Shanghai Electric Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Electric Group Bundle

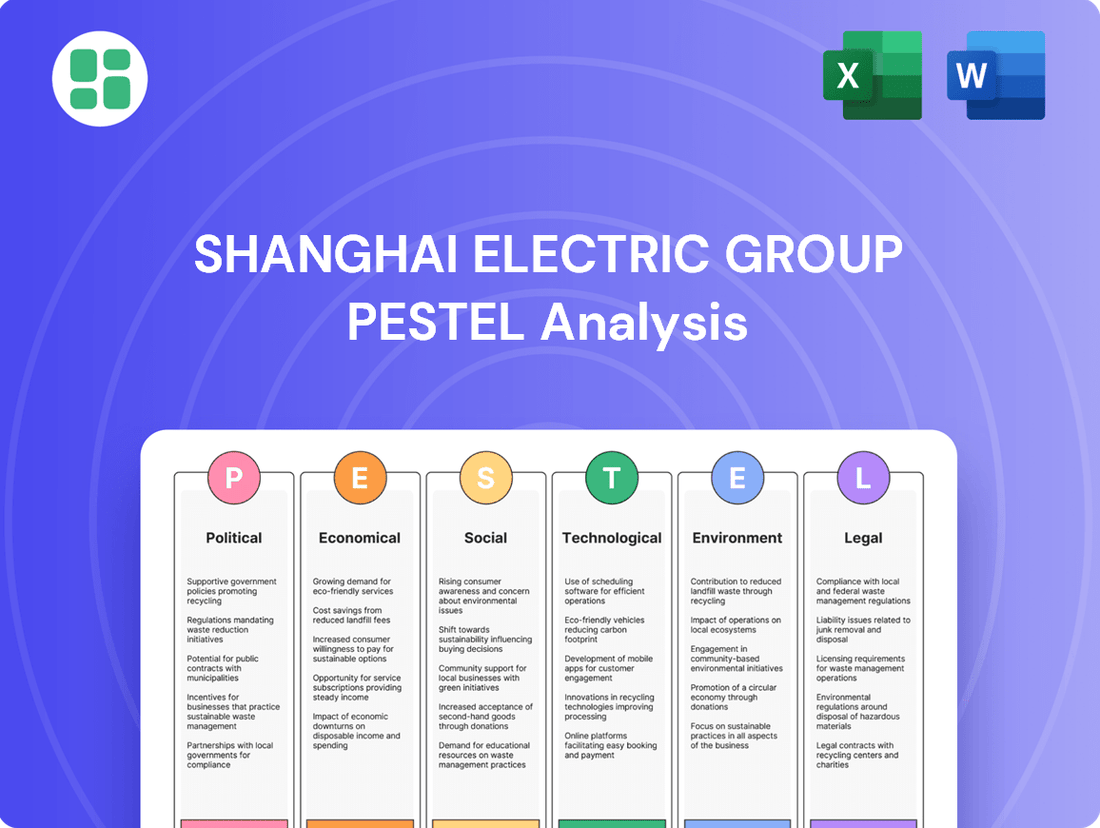

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting Shanghai Electric Group. Our PESTLE analysis provides a clear roadmap of the external forces shaping their operations and future growth. Equip yourself with this essential intelligence to refine your strategy and gain a competitive edge. Download the full, actionable report today!

Political factors

Shanghai Electric Group is a major beneficiary of China's strong governmental push towards advanced manufacturing and the new energy sector. Initiatives like Made in China 2025 and the 14th Five-Year Plan directly target sectors where Shanghai Electric is a key player, such as power generation equipment and industrial machinery.

These national strategies translate into tangible benefits, including potential subsidies, preferential loan terms, and enhanced access to domestic markets for companies like Shanghai Electric. For instance, the 14th Five-Year Plan (2021-2025) specifically highlights the development of advanced manufacturing clusters and the acceleration of green energy technologies, aligning perfectly with Shanghai Electric's strategic direction.

In 2023, China's investment in renewable energy capacity reached a record high, with significant growth in wind and solar power installations, areas where Shanghai Electric is a prominent supplier of turbines and related equipment. This government-backed expansion provides a robust demand environment for the company's offerings.

China's commitment to its 'dual carbon' targets, aiming for peak CO2 emissions before 2030 and carbon neutrality by 2060, significantly shapes Shanghai Electric's strategic landscape. This strong political mandate fuels demand for green technologies and sustainable energy solutions.

The government's proactive push for higher non-fossil fuel consumption and expanded renewable energy capacity directly benefits Shanghai Electric's core business segments. In 2023, China's installed renewable energy capacity reached 1.45 billion kilowatts, a substantial increase that underscores the market's growth potential for companies like Shanghai Electric.

This supportive political environment provides a predictable and expanding market for Shanghai Electric's clean energy equipment and services. The company’s investments in wind power, solar energy, and hydrogen fuel cell technologies are well-positioned to capitalize on these national policy priorities.

