Sime Darby Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sime Darby Bundle

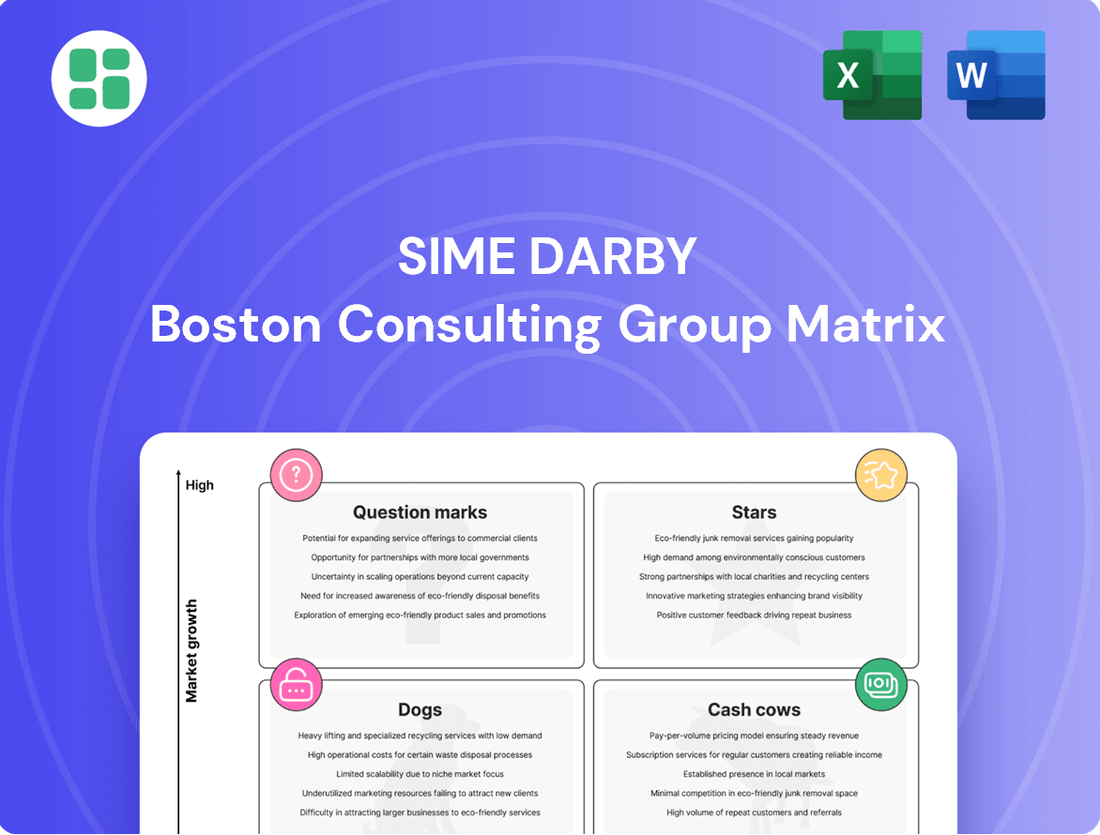

Curious about Sime Darby's product portfolio performance? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a strategic overview. Uncover the full picture and actionable insights by purchasing the complete BCG Matrix report, designed to empower your investment and product development decisions.

Stars

Sime Darby's electric vehicle (EV) sales in Singapore have been a standout performer, contributing significantly to the company's overall revenue and market position. In 2024, Singapore's EV market saw robust growth, with EV registrations increasing by over 50% compared to the previous year, driven by government incentives and growing consumer demand. Sime Darby has capitalized on this trend, securing a substantial market share in Singapore's burgeoning EV segment, which demonstrates a high-growth, high-share scenario within the BCG matrix.

This strong performance in Singapore's EV market places Sime Darby's EV division squarely in the Stars quadrant of the BCG matrix. The rapid expansion of the EV market globally, and particularly in Singapore, signifies a promising growth trajectory. Sime Darby's leading position here necessitates continued strategic investment to maintain its competitive edge, expand its offerings, and further solidify its dominance as the EV market continues its upward climb.

