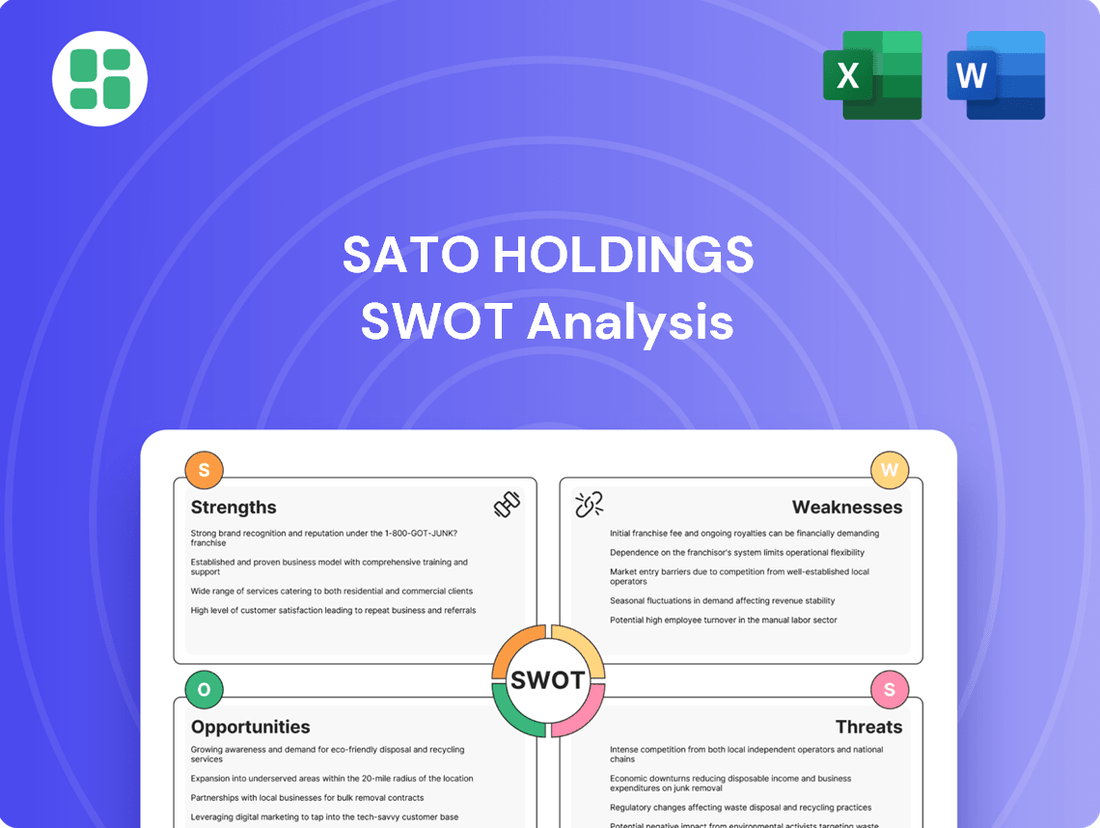

Sato Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sato Holdings Bundle

Sato Holdings is navigating a dynamic market, leveraging its established brand while facing evolving competitive pressures. Our analysis reveals key strengths in its operational efficiency and a significant opportunity in emerging digital services. However, potential threats from technological disruption and shifting consumer preferences demand strategic attention.

Want the full story behind Sato Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

SATO Holdings boasts a wide array of auto-identification and data collection (AIDC) solutions, encompassing barcode and RFID printers, labels, and sophisticated integrated software. This extensive portfolio enables SATO to deliver complete, end-to-end solutions tailored to diverse customer requirements, thereby strengthening its value proposition across multiple sectors.

By supplying a unified package of hardware, consumables, and software, SATO cultivates a loyal customer base and establishes predictable, recurring revenue streams. This integrated approach is a significant competitive advantage, particularly as businesses increasingly rely on seamless data management systems.

SATO's deep roots in the Auto-ID and Data Capture (AIDC) industry, dating back to 1940, have cemented its reputation as an 'Expert of the Experts'. This extensive history translates into unparalleled industry specialization, particularly in retail, manufacturing, logistics, and healthcare sectors. Their focused approach allows for the development of highly customized and effective solutions, fostering significant trust and establishing SATO as a preferred partner within these critical markets.