The Belt and Road Initiative (BRI) presents a substantial avenue for Shanghai Electric to broaden its international reach, especially in power generation and infrastructure development. This ambitious global strategy fosters cross-border collaboration and investment in energy and industrial sectors across numerous nations, creating a consistent demand for Shanghai Electric's engineering, procurement, and construction (EPC) services and equipment.

By engaging with BRI projects, Shanghai Electric can effectively reduce its dependence on the Chinese domestic market, utilizing its established expertise to secure contracts and drive revenue growth in emerging economies. For instance, as of early 2024, China had signed BRI cooperation agreements with over 150 countries, many of which are actively seeking energy infrastructure upgrades, a key area of Shanghai Electric's specialization.

Geopolitical Tensions and Trade Policies

Global geopolitical tensions and shifting trade policies, particularly between China and key economic players, present significant challenges for Shanghai Electric's international operations and its intricate supply chains. For instance, the ongoing trade friction between the United States and China, which intensified in recent years, has led to increased tariffs on various goods. In 2023, the US imposed tariffs on a range of Chinese imports, impacting the cost of components and finished products, which could indirectly affect Shanghai Electric's sourcing and market access.

These evolving trade dynamics, including potential export controls and restrictions on technology transfers, can directly influence the cost and availability of critical components for Shanghai Electric's diverse product lines, from power generation equipment to industrial machinery. Such measures might also limit the company's ability to access certain markets or engage in vital technological collaborations. Navigating these complex international relations is crucial for maintaining operational efficiency and global market reach.

Shanghai Electric must remain agile in adapting to these geopolitical shifts. For example, the company may need to diversify its sourcing strategies and explore alternative markets to mitigate the impact of trade barriers. Proactive engagement with policymakers and a keen understanding of international trade regulations will be essential for ensuring the continuity of its global business.

- Trade Tensions Impact: US tariffs on Chinese goods in 2023, for example, could raise costs for imported components used by Shanghai Electric.

- Supply Chain Vulnerability: Restrictions on technology transfer can hinder access to essential components and affect manufacturing capabilities.

- Market Access Risks: Evolving trade policies may limit Shanghai Electric's ability to export products to key international markets.

- Strategic Adaptation: The company's success hinges on its capacity to adapt sourcing, explore new markets, and manage regulatory changes effectively.

Regulatory Stability and Industrial Policy Implementation

Regulatory stability in China significantly impacts Shanghai Electric's strategic planning. The government's commitment to high-end manufacturing and green energy, as evidenced by continued investment in renewable energy projects, provides a favorable backdrop. For instance, China's installed renewable energy capacity reached over 3.1 billion kilowatts by the end of 2023, a testament to supportive industrial policies.

However, the effectiveness of these policies hinges on consistent implementation at the local level. Shanghai Electric's profitability can be influenced by how local governments administer incentives, streamline permitting processes, and adapt to evolving environmental regulations. A predictable regulatory environment is key for the company to confidently commit capital to new projects and technological advancements.

The company benefits from clear guidelines in sectors like advanced manufacturing and clean energy. For example, policies promoting the development of smart grids and electric vehicle infrastructure directly support Shanghai Electric's product portfolio and market expansion strategies. These consistent frameworks are vital for fostering long-term growth and maintaining a competitive edge.

- Industrial Policy Alignment: China's focus on advanced manufacturing and green energy aligns with Shanghai Electric's core business areas.

- Implementation Variability: Local government execution of national policies can create inconsistencies affecting operational efficiency.

- Regulatory Predictability: Stable and transparent regulations are crucial for Shanghai Electric's investment decisions and project profitability.

- Market Support: Policies supporting sectors like renewable energy and smart grids provide direct market opportunities for the company.

China's strong political will to advance its manufacturing sector and green energy initiatives directly benefits Shanghai Electric. National plans like Made in China 2025 and the 14th Five-Year Plan champion areas where the company is a leader, such as power generation equipment. This alignment translates into tangible advantages like potential subsidies and favorable financing, bolstering market access.

The government's commitment to carbon neutrality targets fuels demand for Shanghai Electric's clean energy solutions. In 2023, China's renewable energy capacity saw record growth, with wind and solar installations expanding significantly, creating a robust market for the company's turbines and related equipment.

The Belt and Road Initiative offers Shanghai Electric substantial opportunities for international expansion, particularly in infrastructure and power generation. This global strategy fosters cross-border projects, creating consistent demand for the company's engineering, procurement, and construction services, as evidenced by over 150 BRI cooperation agreements signed by China as of early 2024.

However, global geopolitical tensions and trade policies present challenges. For instance, US tariffs imposed in 2023 on Chinese goods can increase costs for imported components. Evolving trade dynamics, including potential export controls, may also affect market access and the availability of critical technologies for Shanghai Electric.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting Shanghai Electric Group, covering political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides strategic insights for identifying market opportunities and potential risks to inform decision-making and future planning.

