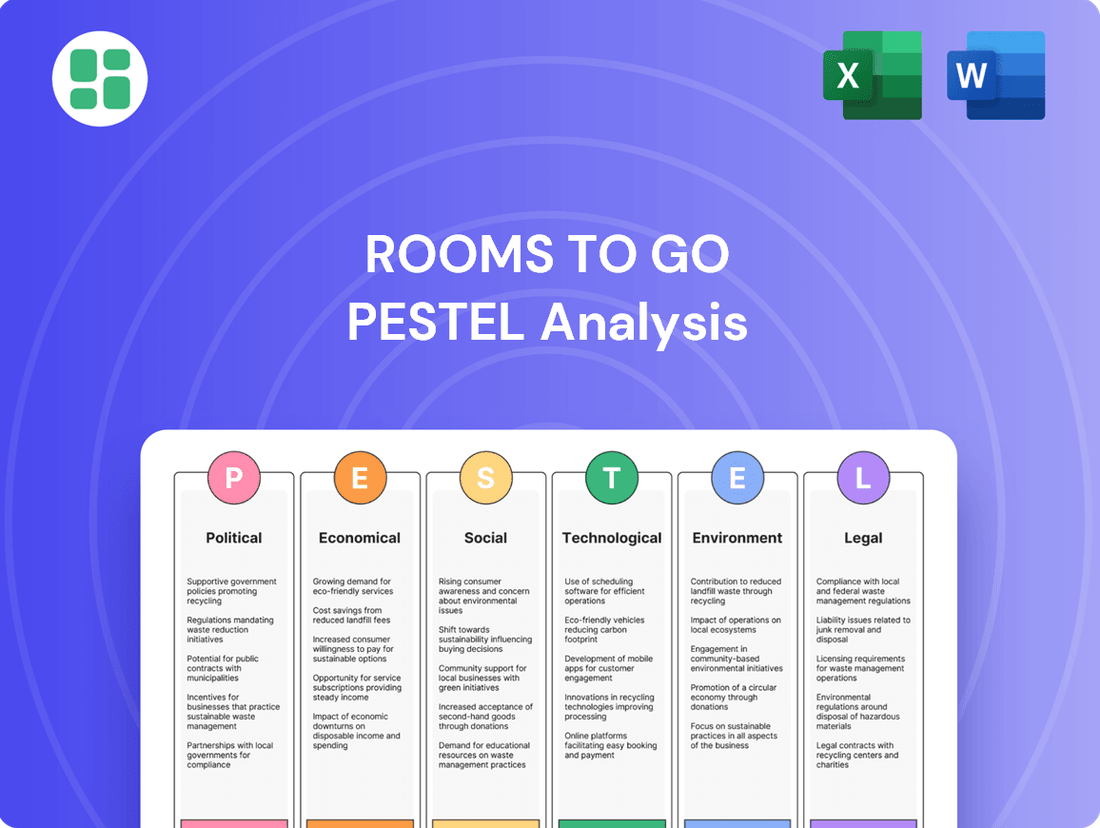

Rooms To Go PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rooms To Go Bundle

Unlock the secrets to Rooms To Go's market position with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are shaping their operations and future growth. Equip yourself with actionable intelligence to navigate the competitive landscape. Download the full PESTLE analysis now and gain a strategic advantage.

Political factors

Government regulations, particularly those concerning import tariffs on furniture materials like wood or textiles, can significantly affect Rooms To Go's supply chain costs. For instance, a hypothetical 10% tariff on imported furniture components could directly increase the cost of goods sold. Trade agreements, such as the USMCA, can also influence sourcing strategies by making North American production more cost-effective, potentially shifting manufacturing closer to home.

Domestic manufacturing incentives or restrictions play a crucial role in operational strategies. If the U.S. government were to offer tax credits for domestic furniture production, as some proposals in 2024 have suggested, Rooms To Go might re-evaluate its sourcing to capitalize on these benefits. Conversely, stricter environmental regulations on manufacturing processes could necessitate investments in compliance, impacting overheads and potentially product pricing.

Consumer protection laws significantly shape Rooms To Go's operational landscape, particularly concerning product warranties, return policies, and advertising accuracy. The Federal Trade Commission (FTC) oversees many of these regulations in the United States, ensuring fair business practices. For instance, the FTC's Cooling-Off Rule, which allows consumers to cancel certain sales within three business days, directly impacts Rooms To Go's sales processes and requires clear disclosure.

Compliance with these evolving consumer protection statutes is paramount for Rooms To Go to safeguard its reputation and avert costly legal repercussions. Failure to adhere to regulations regarding product safety, deceptive advertising, or fair financing practices, as enforced by bodies like the Consumer Financial Protection Bureau (CFPB), can lead to substantial fines and damage brand loyalty, directly influencing sales strategies and marketing campaigns.

