Rooms To Go SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rooms To Go Bundle

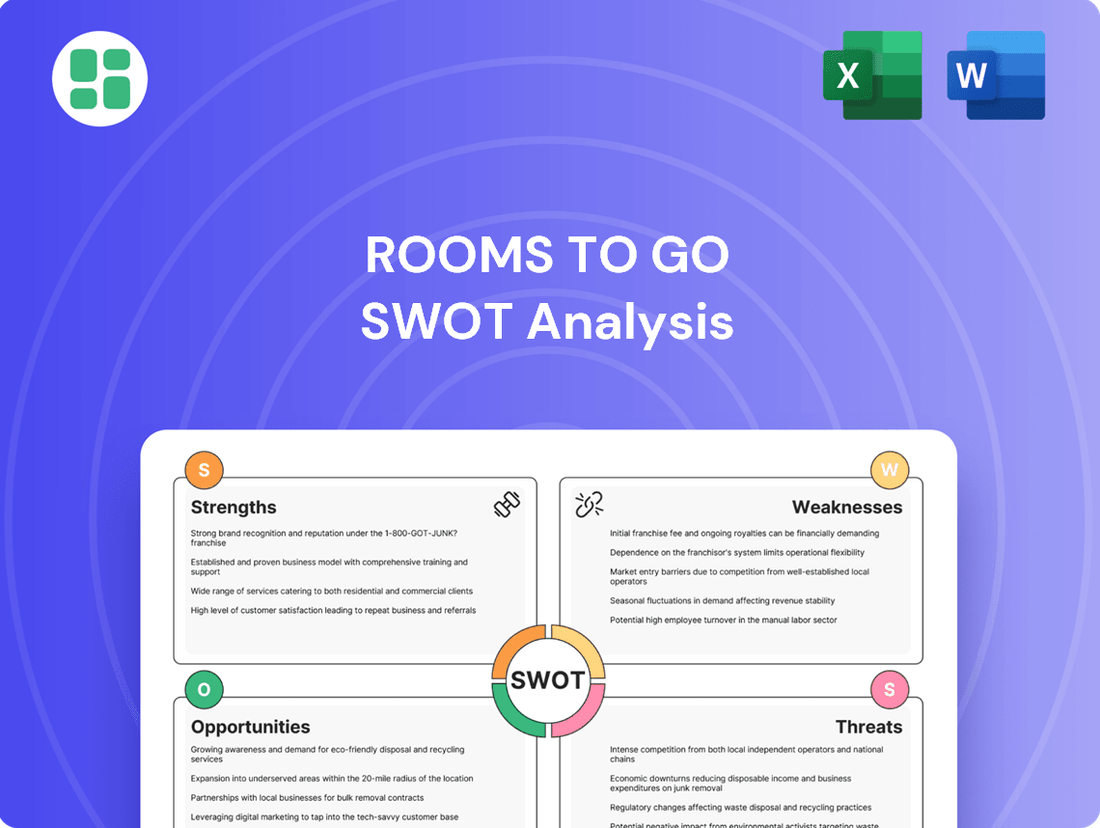

Rooms To Go leverages its strong brand recognition and extensive store network as key strengths, but faces challenges from intense online competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or strategize within the furniture retail sector.

Want the full story behind Rooms To Go’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Rooms To Go's integrated room package model is a significant strength, offering customers a complete, coordinated look that simplifies furniture buying. This unique selling proposition addresses the common customer pain point of matching individual pieces, providing a cohesive design solution that appeals to those prioritizing convenience and a unified aesthetic.

This strategy directly contrasts with many traditional furniture retailers who focus on selling individual items, giving Rooms To Go a distinct market advantage. For instance, in 2023, the company reported strong sales growth, partly attributed to the appeal of these bundled offerings, which streamline the decision-making process for consumers looking for a hassle-free home furnishing experience.

Rooms To Go's extensive physical retail footprint, particularly strong across the southeastern United States, grants them substantial market penetration and high brand visibility in a crucial economic area. This network of over 150 showrooms as of early 2024 allows customers to touch, feel, and test furniture, enhancing the buying experience and fostering trust.

