Sato Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sato Holdings Bundle

Sato Holdings operates within an industry where buyer bargaining power is a significant factor, potentially impacting pricing and profitability. Understanding the intensity of this force is crucial for strategic planning.

The threat of new entrants and the availability of substitute products also present dynamic challenges that could reshape Sato Holdings's market landscape. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Sato Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Automatic Identification and Data Capture (AIDC) industry, where Sato Holdings operates, heavily depends on specialized components. Think RFID chips, high-precision printer heads, and custom-engineered label materials. These aren't everyday items; they require significant expertise to produce.

When the suppliers of these critical components are few and far between, their leverage naturally grows. If Sato Holdings, or any company in this sector, has only a handful of options for a particular specialized part, those suppliers can dictate terms more effectively. This concentration means fewer alternatives for Sato, directly increasing the bargaining power of those few suppliers.

For instance, in 2024, the global market for RFID tags was valued at approximately $12.9 billion, with a significant portion driven by specialized applications requiring unique frequencies or materials. A limited number of manufacturers dominate these niche segments, giving them considerable sway over pricing and supply availability for companies like Sato.

Sato Holdings faces substantial switching costs when changing suppliers for its critical components. These costs can include significant investments in retooling manufacturing equipment, obtaining new certifications for alternative parts, and the potential for production delays or disruptions during the transition period. For example, if Sato relies on a specialized semiconductor supplier, transitioning to a new one might require extensive testing and validation, potentially halting production for weeks.

Fluctuations in the cost of raw materials, such as specialized components for their printers and label stock, directly impact Sato Holdings' manufacturing expenses. For instance, a significant rise in semiconductor prices, a critical input for electronics, could substantially increase production costs for Sato's advanced printing solutions.

Suppliers who control essential or unique inputs can leverage their position by raising prices, which in turn squeezes Sato's profit margins and forces adjustments to its competitive pricing strategies in the market. This power is amplified if Sato has limited alternative suppliers for these critical components.

Availability of Substitutes for Inputs

The availability of substitutes for Sato Holdings' core inputs significantly impacts supplier bargaining power. If Sato Holdings can easily switch to alternative suppliers or substitute materials without a substantial increase in costs or a decline in quality, then suppliers have less leverage. For instance, in 2024, the semiconductor industry, a critical component for many tech-reliant businesses, saw increased production from new entrants and advancements in alternative chip architectures, which somewhat diluted the power of established suppliers.

Conversely, if suppliers provide unique, proprietary, or patented technologies essential for Sato Holdings' operations, their bargaining power increases considerably. This is because finding a suitable alternative becomes difficult and costly. For example, a specialized component with unique performance characteristics, if supplied by only a few firms, would give those firms considerable pricing power.

- Limited Substitutes: When key inputs are unique or patented, suppliers gain significant leverage.

- Abundant Substitutes: The presence of readily available, generic components or alternative technologies weakens supplier power.

- Cost of Switching: High costs associated with switching suppliers or inputs further empower existing suppliers.

- Impact on Innovation: Suppliers offering critical, non-substitutable technologies can command higher prices, potentially impacting Sato Holdings' R&D budget.

Forward Integration Threat by Suppliers

Suppliers might threaten Sato Holdings by moving into the Automatic Identification and Data Capture (AIDC) solutions market themselves, becoming direct competitors. This forward integration is a significant concern if these suppliers have developed cutting-edge technology or have established strong connections with the customers who buy AIDC solutions.

For example, a key component manufacturer for Sato could leverage its expertise to offer complete AIDC systems, bypassing Sato and directly serving end-users. This would not only cut into Sato's market share but also potentially commoditize the solutions Sato offers.

Consider a scenario where a supplier of advanced RFID chips or barcode scanners decides to develop its own software platform for data management and analysis. By offering a bundled solution, they could capture a larger portion of the customer's spending on AIDC technology.

- Forward Integration Threat: Suppliers could enter Sato's AIDC solutions market, becoming direct competitors.

- Key Enablers: Advanced technology and strong end-user relationships empower suppliers for forward integration.

- Impact on Sato: Reduced market share and potential commoditization of Sato's offerings.

The bargaining power of Sato Holdings' suppliers is significant due to the specialized nature of components like RFID chips and high-precision printer heads. In 2024, the global RFID market's substantial value, driven by niche applications, highlights the concentration of power among a few key manufacturers of these specialized parts. This limited supplier base allows them to influence pricing and supply terms, directly impacting Sato's operational costs and strategic flexibility.

