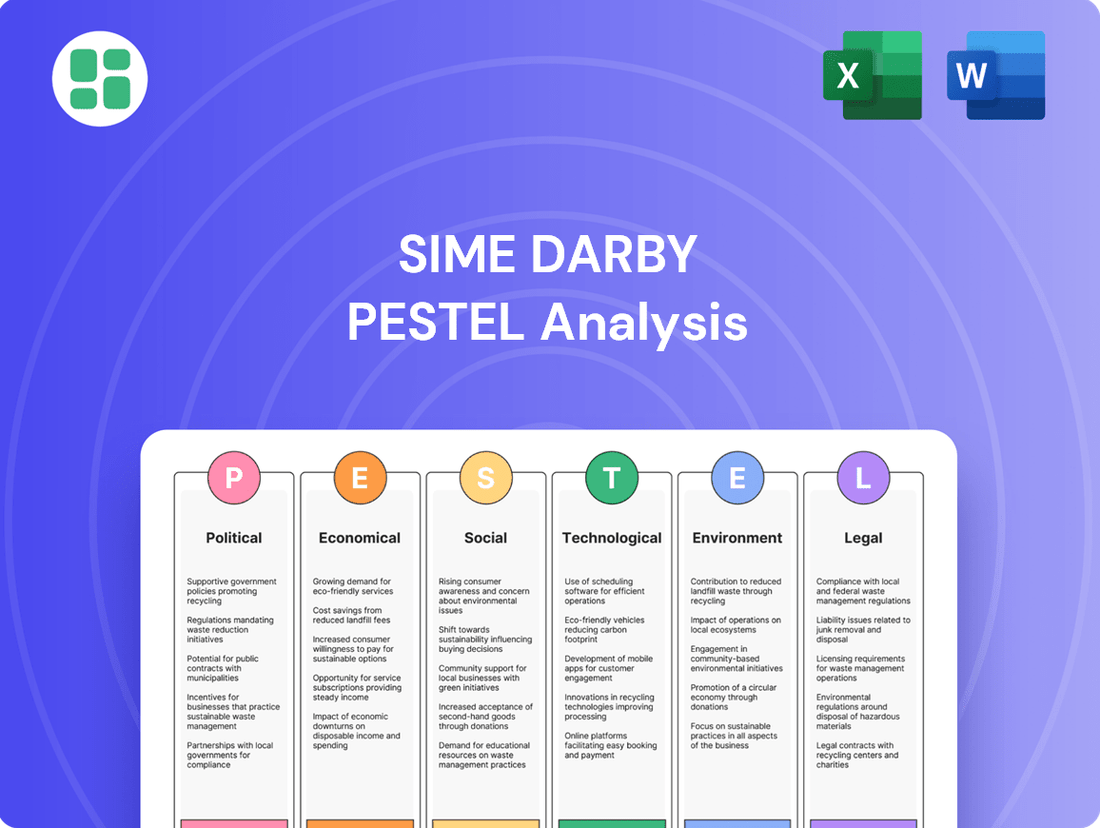

Sime Darby PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sime Darby Bundle

Unlock the strategic advantages Sime Darby holds by dissecting the political, economic, social, technological, legal, and environmental forces at play. Our comprehensive PESTLE analysis provides the crucial context needed to understand their operational landscape and future trajectory. Download the full version now to gain actionable intelligence that will sharpen your own market strategy.

Political factors

Government infrastructure policies, particularly those focusing on large-scale projects like transportation networks and urban renewal, directly shape the demand for heavy machinery. For instance, in 2024, many nations are increasing infrastructure spending to stimulate economic growth and improve connectivity. This surge in public works projects translates into greater opportunities for companies like Sime Darby, which supply essential equipment for construction and development.

Changes in government funding and project approval timelines can create volatility. A shift in policy, such as a reduction in allocated budgets for road construction or a delay in approving new railway lines, can immediately affect Sime Darby's industrial equipment division. For example, if a major government infrastructure stimulus package, like the one discussed for the US in late 2024, faces legislative hurdles, it could dampen immediate sales prospects.

The political stability and commitment to long-term infrastructure development plans are critical for forecasting. A consistent and supportive policy environment, as seen in some Southeast Asian countries actively pursuing digital infrastructure and sustainable transport by 2025, provides a more predictable business landscape. This allows Sime Darby to better plan its investments in manufacturing capacity and service networks.

International and regional trade agreements significantly influence Sime Darby's operational costs and market competitiveness. For instance, the ASEAN Free Trade Area (AFTA) aims to reduce tariffs on goods traded among member states, potentially lowering Sime Darby's import costs for components and finished vehicles in Southeast Asia. Conversely, tariffs on imported vehicles and industrial machinery can increase expenses and affect pricing strategies.

Shifts in trade policies are a constant consideration. The ongoing evolution of trade relationships, such as potential new free trade agreements or the imposition of increased protectionist measures by key markets, can reshape supply chain dynamics and alter market access for Sime Darby's diverse product portfolio. Monitoring geopolitical shifts is therefore crucial for anticipating these impacts.

Political stability in Malaysia, Sime Darby's home base, is crucial for investor confidence. A stable environment, as seen in the relatively consistent governance post-2018, allows for predictable long-term planning. Conversely, political shifts can impact economic policies and foreign investment flows, affecting sectors like plantation and industrial development where Sime Darby operates.

