QS Communications SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QS Communications Bundle

QS Communications boasts a strong brand reputation and a loyal customer base, key strengths that position them favorably in the competitive communications landscape. However, understanding the nuances of their operational efficiencies and potential market threats is crucial for sustained growth.

Want the full story behind QS Communications' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

QSC AG's strength lies in its dedicated focus on Germany's small and medium-sized enterprises (SMEs), the vital Mittelstand. This specialization allows QSC to craft solutions precisely tailored to the digital transformation needs of this significant economic sector.

By deeply understanding the challenges and opportunities faced by German SMEs, QSC cultivates robust, enduring client relationships. This niche expertise is a key differentiator in a competitive market, enabling them to effectively address the specific demands of businesses that are crucial to Germany's economic landscape.

QS Communications boasts a comprehensive IT service portfolio, covering cloud, security, and SAP solutions. This breadth is enhanced by strong consulting, implementation, and managed services, allowing them to tackle a wide range of client needs. This integrated approach supports clients throughout their digital transformation, fostering loyalty and creating avenues for additional service sales.

QS Communications, now operating as q.beyond AG, is showing impressive financial resilience. For the first quarter of 2025, the company reported a debt-free balance sheet and positive free cash flow, underscoring its solid financial health. This strong foundation is a direct result of their strategic focus on operational efficiency, aiming for a medium-term EBITDA margin of at least 10% as outlined in their '2025 Strategy'.

Robust Cybersecurity Capabilities

QS Communications boasts robust cybersecurity capabilities, a significant strength in today's digital landscape. The company has notably expanded its IT security services, demonstrating a commitment to protecting client data and infrastructure. This expansion is underscored by the opening of their second Cyber Defence Center in Riga in June 2025, a strategic move to bolster their capacity to combat evolving cyber threats.

This enhanced security infrastructure provides a critical competitive advantage, assuring clients of QSC AG's ability to deliver resilient and secure digital solutions. The investment in advanced defense centers and expanded services positions QS Communications as a trusted partner for businesses navigating the complexities of cybersecurity. Their proactive approach ensures clients are better equipped to handle the increasing volume and sophistication of cyberattacks.

Key aspects of their cybersecurity strengths include:

- Expanded IT Security Services: A comprehensive suite of services designed to address a wide range of cyber threats.

- Second Cyber Defence Center: The June 2025 opening in Riga enhances their operational capacity and geographic reach for security operations.

- Client Confidence and Resilience: Providing clients with the assurance of robust protection against digital vulnerabilities.

Strategic Nearshoring and Offshoring Model

QS Communications' strategic nearshoring and offshoring model is a significant strength. By increasing its workforce in locations like Latvia, Spain, India, and the USA, the company enhances operational efficiency and cost-effectiveness. This global talent strategy allows QS Communications to access specialized skills and optimize resource deployment, ultimately leading to better service delivery and improved profitability.

This diversification of its employee base is particularly beneficial in the current economic climate. For instance, in 2024, companies leveraging nearshoring reported an average cost reduction of 20-30% compared to onshore operations, according to industry analyses. QS Communications' presence in these key regions not only provides a cost advantage but also ensures business continuity and access to a wider range of expertise.

- Global Talent Access: Taps into diverse skill sets across Latvia, Spain, India, and the USA, fostering innovation and specialized service capabilities.

- Cost Optimization: Leverages competitive labor markets to reduce operational expenses, enhancing overall financial performance.

- Operational Efficiency: Streamlines processes and resource allocation by strategically placing employees in optimal locations.

- Resilience and Scalability: Builds a more robust operational framework capable of adapting to market demands and scaling services effectively.

QS Communications, now q.beyond AG, demonstrates a strong financial footing with a debt-free balance sheet and positive free cash flow as of Q1 2025. Their strategic focus on operational efficiency, targeting an EBITDA margin of at least 10% by 2025, underpins this resilience.

The company's robust cybersecurity services, highlighted by the June 2025 opening of their second Cyber Defence Center in Riga, significantly bolsters client confidence and operational resilience against evolving threats.

QS Communications' strategic nearshoring and offshoring model, with a growing workforce in Latvia, Spain, India, and the USA, enhances cost-effectiveness and access to specialized talent, contributing to improved service delivery and profitability.

