Shanghai Electric Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Electric Group Bundle

Shanghai Electric Group operates within a complex industrial landscape, facing significant pressure from intense rivalry and the substantial bargaining power of its buyers. Understanding these dynamics is crucial for navigating its market. The threat of substitutes also looms, demanding constant innovation and cost management.

The complete report reveals the real forces shaping Shanghai Electric Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Shanghai Electric Group, operating in the high-end equipment manufacturing sector, frequently depends on specialized components and materials. When these critical inputs originate from a concentrated supplier base, or if the components themselves are proprietary, these suppliers can wield considerable bargaining power. For instance, the unique nature of parts essential for nuclear power, wind turbines, or heavy-duty gas turbines significantly restricts Shanghai Electric’s available sourcing alternatives, potentially increasing costs.

The bargaining power of suppliers for Shanghai Electric is significantly influenced by high switching costs for complex equipment manufacturing. These costs can encompass substantial investments in re-engineering existing product lines, re-tooling production facilities, obtaining new certifications, and implementing rigorous quality assurance protocols. For instance, a shift in a critical component supplier for their power generation turbines could necessitate millions in upfront costs for testing and validation.

These substantial switching costs effectively lock Shanghai Electric into current supplier relationships, thereby increasing the leverage of those suppliers. This situation means suppliers can potentially demand higher prices or more favorable terms, as the financial and operational disruption for Shanghai Electric to find and integrate an alternative would be considerable. This dynamic directly impacts Shanghai Electric's cost structure and operational flexibility.

The bargaining power of suppliers for Shanghai Electric Group is significantly influenced by the criticality of their inputs to the final product's quality and cost. If Shanghai Electric relies on specialized, high-quality components or advanced materials that are not easily sourced elsewhere, these suppliers gain considerable leverage. For example, suppliers of advanced materials crucial for Shanghai Electric's new energy equipment, such as high-performance turbine blades or specialized battery components, can command higher prices and dictate terms due to the unique nature of their offerings.

This dependence is particularly evident in sectors like automation systems, where precision-engineered components are vital for system performance and reliability. Suppliers of these critical parts can exert substantial influence over pricing and supply conditions. In 2024, the global market for advanced materials saw continued price volatility, with some specialized inputs experiencing cost increases of up to 15% due to supply chain constraints and increased demand, directly impacting manufacturers like Shanghai Electric.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Shanghai Electric's business, while generally low, could significantly increase their bargaining power. This would involve suppliers starting to manufacture the power generation equipment that Shanghai Electric currently produces.

However, the substantial capital investment and advanced technological expertise required to compete in Shanghai Electric's core markets, such as large-scale power generation systems, act as significant deterrents. For instance, the development and manufacturing of a single supercritical steam turbine can involve billions of dollars in R&D and specialized production facilities.

- High Capital Requirements: Building facilities capable of producing complex power plant components like turbines or generators requires immense upfront investment, often in the hundreds of millions to billions of dollars.

- Technological Sophistication: Suppliers would need to acquire or develop highly specialized engineering knowledge and manufacturing processes, a significant hurdle in an industry dominated by established players.

- Market Entry Barriers: Shanghai Electric benefits from established supply chains, customer relationships, and brand reputation, making it difficult for new entrants, even integrated suppliers, to gain market share.

Availability of Substitute Inputs

The bargaining power of suppliers for Shanghai Electric Group is significantly influenced by the availability of substitute inputs. When there are few or no readily available alternatives for critical components or raw materials, suppliers gain considerable leverage. This lack of substitutes means Shanghai Electric has limited options if a supplier decides to increase prices or alter terms, forcing the company to accept those conditions to maintain production continuity.

For instance, if Shanghai Electric relies on specialized rare earth metals for its advanced turbine technologies and few other suppliers can provide these materials with the required purity and volume, the existing suppliers hold substantial power. This dependency restricts Shanghai Electric's ability to negotiate favorable pricing or terms, directly impacting its cost of goods sold and overall profitability. The absence of alternative technologies that perform comparably also reinforces this supplier strength.

Consider the market for high-efficiency generator components. If only a handful of manufacturers possess the proprietary technology and manufacturing capabilities to produce these essential parts, they can command higher prices. In 2024, the global supply chain for specialized industrial materials continued to face volatility, with lead times for certain advanced alloys extending by an average of 15% compared to the previous year, underscoring the critical nature of supplier relationships when substitutes are scarce.