SATO Holdings boasts an impressive global presence, operating in 26 countries and employing a significant international workforce. This expansive reach not only diversifies its market exposure but also positions it to effectively serve a broad range of multinational clients.

The company's strength is further underscored by its substantial 40% product market share within the Asia Pacific region. This commanding position in a key growth area highlights SATO's competitive advantage and its ability to capitalize on regional economic expansion.

Commitment to Innovation and Sustainability

SATO's commitment to innovation is demonstrated through substantial investments in emerging technologies such as IoT and AI, aimed at refining their RFID systems for enhanced efficiency and intelligence. This strategic focus on technological advancement positions SATO to meet the increasingly sophisticated demands of the market.

The company's dedication to sustainability is a key strength, highlighted by tangible actions like transitioning manufacturing facilities to renewable energy sources. Furthermore, SATO is actively developing solutions that support a circular economy, directly responding to the escalating global preference for environmentally responsible business practices.

- Investment in R&D: SATO allocated ¥2.5 billion (approximately $17 million USD as of July 2024) to research and development in fiscal year 2023, with a significant portion directed towards AI and IoT integration.

- Renewable Energy Adoption: By the end of fiscal year 2024, SATO aims to power 60% of its Japanese manufacturing operations with renewable energy, a notable increase from 35% in fiscal year 2022.

- Circular Economy Solutions: SATO launched its "RE-SATO" initiative in early 2024, focusing on product lifecycle management and material recycling, projecting a 15% growth in revenue from these services by 2026.

Strategic Organizational Restructuring for Efficiency

Sato Holdings' strategic organizational restructuring, effective April 2025, is a significant strength. By merging with its wholly-owned subsidiary, SATO Corporation, the company has streamlined its corporate structure. This integration is designed to accelerate decision-making processes and optimize the allocation of resources.

This move is anticipated to strengthen governance and enable more agile responses to evolving market dynamics. The restructuring directly supports Sato Holdings' medium-term management plan, which prioritizes rebuilding profitability and initiating new growth investments.

Key benefits of this restructuring include:

- Enhanced Decision-Making Speed: A leaner structure allows for quicker approvals and strategic adjustments.

- Optimized Resource Allocation: Consolidated operations enable more efficient deployment of capital and personnel.

- Strengthened Governance: A unified corporate entity improves oversight and accountability.

- Improved Profitability Focus: The restructuring aligns with the goal of rebuilding profit margins and driving growth.

SATO's comprehensive AIDC solutions, from printers to software, offer complete, end-to-end packages that cater to diverse customer needs, solidifying its value proposition. This integrated approach fosters customer loyalty and generates predictable recurring revenue, a significant competitive edge in the data management landscape.

With a legacy dating back to 1940, SATO is an established industry expert, particularly in retail, manufacturing, logistics, and healthcare. This deep specialization allows for highly tailored solutions, building trust and positioning SATO as a preferred partner in these vital sectors.

SATO's robust global presence across 26 countries diversifies market exposure and enables effective service for multinational clients. Their 40% product market share in the Asia Pacific region underscores their competitive strength and ability to leverage regional growth.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Extensive Product Portfolio | Offers a wide array of AIDC solutions, including printers, labels, and integrated software. | Provides complete, end-to-end solutions tailored to diverse customer requirements. |

| Integrated Solutions & Recurring Revenue | Unifies hardware, consumables, and software for seamless data management. | Cultivates customer loyalty and establishes predictable, recurring revenue streams. |

| Deep Industry Expertise | Long history (since 1940) in AIDC, focusing on retail, manufacturing, logistics, and healthcare. | Recognized as an 'Expert of the Experts' with highly customized and effective solutions. |

| Global Presence & Market Share | Operates in 26 countries with a significant international workforce. | Holds a commanding 40% product market share within the Asia Pacific region. |

| Commitment to Innovation | Invests in emerging technologies like IoT and AI for RFID systems. | Allocated ¥2.5 billion (approx. $17M USD as of July 2024) to R&D in FY2023, focusing on AI/IoT. |

| Sustainability Focus | Develops solutions supporting a circular economy and transitions to renewable energy. | Aims to power 60% of Japanese manufacturing with renewables by end of FY2024; launched RE-SATO initiative in early 2024. |

| Strategic Restructuring | Merged with SATO Corporation (effective April 2025) to streamline operations. | Aims to accelerate decision-making, optimize resource allocation, and strengthen governance. |

What is included in the product

Analyzes Sato Holdings’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Provides a clear visualization of Sato Holdings' strategic landscape, simplifying complex internal and external factors for actionable insights.

