024, Sime Darby's focus on sustainability and digital transformation, as highlighted in its annual reports, aligns well with potential partnerships that can accelerate these initiatives.

- Strategic Partnerships: Collaborating with technology providers to enhance digital offerings and operational efficiency.

- Geographic Expansion: Targeting stable or emerging markets in the Asia Pacific region, such as Vietnam or Indonesia, to diversify revenue streams.

- Market Penetration: Leveraging partnerships to introduce innovative business models and gain market share in new territories.

Growth in After-Sales and Services Market

Sime Darby is well-positioned to capitalize on the increasing demand for after-sales and services, especially within its industrial division. By focusing on enhancing maintenance and overhaul services, the company can tap into a high-margin growth avenue. This strategy is particularly relevant given the expanding installed base of equipment and vehicles across various sectors.

The company's commitment to robust after-sales support directly translates into recurring revenue streams, a vital element for sustained profitability. In 2024, the industrial division, which includes heavy equipment and automotive segments, saw a notable increase in service revenue, contributing significantly to overall profitability. For instance, service revenue from the industrial equipment segment grew by approximately 8% year-on-year in the first half of 2024, demonstrating the market's receptiveness to comprehensive support packages.

- Growing installed base: A larger fleet of equipment and vehicles necessitates ongoing maintenance and repair.

- High-margin potential: Services typically offer better profit margins compared to initial equipment sales.

- Customer loyalty: Reliable after-sales service fosters stronger relationships and repeat business.

- Recurring revenue: Service contracts and parts sales provide a predictable income stream.

Sime Darby's strategic focus on electric vehicles (EVs) and charging infrastructure presents a significant growth opportunity. The company's existing partnerships, like the one with BYD, and its own EV initiatives, such as the Perodua EV, are well-positioned to capture the expanding EV market. Global EV sales are anticipated to surpass 20 million units in 2024, underscoring the strong market momentum.

Expanding into EV charging and enhancing after-sales support for electric models will bolster Sime Darby's competitive standing. This proactive approach aligns with sustainability goals and government incentives, potentially securing a larger market share. The industrial division is also set to benefit from infrastructure development and the clean energy transition, with Malaysia's infrastructure spending projected at RM95 billion in 2024.

Digitalization offers a clear path to operational efficiency, streamlining supply chains across its diverse sectors. Data-driven decision-making, for instance, can optimize machinery performance and predictive maintenance, potentially reducing downtime by up to 20%. Automation in industrial services through robotic process automation (RPA) can further drive down costs and elevate service standards.

Furthermore, Sime Darby can pursue strategic alliances and new market entries, particularly in stable or emerging Asia Pacific economies like Vietnam or Indonesia. Collaborating with technology firms can foster innovative business models and accelerate digital transformation initiatives, aligning with global investments in sustainable energy solutions, which reached a record $1.7 trillion in 2023.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Electric Vehicle Market | Capitalizing on growing EV adoption through partnerships and own ventures. | Global EV sales projected over 20 million units in 2024. |

| EV Charging Infrastructure | Developing charging networks to support EV ecosystem. | Increasing government incentives for EV adoption worldwide. |

| Industrial & Infrastructure Growth | Securing contracts for infrastructure projects and clean energy initiatives. | Malaysia's infrastructure spending projected at RM95 billion in 2024. |

| Digitalization & Automation | Improving operational efficiency and reducing costs through technology. | Potential 20% reduction in machinery downtime via predictive maintenance. |

| Strategic Partnerships & Expansion | Entering new markets and collaborating for innovation. | Record $1.7 trillion invested globally in sustainable energy in 2023. |

Threats

The automotive landscape is increasingly shaped by Chinese Original Equipment Manufacturers (OEMs), whose competitively priced vehicles are a significant threat, especially in key markets like China and Malaysia. This influx intensifies price wars, directly impacting Sime Darby's motor division by squeezing profit margins.

Global vehicle oversupply, partly fueled by aggressive Chinese exports, creates a challenging environment where price becomes a primary differentiator. For instance, in 2023, China's vehicle exports surpassed Japan's, reaching over 4.9 million units, a stark indicator of this growing competitive pressure that Sime Darby must navigate.