- Limited Substitutes Increase Supplier Leverage: When Shanghai Electric cannot easily source comparable materials or technologies, its reliance on current suppliers grows, granting them greater bargaining power.

- Impact on Costs and Profitability: Supplier dependence due to a lack of substitutes can lead to higher input costs, directly squeezing profit margins for Shanghai Electric.

- Technological Dependencies: Reliance on proprietary technologies for critical components, with no readily available alternatives, further amplifies supplier control over pricing and supply.

- Market Dynamics in 2024: Supply chain disruptions in 2024, including extended lead times for specialized industrial materials, highlighted the increased power of suppliers in markets with limited substitute options.

The bargaining power of suppliers for Shanghai Electric Group is substantial, particularly for specialized components like those used in advanced power generation equipment. High switching costs, stemming from the need for re-engineering, re-tooling, and rigorous testing, lock the company into existing supplier relationships, allowing suppliers to dictate terms and prices.

The lack of readily available substitutes for critical, high-purity materials or proprietary technologies further amplifies supplier leverage. This dependence directly impacts Shanghai Electric's cost structure and profitability, as evidenced by market trends in 2024 where specialized industrial materials experienced extended lead times, increasing costs for manufacturers.

While the threat of supplier forward integration is low due to immense capital and technological barriers, the core issue remains the dependence on a concentrated supplier base for essential, often proprietary, inputs.

| Factor | Impact on Shanghai Electric | Example/Data Point (2024) |

|---|---|---|

| Supplier Concentration | Increases leverage for few suppliers | Dependence on specific manufacturers for advanced turbine components. |

| Switching Costs | Locks in suppliers; high costs to change | Millions in re-tooling and validation for a single component change. |

| Proprietary Inputs | Limits sourcing alternatives | Reliance on unique materials for new energy equipment. |

| Lack of Substitutes | Amplifies supplier control over pricing | Extended lead times (avg. 15%) for specialized alloys in 2024. |

What is included in the product

Uncovers the competitive intensity for Shanghai Electric Group by examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Gain immediate clarity on competitive pressures within the power generation sector, enabling Shanghai Electric Group to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Shanghai Electric's customer base is heavily concentrated in large-scale energy, industrial, and infrastructure projects. These customers are typically major state-owned enterprises, national utilities, or significant industrial conglomerates, meaning a few key clients represent a substantial portion of their business.

For substantial Engineering, Procurement, and Construction (EPC) contracts, these large customers wield considerable bargaining power. Their ability to place massive orders, often worth billions, gives them leverage to negotiate favorable terms, pricing, and specifications, directly impacting Shanghai Electric's profitability.

For instance, in 2023, Shanghai Electric secured a significant order for wind turbines from a major Chinese utility, highlighting the scale of individual projects and the associated customer influence. This project's value underscored the strategic importance of such large clients.

For Shanghai Electric Group, customer switching costs are a significant factor, especially with large-scale equipment like power generation turbines. The immense capital investment and the intricate integration required for these complex industrial systems mean that once a customer commits, changing suppliers becomes prohibitively expensive and disruptive. This high switching cost effectively limits customer power once a contract is secured.

However, the bargaining power of customers is most pronounced during the initial bidding and negotiation stages. Before a purchase decision is finalized, customers can leverage the high switching costs to demand favorable terms, pricing, and specifications, knowing that Shanghai Electric will likely need to offer competitive advantages to secure the deal. This pre-contractual phase is where customers exert considerable influence.

Shanghai Electric's product strategy, balancing standardization with customization, significantly influences customer bargaining power. For its standardized power generation equipment, customers can readily compare offerings from various manufacturers, increasing their ability to negotiate on price and terms. This is evident in the competitive landscape for components like turbines and generators, where interchangeability is higher.

Conversely, when Shanghai Electric provides highly customized solutions, such as integrated Engineering, Procurement, and Construction (EPC) services for complex power projects or specialized industrial equipment, customer bargaining power diminishes. These bespoke offerings are designed to meet unique client specifications and project demands, making direct price comparisons difficult and increasing switching costs for the customer.

Customer Price Sensitivity

Customers in the energy and industrial sectors exhibit significant price sensitivity, particularly when undertaking large-scale capital projects. This sensitivity often translates into aggressive price negotiations for Shanghai Electric, especially for standardized equipment or during periods of economic contraction, directly affecting profitability.