What is included in the product

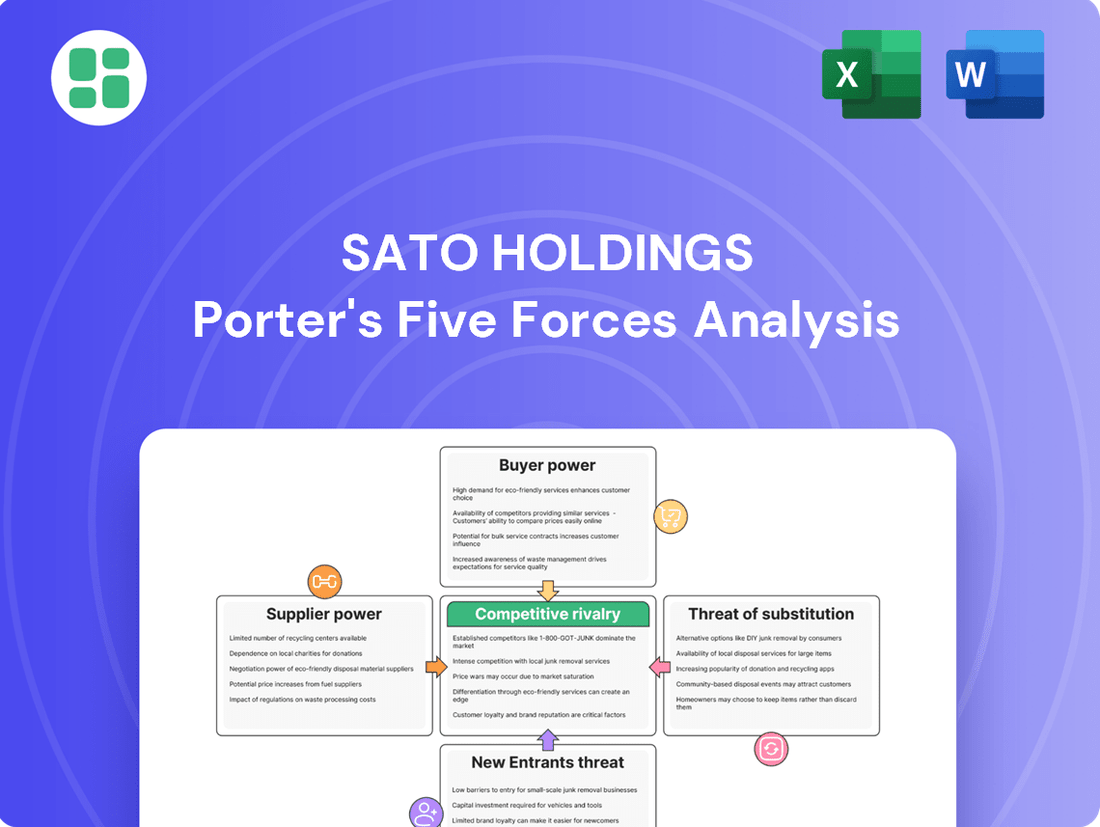

This analysis unpacks the competitive forces impacting Sato Holdings, detailing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its markets.

Instantly identify and mitigate competitive threats with a clear, visual breakdown of Sato Holdings' Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Sato Holdings serves a broad range of industries, but its significant enterprise clients in retail, manufacturing, and healthcare can represent substantial purchasing volumes. These large-volume buyers possess considerable leverage, enabling them to negotiate for reduced pricing or tailored service packages.

For instance, if a major retail chain accounts for a considerable percentage of Sato Holdings’ revenue, that chain can exert significant pressure on pricing and service terms. In 2023, for example, large enterprise clients in the manufacturing sector, a key market for Sato Holdings, saw an average increase of 3% in their purchasing power due to consolidated buying efforts.

Switching costs for customers in the Automatic Identification and Data Capture (AIDC) solutions market, relevant to Sato Holdings, can significantly influence their bargaining power. These costs encompass not only the direct expenses of migrating to a new provider's system but also the indirect impacts of integration challenges, employee retraining, and potential disruptions to ongoing operations. For instance, a business heavily reliant on Sato's barcode printers and RFID tags might incur substantial costs if they decide to switch to a competitor, including the need for new software compatible with the new hardware, extensive staff training on new interfaces, and the risk of operational downtime during the transition period.