Political stability in the Southeastern United States, a key market for Rooms To Go, directly impacts consumer confidence and discretionary spending on big-ticket items like furniture. For instance, a stable political climate fosters a sense of security, encouraging households to make larger purchases. Conversely, political uncertainty can lead to cautious spending, affecting Rooms To Go's sales volumes.

Broader economic policies enacted by the federal and state governments also play a crucial role. Fiscal stimulus measures, such as tax rebates or increased government spending, can boost consumer disposable income, potentially benefiting furniture retailers. In 2024, while specific stimulus packages for furniture were not prevalent, broader economic support aimed at boosting consumer spending indirectly aids companies like Rooms To Go. Conversely, austerity measures could dampen demand.

Labor Laws and Employment Policies

Federal and state labor laws significantly impact Rooms To Go's operational costs and human resource strategies. Changes in minimum wage, worker safety standards, and unionization activities directly affect the company's expenses and employee relations. For instance, the U.S. federal minimum wage remains at $7.25 per hour, but many states have enacted higher minimums. As of January 1, 2024, 22 states and numerous cities had minimum wages above the federal level, with some reaching $15 or more per hour. This necessitates careful management of payroll and benefits to ensure compliance and maintain competitive compensation, especially for frontline sales and delivery staff.

Compliance with these regulations is paramount for effective workforce management. Rooms To Go must navigate a complex web of legislation covering areas such as overtime pay, workplace safety (OSHA standards), and anti-discrimination laws. For example, OSHA's general duty clause requires employers to provide a workplace free from recognized hazards. Failure to comply can result in substantial fines and legal challenges, impacting the company's financial performance and reputation. In 2023, OSHA reported significant penalties for workplace safety violations, underscoring the importance of robust safety protocols.

Unionization efforts also present a potential factor influencing labor relations and costs. While Rooms To Go has historically operated with a non-unionized workforce, shifts in labor activism could lead to increased organizing activity. Union contracts often include provisions for higher wages, enhanced benefits, and specific work rules that can increase operating expenses. The National Labor Relations Board (NLRB) reported a notable increase in union election filings in 2023 compared to previous years, indicating a broader trend that could affect companies across various sectors.

- Minimum Wage Impact: As of early 2024, 22 U.S. states had minimum wages exceeding the federal $7.25 per hour, directly influencing Rooms To Go's labor costs for entry-level positions.

- Worker Safety Compliance: Adherence to OSHA standards is critical; in 2023, OSHA issued penalties for violations that could range from hundreds to thousands of dollars per infraction.

- Labor Relations Trends: The NLRB observed a rise in union election petitions in 2023, suggesting a growing potential for unionization efforts that could impact Rooms To Go's human resource policies and costs.

Taxation Policies

Rooms To Go's profitability is significantly influenced by corporate tax rates. For instance, the U.S. federal corporate tax rate stands at 21%. Changes in this rate, or the introduction of new state-level taxes, directly impact the company's net income and its ability to reinvest capital.

Sales tax policies also play a crucial role in Rooms To Go's pricing strategies. As of 2024, sales tax rates vary considerably across states, with some exceeding 7%. This necessitates careful management of pricing to remain competitive in diverse markets while ensuring compliance with varying tax regulations.

Furthermore, shifts in tax legislation, such as potential changes to deductions or credits affecting capital expenditures, can influence Rooms To Go's investment decisions in areas like inventory management, distribution networks, and store expansions.

Key considerations for Rooms To Go regarding taxation include:

- Federal Corporate Tax Rate: The current 21% U.S. federal rate directly impacts overall profitability.

- State and Local Sales Taxes: Varying rates across operating regions necessitate adaptive pricing models.

- Tax Incentives for Investment: Potential changes in tax laws could affect decisions regarding capital expenditures and business growth.

Government stability and policy continuity are crucial for Rooms To Go's long-term planning and investment. A stable political environment fosters consumer confidence, encouraging spending on durable goods like furniture. For example, in 2024, continued economic growth in key markets like Florida and Texas, areas with significant Rooms To Go presence, was partly attributed to stable state-level governance, supporting consumer spending.

Changes in trade policies and international relations can impact sourcing and costs. For instance, any significant shifts in trade agreements affecting furniture imports or exports could alter supply chain economics. Political dialogues around tariffs on goods from major furniture manufacturing countries, ongoing in 2024, represent a direct risk or opportunity for Rooms To Go's cost structure.

Government initiatives supporting domestic manufacturing or consumer spending, such as potential tax incentives or infrastructure projects, can indirectly benefit furniture retailers. While no specific furniture-related stimulus was a major focus in 2024, broader economic policies aimed at boosting household disposable income, like adjustments to tax brackets or child tax credits, can positively influence demand for Rooms To Go's products.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Rooms To Go across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive understanding of the market landscape.

A PESTLE analysis for Rooms To Go can alleviate the pain point of strategic uncertainty by providing a clear, summarized overview of external factors influencing the furniture industry, enabling more informed decision-making.