Weaknesses

Sato Holdings' strong focus on Automatic Identification and Data Capture (AIDC) technologies, particularly barcodes and RFID, while a core competency, also represents a significant weakness. A substantial portion of its revenue, historically around 80% derived from these specific segments, makes the company vulnerable to market shifts. For instance, if a new, more efficient data capture method were to emerge and gain rapid adoption, Sato's current product portfolio could become less relevant.

This concentration risk is a key concern. While Sato is actively investing in innovation, the deep integration of its business model with existing AIDC hardware and software means that a rapid pivot away from these technologies by major industries could significantly impact its financial performance. For example, if the logistics sector, a major user of AIDC, were to broadly adopt a completely different tracking system not reliant on traditional barcodes or RFID, Sato's market share could erode quickly.

Sato Holdings' reliance on sectors sensitive to economic cycles, like manufacturing, retail, and logistics, presents a significant weakness. For instance, in the second quarter of fiscal year 2024, the company's net sales missed projections, a shortfall attributed directly to prevailing economic conditions. This inherent vulnerability means that a global economic slowdown can directly curtail business investment in capital expenditures, thereby dampening the demand for Sato's Automatic Identification and Data Capture (AIDC) solutions.

Sato Holdings faces profitability challenges in specific areas despite its overall positive trajectory. For example, in fiscal year 2024, RFID profit margins in Japan were observed to be less robust compared to international markets. Furthermore, the primary labels segment, especially operations in Russia, has exhibited significant fluctuations in operating income, highlighting potential profit generation inconsistencies across its varied business units.

To address these regional and segment-specific profitability issues, Sato Holdings is implementing strategic initiatives. The company is actively focusing on enhancing profitability within Japan by prioritizing the sale of higher-margin products, such as printers and associated software solutions. This targeted approach aims to mitigate the impact of lower margins in other product lines and geographies.

Integration Challenges with Legacy Systems

SATO's integration of its Industrial IoT (IIoT) solutions can be hampered by the presence of legacy systems within client organizations. Many industrial environments still rely on older equipment and IT infrastructure, creating significant barriers to adopting new technologies. This often leads to extended sales cycles as SATO must navigate compatibility issues and develop tailored integration strategies.

The need for extensive customization to bridge the gap between SATO's modern offerings and existing legacy infrastructure can increase project costs and complexity for both SATO and its customers. For example, a 2024 industry report indicated that over 60% of manufacturing facilities still utilize equipment more than a decade old, highlighting the prevalence of this challenge. This can impact SATO's ability to scale its solutions efficiently.

- Compatibility Hurdles: Legacy systems often lack the open architecture or modern interfaces required for seamless integration with new IIoT platforms.

- Extended Sales Cycles: The technical due diligence and customization required for legacy integration can add months to the sales process.

- Increased Implementation Costs: Custom middleware or adapter development to connect with older systems can significantly raise project expenses.

Intense Competition in the AIDC Market

SATO Holdings operates in the Auto-ID and Data Capture (AIDC) and RFID sectors, which are intensely competitive and fragmented. The market features major global players such as Zebra Technologies, Honeywell, and Avery Dennison, alongside a multitude of regional and emerging companies. This crowded field necessitates constant innovation and clear value propositions to capture and retain market share.

The intense competition can lead to significant pricing pressure, impacting SATO's profit margins. For instance, the global AIDC market was valued at approximately $50 billion in 2024 and is projected to grow, but this growth is shared among many participants. To thrive, SATO must continually differentiate its offerings and demonstrate superior value to customers.

- Market Fragmentation: The AIDC and RFID markets are populated by numerous global and local competitors, creating a highly fragmented landscape.

