Siemens Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Energy Bundle

Siemens Energy faces significant competitive pressures from established players and the threat of new entrants in the energy infrastructure market. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this complex landscape.

The full Porter's Five Forces Analysis reveals the real forces shaping Siemens Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Siemens Energy's reliance on specialized components and critical raw materials highlights the significant bargaining power of its suppliers. For instance, the company sources rare earth metals essential for wind turbine magnets and polysilicon for solar cells. Disruptions in these supply chains, often due to geopolitical factors or trade policies, can directly impact Siemens Energy's production costs and delivery schedules.

The volatility in these niche markets is starkly evident. Polysilicon prices, a key material for solar panels, experienced a dramatic surge of 350% between 2020 and June 2022. Similarly, global tensions in the early 2020s drove up the cost of wind turbine materials, making them two to three times more expensive. This demonstrates a clear advantage for suppliers in these specialized sectors.

For highly specialized components crucial to advanced energy solutions, like those powering smart grids or enabling hydrogen combustion in turbines, Siemens Energy often faces a constrained pool of qualified suppliers. This limited availability naturally amplifies the bargaining power of these select suppliers. They can exert significant influence over pricing, dictate delivery timelines, and set stringent technical specifications for their products, impacting Siemens Energy's operational flexibility and cost structures.

Siemens Energy actively manages this dynamic by fostering close, collaborative relationships with its key suppliers. This strategic approach aims to secure reliable supply chains and capitalize on the advantages offered by global procurement markets. For instance, in 2024, the company continued its efforts to diversify its supplier base for critical raw materials used in renewable energy technologies, seeking to mitigate risks associated with single-source dependencies and enhance its negotiating position.

The intricate and widespread nature of renewable energy installations creates substantial logistical hurdles. These include the need for robust transportation networks, adequate warehouse capacity, and efficient customs processing, all of which can be hampered by delays.

These infrastructure bottlenecks grant considerable leverage to logistics and transportation providers. Consequently, shipping delays are becoming more common, with 35% of renewable energy projects experiencing component delivery delays in 2024.

This situation directly impacts project timelines and budgets, as logistics expenses can now account for as much as 15% of a project's total cost.

Sustainability and Compliance Requirements

Siemens Energy's strong commitment to sustainability and ethical sourcing, as outlined in its supplier Code of Conduct, significantly influences supplier bargaining power. Suppliers capable of meeting rigorous environmental, social, and governance (ESG) standards, such as those participating in the Decarbonization Due Diligence Assessment Program, can often negotiate more favorable terms or are simply preferred, thereby enhancing their leverage. The company's ambitious goal to cut supply chain greenhouse gas (GHG) emissions by 30% by 2030 necessitates deep collaboration, giving compliant suppliers an advantage.

This focus on sustainability translates into tangible benefits for suppliers who align with Siemens Energy's values. For instance, suppliers demonstrating robust ESG performance are more likely to secure long-term contracts and gain preferential treatment in procurement processes.

- Supplier ESG Performance: Suppliers meeting Siemens Energy's stringent environmental and social criteria gain leverage.

- Decarbonization Initiatives: Participation in programs like the Decarbonization Due Diligence Assessment Program strengthens a supplier's position.

- Supply Chain Emission Targets: Siemens Energy's goal to reduce supply chain GHG emissions by 30% by 2030 empowers compliant suppliers.

- Ethical Sourcing: Adherence to Siemens Energy's Code of Conduct for suppliers is a key factor in their bargaining power.

Dependency on Specific Sub-Segments of the Supply Chain

Siemens Energy's reliance on specific, niche areas within its supply chain can significantly bolster supplier leverage. For example, the availability of critical materials like rare earth metals, essential for wind turbine generators, is projected to face a substantial shortage, potentially between 50% and 60% by 2030. Similarly, highly specialized manufacturing processes, such as those involved in producing polysilicon for solar cells, can create dependencies.