Economic factors

Consumer spending habits and disposable income are critical drivers for Rooms To Go. A rise in disposable income generally translates to increased demand for furniture, as it's a significant discretionary purchase. Conversely, economic downturns that reduce disposable income can lead to a sharp decline in furniture sales.

For instance, in late 2024 and early 2025, persistent inflation and rising interest rates have put pressure on household budgets, potentially dampening consumer confidence and discretionary spending on big-ticket items like furniture. Reports from the Bureau of Economic Analysis in early 2025 indicated a slowdown in consumer spending growth compared to the previous year, directly impacting sectors reliant on non-essential purchases.

The health of the housing market is a significant driver for furniture sales, directly impacting companies like Rooms To Go. When new home sales and existing home turnovers are strong, it typically translates to increased demand for home furnishings as people move into new spaces or renovate existing ones. In 2024, for instance, the U.S. housing market saw a notable increase in existing home sales compared to the previous year, with sales rising by 13.5% in the first quarter of 2024, according to the National Association of Realtors. This trend bodes well for furniture retailers.

A booming housing market means more opportunities for Rooms To Go to sell furniture for newly built homes and for those undertaking renovations. The U.S. Census Bureau reported that housing starts increased by 5.7% in April 2024 compared to the same month in 2023, indicating continued new construction that requires furnishing. This sustained activity in both new and existing home markets creates a positive environment for furniture demand.

Rising interest rates, like the Federal Reserve's benchmark rate which saw multiple hikes throughout 2023 and into early 2024, directly impact consumer financing for major purchases. Higher rates mean increased monthly payments for furniture loans, potentially dampening demand for big-ticket items at Rooms To Go as affordability decreases.

Furthermore, these elevated interest rates affect Rooms To Go's operational costs. The company's ability to secure capital for inventory, store expansion, or other strategic initiatives becomes more expensive, potentially leading to slower growth or a need to adjust pricing strategies.

Inflation and Cost of Goods

Inflation significantly impacts Rooms To Go by increasing the cost of raw materials like lumber and fabric, as well as manufacturing and transportation expenses. For instance, the Producer Price Index (PPI) for furniture and related products saw a notable increase in late 2023 and early 2024, reflecting these rising input costs. This upward pressure on costs directly affects Rooms To Go's cost of goods sold.

If Rooms To Go cannot fully pass these higher costs onto consumers through price adjustments, profit margins will likely be squeezed. In 2024, many retailers, including furniture companies, faced challenges balancing competitive pricing with the need to cover escalating operational expenses. This dynamic is crucial for maintaining profitability in the furniture retail sector.

- Rising raw material costs: Lumber prices, a key component in furniture manufacturing, experienced volatility in 2023-2024, impacting production expenses.

- Increased transportation fees: Fuel surcharges and shipping costs continued to be a significant factor in the cost of delivering goods to customers.

- Manufacturing overhead: Energy costs and labor wages in manufacturing facilities also contribute to the overall cost of goods sold.

- Margin pressure: The inability to pass on all cost increases to consumers directly erodes profit margins for furniture retailers.

Regional Economic Growth

The economic health of the Southeastern United States is crucial for Rooms To Go, as this region represents its core market. Robust economic expansion, marked by job growth and a rising population, directly translates to increased consumer spending power and a greater demand for home furnishings.

For instance, the Southeast has consistently shown strong economic indicators. As of early 2024, several states in this region, such as Florida and Texas, continued to report positive job growth rates exceeding the national average. This influx of new residents and expanding employment opportunities fuels demand for housing and, consequently, for furniture and home decor.

- Job Creation: The Southeast's diverse economy, with growing sectors like technology and healthcare, is a consistent driver of employment.

- Population Growth: States like Florida and North Carolina are among the fastest-growing in the US, increasing the potential customer base.

- Consumer Confidence: Rising regional economic confidence, often tied to employment stability, encourages discretionary spending on home goods.

- Housing Market: A healthy housing market, with new construction and home sales, directly correlates with furniture purchases.

Economic factors significantly influence Rooms To Go's performance, with consumer spending and housing market vitality being paramount. In 2024, while housing starts saw a modest increase, persistent inflation and higher interest rates began to temper consumer confidence and purchasing power for discretionary items like furniture.

The company faces challenges from rising input costs, including lumber and transportation, which pressured profit margins throughout 2023 and into early 2024. Despite these headwinds, a strong housing market in key regions like the Southeast, driven by population growth and job creation, continues to provide a foundational demand for home furnishings.

| Economic Factor | 2024 Impact | Outlook (Early 2025) |

|---|---|---|

| Consumer Spending | Moderated due to inflation and interest rates | Continued pressure on discretionary purchases |

| Housing Market | Increased existing home sales; steady new construction | Sustained demand from home turnover and new builds |

| Interest Rates | Increased financing costs for consumers and business | Potential for stabilization, but rates remain elevated |

| Inflation | Higher raw material and operational costs | Persistent cost pressures impacting margins |

Same Document Delivered

Rooms To Go PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Rooms To Go delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain a clear understanding of the external forces shaping Rooms To Go’s market landscape, from consumer trends to regulatory changes.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into how these PESTLE elements can be leveraged for competitive advantage and risk mitigation for Rooms To Go.