Sime Darby Motors' strategic partnership with BYD has dramatically reshaped Malaysia's electric vehicle landscape. By 2024, BYD, under Sime Darby's distribution, captured an impressive 46% of the Malaysian EV market, becoming the undisputed top-selling brand.

This significant market share in a rapidly expanding sector firmly places BYD in the Star quadrant of the BCG Matrix. While its rapid growth and market dominance are clear strengths, this position necessitates substantial cash investment in infrastructure, charging networks, and aggressive marketing to sustain and further solidify its leadership.

Sime Darby's Industrial Division is positioning its aftermarket services as a Star in its BCG Matrix. This segment, encompassing rental and after-sales support for industrial equipment, is a significant revenue driver.

In fiscal year 2024, aftermarket services accounted for an impressive 63% of the division's total revenue. This strong performance highlights the segment's robust growth within the industrial equipment sector.

Strategic acquisitions, including Onsite Rental Group and Cavpower Group, have further solidified the division's market share in this expanding service-oriented revenue stream, reinforcing its Star status.

Australian Mining Sector Equipment Sales

Sime Darby's industrial division in Australia is performing exceptionally well, largely due to the mining sector's strong demand. This is evident in their impressive RM4.8 billion order book as of December 2024, a record high. The company has secured a significant market share within this expanding market for mining equipment, positioning it as a Star performer that significantly contributes to overall earnings.

The Australian mining equipment market is experiencing substantial growth, fueled by sustained high commodity prices. Sime Darby's strategic positioning and substantial market share in this segment solidify its status as a Star in the BCG Matrix. This strong performance directly translates into robust earnings for the company.

- Record Order Book: RM4.8 billion as of December 2024, highlighting strong demand.

- High Market Share: Dominant position in the growing Australian mining equipment market.

- Key Earnings Driver: This segment is a significant contributor to Sime Darby's overall profitability.

- Favorable Market Conditions: Benefiting from high commodity prices and sector growth.

Perodua and Toyota Businesses in Malaysia (Post-UMW Acquisition)

Sime Darby's acquisition of UMW Holdings, bringing Toyota and Perodua under its Malaysian automotive umbrella, creates a formidable presence. Perodua, a key player, has set an ambitious sales target of 345,000 units for 2025. This strategic move solidifies Sime Darby's dominance in the high-volume Malaysian automotive sector.

The integration positions both Perodua and Toyota as Stars within Sime Darby's portfolio. Despite potential normalization in overall Malaysian auto sales, their strong market share and continued growth prospects in the mass-market segment are undeniable. This growth trajectory is supported by Perodua's consistent sales performance, which has historically outpaced many competitors.

- Perodua's 2025 Sales Target: 345,000 units.

- Market Position: Dominant in the high-volume Malaysian automotive market.

- Growth Potential: Strong within the mass-market segment following the UMW acquisition.

- Strategic Significance: Enhances Sime Darby's automotive market share considerably.

Sime Darby's electric vehicle (EV) sales in Singapore and BYD's performance in Malaysia, driven by strategic partnerships, firmly place these ventures in the Stars quadrant. The industrial division's aftermarket services and Australian mining equipment operations also exhibit Star characteristics due to robust growth and market share. Perodua, under the UMW Holdings acquisition, is another key Star, demonstrating strong sales targets and market dominance.

| Business Unit | BCG Quadrant | Key Performance Indicator | Data Point |

| Sime Darby EVs (Singapore) | Star | Market Share Growth | Over 50% increase in EV registrations in Singapore in 2024. |

| BYD (Malaysia) | Star | Market Share | 46% of Malaysian EV market in 2024. |

| Industrial Aftermarket Services | Star | Revenue Contribution | 63% of division's revenue in FY2024. |

| Industrial (Australia - Mining) | Star | Order Book | RM4.8 billion as of December 2024. |

| Perodua (Malaysia) | Star | Sales Target | 345,000 units for 2025. |

What is included in the product

Sime Darby's BCG Matrix offers a strategic overview of its business units, identifying growth potential and market share.

It guides investment decisions by categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The Sime Darby BCG Matrix provides a clear, one-page overview, relieving the pain of unclear business unit performance and strategic direction.

