Siemens Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Energy Bundle

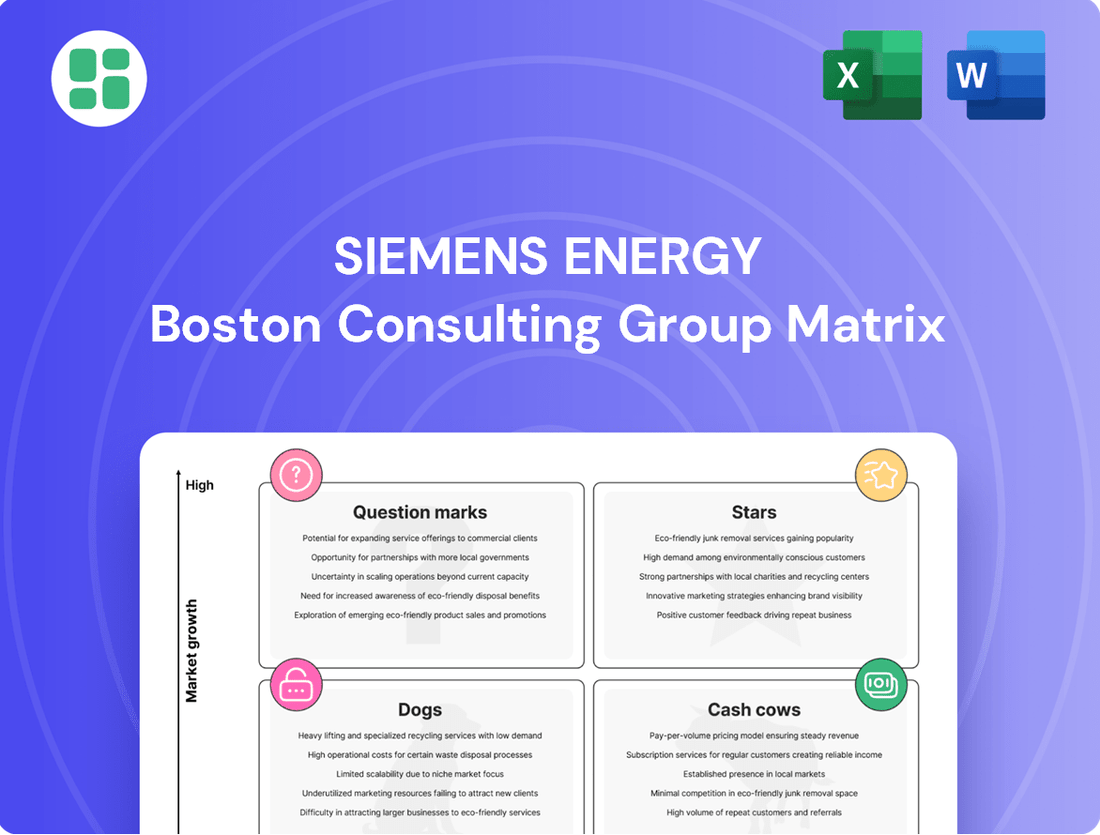

Curious about Siemens Energy's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned across Stars, Cash Cows, Dogs, and Question Marks. Unlock the full potential of this analysis by purchasing the complete report for detailed quadrant breakdowns and actionable strategies to optimize your own investments.

Stars

Siemens Energy's Advanced Grid Technologies are a star performer, showcasing robust growth. In fiscal year 2024, this segment saw significant comparable revenue increases and a substantial order intake, a trend expected to continue into 2025. This strong performance is fueled by the booming global smart grid market and the urgent need for more dependable energy systems.

The company's focus on cutting-edge solutions like High-Voltage Direct Current (HVDC) transmission and advanced digital grid management tools places Siemens Energy at the forefront of this rapidly expanding sector. These innovations are crucial for modernizing energy infrastructure, making the Grid Technologies segment a clear leader in a high-growth, high-demand market.

Siemens Energy is making substantial investments in green hydrogen production, particularly through its advanced PEM electrolyzer technology. The company has secured significant contracts for large-scale projects, positioning itself as a leader in this rapidly expanding market. This focus is vital for global decarbonization, with projects like the one in Germany, aiming for 60 MW capacity, showcasing their commitment.