Rooms To Go boasts a robust e-commerce platform that seamlessly integrates with its brick-and-mortar stores. This omni-channel strategy allows customers to browse, select, and purchase furniture conveniently online, extending the company's reach far beyond its physical locations. In 2024, online furniture sales continued their upward trajectory, with projections indicating significant growth, making Rooms To Go's digital investment a key competitive advantage.

Streamlined Customer Experience

Rooms To Go excels by offering ready-to-go room packages, which significantly simplifies the furniture buying process for customers. This approach cuts down on decision fatigue and design guesswork, making it easier for consumers to furnish their homes quickly and confidently. For instance, the company reported robust sales growth in its fiscal year 2024, partly attributed to the popularity of these curated collections.

This streamlined approach translates into a superior customer experience. By bundling complementary items and offering a clear, cohesive vision for a room, Rooms To Go reduces the perceived complexity of interior design. This ease of purchase, coupled with efficient delivery and setup, fosters high levels of customer satisfaction and loyalty, a key driver for their continued market presence.

The company's focus on packaged solutions also aids in inventory management and marketing. They can more effectively promote complete room sets, which often leads to higher average transaction values. In 2024, the average order value for a complete room package at Rooms To Go was approximately $2,500, demonstrating the financial benefit of this strategy.

- Simplified Purchasing: Ready-to-go room packages eliminate consumer indecision.

- Enhanced Satisfaction: Efficient delivery and assembly of packages boost customer happiness.

- Increased Trust: A clear and easy buying journey builds confidence and repeat business.

- Higher Transaction Value: Bundled offerings encourage larger purchases, as seen in 2024 average order values.

Efficient Inventory and Logistics

Rooms To Go’s focus on package deals significantly streamlines inventory and logistics. This approach enables more accurate demand forecasting, allowing for bulk purchasing which drives down costs and enhances supply chain efficiency. For instance, in 2023, efficient inventory management was crucial for retailers, with average inventory turnover rates for furniture stores hovering around 3-4 times per year, a metric Rooms To Go likely aims to optimize through its model.

The company’s strategy of selling complete room sets rather than individual pieces optimizes warehousing space and reduces the complexity of managing a vast array of SKUs. This consolidation directly translates to lower holding costs and a more predictable outbound logistics flow, ensuring customers receive coordinated deliveries. In the competitive furniture retail landscape, where carrying costs can significantly impact profitability, this operational advantage is key.

- Predictable Demand: Package deals simplify forecasting, improving stock management.

- Bulk Purchasing Power: Negotiating better prices through larger, consolidated orders.

- Optimized Warehousing: Reduced complexity in storing and managing inventory.

- Smoother Logistics: Efficient delivery of complete sets to customers.

Rooms To Go's strength lies in its innovative approach to furniture retail, centered on pre-designed room packages. This model simplifies the buying process for consumers, offering a cohesive aesthetic that many find appealing. The company's ability to provide complete room solutions directly addresses customer needs for convenience and coordinated design, a significant differentiator in the market.

This strategy has proven financially beneficial, with the average order value for a complete room package at Rooms To Go reaching approximately $2,500 in 2024. Furthermore, their integrated omni-channel approach, combining a strong online presence with over 150 physical showrooms as of early 2024, ensures broad market reach and customer accessibility.

The operational efficiency gained from selling packages also contributes to Rooms To Go's success. Simplified demand forecasting and bulk purchasing power, facilitated by their model, lead to cost reductions and improved supply chain management. This focus on streamlined operations is crucial for maintaining competitiveness in the furniture industry.

| Key Strength | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Room Packages | Offers complete, coordinated room sets for simplified customer purchasing. | Average order value of ~$2,500 per package. |

| Omni-channel Presence | Combines extensive physical showrooms (150+ as of early 2024) with a robust e-commerce platform. | Extends market reach and enhances customer accessibility. |

| Operational Efficiency | Streamlined inventory, logistics, and demand forecasting due to package model. | Supports cost reduction and supply chain optimization. |

What is included in the product

Delivers a strategic overview of Rooms To Go’s internal and external business factors, highlighting its brand recognition and operational efficiency against market competition and changing consumer preferences.