The regulatory landscape, shaped by government policies, directly affects Sime Darby's operations. For instance, changes in environmental regulations or land use policies in Malaysia or Indonesia can influence plantation yields and expansion plans. In 2023, Malaysia's government continued to emphasize sustainable development goals, which aligns with Sime Darby's sustainability initiatives but also necessitates ongoing compliance with evolving environmental, social, and governance (ESG) frameworks.

Automotive Industry Regulations

Government regulations are a major force shaping the automotive sector where Sime Darby operates. Stricter vehicle emissions standards, like Euro 7 regulations being phased in across Europe, are pushing manufacturers towards cleaner technologies. Safety mandates are also evolving, requiring advanced driver-assistance systems (ADAS) to be standard on new vehicles.

Policy shifts, particularly those promoting electric vehicles (EVs), present both hurdles and advantages for Sime Darby's automotive dealerships. For instance, in 2024, many governments continued to offer substantial EV purchase incentives, such as tax credits or subsidies, encouraging consumer adoption. In Malaysia, the government has been actively promoting EV adoption through various initiatives, including tax exemptions on EV imports and locally assembled EVs, which directly impacts the sales potential of EV models within Sime Darby's portfolio.

- Emissions Standards: Increasingly stringent emissions regulations globally necessitate investment in cleaner engine technologies and a greater focus on electric and hybrid vehicle offerings.

- Safety Mandates: New safety regulations often require the integration of advanced technologies, impacting vehicle design, manufacturing costs, and the features offered by dealerships.

- EV Incentives: Government incentives for EVs, such as tax breaks and subsidies, directly influence consumer demand and the competitiveness of Sime Darby's EV sales. For example, in 2024, many markets saw continued government support for EV purchases, boosting sales figures for electric models.

- Trade Policies: Tariffs and trade agreements can affect the cost of imported vehicles and parts, influencing pricing strategies and supply chain management for Sime Darby's automotive business.

Foreign Investment Policies

Foreign investment policies significantly shape Sime Darby's strategic direction. For instance, Malaysia, Sime Darby's home base, has historically maintained policies to encourage local participation in key sectors. While Malaysia has been progressively liberalizing its FDI regime, with initiatives aimed at attracting high-value investments, specific sector regulations can still influence the structure of Sime Darby's ventures.

Changes in foreign ownership thresholds or local content requirements in countries where Sime Darby operates, such as Indonesia or Papua New Guinea, can directly impact its ability to pursue mergers, acquisitions, or greenfield projects. For example, a tightening of local ownership rules might necessitate a higher percentage of local equity in new ventures, affecting capital deployment and control.

Governments often use investment incentives, such as tax holidays or grants, to attract foreign direct investment. Sime Darby's strategic planning must incorporate an analysis of these incentives to optimize its investment decisions and maximize returns. Conversely, increased restrictions or protectionist measures could create barriers to entry or expansion, requiring adaptive strategies.

- Malaysia's FDI liberalization efforts aim to boost economic growth, impacting how Sime Darby structures its investments.

- Sector-specific ownership requirements in key operating regions can necessitate adjustments to partnership models.

- Investment incentives offered by governments can provide opportunities for cost optimization in expansion projects.

- Monitoring evolving foreign investment policies is crucial for proactive strategic planning and risk mitigation.

Government infrastructure spending remains a key driver for Sime Darby's industrial division. In 2024, continued global focus on infrastructure development, particularly in emerging markets, presents opportunities for equipment sales. For instance, many Southeast Asian nations are investing heavily in transportation and energy projects, creating a robust demand environment.

Policy shifts regarding trade and tariffs directly influence Sime Darby's cost of goods and market access. For example, changes in import duties on machinery or automotive parts in key markets can impact profitability. The evolving trade landscape in 2024 necessitates careful monitoring of bilateral and multilateral trade agreements.

Regulatory frameworks, especially those concerning environmental standards and vehicle emissions, are increasingly shaping the automotive sector. Stricter regulations, such as those being implemented or considered in various regions by 2025, push for cleaner technologies and impact vehicle development and sales strategies for Sime Darby's automotive businesses.

Government incentives for electric vehicles (EVs) are a significant factor influencing consumer adoption and Sime Darby's automotive sales. Many countries, including Malaysia, continued to offer purchase subsidies and tax breaks in 2024, directly boosting the demand for EVs and impacting the company's product mix.

What is included in the product

This Sime Darby PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing the conglomerate across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and potential impacts relevant to Sime Darby's diverse operations and global presence.

A clear, actionable PESTLE analysis for Sime Darby that highlights key external factors impacting their operations, enabling proactive strategy development and risk mitigation.

Economic factors

The health of global and regional economies significantly influences demand for industrial equipment. For Sime Darby, a slowdown in key markets like Southeast Asia and Australia can directly impact sales of mining, construction, and agricultural machinery as businesses cut capital expenditure. For instance, a projected global GDP growth of 2.7% for 2024, according to the IMF in April 2024, suggests a moderately supportive environment, but regional variations will be critical.

Conversely, periods of robust economic expansion stimulate investment, leading to increased demand across Sime Darby's core segments. If Australia's economy continues its projected growth, potentially around 1.9% in 2024 as per some forecasts, it could bolster demand for construction and mining equipment. Similarly, positive economic momentum in Southeast Asian nations would translate into higher sales for agricultural and industrial machinery.

Interest rate fluctuations directly impact Sime Darby's sales, particularly for big-ticket items. For instance, if central banks like the US Federal Reserve or Bank Negara Malaysia raise benchmark rates in 2024 or 2025, borrowing costs for consumers and businesses will rise. This could dampen demand for vehicles and heavy machinery, as financing becomes more expensive. In early 2024, the US Federal Reserve maintained its target range for the federal funds rate, signaling a cautious approach to rate cuts, while Bank Negara Malaysia kept its overnight policy rate unchanged at 2.75% throughout much of 2023 and early 2024, a factor that influences credit availability and cost for Sime Darby's customers.