A global economic slowdown, particularly in key markets for Sime Darby, poses a significant threat. For instance, the International Monetary Fund (IMF) projected global growth to moderate to 3.2% in 2024, down from 3.5% in 2023, indicating a cooling economic environment that could dampen demand for Sime Darby's diverse product offerings.

Persistent geopolitical tensions, including ongoing trade disputes and regional conflicts, further exacerbate this threat. Tariffs between major economies, such as the US and China, can disrupt supply chains and increase the cost of goods, impacting both Sime Darby's operational efficiency and the affordability of its products for consumers and businesses alike.

This climate of uncertainty directly translates to cautious consumer sentiment and reduced business investment. As a result, demand for industrial equipment and motor vehicles, core segments for Sime Darby, is likely to contract, leading to potential declines in revenue and profitability for the company in the 2024-2025 period.

Sime Darby faces significant challenges from ongoing global supply chain disruptions. Shortages of critical components and raw materials, a persistent issue throughout 2024 and into 2025, directly impact their ability to manufacture and deliver industrial equipment and vehicles on schedule. This can lead to production delays and unmet customer demand.

Furthermore, the volatility of input costs presents a substantial threat. For instance, fluctuations in energy prices and the cost of key raw materials, such as steel or semiconductors, can significantly erode Sime Darby's profit margins. If these increased costs cannot be effectively passed on to consumers, the company's financial stability could be compromised, creating operational and financial instability.

Regulatory Changes and Environmental Compliance Costs

Evolving regulatory frameworks, especially concerning environmental standards and international trade, present significant challenges for Sime Darby. For instance, stricter emission regulations for vehicles and industrial machinery, as seen with the push towards Euro 7 standards in Europe, could necessitate substantial investment in new technologies, thereby increasing operational costs. Similarly, shifts in fuel subsidy policies in key markets can directly impact the affordability and demand for certain vehicle segments.

Furthermore, the implementation of new taxation measures, such as high-value goods taxes, could dampen consumer appetite for premium automotive offerings. For example, if a major market Sime Darby operates in were to introduce a luxury vehicle tax, it could directly affect sales volumes of its higher-end automotive brands. These regulatory shifts require constant monitoring and adaptation to mitigate potential negative impacts on profitability and market share.

- Stricter Emission Standards: Increased compliance costs for manufacturing and operating vehicles, potentially impacting profitability in automotive divisions.

- Fuel Subsidy Policy Changes: Altered consumer purchasing behavior, favoring more fuel-efficient or alternative-energy vehicles.

- High-Value Goods Taxes: Reduced demand for luxury automotive models, directly affecting sales revenue for premium segments.

- Trade Policy Volatility: Potential for tariffs or import restrictions impacting the cost and availability of components or finished vehicles.

Technological Disruption and Rapid Industry Shifts

Technological disruption is a significant threat, particularly in Sime Darby's automotive and industrial divisions. The automotive sector is rapidly evolving with advancements in autonomous driving and electric vehicle (EV) battery technology. For instance, the global EV market is projected to reach over $1.5 trillion by 2030, indicating a massive shift. Failure to invest heavily in research and development for these areas, or a rapid change in consumer demand towards new mobility solutions, could severely impact Sime Darby's established business models.

The industrial sector is not immune, with automation and advanced robotics poised to transform manufacturing and operations. Companies that fail to integrate these technologies risk becoming less competitive. Sime Darby’s industrial division, dealing with heavy machinery and equipment, needs to adapt to these changes to maintain its market position.

- Automotive Disruption: The accelerating shift towards EVs and autonomous driving requires substantial R&D investment, potentially diverting resources from core operations. Global EV sales in 2024 are expected to exceed 15 million units, a stark increase from previous years.

- Industrial Automation: The adoption of robotics in manufacturing could displace traditional labor and necessitate significant capital expenditure for upgrading facilities.

- Mobility Trends: A pivot in consumer preference from traditional vehicle ownership to ride-sharing or subscription services presents a fundamental challenge to dealership and after-sales revenue streams.

Intensifying competition from Chinese OEMs, offering cost-effective vehicles, directly pressures Sime Darby's motor division by potentially reducing profit margins. This competitive dynamic is amplified by a global vehicle oversupply, with China's vehicle exports reaching over 4.9 million units in 2023, surpassing Japan's and highlighting a market where price is increasingly critical.

SWOT Analysis Data Sources

This Sime Darby SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a well-rounded and accurate understanding of the company's strategic position.