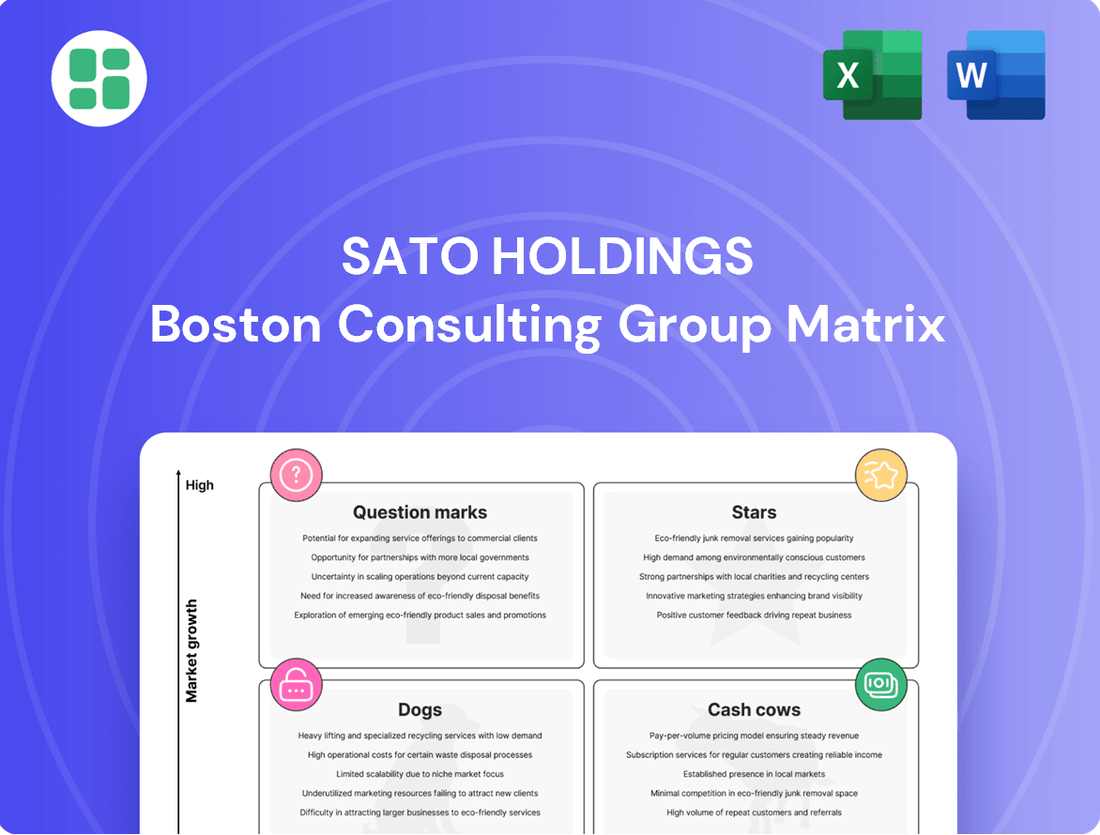

Sato Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sato Holdings Bundle

Curious about Sato Holdings' strategic product portfolio? This glimpse into their BCG Matrix reveals the potential for growth and stability across their offerings. Understand where their Stars, Cash Cows, Dogs, and Question Marks lie to make informed decisions.

Unlock the full strategic advantage by purchasing the complete Sato Holdings BCG Matrix. Gain detailed quadrant analysis, actionable insights, and a clear roadmap to optimize resource allocation and drive future success.

Stars

SATO Holdings' RFID solutions, especially passive UHF-RFID and PJM RFID for the healthcare sector, are a significant growth driver. This aligns with the broader Automatic Identification and Data Capture (AIDC) market, which is expected to grow at over 10% annually through 2030, fueled by a strong demand for enhanced traceability and operational efficiency.