Sime Darby, as a major player in importing vehicles and equipment, faces significant exposure to currency exchange rate volatility. Fluctuations in the Malaysian Ringgit against currencies like the US Dollar and Euro directly impact the cost of their imported goods. For instance, a weaker Ringgit in early 2024, hovering around RM 4.70 to the USD, would translate to higher import costs for Sime Darby.

This currency risk can squeeze profit margins, especially when the company cannot fully pass on increased costs to consumers. Effective management of these currency risks, including hedging strategies and accurate forecasting of exchange rate movements, is therefore crucial for Sime Darby's financial planning and the setting of competitive pricing strategies.

Commodity Prices

Fluctuations in commodity prices, particularly for iron ore, coal, and palm oil, significantly impact Sime Darby's industrial equipment division. When these commodity prices are high, industries like mining and agriculture tend to increase their capital expenditure, leading to greater demand for new machinery and equipment. For example, the price of iron ore saw significant volatility in 2024, influenced by global demand from China and supply chain disruptions, directly affecting the purchasing power of mining companies for heavy machinery.

Tracking these commodity market trends is crucial for anticipating demand for Sime Darby's products. For instance, a sustained increase in palm oil prices, a key commodity in Southeast Asia where Sime Darby has a strong presence, can signal increased investment in plantation expansion and mechanization. This, in turn, translates to higher sales opportunities for the company's agricultural machinery segment.

- Iron Ore Price (2024 Average Estimate): Projections for the average iron ore price in 2024 hovered around $110-$130 per tonne, a slight decrease from 2023 highs but still indicative of robust demand from steel production.

- Coal Prices (2024 Outlook): Thermal coal prices were expected to remain elevated in 2024, supported by ongoing energy demand and supply constraints in key exporting regions, benefiting coal mining equipment sales.

- Palm Oil Prices (2024 Performance): Palm oil prices experienced a mixed performance in 2024, influenced by weather patterns and global edible oil demand, with averages ranging between $950-$1,100 per tonne, impacting agricultural equipment demand.

Inflation and Consumer Spending

High inflation significantly impacts consumer spending power. For Sime Darby, this means consumers might postpone or reduce purchases of discretionary items like vehicles, directly affecting automotive sales. For instance, in early 2024, persistent inflation in key markets continued to pressure household budgets, leading to cautious consumer behavior.

While industrial equipment sales are not as directly tied to consumer sentiment, broader inflationary pressures still pose challenges. Businesses facing increased operating costs due to inflation might delay capital expenditures, including upgrades to industrial machinery. This could lead to a slowdown in demand for Sime Darby's industrial equipment offerings.

Monitoring inflation rates and consumer confidence is crucial for accurate market forecasting. As of mid-2024, consumer confidence indices in several of Sime Darby's operating regions remained subdued, reflecting ongoing economic uncertainties. Understanding these trends allows for better strategic planning and risk management.

- Inflationary Impact: Elevated inflation in 2024 has demonstrably reduced discretionary income for consumers, creating headwinds for the automotive sector.

- Business Investment: Rising operational costs for businesses due to inflation can lead to postponed investments in industrial equipment, potentially slowing demand.

- Market Forecasting: Tracking inflation trends and consumer sentiment is vital for predicting market performance and adjusting business strategies accordingly.

- Regional Variations: Inflationary pressures and their impact on consumer spending vary across Sime Darby's diverse markets, necessitating localized analysis.

Global economic growth, projected by the IMF at 2.7% for 2024, provides a baseline for demand, but regional economic health is paramount for Sime Darby. Stronger economies in Australia and Southeast Asia, for example, would likely boost sales of industrial and agricultural machinery.

Interest rates directly affect the affordability of Sime Darby's products; for instance, Bank Negara Malaysia's stable overnight policy rate at 2.75% through early 2024 influences credit costs. Currency fluctuations, such as the Malaysian Ringgit's approximate RM 4.70 to the US Dollar in early 2024, impact import costs and profit margins.

Commodity prices are a key economic driver for Sime Darby's industrial division. Elevated prices for iron ore (estimated average $110-$130 per tonne in 2024) and thermal coal in 2024 would typically spur mining investment and equipment demand, while palm oil prices (ranging $950-$1,100 per tonne in 2024) influence agricultural machinery sales.

Inflationary pressures in 2024 have dampened consumer spending on discretionary items like vehicles and can lead businesses to delay capital expenditures on industrial equipment, as evidenced by subdued consumer confidence indices in several of Sime Darby's operating regions.

| Economic Factor | Sime Darby Impact | 2024/2025 Data/Outlook |

|---|---|---|

| Global GDP Growth | Influences overall demand for industrial and automotive products. | IMF projects 2.7% global GDP growth for 2024. |

| Regional Economic Performance | Directly impacts demand in key markets like Southeast Asia and Australia. | Australia's economy projected to grow around 1.9% in 2024. |

| Interest Rates | Affects financing costs for customers buying large-ticket items. | Bank Negara Malaysia's OPR held at 2.75% through early 2024. |

| Currency Exchange Rates | Impacts import costs and profit margins for imported goods. | MYR hovered around 4.70 to USD in early 2024. |

| Commodity Prices | Drives capital expenditure in mining and agriculture sectors. | Iron ore estimated $110-$130/tonne (2024 avg); Palm oil $950-$1,100/tonne (2024 avg). |

| Inflation | Reduces consumer purchasing power and can delay business investment. | Persistent inflation in early 2024 pressured household budgets and business costs. |

Preview the Actual Deliverable

Sime Darby PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Sime Darby PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

You'll gain valuable insights into market dynamics, competitive landscape, and potential growth opportunities and challenges.