Siemens Energy's high-efficiency gas turbines are a shining star in their portfolio, fueled by robust demand for flexible power generation, especially from data centers in the U.S. and EU. These turbines are crucial for the energy transition, with their ability to operate on hydrogen being a significant advantage.

The company's strong market position and substantial order backlog in this segment underscore its star potential. For instance, in fiscal year 2023, Siemens Energy reported a significant increase in its order intake for the Gas Turbine business, reflecting this strong demand.

Digitalization and Automation for Energy Systems

Siemens Energy is aggressively integrating digitalization and automation throughout its offerings, a strategic move capitalizing on the increasing demand for optimized energy systems. This focus directly addresses the industry's drive for greater efficiency and reduced environmental impact.

Their efforts include modernizing existing turbines and developing innovative designs that boost efficiency and lower emissions. This commitment to technological advancement is crucial in a market increasingly prioritizing sustainability and operational excellence. For instance, by 2024, a significant portion of new turbine installations will incorporate advanced digital control systems, promising up to a 3% improvement in fuel efficiency.

Siemens Energy's investment in industrial AI is a key differentiator, further solidifying its leadership in this high-growth sector. This AI integration is projected to enhance predictive maintenance capabilities, potentially reducing unscheduled downtime by as much as 20% in the coming years.

- Digitalization drives efficiency: Siemens Energy's digital solutions aim to optimize energy system performance.

- Automation reduces emissions: New designs and AI integration contribute to lower carbon footprints.

- Industrial AI advantage: Advanced AI capabilities enhance predictive maintenance and operational reliability.

- Market growth: The demand for optimized and sustainable energy solutions is a significant growth driver for Siemens Energy.

Renewable Energy Integration Technologies

Siemens Energy's renewable energy integration technologies are a key component of its BCG Matrix, positioned to capitalize on the accelerating global shift towards sustainable power. These solutions, including advanced power converters and sophisticated control systems, are crucial for seamlessly incorporating diverse renewable sources like solar and wind into existing electricity grids. The market for these technologies is experiencing robust growth, directly fueled by worldwide energy transition initiatives.

This segment is performing strongly due to several factors:

- High Demand: The increasing adoption of renewable energy sources globally creates a substantial need for effective integration solutions.

- Market Growth: The energy transition is a major driver, pushing significant market expansion for grid modernization and renewable integration.

- Portfolio Strength: Siemens Energy's offerings directly support the expansion of renewable capacity and the necessary upgrades to electricity grids.

- Technological Advancement: Investments in smart grid technologies and advanced power electronics are essential for managing the intermittency of renewables.

Siemens Energy's Advanced Grid Technologies are a star performer, showcasing robust growth. In fiscal year 2024, this segment saw significant comparable revenue increases and a substantial order intake, a trend expected to continue into 2025. This strong performance is fueled by the booming global smart grid market and the urgent need for more dependable energy systems.

The company's focus on cutting-edge solutions like High-Voltage Direct Current (HVDC) transmission and advanced digital grid management tools places Siemens Energy at the forefront of this rapidly expanding sector. These innovations are crucial for modernizing energy infrastructure, making the Grid Technologies segment a clear leader in a high-growth, high-demand market.

Siemens Energy's high-efficiency gas turbines are a shining star in their portfolio, fueled by robust demand for flexible power generation, especially from data centers in the U.S. and EU. These turbines are crucial for the energy transition, with their ability to operate on hydrogen being a significant advantage.

The company's strong market position and substantial order backlog in this segment underscore its star potential. For instance, in fiscal year 2023, Siemens Energy reported a significant increase in its order intake for the Gas Turbine business, reflecting this strong demand.

Siemens Energy's renewable energy integration technologies are a key component of its BCG Matrix, positioned to capitalize on the accelerating global shift towards sustainable power. These solutions, including advanced power converters and sophisticated control systems, are crucial for seamlessly incorporating diverse renewable sources like solar and wind into existing electricity grids. The market for these technologies is experiencing robust growth, directly fueled by worldwide energy transition initiatives.

This segment is performing strongly due to several factors:

- High Demand: The increasing adoption of renewable energy sources globally creates a substantial need for effective integration solutions.

- Market Growth: The energy transition is a major driver, pushing significant market expansion for grid modernization and renewable integration.

- Portfolio Strength: Siemens Energy's offerings directly support the expansion of renewable capacity and the necessary upgrades to electricity grids.

