Rooms To Go Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rooms To Go Bundle

Rooms To Go faces significant competitive pressures, with moderate bargaining power from both suppliers and buyers. The threat of new entrants is a key consideration, as is the availability of substitute products in the furniture market. Understanding these dynamics is crucial for any business operating in or analyzing this sector.

The complete report reveals the real forces shaping Rooms To Go’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Global supply chains are navigating persistent turbulence in 2024 and extending into 2025. These ongoing challenges, marked by elevated freight expenses, persistent labor scarcities, and the ripple effects of geopolitical instability, directly translate into higher input costs for furniture manufacturers. Consequently, retailers like Rooms To Go face increased expenses for sourcing raw materials and finished goods.

These disruptions don't just mean higher prices; they also lead to significant operational hurdles. Delays in shipments and increased logistics costs can impact Rooms To Go's ability to maintain consistent product availability and manage inventory efficiently. This directly affects their profitability and customer satisfaction, as the cost of doing business rises across the board.

Economic uncertainty, inflation, and rising interest rates are major worries for furniture retailers heading into 2025, with suppliers passing on increased costs. Tariffs on imported goods, especially from crucial manufacturing hubs, directly inflate the price of raw materials and finished furniture, squeezing Rooms To Go's input costs. This cost pressure can weaken Rooms To Go's ability to negotiate favorable terms with its suppliers.

The furniture industry, including companies like Rooms To Go, is increasingly focused on sustainable and eco-friendly materials. If Rooms To Go relies on specialized or ethically sourced components, the pool of qualified suppliers naturally shrinks. This limited availability can significantly enhance the bargaining power of these specialized suppliers, potentially leading to increased costs or more demanding contractual conditions for Rooms To Go.

Supplier concentration in key manufacturing regions

The global furniture production is heavily centered in Asia-Pacific, with China and Vietnam being significant exporters. This concentration means that manufacturers in these regions, especially those with specialized capabilities and economies of scale, can wield considerable influence over pricing and terms. Rooms To Go's extensive product catalog implies sourcing from these large-scale manufacturers, potentially increasing their bargaining power.

This supplier concentration can lead to several implications for Rooms To Go:

- Increased negotiation leverage for suppliers: Dominant manufacturers in concentrated regions can dictate terms due to high demand and limited alternative large-scale suppliers.

- Potential for price volatility: Disruptions or increased demand in key manufacturing hubs can lead to price fluctuations for finished goods.

- Reliance on specific production expertise: Specialized manufacturing processes concentrated in certain areas can create dependencies for buyers like Rooms To Go.

- Impact on supply chain resilience: Over-reliance on a few regions can make the supply chain vulnerable to geopolitical events or logistical challenges.

High switching costs for established relationships

For a large retailer like Rooms To Go, switching core suppliers can be a costly endeavor. This is especially true when considering the extensive distribution centers and intricate inventory management systems they employ. The logistical hurdles and operational disruptions associated with onboarding new suppliers for such a complex operation can be substantial.

Established relationships with current suppliers often come with integrated supply chain analytics. Rooms To Go likely leverages these systems, making it more difficult and expensive to transition to a new provider. This deep integration effectively raises the switching costs for Rooms To Go, thereby strengthening the bargaining power of their existing suppliers.

- Logistical Costs: Implementing new supplier logistics for a national furniture retailer like Rooms To Go can involve significant upfront investment in new warehousing, transportation contracts, and staff training.

- Inventory Management Integration: Rooms To Go's reliance on sophisticated inventory management software, potentially tailored to existing supplier data and processes, creates a barrier to switching.

- Data Migration and System Compatibility: Transitioning supplier data and ensuring compatibility with existing IT infrastructure can be a time-consuming and expensive process.

- Relationship Value: Long-standing supplier relationships often include preferential pricing, dedicated support, and customized product development, which are difficult to replicate quickly with new partners.

The bargaining power of suppliers for Rooms To Go is a significant factor, particularly given the global supply chain disruptions continuing into 2024 and 2025. Elevated freight costs and labor shortages are directly increasing input expenses for furniture manufacturers, which are then passed on to retailers like Rooms To Go. This dynamic strengthens suppliers' ability to dictate terms, especially for specialized or ethically sourced materials where supplier options are limited. For instance, the concentration of furniture manufacturing in Asia-Pacific, with countries like China and Vietnam dominating, grants large-scale manufacturers considerable leverage over pricing and supply, impacting Rooms To Go's sourcing strategies.