For instance, in 2024, global infrastructure spending, a key market for Shanghai Electric, saw varied performance across regions. While some emerging markets continued robust investment, mature markets experienced slower growth due to inflationary pressures and higher interest rates, intensifying the focus on cost-effectiveness for buyers.

- High Capital Expenditure: Major projects in power generation and industrial manufacturing involve substantial upfront costs, making price a critical factor in purchasing decisions.

- Commodity-Like Equipment: For standard components like turbines or transformers, where differentiation is minimal, customers can readily compare prices across suppliers.

- Economic Downturns: During economic slowdowns, businesses prioritize cost savings, leading to increased pressure on suppliers to lower prices, impacting Shanghai Electric's revenue streams.

Availability of Alternative Suppliers

The bargaining power of customers is significantly influenced by the availability of alternative suppliers. When customers have many choices for power generation and industrial equipment, their leverage over Shanghai Electric Group naturally increases.

In the highly competitive global market, Shanghai Electric faces a substantial number of both domestic and international rivals. This abundance of alternatives means customers can readily compare offerings and negotiate more favorable terms, impacting Shanghai Electric's pricing and profit margins.

- Numerous Competitors: The global power generation and industrial equipment sector features a wide array of established players and emerging companies, providing customers with ample substitution options.

- Customer Choice: This competitive landscape empowers customers by allowing them to select suppliers based on price, quality, technology, and service, thereby enhancing their negotiating position.

- Price Sensitivity: For customers where equipment cost is a major factor, the presence of many suppliers intensifies price competition, potentially pressuring Shanghai Electric's profitability.

Shanghai Electric's large, concentrated customer base, primarily major state-owned enterprises and national utilities, grants them substantial bargaining power, especially for massive EPC contracts. Their ability to place multi-billion dollar orders allows for aggressive negotiation on pricing, terms, and specifications, directly impacting Shanghai Electric's profitability.

Customer price sensitivity is high for large capital projects, intensifying negotiations for standardized equipment. For instance, in 2024, inflationary pressures and higher interest rates in mature markets made buyers more cost-focused, increasing pressure on suppliers like Shanghai Electric.

The availability of numerous domestic and international competitors further amplifies customer leverage. Customers can readily compare offerings, driving down prices and potentially squeezing Shanghai Electric's profit margins, particularly for components with minimal differentiation.

| Customer Characteristic | Impact on Shanghai Electric | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Customer Concentration | High bargaining power due to large order volumes | Major utility orders represent significant revenue chunks. |

| Price Sensitivity | Intensified price negotiations, especially for standardized products | Inflationary pressures in 2024 increased buyer focus on cost-effectiveness. |

| Availability of Alternatives | Increased customer leverage and competitive pressure | Global market has numerous established and emerging competitors. |