- Technological Advancement: Investments in smart grid technologies and advanced power electronics are essential for managing the intermittency of renewables.

| Segment | BCG Category | Key Drivers | 2024 Performance Indicators | Outlook |

|---|---|---|---|---|

| Advanced Grid Technologies | Star | Smart grid demand, grid modernization | Significant revenue increase, strong order intake | Continued growth expected |

| Gas Turbines | Star | Flexible power generation, data center demand, hydrogen capability | Strong order intake, high utilization rates | Sustained demand |

| Renewable Energy Integration | Star | Global energy transition, renewable capacity expansion | Robust market growth, increasing project pipeline | Positive growth trajectory |

What is included in the product

Siemens Energy's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment decisions.

A clear BCG Matrix visualizes Siemens Energy's portfolio, easing strategic decision-making and resource allocation.

Cash Cows

Siemens Energy's long-term service and maintenance for conventional power plants, especially gas turbines, are a significant cash cow. These contracts provide a steady, high-margin income because they keep existing, vital infrastructure running efficiently.

This segment benefits from a mature market where Siemens Energy holds a strong position, ensuring consistent cash flow. While growth prospects are modest, the stability and profitability of these services make them a core element of Siemens Energy's financial strength, contributing significantly to their overall portfolio stability.

Siemens Energy's established power transmission components, like standard transformers and switchgear, are firmly in the Cash Cows quadrant of the BCG Matrix. These are the backbone of existing power grids, ensuring reliable energy flow and experiencing steady, predictable demand. In 2023, the company's Grid Technologies segment, which houses many of these mature products, generated a substantial portion of its revenue, highlighting their ongoing financial contribution.

Siemens Energy's legacy gas turbine fleet upgrades represent a significant Cash Cow. These services focus on enhancing efficiency and extending the operational life of existing turbines that aren't yet hydrogen-ready, ensuring a reliable revenue stream.

While the market for new, traditional gas turbines may be experiencing slower growth, the aftermarket and upgrade sector for Siemens Energy's extensive installed base offers consistent, high-margin business. For instance, in fiscal year 2023, Siemens Energy reported a substantial increase in its service business, driven in part by these modernization efforts.

Industrial Power Applications

Siemens Energy's industrial power applications are a classic example of a Cash Cow within the BCG matrix. These solutions are designed for industries that prioritize stability and proven reliability, such as process manufacturing. This segment benefits from a mature market where demand for dependable power is consistent, allowing Siemens Energy to generate substantial, predictable cash flow.

The focus here is on maintaining market share rather than aggressive expansion, meaning capital expenditure requirements are typically lower. This allows the business unit to be a significant contributor to the company's overall profitability. For instance, in 2023, Siemens Energy reported a substantial increase in its industrial applications segment, reflecting the ongoing demand for robust power generation and distribution systems in established industrial sectors.

- Mature Market Demand: Industrial sectors consistently require reliable power, ensuring steady revenue streams for Siemens Energy's established solutions.

- Low Investment Needs: These applications generally require minimal new investment for growth, as the focus is on maintaining existing market share.

- Strong Cash Flow Generation: The stable demand and lower investment needs translate into significant and predictable cash flow for the company.

Steam Turbines and Generators

Siemens Energy's traditional steam turbines and generators, especially those serving existing thermal power plants, are firmly in the mature phase of their lifecycle. This segment is characterized by a strong, established market position for the company, providing a stable foundation for revenue.

While the market for new thermal power plant construction is not expanding significantly, the ongoing need for replacement parts, upgrades, and maintenance services ensures a consistent and predictable revenue stream. This mature market segment is known for its high profit margins, contributing significantly to Siemens Energy's overall profitability.

In 2024, the global market for industrial steam turbines, a key component of this business, was valued at approximately $15 billion. Siemens Energy holds a substantial share within this market, particularly in the aftermarket services sector, which is projected to grow at a compound annual growth rate of around 4% through 2030, driven by the need to maintain aging infrastructure.

- Market Maturity: The traditional steam turbine and generator market is mature, with limited new installations but strong demand for aftermarket services.

- Revenue Stability: Replacement and maintenance activities provide predictable and stable revenue streams for Siemens Energy.

- Profitability: This segment typically offers high profit margins due to established expertise and ongoing service contracts.