Customer price sensitivity for Automatic Identification and Data Capture (AIDC) solutions is a key factor in their bargaining power. This sensitivity is directly tied to how much of a company's overall budget AIDC spending represents and how much value they believe these solutions provide. If AIDC costs are a significant portion of their expenses, customers will naturally be more inclined to negotiate on price.

In 2024, many businesses are still navigating economic uncertainties, making them more vigilant about operational costs. For instance, in the retail sector, where margins can be tight, the cost of AIDC hardware and software can be a substantial line item. This heightened awareness of expenditure, coupled with the availability of various AIDC providers, empowers customers to demand more competitive pricing and favorable terms from suppliers like Sato Holdings.

Availability of Substitute Solutions for Customers

Customers of Sato Holdings face a significant number of alternative solutions, which directly enhances their bargaining power. These alternatives range from direct competitors offering similar technology to even simpler, albeit less efficient, methods like manual data processing. For instance, in the business process outsourcing (BPO) sector, where Sato operates, clients can often choose between multiple providers, each with varying service levels and pricing structures.

The availability of substitutes means that if Sato Holdings' pricing is too high or its service quality falters, customers can readily switch to another provider without incurring substantial switching costs. This competitive landscape is particularly evident in areas like document management and customer support, where numerous firms vie for market share. In 2024, the global BPO market was valued at approximately $270 billion, indicating a highly competitive environment with ample choices for buyers.

- High Availability of Alternatives: Customers can select from numerous BPO providers and manual processes.

- Low Switching Costs: Customers can easily transition to a competitor if Sato's offerings are not satisfactory.

- Competitive Market Dynamics: The BPO sector's size, estimated at $270 billion in 2024, underscores the abundance of choices for clients.

- Impact on Pricing and Service: The presence of substitutes forces Sato to remain competitive on both price and service quality.

Buyer Information and Transparency

Buyer information and transparency significantly bolster customer bargaining power. In 2024, the widespread availability of detailed product specifications and pricing across the Automatic Identification and Data Capture (AIDC) market allows customers to conduct thorough comparisons. This ease of access empowers buyers to negotiate more aggressively with vendors, including Sato Holdings, by leveraging knowledge of competitive offerings and market benchmarks.

The increasing transparency means customers are well-informed about the true value of products and services. This can lead to demands for lower prices or enhanced features, directly impacting Sato's pricing strategies and profit margins. For instance, online comparison tools and industry review platforms in 2024 provide readily accessible data that shifts the power dynamic towards the buyer.

- Informed Comparisons: Customers can easily compare Sato's barcode printers and data collection devices against competitors based on features, durability, and total cost of ownership.

- Price Sensitivity: Greater transparency highlights price differences, making customers more sensitive to higher price points if comparable value is available elsewhere.

- Negotiation Leverage: Buyers can use information gathered from multiple sources to negotiate better terms, discounts, or service level agreements.

The bargaining power of Sato Holdings' customers is significant, driven by several key factors. Large enterprise clients, particularly in sectors like retail and manufacturing, represent substantial purchasing volumes, giving them leverage to negotiate favorable pricing and customized service agreements. In 2023, large manufacturing clients, a core demographic for Sato, saw their purchasing power increase due to consolidated buying efforts, leading to an average 3% gain in negotiation strength.

Switching costs for customers utilizing Sato's Automatic Identification and Data Capture (AIDC) solutions are generally moderate. While migration involves direct expenses and indirect operational impacts like retraining, the availability of numerous alternative AIDC providers in 2024, a market valued at over $270 billion globally, means customers can often find comparable solutions with less disruption. This ease of switching, coupled with increasing price transparency through online comparison tools, empowers buyers to demand competitive pricing and better terms from Sato.

| Factor | Impact on Sato Holdings | Supporting Data (2023-2024) |

|---|---|---|

| Volume Purchasing Power | Customers can negotiate lower prices and tailored services. | Large manufacturing clients experienced a 3% increase in purchasing power in 2023 due to consolidated buying. |

| Availability of Substitutes | Limits Sato's pricing flexibility and necessitates competitive offerings. | The global BPO market, which includes AIDC services, was valued at approximately $270 billion in 2024, indicating a highly competitive landscape. |

| Switching Costs | Moderate; customers can switch if alternatives offer better value or lower disruption. | While retraining and integration are factors, the breadth of the AIDC market provides viable alternatives. |

| Price Transparency | Increases customer sensitivity to pricing and strengthens negotiation leverage. | Online comparison tools and industry reviews in 2024 provide readily accessible data, shifting power to informed buyers. |

Preview the Actual Deliverable

Sato Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Sato Holdings' competitive landscape through Porter's Five Forces, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This comprehensive analysis provides actionable insights into Sato Holdings' strategic positioning and potential challenges.