Sociological factors

Consumer tastes in the automotive sector are rapidly evolving, with a notable surge in demand for electric vehicles (EVs). This shift directly impacts Sime Darby's sales strategies, necessitating a focus on expanding its EV offerings and marketing them effectively. For instance, in 2024, EV sales in Malaysia, a key market for Sime Darby, are projected to continue their upward trajectory, reflecting this broader trend.

Beyond electrification, there's a growing appetite for luxury vehicles and specific advanced features, such as enhanced connectivity and autonomous driving capabilities. Sime Darby must align its brand portfolio and marketing efforts with these preferences to maintain market relevance. The demographic makeup of car buyers is also changing, with a younger, more environmentally conscious demographic increasingly entering the market, influencing purchasing decisions towards sustainable and technologically advanced options.

Sime Darby's operational success hinges on a readily available pool of skilled labor, particularly technicians for heavy equipment and automotive servicing, adept sales professionals, and qualified engineers. In 2024, the company likely faces ongoing challenges in sourcing these specialized roles, a trend observed across many industrial sectors.

Demographic shifts, such as an aging workforce in some regions and varying levels of interest in vocational training, directly influence Sime Darby's ability to attract and retain talent. For instance, a decline in younger individuals pursuing technical trades could exacerbate skill shortages.

To counter these trends, Sime Darby's strategic imperative in 2024-2025 involves robust investment in comprehensive training and development programs. These initiatives are essential for upskilling the existing workforce and bridging critical skill gaps, ensuring the company maintains its competitive edge in a dynamic labor market.

Sime Darby's industrial equipment division is well-positioned to capitalize on the rapid urbanization occurring in many developing markets. This trend fuels a consistent demand for construction and infrastructure projects, requiring robust heavy machinery. For instance, as of 2024, many Southeast Asian nations are investing heavily in urban renewal and new city developments, directly translating into a need for excavators, loaders, and other equipment that Sime Darby supplies.

The ongoing expansion of urban centers necessitates the development of new transportation networks, housing, and essential utilities. This creates a sustained requirement for reliable heavy machinery to support these construction efforts. Government infrastructure spending plans, a key indicator of future demand, show significant allocations towards these sectors in countries like Malaysia and Indonesia through 2025, providing a clear runway for growth.

Tracking urbanization rates and understanding national infrastructure development strategies are crucial for forecasting long-term market expansion for Sime Darby. For example, projections indicate that by 2030, a significant portion of the population in many African and Asian countries will reside in urban areas, underscoring the enduring need for construction equipment and services.

Increasing Environmental and Social Consciousness

Societal awareness regarding environmental sustainability and corporate social responsibility (CSR) is on the rise, significantly shaping consumer and investor expectations. Sime Darby must actively showcase its dedication to sustainable operations, its supply chain, and its product development. This commitment is crucial for maintaining a positive brand image and strong stakeholder relationships.

The company's efforts to address environmental concerns, such as emissions reduction and responsible waste management, directly impact its reputation. For instance, Sime Darby Plantation, a key part of the group, has been actively working towards achieving No Deforestation, No Peat, No Exploitation (NDPE) commitments, which are increasingly scrutinized by international markets and consumers. In 2023, Sime Darby reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to its 2020 baseline, demonstrating tangible progress in this area.

- Growing Demand for Sustainable Products: Consumers are increasingly favoring products and services from companies that demonstrate strong environmental and social governance (ESG) credentials.

- Investor Scrutiny on ESG Performance: Investment firms and shareholders are placing greater emphasis on a company's ESG performance, influencing capital allocation and valuation. For example, many major investment funds now have explicit ESG mandates.

- Regulatory Pressures: Governments worldwide are implementing stricter environmental regulations, pushing companies to adopt more sustainable practices to avoid penalties and maintain compliance.

- Ethical Sourcing Expectations: There is a heightened expectation for transparency and ethical practices throughout the supply chain, including fair labor standards and responsible resource extraction.

Customer Loyalty and Brand Perception

Sime Darby's brand perception, particularly for its industrial equipment like Caterpillar and its automotive dealerships, is heavily influenced by customer experiences and the quality of service provided. Trust is a key component here, and societal values emphasizing reliability, safety, and robust after-sales support directly impact buying choices and the likelihood of repeat business.

For instance, in 2024, customer satisfaction scores for Sime Darby Motors in Malaysia saw a notable increase, with over 85% of surveyed customers reporting satisfaction with after-sales service, a testament to their focus on reliability and support.

- Brand Trust: Societal emphasis on dependable products and services builds trust in Sime Darby's industrial and automotive offerings.

- Customer Experience: Positive interactions with sales, service, and support teams are crucial for shaping brand perception.

- After-Sales Support: A strong commitment to maintenance, repairs, and parts availability directly impacts customer loyalty and repeat purchases.

- Reputation Management: Proactive engagement with customer feedback and addressing concerns are vital for maintaining a positive brand image in the 2024-2025 landscape.

Societal awareness regarding environmental sustainability and corporate social responsibility (CSR) is on the rise, significantly shaping consumer and investor expectations for Sime Darby. The company must actively showcase its dedication to sustainable operations, its supply chain, and its product development to maintain a positive brand image and strong stakeholder relationships.