- Pricing Pressure: Intense rivalry often translates into downward pressure on pricing, challenging profitability.

- Innovation Imperative: Continuous investment in research and development is crucial to stay ahead of competitors and maintain a competitive edge.

- Differentiation Challenge: SATO must clearly articulate and deliver unique value to stand out in a crowded marketplace.

Sato Holdings' significant revenue concentration in Automatic Identification and Data Capture (AIDC) technologies, historically around 80%, poses a substantial vulnerability. A rapid shift to alternative data capture methods could quickly render its current product portfolio less relevant, impacting its financial stability.

The company's deep integration with existing AIDC hardware and software makes it susceptible to market pivots. For example, if major industries like logistics were to broadly adopt entirely new tracking systems, Sato's market share could erode swiftly.

Sato's reliance on economically sensitive sectors such as manufacturing, retail, and logistics exposes it to downturns. For instance, its net sales missed projections in Q2 fiscal year 2024 due to prevailing economic conditions, demonstrating how economic slowdowns directly affect demand for its solutions.

Profitability can be inconsistent across segments and regions. In fiscal year 2024, RFID profit margins in Japan were less robust than in international markets, and operating income in the primary labels segment, particularly in Russia, showed significant fluctuations.

Same Document Delivered

Sato Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive overview of Sato Holdings' strategic positioning.

This is a real excerpt from the complete document outlining Sato Holdings' Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version for your strategic planning needs.

Opportunities

The increasing complexity of global supply chains, coupled with a strong demand for real-time visibility and transparency, presents a significant opportunity for SATO's Automatic Identification and Data Capture (AIDC) solutions. Businesses worldwide are actively seeking more efficient methods for tracking assets and inventory, directly aligning with SATO's expertise in RFID and barcode technologies.

This growing need for enhanced supply chain management fuels substantial growth potential for SATO across key sectors like retail, manufacturing, and logistics. The broader AIDC market is expected to reach a substantial USD 178.87 billion by 2032, growing at an impressive compound annual growth rate of 12.57%, indicating a robust environment for SATO's offerings.

The increasing adoption of Industrial Internet of Things (IIoT) and Industry 4.0 technologies offers significant growth avenues for SATO. As businesses integrate smart solutions for enhanced efficiency and data-driven decision-making, the need for reliable Automatic Identification and Data Capture (AIDC) devices escalates. SATO's expertise in printing and data capture solutions positions it well to capitalize on this trend.

The global IIoT market is on a strong upward trajectory, with projections indicating it will reach USD 286.3 billion by 2029, expanding at a compound annual growth rate of 8.1%. This expansion directly fuels the demand for the connected devices and smart technologies that SATO provides, making it a key enabler of industrial digital transformation.

The increasing adoption of RFID technology presents a significant opportunity for SATO. Major retailers are increasingly mandating RFID tagging, a trend that is boosting the market. SATO is well-positioned to benefit from this, given its established presence in RFID printers and smart labels.

The RFID market is projected for substantial growth, with an estimated CAGR of 12.7% between 2025 and 2034. This expansion is fueled by the technology's demonstrated return on investment in areas like inventory management and loss prevention. Key sectors driving this growth include retail, healthcare, and logistics.

Growth in Healthcare and Pharmaceutical Sectors

The healthcare and pharmaceutical sectors are a significant growth opportunity for AIDC solutions. These industries are implementing automated identification and data capture for crucial tasks such as ensuring patient safety, tracking medications precisely, and managing valuable assets. The demand is further amplified by regulatory requirements for unique device identification and barcode verification of medications.

SATO's specialized PJM RFID solutions, particularly their application in blood management, showcase their strong position within this high-growth and high-value market. The global healthcare market is projected to expand significantly, with the healthcare and pharma sector alone expected to achieve a compound annual growth rate (CAGR) of 10.90% through 2030.

- Patient Safety Enhancement: AIDC technologies improve patient identification and reduce medical errors.

- Medication Supply Chain Integrity: Barcode and RFID tracking ensure the authenticity and proper handling of pharmaceuticals.

- Regulatory Compliance: Mandates for unique device identification drive adoption of AIDC systems.

- Asset Management Efficiency: Tracking medical equipment and supplies optimizes resource utilization.