Sociological factors

Shifting lifestyle preferences are significantly impacting home decor. Consumers increasingly desire spaces that reflect personal style and offer enhanced functionality, driving demand for versatile and aesthetically pleasing furniture. Rooms To Go's emphasis on curated room packages directly addresses this by simplifying the design process for homeowners looking for cohesive and stylish interiors.

In 2024, the home furnishings market is seeing a strong trend towards biophilic design and sustainable materials, reflecting a growing consumer consciousness about well-being and environmental impact. For instance, sales of indoor plants and natural wood furniture saw a notable uptick in late 2023, suggesting a broader embrace of nature-inspired aesthetics in living spaces. Rooms To Go's ability to adapt its product offerings to these evolving tastes, perhaps by incorporating more eco-friendly materials or nature-themed collections, will be key to capturing this segment of the market.

The growing number of smaller households, with an increasing proportion of single-person and two-person units, directly influences demand for more compact and multi-functional furniture. For instance, in 2024, the average household size in the US continued its long-term decline, with a significant portion now consisting of one or two individuals, driving demand for studio apartment-friendly pieces and space-saving solutions.

Millennials and Gen Z are now major consumer groups, and their preferences lean towards flexible living arrangements and often smaller living spaces, impacting the types of bedroom sets, living room furniture, and dining sets that are most appealing. These demographics are also more inclined towards online purchasing and value-driven options, pushing retailers like Rooms To Go to adapt their digital strategies and product assortments.

As more people move to cities, living spaces are often smaller. This trend, seen globally, means consumers are looking for furniture that fits these compact areas and can do more than one thing. For instance, in 2024, many major cities reported a continued rise in apartment living, with average unit sizes shrinking by 5-10% compared to a decade ago.

Rooms To Go must recognize this shift. Offering furniture that is both space-saving and multi-functional, like sofa beds or storage ottomans, will be key. This adaptation directly addresses the need for practical solutions in urban environments, where every square foot counts.

Consumer Values and Ethical Consumption

Consumer values are increasingly leaning towards ethical consumption, with a significant portion of shoppers actively seeking out products that are sustainably sourced and environmentally responsible. This trend directly impacts how companies like Rooms To Go are perceived. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for products from brands committed to sustainability.

Rooms To Go's brand image and product sourcing strategies are therefore under scrutiny, as consumers connect their purchasing decisions with their personal values. This societal shift means that transparency in supply chains and a demonstrable commitment to eco-friendly practices are becoming critical differentiators. Failing to align with these values can lead to negative consumer perception and a potential loss of market share.

- Growing Demand for Sustainability: Consumers are actively prioritizing products with eco-friendly attributes.

- Ethical Sourcing Importance: Transparency in supply chains and fair labor practices are key purchasing drivers.

- Brand Reputation Impact: Companies demonstrating ethical and sustainable practices often enjoy enhanced brand loyalty.

- Willingness to Pay Premium: A substantial segment of consumers will pay more for goods aligned with their values.

Digital Lifestyles and Online Shopping Behavior

Consumers increasingly prefer researching and buying furniture online, making Rooms To Go's digital strategy crucial. In 2024, e-commerce is expected to continue its strong growth trajectory, with a significant portion of furniture purchases initiated or completed online. This shift demands a robust online presence and effective digital marketing to connect with customers at every stage of their buying journey.

Rooms To Go's investment in its e-commerce platform and digital marketing initiatives directly addresses this trend. By offering a seamless online shopping experience, from product discovery to virtual room planning, the company aims to capture market share from consumers who value convenience and digital engagement. This focus is essential as digital channels become primary touchpoints for furniture discovery and purchase.

- E-commerce Growth: Online furniture sales have seen consistent year-over-year increases, with projections indicating continued expansion through 2025.

- Digital Discovery: A majority of consumers now begin their furniture shopping process by searching online, highlighting the importance of SEO and targeted digital advertising.

- Mobile Shopping: The rise of mobile commerce means that optimizing the online experience for smartphones is paramount for reaching a broad customer base.

Societal shifts are reshaping how people live and furnish their homes, with a notable trend towards smaller households and urban living. By 2024, the average household size continued its decline, with a significant portion now consisting of one or two individuals, directly influencing demand for compact and multi-functional furniture. Rooms To Go's focus on curated room packages and adaptable furniture solutions aligns well with these evolving consumer needs, particularly for those in smaller urban dwellings.