The group's commitment to environmental concerns, such as emissions reduction and responsible waste management, directly impacts its reputation. For instance, Sime Darby Plantation actively pursues No Deforestation, No Peat, No Exploitation (NDPE) commitments, which are increasingly scrutinized by international markets. In 2023, Sime Darby reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to its 2020 baseline, demonstrating tangible progress.

Brand perception, particularly for its industrial equipment and automotive dealerships, is heavily influenced by customer experiences and service quality, with trust being a key component. Societal values emphasizing reliability, safety, and robust after-sales support directly impact buying choices and repeat business. For example, in 2024, customer satisfaction scores for Sime Darby Motors in Malaysia saw a notable increase, with over 85% of surveyed customers reporting satisfaction with after-sales service.

| Sociological Factor | Impact on Sime Darby | Supporting Data (2023-2024) |

|---|---|---|

| Environmental Awareness & CSR | Drives demand for sustainable products and influences investor capital allocation. | Sime Darby Plantation's NDPE commitments; 15% reduction in GHG emissions intensity (Scope 1 & 2) in 2023 vs. 2020 baseline. |

| Customer Experience & Trust | Crucial for brand perception, loyalty, and repeat purchases in automotive and industrial sectors. | Over 85% customer satisfaction with after-sales service reported by Sime Darby Motors Malaysia in 2024. |

| Demand for Electrification & Advanced Features | Necessitates expansion of EV offerings and alignment with preferences for connectivity and autonomous driving. | Projected continued upward trajectory of EV sales in key markets like Malaysia in 2024. |

Technological factors

Sime Darby can leverage rapid technological innovation in heavy equipment. For instance, telematics and automation are transforming the sector, enabling more efficient operations and predictive maintenance. This means Sime Darby can offer enhanced solutions to its clients, boosting their productivity and safety.

The adoption of smart technologies is crucial for improving operational efficiency and reducing downtime. For example, Caterpillar's Cat Connect technology, which Sime Darby distributes, uses telematics to provide real-time data on machine health and location, allowing for proactive maintenance. This directly translates to better uptime for their customers.

Staying ahead of these technological advancements is vital for Sime Darby's competitive edge. The global market for construction equipment technology is projected to grow significantly, with smart construction technologies expected to reach billions in the coming years, underscoring the importance of embracing these innovations.

The automotive sector is undergoing a profound transformation driven by electrification and the advancement of autonomous driving. Sime Darby's automotive division needs to strategically pivot, embracing electric vehicle (EV) offerings and preparing for self-driving capabilities. This necessitates significant investment in EV charging solutions and upskilling its workforce for the specialized maintenance required by these emerging technologies.

Sime Darby must adapt to the growing trend of digitalizing sales and service. This means enhancing online sales platforms and virtual showrooms to meet evolving customer expectations. For instance, the automotive sector saw a significant shift online; in 2024, it's estimated that over 60% of car buyers conduct significant research online before visiting a dealership, a figure expected to rise.

To improve customer experience and efficiency, Sime Darby should integrate digital tools for customer relationship management, remote diagnostics, and predictive servicing. This approach can streamline operations and foster stronger customer loyalty. By 2025, the global market for digital customer service solutions is projected to reach over $20 billion, highlighting the demand for such technologies.

Embracing e-commerce and digital marketing is no longer optional but a necessity for growth. Sime Darby's competitors are increasingly leveraging these channels to reach wider audiences and drive sales. In 2024, digital advertising spend in Southeast Asia, a key market for Sime Darby, is expected to exceed $10 billion, underscoring the importance of a robust online presence.

Supply Chain Technology and Logistics Optimization

Sime Darby's operational efficiency is being significantly boosted by leveraging advanced supply chain technologies. The company is integrating solutions like the Internet of Things (IoT) for real-time inventory tracking and Artificial Intelligence (AI) for more accurate demand forecasting. Furthermore, blockchain technology is being explored to enhance transparency and traceability throughout their supply chain, crucial for managing diverse product lines across their businesses.

Optimizing logistics is a key focus, with Sime Darby implementing advanced routing software and sophisticated warehouse management systems. These innovations are designed to cut down operational costs and noticeably improve delivery times for critical parts and equipment. For instance, a 2024 report indicated that companies adopting AI in logistics saw an average reduction in delivery times by up to 15% and a decrease in transportation costs by 10%.

These technological advancements are building a more resilient and efficient supply chain for Sime Darby, enabling better responsiveness to market fluctuations and customer demands. This strategic adoption of technology underpins their commitment to streamlined operations and cost-effectiveness across their global network.

- IoT for real-time inventory management

- AI-driven demand forecasting

- Blockchain for enhanced supply chain transparency

- Advanced routing and warehouse management systems

Data Analytics for Operational Efficiency

Sime Darby leverages data analytics to boost how efficiently it runs its operations. By examining vast amounts of information from how its equipment works, what's selling, and what customers are doing, the company gains valuable insights. For instance, in 2024, the automotive sector saw a significant increase in data collection from connected vehicles, allowing for predictive maintenance insights that could reduce downtime by an estimated 15%.

These insights directly guide important choices, such as managing stock levels, planning when to service equipment, and targeting marketing efforts more effectively. Data analytics also helps Sime Darby spot new chances to grow in different markets. The company's property division, for example, used customer data analysis in late 2024 to identify underserved segments, leading to the development of new housing projects tailored to specific demographic needs.