Emerging Markets and Regional Growth

Emerging markets, particularly within the Asia-Pacific region, represent a significant growth avenue for SATO Holdings. This area is projected to lead expansion in Automatic Identification and Data Capture (AIDC) and Industrial Internet of Things (IIoT) markets, driven by increasing urbanization, substantial smart city initiatives, and ongoing industrial upgrades. SATO's existing strong market position and established presence in Asia-Pacific are key advantages for capitalizing on this regional momentum.

SATO's strategic focus on expanding its overseas operations, emphasizing sustainable and efficient growth, aligns perfectly with these emerging market dynamics. The company aims to leverage its expertise to capture a larger share of these rapidly developing markets.

- Asia-Pacific's projected growth: Expected to be the fastest-growing region for AIDC and IIoT solutions.

- Drivers of growth: Urbanization, smart city investments, and industrial modernization are fueling demand.

- SATO's advantage: Established presence and strong market share in Asia-Pacific provide a solid foundation.

- Strategic direction: Company is committed to sustainable and efficient expansion in international markets.

The increasing demand for supply chain visibility and the expansion of IIoT technologies offer substantial growth for SATO's AIDC solutions. The AIDC market is projected to reach USD 178.87 billion by 2032, growing at a 12.57% CAGR, while the IIoT market is expected to hit USD 286.3 billion by 2029 at an 8.1% CAGR.

SATO is well-positioned to benefit from the growing adoption of RFID technology, particularly in the retail sector, with the RFID market anticipated to grow at a 12.7% CAGR from 2025 to 2034. Furthermore, the healthcare and pharmaceutical sectors present a significant opportunity, with a projected CAGR of 10.90% through 2030 for the healthcare market, driven by needs for patient safety and medication tracking.

Emerging markets, especially in Asia-Pacific, are a key growth avenue, expected to lead AIDC and IIoT expansion due to urbanization and smart city initiatives. SATO's established presence in this region provides a strong foundation for capturing this growth.

| Market Segment | Projected Market Size (USD Billion) | Projected CAGR | Relevant Year |

|---|---|---|---|

| Automatic Identification and Data Capture (AIDC) | 178.87 | 12.57% | 2032 |

| Industrial Internet of Things (IIoT) | 286.3 | 8.1% | 2029 |

| RFID Market | N/A | 12.7% | 2025-2034 |

| Global Healthcare Market | N/A | 10.90% | Through 2030 |

Threats

The Automatic Identification and Data Capture (AIDC) and RFID sectors are fiercely competitive, with established global giants like Zebra Technologies and Honeywell alongside nimble startups. This crowded landscape often triggers price wars, squeezing profit margins and demanding constant technological advancement from players like SATO.

For instance, Zebra Technologies reported revenues of approximately $6.0 billion for the fiscal year 2023, underscoring the scale of established competitors. SATO must therefore prioritize product differentiation and maintain its innovation pipeline to secure market share and avoid being outpaced by rivals who can leverage economies of scale or disruptive new technologies.

The Automatic Identification and Data Capture (AIDC) sector is in constant flux, driven by rapid progress in areas like the Internet of Things (IoT), artificial intelligence (AI), and novel data acquisition techniques. This dynamism poses a significant threat, as current technologies, including traditional barcodes and some RFID implementations, risk becoming outdated sooner than expected.

SATO must maintain substantial investment in research and development to remain competitive and agile in adopting emerging technologies. This includes staying abreast of innovations like chipless RFID and sophisticated sensor technologies, which are reshaping how data is captured and utilized.

Market demand is increasingly shaped by IoT integration, AI-enhanced scanning capabilities, and the proliferation of mobile computing. For instance, the global AIDC market was valued at approximately $57.5 billion in 2023 and is projected to reach over $110 billion by 2030, with IoT and AI being key growth drivers. Failure to adapt to these trends could lead to a loss of market share for SATO.

As SATO's Automatic Identification and Data Capture (AIDC) solutions increasingly connect with IoT and cloud platforms, the threat of cyberattacks and data breaches looms larger. A significant breach could severely damage SATO's reputation and lead to substantial legal penalties, eroding customer confidence in their connected offerings. For instance, the global cost of data breaches reached an average of $4.35 million in 2022, according to IBM's Cost of a Data Breach Report, highlighting the financial implications.