High switching costs further amplify supplier bargaining power. Rooms To Go's extensive infrastructure, including distribution centers and integrated inventory management systems, makes transitioning to new suppliers a complex and expensive undertaking. The potential loss of preferential pricing, dedicated support, and customized product development from existing, long-term supplier relationships also discourages switching, effectively locking in current arrangements and reinforcing supplier influence.

| Factor | Impact on Rooms To Go | Supplier Bargaining Power |

|---|---|---|

| Supply Chain Disruptions (2024-2025) | Increased input costs, potential for stockouts | High |

| Supplier Concentration (Asia-Pacific) | Limited negotiation options for large-scale orders | High |

| Specialized Material Sourcing | Dependence on niche suppliers with fewer alternatives | Very High |

| High Switching Costs | Operational complexity and expense to change suppliers | High |

What is included in the product

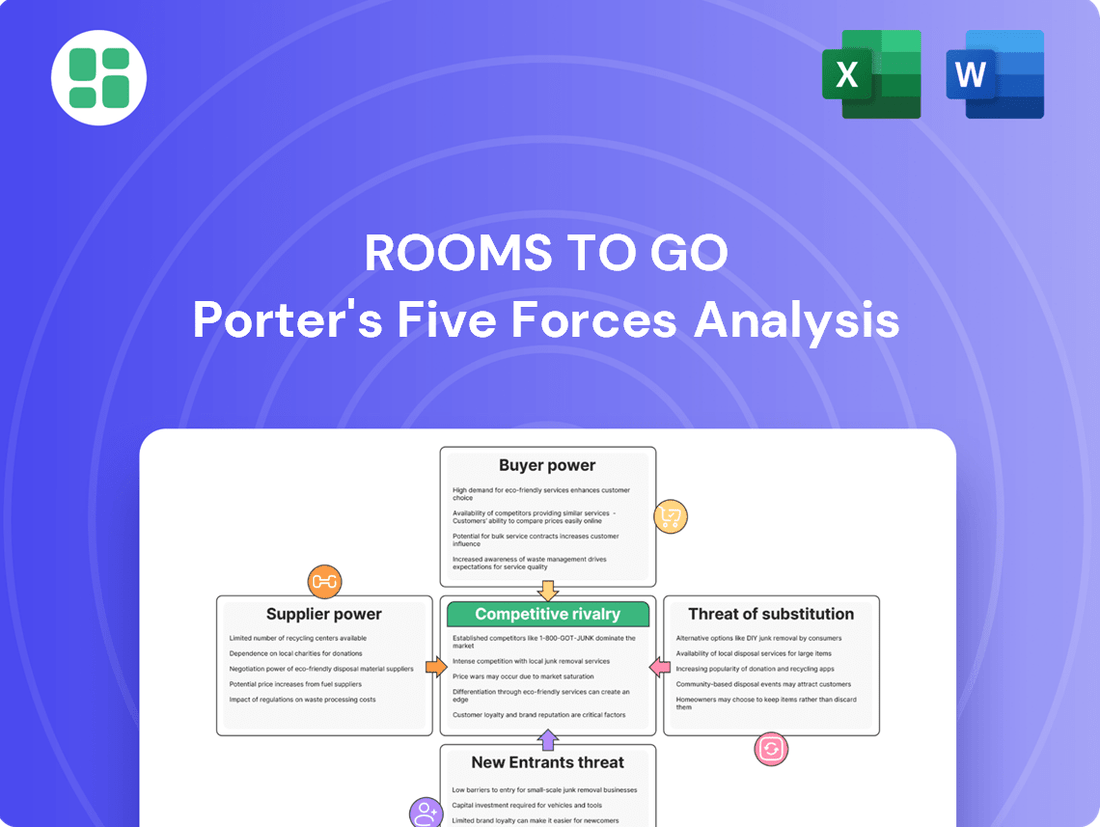

This analysis of Rooms To Go's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces chart, simplifying complex market dynamics for Rooms to Go.