Their deep specialization in serving Germany's vital SME sector, the Mittelstand, allows for highly tailored digital transformation solutions and fosters strong, enduring client relationships.

| Metric | Q1 2025 (Actual) | Target 2025 |

|---|---|---|

| Balance Sheet Status | Debt-Free | N/A |

| Free Cash Flow | Positive | N/A |

| EBITDA Margin | N/A | >= 10% |

What is included in the product

Analyzes QS Communications’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Highlights key communication strengths and weaknesses to proactively address potential issues and improve messaging effectiveness.

Weaknesses

QS Communications saw a modest adjusted revenue growth of 2% in Q1 2025 compared to the prior quarter. This indicates a potential hurdle in expanding its market share within the dynamic IT sector or in translating new client acquisitions into substantial revenue gains.

QSC AG's significant reliance on the German market presents a notable weakness. In 2023, the company generated the vast majority of its revenue domestically, with international sales accounting for a minimal percentage. This geographic concentration means QSC is highly susceptible to the specific economic downturns, evolving regulatory landscapes, and intense competition within Germany, limiting its potential for growth and resilience.

The current economic climate in Germany presents a significant challenge for QSC AG. A prolonged period of economic weakness could lead to businesses, particularly small and medium-sized enterprises (SMEs) that form a core part of QSC's customer base, scaling back their IT investments or postponing crucial digital transformation initiatives. This directly translates into a potential slowdown in new orders and can dampen revenue growth, even with QSC's efforts to build a more resilient business model.

Exposure to Customer Insolvency Risks

QS Communications faces a significant weakness in its exposure to customer insolvency risks. A reported EBITDA loss in Q1 2025, directly attributed to a customer's insolvency, underscores this vulnerability. This event highlights that the financial health of its client base is a direct determinant of the company's own financial performance.

The potential for a broader trend of Small and Medium-sized Enterprise (SME) insolvencies, particularly in the current economic climate, poses a substantial threat. If more clients face financial distress, QS Communications could experience a cascading negative impact on its revenue and profitability. This necessitates a more robust and proactive approach to credit risk assessment and management.

- EBITDA Impact: A Q1 2025 EBITDA loss was directly linked to a customer insolvency.

- SME Vulnerability: A wider trend of SME insolvencies could disproportionately affect QS Communications.

- Risk Management Need: The company must enhance its credit risk assessment protocols.

Intense Competition from Larger Players

QS Communications faces a significant hurdle due to intense competition within the German IT services sector. This market is characterized by a multitude of players, including large, established global technology and consulting firms that wield considerable influence.

These larger competitors often leverage their substantial financial backing to engage in aggressive pricing strategies, broad-reaching marketing campaigns, and significant investments in research and development. This can directly impact QSC AG's ability to maintain its market share and exert pricing power.

- Market Share Pressure: Larger rivals with deeper pockets can absorb lower margins, potentially squeezing QSC AG's profitability.

- R&D Disadvantage: Competitors investing heavily in innovation may offer more advanced solutions, making it harder for QSC AG to compete on technological merit.

- Brand Recognition: Global players often benefit from established brand recognition, which can sway customer preference.

QS Communications' heavy reliance on the German market, where it generated the vast majority of its revenue in 2023, leaves it vulnerable to domestic economic fluctuations and intense local competition.

The company experienced an EBITDA loss in Q1 2025 directly attributed to a customer insolvency, highlighting a significant weakness in managing customer credit risk, especially given the potential for broader SME insolvencies in the current economic climate.

Intense competition from larger, well-funded global IT firms puts pressure on QSC AG's market share and pricing power, as these competitors can invest more heavily in R&D and marketing.

| Weakness | Description | Impact |

|---|---|---|

| Geographic Concentration | Over 90% of revenue from Germany (2023) | Susceptible to German economic downturns and regulatory changes |

| Customer Insolvency Risk | EBITDA loss in Q1 2025 due to customer insolvency | Directly impacts profitability; potential for cascading effects from SME distress |

| Intense Competition | Presence of large global IT firms | Challenges market share, pricing power, and R&D investment capacity |