A concise PESTLE analysis of Shanghai Electric Group, highlighting key external factors impacting the company, serves as a pain point reliever by providing a clear, actionable framework for strategic decision-making.

This analysis offers a readily digestible overview of political, economic, social, technological, legal, and environmental influences, enabling stakeholders to proactively address challenges and capitalize on opportunities.

Economic factors

Shanghai Electric's fortunes are intrinsically linked to the ebb and flow of global and domestic economic growth, directly influencing demand for its core offerings in energy, industrial machinery, and infrastructure development. While China's economic expansion is projected to moderate from its previous high rates, ongoing urbanization and the push for industrial modernization continue to fuel substantial domestic demand.

Globally, economic stability plays a crucial role, affecting the feasibility of international ventures and Shanghai Electric's capacity to export its products and services effectively. For instance, the International Monetary Fund's (IMF) October 2024 World Economic Outlook projected global growth at 3.1% for 2024, a slight uptick from 2023, but still subject to geopolitical uncertainties and inflationary pressures.

Shanghai Electric's performance is intrinsically linked to global infrastructure and energy project investments. Government and private sector spending on power generation and transmission equipment, along with Engineering, Procurement, and Construction (EPC) services, directly drives demand for Shanghai Electric's offerings. For instance, China's commitment to grid modernization and renewable energy expansion, as highlighted by its 14th Five-Year Plan (2021-2025) targeting significant renewable energy capacity increases, provides a robust domestic market.

Beyond China, emerging markets present substantial growth avenues. Many developing nations are actively seeking to upgrade their power infrastructure to meet rising energy demands. This global push for infrastructure development, particularly in renewables and grid modernization, creates significant opportunities for Shanghai Electric to leverage its expertise and product portfolio, contributing to its revenue streams and market position.

Fluctuations in raw material costs, like steel and copper, directly influence Shanghai Electric's production expenses and bottom line. For instance, global steel prices saw significant volatility in late 2023 and early 2024, impacting heavy manufacturing sectors.

Supply chain disruptions remain a key concern, affecting component delivery and increasing logistics costs for Shanghai Electric. The ongoing geopolitical tensions and shipping challenges experienced in 2024 continue to pose risks to timely operations.

Developing resilient and diversified supply chains is paramount for Shanghai Electric to manage costs effectively and ensure uninterrupted operations. Companies in this sector are increasingly investing in nearshoring and multi-sourcing strategies to mitigate these risks.

Exchange Rate Volatility

Shanghai Electric, as a global player with extensive international projects and export activities, faces significant exposure to exchange rate volatility. Fluctuations in major currencies like the US Dollar and Euro can directly impact the cost competitiveness of its equipment and services sold abroad. For instance, a stronger RMB against these currencies would make Shanghai Electric's offerings more expensive for international buyers, potentially dampening demand.

The company's financial performance is also susceptible to currency swings affecting its overseas revenues and expenses. When international earnings are repatriated, their value in Renminbi (RMB) can be significantly altered by exchange rate movements. In 2024, the RMB experienced periods of depreciation against the US Dollar, which could have favorably impacted reported international profits when converted, while also increasing the cost of imported components for its manufacturing processes.

Effective currency risk management through hedging strategies is therefore crucial for Shanghai Electric. These strategies aim to lock in exchange rates for future transactions, providing greater certainty over costs and revenues. For example, forward contracts or options can be used to mitigate the impact of adverse currency movements on large international contracts or anticipated foreign currency cash flows.

- Impact on Competitiveness: A 5% appreciation of the RMB against the Euro in early 2025 could increase the price of Shanghai Electric's wind turbines sold in the Eurozone by a similar margin, affecting its market share.

- Revenue Translation: In 2024, Shanghai Electric reported that approximately 30% of its revenue was generated from overseas markets, making it highly sensitive to currency fluctuations.

- Hedging Costs: While hedging mitigates risk, it also incurs costs. The expense of hedging instruments can reduce profit margins, requiring a careful balance between risk reduction and cost efficiency.

Access to Capital and Financing Costs

Shanghai Electric's ability to finance its substantial projects, including those in renewable energy and advanced manufacturing, is directly tied to capital availability and its associated costs. For instance, in early 2024, China's benchmark lending rates, such as the Loan Prime Rate (LPR), remained a key indicator for Shanghai Electric's borrowing expenses. Access to state-backed funds and favorable lending conditions from Chinese policy banks significantly bolsters its competitive edge in securing financing for long-term, capital-intensive endeavors.

The cost of capital is heavily influenced by broader economic conditions and monetary policy. Fluctuations in global interest rates and the overall liquidity of financial markets, both within China and internationally, directly impact Shanghai Electric's ability to secure loans at competitive rates. This access to affordable financing is crucial for its ongoing investments in research and development and the execution of massive infrastructure projects.

