Siemens Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Energy Bundle

Unlock the strategic forces shaping Siemens Energy's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities. Download the full version now for actionable intelligence to refine your own market approach and gain a significant competitive advantage.

Political factors

Governments globally are pushing for a faster energy transition, with policies aimed at cutting carbon emissions and boosting renewables. For instance, the EU Green Deal, targeting climate neutrality by 2050, and numerous national net-zero commitments are shaping market demand. These initiatives directly impact Siemens Energy, driving growth in areas like hydrogen technology and advanced grid solutions, with the company actively investing in these sectors to align with these policy shifts.

Global geopolitical events, such as the ongoing conflict in Ukraine, have underscored the critical importance of energy security for nations. This volatility directly impacts the energy sector, influencing supply chains and pricing for critical components Siemens Energy utilizes.

Siemens Energy's diversified portfolio, spanning gas turbines, wind power, and hydrogen technologies, positions it as a key player in helping countries achieve energy independence. For instance, the company's gas turbine business is vital for reliable baseload power, while its renewable energy divisions support diversification away from single-source dependencies.

The drive for resilient energy systems, amplified by recent global challenges, is a significant market driver. In 2023, Siemens Energy reported a notable increase in orders for its gas turbine business, reflecting this demand for stable and secure power generation solutions, with orders growing by 13% year-on-year to €35.5 billion.

International trade policies, including tariffs and trade agreements, directly influence Siemens Energy's global supply chains and overall cost structures. For instance, the US government's announcement of new tariffs in April 2025 necessitates close monitoring and impact analysis.

Siemens Energy is actively assessing these developments, anticipating a limited direct financial impact for the latter half of fiscal year 2025 due to implemented mitigation strategies. However, such evolving trade policies introduce a layer of economic uncertainty that requires ongoing strategic adaptation.

Subsidies and Incentives for Renewable Energy

Government subsidies and tax credits are crucial drivers for renewable energy adoption, directly impacting companies like Siemens Energy. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, provides significant incentives, extending through 2030, which bolster the economic feasibility of wind and solar projects. This legislation alone is projected to spur hundreds of billions of dollars in clean energy investments over the next decade.

These financial mechanisms are vital for Siemens Energy, especially its Siemens Gamesa division, a major player in wind turbine manufacturing. The stability and predictability of these incentives directly influence Siemens Energy's investment decisions and the pace of renewable energy project development globally. For example, in 2023, the European Union's renewable energy targets continued to encourage substantial investment in the sector, with many member states offering their own national support schemes.

- IRA Impact: The US Inflation Reduction Act is expected to drive over $1.7 trillion in clean energy investments by 2030.

- EU Support: European nations are increasingly relying on subsidies and feed-in tariffs to meet ambitious renewable energy goals.

- Investment Decisions: The long-term availability of incentives directly affects Siemens Energy's capital allocation for new projects and manufacturing capacity.

- Market Growth: Reliable government support is a key factor in the sustained growth of the wind and solar power markets where Siemens Energy operates.

Regulatory Frameworks for Power Grids

Government policies and regulatory frameworks significantly shape the power grid and energy infrastructure landscape. These regulations often mandate grid modernization, prioritize reliability, and encourage the integration of renewable energy sources, directly impacting companies like Siemens Energy.

Siemens Energy's Grid Technologies segment is well-positioned to capitalize on these mandates. For instance, the push for grid resilience and the integration of distributed energy resources (DERs) fuels demand for advanced solutions such as smart grids and high-voltage direct current (HVDC) transmission systems. In 2024, global investment in grid modernization was projected to reach hundreds of billions of dollars, driven by these regulatory imperatives.

- Regulatory Mandates: Governments worldwide are implementing policies to upgrade aging power grids and incorporate cleaner energy sources, creating opportunities for grid technology providers.

- Smart Grid Adoption: Regulations promoting smart grid technologies are increasing, encouraging investments in areas like advanced metering infrastructure and grid automation.

- Renewable Integration: Policies supporting renewable energy targets necessitate robust grid infrastructure, driving demand for HVDC and flexible grid solutions.

- Grid Resilience: A growing focus on grid resilience against extreme weather events and cyber threats is leading to stricter regulatory standards for grid stability and security.

Government policies are a primary driver for Siemens Energy, with a strong global push towards decarbonization and renewable energy adoption. The EU's commitment to climate neutrality by 2050, for example, directly stimulates demand for Siemens Energy's hydrogen and grid solutions.

Geopolitical instability, such as the conflict in Ukraine, has heightened the focus on energy security, benefiting Siemens Energy's reliable gas turbine solutions. This trend is reflected in their 2023 order intake, which saw a 13% increase year-on-year to €35.5 billion, underscoring the demand for stable power generation.