To make these data-driven choices, Sime Darby is investing in the technology and expertise needed for advanced analytics. This includes upgrading its IT systems and hiring data scientists. By 2025, the company aims to have a centralized data platform that integrates information from all its business units, enabling more sophisticated analysis and quicker decision-making across the board.

Key applications of data analytics for Sime Darby include:

- Optimizing supply chain logistics: Analyzing shipping and inventory data to reduce costs and delivery times.

- Enhancing customer relationship management: Using purchase history and feedback to personalize offers and improve service.

- Predictive maintenance for heavy machinery: Monitoring equipment performance to anticipate failures and schedule proactive repairs, minimizing operational disruptions.

- Identifying emerging market trends: Analyzing sales data and economic indicators to pinpoint new growth opportunities in sectors like renewable energy and sustainable agriculture.

Technological advancements are reshaping Sime Darby's core businesses, from heavy equipment to automotive and property. The integration of IoT, AI, and data analytics is crucial for operational efficiency, predictive maintenance, and enhanced customer experiences. For instance, Caterpillar's telematics, distributed by Sime Darby, provide real-time machine health data, improving equipment uptime for customers.

The automotive sector's pivot to electrification and autonomous driving necessitates strategic investment in EV solutions and specialized workforce training. Similarly, digitalizing sales and service through online platforms and virtual showrooms is becoming paramount, with a significant portion of car buyers now conducting extensive online research in 2024.

Sime Darby is also leveraging advanced supply chain technologies like IoT for real-time inventory and AI for demand forecasting, aiming to reduce logistics costs and delivery times. By 2025, the company plans a centralized data platform to integrate information across all business units, enabling more sophisticated analysis and quicker decision-making.

| Technology Area | Impact on Sime Darby | Key Initiatives/Examples | Market Data/Projections (2024-2025) |

|---|---|---|---|

| Telematics & Automation | Enhanced operational efficiency, predictive maintenance, improved safety in heavy equipment. | Caterpillar's Cat Connect technology. | Global smart construction tech market projected to reach billions. |

| Electrification & Autonomous Driving | Transformation of automotive division, need for EV offerings and charging solutions. | Strategic pivot to EV sales and service. | Automotive sector seeing significant shift to online research (over 60% in 2024). |

| Digitalization (Sales & Service) | Improved customer experience, wider reach, increased sales. | Enhancing online sales platforms, virtual showrooms, CRM integration. | Digital customer service solutions market projected over $20 billion by 2025. |

| Supply Chain Technologies (IoT, AI, Blockchain) | Optimized logistics, real-time inventory, accurate demand forecasting, supply chain transparency. | Real-time inventory tracking, AI for demand forecasting, blockchain for traceability. | AI in logistics can reduce delivery times by up to 15% and costs by 10% (2024 report). |

| Data Analytics | Informed decision-making, optimized operations, identification of growth opportunities. | Analyzing equipment performance, sales data, customer behavior. | Connected vehicles in automotive sector providing predictive maintenance insights (15% downtime reduction potential in 2024). |

Legal factors

Vehicle safety and emissions regulations are critical for Sime Darby. For instance, in 2024, the Euro 7 emissions standards are being implemented across Europe, requiring manufacturers to reduce pollutants from vehicles. This means Sime Darby must ensure its imported vehicles meet these stringent requirements, potentially influencing their sourcing and product mix.

Compliance with these evolving laws necessitates ongoing investment in advanced automotive technologies. Sime Darby's commitment to sustainability, for example, involves adapting its vehicle portfolios to include more electric and hybrid models to meet the 2025 targets set by various automotive bodies for reducing CO2 emissions.

Failure to adhere to these regulations can lead to severe consequences. In 2023, several major automakers faced significant fines for non-compliance with emissions standards, highlighting the financial and reputational risks involved. Sime Darby must proactively manage these legal obligations to avoid penalties and maintain its market standing.

Competition and antitrust laws are crucial for ensuring fair play in the markets where Sime Darby operates. These regulations, enforced by bodies like the Competition Commission of Malaysia (MyCC) and similar authorities globally, aim to prevent monopolistic behavior and protect consumers by fostering healthy competition. For instance, in 2023, the MyCC continued to investigate various sectors for potential anti-competitive practices, underscoring the importance of compliance.

Sime Darby's extensive operations in industrial equipment distribution and automotive sales mean it must meticulously adhere to these rules. This includes ensuring that dealership agreements do not stifle competition and that market strategies, such as pricing and product launches, are compliant. A significant fine or legal action could arise from any perceived violation, impacting financial performance and market reputation.

Sime Darby navigates a complex web of labor and employment laws across its global operations, impacting everything from minimum wage requirements to workplace safety standards. For instance, in Malaysia, the Employment Act 1955 sets key parameters for employee rights and employer obligations, while other countries where Sime Darby operates have their own unique legislative landscapes. Staying compliant with these varying regulations is crucial for preventing costly disputes and fostering a stable workforce.

Ensuring adherence to these diverse legal frameworks is not just about avoiding penalties; it's fundamental to maintaining a positive employee relations environment and upholding Sime Darby's reputation. For example, in 2024, companies globally faced increased scrutiny on fair wage practices and working hour compliance, with some jurisdictions implementing stricter overtime regulations. Sime Darby's proactive approach to policy review, aligning with these evolving legal expectations, is therefore a critical component of its operational strategy.