- Market Size: The global industrial steam turbine market was valued around $15 billion in 2024, with aftermarket services showing steady growth.

Siemens Energy's extensive portfolio of legacy gas turbine services acts as a significant cash cow. These offerings focus on maintaining and upgrading existing, operational gas turbines, ensuring their continued efficiency and longevity. This segment benefits from a mature market where Siemens Energy has a strong installed base, leading to predictable, high-margin revenue from aftermarket support and modernization projects.

In fiscal year 2023, Siemens Energy's service business saw a notable increase, with the company emphasizing its role in supporting existing energy infrastructure. This trend is expected to continue as many conventional power plants require ongoing maintenance to remain operational, underscoring the stable cash-generating capacity of these services.

Siemens Energy's traditional power transmission components, such as standard transformers and switchgear, are also key cash cows. These products are essential for the reliable operation of existing power grids, enjoying consistent demand. The Grid Technologies segment, which includes these mature offerings, contributed significantly to Siemens Energy's revenue in 2023, demonstrating their ongoing financial importance.

| Business Segment | BCG Category | Key Characteristics | 2023 Financial Insight |

| Gas Turbine Services (Legacy) | Cash Cow | Mature market, high-margin aftermarket, stable demand | Increased service revenue in FY23 |

| Power Transmission Components | Cash Cow | Essential infrastructure, predictable demand, strong market position | Significant revenue contribution from Grid Technologies |

Full Transparency, Always

Siemens Energy BCG Matrix

The Siemens Energy BCG Matrix preview you're seeing is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, contains no watermarks or demo content, ensuring you get a polished and actionable strategic tool. You can confidently rely on this preview as a true representation of the professional-grade report that will be yours to edit, present, and implement for your business planning needs.

Dogs

Outdated small-scale conventional power solutions, such as older diesel generators or small, inefficient gas turbines, fall into the Dogs category of the Siemens Energy BCG Matrix. These units are characterized by their low efficiency and lack of adaptability to modern decarbonization efforts, including hydrogen co-firing capabilities. For instance, the global market for reciprocating engines below 1MW, often used in smaller-scale applications, has seen a slowdown in new investment as larger, more efficient, and cleaner alternatives become available.

Siemens Energy’s portfolio likely includes highly niche industrial applications where demand is dwindling. These could be specialized power generation units for legacy industries or older, less efficient turbine technologies. For example, if Siemens Energy has a minimal presence in supplying equipment for very specific, declining manufacturing processes, these would fit here.

These segments typically offer little to no growth potential and may even be shrinking. In 2024, such areas might represent a small fraction of Siemens Energy's overall revenue, perhaps less than 1%, with minimal investment returns. The focus here would be on managing these assets efficiently and potentially divesting if feasible, rather than investing in their expansion.

Non-Strategic Legacy Infrastructure Services in Siemens Energy's BCG Matrix represent areas where the company faces intense competition and operates with slim profit margins. These services often involve maintaining older, less profitable asset bases where Siemens Energy doesn't hold a commanding market share. For instance, in 2024, a significant portion of the energy sector’s legacy infrastructure maintenance, particularly for older power generation units, is characterized by commoditized service offerings and price-sensitive customers.

These segments can drain valuable resources, including capital and skilled personnel, that could be more effectively deployed in growth areas. The focus here is on managing these services efficiently to minimize losses and free up capacity for more strategic investments. In 2024, Siemens Energy's efforts in this area likely involve optimizing operational costs and potentially divesting non-core legacy service contracts to improve overall portfolio performance.

Underperforming Regional Markets

Underperforming regional markets for Siemens Energy, fitting the 'Dog' category in the BCG Matrix, are characterized by persistent struggles to capture substantial market share. These markets often present intense local competition and regulatory hurdles that hinder the adoption of Siemens Energy's core technologies. For instance, in certain parts of Southeast Asia, while the overall energy demand is growing, Siemens Energy has faced significant challenges from established local players in the power generation sector, leading to lower-than-expected returns on investment in these specific territories.

These segments typically exhibit low profitability and minimal growth prospects, demanding careful evaluation of continued resource allocation. Despite efforts to adapt offerings and strategies, these regional operations may consistently fail to meet internal performance benchmarks. For example, in some Latin American countries, complex import regulations and a preference for domestically manufactured components have limited Siemens Energy's ability to secure large-scale projects for its advanced gas turbines.