Preview Before You Purchase

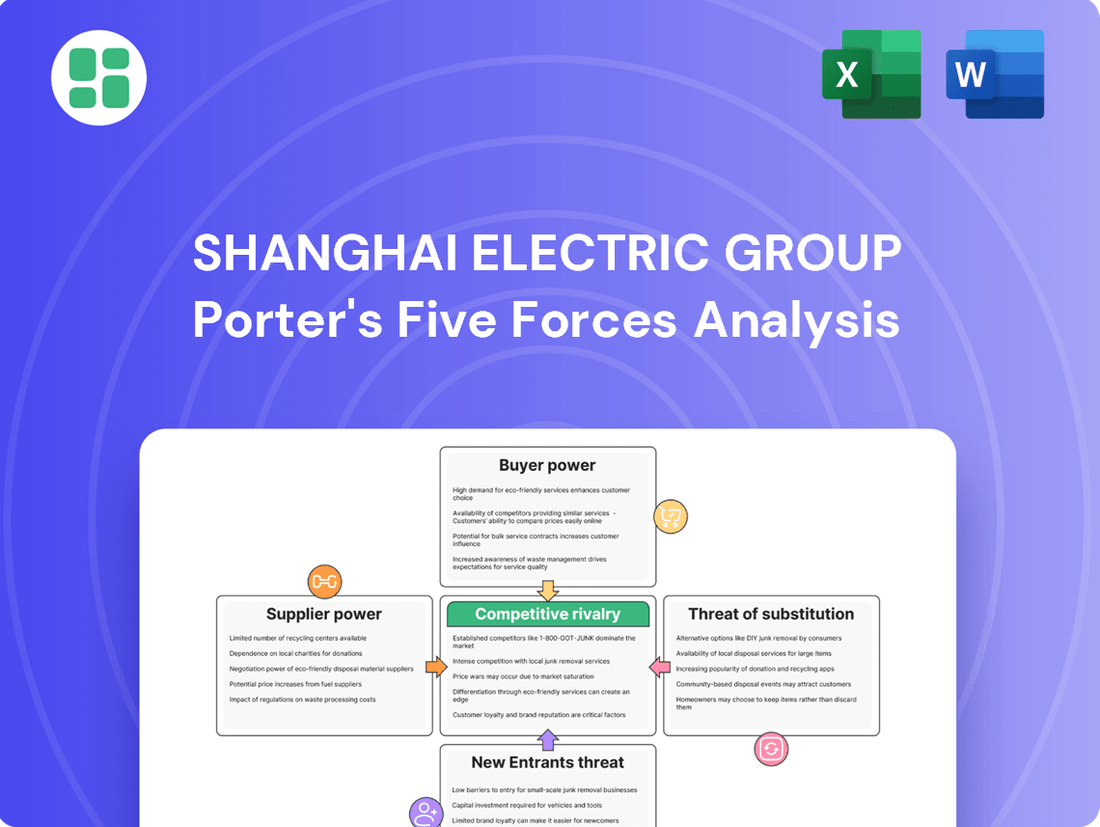

Shanghai Electric Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Shanghai Electric Group, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing immediate strategic insights into Shanghai Electric's market landscape.

Rivalry Among Competitors

Shanghai Electric operates in a fiercely competitive landscape within the high-end equipment manufacturing sector. Domestic Chinese manufacturers, alongside major international conglomerates, vie for market share in areas like power generation and industrial machinery.

The company encounters significant rivalry across its diverse product lines, which span traditional power equipment, emerging new energy solutions, and advanced industrial automation systems. For instance, in the global power generation equipment market, competitors like GE and Siemens are major players, while domestically, companies such as Dongfang Electric Corporation represent substantial competition.

The global power generation equipment market is expected to see robust growth, with projections indicating a 4.96% compound annual growth rate from 2025 to 2035. This expansion, however, can lead to intensified competition. When growth in traditional power segments slows or economic downturns hit key markets, companies often battle more fiercely for the available new projects, increasing rivalry.

While overall market expansion is positive, the nature of this growth matters. A significant portion of the growth is anticipated in new energy technologies and advanced manufacturing sectors. This shift creates opportunities for companies like Shanghai Electric Group to innovate and capture new market share, but it also means that competition will be particularly sharp among those players capable of adapting to and excelling in these evolving technological landscapes.

Shanghai Electric operates in a capital-intensive industry where significant investments in R&D, advanced manufacturing facilities, and a highly skilled workforce are essential. This creates substantial fixed costs for all players.

High exit barriers, such as specialized, non-transferable assets and the need to manage a large workforce, make it difficult and costly for companies to leave the market. For instance, the global power generation equipment market, where Shanghai Electric is a major player, requires billions in upfront investment for a single manufacturing plant.

These factors compel firms like Shanghai Electric to maintain high operational capacity and aggressively pursue market share, even if it means accepting lower profit margins on contracts to ensure they can cover their considerable fixed expenses.

Product Differentiation and Innovation

Shanghai Electric actively differentiates itself beyond basic equipment through significant investment in advanced technologies. This focus on innovation, particularly in areas like heavy-duty gas turbines and next-generation wind power solutions, aims to reduce reliance on price competition.

The company's commitment to research and development is a key strategy to stay ahead. For instance, in 2023, Shanghai Electric reported substantial R&D expenditure, channeling resources into developing cutting-edge solutions such as integrated energy storage systems and green methanol production technologies.

- Innovation Focus: Heavy-duty gas turbines, advanced wind turbines, energy storage, green methanol production.

- R&D Investment: Crucial for maintaining competitive edge and reducing price-based rivalry.

- 2023 Data: Shanghai Electric's R&D spending highlights commitment to product differentiation.