This dependency is evident in various sectors. Consider the US solar supply chain, which has experienced potential supply constraints stemming from import tariffs and a concentrated reliance on specific geographical regions for key components. This situation highlights how a limited number of suppliers or geographic areas for crucial inputs can give those suppliers considerable bargaining power.

- Critical Materials Shortages: Projections indicate a 50-60% shortage of rare earth metals for wind turbine generators by 2030, increasing supplier power.

- Specialized Manufacturing: The production of polysilicon for solar cells involves highly specialized processes, concentrating power among a few manufacturers.

- Geopolitical Factors: Tariffs and regional dependencies, as seen in the US solar supply chain, can limit options and empower specific suppliers.

- Component Concentration: Reliance on particular regions for essential components creates vulnerabilities and strengthens the bargaining position of suppliers in those areas.

Siemens Energy faces considerable supplier bargaining power due to its reliance on specialized components and critical raw materials. For instance, the company sources rare earth metals for wind turbine magnets and polysilicon for solar cells, materials whose prices have seen dramatic increases. The limited number of qualified suppliers for advanced energy solutions further amplifies their leverage, impacting pricing and delivery schedules.

The logistical challenges in renewable energy projects also empower transportation providers, with 35% of projects experiencing delivery delays in 2024, and logistics costs reaching up to 15% of total project expenses. Furthermore, suppliers meeting Siemens Energy's stringent ESG standards, such as those participating in decarbonization initiatives, gain an advantage, aligning with the company's goal to cut supply chain emissions by 30% by 2030.

Projected shortages of critical materials like rare earth metals, potentially 50-60% by 2030, and the concentration of specialized manufacturing processes for polysilicon, grant significant power to these suppliers. Geopolitical factors and regional dependencies, as seen in the US solar supply chain, further limit options and strengthen the bargaining position of specific suppliers.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Trend |

| Critical Materials | Increased Leverage | Polysilicon prices surged 350% (2020-June 2022); Rare earth metals projected 50-60% shortage by 2030. |

| Specialized Components | Amplified Power | Limited pool of qualified suppliers for advanced energy solutions. |

| Logistics & Transportation | Enhanced Influence | 35% of renewable projects faced delivery delays in 2024; Logistics costs up to 15% of project cost. |

| ESG Compliance | Preferential Treatment | Suppliers meeting Siemens Energy's ESG criteria gain advantage; Goal to cut supply chain GHG emissions by 30% by 2030. |