- Struggling Market Share: Siemens Energy may find it difficult to penetrate markets with strong incumbent local competitors, such as in specific regions of Eastern Europe where established manufacturers dominate the grid infrastructure segment.

- Unfavorable Regulatory Environments: Regions with protectionist policies or stringent local content requirements can stifle growth for multinational energy technology providers, impacting profitability in those areas.

- Low Returns Despite Investment: Even with significant capital injected into operations, certain markets, like some African nations with underdeveloped energy grids and limited project financing, have yielded consistently low returns for Siemens Energy's transmission solutions.

Non-core, Divested or Phased-Out Product Lines

Siemens Energy's non-core, divested, or phased-out product lines represent areas where the company has strategically reduced its focus. These are typically product lines or technologies that have experienced low market share and declining growth prospects, making them less central to Siemens Energy's overall energy transition strategy.

These segments are prime candidates for further rationalization or complete divestment. For instance, while specific recent divestitures are not publicly detailed in this context, companies often shed legacy technologies or non-strategic business units to concentrate resources on growth areas. In 2023, Siemens Energy continued its portfolio optimization efforts, although specific figures for divested product lines within this category are not readily available as standalone metrics.

- Legacy Power Generation Components: Older, less efficient turbine technologies or components that are being replaced by newer, more sustainable alternatives.

- Non-Strategic Service Contracts: Service agreements for equipment or technologies that are no longer part of the company's core offering or future roadmap.

- Phased-Out Manufacturing Facilities: Production sites dedicated to products that have been discontinued or are being phased out due to market shifts or technological obsolescence.

Siemens Energy's 'Dogs' in the BCG Matrix encompass outdated, low-efficiency power generation units and niche industrial applications with shrinking demand. These segments, such as older reciprocating engines below 1MW, represent areas with minimal growth and low profitability, often less than 1% of revenue in 2024. The company's strategy for these 'Dogs' focuses on efficient management and potential divestment to reallocate resources to more promising ventures.

These underperforming areas also include non-strategic legacy infrastructure services where competition is fierce and profit margins are thin, as seen in the commoditized maintenance of older power generation units in 2024. Furthermore, struggling regional markets with persistent low market share and unfavorable regulatory environments, like certain areas in Southeast Asia or Latin America, also fall into this category.

The company's portfolio may also include phased-out product lines and non-core service contracts for legacy equipment. These are areas where Siemens Energy has deliberately reduced focus due to declining market share and growth prospects, aiming to streamline operations and enhance overall portfolio performance by divesting or rationalizing these less strategic assets.

| Category | Characteristics | 2024 Outlook/Strategy | Examples |

|---|---|---|---|

| Outdated Conventional Power Solutions | Low efficiency, lack of decarbonization adaptability | Manage efficiently, potential divestment | Older diesel generators, small inefficient gas turbines |

| Niche Industrial Applications | Dwindling demand, specialized legacy industries | Rationalize, focus on core offerings | Equipment for declining manufacturing processes |

| Underperforming Regional Markets | Struggling market share, intense local competition, unfavorable regulations | Evaluate resource allocation, optimize operations | Specific markets in Southeast Asia or Latin America |

| Phased-Out Product Lines | Low market share, declining growth, non-core | Divestment or complete rationalization | Legacy power generation components, non-strategic service contracts |

Question Marks

Siemens Gamesa Renewable Energy (SGRE) is positioned as a Question Mark within Siemens Energy's BCG Matrix. While it holds a strong market position in the rapidly expanding wind power sector, the company is grappling with substantial profitability issues. This necessitates significant investment to overcome technical challenges and achieve financial stability.

The company's turnaround plan aims for break-even by fiscal year 2026. In fiscal year 2023, Siemens Gamesa reported a significant loss, underscoring the need for strategic adjustments and capital infusion to navigate its current predicament.

Siemens Energy is actively exploring emerging energy storage technologies like solid-state batteries and advanced flow batteries. These represent a burgeoning high-growth market, with the global energy storage market projected to reach $300 billion by 2030. While Siemens Energy is investing heavily in research and development, its current market share in these nascent areas is likely limited, positioning them as potential future Stars.