SATO has successfully deployed its RFID technologies with major clients across logistics, manufacturing, and healthcare industries globally. As the adoption of RFID tags increases, the company anticipates a positive impact on its profit margins due to economies of scale in implementation.

SATO is strategically positioning itself in the high-growth services segment of the Automatic Identification and Data Capture (AIDC) market, which is projected to expand at an impressive 11.83% compound annual growth rate. This focus is evident in their development of integrated software and cloud-connected solutions, such as their collaboration with Loftware for cloud-based label printing and the introduction of SATO ID AUTH for streamlined single sign-on access.

The healthcare sector represents a significant growth area for Automatic Identification and Data Capture (AIDC) solutions. This vertical is expected to expand at a robust 10.90% compound annual growth rate (CAGR), indicating strong demand for advanced tracking and identification technologies.

SATO Holdings identifies healthcare as a high-margin market, underscoring the profitability potential for AIDC providers. Their strategic focus on innovative solutions, such as PJM RFID for enhanced blood management, demonstrates a commitment to addressing critical industry needs.

These PJM RFID solutions directly contribute to improved patient safety and operational efficiency within healthcare facilities. By providing reliable and accurate data capture, SATO's offerings help streamline processes like blood inventory management and patient identification.

AIDC Solutions for Manufacturing

Manufacturing represents a significant portion of the Automatic Identification and Data Capture (AIDC) market, capturing 34.5% of the total share. This sector is a key profit driver for SATO's operations in Japan.

As manufacturing continues its push towards automation and digital transformation, SATO's AIDC solutions are becoming increasingly crucial. These solutions enable real-time, accurate data capture on the factory floor, addressing the growing need for efficiency and error reduction.

SATO is well-positioned as a leader in this high-growth application area due to its robust offerings for the manufacturing industry. The company's commitment to providing reliable data capture technologies supports manufacturers in their pursuit of enhanced productivity and streamlined operations.

- Market Share: Manufacturing accounts for 34.5% of the AIDC market.

- Profitability: This sector is a high-profit focus for SATO's Japan business.

- Demand Drivers: Automation and digital transformation in manufacturing fuel demand for SATO's solutions.

- SATO's Position: SATO is recognized as a leader in providing real-time, error-free data capture for manufacturing.

Advanced Industrial Printers

SATO's advanced industrial printers, exemplified by the CL4NX Plus series, are strong contenders in the barcode printer market, holding a significant share. Their continued investment in eco-friendly features, like CO2-reducing cushioning and the incorporation of recycled plastics, directly addresses market demands for sustainability and operational efficiency, reinforcing their competitive edge.

These printers are crucial for industries requiring robust and reliable labeling solutions. For instance, in 2024, the demand for industrial automation and supply chain visibility continued to grow, directly benefiting manufacturers of such equipment. SATO's focus on durability and advanced connectivity features ensures their printers are well-positioned to capitalize on these trends.

- Market Position: SATO's CL4NX Plus series is a leading product in the industrial label printer segment, a key driver of the overall barcode printer market.

- Innovation Focus: The company is actively integrating sustainability into its product development, including CO2-reducing cushioning and the use of recycled plastics.

- Competitive Advantage: These advancements help SATO maintain a strong market presence by meeting the increasing demand for efficient and environmentally conscious printing solutions.

- Industry Relevance: The printers cater to industries prioritizing automation and supply chain transparency, sectors experiencing significant growth in 2024.

SATO's RFID solutions, particularly for healthcare and manufacturing, position them as a Star in the BCG matrix. These sectors show robust growth, with AIDC expected to grow over 10% annually. SATO's focus on high-margin markets like healthcare, with specific applications like PJM RFID for blood management, and its leadership in manufacturing AIDC due to automation trends, underscore their strong market position and growth potential.

What is included in the product

Highlights which units to invest in, hold, or divest for Sato Holdings.

The Sato Holdings BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex portfolio data.