Government incentives, like the US Inflation Reduction Act, are crucial for renewable energy projects, potentially driving over $1.7 trillion in clean energy investments by 2030. These subsidies directly influence Siemens Energy's investment decisions, particularly for its wind power division, Siemens Gamesa.

Regulatory frameworks mandating grid modernization and renewable integration are also key. Global investment in grid modernization was projected to reach hundreds of billions of dollars in 2024, creating significant opportunities for Siemens Energy's Grid Technologies segment, especially for advanced solutions like HVDC transmission.

What is included in the product

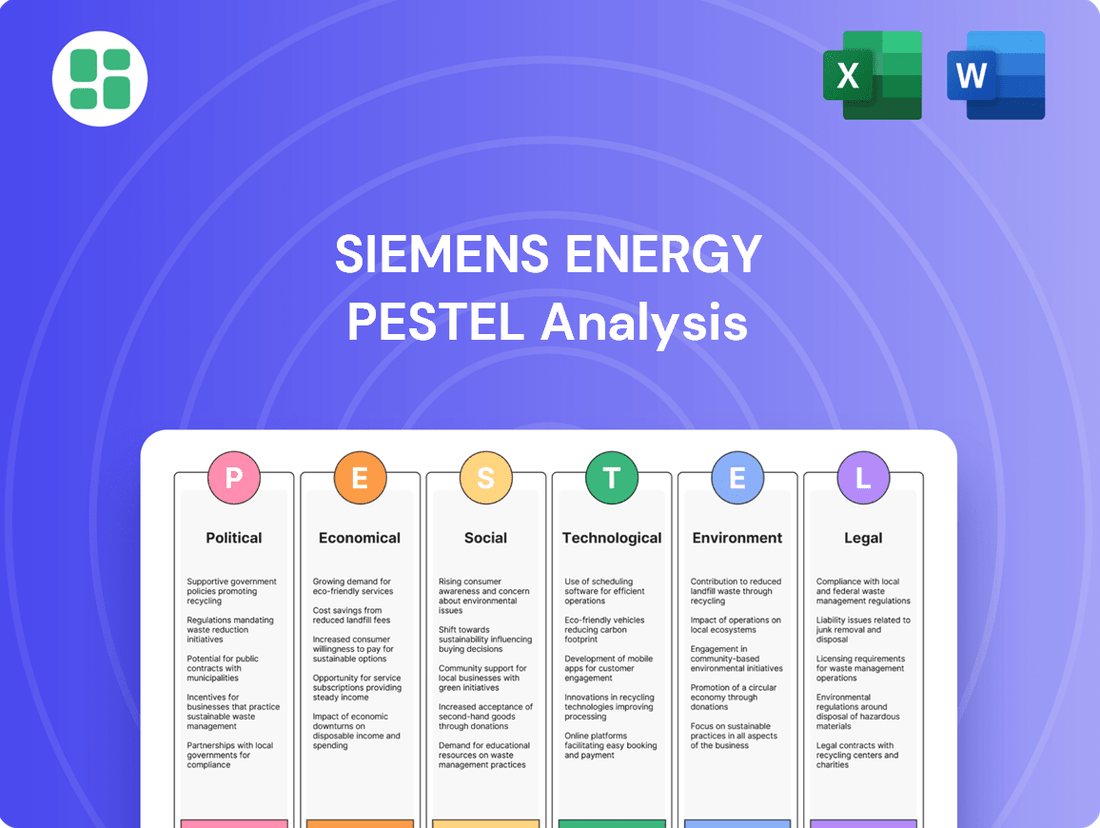

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Siemens Energy's global operations, providing a strategic framework for navigating the energy sector's complex landscape.

A concise, visually segmented PESTLE analysis of Siemens Energy, presented in a clear and simple language, empowers stakeholders to quickly grasp external factors impacting the business and supports informed discussions on risk and market positioning.

Economic factors

The robust health of the global economy and industrial sectors is a primary driver for energy demand, directly influencing the market for Siemens Energy's offerings. Strong economic expansion typically translates to higher energy consumption and increased investment in power generation infrastructure and industrial processes.

Siemens Energy's Q2 FY2025 results, showcasing double-digit revenue growth across all its business segments, underscore this correlation. This positive performance is indicative of favorable market conditions, fueled by the escalating global demand for electricity and energy solutions.

Inflationary pressures and rising interest rates significantly impact project financing costs and the profitability of long-term energy infrastructure. For instance, the Eurozone experienced an inflation rate of 2.4% in May 2024, a slight increase from April's 2.4%, highlighting persistent cost pressures. This means Siemens Energy faces higher expenses for raw materials, transportation, and labor, directly affecting its margins.