Siemens Energy's involvement in Carbon Capture, Utilization, and Storage (CCUS) technologies, while aligned with their decarbonization strategy, likely places them in a question mark position within a BCG matrix. This is a rapidly expanding sector crucial for industrial emissions reduction, with global CCUS capacity projected to reach over 500 million tonnes per annum by 2030, according to the International Energy Agency (IEA).

While the overall market for CCUS is experiencing substantial growth, Siemens Energy's specific market share within this niche may still be developing. This suggests a need for significant strategic investment to capture a larger portion of this high-potential, yet competitive, market.

Advanced Digital Solutions for New Energy Markets

Siemens Energy is actively developing and penetrating markets with advanced digital solutions tailored for new energy sectors. These include AI-powered predictive maintenance for evolving renewable energy assets and sophisticated energy management software designed for microgrids, representing significant growth opportunities. The company's strategic investments in these high-potential areas aim to capture a larger market share in this rapidly expanding digital energy landscape.

The market for specialized digital solutions in new energy is experiencing robust growth, driven by the increasing complexity and decentralization of energy systems. For instance, the global market for grid modernization, which heavily relies on digital solutions, was projected to reach over $100 billion by 2024, with digital components forming a substantial portion of this. Siemens Energy's focus on AI and advanced software positions it to capitalize on this trend.

- AI-driven predictive maintenance for wind turbines and solar farms, reducing downtime and operational costs.

- Microgrid management software enabling efficient energy distribution and integration of diverse renewable sources.

- Digital twins for optimizing the performance and lifecycle of new energy infrastructure.

- Cybersecurity solutions specifically designed for the vulnerabilities of distributed energy networks.

Innovative Hydrogen Applications (e.g., e-fuels)

Siemens Energy is actively pursuing the development and commercialization of e-fuels, such as e-methanol and e-ammonia, beyond traditional green hydrogen production. These innovative applications represent a significant growth opportunity by tapping into new markets, particularly in sectors like aviation and shipping that are difficult to decarbonize. For instance, the global e-fuels market is projected to reach tens of billions of dollars by the early 2030s, with e-kerosene for aviation being a key driver.

These e-fuel markets are currently in their nascent stages, meaning Siemens Energy is focused on establishing its market presence and building share. This necessitates substantial upfront investment in research, development, and the scaling of production facilities. The company's strategy involves leveraging its expertise in electrolysis and power-to-X technologies to create a competitive advantage.

- E-Methanol: Potential to replace traditional methanol in chemical production and as a marine fuel, with the global methanol market valued at over $30 billion in 2023.

- E-Ammonia: A promising alternative fuel for shipping and a key component in fertilizer production, with the global ammonia market exceeding $60 billion.

- E-Jet Fuel: Critical for decarbonizing the aviation sector, where sustainable aviation fuel (SAF) mandates are increasingly being implemented, driving demand for synthetic fuels.

- Investment Requirements: Significant capital expenditure is needed for electrolyzer capacity, synthesis plants, and infrastructure development to support e-fuel production and distribution.

Question Marks within Siemens Energy's portfolio represent areas with high growth potential but currently low market share. These segments require substantial investment to capture market opportunities and achieve profitability.

Siemens Gamesa Renewable Energy (SGRE) is a prime example, operating in the expanding wind energy market but facing profitability challenges. Its turnaround plan highlights the significant investment needed to overcome technical hurdles and reach financial stability.

Emerging energy storage technologies and e-fuels also fall into this category. While the markets for these solutions are projected for significant growth, Siemens Energy's current market penetration is limited, necessitating considerable investment to build share.

The company's strategic focus on digital solutions for new energy sectors, such as AI-driven predictive maintenance and microgrid management software, positions them as Question Marks. These areas offer high growth, but require investment to establish a stronger market presence.

| Business Unit/Technology | Market Growth | Market Share | Investment Needs | Potential |

|---|---|---|---|---|

| Siemens Gamesa (Wind) | High | Moderate | High | Star (with investment) |

| Energy Storage (Batteries) | Very High | Low | High | Star |

| Carbon Capture, Utilization, and Storage (CCUS) | High | Developing | High | Star |

| Digital Solutions for New Energy | High | Developing | Moderate | Star |

| E-fuels (e-methanol, e-ammonia) | Very High | Very Low | Very High | Star |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.