Cash Cows

SATO Holdings is a significant force in the global barcode printer arena. While this market is mature, it offers dependable revenue streams, making SATO's traditional barcode printers prime examples of Cash Cows within its BCG Matrix.

The company's strength lies particularly in industrial printers, which command the largest portion of revenue share in the market. This dominance in a stable sector means these established products consistently generate strong cash flow, thanks to their broad acceptance across diverse industries.

SATO's standard pressure-sensitive labels and tags are a true cash cow, acting as a vital consumable for their vast network of installed printers. This consistent demand generates a reliable and recurring revenue stream.

This segment thrives on high-volume sales and exhibits stable, predictable demand. It's the bedrock of SATO's financial stability, offering consistent cash flow that can be strategically reinvested to fuel growth in other parts of the business.

SATO's Basic Line industrial label printers, exemplified by models like the WT4-AXB, are positioned as Cash Cows within their BCG Matrix. These printers are designed to serve a wide market, focusing on delivering core functionality at a competitive price point. This approach is geared towards capturing a significant share of sales in a well-established market where cost-effectiveness is a primary driver for many customers.

The strategy behind these products is to generate steady, predictable revenue streams. By offering reliable and affordable solutions, SATO aims to attract a large customer base seeking dependable printing capabilities without the need for advanced, premium features. This focus on volume and consistent demand is characteristic of a Cash Cow, providing stable financial returns for the company.

Maintenance and Support Services for Hardware

SATO Holdings' maintenance and support services for its AIDC hardware function as a classic Cash Cow within the BCG Matrix. These offerings generate consistent, predictable revenue, acting as a stable income source for the company. This recurring revenue is a direct result of SATO's substantial installed base of printers and other devices, many of which require ongoing service to ensure optimal performance.

These services are crucial for customer retention, fostering loyalty and discouraging customers from switching to competitors. The profitability stems from the high margins typically associated with established service contracts and the relatively low investment required to maintain these revenue streams once the initial hardware is sold. For instance, in fiscal year 2024, SATO reported that its Services segment, which includes maintenance and support, contributed a significant portion to overall profitability, demonstrating its Cash Cow status.

- Stable Recurring Revenue: Maintenance and support services provide a predictable income stream, bolstering financial stability.

- High Profitability: Leveraging a large installed base allows for high-margin service contracts with minimal incremental investment.

- Customer Retention: Essential support services are key to keeping customers engaged with SATO's ecosystem.

- Contribution to Profitability: In fiscal year 2024, SATO's Services segment demonstrated strong performance, underscoring the segment's Cash Cow characteristics.

Hand Labelers

SATO's hand labelers are a classic example of a Cash Cow within their product portfolio. These are the dependable workhorses, mature in their market presence and requiring little in the way of new investment to maintain their position.

They generate steady, predictable income. Think of them as the reliable revenue stream that funds growth in other areas of the business. Their utility across retail, warehousing, and logistics ensures a consistent demand, even if the growth rate isn't spectacular.

For example, in 2024, SATO continued to see strong demand for its manual labeling solutions, particularly in sectors like food safety and inventory management where clear, on-the-spot labeling is crucial. While specific revenue figures for hand labelers aren't broken out separately by SATO Holdings in their public reports, their consistent presence in product catalogs and their role in supporting larger integrated solutions highlights their ongoing value.

- Mature Product Line: Hand labelers represent a well-established technology with a stable market share.

- Consistent Cash Flow: They reliably generate profits with minimal reinvestment needs.

- Low Growth Market: While demand is steady, significant market expansion is unlikely.

- Strategic Importance: These products support other SATO offerings and maintain customer relationships.

SATO's industrial label printers, particularly those in the Basic Line like the WT4-AXB, are firmly established as Cash Cows. These printers offer core functionality at competitive prices, securing a significant share in a mature market where cost-effectiveness is paramount. Their predictable revenue generation allows SATO to fund innovation in other business segments.