What is included in the product

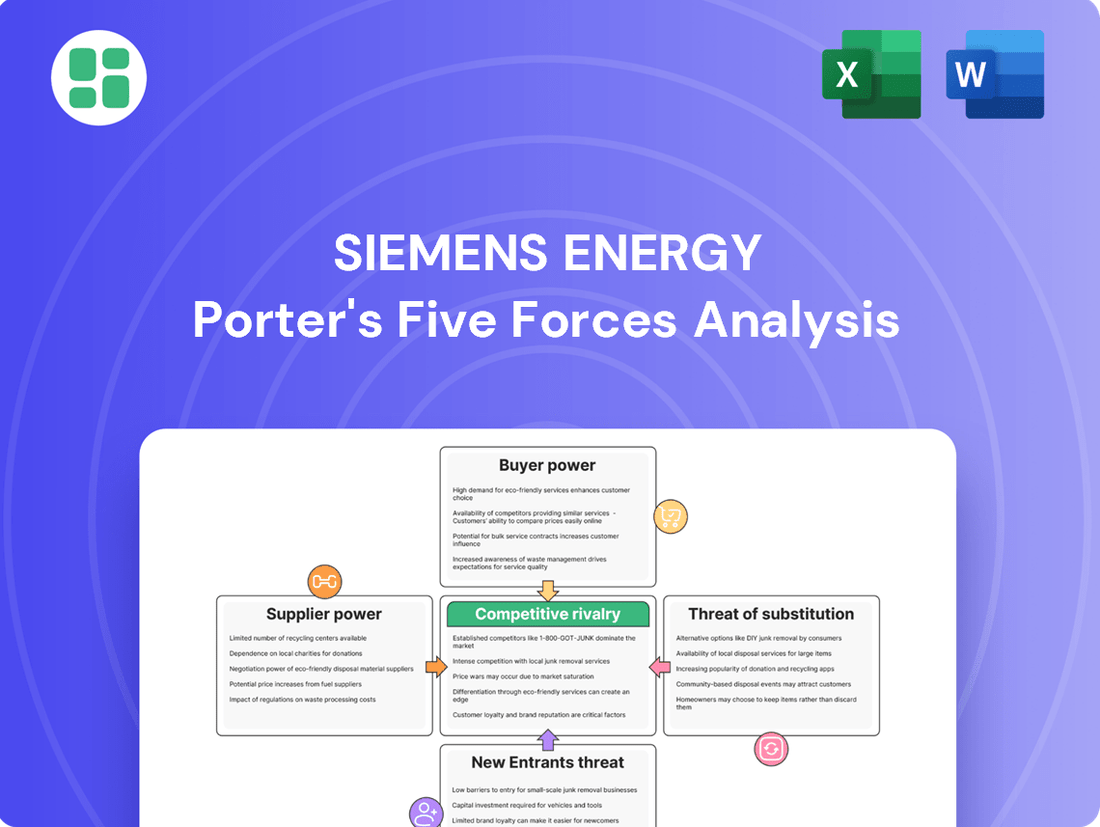

This analysis dissects the competitive forces impacting Siemens Energy, evaluating the intensity of rivalry, buyer and supplier power, the threat of new entrants, and the impact of substitutes.

Gain immediate clarity on competitive pressures with a dynamic, interactive framework that highlights key threats and opportunities, allowing for proactive strategic adjustments.

Customers Bargaining Power

Siemens Energy's largest customers are typically major utilities, industrial giants, and governmental bodies. These clients often engage in colossal infrastructure undertakings, such as constructing new power plants or upgrading national power grids. Their sheer size and the critical nature of these projects grant them considerable leverage when negotiating with suppliers like Siemens Energy.

Because these customers purchase in such large volumes and their orders are strategically vital, they can effectively negotiate for better pricing, customized solutions, and more favorable contract terms. This bargaining power is a significant factor for Siemens Energy.

The company's robust order backlog, which stood at €119 billion in the second quarter of fiscal year 2024 and grew to €131 billion by the first quarter of fiscal year 2025, underscores the consistent and substantial demand from these powerful customer segments.

Siemens Energy often engages customers through long-term contracts and service agreements, particularly for its power generation and transmission equipment. These agreements, which can span many years, lock in customers for ongoing maintenance, spare parts, and upgrades. This creates a significant switching cost for the customer, thereby diminishing their bargaining power over time for these essential services.

For instance, the $1.6 billion contract awarded in 2025 for turbines and generators in Saudi Arabia exemplifies this strategy. Such long-term commitments not only secure a recurring revenue stream for Siemens Energy but also solidify customer loyalty, making it less likely for clients to seek alternative providers for essential operational needs.

Customers in the energy sector place a high value on reliability and performance. This is because power supply and industrial processes are critical, meaning any disruption can be incredibly costly. Siemens Energy's focus on robust engineering and advanced technology directly addresses this need.

This strong emphasis on quality and established technology means customers are often less sensitive to price. They understand that investing in dependable solutions from a trusted provider like Siemens Energy can prevent much larger future expenses related to downtime or inefficiency. This can significantly reduce the bargaining power customers might otherwise wield based purely on cost.

For instance, in 2023, Siemens Energy reported a significant increase in orders for its gas turbines, a testament to the demand for reliable power generation solutions. Their ability to deliver high-performance, dependable equipment is a key factor that strengthens their position against price-focused customer demands.