Millennials and Gen Z are increasingly influential consumer groups, prioritizing flexible living and often smaller spaces, which impacts furniture preferences. These demographics also favor online purchasing and value-driven options, necessitating that Rooms To Go enhance its digital strategies and product assortments to appeal to these key segments.

Consumer values are increasingly centered on ethical consumption and sustainability, with many shoppers seeking eco-friendly and responsibly sourced products. A 2024 survey revealed that over 60% of consumers are willing to pay a premium for brands committed to sustainability, making transparency and ethical practices crucial for Rooms To Go's brand perception and market competitiveness.

Technological factors

Rooms To Go's e-commerce platform is a critical engine for driving online sales and customer engagement. In 2024, e-commerce sales for furniture are projected to continue their upward trend, with digital channels becoming increasingly vital for product discovery and purchase. The company's investment in website functionality, including intuitive navigation and high-quality product imagery, directly impacts its ability to convert online traffic into revenue.

Maintaining a seamless user experience across all devices, especially mobile, is paramount. As of early 2025, mobile commerce continues to dominate online shopping, with a significant percentage of furniture purchases initiated or completed on smartphones. Rooms To Go's focus on mobile optimization ensures it captures this growing segment of the market, offering convenience and accessibility to a wider customer base.

Rooms To Go can significantly boost its operational efficiency through advanced supply chain and logistics technologies. Real-time inventory tracking, for instance, minimizes stockouts and overstocking, a critical factor in managing a vast product catalog. In 2024, companies leveraging such systems reported an average 15% reduction in inventory holding costs.

Automated warehousing solutions, including robotics and AI-driven sorting, streamline the movement of goods within distribution centers. This automation can lead to faster order fulfillment and a decrease in labor-related expenses. Industry reports from late 2024 indicate that warehouses employing advanced automation saw a 20% increase in throughput capacity.

Optimized delivery route planning, powered by real-time traffic data and predictive analytics, directly impacts customer satisfaction and operational costs. By reducing transit times and fuel consumption, Rooms To Go can improve delivery speed and lower its carbon footprint. By mid-2025, businesses using dynamic route optimization software are experiencing an average 10% decrease in delivery expenses.

Rooms To Go leverages advanced data analytics to deeply understand customer behavior, from browsing habits to purchase history. This allows for highly personalized product recommendations and marketing campaigns, enhancing the customer shopping experience. For instance, by analyzing millions of customer interactions, they can predict which furniture styles will be popular in specific regions, informing inventory decisions and reducing waste.

Virtual Reality (VR) and Augmented Reality (AR)

Virtual Reality (VR) and Augmented Reality (AR) present significant opportunities for Rooms To Go to revolutionize the customer experience. By allowing shoppers to virtually place furniture in their own living spaces, these technologies can dramatically improve purchase confidence and reduce costly returns. For instance, a 2024 Statista report indicated that 60% of consumers are more likely to buy a product if they can visualize it in their space using AR, a figure expected to grow.

The integration of VR/AR can create a more engaging and interactive online shopping journey, setting Rooms To Go apart in a competitive market. This enhanced visualization not only aids decision-making but also offers a novel way to explore product options. By 2025, the global AR/VR market is projected to reach over $300 billion, highlighting the increasing consumer and business adoption of these immersive technologies.

- Enhanced Visualization: Customers can see how furniture fits and looks in their actual homes, boosting confidence.

- Reduced Returns: Accurate pre-purchase visualization leads to fewer product returns due to size or style mismatches.

- Competitive Differentiation: Offering advanced AR/VR experiences can attract tech-savvy consumers and create a unique selling proposition.

In-store Technology Enhancements

Rooms To Go is leveraging in-store technology to create a more engaging and efficient customer journey. Interactive digital displays showcase product options and customization, allowing customers to visualize furniture in different configurations. For instance, by mid-2024, many retailers are reporting a significant increase in customer dwell time when interactive displays are implemented.

Self-service kiosks are also being integrated to streamline the purchasing process, offering customers the ability to browse inventory, check stock, and even place orders independently. This not only empowers customers but also frees up sales associates to provide more personalized assistance. Point-of-sale systems are being upgraded to handle faster transactions and integrate with loyalty programs, aiming to reduce checkout times, which in 2023 saw a 15% reduction in stores that adopted advanced POS technology.

- Interactive Displays: Enhance product visualization and customization, leading to increased customer engagement.

- Self-Service Kiosks: Streamline the purchasing process, offering customers greater autonomy and faster transactions.

- Advanced POS Systems: Improve checkout efficiency and enable seamless integration with customer loyalty programs.

Technological advancements are reshaping how Rooms To Go operates and interacts with customers. The company's e-commerce platform is central to its sales strategy, with online furniture sales projected to continue their strong growth through 2024. Investing in a user-friendly website and high-quality visuals is crucial for converting online visitors into buyers.