Key financing considerations for Shanghai Electric include:

- Interest Rate Environment: Monitoring domestic and international interest rate trends, such as the People's Bank of China's policy rates, directly affects borrowing costs.

- Government Support: The availability of state-backed financing, subsidies, and guarantees from entities like China Development Bank can significantly reduce capital costs.

- Market Liquidity: The overall health and liquidity of financial markets determine the ease and cost of raising funds through debt or equity issuance.

Shanghai Electric's growth is closely tied to China's economic trajectory, with ongoing urbanization and industrial upgrades driving domestic demand for its energy and manufacturing solutions. Global economic stability is also crucial, impacting its international projects and export competitiveness, as seen in the IMF's projected 3.1% global growth for 2024, albeit with lingering uncertainties.

The company's performance hinges on infrastructure and energy investments, with China's 14th Five-Year Plan (2021-2025) emphasizing renewable energy expansion providing a strong domestic market. Emerging markets also offer significant opportunities for Shanghai Electric to contribute to grid modernization and renewable energy development.

Fluctuations in raw material costs, such as steel and copper, directly impact production expenses, with prices showing volatility in late 2023 and early 2024. Supply chain disruptions, exacerbated by geopolitical tensions and shipping challenges in 2024, continue to affect component delivery and logistics costs, necessitating diversified supply chain strategies.

Shanghai Electric's significant overseas revenue, approximately 30% as of 2024, makes it susceptible to exchange rate volatility, impacting the cost-competitiveness of its exports and the value of repatriated earnings. For instance, RMB depreciation in 2024 could have favorably impacted reported international profits when converted.

What You See Is What You Get

Shanghai Electric Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shanghai Electric Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. You'll gain a clear understanding of the external forces shaping this major industrial player.

Sociological factors

China's rapid urbanization continues to fuel demand for energy. By the end of 2023, the country's urban population accounted for 66.16% of its total population, a figure that is projected to reach over 70% by 2025. This ongoing shift means more people require access to reliable electricity and advanced industrial infrastructure, directly benefiting Shanghai Electric's core businesses in power generation and equipment manufacturing.

Shanghai Electric's success hinges on access to a skilled workforce, especially in advanced manufacturing and digital sectors. The company's 2024-2025 strategy emphasizes recruiting talent in AI and new energy, critical for maintaining its innovative edge. This focus is supported by China's ongoing efforts to boost vocational training and higher education in these high-demand fields, aiming to fill an estimated 30 million high-tech jobs by 2030.

Public perception of industrial companies, particularly concerning their environmental footprint and commitment to sustainability, is a major driver of their social license to operate. Shanghai Electric's proactive stance on corporate social responsibility, demonstrated through investments in green energy technologies and community development initiatives, directly influences its brand image and public trust. For instance, in 2023, the company reported a 15% reduction in carbon emissions from its manufacturing operations compared to 2020 levels, a figure that resonates positively with environmentally conscious stakeholders.

Changing Consumer Preferences for Green Products and Services

Societal trends are increasingly pushing for environmentally friendly options, and this affects even industrial giants like Shanghai Electric. While their direct customers are often utilities and large industries, these clients are themselves facing pressure to adopt greener practices. This translates into a growing demand for Shanghai Electric's renewable energy components, such as wind turbines and solar power equipment, as well as machinery designed for greater energy efficiency in manufacturing processes.

The push for sustainability isn't just about new equipment; it also influences the lifecycle of existing infrastructure. Shanghai Electric's clients are looking for solutions that minimize environmental impact, including advanced pollution control systems and technologies for waste heat recovery. For example, China's commitment to carbon neutrality by 2060 is a significant driver for investments in green technologies across all sectors, impacting the types of projects Shanghai Electric secures.

- Renewable Energy Growth: Global renewable energy capacity additions reached a record 576 GW in 2023, a 10.5% increase from 2022, highlighting the strong market pull for sustainable power solutions.

- Energy Efficiency Mandates: Many countries, including China, are implementing stricter energy efficiency standards for industrial machinery, compelling manufacturers to upgrade to more efficient equipment.

- ESG Investing: The rise of Environmental, Social, and Governance (ESG) investing means companies are increasingly evaluated on their sustainability performance, influencing their purchasing decisions towards greener suppliers.

- Circular Economy Focus: There's a growing emphasis on the circular economy, encouraging the development of products that are durable, repairable, and recyclable, which Shanghai Electric must consider in its innovation pipeline.

Safety and Health Standards for Industrial Operations

Societal expectations and regulatory scrutiny regarding workplace safety and health in heavy manufacturing and power projects are on the rise. This heightened awareness means companies like Shanghai Electric face increasing pressure to ensure the well-being of their workforce.