Simplifies understanding of Rooms To Go's competitive landscape, highlighting areas for growth and mitigating risks.

Weaknesses

The strength of Rooms To Go's complete room packages, while convenient, inherently restricts individual customization. Customers cannot easily swap out pieces or mix styles outside the pre-designed sets, potentially alienating those with distinct design visions or unique space needs. This focus on curated convenience may limit appeal to a market segment prioritizing bespoke choices.

Rooms To Go's primary weakness lies in its significant geographic concentration, with a vast majority of its retail footprint concentrated in the southeastern United States. This over-reliance on a single region exposes the company to substantial risk from localized economic downturns, severe weather events, or demographic shifts that could disproportionately affect its sales and operational stability. For instance, a regional recession in the Southeast could have a far greater impact on Rooms To Go than on a competitor with a more geographically diversified store base.

Rooms To Go's reliance on durable goods like furniture makes it particularly vulnerable to economic downturns. When consumer confidence wanes, perhaps due to inflation or rising interest rates, big-ticket purchases are often postponed. For instance, in late 2023 and early 2024, elevated inflation and interest rates led many consumers to delay discretionary spending, a trend that directly impacted furniture retailers.

High Overhead from Physical Stores

Rooms To Go's extensive network of physical showrooms, while a key strength, also presents a significant weakness due to high overhead. Maintaining these large retail spaces involves substantial costs such as rent, utilities, property taxes, and store upkeep. For instance, in 2023, retail real estate costs continued to be a major expense for brick-and-mortar businesses, with average commercial rents varying significantly by region but consistently representing a large portion of operating budgets.

These fixed expenses can place a considerable burden on profit margins, particularly when sales volumes fluctuate or when competing with online retailers who avoid these extensive physical infrastructure costs. The need to cover these overheads means Rooms To Go must achieve a certain sales threshold to remain profitable, making it vulnerable to economic downturns or shifts in consumer purchasing habits towards e-commerce. This financial pressure necessitates efficient cost management across all store operations.

- Significant Fixed Costs: Rent, utilities, and maintenance for numerous large showrooms contribute heavily to operating expenses.

- Competitive Disadvantage: Online-only competitors often have lower overhead, allowing for potentially more aggressive pricing.

- Margin Pressure: High fixed costs can compress profit margins, especially during periods of reduced consumer spending.

- Operational Complexity: Managing a vast physical footprint requires substantial resources for staffing, inventory, and logistics.

Potential for Inventory Bloat

While Rooms To Go's package deals can simplify inventory, the sheer variety of complete room sets across their numerous locations presents a significant challenge. If specific styles become less popular or sales predictions miss the mark, the company could face substantial excess inventory. This situation often necessitates costly markdowns, directly impacting profit margins.

Effective inventory turnover is paramount for Rooms To Go to prevent capital from being immobilized in unsold merchandise. For instance, in the furniture retail sector, a slow inventory turnover rate can strain cash flow. While specific 2024/2025 data for Rooms To Go's inventory turnover isn't publicly available, industry benchmarks suggest that a healthy turnover rate is crucial for profitability, with many furniture retailers aiming for multiple turns per year.

- Inventory Complexity: Managing a vast catalog of pre-designed room sets across many stores increases the risk of overstocking unpopular styles.

- Markdown Impact: Unsold inventory often requires significant price reductions, eroding profit margins.

- Capital Tie-up: Excess inventory directly reduces available working capital, hindering investment and operational flexibility.

- Forecasting Accuracy: Inaccurate sales forecasts are a primary driver of inventory bloat in this model.