Mobile commerce remains a dominant force, with a significant portion of furniture purchases happening on smartphones as of early 2025. Rooms To Go's focus on mobile optimization ensures it caters to this trend, providing convenience and accessibility. Furthermore, adopting advanced supply chain technologies, like real-time inventory tracking, can reduce inventory holding costs by an estimated 15% for companies in 2024.

Automation in warehouses, utilizing robotics and AI, is boosting operational efficiency. Warehouses employing such systems saw a 20% increase in throughput capacity by late 2024. Optimized delivery routes, informed by real-time data, can cut delivery expenses by an average of 10% by mid-2025, while also improving customer satisfaction.

Rooms To Go uses data analytics to understand customer behavior, enabling personalized recommendations. Technologies like Virtual Reality (VR) and Augmented Reality (AR) are transforming the customer experience, with 60% of consumers in 2024 more likely to buy if they can visualize a product using AR. This immersive technology is expected to drive significant growth in the VR/AR market, projected to exceed $300 billion by 2025.

| Technology Area | Impact on Rooms To Go | Supporting Data/Trend (2024-2025) |

| E-commerce Platform | Drives online sales and customer engagement. | Online furniture sales projected for continued growth in 2024. |

| Mobile Optimization | Captures growing mobile commerce market share. | Mobile commerce continues to dominate online shopping in early 2025. |

| Supply Chain Tech | Reduces inventory costs and stockouts. | 15% average reduction in inventory holding costs reported by tech-adopting firms in 2024. |

| Warehouse Automation | Increases throughput and reduces labor costs. | 20% increase in throughput capacity in advanced automation warehouses (late 2024). |

| Route Optimization | Improves delivery efficiency and customer satisfaction. | 10% decrease in delivery expenses for businesses using dynamic route optimization (mid-2025). |

| Data Analytics | Enables personalized marketing and inventory decisions. | Used to predict regional furniture style popularity and reduce waste. |

| VR/AR Integration | Enhances customer visualization and reduces returns. | 60% of consumers more likely to buy with AR visualization (2024); VR/AR market >$300B by 2025. |

| In-Store Technology | Improves customer engagement and checkout efficiency. | Increased customer dwell time with interactive displays; 15% reduction in checkout times with advanced POS (2023). |

Legal factors

Rooms To Go must adhere to stringent legal mandates concerning furniture safety and quality. This includes compliance with federal regulations like the Consumer Product Safety Improvement Act (CPSIA), which sets limits on lead and phthalates in children's products, a segment Rooms To Go serves. Failure to meet these standards, such as flammability requirements for upholstery or ensuring structural integrity of furniture, can result in significant penalties, including fines that can reach millions of dollars, and costly product recalls impacting brand trust.

Consumer data privacy regulations, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), significantly impact how Rooms To Go handles customer information collected online and through loyalty programs. These laws dictate how personal data can be gathered, stored, processed, and shared, requiring robust consent mechanisms and clear privacy policies. Failure to comply can result in substantial fines; for instance, CCPA violations can lead to penalties of up to $7,500 per intentional violation, as of early 2024, directly affecting operational costs and brand reputation.

Advertising and marketing laws significantly shape how Rooms To Go can promote its products. The company must adhere to regulations ensuring all claims about furniture quality, origin, and pricing are truthful and not misleading. For instance, the Federal Trade Commission (FTC) in the US actively enforces rules against deceptive advertising, a critical consideration for Rooms To Go's national campaigns.

Compliance with consumer protection statutes is paramount. This includes transparently detailing promotional offers, financing terms, and any associated fees to avoid violating laws like the Truth in Lending Act. Failure to maintain pricing transparency or making unsubstantiated claims could lead to hefty fines and damage to Rooms To Go's brand reputation, impacting sales and customer trust.

Employment and Labor Laws

Rooms To Go operates within a complex web of employment and labor laws, necessitating strict adherence to regulations concerning employee rights, fair wages, and safe working conditions. The company must navigate federal statutes like the Fair Labor Standards Act (FLSA) and state-specific labor codes to ensure compliance in all its hiring, management, and termination processes. For instance, as of 2024, the federal minimum wage remains $7.25 per hour, but many states and cities have enacted significantly higher minimums, impacting Rooms To Go's payroll obligations across its diverse operational footprint.

Failure to comply with these legal mandates can lead to costly litigation and damage to the company's reputation. This includes ensuring fair treatment and preventing discrimination in the workplace, a critical aspect of maintaining a positive employee relations environment. Rooms To Go's commitment to these legal frameworks is essential for mitigating risks and fostering a stable workforce, particularly as labor market dynamics continue to evolve.

- Compliance with FLSA: Ensuring all employees are correctly classified as exempt or non-exempt and that overtime is paid appropriately, with average overtime pay rates varying by state.

