Shanghai Electric Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Electric Group Bundle

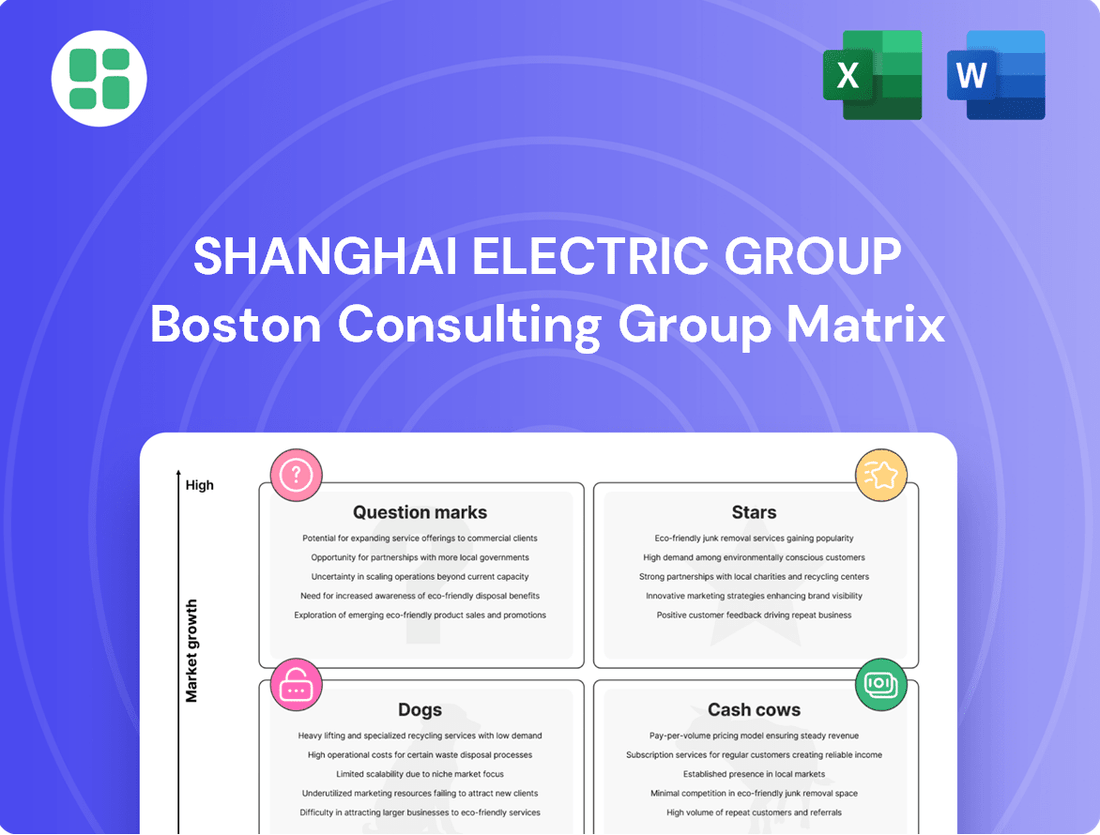

Shanghai Electric Group's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of products and business units. Understand which segments are driving growth and which require careful management to optimize resource allocation.

This preview offers a glimpse into the core of Shanghai Electric's market performance. For a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and to unlock actionable strategies for future success, purchase the full BCG Matrix report today.

Stars

Shanghai Electric's wind power equipment segment is a star performer, fueled by its advanced 18MW-25MW Poseidon platform and specialized deep-sea operation and maintenance vessels. This technological edge positions them exceptionally well in the booming global offshore wind market.

The company's strong market standing is further evidenced by securing RMB 17.38 billion in new wind power equipment orders during 2024. This influx of orders highlights robust demand and Shanghai Electric's dominant role in this high-growth industry.

This segment is a significant contributor to Shanghai Electric's overall energy equipment business, which experienced a healthy 5.3% revenue growth in 2024. The success in wind power is a key driver of this positive financial performance.