Furthermore, increased borrowing costs for Siemens Energy's customers, driven by central bank rate hikes, can lead to delayed or reduced investments in new energy projects. The European Central Bank's key interest rates remained at 3.75% as of June 2024, making capital more expensive. This economic environment necessitates robust cost management strategies for Siemens Energy to achieve its profitability targets.

Fluctuations in energy commodity prices, especially natural gas, directly impact the demand for various power generation technologies. Siemens Energy, while expanding in renewables and grid solutions, still sees its Gas Services segment as a key business driver.

For instance, in the first quarter of 2024, Siemens Energy reported a significant increase in its Gas Services order intake, partly driven by the need for reliable power generation amidst volatile energy markets. Stable or increasing natural gas prices can bolster the demand for gas turbines and associated services, reinforcing Siemens Energy's strong order backlog in this sector.

Currency Exchange Rate Fluctuations

Siemens Energy, as a global player with operations in over 90 countries, is significantly influenced by currency exchange rate fluctuations. These shifts can alter the value of its international revenues and expenses when converted into its primary reporting currency, the Euro, directly impacting its overall financial health. For instance, a stronger Euro could reduce the reported value of earnings generated in weaker currencies, while a weaker Euro would have the opposite effect.

To offer a clearer picture of its operational performance, Siemens Energy often presents its financial results on a comparable basis. This involves adjusting for currency translation effects, allowing stakeholders to better understand the underlying business trends without the noise of currency volatility. This practice is crucial for investors and analysts trying to gauge the company's organic growth and profitability.

- Impact on Revenue: In 2023, Siemens Energy reported that currency translation effects had a notable impact on its revenue, with unfavorable currency movements leading to a reduction in reported figures for certain segments.

- Hedging Strategies: The company employs various financial instruments to hedge against currency risks, aiming to mitigate the negative consequences of adverse exchange rate movements on its profitability.

- Regional Performance: Fluctuations can disproportionately affect performance in specific regions; for example, significant currency depreciation in emerging markets might boost local currency earnings but translate to lower Euro-denominated results.

- Cost of Goods Sold: Beyond revenue, currency rates also impact the cost of goods sold for components sourced internationally, affecting gross margins.

Investment Cycles in Energy Infrastructure

The energy sector, particularly power generation and transmission, operates on extended investment cycles. Siemens Energy's financial health is directly linked to these long-term investment trends, which are shaped by regulatory frameworks, technological innovation, and the broader economic climate.

Siemens Energy's robust order backlog, reaching €133 billion by the second quarter of fiscal year 2025, underscores significant current investment activity in global energy infrastructure. This backlog reflects a strong demand for the company's solutions across various energy segments.

- Government Policies: Subsidies for renewables and carbon pricing mechanisms significantly influence investment decisions in new energy infrastructure.

- Technological Advancements: Innovations in areas like hydrogen technology and grid modernization drive capital expenditure.

- Economic Outlook: Global economic growth directly impacts energy demand and the willingness of utilities and industries to invest in upgrades and new builds.

Global economic expansion directly fuels demand for Siemens Energy's products and services, as seen in their Q2 FY2025 results which showed double-digit revenue growth across all segments. However, persistent inflation, with the Eurozone at 2.4% in May 2024, increases operational costs and makes financing more expensive, as evidenced by the European Central Bank's key interest rates remaining at 3.75% in June 2024. Fluctuations in natural gas prices also play a crucial role, with strong demand in Q1 2024 boosting Siemens Energy's Gas Services segment orders, highlighting the interplay between commodity prices and energy infrastructure investment.

| Economic Factor | Impact on Siemens Energy | Data Point (2024/2025) |

|---|---|---|

| Global Economic Growth | Increases energy demand and investment in infrastructure. | Q2 FY2025: Double-digit revenue growth across all segments. |

| Inflation | Raises operational costs (materials, labor) and project financing expenses. | Eurozone Inflation (May 2024): 2.4%. |

| Interest Rates | Increases borrowing costs for customers, potentially delaying projects. | ECB Key Interest Rates (June 2024): 3.75%. |

| Energy Commodity Prices (e.g., Natural Gas) | Influences demand for specific power generation technologies. | Q1 2024: Strong order intake in Gas Services segment. |

| Currency Exchange Rates | Affects the reported value of international revenues and expenses. | 2023: Currency translation effects notably impacted reported revenue. |

Preview the Actual Deliverable

Siemens Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Siemens Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Understand the external forces shaping Siemens Energy's future landscape with this detailed report.