- State Minimum Wage Adherence: Factoring in the varying state minimum wage laws, some of which, like California's, are projected to reach $16.00 per hour or higher by 2024-2025, impacting labor costs.

- Anti-Discrimination Laws: Upholding Title VII of the Civil Rights Act of 1964 and subsequent legislation to prevent discrimination based on race, color, religion, sex, and national origin in all employment practices.

- Workplace Safety Regulations: Adhering to Occupational Safety and Health Administration (OSHA) standards to ensure a safe working environment for all employees, with the agency continuing to enforce stringent safety protocols.

Zoning and Retail Operations Regulations

Zoning and retail operations regulations significantly impact Rooms To Go's physical footprint. Local zoning laws dictate where retail stores and distribution centers can be established, influencing site selection and expansion strategies. For instance, in 2024, navigating varying municipal zoning ordinances across different states remains a key operational challenge for large retailers like Rooms To Go, potentially delaying new store openings or requiring costly site modifications.

Compliance with building codes and obtaining necessary operational permits are critical for maintaining existing facilities and undertaking renovations. Failure to adhere to these legal frameworks can result in fines or operational disruptions. Rooms To Go must ensure all its locations, from showrooms to warehouses, meet current safety and accessibility standards, a process that often involves regular inspections and permit renewals.

Key considerations include:

- Zoning ordinances restricting retail development in certain commercial or industrial zones.

- Building codes mandating specific construction standards for safety and accessibility.

- Operational permits required for the day-to-day running of retail stores and warehouses, including fire safety and occupancy permits.

- Land use regulations impacting the size and scope of new retail developments or expansions.

Rooms To Go must navigate a complex landscape of product safety regulations, including the Consumer Product Safety Improvement Act (CPSIA), which sets standards for lead and phthalates in furniture. Non-compliance can result in substantial fines, with penalties for CPSIA violations potentially reaching tens of thousands of dollars per violation, and costly recalls impacting brand reputation.

Data privacy laws like the California Privacy Rights Act (CPRA) significantly affect how Rooms To Go handles customer information, with potential fines of up to $7,500 per intentional violation. Truthful advertising is also mandated by the Federal Trade Commission (FTC), preventing misleading claims about product quality or pricing, which could incur penalties and erode customer trust.

Employment laws, such as the Fair Labor Standards Act (FLSA), require adherence to wage and hour regulations, with state minimum wages varying significantly; for example, some states were projected to have minimum wages around $16.00 per hour by 2024-2025. Additionally, anti-discrimination laws and workplace safety standards enforced by OSHA are crucial for maintaining a compliant and safe operational environment.

| Legal Factor | Description | Potential Impact/Cost | Relevant Legislation/Body |

| Product Safety | Ensuring furniture meets safety standards for materials and construction. | Fines, recalls, brand damage. | CPSIA, CPSC |

| Data Privacy | Protecting customer data and adhering to consent requirements. | Fines up to $7,500 per violation (CCPA/CPRA), reputational damage. | CCPA, CPRA |

| Advertising Standards | Ensuring all marketing claims are truthful and not misleading. | FTC penalties, loss of consumer trust. | FTC Act |

| Labor Laws | Compliance with wage, hour, anti-discrimination, and safety regulations. | Increased labor costs due to varying minimum wages (e.g., $16+/hr in some states by 2024-2025), litigation, fines. | FLSA, Title VII, OSHA |

Environmental factors

Rooms To Go faces increasing pressure to adopt sustainable sourcing for materials like wood and fabrics. This means prioritizing responsibly harvested timber and increasing the use of recycled content in their furniture. For example, in 2024, consumer surveys indicated that over 60% of furniture buyers consider environmental impact when making purchasing decisions, directly influencing Rooms To Go's supply chain choices and product development.

Rooms To Go faces environmental scrutiny regarding the waste generated from furniture manufacturing, including materials like wood, fabric, and plastics, as well as significant packaging. For instance, the U.S. Environmental Protection Agency (EPA) reported that in 2018, over 12 million tons of furniture and furnishings ended up in landfills. This highlights the critical need for effective waste management strategies.

The company can mitigate its environmental footprint by adopting more sustainable manufacturing processes that minimize material offcuts and by partnering with suppliers who prioritize eco-friendly packaging. Furthermore, implementing robust in-store and customer-facing recycling programs for old furniture and packaging materials could significantly divert waste from landfills, aligning with growing consumer demand for corporate environmental responsibility.

Rooms To Go's extensive network of physical stores, warehouses, and delivery fleet significantly contributes to its environmental impact. In 2024, the furniture retail sector, including companies like Rooms To Go, faces increasing scrutiny over its energy consumption and carbon footprint. Efforts to enhance energy efficiency in retail spaces and distribution centers, alongside the adoption of more fuel-efficient transportation, are crucial for reducing emissions.