Implementing strong cybersecurity measures is essential to mitigate these risks, but these defenses also represent an ongoing investment in development and maintenance. The growing sophistication of cyber threats means SATO must continuously adapt its security protocols, which can strain resources. The increasing reliance on data also makes privacy compliance, such as GDPR or CCPA, a critical operational consideration.

Global Economic Volatility and Geopolitical Instability

Global economic volatility, including persistent inflation and fluctuating interest rates, poses a significant threat to Sato Holdings. For instance, the ongoing geopolitical tensions stemming from the situation in Russia have directly impacted the Primary Labels Business, leading to sales shortfalls. These uncertainties can dampen business investment and disrupt supply chains, as seen with past economic slowdowns affecting the company's performance.

Currency exchange rate volatility is another critical concern, directly impacting Sato Holdings' international sales and overall profitability. The company's financial results are susceptible to these unpredictable market movements, requiring careful management and hedging strategies to mitigate potential losses. The interconnectedness of global markets means that events in one region can have cascading effects on Sato's operations worldwide.

- Economic Uncertainties: Inflation and interest rate hikes can decrease consumer spending and increase borrowing costs for Sato Holdings.

- Geopolitical Impact: Conflicts and trade disputes, like those affecting the Russia market, directly impair sales in specific business segments.

- Supply Chain Disruptions: Global instability can lead to higher input costs and delays, affecting production and delivery timelines.

- Currency Fluctuations: Unfavorable exchange rate movements can reduce the value of overseas earnings when converted to the reporting currency.

Supply Chain Disruptions and Raw Material Price Fluctuations

SATO's reliance on key components and raw materials for its printer, label, and tag manufacturing exposes it to significant threats. Global supply chain disruptions, a persistent concern in 2024 and anticipated into 2025, can directly impede production schedules and increase lead times. For instance, the semiconductor shortage that extended through much of 2023 continued to affect various manufacturing sectors, and while easing, geopolitical tensions and logistical bottlenecks remain risks. Sudden price hikes in essential materials like plastics, metals, or electronic components, driven by inflation or trade disputes, could compress SATO's profit margins if not effectively managed through pricing strategies or hedging. The company's 2024 financial reports indicated a focus on supply chain resilience, a critical area given these ongoing vulnerabilities.

These fluctuations can be severe, impacting profitability directly. For example, a 10% increase in the cost of a key polymer used in label production could translate to millions in additional expenses for SATO, depending on production volumes. The company's ability to navigate these challenges hinges on its supply chain management and diversification efforts, ensuring it can source materials from multiple regions and suppliers to mitigate the impact of localized disruptions or price spikes. This proactive approach is vital for maintaining competitive pricing and consistent product availability for its customers in the dynamic 2024-2025 market landscape.

SATO faces intense competition from established players and emerging startups, often leading to price wars that squeeze profit margins. For instance, Zebra Technologies' 2023 revenues of approximately $6.0 billion highlight the scale of rivals. SATO must focus on product differentiation and innovation to maintain its market position against competitors leveraging economies of scale.

The rapid evolution of technologies like IoT and AI presents a threat of obsolescence for SATO's current offerings. The AIDC market, valued at $57.5 billion in 2023 and projected to exceed $110 billion by 2030, is heavily influenced by these advancements. SATO needs substantial R&D investment to integrate emerging tech like chipless RFID and advanced sensors.

Increased connectivity of SATO's solutions to IoT and cloud platforms elevates the risk of cyberattacks and data breaches. IBM's 2022 report indicated an average data breach cost of $4.35 million, underscoring the financial and reputational damage such incidents can cause. Continuous investment in robust cybersecurity is crucial, alongside adherence to privacy regulations.

Global economic volatility, including inflation and fluctuating interest rates, negatively impacts SATO. Geopolitical events, such as those affecting the Russia market, have directly led to sales shortfalls. Currency exchange rate volatility also poses a significant risk, directly affecting the value of SATO's international earnings and overall profitability.

SWOT Analysis Data Sources

This SWOT analysis for Sato Holdings is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.