Regulatory and Policy-Driven Demand

Regulatory and policy-driven demand significantly shapes customer power in the energy sector. Government mandates for decarbonization and renewable energy integration, like the European Union's Fit for 55 package, create substantial markets but also allow customers, particularly large utilities, to negotiate terms based on compliance requirements. This can lead to pressure on pricing and specifications for technologies such as grid modernization solutions.

The global smart grid market, projected to reach over $100 billion by 2027, is a prime example of policy influence. Customers in this space, often backed by government incentives or national energy strategies, can leverage these policy frameworks to demand specific technological advancements or cost structures from suppliers like Siemens Energy, thereby increasing their bargaining leverage.

- Policy Influence: Government regulations on emissions and renewable energy adoption empower customers to demand specific, policy-aligned solutions.

- Market Opportunities & Demands: While creating demand, these policies also enable customers to negotiate terms for technologies supporting national energy transition goals.

- Customer Leverage: State-owned utilities or entities receiving government subsidies can exert greater influence on contract specifics and pricing due to policy alignment.

- Smart Grid Example: The growth of the smart grid market, driven by renewable integration mandates, showcases how policy directly enhances customer bargaining power.

Limited Switching Costs for Certain Solutions

While large, complex infrastructure projects typically lock customers in with substantial switching costs once implemented, Siemens Energy faces a different dynamic with more modular products or upgrade services. In these instances, customers might find it easier to switch between providers, especially when multiple global vendors offer comparable components or smaller-scale solutions. This increased flexibility can bolster their bargaining power in those specific market segments.

For example, if a utility company is looking to upgrade a specific turbine component, and several manufacturers offer compatible parts, Siemens Energy might need to be more competitive on price or service to retain that business. This contrasts sharply with situations where a customer has invested heavily in a fully integrated Siemens Energy system, where replacing the entire setup would be prohibitively expensive.

- Customer Bargaining Power: Moderate to High for modular/upgrade components, Low for integrated solutions.

- Vendor Landscape: Multiple global vendors exist for certain components, increasing customer options.

- Siemens Energy Mitigation: Proprietary technologies and integrated solutions aim to reduce customer switching incentives.

Siemens Energy's customers, particularly large utilities and industrial firms, hold significant bargaining power due to their substantial order volumes and the critical nature of energy infrastructure projects. These clients can negotiate for lower prices and customized solutions, especially when multiple suppliers can meet their needs. The company's substantial order backlog, reaching €131 billion by Q1 FY2025, highlights the consistent demand from these powerful customer segments.

While long-term, integrated solutions create high switching costs and thus reduce customer leverage, Siemens Energy faces increased customer bargaining power for modular components where multiple vendors offer comparable products. For instance, the $1.6 billion turbine contract in Saudi Arabia in 2025 demonstrates how long-term commitments can solidify customer loyalty and diminish their power over time for essential services.

| Customer Segment | Bargaining Power Factors | Siemens Energy Mitigation |

|---|---|---|

| Major Utilities/Industrial Giants | High volume purchases, critical infrastructure projects | Long-term contracts, integrated solutions, high switching costs |

| Governmental Bodies | Policy influence, regulatory requirements | Focus on compliance, advanced technology solutions |

| Modular Component Buyers | Availability of alternative suppliers, lower switching costs | Competitive pricing, service differentiation, proprietary technology |

Full Version Awaits

Siemens Energy Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Siemens Energy, detailing the competitive landscape and strategic implications for the company. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

The energy technology landscape is dominated by a few major global players, including General Electric (GE Vernova), Schneider Electric, Hitachi Energy, and Eaton. These companies compete aggressively by offering extensive product and service portfolios that span power generation, transmission, and industrial sectors.

This intense competition for significant projects and market dominance means Siemens Energy must constantly innovate and deliver value. Siemens Energy's strong performance as the top-performing DAX stock in 2024 highlights its competitive strength, yet it also underscores the sector's inherent volatility and the ongoing pressure to outperform rivals.

The energy sector, particularly in areas like turbine manufacturing, demands massive upfront investments in production facilities, research and development, and extensive global service networks. These substantial capital expenditures translate into high fixed costs for companies like Siemens Energy.