Sociological factors

Public attitudes significantly shape the success of new energy technologies. For instance, a 2024 survey indicated that 68% of European consumers are willing to pay a premium for electricity generated from renewable sources, demonstrating a strong societal push towards cleaner energy solutions that Siemens Energy's portfolio supports.

Siemens Energy's proactive communication, emphasizing its role in building a resilient and sustainable energy future, is key to gaining this public trust. Their focus on technologies like hydrogen-ready turbines directly addresses public concerns about energy security and environmental impact, fostering acceptance for these critical infrastructure upgrades.

Societal awareness regarding environmental issues and the escalating climate crisis is fueling a significant global surge in demand for sustainable and green energy solutions. This trend is a primary driver for companies like Siemens Energy.

Siemens Energy is strategically positioned to capitalize on this demand by emphasizing power generation technologies that produce low or zero emissions, alongside advancements in efficient electricity transmission and storage. Their focus also extends to helping industries reduce their carbon footprint.

The company's product and service offerings are directly aligned with this societal evolution towards a cleaner energy landscape. For instance, in 2023, Siemens Energy reported a substantial increase in orders for its gas turbines equipped with hydrogen blending capabilities, indicating a strong market appetite for their decarbonization solutions.

The global shift towards cleaner energy sources, particularly in 2024 and 2025, is creating a significant demand for a specialized workforce. This demand directly impacts Siemens Energy's ability to execute projects and drive innovation. For instance, the International Renewable Energy Agency (IRENA) projects that the renewable energy sector could employ over 43 million people globally by 2030, a substantial increase from current figures, highlighting the need for skilled personnel.

Siemens Energy, a company with a vast global presence and over 98,000 employees, faces the critical challenge of attracting and retaining talent with expertise in areas like renewable energy technologies, digital solutions for grid management, and advanced manufacturing processes. The company’s success in navigating the energy transition hinges on its capacity to secure individuals proficient in these evolving fields.

To bridge potential skill gaps within its workforce, Siemens Energy must continue to prioritize and expand its investments in comprehensive training and development programs. These initiatives are crucial for equipping employees with the necessary competencies to adapt to the rapidly changing landscape of the energy sector, ensuring the company remains competitive and at the forefront of technological advancements.

Corporate Social Responsibility (CSR) and Stakeholder Expectations

Siemens Energy faces growing pressure regarding its corporate social responsibility (CSR) and the impact of its operations on communities. Adhering to sustainable practices and transparently reporting on environmental and social performance are crucial for reputation and attracting ethically-minded investors. For instance, in its 2023 sustainability report, Siemens Energy highlighted a reduction in its Scope 1 and 2 greenhouse gas emissions by 16% compared to the previous year, demonstrating a tangible commitment to environmental stewardship.

The company's dedication to principles like the UN Global Compact reinforces its focus on these critical areas. This commitment is further evidenced by its detailed sustainability reports, which provide stakeholders with insights into its social and environmental performance metrics. These reports are essential for building trust and demonstrating accountability to a broad range of stakeholders, from employees and customers to investors and the public.

- Reputation Management: Societal expectations for ethical business conduct are intensifying, directly impacting a company's brand image and ability to attract talent and customers.

- Investor Attraction: A strong CSR record, including transparent reporting on environmental, social, and governance (ESG) factors, is increasingly a prerequisite for attracting capital from ethical investors, a segment that saw significant growth in 2024.

- Operational Alignment: Integrating CSR into core business strategies, such as Siemens Energy's focus on decarbonization technologies, can create both social value and competitive advantage.

- Stakeholder Engagement: Proactive engagement with stakeholders on CSR issues, including community impact and supply chain responsibility, is vital for mitigating risks and fostering long-term relationships.

Urbanization and Energy Demand in Developing Regions

Rapid urbanization and industrialization across developing regions are creating an unprecedented surge in energy demand. For instance, projections indicate that by 2050, urban populations in Africa will nearly quadruple, placing immense pressure on existing energy infrastructure. This dynamic environment necessitates innovative and robust energy solutions, presenting a substantial growth avenue for Siemens Energy.

Siemens Energy is strategically positioned to capitalize on these evolving energy needs. Their global footprint allows them to tailor solutions for diverse markets, from powering burgeoning megacities to supporting industrial expansion. The company's focus on scalable and reliable energy technologies, including renewable integration and efficient grid management, directly addresses the challenges posed by this rapid demographic and economic shift.

- Growing Urban Populations: By 2030, it's estimated that over 60% of the world's population will reside in urban areas, with the majority of this growth occurring in developing nations.

- Increased Industrial Activity: Developing economies are experiencing significant industrial growth, driving up demand for electricity to power factories and manufacturing processes.