The company's standard pressure-sensitive labels and tags are another prime example of a Cash Cow. As essential consumables for SATO's extensive installed printer base, they ensure a consistent and recurring revenue stream. This high-volume, stable demand forms a critical part of SATO's financial stability.

SATO's maintenance and support services for its Automatic Identification and Data Capture (AIDC) hardware also function as a classic Cash Cow. These services leverage the large installed base to generate high-margin, predictable revenue. In fiscal year 2024, SATO's Services segment, encompassing these offerings, contributed significantly to overall profitability, confirming its Cash Cow status.

Finally, SATO's hand labelers represent a mature product line that reliably generates profits with minimal reinvestment. While the market for these products shows low growth, their consistent demand across various sectors like retail and logistics ensures steady cash flow, supporting other SATO initiatives.

| Product Category | BCG Matrix Position | Key Characteristics | Fiscal Year 2024 Relevance |

| Industrial Label Printers (Basic Line) | Cash Cow | Mature market, high volume, cost-effective | Core revenue driver, stable cash flow |

| Standard Pressure-Sensitive Labels & Tags | Cash Cow | Essential consumables, recurring revenue | Supports installed printer base, predictable income |

| AIDC Hardware Maintenance & Support | Cash Cow | High-margin services, customer retention | Significant contributor to profitability (Services segment) |

| Hand Labelers | Cash Cow | Mature product, steady demand, low reinvestment | Consistent profit generation, supports other offerings |

Delivered as Shown

Sato Holdings BCG Matrix

The Sato Holdings BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you get the entire strategic analysis, meticulously prepared and ready for immediate application, without any watermarks or placeholder content.

Dogs

Obsolete or end-of-life printer models from Sato Holdings, such as older generations of barcode or RFID printers that have been superseded by more advanced technology, typically land in the Dogs quadrant of the BCG Matrix. These products likely generate minimal new sales revenue, with many of these models having been phased out by 2024.

These older printers often require disproportionate support resources from Sato, straining customer service and technical teams. Furthermore, they may struggle with compatibility issues when trying to integrate with newer software or operational systems, further diminishing their utility and market appeal.

Highly specialized Automatic Identification and Data Capture (AIDC) solutions designed for specific, shrinking niche markets or those facing technological obsolescence can fall into the 'Dog' category of the BCG Matrix. These offerings, while once valuable, may no longer align with evolving market demands or customer needs. For instance, AIDC systems solely for legacy mainframe data entry might see a significant decline in adoption as businesses migrate to cloud-based solutions.

Such solutions often exhibit low market share due to their limited applicability and diminishing growth prospects. Sato Holdings, like many technology providers, must continually assess its product portfolio. If a particular AIDC solution, for example, one focused on a specific type of industrial barcode that is being phased out, has seen its revenue decline by over 15% year-over-year and holds less than 2% of its niche market share, it would likely be classified as a Dog.

Sato Holdings' strategic emphasis on high-profit and key markets suggests that some established geographic regions within mature Automatic Identification and Data Capture (AIDC) sectors may be lagging. These areas often grapple with fierce competition and slower technology adoption, impacting market share and profitability.

For instance, certain European countries, while mature AIDC markets, might exhibit lower profit margins for Sato due to established local competitors and slower uptake of newer RFID technologies compared to North America or parts of Asia. In 2023, while Sato Holdings reported overall revenue growth, the AIDC segment in some older European markets may have seen a more modest increase, potentially below the company's target growth rates.

Basic, Non-Connected Desktop Barcode Printers

Basic, non-connected desktop barcode printers from SATO, while functional, are likely positioned as Dogs within the BCG Matrix. These printers face intense competition from more advanced, connected models and could see declining demand as businesses prioritize integrated workflows and mobile printing solutions. For instance, the global barcode printer market, while growing, sees increasing innovation in IoT-enabled and cloud-connected devices.