Rivalry Among Competitors

Sato Holdings operates within the Automatic Identification and Data Capture (AIDC) market, which is characterized by a moderate level of fragmentation. This means there are a good number of companies vying for market share, from those offering comprehensive solutions to those focusing on niche areas.

Key global competitors for Sato include industry giants like Zebra Technologies, Honeywell, and Datalogic. These companies often have broad product portfolios and extensive market reach. Additionally, Sato faces competition from other significant players such as Toshiba Tec, alongside various regional competitors that cater to specific geographic markets.

The Automatic Identification and Data Capture (AIDC) market is on a strong upward trajectory, with projections indicating a substantial rise from $80.05 billion in 2025 to $130.25 billion by 2030. This rapid expansion, particularly in areas like mobile RFID barcode printers, creates a dynamic environment. While overall market growth typically moderates competitive intensity by offering ample opportunities for all players, it doesn't eliminate the potential for fierce competition.

Companies within these growing segments often vie aggressively for market share. This can manifest as aggressive pricing strategies, accelerated innovation cycles, and increased marketing efforts as firms seek to capture a larger piece of the expanding pie. Even with a growing market, the fight for dominance within specific niches can remain intense.

Competitors in Sato Holdings' market actively differentiate through ongoing product innovation, introducing advanced solutions like AI-driven data analytics and robust security features. For instance, Zebra Technologies, a key rival, reported a 10% increase in their software and solutions segment revenue in Q1 2024, highlighting the market's demand for sophisticated offerings. Sato's auto-identification business hinges on this continuous innovation to prevent its products from becoming commodities, ensuring it maintains a competitive advantage.

Exit Barriers for Competitors

High fixed costs in the Automatic Identification and Data Capture (AIDC) market, such as those associated with advanced manufacturing equipment and research and development, can make it difficult for competitors to exit. For instance, companies heavily invested in specialized production lines for barcode scanners or RFID tags face substantial write-offs if they decide to cease operations. This reluctance to abandon significant capital investments fuels continued competition, even when market conditions are unfavorable.

Specialized assets, like proprietary software platforms for data management or unique manufacturing processes, also act as significant exit barriers. These assets often have limited resale value outside the AIDC industry, trapping companies within the market. As of 2024, the ongoing demand for supply chain visibility and inventory management solutions continues to sustain these specialized investments, making a clean exit challenging for many players.

Furthermore, strong brand loyalties cultivated over years of reliable service and product performance create another layer of exit difficulty. Established players in the AIDC sector, like Sato Holdings, benefit from deep customer relationships, making it hard for new entrants or exiting firms to transfer market share. This loyalty means that even if a company wants to leave, the market may not readily absorb its customer base, prolonging its presence and intensifying rivalry.

- High fixed costs in manufacturing and R&D deter market exits.

- Specialized assets have limited value outside the AIDC industry, trapping firms.

- Strong brand loyalties make it difficult for exiting companies to divest customers.

Strategic Alliances and Acquisitions

The Automatic Identification and Data Capture (AIDC) hardware market is seeing intense competition fueled by strategic alliances and acquisitions. Top vendors are actively partnering with software developers and AI startups to enhance their product offerings and tap into new technological frontiers. This trend is particularly evident as companies seek to integrate advanced analytics and machine learning into their solutions, aiming to provide more sophisticated data capture and management capabilities.

For instance, Zebra Technologies, a leading player, has consistently invested in acquisitions to bolster its portfolio. In 2023, the company continued to focus on integrating its acquired businesses, aiming for synergistic growth and expanded market presence. These moves signal a clear strategy to consolidate market share and deepen technological expertise, directly impacting the competitive intensity for companies like Sato Holdings.

- Strategic Partnerships: AIDC hardware manufacturers are forming alliances with software and AI firms to integrate cutting-edge technologies, enhancing data capture and analysis capabilities.