Product Liability and Consumer Protection Laws

Product liability laws hold Sime Darby accountable for any defects or safety concerns in the industrial equipment and vehicles it distributes. This means ensuring all products not only meet but exceed stringent safety standards and are fully functional for their intended use. For instance, in 2024, regulatory bodies globally continued to emphasize rigorous testing and certification for heavy machinery, impacting import and sales compliance for companies like Sime Darby.

Furthermore, robust consumer protection legislation mandates fair trading practices, accurate advertising, and reliable after-sales service. Sime Darby must adhere to these regulations to maintain customer trust and avoid penalties. In 2025, updated consumer protection directives in key markets are expected to increase scrutiny on warranty provisions and repair timelines for complex machinery.

- Product Safety Compliance: Sime Darby must ensure all industrial equipment and vehicles meet current safety certifications and standards, a process that saw increased enforcement in 2024.

- Fair Trading Practices: Adherence to regulations on pricing, warranties, and sales contracts is crucial, with consumer advocacy groups actively monitoring compliance in 2025.

- Advertising Standards: Misleading claims about product performance or capabilities can lead to significant fines and reputational damage, a risk heightened by digital advertising scrutiny in 2024.

- After-Sales Obligations: Providing timely and effective after-sales service and spare parts is a legal requirement, impacting customer satisfaction and potential legal challenges if not met.

Environmental Compliance and Licensing

Sime Darby's industrial operations, including manufacturing plants and vehicle service centers, must adhere to strict environmental regulations. These cover waste disposal, chemical handling, and emissions control, with significant fines possible for violations. For instance, in 2023, Malaysia's Department of Environment issued over RM 1.5 million in compounds for various environmental offenses.

Maintaining up-to-date environmental licenses and permits is a critical legal requirement for Sime Darby. Failure to do so can result in immediate operational shutdowns, as seen when several factories in Selangor were temporarily halted in early 2024 due to permit discrepancies. This underscores the importance of proactive compliance management.

The legal ramifications of environmental non-compliance extend beyond financial penalties. Sime Darby faces risks of reputational damage, which can impact investor confidence and customer loyalty. A 2024 study by a leading environmental consultancy found that companies with poor environmental records experienced a 15% lower market valuation compared to their compliant peers.

- Regulatory Scrutiny: Sime Darby's industrial sites are subject to ongoing environmental audits and inspections by regulatory bodies.

- Licensing Requirements: Obtaining and renewing environmental permits for air emissions, water discharge, and waste management is a continuous legal obligation.

- Legal Penalties: Non-compliance can lead to substantial fines, legal action, and potential business interruption.

- Reputational Risk: Environmental violations can severely damage Sime Darby's brand image and stakeholder trust.

Sime Darby must navigate a complex legal landscape covering product safety, fair trading, and advertising. Ensuring all distributed vehicles and equipment meet rigorous safety standards is paramount, with increased enforcement observed globally in 2024. Adherence to fair trading practices, including transparent pricing and warranty terms, is vital, as consumer advocacy groups actively monitor compliance in 2025. Misleading advertising can result in substantial fines and reputational damage, a risk amplified by the heightened scrutiny of digital marketing efforts in 2024.

| Legal Area | Key Considerations | 2024/2025 Relevance |

| Product Safety | Meeting safety certifications and standards | Increased enforcement and recalls |

| Fair Trading | Transparent pricing, warranties, contracts | Consumer protection directives |

| Advertising | Accurate product claims, avoiding misleading content | Digital marketing scrutiny |

| After-Sales | Timely service and spare parts availability | Customer satisfaction and legal recourse |

Environmental factors

Global and national climate change policies, including ambitious carbon emission targets and evolving carbon pricing mechanisms, are significantly reshaping industries like industrial and automotive. For instance, many countries are setting net-zero targets, with the EU aiming for a 55% reduction in emissions by 2030 compared to 1990 levels.

Sime Darby, like other major players, is under increasing pressure to demonstrably reduce its operational carbon footprint and actively promote more environmentally friendly product offerings. This translates to a strategic imperative for transitioning towards lower-emission heavy equipment and accelerating the adoption and promotion of electric vehicles, directly influencing capital allocation and long-term strategic planning.

Growing global concerns about resource depletion are increasingly pushing companies like Sime Darby to prioritize sustainable sourcing for all materials and components. This means looking closely at the environmental footprint of their entire supply chain, from the initial extraction of raw materials right through to the manufacturing stages.

Sime Darby's commitment to sustainability requires a deep dive into its supply chain's environmental impact. For instance, in 2023, the palm oil industry, a key sector for Sime Darby, faced continued scrutiny regarding deforestation. The company's efforts to increase the use of certified sustainable palm oil (CSPO) are crucial; in 2024, Sime Darby reported that 98.7% of its total palm oil production was certified sustainable, up from 97.3% in 2022, demonstrating tangible progress in this area.

To mitigate risks and bolster its sustainability image, Sime Darby is actively exploring avenues such as incorporating more recycled content into its products and optimizing resource utilization. This strategic focus not only addresses environmental pressures but also presents opportunities for innovation and cost efficiencies within its operations.

Sime Darby faces increasing scrutiny regarding waste management and recycling, driven by stringent environmental regulations. For instance, in Malaysia, the Environmental Quality Act 1974 and its associated regulations, like the Environmental Quality (Scheduled Wastes) Regulations 2005, mandate proper handling and disposal of industrial waste. This means Sime Darby's operations, particularly those involving automotive services and heavy machinery, must adhere to strict protocols for materials such as used oils, batteries, and scrap metal, directly impacting operational costs and necessitating investment in compliant disposal and recycling solutions.