Customers Bargaining Power

Consumers, especially younger demographics and those with tighter budgets, are keenly aware of furniture prices. This price sensitivity is amplified by ongoing economic uncertainty, with many households postponing significant purchases like furniture into 2025. As a result, customers are actively seeking deals and greater value, which naturally strengthens their bargaining position with retailers like Rooms To Go.

The furniture market is incredibly crowded, with countless retailers both online and in physical stores presenting a vast selection of furniture. This abundance of choices means Rooms To Go customers can readily compare prices and styles from competitors like Ashley Furniture and Wayfair, significantly boosting their leverage.

Hybrid shopping trends are significantly bolstering the bargaining power of customers for retailers like Rooms To Go. Consumers are increasingly researching products online, comparing prices and features, before heading to physical stores. This dual approach allows them to leverage the convenience of digital platforms with the tangible experience of seeing and touching furniture, giving them more leverage in negotiations.

In 2024, a significant portion of furniture purchases began online, with data suggesting over 60% of consumers conduct extensive online research before any in-store visit. This informed customer base, armed with readily available price comparisons and reviews, can more effectively pressure retailers for better deals or concessions. The ability to easily switch between online and offline channels means customers are less tied to a single retailer, further enhancing their bargaining position.

Low switching costs for consumers

For consumers, the cost and effort involved in switching from one furniture retailer to another are quite low. With numerous competitors offering comparable products and services, customers can easily move between brands. This accessibility means Rooms To Go needs to consistently provide competitive pricing, appealing financing deals, and an engaging shopping experience to keep its customer base.

The low switching costs for consumers directly impact Rooms To Go's ability to retain customers. In 2024, the furniture retail sector saw a significant increase in online sales, with consumers having even more options readily available at their fingertips. This trend underscores the importance of customer loyalty programs and personalized service to differentiate from competitors.

- Low switching costs: Consumers face minimal financial or effort-based barriers when changing furniture providers.

- Competitive landscape: A crowded market offers many alternatives, increasing customer choice and mobility.

- Customer retention strategies: Rooms To Go must focus on value, financing, and experience to maintain loyalty.

- Impact of online retail: The growth of e-commerce in 2024 has further amplified consumer options and ease of switching.

Demand for customization and value

Customers increasingly desire personalized furniture solutions, moving beyond standardized room packages. This demand for customization, coupled with a strong focus on value for money, significantly influences furniture retailers like Rooms To Go. Even with a growing awareness of sustainable practices, consumers are looking for options that reflect their individual tastes and budgets.

Rooms To Go is actively responding to this by investing in data analytics to better understand and cater to individual customer preferences, aiming to offer more tailored product selections and purchasing experiences. For instance, by analyzing purchasing patterns, they can identify popular customization requests and adapt their offerings accordingly.

- Demand for Personalization: Consumers are actively seeking furniture that can be adapted to their specific needs and aesthetic preferences, rather than accepting pre-set room designs.

- Value Consciousness: Customers are scrutinizing prices and seeking the best possible quality and features for their investment, especially as economic conditions fluctuate.

- Sustainability Awareness: While not always the primary driver, a growing segment of consumers considers the environmental impact of their purchases, influencing their choices and expectations from retailers.

- Data-Driven Customization: Retailers like Rooms To Go are leveraging customer data to offer more tailored product recommendations and customization options, directly addressing this evolving customer demand.

The bargaining power of customers for Rooms To Go remains substantial, driven by a highly competitive market and increasing consumer savviness. In 2024, the furniture industry continued to see a significant influx of online retailers, offering consumers a wider array of choices and price points. This accessibility empowers shoppers to easily compare offerings, pushing retailers to maintain competitive pricing and attractive promotions to secure sales.

Consumers are well-informed, utilizing online platforms to research products, read reviews, and compare prices extensively before making a purchase. This trend, which intensified in 2024 with over 60% of consumers conducting thorough online research, means customers enter negotiations with a clear understanding of market value. Consequently, Rooms To Go faces pressure to offer compelling value propositions, including flexible financing and transparent pricing, to retain its customer base.