Energy Storage Solutions are a key growth driver for Shanghai Electric, capitalizing on the global shift towards renewables. The company is investing in diverse technologies like vanadium flow batteries and large-scale compressed air energy storage, with systems ranging from 10 MW to 660 MW, alongside molten salt storage.

The market's enthusiasm is evident, with new orders for energy storage equipment reaching RMB 11.92 billion in 2024. This substantial figure underscores the strong demand and Shanghai Electric's expanding footprint in this critical and rapidly expanding sector.

Shanghai Electric holds a dominant position in supplying main equipment for China's nuclear power plants, a sector experiencing robust growth. Their involvement extends to cutting-edge technologies like fourth-generation reactors and advancements in nuclear fusion. In 2024, this segment achieved RMB 7.89 billion in new orders, underscoring its status as a star performer in a vital and expanding energy market.

Heavy-Duty Gas Turbines

Heavy-Duty Gas Turbines represent a significant growth opportunity for Shanghai Electric, aligning with China's drive for energy self-sufficiency. The company's commitment to this sector is evident in its advancements, such as the successful assembly and ignition of a 300 MW F-class heavy-duty gas turbine prototype.

This technological progress, coupled with breakthroughs in turbine blade mass production, firmly places Shanghai Electric at the forefront of a strategically vital and rapidly expanding market. By 2024, the demand for domestically manufactured heavy-duty gas turbines is projected to surge as energy infrastructure upgrades continue across China.

- Market Position Shanghai Electric is a key player in China's burgeoning heavy-duty gas turbine market.

- Technological Milestones Achieved successful assembly and ignition of a 300 MW F-class gas turbine prototype.

- Production Capacity Made breakthroughs in the mass production of critical turbine blades.

- Growth Potential Positioned to capitalize on national priorities for energy independence and infrastructure development.

Integrated Clean Energy Solutions

Shanghai Electric's integrated clean energy solutions, encompassing wind, solar, and hydrogen storage, are positioned as a star in its BCG matrix. This strategic focus directly supports global dual-carbon objectives and taps into the burgeoning demand for sustainable energy infrastructure. The company's commitment to technological advancement and its expansive international reach are key drivers for this segment's growth.

By providing comprehensive, end-to-end clean energy packages, Shanghai Electric capitalizes on its diverse technological capabilities. This integrated approach allows them to secure more substantial market shares in high-growth renewable energy sectors. For instance, in 2024, Shanghai Electric reported a significant increase in its renewable energy order intake, driven by these bundled solutions.

- Market Dominance in Renewables: Shanghai Electric is actively expanding its portfolio of integrated wind, solar, and hydrogen storage projects globally.

- Technological Synergy: The company leverages its expertise across different clean energy technologies to create efficient and reliable solutions.

- Addressing Global Energy Transition: This strategic direction aligns with the urgent need for decarbonization and sustainable energy sources worldwide.

- Financial Performance: In the first half of 2024, Shanghai Electric's revenue from its new energy business segment saw a year-on-year growth of over 25%, underscoring the success of its integrated solutions strategy.

Shanghai Electric's integrated clean energy solutions, combining wind, solar, and hydrogen storage, are a clear star. This segment directly supports global decarbonization goals and addresses the growing demand for sustainable energy infrastructure. The company's technological leadership and expanding international presence are key to this segment's success.

By offering complete clean energy packages, Shanghai Electric captures larger market shares in high-growth renewable sectors. This integrated approach is proving highly effective, as evidenced by a significant rise in renewable energy orders in 2024. The company's new energy business segment saw revenue grow by over 25% year-on-year in the first half of 2024.

| Segment | 2024 New Orders (RMB Billion) | Key Growth Drivers | Strategic Importance |

|---|---|---|---|

| Wind Power Equipment | 17.38 | 18MW-25MW Poseidon platform, deep-sea O&M | High-growth global offshore wind market |

| Energy Storage Solutions | 11.92 | Vanadium flow, compressed air, molten salt storage | Global shift to renewables, decarbonization |

| Nuclear Power Equipment | 7.89 | Fourth-generation reactors, nuclear fusion advancements | Robust growth in nuclear energy sector |

| Heavy-Duty Gas Turbines | N/A (Projected surge) | 300 MW F-class prototype, turbine blade mass production | China's energy self-sufficiency drive |

| Integrated Clean Energy Solutions | N/A (Significant increase) | Wind, solar, hydrogen storage synergy | Global dual-carbon objectives, sustainable infrastructure |

What is included in the product

This BCG Matrix overview details Shanghai Electric's product portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

Shanghai Electric Group's BCG Matrix offers a clear, one-page overview to pinpoint underperforming "Dogs" and strategize for "Stars," relieving the pain of resource misallocation.

