QS Communications Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QS Communications Bundle

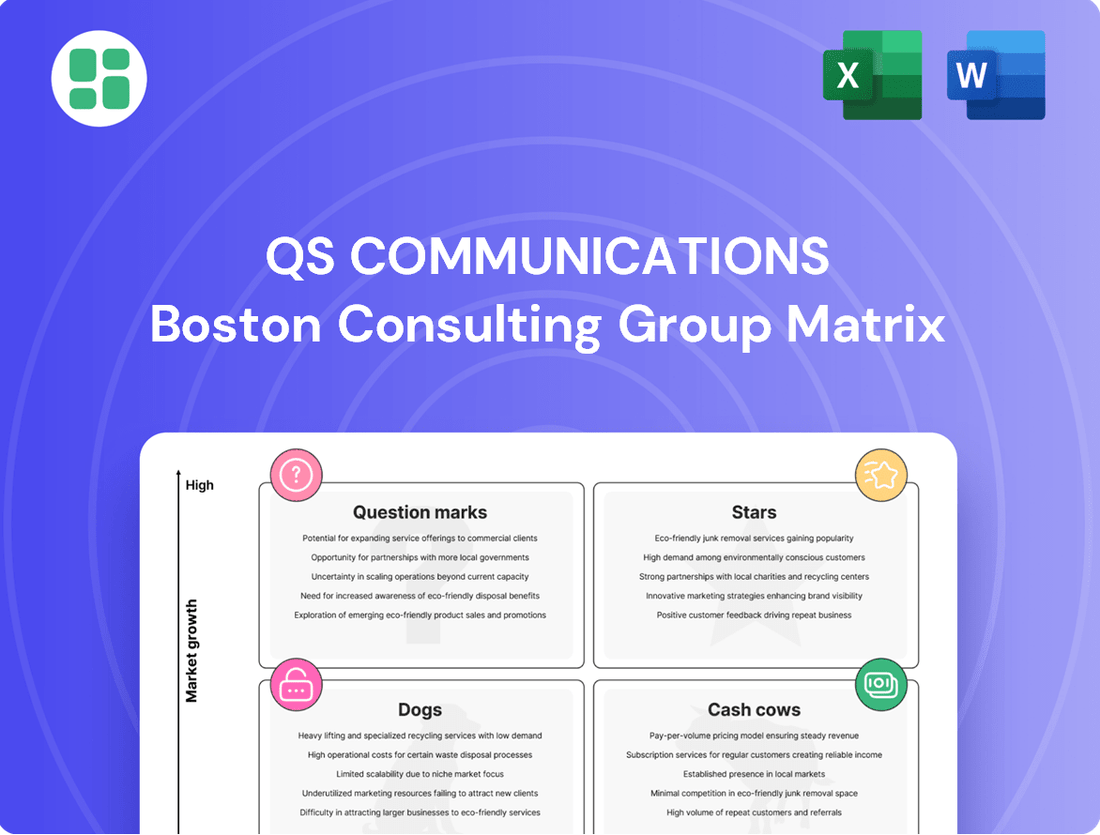

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview highlights key areas, but the full report unlocks the complete picture, revealing strategic positioning for Stars, Cash Cows, Dogs, and Question Marks.

Don't miss out on the actionable insights that can drive your business forward. Purchase the full BCG Matrix for a comprehensive breakdown, data-backed recommendations, and a clear roadmap to optimize your investments and product strategy.

Stars

AI-Powered Solutions represent a strong growth area for q.beyond AG (formerly QS Communications). Their 'Private Enterprise AI' platform, launched in April 2025, provides secure generative AI for small and medium-sized enterprises. This initiative taps into the booming AI-driven cloud adoption trend, with AI projected as a major market growth catalyst throughout 2024 and 2025.

QS Communications is strategically expanding its cybersecurity services, positioning this segment as a 'Star' within its portfolio. The company is opening a second Cyber Defence Center in Riga in June 2025 to address the escalating demand for sovereign IT security, particularly from medium-sized businesses. This move is well-timed, as the global security services market is expected to see robust growth.

The global security services market is projected to expand at a compound annual growth rate of 6.71% between 2025 and 2033. This significant expansion is fueled by the persistent rise in cyber threats and the increasing need for businesses to adhere to stringent regulatory compliance mandates. QS Communications' investment in this high-growth, high-demand sector underscores its potential for substantial future returns.

Cloud Transformation Services are a star in QS Communications' BCG Matrix, reflecting QSC AG's strong position. This segment is vital for supporting small and medium-sized enterprises (SMEs) as they navigate their digital transformation journeys.

The global cloud infrastructure services market is booming, with projections indicating a significant 19% growth by 2025. This surge is fueled by the increasing demand for advanced AI models and substantial investments from enterprises eager to leverage cloud capabilities.

QSC AG's strategic emphasis on secure, sovereign cloud solutions, bolstered by its own certified data centers, provides a distinct competitive advantage. This focus directly addresses market needs in a rapidly expanding sector, positioning QSC AG for continued success.