Strategic Importance and Government Support

The strategic importance of high-end equipment manufacturing and energy infrastructure to China's national development means companies like Shanghai Electric frequently benefit from government backing and participation in national strategic initiatives. This government involvement can significantly shape competitive dynamics, often fueling intense competition for state-backed projects and overall market share.

For instance, in 2024, China continued its focus on energy transition and advanced manufacturing, with significant state investment directed towards sectors where Shanghai Electric operates. This support can manifest as subsidies, preferential policies, or direct funding for research and development, thereby influencing the competitive landscape by bolstering the capabilities of favored enterprises.

- Government Subsidies: Shanghai Electric, as a key player in strategic industries, is likely to benefit from various government subsidies aimed at promoting domestic high-end manufacturing and clean energy technologies.

- National Projects: Participation in large-scale national projects, such as renewable energy installations or infrastructure upgrades, often involves significant government coordination and funding, creating concentrated areas of competition.

- Market Share Focus: The drive for technological self-sufficiency and dominance in strategic sectors encourages intense competition among Chinese companies vying for government contracts and market leadership, impacting Shanghai Electric's competitive positioning.

Shanghai Electric faces intense rivalry from both domestic and international players in the high-end equipment manufacturing sector. This competition is particularly fierce in power generation and industrial automation, where global giants like GE and Siemens, and domestic firms such as Dongfang Electric, are significant rivals.

The capital-intensive nature of the industry, coupled with high exit barriers due to specialized assets and workforce management, forces companies to maintain high operational capacity and aggressively pursue market share, often leading to price-based competition.

Shanghai Electric counters this by heavily investing in R&D and innovation, focusing on advanced technologies like heavy-duty gas turbines and new energy solutions to differentiate itself and reduce reliance on price alone. Their 2023 R&D expenditure reflects this commitment.

Government support and national strategic initiatives in China's energy transition and advanced manufacturing sectors also shape the competitive landscape, often intensifying competition for state-backed projects and overall market leadership, with significant state investment directed towards these areas in 2024.

| Competitor Type | Key Areas of Competition | Examples |

| International Conglomerates | Power Generation Equipment, Industrial Machinery | GE, Siemens |

| Domestic Manufacturers | Power Generation Equipment, New Energy Solutions, Industrial Automation | Dongfang Electric Corporation |

| Emerging Technology Firms | Advanced Wind Turbines, Energy Storage, Green Technologies | Various specialized companies |

SSubstitutes Threaten

The global push for decarbonization presents a substantial threat of substitution for Shanghai Electric's traditional power generation equipment. As countries prioritize renewable energy, customers are increasingly opting for solar, wind, and hydrogen technologies over conventional thermal or nuclear power plants.

This shift is evident in the growing investment in renewables; for instance, global investment in the energy transition reached a record $1.7 trillion in 2024, with a significant portion directed towards clean energy generation. Shanghai Electric's reliance on traditional equipment faces direct competition from these cleaner, often more cost-effective alternatives in the long run.

The growing adoption of decentralized energy solutions, such as rooftop solar and battery storage, presents a significant threat of substitutes for Shanghai Electric Group's traditional centralized power generation business. These distributed energy resources (DERs) enable consumers to generate and store their own electricity, reducing reliance on the grid and large-scale power plants. In 2024, the global renewable energy market continued its robust expansion, with solar PV installations alone expected to add a record-breaking amount of capacity.

Microgrids, which can operate independently or connected to the main grid, further enhance this substitution threat by offering localized power reliability and resilience. This trend directly impacts demand for conventional power generation equipment and infrastructure that Shanghai Electric Group provides. For instance, the increasing prevalence of behind-the-meter solar in many markets means fewer kilowatt-hours are purchased from traditional utility providers.

Improvements in energy storage, like advanced battery systems and other solutions, are making it possible to manage power more flexibly. This can reduce the need for constant output from certain equipment, potentially replacing the role of peaking power plants or grid stabilization gear.

Shanghai Electric Group is actively investing in these emerging energy storage technologies. For instance, in 2024, the company announced significant R&D funding allocated to developing next-generation battery chemistries and integrated storage solutions, aiming to stay ahead of potential disruptions.

Alternative Industrial Processes or Materials

Shanghai Electric Group faces a threat from alternative industrial processes and materials that can reduce demand for its traditional equipment. For instance, advancements in additive manufacturing (3D printing) could lessen the need for certain fabricated parts that Shanghai Electric traditionally produces or supplies. In 2023, the global 3D printing market was valued at over $20 billion, demonstrating its growing impact.