Preview the Actual Deliverable

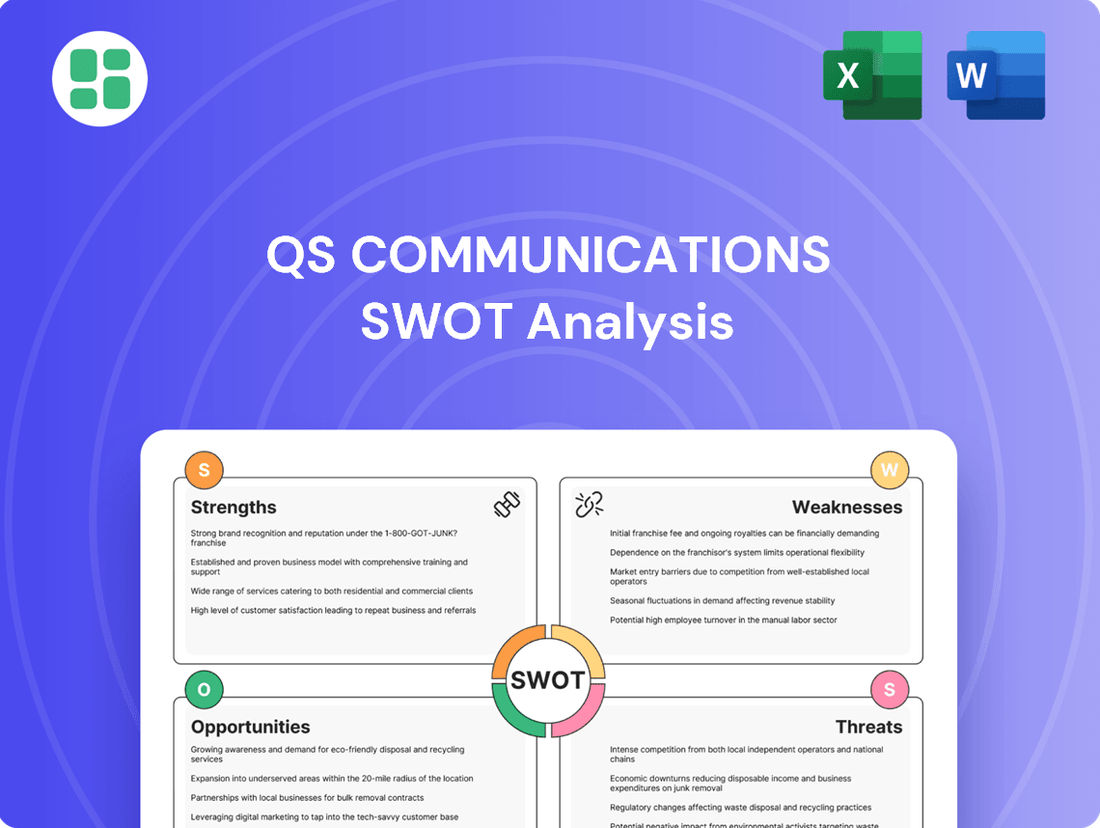

QS Communications SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the comprehensive analysis for QS Communications, offering a clear glimpse into its strategic landscape.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete understanding of QS Communications' strengths, weaknesses, opportunities, and threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, ensuring you receive the full, detailed strategic assessment for QS Communications.

Opportunities

Germany's digital transformation is a major opportunity, especially for small and medium-sized businesses (SMEs). This sector is actively seeking to modernize, creating a substantial and growing market for companies like QSC AG that offer comprehensive IT solutions. Projections indicate this trend will continue, with significant growth expected through 2029, meaning a larger pool of potential clients.

The German IT market's strong growth, particularly within the SME segment, presents a clear advantage for QSC AG. In 2023, the German IT market was valued at approximately €108 billion and is forecast to expand further. This widespread adoption of digital technologies by businesses directly translates into a vast and expanding addressable market for QSC AG's diverse IT services and solutions.

The German market for digital transformation, particularly cloud computing, is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2027. This surge in cloud adoption presents a significant opportunity for QSC AG, given its established expertise and comprehensive portfolio of cloud solutions. The company is well-positioned to capitalize on this trend, driving increased customer adoption and expanding its revenue streams within this dynamic sector.