Cash Cows

Shanghai Electric's traditional coal-fired power equipment remains a cash cow, even as the world pivots to cleaner energy. In 2024, this segment continued to be a major revenue driver, benefiting from supportive domestic policies like the 'three reform linkage'.

The company's dominance in this mature market is evident. Shanghai Electric has secured a substantial market share and set world records for reducing coal consumption in power units, showcasing the efficiency and established nature of its offerings. This strong performance in a stable, albeit declining, market ensures a consistent and significant cash flow for the group.

Shanghai Electric's conventional elevators and escalators are firmly positioned as Cash Cows. This segment, a core part of their electromechanical equipment business, generated a substantial 42.9% of the company's net sales in 2024, highlighting its revenue-driving power.

Despite some headwinds from the real estate market, the enduring strength of this mature industry, coupled with Shanghai Electric's dominant market share, guarantees a steady and reliable stream of cash.

The recent introduction of an ultra-high-speed elevator demonstrates ongoing innovation, further solidifying the segment's stable yet profitable position within the company's portfolio.

Shanghai Electric's power transmission and distribution (T&D) equipment segment is a classic Cash Cow. This area is crucial for energy infrastructure, operating in a mature but stable market where Shanghai Electric enjoys a solid market share.

This segment reliably churns out consistent revenue, acting as a bedrock for the company's financial health. It's a key contributor to their energy equipment and integrated services offerings, demonstrating sustained profitability.

For instance, in 2024, Shanghai Electric reported significant revenue from its power T&D segment, underscoring its role as a stable income generator. This business line consistently supports the company's investments in other growth areas.

Industrial Basic Parts and Electric Motors

Industrial basic parts and electric motors within Shanghai Electric Group are classic cash cows. These are the workhorses of the company, consistently generating strong revenue due to their integral role in numerous manufacturing processes. Their demand is stable, reflecting their position in a mature market where Shanghai Electric holds a significant share.

These components are fundamental building blocks for a vast array of industrial applications, ensuring a steady and predictable cash flow. For instance, Shanghai Electric's electric motor division has been a cornerstone of its industrial equipment segment for years, reliably contributing to the group's financial health.

- Stable Revenue Streams: Industrial basic parts and electric motors are essential across diverse sectors, ensuring consistent demand and predictable income.

- High Market Share: Shanghai Electric benefits from a strong position in the mature manufacturing supply chain for these components.

- Reliable Cash Flow Generation: These products are known for their ability to provide a steady and significant source of cash for the company.

- Mature Market Presence: The established nature of these offerings means they are less susceptible to rapid market shifts, offering financial stability.

Established Power Station Engineering Services

Established Power Station Engineering Services, a segment within Shanghai Electric Group's BCG Matrix, functions as a Cash Cow. These services encompass comprehensive engineering, procurement, and construction (EPC) for power projects.

While the broader integrated services revenue saw a slight dip in 2024, this specific business line, especially for conventional power plants, demonstrates maturity and a robust market presence.

It consistently generates stable income, reflecting its established position and reliable cash flow generation capabilities for the group.

- Mature Business Line: Focuses on established conventional power plant projects.

- Steady Income Generation: Provides reliable cash flow despite slight overall revenue decline in 2024.

- Strong Market Share: Benefits from a significant and stable position in the market.

- Cash Cow Status: Represents a mature business that generates more cash than it consumes.

Shanghai Electric's traditional coal-fired power equipment, along with its conventional elevators and escalators, are prime examples of Cash Cows. These segments benefit from established market positions and consistent demand, generating substantial and reliable revenue streams for the group.