Cash Cows

Sime Darby's traditional heavy equipment distribution, notably with Caterpillar, represents a significant Cash Cow. This segment benefits from a long-standing presence and high market share in mature industrial markets. For instance, in 2023, Sime Darby Industrial reported a revenue of RM 7.1 billion, underscoring its substantial contribution to the group's overall financial health.

The established nature of these markets means that the need for aggressive marketing or product development is reduced, allowing this division to generate consistent and substantial cash flow. This reliable income stream is crucial for funding growth initiatives in other business areas within Sime Darby. The company's extensive network and strong brand association with Caterpillar solidify its dominant position.

Sime Darby's well-established dealerships for premium brands like BMW and Porsche in Malaysia are classic Cash Cows. These operations hold a significant market share within a stable, high-margin luxury automotive segment.

In 2024, the Malaysian automotive market saw continued demand for premium vehicles, with brands like BMW and Porsche maintaining strong sales figures. These dealerships benefit from brand loyalty and consistent consumer spending on luxury goods, generating substantial and reliable cash flow for Sime Darby.

The Industrial Division's core parts and maintenance operations in stable markets represent a classic Cash Cow for Sime Darby. This segment benefits from consistent demand, even with some price adjustments, ensuring a reliable revenue flow.

This high-market-share, low-growth area is crucial for generating strong, predictable cash flow. For instance, in the fiscal year ending June 30, 2023, Sime Darby's Industrial division reported revenue of RM 13.5 billion, with a significant portion attributed to these stable aftermarket services.

UMW's Automotive Business in Malaysia (excluding EV growth)

UMW's automotive business in Malaysia, primarily driven by Toyota and Perodua, continues to be a strong cash generator. Despite market normalization, these brands maintain a significant market share in the traditional internal combustion engine (ICE) segment.

The consistent demand for these established models translates into stable profits and substantial cash flow for UMW. In 2023, UMW Holdings reported a notable increase in its automotive division's profit before tax, reaching RM 1.04 billion, up from RM 749 million in 2022, highlighting the segment's robust performance.

- Market Dominance: Perodua and Toyota hold a commanding presence in the Malaysian automotive market, consistently ranking among the top brands for sales volume.

- Stable Cash Flow: The high sales volume of established ICE models ensures a predictable and substantial inflow of cash, crucial for funding other business ventures.

- Profitability: Strong brand loyalty and efficient operations allow UMW's automotive segment to deliver consistent and significant profits.

- Contribution to UMW: In the first half of 2024, the automotive segment remained a key contributor to UMW Holdings' financial results, demonstrating its ongoing importance.

Sime Darby Property's Industrial Landed and Commercial Products

Sime Darby Property's industrial landed and commercial products are strong cash generators, reflecting their status as cash cows within the broader group's portfolio. In the first quarter of fiscal year 2025, these segments accounted for a substantial 50% of the company's sales, demonstrating their significant market presence and revenue contribution.

The performance of these industrial and commercial offerings is further bolstered by improved margins, indicating efficient operations and strong pricing power in a market that is both developing and maturing. This robust financial performance directly translates into healthy cash flow for Sime Darby Property's division.

The consistent generation of strong cash flow from these high-margin segments indirectly benefits the larger Sime Darby group, providing financial flexibility and supporting other strategic initiatives. This cash cow status highlights the critical role these property products play in the overall financial health and strategic positioning of Sime Darby.

- Significant Sales Contribution: Industrial products represented 50% of Sime Darby Property's sales in Q1 FY2025.

- Improved Margins: Both industrial and commercial product segments have seen margin enhancements.

- Cash Flow Generation: These segments are key drivers of strong cash flow for the property division.

- Strategic Importance: The cash generated indirectly supports the broader Sime Darby group.

Sime Darby's established heavy equipment distribution, particularly with Caterpillar, functions as a prime Cash Cow. This segment thrives due to its long-standing market presence and substantial market share in mature industrial sectors. In fiscal year 2023, Sime Darby Industrial achieved revenues of RM 7.1 billion, showcasing its significant financial contribution to the group.

The mature nature of these markets minimizes the need for extensive marketing or rapid product development, enabling this division to consistently generate robust cash flow. This reliable income stream is vital for financing growth opportunities in other Sime Darby business units, further solidifying its position.