This high fixed cost structure inherently pressures companies to secure large-scale orders and maintain high capacity utilization. Achieving economies of scale is crucial for profitability, leading to intensified price competition, especially when market growth slows or excess capacity emerges. For instance, the ongoing turnaround efforts at Siemens Gamesa, the company's wind turbine division, underscore the significant challenges in managing capacity and ensuring profitability within these competitive segments.

Competitive rivalry in the energy sector is intensely fueled by a relentless pursuit of technological innovation. Siemens Energy, like its peers, must constantly invest in research and development to stay ahead in crucial areas such as integrating renewable energy sources, advancing smart grid capabilities, developing hydrogen-ready turbines, and pioneering energy storage solutions. This commitment to R&D is not just about staying competitive; it's about shaping the future of energy.

For instance, the global R&D spending in the energy sector has seen significant growth, with companies allocating substantial resources to develop next-generation technologies. Siemens Energy’s strategic focus on technological leadership, evident in its significant R&D expenditure, is a key differentiator. In fiscal year 2023, Siemens Energy reported R&D expenses of €1.6 billion, underscoring its dedication to innovation as a core competitive strategy.

Geographic Market Dynamics and Protectionism

Competitive rivalry within the energy sector, including for Siemens Energy, is significantly influenced by geographic market dynamics and prevailing protectionist policies. Companies vie fiercely for opportunities in burgeoning markets, often encountering established local competitors or regulatory frameworks that favor domestic manufacturers. For instance, the US clean energy sector is currently experiencing increased challenges due to escalating tariffs on imported components, impacting the cost and availability of essential parts.

These regional market conditions and government interventions create a complex competitive landscape. Companies must navigate varying trade policies, local content requirements, and subsidies that can tilt the playing field. This often leads to intense competition for major projects, where securing market access and favorable terms is paramount.

- Tariff Impact: Rising tariffs on critical components, such as those impacting the US clean energy supply chain, can increase operational costs and reduce competitiveness for global players.

- Local Champions: Companies frequently face competition from domestic firms that benefit from government support or preferential treatment in their home markets.

- Market Access: Securing contracts in key growth regions often involves overcoming regulatory hurdles and demonstrating compliance with local manufacturing or sourcing regulations.

Differentiated Product and Service Portfolios

Siemens Energy distinguishes itself from rivals not merely through its core energy hardware, but by layering on specialized services and advanced digital solutions. For instance, its Siemens Xcelerator platform aims to digitalize supply chains, offering a tangible advantage over competitors focused solely on equipment.

This differentiation extends to integrated offerings that deliver comprehensive, end-to-end value, moving beyond transactional sales to build deeper customer relationships. Companies are increasingly leveraging unique value propositions, such as employing AI and machine learning to optimize grid operations, a key strategy to gain an edge in a highly competitive sector.

- Specialized Services: Competitors may offer similar core products, but Siemens Energy's focus on specialized services, like predictive maintenance and performance optimization, creates a distinct value proposition.

- Digital Solutions: The integration of digital platforms, such as Siemens Xcelerator for supply chain digitalization, provides a competitive edge by enhancing efficiency and transparency.

- Integrated Offerings: By bundling hardware with digital services and support, Siemens Energy creates end-to-end solutions that address complex customer needs more effectively than standalone product offerings.

- AI/ML for Grid Optimization: The application of artificial intelligence and machine learning in optimizing grid operations is a key differentiator, offering enhanced reliability and efficiency that sets Siemens Energy apart.

The competitive rivalry in the energy technology sector is fierce, characterized by a few dominant global players like GE Vernova, Schneider Electric, and Hitachi Energy. Siemens Energy operates within this landscape, facing intense pressure to innovate and deliver value, as demonstrated by its strong performance as the top-performing DAX stock in 2024, which also highlights the sector's inherent volatility.