Rooms To Go's reliance on a concentrated geographic footprint, primarily in the southeastern United States, exposes it to significant regional economic risks. For example, a slowdown in the housing market or a natural disaster impacting this region could disproportionately affect sales and operations. This lack of diversification makes the company more vulnerable than competitors with a broader national presence.

The company's business model, heavily dependent on large physical showrooms, results in substantial fixed overhead costs. These include rent, utilities, and staffing for numerous stores, which can compress profit margins, especially during periods of reduced consumer spending. In 2023, the cost of commercial real estate remained a significant expense for brick-and-mortar retailers nationwide.

Rooms To Go's strength in complete room packages, while convenient, limits individual customer customization. This can deter buyers seeking to mix and match styles or purchase individual pieces, potentially alienating a segment of the market that values personalization in their home furnishings.

The company's vulnerability to economic downturns is amplified by its focus on durable goods. Big-ticket purchases like furniture are often deferred when consumer confidence is low, a trend observed in late 2023 and early 2024 due to persistent inflation and rising interest rates.

Managing a wide array of pre-designed room sets across numerous locations creates inventory complexity. If certain styles fall out of favor, Rooms To Go could face overstocking issues, necessitating costly markdowns that erode profitability. In the furniture sector, efficient inventory turnover is crucial for cash flow, with industry benchmarks indicating the importance of multiple inventory turns annually.

Full Version Awaits

Rooms To Go SWOT Analysis

The preview you see is the same document the customer will receive after purchasing, offering a transparent look at the Rooms To Go SWOT analysis. This ensures you know exactly what you're getting—a comprehensive and professionally structured report. Purchase unlocks the full, detailed analysis for your strategic planning needs.

Opportunities

Rooms To Go can capitalize on its proven business model by expanding its physical store presence into new geographic territories beyond its current stronghold in the southeastern United States. This strategic move offers a significant opportunity to tap into previously unreached customer segments, thereby diversifying revenue sources and mitigating the risks associated with over-reliance on any single region.

For instance, a successful expansion into the Midwest or West Coast could mirror the company's established success in markets like Florida and Texas, where it has consistently demonstrated strong sales performance. The company's 2023 revenue of $2.4 billion indicates a solid foundation for such ambitious growth initiatives.

Rooms To Go can significantly boost its online presence by investing further in its e-commerce platform. Imagine using augmented reality (AR) to virtually place furniture in your own room before buying – that's the kind of advanced visualization that enhances the digital experience. This focus on a seamless online journey is crucial, especially as e-commerce sales continue to grow; in 2024, online retail sales are projected to reach over $2.7 trillion globally, highlighting the importance of a robust digital strategy.

Optimizing the website for mobile devices is another key opportunity, as mobile commerce accounts for a substantial portion of online transactions. Furthermore, integrating AI-driven personalization can tailor product recommendations and offers to individual customers, potentially increasing conversion rates and fostering deeper engagement. By prioritizing a smooth digital experience, Rooms To Go can tap into the expanding online market and strengthen customer loyalty.

Rooms To Go could broaden its appeal by expanding beyond its signature room packages. Introducing more customizable furniture options, integrating smart home technology into its designs, or launching eco-friendly and sustainable collections would tap into diverse consumer demands. This strategic shift could attract new customer segments and create additional revenue streams. For instance, the global smart furniture market was projected to reach over $2.5 billion by 2028, indicating a significant growth opportunity.

Strategic Partnerships and Collaborations

Forming strategic partnerships with interior designers and real estate developers presents a significant opportunity for Rooms To Go. In 2024, the real estate market saw continued activity, with an estimated 6.3 million existing homes sold in the US, according to the National Association of Realtors. Collaborating with these professionals can tap into a steady stream of new homeowners actively seeking furnishings, thereby creating new sales channels and enhancing brand visibility.

Expanding collaborations to include home staging companies and complementary businesses like home improvement retailers or appliance stores offers further avenues for growth. These alliances can facilitate cross-promotional activities and the creation of bundled packages, extending Rooms To Go’s reach beyond traditional furniture sales. Such strategic alliances are key to broader market penetration and customer acquisition in the competitive home goods sector.