The ease with which customers can switch between furniture retailers further amplifies their bargaining power. With minimal switching costs, consumers can readily explore alternatives if they are not satisfied with Rooms To Go's offerings or pricing. This dynamic necessitates a strong focus on customer experience and loyalty programs to foster repeat business and mitigate the impact of customer churn.

| Factor | Description | 2024 Impact |

|---|---|---|

| Price Sensitivity | Customers are highly aware of furniture costs and actively seek deals. | Economic uncertainty in 2024 led to increased price consciousness. |

| Availability of Substitutes | Numerous competitors offer similar furniture products. | The growth of online furniture retailers in 2024 expanded consumer options significantly. |

| Switching Costs | Low effort and financial barriers to changing retailers. | Consumers can easily move between brands, requiring retailers to offer continuous value. |

| Information Availability | Easy access to product information, reviews, and price comparisons. | Informed consumers in 2024 leveraged data to negotiate better terms. |

Preview Before You Purchase

Rooms To Go Porter's Five Forces Analysis

This preview showcases the comprehensive Rooms To Go Porter's Five Forces Analysis, reflecting the exact document you will receive immediately after purchase. You're not looking at a sample; this is the complete, professionally formatted analysis ready for your immediate use. Rest assured, what you see here is precisely what you'll be able to download and leverage for your strategic insights.

Rivalry Among Competitors

The furniture retail landscape is incredibly fragmented, featuring a multitude of global, national, and local competitors vying for consumer attention. Rooms To Go, despite its significant presence, contends with a vast array of players, including large national chains like Ashley Furniture HomeStore and IKEA, as well as a growing number of online-only retailers such as Wayfair and Amazon. This intense competition forces companies to adopt aggressive pricing and promotional strategies to capture market share.

The furniture sector's e-commerce growth is accelerating, with online sales expected to represent a substantial portion of the market by 2024. This surge means giants like Wayfair and Amazon are offering immense product variety and seamless shopping experiences, forcing established players like Rooms To Go to bolster their own digital infrastructure and integrate online and in-store operations.

This heightened online presence directly translates to increased price transparency, making it easier for consumers to compare offerings. Consequently, Rooms To Go faces intensified pressure to remain competitive on pricing and to continually enhance its digital customer journey to match the convenience and breadth of offerings from online-only competitors.

Omnichannel strategy has become a crucial battleground for furniture retailers, demanding a seamless integration of online and physical shopping experiences to stay competitive. Retailers like Rooms To Go are investing heavily in this area, recognizing that customers expect a consistent and convenient journey whether they browse online or visit a showroom.

Rooms To Go's commitment to a robust omnichannel approach, encompassing both its extensive network of physical stores and its evolving e-commerce platform, is vital. By enhancing digital features such as accessible financing options and leveraging improved supply chain analytics, the company aims to not only survive but also thrive amidst intense competition.

Economic headwinds and consumer restraint

Economic headwinds, including persistent inflation and a general sense of uncertainty, are significantly impacting consumer spending habits in 2024 and into 2025. This translates to heightened consumer restraint, particularly for discretionary purchases like furniture. As consumers become more cautious with their budgets, the demand for big-ticket items softens, intensifying the competitive landscape for furniture retailers like Rooms To Go.

This pressure on demand forces retailers to compete more aggressively for a shrinking pool of immediate purchasing opportunities. Expect to see an increase in promotional activities and aggressive pricing strategies as companies vie for market share. This price competition directly escalates the level of rivalry within the furniture industry.

- Consumer Spending Slowdown: In early 2024, consumer confidence remained somewhat subdued, with many households prioritizing essential spending over discretionary purchases.

- Inflationary Impact: Persistent inflation in 2024 continued to erode purchasing power, making consumers more hesitant to commit to large furniture investments.

- Promotional Activity Surge: Retailers responded to slower sales by increasing discounts and offering more financing options, a trend expected to continue as they fight for customer wallets.

- Market Share Battles: The struggle for market share intensifies as fewer consumers are actively buying, leading to more aggressive marketing and sales tactics among competitors.

Differentiation through unique offerings and technology

Rooms To Go differentiates itself by offering complete room packages, a distinct approach in the furniture industry. This strategy is further bolstered by significant investments in technology, including AI for customer service and advanced supply chain optimization, aiming to streamline operations and enhance customer experience.

However, the competitive landscape is dynamic, with rivals increasingly adopting similar technological advancements. Competitors are actively integrating smart furniture, offering 3D visualization tools for better customer engagement, and developing personalized shopping experiences. This means Rooms To Go must continuously innovate to sustain its unique market position.

- Unique Offerings: Rooms To Go's core strategy revolves around selling coordinated room sets, simplifying the furniture buying process for consumers.