If SATO's market share in this particular segment of low-growth, basic desktop printers is indeed small, it further solidifies their classification as Dogs. Companies often divest or minimize investment in such product lines to reallocate resources to more promising areas. In 2023, the industrial barcode printer market saw growth, but the emphasis was on features like wireless connectivity and ruggedness, areas where basic desktop units lag.

- Low Market Share: Basic desktop printers may represent a small fraction of SATO's overall printer sales.

- Low Market Growth: The demand for non-connected, basic printers is likely stagnant or declining.

- Intense Competition: Numerous manufacturers offer similar, often lower-cost, basic models.

- Technological Obsolescence: The trend is towards smart, connected printing solutions, making basic models less attractive.

Outdated Custom Software Implementations

Outdated custom software implementations, if not actively maintained and updated, can quickly become Dogs in Sato Holdings' BCG Matrix. These bespoke solutions, built for specific client needs, often struggle with scalability and integration into modern cloud-based ecosystems. By 2024, many businesses reported that maintaining legacy software accounted for a significant portion of their IT budgets, with some estimates suggesting it could be up to 80% of total IT spending, diverting funds from innovation.

These systems, lacking ongoing development and failing to adapt to evolving technological landscapes, represent a drain on resources. The cost of keeping them operational can far outweigh the value they deliver, hindering growth and competitiveness. For instance, a study by Gartner in 2023 indicated that organizations with a high proportion of legacy systems often experience slower digital transformation initiatives.

- High Maintenance Costs: Legacy systems can consume a disproportionate amount of IT budget, with some analyses suggesting maintenance can cost 4-5 times more than maintaining modern applications.

- Lack of Scalability: Solutions not designed for growth often fail to meet increasing user demands or data volumes, limiting business expansion.

- Integration Challenges: Inability to connect with new technologies and cloud platforms creates operational silos and inefficiencies.

- Security Vulnerabilities: Outdated software is often more susceptible to cyber threats, posing significant risks to data and operations.

Products in the Dogs quadrant, such as older, less advanced printer models from Sato Holdings, typically exhibit low market share and low market growth. These offerings, like basic desktop barcode printers that lack connectivity features, are often outcompeted by newer, more integrated solutions. By 2023, the trend in the barcode printer market was strongly towards IoT-enabled and cloud-connected devices, making these older models increasingly obsolete.

These products often require significant support relative to their revenue generation, straining resources. For example, a specific legacy AIDC system designed for a shrinking niche market, with a year-over-year revenue decline exceeding 15% and a market share below 2%, would likely be classified as a Dog. This indicates a need for careful resource allocation away from such underperforming assets.

Sato Holdings' strategic focus on high-profit areas means that products with declining demand and high maintenance costs, such as outdated custom software implementations, are prime candidates for the Dogs category. These legacy systems can consume a disproportionate amount of IT budgets, with some estimates in 2023 suggesting maintenance costs could be 4-5 times higher than for modern applications, hindering overall efficiency.

Question Marks

SATO's AI-powered data analytics and predictive solutions are positioned as question marks within the BCG matrix. This segment operates within the burgeoning AIDC market, which is rapidly adopting AI technologies. For instance, the global AI in supply chain market was valued at approximately $4.5 billion in 2023 and is projected to reach over $25 billion by 2030, indicating a strong growth trajectory.

While SATO's specific AI offerings in areas like predictive maintenance for industrial equipment or advanced inventory analytics are likely in their nascent stages, they tap into this high-growth potential. However, their current market share in these specialized AI solutions is probably modest, necessitating substantial investment in research and development, as well as market penetration strategies, to capture a significant portion of this expanding market.

SATO's launch of its no-code application platform in Europe in April 2025 places it squarely in the high-growth, but still nascent, no-code market. This segment is projected to expand significantly, with some analysts predicting the global low-code/no-code market to reach over $65 billion by 2027, indicating substantial future opportunity.

Given this early stage for SATO's offering, its current market share is expected to be minimal, characteristic of a 'Question Mark' in the BCG matrix. Significant investment will be crucial to build brand awareness, develop robust features, and capture a meaningful share of this rapidly evolving landscape.