- Energy Infrastructure Needs: The International Energy Agency (IEA) highlights that substantial investment is required in energy infrastructure in these regions to meet projected demand, creating opportunities for companies like Siemens Energy.

Public acceptance of new energy technologies significantly influences Siemens Energy's market penetration. A 2024 survey revealed that 68% of European consumers are willing to pay more for renewable energy, underscoring a societal preference for cleaner sources that aligns with Siemens Energy's offerings.

Societal awareness of climate change continues to drive demand for sustainable energy solutions, directly benefiting Siemens Energy. In 2023, the company saw a notable increase in orders for its hydrogen-ready gas turbines, reflecting market confidence in its decarbonization technologies.

The growing global demand for skilled labor in the renewable energy sector, projected by IRENA to reach over 43 million jobs by 2030, presents both an opportunity and a challenge for Siemens Energy in talent acquisition and development.

Siemens Energy's commitment to corporate social responsibility, demonstrated by a 16% reduction in Scope 1 and 2 emissions in 2023, is crucial for attracting ethically-minded investors and maintaining a positive brand reputation.

Technological factors

Siemens Energy is heavily invested in the ongoing innovation within renewable energy sectors, with a particular focus on wind, solar, and the burgeoning hydrogen market. This commitment is a cornerstone of their strategic direction, aiming to significantly ramp up renewable power generation and establish robust green hydrogen production capabilities.

The company's subsidiary, Siemens Gamesa, is actively developing next-generation wind turbines designed for enhanced efficiency and output. Concurrently, Siemens Energy is pushing forward with its electrolyzer product lines, a move intended to drive sales growth and provide critical support for global decarbonization initiatives.

In 2023, Siemens Energy reported a substantial increase in its order intake for electrolyzers, signaling strong market demand for green hydrogen solutions. This growth trajectory is expected to continue through 2024 and 2025 as more industries seek to transition to cleaner energy sources.

The energy sector's digital transformation is accelerating with smart grid advancements and innovative digital solutions. Siemens Energy is at the forefront, providing expertise in grid digitalization, advanced grid components, and compact energy systems designed for enhanced resilience and operational efficiency. These offerings are crucial for modernizing energy infrastructure, with the global smart grid market projected to reach over $100 billion by 2027, highlighting the significant investment in this area.

Siemens Energy's commitment to digital solutions is exemplified by its Siemens Xcelerator platform, which empowers customers to leverage digital technologies for improved performance and sustainability. This platform facilitates the integration of disruptive grid elements and high-energy-density systems, enabling better fault detection and optimized energy management. The company's focus on these areas positions it to capitalize on the growing demand for intelligent and adaptable energy networks.

Advancements in energy storage, particularly in battery technologies and Power-to-X solutions like green hydrogen, are vital for incorporating variable renewable energy sources into power grids. Siemens Energy is actively investing in these critical areas, including high-temperature heat pumps and CO₂ electrolysis, which are foundational for efficient energy storage and the decarbonization of heavy industry.

Efficiency Improvements in Conventional Power Generation

Siemens Energy isn't solely focused on renewables; they are also making significant strides in enhancing the efficiency and adaptability of traditional power generation, particularly with gas and steam turbines. This dual approach is crucial for a balanced energy transition. A key development is their work on hydrogen-ready gas turbines, designed to accommodate cleaner fuels in the future. Furthermore, modernizing existing conventional power plants is a priority to cut down emissions and maintain grid reliability as the energy landscape shifts.

This commitment is underscored by tangible projects, such as Siemens Energy's contract to deliver state-of-the-art gas and steam turbines for new power facilities in Saudi Arabia. This deal, valued in the hundreds of millions of Euros, demonstrates the ongoing demand for advanced conventional power technology that can operate more cleanly and efficiently. These upgrades are vital for ensuring a stable power supply while simultaneously reducing the environmental impact of existing infrastructure.

Siemens Energy's efforts in this area are reflected in their technological advancements:

- Development of hydrogen-ready gas turbines: Enabling a future transition to cleaner fuels.

- Modernization of existing assets: Improving efficiency and reducing emissions in current power plants.

- Contract wins for advanced turbines: Such as the significant deal in Saudi Arabia, showcasing market relevance and technological capability.

- Focus on grid stability: Ensuring reliable power delivery during the ongoing energy transition.

Cybersecurity Threats to Energy Infrastructure

The increasing digitalization of energy grids and industrial control systems, driven by the adoption of smart grid technologies and the Internet of Things (IoT), significantly expands the attack surface for cyber threats. This trend, evident across the global energy sector, means that critical infrastructure is more vulnerable than ever to disruptions. For instance, a 2024 report by the U.S. Department of Energy highlighted a rise in sophisticated cyberattacks targeting energy utilities, emphasizing the need for enhanced defenses.