- Technology Investment: The company is investing in AI for customer support and optimizing its supply chain, enhancing efficiency and customer interaction.

- Competitive Response: Competitors are also leveraging technology, introducing smart furniture and 3D visualization tools.

- Need for Innovation: Continuous technological and product innovation is crucial for Rooms To Go to maintain its competitive edge against these evolving strategies.

The furniture market remains highly competitive, with Rooms To Go facing intense rivalry from large national players like Ashley Furniture HomeStore and IKEA, as well as agile online retailers such as Wayfair and Amazon. This fragmented landscape, amplified by e-commerce growth, forces aggressive pricing and continuous innovation in customer experience to capture market share.

Economic pressures in 2024, including inflation and consumer spending caution, further escalate rivalry, pushing retailers towards increased promotions and price competition to secure sales from a more discerning customer base.

Rooms To Go's strategy of offering complete room packages and investing in technology like AI and supply chain optimization is a key differentiator, but competitors are also rapidly adopting similar technological advancements, necessitating ongoing innovation.

The furniture retail sector saw online sales continue to gain significant traction through 2024. For instance, Wayfair reported a 1.7% year-over-year increase in net revenue for the first quarter of 2024, highlighting the growing importance of digital channels and the competitive pressure they exert on traditional retailers.

| Competitor Type | Key Players | Competitive Tactics | Impact on Rooms To Go |

| Large National Chains | Ashley Furniture HomeStore, IKEA | Aggressive pricing, extensive store networks, brand recognition | Pressure on pricing, need for strong in-store experience |

| Online-Only Retailers | Wayfair, Amazon | Vast product selection, competitive pricing, seamless online experience, fast delivery | Need for robust e-commerce, price transparency, digital customer journey enhancement |

| Specialty Retailers | Local boutiques, niche online stores | Unique designs, personalized service, curated selections | Challenge to differentiate beyond core offerings, need for specialized marketing |

SSubstitutes Threaten

The DIY furniture market is a growing concern for Rooms To Go. In 2024, the global DIY market was valued at over $100 billion, with a significant portion dedicated to home improvement and furnishings. This trend empowers consumers to build or customize their own pieces, bypassing traditional retailers and directly impacting sales of new furniture.

Furthermore, the second-hand furniture market presents a substantial substitute. Platforms like Facebook Marketplace and OfferUp saw a surge in activity in 2024, with millions of transactions occurring. This readily available and often much cheaper alternative directly competes with Rooms To Go's new product offerings, appealing to budget-conscious consumers.

The rise of multi-functional and modular furniture presents a significant threat of substitutes for traditional furniture offerings. As living spaces shrink, consumers increasingly seek adaptable solutions. For instance, a modular sofa that can be reconfigured into a sectional, a chaise, or even separate chairs directly competes with the need to buy multiple distinct pieces.

This trend is fueled by a demand for versatility, meaning one piece of furniture can serve several purposes, thereby reducing the overall quantity of furniture a household might need. This directly impacts traditional furniture sales by offering a more efficient use of space and a potentially lower overall cost for adaptable living arrangements.

The increasing consumer focus on experiences over tangible goods presents a significant threat of substitutes for furniture retailers like Rooms To Go. Economic shifts and evolving preferences are leading many to prioritize spending on travel, entertainment, or even newer electronics and vehicles, delaying furniture acquisition.

This trend means that discretionary income that might have once gone towards a new sofa or dining set is now being allocated elsewhere. For example, a 2024 survey indicated that over 60% of consumers aged 25-40 now consider travel a higher priority than purchasing new home furnishings, directly impacting demand for furniture.

Alternative materials and lower-cost options

The threat of substitutes for Rooms To Go is amplified by the availability of furniture crafted from alternative, often more affordable, materials such as metal and plastic. These substitutes directly challenge traditional wood and upholstered furniture, especially for consumers prioritizing price over premium materials or intricate design. For instance, the global furniture market saw significant growth in 2024, with a notable segment driven by value-oriented consumers seeking cost-effective solutions.

Budget-conscious shoppers might readily choose these less expensive material options from competitors. This trend is particularly evident when design or long-term durability is not the primary purchase driver. In 2023, the demand for ready-to-assemble furniture, often utilizing these materials, continued to rise, indicating a consumer shift towards accessibility and lower price points.