Key opportunities through strategic partnerships include:

- Enhanced Sales Channels: Direct access to new homeowner markets through real estate developers and interior designers.

- Brand Exposure: Increased visibility by association with established players in complementary industries.

- Cross-Promotional Synergies: Joint marketing efforts with home improvement and appliance retailers to offer comprehensive home solutions.

- Expanded Product Offerings: Potential for curated packages and bundled deals that increase average transaction value.

Leveraging Data Analytics for Personalization

Rooms To Go can significantly enhance its customer engagement by leveraging data analytics. By analyzing purchase history from both online and brick-and-mortar stores, the company can gain a deeper understanding of individual customer preferences, buying habits, and demographic profiles. This granular insight allows for the creation of highly personalized marketing efforts, ensuring that promotions and product recommendations resonate more effectively with each customer. For instance, if data shows a strong correlation between sectional sofa purchases and specific regional weather patterns, marketing can be tailored accordingly.

This data-driven approach extends beyond marketing to operational efficiencies and product development. Personalized insights can guide inventory management, ensuring that popular items are readily available and that stock levels align with predicted demand based on customer segments. Furthermore, understanding what customers are buying and how they are furnishing their homes can directly influence the design and curation of new room packages, making them more appealing and relevant. This strategic use of data is projected to boost customer lifetime value by fostering loyalty through tailored experiences.

The potential impact of data analytics is substantial. In the furniture retail sector, personalized recommendations have been shown to increase conversion rates. For example, a study by Accenture found that 91% of consumers are more likely to shop with brands that provide relevant offers and recommendations. By implementing advanced analytics, Rooms To Go could see a tangible uplift in sales and customer retention.

- Personalized Marketing: Tailoring promotions and product suggestions based on individual purchase history and preferences.

- Optimized Inventory: Aligning stock levels with predicted demand derived from customer data analysis.

- Informed Product Development: Using insights into customer buying patterns to design new, relevant room packages.

- Increased Customer Lifetime Value: Fostering loyalty through customized experiences and targeted offers.

Rooms To Go can expand its reach by entering new geographic markets, mirroring its past successes in regions like Florida and Texas. With 2023 revenues of $2.4 billion, the company has a solid financial base for this expansion.

Investing in its e-commerce platform, particularly with features like augmented reality, presents a significant opportunity. Global online retail sales are expected to exceed $2.7 trillion in 2024, underscoring the importance of a strong digital presence and mobile optimization.

Broadening its product assortment to include more customizable options, smart home technology, and sustainable collections can attract new customer segments. The global smart furniture market alone is projected to reach over $2.5 billion by 2028.

Forming strategic partnerships with interior designers and real estate developers can create new sales channels. With an estimated 6.3 million existing homes sold in the US in 2024, these collaborations offer direct access to new homeowners.

Threats

Rooms To Go encounters formidable competition from a wide array of retailers. This includes established furniture chains, large general merchandise stores like Walmart and Target that also carry home goods, and the rapidly growing online furniture sector. Companies such as Wayfair and Amazon continue to expand their furniture offerings, presenting a significant challenge.

The furniture market is highly fragmented, with numerous players vying for market share. This intense rivalry puts constant pressure on Rooms To Go to maintain competitive pricing, introduce innovative products, and deliver exceptional customer experiences. For instance, in 2024, the online furniture market is projected to reach over $200 billion globally, highlighting the scale of competition Rooms To Go faces in the digital space.

Big-box retailers often leverage economies of scale to offer lower prices, while online-only brands benefit from lower overheads and direct-to-consumer models. This forces Rooms To Go to continuously evaluate its strategies to differentiate itself and retain its customer base in a dynamic retail landscape.

Economic downturns, characterized by high inflation and rising unemployment, present a significant threat to Rooms To Go. These conditions directly impact discretionary spending, making consumers less likely to purchase large furniture items. For instance, if inflation continues to hover around 3-4% in 2024-2025, as projected by many economic forecasts, consumers will have less disposable income for non-essential purchases like new sofas or dining sets.