Sime Darby's premium automotive dealerships, such as BMW and Porsche in Malaysia, are prime examples of Cash Cows. These operations command a significant market share within the stable, high-margin luxury vehicle segment. The Malaysian automotive market in 2024 continued to see robust demand for premium vehicles, with BMW and Porsche reporting strong sales figures, underscoring the segment's consistent profitability.

The industrial landed and commercial property offerings from Sime Darby Property are also strong cash generators, firmly establishing them as Cash Cows. In the first quarter of fiscal year 2025, these segments collectively represented 50% of the company's total sales, highlighting their significant market penetration and revenue impact. These segments benefit from enhanced margins, indicative of efficient operations and strong pricing power in both developing and established markets.

| Business Segment | Role in BCG Matrix | Key Performance Indicator (FY23/Q1 FY25) | Rationale |

|---|---|---|---|

| Heavy Equipment Distribution (Caterpillar) | Cash Cow | RM 7.1 billion revenue (FY23) | High market share in mature industrial markets, consistent cash generation. |

| Premium Automotive Dealerships (BMW, Porsche) | Cash Cow | Strong sales figures (2024) | Dominant position in stable, high-margin luxury automotive segment. |

| Industrial Landed & Commercial Property | Cash Cow | 50% of sales (Q1 FY25) | High sales contribution, improved margins, consistent cash flow. |

Full Transparency, Always

Sime Darby BCG Matrix

The Sime Darby BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report is meticulously designed to provide a clear strategic overview of Sime Darby's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate. You can confidently proceed with your purchase, knowing you are acquiring a fully formatted, analysis-ready tool ready for immediate integration into your strategic planning processes.

Dogs

Sime Darby's China Motors Division's greenfield dealerships are currently experiencing substantial losses. This underperformance is largely attributed to fierce price competition within the Chinese automotive market, which has significantly eroded market share and growth potential for these newer ventures. For instance, in the fiscal year 2024, the China Motors division reported a net loss of RM 150 million, with a significant portion stemming from these specific greenfield operations.

These dealerships are essentially cash traps, demanding continuous capital infusion without generating commensurate returns. The intense market dynamics and low market share suggest that these assets are unlikely to recover without a drastic strategic shift. Sime Darby is therefore evaluating options ranging from divestment to comprehensive restructuring to mitigate further financial drain.

Sime Darby's legacy oil and gas liabilities, retranslated in Q1 FY2025, highlight past ventures that likely fit the 'Dog' category. While this retranslation yielded a gain, it signifies a segment that was probably low-growth and held a small market share.

These residual liabilities, if still requiring active management, are characteristic of a 'Dog' in the BCG Matrix. Their non-core status and potential for value destruction, even with a recent gain, suggest they are a drain on resources without significant future prospects.

Sime Darby's motors division saw a dip in its profit before interest and taxes (PBIT) during Q1 FY2025. This was primarily driven by decreased vehicle sales in specific Malaysian and Australasian markets. The luxury segment, in particular, experienced a noticeable slowdown, alongside a broader softening of consumer demand.

These underperforming segments, characterized by low market share within shrinking sub-sectors, would align with the characteristics of Dogs in the BCG Matrix. For instance, if luxury car sales in a particular Australasian market represent a small fraction of Sime Darby's overall business and that specific market segment is contracting, it fits the Dog profile.

Certain Non-Core or Land Bank Assets Targeted for Divestment

Sime Darby is strategically evaluating the divestment of certain non-core assets and its land bank. This move suggests these assets are not central to the company's primary growth engines and likely hold a minor position within their respective markets, aligning with the characteristics of 'Dogs' in the BCG Matrix.

The decision to explore monetization indicates Sime Darby's intention to exit these underperforming or non-strategic areas. For instance, in 2024, Sime Darby Property, a subsidiary, announced plans to potentially divest non-strategic land parcels, aiming to unlock capital and focus resources on higher-yield developments.

- Non-core assets identified for potential divestment.

- Land bank assets are also targeted for monetization.

- These assets likely exhibit low market share and slow growth.

- Divestment signals a strategic exit to reallocate capital.