Siemens Energy, as a key player in providing advanced energy technologies, faces a direct imperative to invest substantially in robust cybersecurity measures. This investment is crucial not only for safeguarding its internal operations and intellectual property but also for protecting the critical infrastructure it supplies to customers worldwide. The company's commitment to cybersecurity is directly linked to its ability to maintain customer trust and ensure the uninterrupted operation of power generation and distribution systems. In 2024, Siemens Energy announced a significant increase in its cybersecurity R&D budget, aiming to develop next-generation protective solutions for the evolving threat landscape.

Ensuring the security of digital energy solutions is paramount for maintaining reliable power delivery and preventing cascading failures. The interconnected nature of modern energy systems means that a breach in one area can have widespread consequences. Siemens Energy's focus on secure-by-design principles for its digital offerings, such as its grid control software and turbine monitoring systems, is essential. The company's proactive approach to cybersecurity is a critical factor in its long-term strategy for supporting the global energy transition and ensuring grid stability.

- Increased Digitalization: The energy sector's move towards smart grids and IoT devices creates new vulnerabilities.

- Cybersecurity Investment: Siemens Energy must prioritize substantial investment in advanced cybersecurity to protect its assets and customer infrastructure.

- Reliable Power Delivery: Securing digital energy solutions is fundamental to ensuring the continuous and stable supply of electricity.

- Evolving Threats: The sophistication of cyberattacks necessitates continuous adaptation and innovation in security measures.

Siemens Energy is heavily invested in technological advancements, particularly in renewable energy like wind and solar, and the growing hydrogen market. The company's subsidiary, Siemens Gamesa, is developing more efficient wind turbines, while Siemens Energy is expanding its electrolyzer production to support global decarbonization efforts.

The company is also a leader in the digital transformation of the energy sector, offering solutions for smart grids and compact energy systems to enhance resilience. Siemens Energy's Siemens Xcelerator platform helps customers leverage digital technologies for better performance and sustainability, integrating disruptive grid elements for optimized energy management.

Siemens Energy is also focusing on energy storage technologies, including battery solutions and Power-to-X systems like green hydrogen. Investments in high-temperature heat pumps and CO₂ electrolysis are crucial for efficient energy storage and decarbonizing heavy industries.

The increasing digitalization of energy systems, driven by smart grids and IoT, presents significant cybersecurity challenges. Siemens Energy is boosting its cybersecurity R&D to protect its operations and customer infrastructure, recognizing the critical need for robust defenses against evolving cyber threats to ensure reliable power delivery.

| Technology Focus | Key Initiatives | Market Impact/Outlook |

|---|---|---|

| Renewable Energy | Next-gen wind turbines (Siemens Gamesa), Electrolyzer production | Strong order intake for electrolyzers in 2023, expected continued growth through 2024-2025. |

| Digitalization & Smart Grids | Grid digitalization, compact energy systems, Siemens Xcelerator platform | Global smart grid market projected to exceed $100 billion by 2027. |

| Energy Storage | Battery technologies, Power-to-X (green hydrogen), heat pumps, CO₂ electrolysis | Foundational for integrating variable renewables and decarbonizing industry. |

| Cybersecurity | Increased R&D investment, secure-by-design principles for digital offerings | Essential for protecting critical infrastructure amidst rising cyber threats in 2024. |

Legal factors

Siemens Energy operates under increasingly stringent environmental regulations, including CO2 emission limits and pollution control standards. These legal frameworks directly shape the company's product innovation and how it conducts its business. For instance, the ongoing push for lower emissions in power generation and industrial processes necessitates continuous investment in cleaner technologies.

The company's strategic focus on decarbonization, aiming for net-zero emissions in its own operations by 2030, underscores its proactive approach to meeting these legal mandates. This commitment extends to managing Scope 1, 2, and 3 emissions, demonstrating a comprehensive understanding of regulatory pressures and a dedication to compliance.

Beyond direct compliance, Siemens Energy actively engages in partnerships to decarbonize its supply chains, often exceeding minimum legal requirements. This forward-thinking strategy not only mitigates regulatory risk but also positions the company as a leader in the transition to a low-carbon economy, aligning with global environmental policy trends.

The permitting processes for substantial energy initiatives, particularly new power plants and crucial grid upgrades, present considerable hurdles. These can lengthen project schedules and inflate expenses, a factor Siemens Energy must meticulously manage. For instance, in the US, the average time to permit a new utility-scale solar project can range from 1 to 4 years, depending on location and scale.