As of 2025, businesses are increasingly investing in renewable energy sources to power their operations. Rooms To Go could explore solar panel installations at its facilities or procure renewable energy credits to offset its carbon emissions. Optimizing delivery routes and exploring electric or alternative fuel vehicles within its logistics network are also key strategies to lower their environmental impact and meet evolving sustainability expectations.

Climate Change and Supply Chain Resilience

Climate change poses a significant threat to Rooms To Go's supply chain. Extreme weather events, like hurricanes and floods, can severely disrupt the sourcing of raw materials such as lumber and the transportation of finished furniture. For instance, the increasing frequency of severe weather in regions vital for furniture manufacturing, such as Southeast Asia, directly impacts production timelines and costs.

Rooms To Go must proactively build resilience into its logistics and sourcing. This involves diversifying suppliers across different geographical regions less prone to extreme weather and exploring alternative transportation routes. The company is likely assessing its inventory management strategies to hold buffer stock for critical components, mitigating the impact of unforeseen disruptions.

- Increased Material Costs: Extreme weather impacting timber harvests can lead to higher raw material prices for furniture production.

- Transportation Delays: Port closures and damaged infrastructure due to severe weather can cause significant delays in receiving both raw materials and finished goods.

- Production Halts: Flooding or extreme heat in manufacturing hubs can force temporary shutdowns, impacting inventory levels.

- Sourcing Diversification: Companies are increasingly looking to source materials from regions with lower climate risk to ensure continuity.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly furniture is a significant environmental factor for Rooms To Go. Shoppers increasingly favor products with a low environmental footprint and clear sustainability information. For instance, a 2024 survey indicated that 65% of furniture buyers consider sustainability when making a purchase, a notable increase from previous years.

Rooms To Go can leverage this trend by highlighting its commitment to eco-conscious sourcing and manufacturing. Offering furniture made from recycled materials or sustainably harvested wood can appeal to this growing market segment. This focus on sustainability can serve as a key competitive advantage in the furniture retail landscape.

- Growing Market Share: The global market for sustainable furniture is projected to reach $75 billion by 2027, indicating substantial growth potential.

- Brand Perception: Companies with strong sustainability initiatives often enjoy enhanced brand reputation and customer loyalty.

- Regulatory Influence: While not always direct, evolving environmental regulations globally can influence material sourcing and production methods, pushing companies towards greener practices.

Rooms To Go must navigate increasing environmental regulations and consumer expectations for sustainability. In 2024, over 60% of furniture buyers considered environmental impact, pushing companies like Rooms To Go to adopt responsible sourcing for materials like wood and fabrics. This includes prioritizing responsibly harvested timber and increasing recycled content, directly influencing supply chain and product development.

The company faces scrutiny over waste from manufacturing and packaging, with over 12 million tons of furniture and furnishings ending up in landfills in the US in 2018. Implementing effective waste management, adopting eco-friendly packaging, and promoting recycling programs are crucial steps to reduce its environmental footprint.

Rooms To Go's extensive operations, from stores to its delivery fleet, contribute significantly to its environmental impact. Efforts in 2024 to enhance energy efficiency in retail and distribution centers, coupled with adopting more fuel-efficient transportation, are vital for reducing emissions.

As of 2025, investing in renewable energy is a growing trend. Rooms To Go could explore solar installations or renewable energy credits, alongside optimizing delivery routes and considering electric vehicles, to lower its environmental impact and meet sustainability demands.

Climate change poses a threat to Rooms To Go's supply chain, with extreme weather events disrupting raw material sourcing and furniture transportation. The increasing frequency of severe weather in key manufacturing regions directly impacts production timelines and costs.

To build resilience, Rooms To Go is likely diversifying suppliers geographically and exploring alternative transportation routes. Proactive inventory management to hold buffer stock for critical components also mitigates disruption impacts.

| Environmental Factor | Impact on Rooms To Go | Mitigation Strategies | Data Point/Trend |

|---|---|---|---|

| Sustainable Sourcing | Increased pressure for responsibly harvested timber and recycled content. | Supplier audits, material certification programs. | 60% of furniture buyers consider environmental impact (2024). |

| Waste Management | Scrutiny over manufacturing and packaging waste. | Reduce offcuts, eco-friendly packaging, recycling programs. | 12 million tons of furniture/furnishings in US landfills (2018). |

| Energy Consumption & Emissions | Significant footprint from retail, warehouses, and delivery. | Energy efficiency upgrades, renewable energy adoption, fuel-efficient fleets. | Growing investment in renewable energy (2025). |

| Climate Change & Supply Chain Disruption | Risk of extreme weather impacting sourcing and logistics. | Supplier diversification, alternative routes, buffer stock. | Increasing frequency of severe weather in manufacturing hubs. |

PESTLE Analysis Data Sources

Our Rooms To Go PESTLE Analysis is built upon a robust foundation of data sourced from government economic reports, industry-specific market research, and reputable news outlets. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.