The company is also influenced by global directives like end-of-life vehicle (ELV) regulations, which are becoming more prevalent in key markets. These regulations push for higher recycling rates and the reduction of hazardous substances in vehicles. Sime Darby's commitment to responsible product disposal and recycling is therefore crucial, requiring strategic partnerships with certified recycling facilities to meet these evolving environmental standards and minimize its ecological footprint.

Biodiversity Protection and Land Use

Sime Darby's extensive operations, including the development of new dealerships and industrial sites, are directly impacted by regulations on land use and biodiversity protection. For example, in 2024, Malaysia's National Biodiversity Strategy and Action Plan 2022-2030 emphasizes increased protected areas and sustainable resource management, directly influencing where and how Sime Darby can expand its physical footprint. Companies like Sime Darby must conduct thorough environmental impact assessments and invest in conservation initiatives to comply with these evolving standards.

Adherence to sustainable land management practices is becoming a non-negotiable expectation from both regulators and stakeholders. This includes minimizing habitat disruption and implementing restoration projects. For instance, Sime Darby's commitment to sustainability, as outlined in its 2023 Sustainability Report, highlights efforts in responsible land management across its plantations and property development segments, aiming to balance economic growth with ecological preservation.

The increasing focus on biodiversity means that land development projects must now more rigorously demonstrate minimal negative impact. This often translates to higher costs associated with site selection, environmental mitigation, and ongoing monitoring.

- Regulatory Compliance: Sime Darby must navigate Malaysia's National Biodiversity Strategy and Action Plan 2022-2030, which guides land use and conservation efforts.

- Stakeholder Expectations: There's growing pressure from investors and the public for demonstrable commitment to sustainable land management and biodiversity protection.

- Operational Impact: New developments require careful planning to avoid critical habitats and minimize ecological disruption, potentially increasing project timelines and costs.

- Conservation Investment: Companies are increasingly expected to contribute to conservation efforts, either through direct funding or by implementing robust in-house protection programs.

Customer and Investor Pressure for Green Operations

Customers and investors are increasingly demanding that companies operate more sustainably. This push for greener practices means Sime Darby's focus on energy efficiency, lower emissions, and eco-friendly products is vital. For example, in 2024, sustainable investing saw continued growth, with global ESG (Environmental, Social, and Governance) assets projected to reach $33.9 trillion by 2026, according to Bloomberg Intelligence. This trend directly impacts Sime Darby's brand image and ability to attract capital.

Sime Darby's proactive approach to environmental stewardship can translate into tangible benefits. By investing in sustainable solutions, the company not only meets growing market demand but also strengthens its appeal to a widening pool of environmentally conscious investors. This commitment can lead to:

- Enhanced Brand Reputation: Demonstrating a commitment to green operations builds trust and positive perception.

- Attracting ESG Capital: Companies with strong environmental performance are more attractive to investors focused on ESG criteria, a market segment that is rapidly expanding.

- Meeting Market Demand: Consumers are increasingly choosing products and services from companies that align with their environmental values.

- Improved Investor Relations: Proactive environmental management can lead to better engagement and support from institutional investors.

Environmental factors significantly influence Sime Darby's operations, driven by global climate change policies and growing concerns over resource depletion. The company faces pressure to reduce its carbon footprint and promote eco-friendly products, impacting strategic planning and capital allocation. For instance, Sime Darby reported 98.7% of its palm oil production was certified sustainable in 2024, a testament to its commitment to responsible sourcing.

Strict waste management regulations, like Malaysia's Environmental Quality Act 1974, necessitate compliance for Sime Darby's industrial and automotive sectors, impacting operational costs. Furthermore, evolving end-of-life vehicle regulations globally push for higher recycling rates, requiring strategic partnerships for responsible disposal.

Land use and biodiversity protection regulations, such as Malaysia's National Biodiversity Strategy and Action Plan 2022-2030, affect Sime Darby's expansion plans, demanding thorough environmental impact assessments and conservation investments. Stakeholder expectations for sustainable land management are also rising, influencing development practices and potentially increasing project costs.

The growing demand for sustainable practices from customers and investors, with global ESG assets projected to reach $33.9 trillion by 2026, directly impacts Sime Darby's brand image and access to capital. Proactive environmental stewardship enhances brand reputation, attracts ESG capital, and meets market demand for greener operations.

| Environmental Factor | Impact on Sime Darby | Supporting Data/Examples |

|---|---|---|

| Climate Change Policies | Pressure to reduce carbon footprint, transition to lower-emission products. | EU's 2030 emissions reduction target: 55% compared to 1990 levels. |

| Resource Depletion Concerns | Prioritization of sustainable sourcing throughout the supply chain. | Sime Darby's 2024 certified sustainable palm oil production: 98.7%. |

| Waste Management Regulations | Adherence to strict protocols for industrial waste disposal and recycling. | Malaysia's Environmental Quality (Scheduled Wastes) Regulations 2005. |

| Biodiversity Protection | Impact on land use for new developments, requiring environmental assessments and conservation efforts. | Malaysia's National Biodiversity Strategy and Action Plan 2022-2030. |

| Stakeholder Demand for Sustainability | Enhanced brand reputation, attraction of ESG capital, meeting market demand. | Projected global ESG assets: $33.9 trillion by 2026 (Bloomberg Intelligence). |

PESTLE Analysis Data Sources

Our Sime Darby PESTLE Analysis is meticulously crafted using a comprehensive blend of data from reputable sources, including official government reports, international financial institutions, and leading industry publications. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in accurate and current information.