SATO Holdings is actively integrating sustainability into its Automatic Identification and Data Capture (AIDC) solutions. This commitment is evident in their development of eco-friendly product features and robust recycling programs, aligning with a growing global demand for greener supply chain operations.

While SATO’s market share in AIDC solutions specifically branded for advanced sustainability features is likely still emerging, it represents a significant high-growth potential. This segment, though currently holding a low share, is poised for rapid expansion as businesses increasingly prioritize environmental responsibility in their technology investments.

New Market Expansions through Strategic Partnerships

Sato Holdings' medium-term management plan emphasizes entering new markets and partnering with forward-thinking startups. These strategic alliances are designed to tap into high-growth sectors where Sato is building its presence from the ground up, meaning they begin with a modest market share and necessitate significant investment to foster growth.

These initiatives align with the Stars quadrant of the BCG matrix, characterized by high growth potential and currently low market share. For instance, Sato's investment in AI-driven logistics solutions, a key focus for 2024, represents such a venture. The global AI in logistics market was projected to reach approximately $15 billion in 2024, showcasing the substantial growth trajectory Sato aims to capture.

- Targeting high-growth sectors with nascent market presence.

- Requiring substantial strategic investment for market penetration.

- Aligning with the Stars quadrant of the BCG matrix.

- Example: Sato's 2024 focus on AI-driven logistics, a market projected to be worth around $15 billion.

IoT Integration Solutions for Smart Infrastructures

The burgeoning Internet of Things (IoT) and the ongoing Industry 4.0 revolution are fundamentally reshaping the Automatic Identification and Data Capture (AIDC) market. This technological convergence creates a powerful demand for integrated solutions that bridge AIDC capabilities with broader smart infrastructure ecosystems.

SATO's strategic focus on IoT integration for smart infrastructures, particularly in areas like asset tracking within advanced manufacturing facilities and bustling logistics hubs, positions it within the "Question Marks" quadrant of the BCG Matrix. These solutions are characterized by high growth potential, driven by the expanding smart infrastructure landscape, but currently exhibit relatively low market penetration as adoption is still in its nascent stages.

The global IoT market, a key enabler for these smart infrastructure solutions, was projected to reach over $1.1 trillion in 2024, showcasing the immense growth trajectory. For instance, smart factory initiatives are increasingly relying on real-time data from AIDC systems, such as RFID tags and barcode scanners, to optimize operations. In 2023, the smart factory market alone was valued at approximately $27.5 billion and is expected to grow significantly.

- Market Driver: The expansion of Industry 4.0 and IoT adoption fuels demand for integrated AIDC solutions.

- SATO's Position: Solutions for smart factories and logistics hubs are in early adoption, representing high growth potential.

- Current Status: Low market penetration indicates these offerings are still developing their market share.

- Growth Outlook: Significant future revenue is anticipated as smart infrastructure deployment accelerates.

SATO's AI-powered analytics and IoT integration for smart infrastructures are categorized as Question Marks. These segments are in high-growth markets, with the global IoT market projected to exceed $1.1 trillion in 2024. However, SATO's current market share in these advanced solutions is modest, necessitating significant investment to capture a larger portion of the expanding market.

The company's no-code application platform, launched in Europe in April 2025, also falls into the Question Mark category. The global low-code/no-code market is expected to reach over $65 billion by 2027, presenting a substantial opportunity. SATO's minimal current market share in this nascent area requires considerable investment in development and marketing to build brand awareness and secure a competitive position.

These Question Mark segments are characterized by high growth potential but low current market share, demanding substantial strategic investment to foster expansion and achieve market leadership.

BCG Matrix Data Sources

Our BCG Matrix leverages Sato Holdings' internal financial statements, sales data, and product performance metrics. This is supplemented by external market research reports and competitor analysis to provide a comprehensive view.