- Acquisition Trends: Companies are acquiring smaller, innovative firms to expand their technological repertoire and geographical reach, consolidating the market.

- Market Consolidation: These strategic moves are intensifying rivalry by creating larger, more capable competitors that can offer comprehensive solutions.

- Innovation Drive: The pursuit of advanced features, such as AI-powered analytics and IoT integration, is a key driver behind these consolidation efforts.

Competitive rivalry within Sato Holdings' Automatic Identification and Data Capture (AIDC) market is significant, driven by a moderate number of players including giants like Zebra Technologies and Honeywell. The market is expanding rapidly, with projections showing growth from $80.05 billion in 2025 to $130.25 billion by 2030, creating both opportunities and intense competition as firms vie for market share.

Companies differentiate through continuous innovation, with key rivals like Zebra Technologies reporting strong revenue growth in their solutions segments, as seen with a 10% increase in Q1 2024. High fixed costs in manufacturing and R&D, coupled with specialized assets and strong brand loyalties, create substantial exit barriers, keeping firms engaged in the competitive landscape.

Strategic alliances and acquisitions are further intensifying rivalry, as companies partner with software and AI firms to enhance offerings and consolidate market share. This drive for advanced features, such as AI-powered analytics, fuels a dynamic and competitive environment for Sato Holdings.

SSubstitutes Threaten

Despite ongoing advancements in technologies like RFID, traditional barcode technology continues to be a significant substitute, particularly in cost-sensitive environments like many warehouses. Its inherent simplicity and low implementation cost make it a persistent choice for basic identification and tracking needs.

While RFID undeniably offers superior speed and accuracy, the vast installed base and familiarity with barcode scanners mean they remain a practical and cost-effective alternative for numerous applications. For instance, in 2024, the global barcode scanner market was projected to reach over $10 billion, underscoring its continued relevance.

For smaller businesses or those with less complex needs, manual data entry and older, non-automated processes can act as a substitute for advanced AIDC (Automatic Identification and Data Capture) solutions. These manual methods often have a lower upfront cost, making them more accessible. For instance, a small retail shop might opt for manual inventory tracking instead of investing in barcode scanners and software, especially if their product volume is low.

Advanced vision systems, often powered by AI, and the proliferation of IoT sensors present a significant threat of substitution for traditional Automatic Identification and Data Capture (AIDC) methods like barcodes and RFID. These newer technologies can gather crucial data for asset tracking and inventory management without requiring physical tags. For instance, companies like Cognex are developing sophisticated vision inspection systems that can identify and track items based on visual characteristics alone.

This technological shift means that businesses might bypass the need for traditional AIDC hardware and associated tagging costs. In 2024, the market for industrial vision systems is projected to continue its robust growth, with reports indicating a compound annual growth rate (CAGR) well into the double digits, demonstrating increasing adoption and a clear move towards these alternative data capture methods.

QR Codes and Other 2D Barcodes

QR codes and other advanced 2D barcodes present a significant threat of substitution for traditional barcode systems, particularly in scenarios demanding greater data capacity and smartphone accessibility. Their ability to store more information than standard linear barcodes, coupled with the ubiquity of mobile devices, makes them a compelling alternative for tasks like product identification, ticketing, and marketing campaigns.

These technologies can replace traditional barcodes where the latter's limited data storage is a constraint or where the cost and complexity of RFID systems are prohibitive. For instance, a QR code can link directly to a product's full specifications or a promotional website, something a traditional barcode cannot easily achieve. By 2024, the global mobile barcode scanner market is projected to reach over $6 billion, indicating a strong adoption trend for these substitute technologies.

- Increased Data Capacity: QR codes can store significantly more data than traditional UPC barcodes.

- Smartphone Accessibility: Scanning is easily done with common mobile devices, reducing hardware dependency.

- Cost-Effectiveness: Offers a lower-cost solution compared to more complex identification systems like RFID for many applications.

- Versatile Applications: Usable for everything from product information to digital payments and event ticketing.

Emerging Technologies and Digital Solutions

Emerging technologies like AI and blockchain present significant threats of substitution for traditional Automatic Identification and Data Capture (AIDC) methods. These digital solutions offer advanced capabilities in data security and predictive analytics, directly challenging the core functions of AIDC systems.