- Metal and plastic furniture offer lower entry price points compared to traditional wood or fabric pieces.

- Consumers focused on budget may readily switch to these substitute materials, impacting demand for Rooms To Go's core offerings.

- The growing popularity of ready-to-assemble furniture often correlates with the use of these alternative materials, signaling a market trend.

Furniture rental and subscription services

While specific data for Rooms To Go's direct exposure to furniture rental and subscription services isn't readily available, the broader market trend indicates a growing threat. These alternatives cater to consumers seeking flexibility, particularly younger demographics or those with transient living situations. For instance, companies like Feather and Fernish offer curated furniture packages on a subscription basis, allowing users to furnish apartments without the upfront cost or long-term commitment of buying.

The appeal of rental and subscription models lies in their adaptability. Consumers can change their decor or upgrade furniture more frequently without the burden of resale or disposal. This can be particularly attractive in urban areas where living situations may change often. By 2024, the furniture rental market, though niche, is projected to continue its growth, presenting a viable substitute for traditional furniture purchases.

The threat is amplified by the increasing convenience these services offer, often including delivery, assembly, and even pick-up. This seamless experience directly competes with the traditional retail model. Consider the potential impact if a significant portion of the market, especially those prioritizing short-term needs or experiencing lifestyle changes, shifts towards these flexible furniture solutions.

- Growing Market: The global furniture rental market was valued at approximately $10.5 billion in 2023 and is expected to grow.

- Consumer Preference: Younger consumers, particularly Millennials and Gen Z, show a higher propensity for subscription-based services and flexible ownership models.

- Cost-Effectiveness: For short-term needs or those who dislike commitment, rental services can be more financially appealing than outright purchase.

- Convenience Factor: Services often bundle delivery, assembly, and pickup, reducing the hassle for consumers compared to traditional retail.

The threat of substitutes for Rooms To Go is multifaceted, encompassing DIY furniture, the second-hand market, and alternative materials. The DIY furniture market's valuation exceeding $100 billion in 2024 highlights consumer interest in personalized, cost-effective solutions. Similarly, the robust activity on platforms like Facebook Marketplace in 2024 demonstrates the strong appeal of pre-owned furniture as a budget-friendly alternative.

Furthermore, the shift towards experiences over tangible goods, with over 60% of consumers aged 25-40 prioritizing travel in 2024, diverts potential furniture spending. The increasing availability of furniture made from metal and plastic, often found in ready-to-assemble formats, also presents a significant substitute, particularly for value-conscious buyers.

The furniture rental and subscription market, though niche, is also a growing substitute. These services offer flexibility and convenience, appealing to younger demographics and those with transient living situations. By 2024, this market was projected for continued growth, directly challenging traditional ownership models.

| Substitute Category | Key Characteristics | 2024 Market Impact Indicator |

|---|---|---|

| DIY Furniture | Customization, cost savings | Global market > $100 billion |

| Second-Hand Furniture | Affordability, availability | High transaction volume on online platforms |

| Alternative Materials (Metal/Plastic) | Lower price point, ease of assembly | Growing demand in value-oriented segments |

| Rental/Subscription Services | Flexibility, convenience, lower upfront cost | Projected market growth, appealing to younger demographics |

| Experiences Over Goods | Shift in consumer spending priorities | 60%+ of 25-40 year olds prioritize travel over furnishings |

Entrants Threaten

The furniture industry, including companies like Rooms To Go, has seen its entry barriers significantly reduced due to the rise of e-commerce. This shift allows new businesses to bypass the substantial costs associated with establishing a large network of physical showrooms, a traditional hurdle for market entry. For instance, online-only furniture retailers can operate with much leaner overheads, directly competing with established players.

New entrants can leverage digital marketing and direct-to-consumer models to reach customers nationwide without the need for prime real estate. This digital-first approach democratizes market access, enabling smaller, agile companies to gain traction. The global e-commerce furniture market was valued at approximately $230 billion in 2023 and is projected to continue its growth trajectory, illustrating the increasing viability of online-only models.

Niche market opportunities exist for new entrants in the furniture industry, allowing startups to carve out a space without directly competing with established players like Rooms To Go across their entire product range. Segments focusing on sustainable materials, highly personalized furniture, or catering to specific demographics such as millennials and Gen Z are particularly attractive.