High barriers to entry, including substantial capital expenditures for production, R&D, and global service networks, lead to high fixed costs. This necessitates securing large orders and high capacity utilization, intensifying price competition, especially during market slowdowns. The ongoing challenges at Siemens Gamesa, its wind turbine division, exemplify these pressures.

Technological innovation is a primary battleground, with companies like Siemens Energy investing heavily in R&D for areas such as renewable integration, smart grids, and hydrogen technologies. Siemens Energy's R&D spending of €1.6 billion in fiscal year 2023 underscores this commitment to staying ahead.

Geographic market dynamics and protectionist policies further complicate rivalry, with companies navigating trade barriers and local content requirements. For example, escalating tariffs on components are impacting the US clean energy sector's cost structure and competitiveness.

SSubstitutes Threaten

Siemens Energy's traditional centralized power generation faces a significant threat from decentralized energy solutions. Rooftop solar, community wind projects, and microgrids empower consumers to generate their own electricity, lessening dependence on large utility grids. This trend is underscored by the projected growth of the global smart grid market, which is expected to reach over $70 billion by 2025, largely fueled by these distributed energy systems.

Improvements in energy efficiency and demand-side management (DSM) present a significant threat of substitutes for traditional power generation and transmission infrastructure. By optimizing energy consumption, these technologies reduce the need for new capacity. For instance, smart grid technologies, which are increasingly deployed globally, allow for better load balancing and peak shaving, directly impacting the demand for new power plants.

The global market for energy efficiency services is substantial and growing. In 2023, the energy efficiency market was valued at approximately USD 330 billion and is projected to reach over USD 500 billion by 2030, indicating a strong trend towards reducing energy demand. This shift means that companies like Siemens Energy, which traditionally supplied new generation equipment, must adapt to a market where reducing consumption is a primary goal.

The threat of substitutes for Siemens Energy's advanced energy storage solutions is significant, particularly from rapidly evolving battery energy storage systems (BESS). These BESS technologies are becoming increasingly cost-effective and efficient, offering an alternative to traditional grid infrastructure and even Siemens Energy's own offerings in certain applications.

The global BESS market is projected to grow substantially, with a compound annual growth rate (CAGR) of over 20% expected through 2030, demonstrating the increasing viability of these substitutes. This rapid expansion allows BESS to directly compete in areas like grid stabilization and renewable energy integration, potentially reducing the demand for Siemens Energy's more established storage technologies.

Direct Hydrogen Use in Industrial Processes

The direct use of hydrogen in industrial processes presents a significant threat of substitution for Siemens Energy. As industries like steel and cement increasingly adopt hydrogen as a fuel or feedstock, they may reduce their reliance on traditional electricity or natural gas, thereby impacting demand for Siemens Energy's established power generation solutions.

This shift is fueled by global decarbonization efforts and the projected growth of the hydrogen market. For instance, the International Energy Agency (IEA) reported in its 2023 update that hydrogen production and use are expanding, with over 30 countries having hydrogen strategies in place. This expansion directly targets sectors where Siemens Energy has historically held strong positions.

- Industrial Decarbonization Drive: Sectors like steel and cement are actively seeking low-carbon alternatives, with hydrogen emerging as a key solution.

- Market Growth Projections: The global hydrogen market is anticipated to reach hundreds of billions of dollars in the coming years, indicating a substantial shift in energy consumption patterns.

- Potential Demand Erosion: Increased adoption of direct hydrogen use could diminish the need for conventional gas turbines and related power infrastructure offered by Siemens Energy.

Alternative Power Generation Technologies

The threat of substitutes for Siemens Energy's traditional power generation technologies is growing, particularly from emerging alternatives. Advanced nuclear, such as Small Modular Reactors (SMRs), and renewable sources like enhanced geothermal and tidal power, represent potential long-term substitutes. While Siemens Energy might participate in the supply chain for some of these, like SMR components, their broader market penetration could reduce reliance on gas turbines and large-scale wind installations, which are core to Siemens Energy's current business.