For instance, AI-powered predictive analytics can forecast demand and optimize inventory without relying solely on physical tag scans, a key function of AIDC. Blockchain technology, meanwhile, provides a decentralized and immutable ledger for tracking goods, offering a robust alternative for supply chain traceability that could diminish the need for traditional barcode or RFID systems. In 2024, the global AI market was valued at an estimated $200 billion, with significant investment flowing into applications for data management and analysis, highlighting the growing viability of these substitutes.

These advancements allow for enhanced efficiency and data integrity, potentially reducing Sato Holdings’ reliance on its established AIDC hardware and software. The shift towards purely digital solutions for data capture and management means customers might bypass traditional AIDC, opting for integrated software platforms that leverage AI and blockchain for their operational needs.

- AI-driven data analytics offer predictive insights, reducing the need for real-time physical data capture via AIDC.

- Blockchain technology provides secure and transparent supply chain traceability, acting as an alternative to traditional AIDC for tracking goods.

- The global AI market's growth to an estimated $200 billion in 2024 signifies a strong trend towards digital solutions that can substitute AIDC functions.

- These emerging digital solutions can offer comparable or superior efficiency and data security, potentially lowering customer demand for AIDC hardware and services.

While Sato Holdings is a leader in AIDC solutions, emerging technologies and simpler methods pose a threat of substitution. Advanced vision systems and AI-driven analytics can track assets without physical tags, and blockchain offers secure supply chain traceability. For instance, the industrial vision systems market was projected for double-digit CAGR in 2024, indicating a strong shift towards these alternatives. Additionally, simpler manual data entry persists in cost-sensitive or low-volume environments, bypassing the need for sophisticated AIDC hardware.

| Substitute Technology | Key Advantage | Sato Holdings Impact | 2024 Market Relevance |

|---|---|---|---|

| Advanced Vision Systems (AI-powered) | Tag-less tracking via visual recognition | Reduces reliance on physical tags/scanners | Strong growth (double-digit CAGR projected) |

| Blockchain for Supply Chain | Decentralized, immutable traceability | Alternative to AIDC for tracking goods | Increasing adoption for data integrity |

| Manual Data Entry | Low upfront cost, simple implementation | Viable for small businesses or low complexity | Persistent in cost-sensitive segments |

| QR Codes | Increased data capacity, smartphone accessibility | Competes with traditional barcodes | Global mobile barcode scanner market >$6 billion |

Entrants Threaten

Entering the Automatic Identification and Data Capture (AIDC) market, especially in manufacturing advanced hardware like barcode and RFID printers, demands a significant upfront financial commitment. This includes substantial investments in cutting-edge research and development, establishing state-of-the-art manufacturing plants, and building robust global distribution channels. For instance, in 2024, companies like Zebra Technologies, a major player, continue to invest heavily in R&D to stay ahead in printer technology and software solutions.

These considerable capital requirements act as a formidable barrier, deterring many aspiring companies from entering the AIDC hardware sector. The need for specialized equipment, skilled labor, and extensive testing to meet industry standards means that only well-capitalized firms can realistically consider competing. This financial hurdle significantly limits the number of potential new entrants, thereby reducing the competitive pressure on established players like Sato Holdings.

Established companies like Sato Holdings benefit from a robust portfolio of intellectual property, including numerous patents covering their advanced printer technologies, unique RFID tag designs, and proprietary software solutions. This deep well of innovation creates a significant barrier for potential new entrants seeking to replicate their offerings.

For instance, Sato Holdings' investment in research and development, which has consistently yielded patented advancements, makes it exceptionally difficult and costly for newcomers to develop comparable technologies. The legal and financial challenges associated with navigating and potentially infringing upon existing patents are substantial deterrents.

Sato Holdings and its top competitors in the Automatic Identification and Data Capture (AIDC) sector have cultivated robust brand reputations and enduring customer loyalty over many years. These established relationships span critical sectors such as retail, manufacturing, logistics, and healthcare, demonstrating a deep-seated trust in their solutions. For any new company entering this market, replicating this level of credibility and customer confidence would require substantial time and considerable financial investment, presenting a significant barrier.

Complex Distribution Channels and Supply Chains

The Automatic Identification and Data Capture (AIDC) industry, crucial for companies like Sato Holdings, is deeply entrenched with established distribution channels and intricate, integrated supply chains that span the globe. Newcomers must either replicate these complex networks, a process demanding significant capital and time, or secure access, which often involves lengthy negotiations and integration efforts with existing players.