Segments Heavily Impacted by Supply Chain Delays in Manufacturing & Engineering

The manufacturing and engineering sectors within UMW, particularly aerospace and lubricants, are currently facing headwinds due to persistent supply chain disruptions and necessary price adjustments. These challenges can significantly impact production timelines and profitability, especially for components with long lead times or volatile raw material costs.

If Sime Darby holds a minor position in these specific manufacturing and engineering niches, and these markets are experiencing limited growth or are in a state of decline, then these segments would likely be classified as Dogs in the BCG Matrix. This classification suggests that these businesses require careful management to minimize cash outflow and potentially divest if they are not expected to improve.

For instance, the global aerospace sector in 2024 continues to grapple with aircraft production rate increases that strain existing supply chains, leading to extended delivery times for critical components. Similarly, the lubricants market, while generally stable, can be subject to price volatility driven by crude oil prices and geopolitical factors, impacting margins for manufacturers.

- Aerospace Components: Facing extended lead times for specialized materials and parts, impacting production schedules.

- Lubricant Pricing: Experiencing upward price adjustments due to fluctuating raw material costs, affecting profitability.

- Market Growth: If these specific M&E niches are in low-growth or declining markets, their potential for future expansion is limited.

- Sime Darby's Share: A low market share in these challenged segments reinforces their potential classification as Dogs.

Sime Darby's China Motors Division's greenfield dealerships are currently experiencing substantial losses, with the division reporting a net loss of RM 150 million in fiscal year 2024. These dealerships are cash traps demanding continuous capital infusion without generating commensurate returns, indicating they are likely 'Dogs' in the BCG Matrix.

Sime Darby's legacy oil and gas liabilities, even with a recent gain in Q1 FY2025, represent a segment that was probably low-growth and held a small market share, characteristic of a 'Dog'. Their non-core status suggests they are a drain on resources without significant future prospects.

Underperforming segments within the motors division, such as luxury car sales in specific Australasian markets experiencing a slowdown and contracting consumer demand, align with the characteristics of 'Dogs' due to low market share in shrinking sub-sectors.

The potential divestment of non-core assets and land bank, as indicated by Sime Darby Property's plans in 2024 to divest non-strategic land parcels, suggests these assets likely exhibit low market share and slow growth, fitting the 'Dog' profile and signaling a strategic exit.

Question Marks

Sime Darby's strategic expansion into the electric vehicle (EV) sector, marked by the introduction of brands like Denza in Malaysia during Q1 2025, positions these new models as potential Question Marks within its BCG Matrix. Leveraging BYD's advanced technology, these vehicles enter a rapidly expanding EV market, a segment projected to grow significantly in Southeast Asia.

While the overall EV market is experiencing high growth, Sime Darby's market share for these new entrants is currently low. This necessitates substantial investment in marketing, distribution, and brand building to capture consumer interest and establish a foothold.

The Malaysian EV market, for instance, saw registrations of over 10,000 units in 2023, a substantial increase from previous years, indicating strong demand. Denza's entry aims to capitalize on this, but initial market penetration will likely be modest, requiring Sime Darby to pour resources into these ventures to transform them into future Stars.

Sime Darby's focus on sustainable innovation and customer needs hints at a push into digital services for industrial equipment. Think predictive maintenance powered by IoT, which can reduce downtime and boost efficiency for their clients. These are emerging markets with significant growth potential.

In 2024, the industrial IoT market alone was valued at over $100 billion, demonstrating the vast opportunity. Sime Darby's nascent position in this segment suggests they are likely in the question mark category, investing to capture future market share.

Sime Darby's expansion into new geographical markets for niche products, like their BMW dealerships in Indonesia starting April 2023, positions them as a potential 'Question Mark' in the BCG Matrix. This move targets a high-growth market, as Indonesia's automotive sector is experiencing significant expansion.

The company's investment in establishing a presence for these specialized offerings requires substantial capital outlay to build market share in a competitive landscape. This strategic expansion, while promising, carries inherent risks associated with market penetration and brand establishment for niche automotive segments.

Investments in Data Centre Infrastructure Projects in Malaysia

Sime Darby Property's engagement in hyperscale data center development, securing substantial lease values, highlights a strategic push into high-growth infrastructure. This aligns with the broader group's vision, even though the direct operational footprint in data centers might be nascent.