Recognizing this, there's a growing consensus that streamlining these permitting pathways is essential for accelerating the deployment of renewable energy sources. The Biden administration, for example, has aimed to cut permitting times for clean energy projects. This is crucial for meeting ambitious climate goals and ensuring energy security.

Siemens Energy's success hinges on its ability to expertly navigate the intricate web of national and local regulatory environments. Each jurisdiction has its own unique set of rules and requirements, demanding a tailored approach to ensure projects proceed without undue delays and remain compliant.

Siemens Energy navigates a fiercely competitive global landscape, necessitating strict adherence to competition and anti-trust laws across numerous countries. These regulations are designed to foster fair market practices and prevent monopolistic behavior, directly impacting Siemens Energy's strategies concerning collaborations, mergers, and acquisitions. For instance, the European Commission has historically scrutinized large energy sector deals, and Siemens Energy's ongoing market activities are subject to such oversight to ensure a level playing field.

Health and Safety Regulations

Siemens Energy operates under stringent health and safety regulations, a critical aspect given the inherent risks in energy sector manufacturing and infrastructure. Compliance with occupational safety standards is non-negotiable to safeguard its workforce and prevent severe legal repercussions and reputational harm. For instance, in 2023, the International Labour Organization reported that the industrial sector globally still faces significant challenges, with workplace accidents and occupational diseases impacting millions of workers annually, underscoring the importance of robust safety frameworks.

The company must adhere to a complex web of local and international safety protocols, impacting everything from factory floor operations to the installation and maintenance of complex power generation and transmission equipment. Failure to meet these standards can result in substantial fines and operational disruptions. For example, in Germany, where Siemens Energy has a significant presence, the Occupational Safety and Health Act (Arbeitsschutzgesetz) mandates comprehensive risk assessments and preventative measures for all workplaces.

- Compliance with OSHA standards in the US ensures worker safety in manufacturing facilities.

- Adherence to EU directives on workplace safety, such as the Framework Directive 89/391/EEC, is crucial for European operations.

- Regular safety audits and training programs are implemented to maintain high standards and minimize incident rates.

- Investment in advanced safety technologies, like predictive maintenance for machinery, further enhances workplace protection.

International Conventions and Treaties on Climate Change

International climate agreements, like the Paris Agreement, establish global emissions reduction goals, directly shaping national policies that Siemens Energy must navigate. These accords create a framework for climate action, influencing regulatory landscapes and market opportunities for companies like Siemens Energy.

Siemens Energy's commitment to science-based targets, validated by the Science Based Targets initiative (SBTi), demonstrates alignment with these international conventions. For instance, their target to reduce Scope 1 and 2 greenhouse gas emissions by 50% by 2030, compared to a 2019 baseline, reflects a strategic response to global decarbonization imperatives.

- Paris Agreement: Aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- SBTi Validation: Confirms that Siemens Energy's emission reduction targets are in line with climate science.

- Decarbonization Strategy: International agreements drive Siemens Energy's long-term focus on reducing its carbon footprint across operations and product lifecycles.

Siemens Energy navigates a complex legal landscape, with environmental regulations like CO2 emission limits significantly influencing its product development and business operations, demanding continuous investment in cleaner technologies. Permitting processes for energy projects can be lengthy, with US utility-scale solar projects averaging 1-4 years for permits, highlighting the need for streamlined procedures to accelerate clean energy deployment. The company must also adhere to stringent competition and anti-trust laws globally, ensuring fair market practices and facing scrutiny on major deals, as exemplified by European Commission oversight.

Environmental factors

Global efforts to mitigate climate change, including the widespread adoption of carbon pricing, are significant environmental factors for Siemens Energy. The company's commitment to reducing its CO2 emissions, with targets validated by the Science Based Targets initiative (SBTi), directly influences its strategy.

Siemens Energy aims to cut its Scope 1 and 2 emissions by 50% by 2030 compared to a 2019 baseline, and its Scope 3 emissions by 30%. This focus fuels innovation in technologies like hydrogen and carbon capture, utilization, and storage (CCUS), essential for decarbonizing industries.

Growing concerns about the availability of critical raw materials, essential for renewable energy technologies like wind turbines and batteries, are driving a significant push towards circular economy models. This trend directly impacts companies like Siemens Energy, which rely on these resources.

Siemens Energy is actively embracing eco-design and product circularity. For instance, their Siemens EcoTech label highlights products designed for sustainability, and they are actively exploring the use of recycled copper in their transformer production, a tangible step to reduce reliance on virgin materials and minimize waste across the product's lifespan.