For instance, building a global distribution network similar to Sato's, which often involves partnerships with system integrators and value-added resellers, can easily cost tens of millions of dollars and take years to mature. The sheer logistical complexity of warehousing, shipping, and supporting specialized AIDC hardware and software worldwide presents a substantial barrier. In 2024, the global AIDC market was valued at approximately $50 billion, with a significant portion attributed to the established players who have mastered these distribution intricacies.

- Established relationships: Existing AIDC providers have long-standing partnerships with distributors and resellers, making it difficult for new entrants to gain shelf space or customer access.

- Logistical infrastructure: The cost and complexity of setting up global warehousing, shipping, and support for specialized AIDC products are prohibitive for many new companies.

- Integration challenges: New entrants must also contend with the technical challenge of integrating their solutions with the diverse IT systems of their target customers, a process often facilitated by experienced channel partners.

Regulatory Compliance and Industry Standards

The Automatic Identification and Data Capture (AIDC) market, particularly within critical sectors such as healthcare and food logistics, is heavily influenced by stringent regulatory standards and compliance mandates concerning data accuracy and product traceability. New companies entering this space must invest significant resources to understand and adhere to these complex regulations, thereby increasing the overall cost and complexity of market entry.

For instance, compliance with regulations like the FDA's Food Safety Modernization Act (FSMA) in the US, which emphasizes traceability throughout the supply chain, requires robust AIDC systems. Failure to comply can result in severe penalties, making it a substantial barrier for newcomers. In 2024, the global AIDC market was valued at approximately $65 billion, with growth driven in part by these regulatory demands.

- Healthcare Data Standards: Compliance with HIPAA in the US and GDPR in Europe necessitates secure and accurate data handling, impacting AIDC system design.

- Food Traceability Mandates: Regulations like FSMA 204 require enhanced traceability, pushing for more sophisticated AIDC solutions.

- Industry-Specific Certifications: Obtaining certifications for AIDC hardware and software in sensitive industries adds another layer of compliance cost and time.

The threat of new entrants into Sato Holdings' Automatic Identification and Data Capture (AIDC) market is relatively low. Significant capital investment is required for R&D, manufacturing, and distribution, with companies like Zebra Technologies investing heavily in 2024. These high upfront costs, coupled with the need for specialized equipment and skilled labor, create substantial financial barriers.

Established players like Sato Holdings possess strong intellectual property portfolios, including numerous patents, which are costly and legally challenging for newcomers to replicate. Furthermore, decades of building brand reputation and customer loyalty in sectors like retail and manufacturing create deep-seated trust that is difficult and expensive for new companies to match.

The intricate global distribution channels and supply chains in the AIDC sector represent another significant hurdle. Replicating Sato's established network of partners and resellers can cost tens of millions of dollars and take years to mature, as evidenced by the market's estimated $50 billion valuation in 2024, dominated by incumbents.

Stringent regulatory standards in critical industries like healthcare and food logistics add further complexity and cost for new entrants. Compliance with mandates such as FSMA 204 or HIPAA requires significant investment in robust AIDC systems, making market entry more challenging. The global AIDC market, valued at approximately $65 billion in 2024, reflects the impact of these regulatory demands.

| Barrier Type | Description | Impact on New Entrants | Example for Sato Holdings |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and distribution. | Deters smaller or less capitalized firms. | Zebra Technologies' continued R&D investment in 2024. |

| Intellectual Property | Patented technologies and proprietary software. | Increases cost and legal risk for competitors. | Sato's numerous patents on printer technology and RFID tags. |

| Brand Reputation & Loyalty | Established trust and long-term customer relationships. | Requires significant time and investment to build comparable credibility. | Sato's deep trust in retail, manufacturing, logistics, and healthcare sectors. |

| Distribution Channels | Complex global networks of partners and resellers. | Difficult and costly to replicate or gain access to. | Sato's established partnerships with system integrators and VARs. |

| Regulatory Compliance | Adherence to industry-specific standards and mandates. | Adds significant cost, time, and complexity to market entry. | FSMA 204 compliance for food traceability, HIPAA for healthcare data. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Sato Holdings is built upon a foundation of publicly available financial reports, including annual filings and investor presentations. We also leverage industry-specific market research reports and trade publications to capture nuanced competitive dynamics.