The data center market in Malaysia is experiencing robust growth, driven by increasing digitalization and cloud adoption. For instance, Malaysia's data center market size was valued at approximately USD 1.7 billion in 2023 and is projected to grow at a CAGR of over 13% from 2024 to 2029, reaching an estimated USD 3.6 billion by 2029.

Within the Sime Darby BCG Matrix, these data center infrastructure projects, despite their potential, could be classified as Question Marks. This is because while the market itself is a star performer, Sime Darby's current market share in the actual operation and management of data centers, as opposed to property development, may be relatively low compared to established global players.

- Market Growth: Malaysia's data center market is expanding rapidly, with significant investment inflows.

- Strategic Alignment: Sime Darby Property's involvement reflects a group-level interest in future-oriented infrastructure.

- Question Mark Classification: Potential for high growth exists, but Sime Darby's current operational market share in data centers may be limited, requiring careful investment decisions.

Future Perodua EV Launch (Expected December 2025)

Sime Darby's forthcoming Perodua EV, slated for a December 2025 debut, is positioned as a potential Star in the BCG matrix. This move targets the burgeoning mass-market electric vehicle segment, a sector experiencing rapid expansion. Currently, Perodua holds no market share in EVs, necessitating significant capital allocation for research, development, manufacturing, and promotional activities to elevate this new product.

The launch of the Perodua EV is a strategic play to capture a share of the rapidly growing electric vehicle market. In 2024, global EV sales are projected to exceed 15 million units, indicating substantial demand. Sime Darby's investment in this segment aims to transform Perodua from a question mark into a star performer by establishing a strong foothold.

- Target Market: Mass-market consumers seeking affordable electric mobility.

- Investment: High upfront costs for R&D, production facilities, and marketing campaigns.

- Market Position: Entering a high-growth, competitive EV landscape with zero existing market share.

- Potential: Aims to achieve Star status by capturing significant market share in the EV segment.

Sime Darby's new ventures, like the Denza EV in Malaysia (Q1 2025) and the upcoming Perodua EV (December 2025), are classic Question Marks. They operate in high-growth markets, such as the Malaysian EV sector which saw over 10,000 registrations in 2023, but currently hold minimal market share. Significant investment is required to build brand awareness and distribution networks, aiming to convert these into future Stars.

The company's push into industrial IoT services, tapping into a market valued over $100 billion in 2024, also fits the Question Mark profile. These initiatives require substantial capital for development and market penetration, with the goal of capturing future market share in a rapidly evolving technological landscape.

Similarly, Sime Darby's expansion into new markets with niche products, such as BMW dealerships in Indonesia (starting April 2023), represents Question Marks. These ventures are in high-growth automotive sectors but demand considerable investment to establish a competitive presence against existing players.

Sime Darby Property's development of hyperscale data centers is another example. While the Malaysian data center market is projected to grow from USD 1.7 billion in 2023 to USD 3.6 billion by 2029, Sime Darby's operational market share in this specific segment is likely low, classifying it as a Question Mark requiring strategic investment.

| Sime Darby Business Unit | BCG Category | Market Growth | Market Share | Investment Rationale |

| Denza EV (Malaysia) | Question Mark | High (EV Sector) | Low | Capital intensive to build brand and distribution. |

| Perodua EV (Malaysia) | Question Mark | High (Mass-market EV) | Zero | Significant R&D, manufacturing, and marketing investment needed. |

| Industrial IoT Services | Question Mark | High (Global IoT Market > $100B in 2024) | Low | Requires investment in technology and market penetration. |

| BMW Dealerships (Indonesia) | Question Mark | High (Indonesian Automotive Sector) | Low | Capital outlay for market entry and brand establishment. |

| Data Center Development | Question Mark | High (Malaysia Data Center Market ~13% CAGR) | Low (Operational) | Investment in infrastructure to capture future demand. |

BCG Matrix Data Sources

Our Sime Darby BCG Matrix leverages a robust data foundation, incorporating financial disclosures, industry-specific market research, and internal performance metrics to ensure strategic accuracy.