German businesses are significantly boosting their IT security spending, with projections indicating a substantial rise in the cybersecurity market. For instance, the German cybersecurity market was valued at approximately €5.7 billion in 2023 and is expected to grow annually by 8.5% through 2028. This surge is driven by an increase in sophisticated cyberattacks and a growing emphasis on compliance with regulations like the NIS2 Directive.

QSC AG is well-positioned to benefit from this trend. Their enhanced cybersecurity offerings, including advanced threat detection and response capabilities, along with their specialized Cyber Defence Centers, directly address the escalating demand from German enterprises. This strategic focus allows QSC to capture a significant share of this vital and rapidly expanding market segment.

Growth in AI and Automation Adoption

The German market is witnessing a significant surge in Artificial Intelligence (AI) and automation adoption, with businesses increasingly turning to these technologies to boost productivity and drive innovation. For instance, a 2024 Bitkom study revealed that 70% of German companies are already using AI in some form, highlighting a strong demand for AI-driven solutions. QSC AG is well-positioned to capitalize on this trend by embedding AI into its current service offerings and pioneering new AI-powered products. This strategic move can unlock substantial growth opportunities and solidify its competitive standing in the evolving digital landscape.

QSC AG can strategically enhance its market position by focusing on AI and automation in several key areas:

- AI-Powered Network Optimization: Implementing AI to proactively manage and optimize network performance, reducing downtime and improving customer experience.

- Automated Customer Service Solutions: Developing AI-driven chatbots and virtual assistants to handle customer inquiries efficiently, freeing up human resources for more complex tasks.

- Data Analytics and Insights: Leveraging AI to analyze vast datasets, providing clients with actionable business intelligence and predictive insights.

- Smart Building and IoT Integration: Expanding services to include AI-enabled solutions for smart buildings and the Internet of Things (IoT), catering to the growing demand for connected environments.

Government-Backed Digitalization Initiatives

The German government's commitment to digital transformation presents a significant opportunity for QSC AG. Initiatives like the 'Digital Jetzt' program, which provided grants of up to 50% for digitalization projects for small and medium-sized enterprises (SMEs), directly align with QSC's service offerings. The 'Digital Strategy 2025' further underscores this focus, aiming to accelerate digital adoption across various sectors.

QSC can strategically position itself to benefit from these government-backed initiatives. By aligning its cloud, IoT, and cybersecurity solutions with the objectives of these programs, QSC can tap into a broader market of subsidized clients. This alignment can also foster valuable partnerships with government agencies and other technology providers involved in these national digitalization efforts.

- Government Funding: Programs like 'Digital Jetzt' have allocated substantial funds to support SME digitalization, creating a direct avenue for QSC to acquire new clients.

- Market Expansion: Aligning with national digital strategies allows QSC to expand its reach into segments actively encouraged and supported by the German federal government.

- Strategic Partnerships: Collaboration opportunities with government-backed digitalization projects can lead to enhanced credibility and access to a wider ecosystem of stakeholders.

Germany's digital transformation is a significant opportunity, with the IT market valued at approximately €108 billion in 2023 and expected to grow. The increasing adoption of cloud computing, projected with a CAGR over 15% through 2027, and a rising cybersecurity market, valued at €5.7 billion in 2023 and growing 8.5% annually, present substantial avenues for QSC AG. Furthermore, the widespread use of AI, with 70% of German companies employing it in 2024, and supportive government initiatives like 'Digital Jetzt' directly align with QSC's service portfolio, creating a fertile ground for expansion and new client acquisition.

| Market Segment | 2023 Value (Approx.) | Projected Growth | Opportunity for QSC AG |

|---|---|---|---|

| German IT Market | €108 Billion | Continued Expansion | Broad demand for comprehensive IT solutions |

| Cloud Computing (Germany) | - | CAGR > 15% (through 2027) | Leveraging expertise in cloud solutions |

| Cybersecurity (Germany) | €5.7 Billion | 8.5% Annual Growth (through 2028) | Addressing increased demand for security offerings |

| AI Adoption (Germany) | 70% of companies using AI (2024) | Increasing integration | Embedding AI in services and developing new AI products |

Threats

Germany's IT sector is grappling with a critical deficit of skilled professionals, with estimates suggesting over 90,000 open positions in 2024. This acute shortage directly impacts QS Communications by escalating recruitment expenses and potentially delaying crucial project timelines. The inability to secure enough qualified IT personnel can stifle the company's ability to innovate and expand its service offerings.