For instance, the market for eco-friendly furniture is growing significantly. In 2024, consumer demand for sustainable home goods continued to rise, with reports indicating that over 60% of consumers consider sustainability when making purchasing decisions. This trend creates an opening for startups specializing in recycled or ethically sourced furniture to gain initial market share.

Even with the growth of online shopping, building a furniture retail business on the scale of Rooms To Go, complete with numerous physical showrooms and vast warehousing, demands a considerable amount of money. For instance, opening just one new large showroom can easily cost millions in real estate, inventory, and staffing. This high entry cost deters many potential competitors from attempting to replicate Rooms To Go's extensive market reach.

Brand recognition and established supply chains

Rooms To Go, like many established furniture retailers, benefits significantly from strong brand recognition and customer loyalty cultivated over years of operation. This makes it harder for newcomers to attract customers. For instance, in 2024, major furniture retailers continued to invest heavily in marketing and customer experience initiatives to solidify their brand presence.

Established players also possess highly efficient and optimized supply chain networks. These networks, developed through extensive experience and investment, allow for cost-effective sourcing, warehousing, and delivery. New entrants must invest substantial capital and time to replicate these logistical advantages, a significant barrier to entry.

- Brand Equity: Decades of marketing and customer service have built significant brand trust for incumbents like Rooms To Go.

- Supply Chain Mastery: Established retailers operate sophisticated, cost-efficient supply chains for sourcing and delivery.

- Capital Investment: New entrants require massive upfront investment to build comparable brand recognition and supply chain infrastructure.

- Customer Loyalty: Repeat business and positive word-of-mouth from existing customers create a formidable hurdle for new competitors.

Technological investment requirements

New furniture retailers face significant hurdles due to the substantial technological investment required to compete. To offer a compelling customer experience, businesses must integrate advanced solutions like augmented reality (AR) for virtual product placement in homes, artificial intelligence (AI) for personalized customer support, and sophisticated Product Information Management (PIM) systems to handle vast product catalogs. For instance, developing a seamless AR shopping experience can cost hundreds of thousands of dollars, a considerable barrier to entry.

These high upfront costs and the technical expertise needed to implement and maintain such systems create a formidable barrier for emerging companies. The complexity of integrating these technologies effectively means that only well-capitalized entrants can realistically aspire to match the digital capabilities of established players like Rooms To Go.

- High Cost of AR Development: Implementing virtual showroom technology can range from $100,000 to over $500,000 for a robust solution.

- AI Implementation Expenses: Deploying AI for customer service chatbots and personalized recommendations involves significant software and integration costs.

- PIM System Investment: Establishing a comprehensive PIM system, crucial for managing product data across multiple channels, can cost tens of thousands of dollars annually.

While e-commerce has lowered some entry barriers, the threat of new entrants for a large-scale furniture retailer like Rooms To Go remains moderate. The capital required for extensive showroom networks, warehousing, and sophisticated logistics is substantial. For instance, establishing a national distribution network can easily cost tens of millions of dollars.

Brand loyalty and established supply chains are significant deterrents. New entrants must overcome consumer trust built over years and replicate efficient operations. In 2024, major furniture retailers continued to invest heavily in marketing, reinforcing their market positions.

The need for significant technological investment, such as AR and AI integration, further elevates entry barriers. Developing a seamless AR shopping experience can cost upwards of $500,000, a cost many startups cannot afford. This technological sophistication is crucial for competing effectively in the modern furniture market.

| Barrier Type | Estimated Cost/Factor | Impact on New Entrants |

|---|---|---|

| Physical Showrooms & Warehousing | Millions of dollars per location/facility | High capital requirement |

| Brand Recognition & Loyalty | Years of marketing and customer service | Difficult to overcome |

| Supply Chain Infrastructure | Tens of millions for national networks | Requires significant investment and time |

| Technology Integration (AR/AI) | $100,000 - $500,000+ for AR solutions | High upfront cost and technical expertise needed |

Porter's Five Forces Analysis Data Sources

Our Rooms To Go Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Rooms To Go's annual reports and SEC filings, alongside industry-specific research from firms like IBISWorld and Statista.

We also incorporate macroeconomic data and consumer spending trends to provide a robust understanding of the competitive landscape and potential threats.