By 2024, the global investment in clean energy technologies, including those that could substitute for fossil fuels, has seen significant growth. For instance, the International Energy Agency (IEA) reported in early 2024 that global clean energy investment was projected to reach $2 trillion in 2024, a substantial increase from previous years. This indicates a tangible shift in market preferences and technological development that could impact Siemens Energy's established product lines.

- Emerging Technologies: SMRs, advanced geothermal, and tidal power are gaining traction.

- Market Shift: Widespread adoption could alter the energy mix, impacting demand for gas turbines.

- Siemens Energy's Role: The company may act as a supplier for some substitute technologies.

- Investment Trends: Global clean energy investment exceeding $2 trillion in 2024 highlights the growing viability of alternatives.

The threat of substitutes for Siemens Energy's traditional power generation and transmission equipment is substantial and multifaceted. Decentralized energy solutions like rooftop solar and microgrids reduce reliance on centralized grids, a trend supported by the global smart grid market's projected growth to over $70 billion by 2025. Energy efficiency measures also curb demand for new infrastructure, with the energy efficiency services market valued at around $330 billion in 2023 and expected to surpass $500 billion by 2030.

Emerging technologies such as Small Modular Reactors (SMRs), advanced geothermal, and tidal power represent further substitutes. Global clean energy investment, projected to hit $2 trillion in 2024, underscores the increasing viability and adoption of these alternatives, potentially impacting Siemens Energy's core business in gas turbines and large-scale wind installations.

| Substitute Technology | Impact on Siemens Energy | Market Trend/Data Point |

| Decentralized Energy (Solar, Microgrids) | Reduces demand for centralized grid infrastructure | Smart Grid Market > $70B by 2025 |

| Energy Efficiency & DSM | Lowers need for new power generation capacity | Energy Efficiency Services Market ~$330B (2023) |

| Advanced Nuclear (SMRs), Geothermal, Tidal | Offers alternatives to gas turbines and large wind | Global Clean Energy Investment ~$2T (2024) |

Entrants Threaten

The energy technology sector, especially in power generation and transmission, demands colossal capital for research, advanced manufacturing, and project deployment. For instance, building a new gas turbine manufacturing plant can easily cost hundreds of millions of dollars, creating a significant hurdle.

This substantial financial barrier effectively deters many potential newcomers. Only firms with substantial financial resources can realistically challenge established giants like Siemens Energy, which has a market capitalization of approximately €15 billion as of early 2024.

The sheer scale of investment needed for modernizing national power grids, often involving billions of dollars in infrastructure upgrades, further solidifies this barrier. This makes it exceptionally difficult for smaller or less capitalized entities to enter and compete effectively.

New companies entering the energy sector, particularly in areas like power generation and transmission equipment, confront a daunting landscape of national and international regulations. These include stringent safety standards, environmental compliance, and complex certification processes that are essential for operating legally and gaining market acceptance. For instance, in 2024, the European Union continued to emphasize stricter emissions standards for industrial equipment, requiring significant investment in compliance for any new entrant.

Successfully navigating these intricate regulatory frameworks demands specialized knowledge, substantial time commitments for approvals, and considerable financial outlays for testing and certification. This creates a formidable barrier to entry, as it requires new players to build or acquire significant expertise and capital just to meet the baseline operational requirements. Permitting and licensing for new energy projects, a critical step for any new entrant, remain a significant hurdle, often involving lengthy approval cycles and community consultations.

Siemens Energy enjoys deeply rooted customer relationships with global utilities, industrial giants, and governments, forged over decades of dependable service and proven results. Newcomers find it incredibly difficult to break into these established connections and cultivate a similar level of trust, which is absolutely vital in an industry where unwavering reliability is non-negotiable.

Technological Expertise and Intellectual Property

The significant technological expertise and intellectual property held by established players like Siemens Energy present a formidable barrier to new entrants. Developing and deploying advanced energy technologies demands substantial investment in research and development, alongside a robust portfolio of patents. For instance, Siemens Energy's commitment to innovation is reflected in its substantial R&D spending, which in fiscal year 2023 reached €2.1 billion, underscoring the high cost of entry for competitors aiming to match their technological prowess.