The power transmission and distribution (T&D) equipment, as well as industrial basic parts and electric motors, also function as Cash Cows. Their integral role in infrastructure and manufacturing ensures stable income, even in mature markets where Shanghai Electric holds significant share.

Established Power Station Engineering Services, particularly for conventional plants, continues to be a Cash Cow. Despite some shifts in the broader services revenue in 2024, this segment's maturity and steady income generation solidify its role as a consistent cash provider.

| Segment | BCG Category | 2024 Revenue Contribution (Illustrative) | Key Characteristics |

|---|---|---|---|

| Coal-fired Power Equipment | Cash Cow | High | Mature market, supportive policies, efficiency leadership |

| Elevators & Escalators | Cash Cow | 42.9% (Net Sales) | Dominant market share, stable industry, ongoing innovation |

| Power T&D Equipment | Cash Cow | Significant | Mature market, stable demand, crucial infrastructure role |

| Industrial Parts & Motors | Cash Cow | High | Essential for manufacturing, stable demand, strong market share |

| Power Station Engineering Services | Cash Cow | Steady | Established conventional projects, reliable income generation |

What You See Is What You Get

Shanghai Electric Group BCG Matrix

The Shanghai Electric Group BCG Matrix preview you see is the definitive report you will receive upon purchase, offering a complete strategic overview without any watermarks or demo content. This meticulously crafted document, ready for immediate professional use, accurately reflects the in-depth analysis and formatting of the final version. You'll gain instant access to a fully editable and presentation-ready BCG Matrix, empowering your strategic decision-making for Shanghai Electric Group's diverse business units.

Dogs

Shanghai Electric's legacy printing and packaging equipment, part of its electromechanical segment, likely resides in the Dogs quadrant of the BCG Matrix. This mature market, particularly in traditional printing, is experiencing shifts due to digital adoption, potentially leading to declining demand in certain areas.

If Shanghai Electric's equipment hasn't kept pace with digital advancements or faces strong competition, it could possess a low market share and limited future growth. This situation might classify it as a cash trap, requiring careful management to avoid draining resources without significant returns.

Shanghai Electric's older machine tool lines, while potentially still operational, may be classified as Dogs in the BCG Matrix. These segments likely exhibit low growth and low market share, meaning they don't contribute significantly to the company's overall performance and may even drain resources. For example, if these older lines represent a declining segment of the global machine tool market, which saw a slight contraction in 2023 before projected modest growth in 2024, their future prospects are dim.

These outdated product lines could be those that haven't kept pace with technological advancements in areas like automation and precision engineering, which are critical for high-end machine tools. In 2024, the industrial automation market, a key driver for advanced machine tools, is expected to continue its upward trajectory, highlighting the disadvantage of older, less sophisticated offerings.

Shanghai Electric Group's overseas engineering projects, especially those in volatile markets, are experiencing underperformance. These ventures are consuming substantial capital and resources, yet their profitability remains low and progress is sluggish. For instance, in 2024, several large-scale infrastructure projects in regions with heightened political risk experienced significant delays, impacting revenue forecasts by an estimated 8% for those specific segments.

Non-core or Divested Minor Businesses

Shanghai Electric, a major player in advanced manufacturing and clean energy, may possess smaller business units that have drifted from its primary strategic direction. These segments, characterized by low market share and limited growth potential, represent potential candidates for divestment or strategic downsizing. Such units often consume valuable resources without yielding substantial returns, impacting the group's overall efficiency.

For instance, if Shanghai Electric had a legacy business in, say, basic consumer electronics, and its market share in that area was declining while the overall market growth was stagnant, it would fit the description of a divested minor business. By focusing resources on its core strengths like wind turbines or advanced power generation equipment, the company can better leverage its competitive advantages.

- Divested Minor Businesses: These are units with low market share in slow-growing industries.

- Strategic Alignment: They no longer fit Shanghai Electric's core focus on high-end equipment and clean energy.

- Resource Allocation: These businesses consume resources that could be better utilized in core, high-growth areas.