Shanghai Electric must adhere to stringent safety standards to protect its employees and maintain its hard-earned reputation. For instance, in 2023, the International Labour Organization reported that manufacturing remains one of the sectors with a significant number of occupational accidents globally, underscoring the critical need for robust safety measures.

Implementing robust safety protocols and investing in worker training are essential for minimizing accidents and ensuring a responsible operating environment. This includes continuous training on new equipment and safety procedures. Shanghai Electric's commitment to safety is reflected in its ongoing investment in advanced safety equipment and training programs, aiming to reduce its incident rate below the industry average.

- Increased Societal Pressure: Public and governmental demand for safer industrial workplaces is growing, impacting how companies operate.

- Regulatory Scrutiny: Stricter enforcement of safety regulations is becoming common, with significant penalties for non-compliance.

- Reputational Risk: Workplace accidents can severely damage a company's image and public trust, affecting investor confidence and customer loyalty.

- Investment in Safety: Companies are allocating more resources to safety training and advanced protective equipment to mitigate risks and ensure compliance.

Growing demand for sustainable energy solutions, driven by public awareness and corporate ESG goals, directly benefits Shanghai Electric's renewable energy divisions. The company's focus on green technologies aligns with societal shifts towards environmental responsibility, which is increasingly influencing purchasing decisions across industries.

Public perception and demand for ethical business practices are shaping corporate strategies, pushing companies like Shanghai Electric to prioritize social responsibility and transparent operations. This includes a strong emphasis on employee well-being and community engagement, factors that are critical for maintaining a positive brand image and operational license.

The increasing urbanization and demand for reliable energy infrastructure in China, with urban populations projected to exceed 70% by 2025, create a sustained market for Shanghai Electric's power generation and equipment manufacturing capabilities. This demographic shift underscores the ongoing need for the company's core products and services.

Societal trends are heavily influencing the industrial sector towards greater sustainability and efficiency. This translates into a heightened demand for Shanghai Electric's advanced manufacturing solutions, including energy-efficient machinery and components for renewable energy projects, reflecting a broader commitment to environmental stewardship.

| Sociological Factor | Impact on Shanghai Electric | Supporting Data/Trend (2023-2025) |

| Urbanization & Energy Demand | Increased demand for power generation and infrastructure | China's urban population reached 66.16% in 2023, projected over 70% by 2025. |

| Sustainability & ESG Focus | Growth in renewable energy and green tech demand | Global renewable capacity additions hit 576 GW in 2023; ESG investing is a key driver. |

| Workplace Safety & Health | Emphasis on robust safety protocols and training | Heightened societal and regulatory scrutiny on industrial safety. |

| Skilled Workforce Needs | Demand for talent in AI and new energy sectors | Shanghai Electric's strategy prioritizes AI and new energy recruitment. |

Technological factors

Rapid advancements in renewable energy technologies like solar, wind, and energy storage are reshaping the global energy landscape, directly influencing Shanghai Electric's primary business operations. The company is navigating a market where efficiency and cost-effectiveness are paramount, necessitating substantial investment in research and development to stay ahead.

To maintain its competitive edge, Shanghai Electric must innovate in areas such as next-generation solar photovoltaic cells and advanced wind turbine designs, alongside developing more robust energy storage solutions. Their strategic focus on nuclear power and gas turbines also demands continuous technological evolution to meet stringent safety and performance standards.

The equipment manufacturing sector, including Shanghai Electric's operations, is undergoing a significant transformation driven by industrial automation, AI, and smart manufacturing. These technologies are key to boosting efficiency and cutting costs.

Shanghai Electric's strategic integration of these advancements is evident in its focus on digital factories and the acquisition of Ningsheng Industrial. This move aims to enhance production processes, leading to better product quality and operational competitiveness.

The global push towards smart grids and the digitalization of power systems presents significant growth avenues for Shanghai Electric. The company's established capabilities in automation and advanced power equipment are directly applicable to developing and implementing solutions for real-time grid monitoring, efficient energy distribution, and improved grid stability.

By leveraging its expertise, Shanghai Electric can offer integrated systems that enhance grid resilience and optimize energy flow, capitalizing on the increasing adoption of AI and IoT technologies in grid management. For instance, the company's involvement in smart substation projects in China, which saw increased deployment of digital technologies in 2023, highlights its preparedness for this evolving landscape.

Research and Development (R&D) Investment and Patent Portfolio

Shanghai Electric's commitment to innovation is evident in its sustained Research and Development (R&D) investment, crucial for maintaining technological leadership in high-end equipment manufacturing. In 2023, the company reported R&D expenses of approximately RMB 7.3 billion (roughly $1 billion USD), representing a notable increase from previous years and underscoring its focus on future growth.

This investment fuels a substantial patent portfolio, particularly strong in key sectors like gas turbines and wind turbines, where Shanghai Electric holds thousands of patents. For instance, their advancements in high-efficiency gas turbines and offshore wind technology showcase this dedication. Protecting this intellectual property is paramount for ensuring long-term competitiveness and market differentiation.