The German IT market is a crowded space, with many companies vying for business. This intense competition, particularly from both local and global players, puts significant pressure on pricing. For QS Communications, this could mean facing price wars that shrink profit margins, making it harder to invest in growth.

To stand out, QS Communications must constantly innovate and offer unique value. Failing to differentiate in this fragmented market, where providers often offer similar services, risks losing ground. For instance, the German IT services market saw revenue growth of approximately 4.5% in 2024, but this growth is spread across many participants, intensifying the need for strategic positioning.

Germany's economic performance presents a significant challenge for QS Communications. The ongoing weakness, characterized by high energy costs and persistent inflation, directly impacts the IT spending capacity of small and medium-sized enterprises (SMEs), a key customer segment. For instance, in late 2024, German industrial production saw a notable contraction, reflecting broader economic strains.

These macroeconomic headwinds translate into a direct threat of reduced demand for QSC AG's digital transformation and IT services. As businesses tighten their belts, investments in new technologies and outsourced IT solutions are often among the first to be deferred or scaled back, potentially hindering QSC's revenue growth trajectory throughout 2025.

Rapid Technological Obsolescence

The telecommunications sector, including companies like QSC AG, faces significant disruption from rapid technological obsolescence. The relentless pace of innovation in areas such as cloud computing, cybersecurity, and artificial intelligence demands constant and substantial investment in research and development. For instance, the global spending on AI is projected to reach $1.8 trillion by 2030, highlighting the critical need for companies to stay at the forefront of these advancements to remain competitive.

Failure by QSC AG to adapt swiftly to these emerging technologies could lead to its current solutions becoming outdated. This would not only erode its competitive edge but also diminish its market relevance. Companies that lag in adopting new standards, like the ongoing evolution of 5G and the nascent development of 6G, risk losing market share to more agile competitors. QSC AG's strategic response must include continuous upskilling of its workforce to manage and leverage these new technologies effectively.

- Cloud Computing Advancements: Continuous investment is needed to integrate and offer next-generation cloud services, ensuring compatibility with evolving infrastructure.

- Cybersecurity Evolution: The threat landscape changes daily, requiring constant updates to security protocols and solutions to protect against sophisticated cyberattacks.

- AI Integration: Proactive integration of AI into network management, customer service, and data analytics is crucial for efficiency and innovation.

- 5G/6G Development: Staying ahead of the curve in deploying and managing advanced mobile network technologies is essential for future revenue streams.

Increasing Regulatory and Compliance Burden

The increasing regulatory and compliance burden presents a significant threat. New and evolving regulations in Germany and the EU, such as GDPR, NIS2, and DORA, create complex requirements for IT service providers like QS Communications. Failure to comply can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher. This necessitates ongoing investment in legal expertise and robust technical solutions to maintain adherence, diverting resources from core business development.

The intensifying competition within the German IT market, marked by a significant number of players, poses a threat of price erosion for QS Communications. Furthermore, a pronounced shortage of skilled IT professionals in Germany, with over 90,000 unfilled positions in 2024, escalates recruitment costs and risks project delays.

Economic headwinds in Germany, including high energy costs and inflation, are dampening IT spending among SMEs, a key customer base for QS Communications. This macroeconomic weakness, evidenced by contractions in industrial production in late 2024, directly translates to a threat of reduced demand for the company's services.

Rapid technological obsolescence in areas like cloud computing and AI necessitates continuous, substantial R&D investment. Failure to adapt to advancements, such as the ongoing evolution of 5G, could lead to outdated solutions and diminished market relevance for QS Communications.

The increasing regulatory landscape, including GDPR and NIS2, imposes complex compliance demands on IT service providers like QS Communications. Non-compliance risks significant financial penalties, diverting essential resources from core business development and innovation efforts.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from QS Communications' official financial statements, comprehensive market research reports, and valuable insights from industry experts to provide a well-rounded and accurate assessment.