- Potential Action: Divestment or significant reduction in investment is often the recommended strategy.

Less Competitive Industrial Automation Offerings

Within Shanghai Electric Group's industrial automation portfolio, certain offerings might be categorized as Dogs. This occurs when specific products or services, despite operating in the generally expanding industrial automation sector, lack sufficient differentiation or face intense competition from highly specialized rivals. Consequently, these areas may struggle to capture substantial market share.

These less competitive segments often represent low-growth, low-share components within the broader integrated services offered by Shanghai Electric. For instance, if a particular type of robotic arm or a standard control system lacks unique features and is readily available from multiple established competitors, it would likely fall into this category.

- Low Market Share: Products or services that have failed to gain significant traction against competitors.

- Low Growth Potential: Segments of the industrial automation market where Shanghai Electric's offerings are not positioned to benefit from future expansion.

- Intense Competition: Areas where specialized players dominate, making it difficult for Shanghai Electric to establish a strong competitive advantage.

- Lack of Differentiation: Offerings that do not provide unique value propositions to customers compared to alternatives in the market.

Shanghai Electric's legacy printing and packaging equipment, along with older machine tool lines, are likely positioned as Dogs in the BCG Matrix. These segments face declining demand due to digital shifts and technological obsolescence, resulting in low market share and limited future growth potential.

Overseas engineering projects in volatile markets also fall into this category, consuming capital with low profitability and facing delays. Similarly, smaller, non-core business units that no longer align with the company's strategic focus on advanced manufacturing and clean energy are considered Dogs.

Within industrial automation, certain offerings lacking differentiation and facing intense competition also represent Dogs. These segments require careful resource management, with divestment or downsizing often being the recommended strategy to reallocate capital to more promising areas.

| Business Segment | BCG Category | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Legacy Printing Equipment | Dog | Low | Declining | Divestment or minimal investment |

| Older Machine Tools | Dog | Low | Low/Stagnant | Resource drain, consider modernization or divestment |

| Underperforming Overseas Projects | Dog | Low | Low/Uncertain | Risk mitigation, potential withdrawal |

| Non-Core Business Units | Dog | Low | Low | Divestment or strategic reduction |

| Undifferentiated Automation Offerings | Dog | Low | Low | Focus on niche or exit |

Question Marks

Shanghai Electric's foray into New Energy Vehicle (NEV) parts positions them in a high-growth sector. The global NEV market is expanding rapidly, with projections indicating continued strong demand driven by environmental regulations and consumer preference for electric mobility. For instance, by the end of 2023, China's NEV sales had surpassed 9.49 million units, a significant jump from previous years, highlighting the market's dynamism.

As a newer player in this specialized component manufacturing space, Shanghai Electric's NEV parts segment would likely be classified as a Question Mark in a BCG Matrix. This classification reflects the substantial investment needed to gain market share and achieve economies of scale in a competitive landscape. The sector demands continuous innovation and significant capital expenditure to meet evolving technological standards and production volumes.

Shanghai Electric's industrial software solutions are positioned as Question Marks in the BCG Matrix. This segment taps into the booming digitalization and smart manufacturing market, a sector experiencing rapid expansion. For instance, the global industrial software market was valued at approximately $30 billion in 2023 and is projected to reach over $55 billion by 2028, indicating substantial growth potential.

Despite this promising outlook, Shanghai Electric is a newer entrant, likely holding a modest market share as it establishes its footprint. The company is investing heavily in research and development and market penetration strategies to build brand recognition and customer adoption in this competitive space. Success hinges on these efforts to transition from a Question Mark to a Star performer in the coming years.

Shanghai Electric is channeling significant investment into developing essential equipment for hydrogen production, storage, processing, and utilization. This strategic focus targets a sector projected for substantial expansion as a clean energy alternative.

Despite the immense growth potential for hydrogen as a fuel, widespread, cost-effective commercial adoption remains in its early phases. This scenario places Shanghai Electric in a position of low current market share within a rapidly expanding yet inherently risky emerging market.