- Sustained R&D Investment: Shanghai Electric's R&D expenditure in 2023 reached approximately RMB 7.3 billion, highlighting a strategic focus on technological advancement.

- Extensive Patent Portfolio: The company possesses a robust patent portfolio, with a significant number of patents concentrated in critical areas such as gas turbines and wind turbines.

- Intellectual Property Protection: Safeguarding its intellectual property is a vital component of Shanghai Electric's strategy to maintain its competitive edge in the global market.

Cybersecurity in Industrial Control Systems

As industrial operations increasingly rely on digital connectivity, cybersecurity threats to Industrial Control Systems (ICS) are a growing concern for Shanghai Electric. The company must bolster its defenses to safeguard its own operational technology and the critical infrastructure it supports, particularly in energy sectors. For instance, the global average cost of an ICS cyberattack reached $4.51 million in 2024, highlighting the significant financial and operational risks involved.

Shanghai Electric's commitment to providing secure solutions means investing in advanced cybersecurity frameworks. This includes protecting against ransomware and state-sponsored attacks targeting power grids and manufacturing facilities. By 2025, it's estimated that 70% of critical infrastructure organizations will face significant cyber threats, underscoring the urgency for proactive security measures.

- Escalating ICS Threats: The interconnected nature of modern industrial operations amplifies cybersecurity vulnerabilities in control systems.

- Shanghai Electric's Role: The company must implement robust security to protect its own systems and client infrastructure, especially in sensitive sectors.

- Financial Impact: The average cost of an ICS cyberattack was $4.51 million in 2024, emphasizing the need for strong preventative measures.

- Future Risk: Projections suggest 70% of critical infrastructure organizations will face significant cyber threats by 2025, demanding immediate attention.

Technological advancements are a primary driver for Shanghai Electric, particularly in the renewable energy sector where efficiency gains in solar and wind power are critical. The company's substantial R&D investment, reaching approximately RMB 7.3 billion ($1 billion USD) in 2023, fuels innovation in areas like advanced gas turbines and offshore wind technology. Furthermore, the increasing adoption of AI and IoT in smart grids presents significant opportunities for Shanghai Electric to deploy its expertise in automation and power equipment.

| Key Technology Area | Shanghai Electric's Focus/Investment | Market Trend/Impact |

| Renewable Energy Tech | R&D in solar, wind, energy storage | Global shift towards efficiency and cost-effectiveness |

| Industrial Automation & AI | Digital factories, smart manufacturing | Boosting operational efficiency and reducing costs |

| Smart Grids & Digitalization | Integrated systems for grid monitoring and distribution | Growing demand for grid resilience and optimized energy flow |

| Cybersecurity | Investing in advanced ICS security frameworks | Mitigating risks from increasing cyber threats to critical infrastructure |

Legal factors

China's environmental protection laws, including stricter standards for emissions and waste management implemented in recent years, directly impact Shanghai Electric's manufacturing operations. For instance, the nation's updated Environmental Protection Law, effective from 2015 and continually reinforced, mandates significant reductions in industrial pollution. This means Shanghai Electric must invest in cleaner production technologies and ensure its equipment, such as power generation turbines and transmission systems, meets evolving environmental benchmarks.

Globally, there's a growing push for decarbonization, influencing demand for Shanghai Electric's products. The company's 2024 and 2025 strategic planning must account for international regulations and customer preferences for sustainable energy solutions. For example, the increasing adoption of renewable energy sources worldwide necessitates a focus on developing and manufacturing efficient solar panels and wind turbines, areas where Shanghai Electric has been actively expanding its portfolio.

Shanghai Electric Group faces rigorous product safety and quality standards across its global operations, requiring strict adherence to certifications like ISO 9001 and industry-specific regulations for power generation and industrial machinery. For instance, in 2024, the European Union's General Product Safety Regulation continues to emphasize robust safety measures for all manufactured goods entering its market, impacting Shanghai Electric's export strategies.

Failure to meet these evolving legal requirements, such as those mandated by China's Compulsory Certification (CCC) mark for certain electrical products, can result in costly product recalls, significant legal liabilities, and severe damage to the company's reputation, as seen in past instances with other global manufacturers facing penalties for non-compliance.

Shanghai Electric's extensive patent portfolio and other intellectual property are critical assets, particularly given the intense competition in the global high-tech manufacturing sector. In 2023, the company reported holding over 11,000 authorized patents, with a significant portion related to advanced manufacturing processes and green energy technologies. This robust IP base is essential for maintaining its competitive edge and preventing unauthorized use of its innovations.

The effectiveness of legal frameworks for Intellectual Property Rights (IPR) protection, both within China and in the international markets where Shanghai Electric operates, is paramount. China has been strengthening its IP laws, with recent reforms aimed at increasing penalties for infringement and improving enforcement mechanisms. For instance, the average compensation for IP infringement cases in China saw a notable increase in 2023, reflecting a more robust legal environment for rights holders.