Furthermore, the increasing integration of digitalization and artificial intelligence presents a substitute for some physical industrial machinery. AI-powered predictive maintenance software, for example, can optimize the performance of existing equipment, potentially delaying or eliminating the need for new capital expenditures on machinery. This trend is accelerating, with the industrial AI market projected to reach hundreds of billions by the late 2020s.

- 3D Printing Adoption: Growing use of additive manufacturing for components reduces reliance on traditional machining and assembly, impacting demand for related equipment.

- Digitalization and AI: Software solutions that optimize existing physical assets or replace manual processes with automated, intelligent systems act as substitutes for certain machinery.

- Material Innovation: Development of new, high-performance materials might render older equipment obsolete or less efficient, shifting demand towards newer technologies.

Service-Oriented Models vs. Equipment Sales

Customers increasingly favor service-oriented models over direct equipment purchases. For example, the global energy-as-a-service market was valued at approximately $85 billion in 2023 and is projected to grow significantly, presenting a direct substitute for traditional equipment sales by Shanghai Electric Group.

This shift means revenue streams could move from one-time equipment sales to recurring service contracts. This alters the fundamental nature of what Shanghai Electric offers, moving from a product-centric to a solution-centric approach.

- Shift to Service Revenue: Companies offering 'energy-as-a-service' or equipment leasing models can provide a compelling alternative to outright ownership, potentially impacting Shanghai Electric's traditional equipment sales.

- Long-Term Contracts: These service models often involve long-term commitments, which could mean a reduction in upfront capital expenditure for customers but a more predictable, albeit different, revenue stream for providers.

- Evolving Value Proposition: The 'product' becomes the ongoing performance and efficiency of the equipment, rather than the equipment itself, requiring a different sales and operational focus.

The increasing global focus on decarbonization directly substitutes Shanghai Electric's traditional power generation offerings with renewable energy sources like solar and wind. This trend is amplified by substantial investments in clean energy, with global energy transition investments hitting $1.7 trillion in 2024. Furthermore, the rise of decentralized energy solutions, such as rooftop solar and microgrids, reduces reliance on large-scale power plants, impacting demand for Shanghai Electric's core equipment.

| Substitution Area | Substitute Technology/Model | Impact on Shanghai Electric | Supporting Data (2024 unless noted) |

|---|---|---|---|

| Power Generation | Renewable Energy (Solar, Wind) | Reduced demand for thermal/nuclear equipment | Global energy transition investment: $1.7 trillion |

| Energy Distribution | Decentralized Energy Resources (DERs), Microgrids | Lower demand for centralized power plant equipment | Record solar PV installations |

| Industrial Processes | Additive Manufacturing (3D Printing) | Less need for traditional fabricated parts | Global 3D printing market valued over $20 billion (2023) |

| Service Models | Energy-as-a-Service (EaaS) | Shift from equipment sales to recurring service revenue | Global EaaS market valued at ~$85 billion (2023) |

Entrants Threaten

The high-end equipment manufacturing sector, where Shanghai Electric operates, presents a formidable barrier to entry due to exceptionally high capital requirements. Companies need significant investment for research and development, state-of-the-art manufacturing plants, and specialized machinery. For instance, establishing a new advanced manufacturing facility in 2024 could easily require hundreds of millions to billions of dollars.

This substantial financial hurdle deters potential new entrants from challenging established giants like Shanghai Electric. The sheer cost of building the necessary infrastructure and acquiring cutting-edge technology makes it incredibly difficult for smaller or newer companies to gain a foothold and compete on a level playing field.

Shanghai Electric Group, like other major players in the heavy manufacturing sector, benefits significantly from established economies of scale. This means they can produce goods at a lower per-unit cost due to their large-scale operations in manufacturing, raw material procurement, and research and development. For instance, in 2023, Shanghai Electric reported revenue of approximately RMB 150 billion, indicating a substantial operational footprint that underpins these cost advantages.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the same volume of production and accumulated experience, newcomers would struggle to achieve the same low production costs as established giants like Shanghai Electric. This cost disadvantage makes it difficult for them to compete on price, effectively deterring many potential new competitors from entering the market.