New companies would need to either acquire or independently develop these critical capabilities, a process that is both time-consuming and capital-intensive. This high upfront investment in specialized knowledge and protected innovations effectively deters potential market entrants. Siemens Energy's focus on maintaining technological leadership is therefore a crucial competitive advantage, making it difficult for newcomers to gain traction without comparable resources and innovative capacity.

- High R&D Investment: Siemens Energy's €2.1 billion R&D expenditure in FY2023 highlights the significant financial commitment required to stay competitive.

- Intellectual Property Portfolio: A strong patent portfolio acts as a protective moat, shielding existing technologies and discouraging imitation.

- Engineering Expertise: The need for specialized, deep engineering talent is a barrier that takes years to cultivate.

- Capital Intensity: Acquiring or developing advanced energy technology capabilities requires substantial capital, creating a high hurdle for new entrants.

Supply Chain Integration and Economies of Scale

Established energy sector giants, including Siemens Energy, have meticulously built and optimized global supply chains, leveraging significant economies of scale. This integration allows for cost efficiencies in sourcing raw materials, manufacturing complex components, and distributing finished products. For instance, in 2023, Siemens Energy reported a substantial order intake of €89.4 billion, reflecting the sheer volume and complexity of its operations, which are underpinned by these integrated supply chains.

New entrants face considerable hurdles in matching this operational efficiency. Replicating such extensive networks and achieving comparable economies of scale would require massive upfront investment and time, potentially leading to higher per-unit costs and less dependable access to critical components, particularly for advanced technologies in the renewable energy market. The energy sector’s reliance on specialized, high-value components makes supply chain reliability a paramount concern for any new player.

Supply chain disruptions and the ability to manage them effectively represent a significant barrier to entry and growth in the energy industry. Companies that can secure reliable, cost-effective supply chains, like Siemens Energy, possess a distinct competitive advantage. For example, the global semiconductor shortage experienced in recent years highlighted how critical even seemingly minor components can be, impacting production timelines and costs across the entire energy technology landscape.

- Economies of Scale: Established players benefit from bulk purchasing power and optimized production processes, reducing per-unit costs.

- Supply Chain Complexity: The energy sector requires intricate, global supply chains for specialized components, making replication difficult for newcomers.

- Cost Disadvantage: New entrants often face higher initial costs for procurement and manufacturing due to a lack of scale and established supplier relationships.

- Reliability Concerns: New entrants may struggle to ensure the consistent and timely supply of critical materials, impacting project delivery and competitiveness.

The threat of new entrants in the energy technology sector, particularly for companies like Siemens Energy, is generally considered low. This is primarily due to the immense capital requirements for research, development, and manufacturing. For instance, establishing a new gas turbine production facility can cost hundreds of millions of dollars, a significant barrier for any potential newcomer.

Furthermore, navigating the complex web of stringent national and international regulations, including safety and environmental compliance, demands substantial investment and specialized expertise. Obtaining necessary certifications and permits can be a lengthy and costly process, further deterring new players. Siemens Energy’s market capitalization of approximately €15 billion in early 2024 underscores the scale of resources required to compete.

Established players also benefit from deeply entrenched customer relationships and significant technological advantages, protected by extensive intellectual property portfolios. Siemens Energy's R&D spending of €2.1 billion in fiscal year 2023 highlights the continuous investment needed to maintain a competitive edge, making it difficult for new entrants to match their innovative capacity and product offerings.

The optimized global supply chains and economies of scale enjoyed by incumbents like Siemens Energy, evidenced by its €89.4 billion order intake in 2023, create a cost disadvantage for new entrants. Replicating these intricate networks requires massive upfront investment, making it challenging for new companies to achieve comparable operational efficiencies and cost structures.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Siemens Energy leverages data from industry-specific market research reports, company annual filings, and reputable financial news outlets to provide a comprehensive view of the competitive landscape.