International Trade Laws and Sanctions

Shanghai Electric operates within a complex web of international trade laws, including anti-dumping regulations and export controls. These regulations can significantly affect its global business operations and market access. For instance, the imposition of sanctions by various countries can restrict Shanghai Electric's ability to export its products or import necessary components, directly impacting its revenue streams and supply chain efficiency.

Navigating these intricate legal frameworks is crucial for Shanghai Electric to ensure compliance with international trade agreements and avoid substantial penalties or market access limitations. The company's adherence to these laws is paramount for maintaining its reputation and operational continuity in the global marketplace. For example, in 2024, the global trade landscape continued to be shaped by evolving protectionist policies and increased scrutiny on technology transfers, directly impacting large manufacturing conglomerates like Shanghai Electric.

- Compliance Burden: Shanghai Electric faces ongoing costs associated with monitoring and adhering to a growing number of international trade regulations, including those related to environmental standards and labor practices.

- Sanctions Impact: The company must continuously assess and adapt to evolving sanctions regimes, which can disrupt existing contracts and limit opportunities in specific geographic markets.

- Export Controls: Stringent export controls, particularly on advanced technologies, require Shanghai Electric to implement robust internal processes to prevent unauthorized transfers and ensure compliance with national security interests of various countries.

- Trade Disputes: Shanghai Electric may be subject to anti-dumping investigations or other trade disputes, which can lead to tariffs or other trade barriers that negatively affect its pricing and competitiveness.

Corporate Governance and Compliance Regulations

Shanghai Electric, as a dual-listed entity on both the Shanghai Stock Exchange and the Hong Kong Stock Exchange, operates under stringent corporate governance and financial reporting mandates. Compliance with these regulations, including the China Securities Regulatory Commission (CSRC) rules and Hong Kong's Listing Rules, is paramount for maintaining transparency and safeguarding investor confidence. For instance, in 2024, the CSRC continued to emphasize enhanced disclosure requirements for listed companies, particularly concerning related-party transactions and environmental, social, and governance (ESG) factors, directly impacting Shanghai Electric's reporting obligations.

The company's commitment to these legal frameworks is crucial for its market standing and access to capital. Failure to adhere to evolving compliance standards, such as those related to data privacy and cybersecurity, could result in significant penalties and reputational damage. Shanghai Electric's 2024 annual report highlighted its ongoing efforts to strengthen internal controls and audit procedures to meet these complex regulatory demands.

- Dual Listing Compliance: Adherence to both mainland China's CSRC regulations and Hong Kong's Securities and Futures Commission (SFC) and exchange rules.

- Investor Protection: Ensuring transparent financial reporting and fair treatment of all shareholders, a key focus for regulators in 2024.

- Regulatory Adaptation: Continuous monitoring and proactive adjustments to new or amended laws affecting corporate conduct and disclosures, including ESG reporting mandates.

Shanghai Electric must navigate stringent environmental protection laws, including China's updated Environmental Protection Law, to ensure its manufacturing processes meet evolving emission and waste management standards. The company's global operations are also subject to international decarbonization mandates and product safety regulations, such as the EU's General Product Safety Regulation, impacting its product development and export strategies in 2024 and 2025.

The company's intellectual property is a critical asset, with over 11,000 authorized patents as of 2023, necessitating robust legal frameworks for protection. China's strengthening IP laws, evidenced by increased infringement compensation in 2023, provide a more secure environment for Shanghai Electric's innovations.

International trade laws, including anti-dumping regulations and export controls, pose significant challenges, as demonstrated by the ongoing impact of evolving protectionist policies and technology transfer scrutiny in 2024. Sanctions and trade disputes can disrupt contracts and create market access limitations.

As a dual-listed entity, Shanghai Electric faces rigorous corporate governance and financial reporting mandates from both the CSRC and Hong Kong's regulatory bodies, with enhanced disclosure requirements for ESG factors in 2024. Compliance is vital for maintaining investor confidence and market access.

Environmental factors

Global and national imperatives to combat climate change and achieve ambitious decarbonization goals are significantly shaping Shanghai Electric's strategic direction, particularly within its burgeoning new energy segment. The intensifying worldwide commitment to reducing greenhouse gas emissions, especially from heavy industry and power generation, is directly fueling demand for Shanghai Electric's advanced renewable energy solutions and environmental protection technologies. For instance, China, Shanghai Electric's primary market, has pledged to reach peak carbon emissions before 2030 and carbon neutrality before 2060, a commitment that translates into substantial investment opportunities for companies like Shanghai Electric in wind, solar, and energy storage.