In critical sectors like energy and infrastructure, brand reputation and customer loyalty are incredibly important. Shanghai Electric benefits from a long history, establishing trust and reliability, which makes it tough for newcomers to win over clients and secure major projects. For instance, in 2023, Shanghai Electric secured a significant contract for the construction of a major offshore wind farm in Europe, a testament to its established reputation and the trust it commands in the global energy market.

Regulatory Hurdles and Government Policies

The energy and heavy equipment sectors, where Shanghai Electric Group operates, are characterized by substantial regulatory hurdles. New entrants must secure numerous certifications, permits, and comply with rigorous safety and environmental standards, which can be costly and time-consuming. For instance, in 2024, China's stringent environmental protection laws continued to evolve, requiring significant upfront investment in compliance technology for any new power generation equipment manufacturer looking to enter the market.

Government policies also play a crucial role in shaping the competitive landscape. Subsidies for renewable energy or specific manufacturing technologies can favor established players or those with strong government relations, creating an uneven playing field. For example, the Chinese government's continued support for domestic high-end equipment manufacturing through initiatives like Made in China 2025, while beneficial for companies like Shanghai Electric, acts as a significant deterrent for foreign competitors lacking local partnerships and understanding of the policy nuances.

- High Capital Requirements: Significant investment is needed to meet certification and compliance standards.

- Complex Permitting Processes: Obtaining necessary permits can be lengthy and bureaucratic.

- Evolving Environmental Standards: Continuous updates in environmental regulations necessitate ongoing adaptation and investment.

- Government Support for Incumbents: Policies often favor established domestic players, creating barriers for new entrants.

Access to Distribution Channels and Supply Chains

Shanghai Electric's established global distribution networks and specialized supply chains present a significant barrier to new entrants. Building these intricate systems, which involve securing reliable suppliers and fostering strong relationships with key clients, requires substantial investment in time and capital. For instance, in 2023, Shanghai Electric's extensive reach facilitated the delivery of complex power generation equipment to over 100 countries, a feat that would be exceptionally difficult and expensive for a newcomer to replicate.

New companies entering the heavy equipment manufacturing sector would struggle to match Shanghai Electric's existing infrastructure and market penetration. The sheer scale and complexity of managing global logistics and ensuring the timely delivery of large-scale industrial products demand years of operational experience and significant upfront investment. This deep-seated advantage in access to distribution and supply chains effectively deters potential competitors from entering the market.

- Established Global Reach: Shanghai Electric's vast network allows it to serve customers in numerous international markets efficiently.

- Supply Chain Expertise: The company has cultivated reliable and specialized supply chains crucial for delivering complex industrial equipment.

- Customer and Partner Relationships: Strong, long-standing ties with key clients and partners create a significant advantage that is hard for new entrants to overcome.

- High Entry Costs: Replicating Shanghai Electric's distribution and supply chain capabilities requires substantial financial and temporal investment.

The threat of new entrants for Shanghai Electric Group is generally low due to several significant barriers. High capital requirements for advanced manufacturing facilities, estimated in the hundreds of millions to billions of dollars for new operations in 2024, create a substantial financial hurdle. Furthermore, established economies of scale, evidenced by Shanghai Electric's approximately RMB 150 billion revenue in 2023, allow for lower per-unit production costs that newcomers struggle to match.

Brand reputation and customer loyalty in critical sectors like energy are hard-won, with Shanghai Electric's proven track record, including securing major offshore wind farm contracts in 2023, building significant trust. Stringent regulatory and permitting processes, coupled with evolving environmental standards in 2024, add further complexity and cost for any potential new player.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | Extremely high investment needed for R&D, plants, and machinery. | Hundreds of millions to billions of dollars for new advanced manufacturing facilities (2024 estimate). |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Shanghai Electric's 2023 revenue of ~RMB 150 billion indicates significant operational scale. |

| Brand Reputation & Loyalty | Established trust and reliability in key sectors. | Securing major offshore wind farm contracts in 2023 demonstrates strong client confidence. |

| Regulatory Hurdles | Complex certifications, permits, and compliance with safety/environmental standards. | Stringent environmental laws in China require significant upfront investment in compliance technology (2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Shanghai Electric Group is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and official filings. We also incorporate insights from reputable industry research firms and market intelligence platforms to provide a robust understanding of the competitive landscape.