Siemens Energy's operations, particularly in developing large-scale energy projects like wind farms and transmission infrastructure, can significantly affect local biodiversity and demand substantial land. These projects often require careful consideration of their ecological footprint.

To mitigate these impacts, Siemens Energy is actively engaged in biodiversity protection. This includes implementing conservation initiatives at its operational sites and embedding environmental stewardship into the early stages of project planning. For instance, in 2023, the company reported progress on several biodiversity action plans across its global facilities, aiming to enhance local ecosystems.

The company emphasizes adherence to rigorous environmental impact assessments and strives to minimize the ecological disturbance associated with its energy solutions. This commitment is crucial as global regulations, such as the EU Biodiversity Strategy 2030, increasingly mandate nature-positive development, influencing project approvals and operational standards.

Waste Management from Energy Production

The increasing focus on waste management within the energy sector presents a significant environmental challenge. This includes handling byproducts from traditional power generation as well as the disposal and recycling of components from renewable energy technologies, such as end-of-life wind turbine blades. The European Union, for instance, has been actively working on frameworks for managing waste from renewable energy sources, with targets for recycling rates for wind turbine components being a key area of discussion and development leading into 2025.

Siemens Energy is actively addressing these concerns through its dedication to a circular economy. Their strategy emphasizes reducing waste generation and maximizing the recovery of valuable materials from their products throughout their lifecycle. This commitment is crucial for fostering responsible waste management practices and minimizing the environmental footprint of energy production. For example, initiatives in 2024 and projected for 2025 are focused on developing advanced recycling processes for composite materials used in wind turbines, aiming to divert significant tonnage from landfills.

Key aspects of Siemens Energy's approach to waste management include:

- Developing innovative recycling technologies for composite materials, such as those used in wind turbine blades, aiming for higher material recovery rates.

- Implementing product design principles that facilitate easier disassembly and material separation for enhanced end-of-life processing.

- Partnering with specialized waste management firms and research institutions to advance sustainable disposal and repurposing solutions.

- Exploring the use of recycled and sustainable materials in the manufacturing of new energy components to close the loop.

Water Usage in Energy Generation Processes

Water scarcity presents a significant environmental challenge, impacting energy generation. Many conventional power plants, particularly thermal ones, and even some renewable technologies like concentrated solar power, require substantial amounts of water for cooling. This reliance on water makes them vulnerable in regions facing water stress.

Siemens Energy must prioritize optimizing water usage across its own operations and within the technologies it offers. This includes developing and promoting solutions that minimize water consumption. For instance, advancements in dry cooling technologies for gas turbines can drastically reduce water needs compared to traditional wet cooling systems.

The company's commitment to sustainability is crucial, especially as global water stress intensifies. By 2025, it's estimated that over two-thirds of the world's population could face water shortages, making water-efficient energy solutions increasingly vital. Siemens Energy's focus on these areas directly addresses this critical environmental factor.

- Water Intensity: Traditional thermal power plants can consume millions of gallons of water per day for cooling.

- Renewable Impact: Concentrated solar power (CSP) plants can also be water-intensive, though advancements in dry cooling are mitigating this.

- Siemens Energy's Role: Developing and deploying technologies like advanced gas turbines with optimized cooling systems and supporting the transition to less water-dependent energy sources.

Global climate change mitigation efforts, including carbon pricing mechanisms, are profoundly shaping Siemens Energy's strategic direction. The company's validated commitment to reducing its CO2 emissions by 50% for Scope 1 and 2 by 2030 (from a 2019 baseline) and 30% for Scope 3 directly drives innovation in hydrogen and carbon capture technologies.

The circular economy is gaining traction, driven by concerns over critical raw materials needed for renewables. Siemens Energy is integrating eco-design principles, exemplified by its Siemens EcoTech label and the use of recycled copper in transformers, to minimize resource dependency and waste.

Siemens Energy's large-scale energy projects, such as wind farms, necessitate careful management of their ecological footprint, including biodiversity impact and land use. The company is actively implementing biodiversity action plans, with progress reported in 2023, and adhering to environmental impact assessments aligned with frameworks like the EU Biodiversity Strategy 2030.

Waste management is a critical environmental factor, encompassing byproducts from traditional power and end-of-life renewable components like wind turbine blades. By 2025, EU regulations are expected to further emphasize recycling rates for these components. Siemens Energy is advancing this through developing advanced recycling for composites and promoting product designs that facilitate disassembly and material recovery.

PESTLE Analysis Data Sources

Our Siemens Energy PESTLE Analysis is meticulously crafted using data from reputable international organizations like the IEA and IRENA, alongside reports from leading energy consultancies and financial institutions. This ensures a comprehensive understanding of global energy policy, market dynamics, and technological advancements.