The increasing global push for renewable energy, encompassing wind, solar, and hydro power, along with a strong focus on energy efficiency, presents significant growth avenues for Shanghai Electric. As nations and industries prioritize decarbonization efforts, the company's expertise in power generation equipment and energy-saving technologies becomes paramount.

In 2024, global investment in clean energy technologies reached an estimated $2 trillion, a substantial increase reflecting this demand. Shanghai Electric's robust portfolio in wind turbine manufacturing and solar power solutions positions it to capitalize on this trend, contributing to a cleaner energy future.

Growing global concerns about resource scarcity, particularly for water and essential raw materials, are compelling manufacturers like Shanghai Electric to embrace more sustainable production methods. This shift is not just about compliance but also about long-term viability and cost management.

Shanghai Electric is thus motivated to integrate circular economy principles, minimize waste generation, and enhance resource efficiency across its manufacturing processes. For instance, in 2023, the company reported progress in its green manufacturing initiatives, aiming to reduce energy consumption per unit of output by 5% by 2025 compared to 2020 levels.

Furthermore, this environmental imperative fuels demand for advanced environmental protection equipment designed for resource recovery. Companies specializing in such technologies, and those like Shanghai Electric that invest in them, are positioned to benefit from this growing market segment.

Environmental, Social, and Governance (ESG) Reporting and Standards

Environmental, Social, and Governance (ESG) considerations are increasingly vital for investors and stakeholders, influencing capital allocation and corporate reputation. Shanghai Electric's proactive stance on environmental performance, demonstrated through its ESG reports and carbon management strategies, is key to securing investment and fostering a positive public image.

Compliance with evolving ESG reporting standards is a growing expectation for companies worldwide. For Shanghai Electric, adherence to frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) is becoming a standard requirement for demonstrating transparency and accountability. In 2023, Shanghai Electric reported a reduction in its carbon intensity, a move that aligns with global decarbonization efforts and investor demand for sustainable operations.

- ESG Integration: Shanghai Electric's commitment to ESG principles is integral to its long-term strategy, aiming to attract global capital and enhance stakeholder trust.

- Carbon Management: The company's initiatives to reduce emissions and improve energy efficiency are critical for navigating the energy transition and meeting regulatory requirements.

- Reporting Standards: Staying abreast of and complying with evolving international ESG reporting standards is essential for maintaining credibility and access to financial markets.

Impact of Extreme Weather Events on Operations and Infrastructure

Shanghai Electric's operations face significant threats from climate change, with extreme weather events becoming more frequent and intense. This directly impacts their infrastructure projects and existing facilities. For instance, the company's global footprint means exposure to diverse climate risks, from typhoons in Asia to heatwaves impacting energy generation efficiency.

These events can cause substantial disruptions. Supply chains for critical components can be broken, leading to project delays and increased costs. Shanghai Electric's manufacturing plants and power generation sites are also vulnerable to physical damage from floods, storms, or extreme temperatures. For example, a severe flood in a key manufacturing region could halt production for weeks.

Adapting to these challenges is crucial for resilience and long-term viability. This involves investing in climate-resilient infrastructure design and implementing robust risk management strategies.

- Supply Chain Vulnerability: Extreme weather events in 2024 and early 2025 have already demonstrated the fragility of global supply chains, with disruptions in Southeast Asia impacting component availability for renewable energy projects.

- Infrastructure Damage: Reports from early 2025 indicate increased repair costs for infrastructure damaged by severe storms, highlighting the direct financial impact on companies like Shanghai Electric.

- Project Timelines: Delays in the construction of new power plants due to unseasonal heavy rainfall in key project locations have been noted throughout 2024, affecting project completion dates.

- Operational Efficiency: Heatwaves experienced in 2024 led to reduced output from thermal power plants in several regions, impacting overall energy generation efficiency and profitability.

Global decarbonization efforts are a major driver for Shanghai Electric, particularly its new energy division. China's commitment to peak carbon emissions before 2030 and carbon neutrality by 2060 fuels demand for wind, solar, and energy storage solutions. In 2024, global clean energy investments neared $2 trillion, a figure Shanghai Electric is well-positioned to leverage with its wind turbine and solar power offerings.

Resource scarcity is pushing Shanghai Electric towards sustainable manufacturing and circular economy principles. The company aims to cut energy consumption per unit of output by 5% by 2025 compared to 2020 levels, reflecting a broader industry trend towards efficiency and waste reduction.

ESG factors are increasingly influencing investment, making Shanghai Electric's environmental performance crucial for capital attraction and reputation. The company's 2023 carbon intensity reduction aligns with global sustainability goals and investor preferences.

The company faces physical risks from climate change, including extreme weather events that can disrupt supply chains and damage facilities. For instance, 2024 saw supply chain disruptions in Southeast Asia impacting renewable energy projects, and increased infrastructure repair costs due to severe storms were reported in early 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis for Shanghai Electric Group is built on a robust foundation of data sourced from official government publications, reputable financial news outlets, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.