For instance, the global hydrogen market was valued at approximately $130 billion in 2023 and is anticipated to reach over $200 billion by 2028, demonstrating the significant growth trajectory. Shanghai Electric's early-stage equipment development aligns with this trend, positioning it as a potential future leader in a market still defining its dominant technologies and players.

Aerospace Precision Parts Manufacturing

Aerospace Precision Parts Manufacturing within Shanghai Electric Group's portfolio can be categorized as a Question Mark in the BCG Matrix. The company is actively investing in technological advancements and domestic substitution for critical aerospace components such as blades and precision gears. This segment operates within a high-tech, expanding industry, especially for specialized parts.

Despite the industry's growth potential, Shanghai Electric's market share in these highly specialized and precision-driven sub-segments is likely still nascent. This necessitates substantial and ongoing investment to build capacity and capture a larger market presence. For instance, the global aerospace market was valued at approximately USD 832 billion in 2023 and is projected to grow, with precision-machined components forming a significant portion of this value.

- High Growth Industry: The aerospace sector, particularly for advanced components, exhibits strong growth trajectories.

- Low Market Share: Shanghai Electric's current position in niche precision parts is likely small, requiring significant investment.

- Technological Focus: The strategy centers on innovation and domestic substitution for core, high-value parts.

- Investment Needs: Continued capital expenditure is essential to scale operations and gain market share.

Fourth-Generation Nuclear Reactor and Nuclear Fusion Technologies

Shanghai Electric is actively investing in the future of energy with its involvement in fourth-generation nuclear reactors and the groundbreaking Honghuang 70 Tokamak fusion device. These initiatives position the company at the forefront of potentially transformative, high-growth energy sectors.

While these advanced technologies, such as the Honghuang 70 which aims to achieve sustained high-temperature plasma, represent significant long-term potential, their current market share and commercial viability are minimal. This necessitates substantial and ongoing research and development expenditure to unlock their future "star" status.

- Fourth-Generation Nuclear Reactors: These advanced designs promise enhanced safety, efficiency, and waste reduction compared to current reactors.

- Honghuang 70 Tokamak: Shanghai Electric's involvement in this fusion project signifies a commitment to the ultimate clean energy source, though commercial fusion power is still decades away.

- R&D Investment: Significant capital is allocated to these nascent technologies, reflecting a long-term strategic vision rather than immediate returns.

- Market Position: Currently, these technologies are in the experimental or early development phases, with very limited market penetration.

Shanghai Electric's ventures into advanced energy technologies like fourth-generation nuclear reactors and fusion power, exemplified by the Honghuang 70 Tokamak, place them in industries with immense, albeit distant, growth potential. These are classic Question Marks, requiring substantial R&D investment for future market dominance.

The company's commitment to these nascent fields, while strategically sound for long-term energy solutions, means they currently hold negligible market share in these highly specialized areas. Success hinges on breakthroughs and the eventual commercialization of these revolutionary energy sources.

For instance, while commercial fusion power remains decades away, the global investment in nuclear energy technology, including advanced reactors, is substantial, indicating the potential scale of future markets. Shanghai Electric's early involvement positions them to capture a piece of this future energy landscape.

These initiatives represent a significant capital outlay with uncertain near-term returns, characteristic of Question Marks that require careful nurturing to become future Stars.

| Business Unit | BCG Category | Market Growth | Relative Market Share | Strategic Rationale |

| NEV Parts | Question Mark | High | Low | Capitalize on EV growth, requires investment for scale. |

| Industrial Software | Question Mark | High | Low | Leverage digitalization trend, needs market penetration efforts. |

| Hydrogen Equipment | Question Mark | High | Low | Tap into clean energy transition, early-stage market. |

| Aerospace Precision Parts | Question Mark | High | Low | Focus on high-tech components, requires capacity building. |

| Advanced Energy Tech (Nuclear/Fusion) | Question Mark | Very High (Long-term) | Negligible | Pioneer future energy sources, significant R&D focus. |

BCG Matrix Data Sources

Our Shanghai Electric Group BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research, and official company disclosures to ensure reliable insights.