A severe recession could lead to a substantial drop in sales volume for Rooms To Go. The furniture sector is particularly vulnerable, as home furnishings are often among the first expenses cut when household budgets tighten. If unemployment rates climb, for example, exceeding 4.5% in the coming year, a larger portion of the population will be focused on essentials, further dampening demand for Rooms To Go’s products.

Global supply chain disruptions, stemming from issues like raw material shortages and geopolitical events, pose a significant threat to Rooms To Go. For instance, the average cost of shipping a 40-foot container from Asia to the US surged by over 80% in 2024 compared to 2023 levels, impacting inventory costs. These challenges can lead to higher operational expenses and delayed product availability, potentially affecting customer satisfaction and sales.

Shifting Consumer Preferences and Lifestyles

Consumer tastes are changing, and this presents a significant challenge for Rooms To Go. For instance, a growing segment of consumers, particularly younger demographics like Gen Z, are showing a preference for minimalist aesthetics and smaller, more adaptable living spaces. This trend means that bulky, traditional furniture might become less appealing.

Furthermore, there's a noticeable shift towards sustainability and ethical sourcing. Consumers are increasingly interested in where their furniture comes from and how it's made. For example, a 2024 survey indicated that over 60% of furniture buyers consider sustainability a key factor in their purchasing decisions. If Rooms To Go doesn't adapt its product lines to include more eco-friendly materials or transparent supply chains, it risks losing market share to competitors who do.

The demand for modular and multi-functional furniture is also on the rise, driven by the need to maximize space in urban apartments and smaller homes. Additionally, the second-hand furniture market has seen substantial growth, with online platforms making it easier than ever for consumers to buy and sell pre-owned items. This growing acceptance of pre-owned goods could divert sales from new furniture retailers.

- Evolving Aesthetics: A move towards minimalist and space-saving furniture designs.

- Sustainability Demand: Increased consumer focus on eco-friendly materials and ethical production.

- Functional Needs: Growing preference for modular and multi-functional furniture pieces.

- Second-hand Market Growth: Increased adoption of pre-owned furniture as a viable alternative.

Increased Digital Marketing and Acquisition Costs

The intensifying competition within the online furniture market is driving up the costs associated with digital marketing and customer acquisition. This means Rooms To Go likely faces higher expenses for online advertising, search engine optimization (SEO), and attracting new customers through digital channels.

As more furniture companies aggressively expand their online presence, Rooms To Go may need to allocate greater marketing budgets to remain visible and capture online shoppers. This increased spending on marketing can directly impact the company's profitability by reducing profit margins.

For instance, industry reports from late 2024 indicate that the average cost per acquisition (CPA) for online retail has seen a significant uptick, with some sectors experiencing increases of 15-20% year-over-year. This trend directly affects furniture retailers like Rooms To Go.

- Rising Digital Ad Spend: Increased competition leads to higher bids for online ad placements.

- SEO Cost Escalation: Maintaining top search engine rankings requires more investment in content and technical optimization.

- Customer Acquisition Pressure: Attracting new customers online becomes more expensive as more players enter the digital space.

Rooms To Go faces significant threats from evolving consumer preferences, including a growing demand for minimalist designs and multi-functional furniture to suit smaller living spaces. Additionally, the increasing consumer focus on sustainability and ethical sourcing means companies must adapt their product lines and supply chains to meet these expectations, or risk losing market share to more eco-conscious competitors.

The rise of the second-hand furniture market, facilitated by online platforms, presents another challenge by offering a more affordable and sustainable alternative to new purchases. This trend could divert a portion of potential sales away from traditional retailers like Rooms To Go.

Furthermore, the escalating costs of digital marketing and customer acquisition in the increasingly competitive online space are pressuring profit margins. For example, industry data from late 2024 shows a notable increase in customer acquisition costs, potentially requiring Rooms To Go to allocate larger budgets to maintain online visibility and attract new customers.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Rooms To Go's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate assessment.