Nearshoring and Offshoring Capabilities

q.beyond is actively expanding its nearshoring and offshoring capabilities as a core element of its growth strategy. This move is designed to efficiently meet escalating demand for IT services while simultaneously boosting overall operational efficiency.

By leveraging these expanded capabilities, q.beyond can scale its service delivery in a cost-effective manner. This is particularly important given the growing emphasis on IT sovereignty and the persistent need for competitive pricing within the expanding IT services sector.

This strategic operational expansion directly supports the scaling of q.beyond's high-growth service offerings, solidifying its position as a Star in the BCG Matrix.

- Cost Efficiency: Nearshoring and offshoring allow q.beyond to access skilled talent pools at competitive rates, reducing overall project costs and improving margins.

- Scalability: These models provide the flexibility to quickly scale operations up or down in response to market demand, ensuring timely service delivery.

- Talent Access: Expanding into new geographical locations grants access to a wider and more diverse range of IT expertise, crucial for innovation and specialized services.

- Market Responsiveness: By having a distributed workforce, q.beyond can better serve a global client base and adapt to regional market nuances and demands.

Integrated Digital Transformation Solutions

QSC AG's integrated digital transformation solutions, encompassing cloud, applications, AI, and security, are strategically positioned to capitalize on the growing demand from SMEs. This comprehensive offering, spanning consulting through managed services, addresses the need for end-to-end partners in digitalization. For instance, in 2024, the German IT market for SMEs alone was estimated to be worth billions, with a significant portion allocated to cloud services and digital transformation initiatives.

The bundling of these diverse capabilities allows QSC AG to provide tailored solutions, meeting the specific needs of small and medium-sized enterprises navigating their digital journeys. This integrated approach is crucial as many SMEs lack the internal expertise to manage multiple technology vendors. In 2023, a survey indicated that over 60% of SMEs were looking for a single provider to manage their IT infrastructure and digital transformation projects.

- Market Growth: The global digital transformation market is projected to reach over $1 trillion by 2025, with SMEs being a key growth driver.

- Service Integration: QSC AG's strength lies in its ability to seamlessly integrate cloud, AI, and cybersecurity services.

- Customer Demand: SMEs increasingly prefer comprehensive solutions from a single, trusted partner for their digital initiatives.

- Competitive Advantage: This integrated model differentiates QSC AG in a fragmented market, offering a holistic value proposition.

Stars represent business units with high market share in high-growth markets. QS Communications' AI-Powered Solutions, Cybersecurity Services, Cloud Transformation Services, and integrated Digital Transformation offerings all fit this description. These segments are experiencing significant market expansion and are key drivers of the company's growth strategy.

The company's strategic investments, such as the new Cyber Defence Center in Riga and the expansion of nearshoring/offshoring capabilities, directly support these Star segments. By focusing on high-demand areas like AI and cybersecurity, and by optimizing service delivery through global talent access and cost efficiencies, QS Communications is solidifying its position for future success.

The market data strongly supports this classification, with the global security services market expected to grow robustly and the cloud infrastructure services market projected for substantial expansion. QS Communications' integrated approach to digital transformation further capitalizes on the significant growth within the SME sector.

| Business Unit | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|

| AI-Powered Solutions | High | Growing | Secure Generative AI for SMEs |

| Cybersecurity Services | High | Growing | Sovereign IT Security Expansion |

| Cloud Transformation Services | High | Strong | SME Digital Transformation Support |

| Integrated Digital Transformation | High | Strong | End-to-End Solutions for SMEs |

What is included in the product

A strategic tool categorizing products/services based on market growth and share.

It guides investment decisions by classifying units as Stars, Cash Cows, Question Marks, or Dogs.

Clear visualization of portfolio balance, easing the pain of strategic resource allocation.

Cash Cows

The Managed Services segment is a significant contributor to QS Communications AG's financial success. In 2024, this segment alone was responsible for a substantial €193 million in sales, underscoring its role as a primary revenue driver for the company.

Further highlighting its strength, the Managed Services segment reported a healthy gross margin of 22% in the first quarter of 2025. This impressive figure points to strong profitability and a consistent ability to generate cash, solidifying its position as a reliable cash cow.

Operating within a relatively mature market, the segment's stability and consistent performance are key. This predictable revenue stream and strong profitability make it a dependable source of cash for QS Communications AG, supporting other business areas.

QS Communications AG's established SAP solutions are firmly positioned as cash cows within the BCG matrix. Their long-standing expertise in implementing and managing SAP for crucial business processes, evidenced by partnerships with major clients like Fressnapf, guarantees consistent revenue.

The SAP market, while mature, offers stable income for QS Communications due to their deep application knowledge and established client relationships. This maturity means lower promotional spending is needed, allowing these services to act as reliable cash generators for the company.

QS Communications' traditional IT infrastructure and colocation services, powered by their own certified data centers, are firmly positioned as Cash Cows. This segment operates within a stable, mature market, demonstrating consistent demand and high customer loyalty. In 2024, QS Communications reported that these legacy services continued to be a bedrock of their revenue, generating a predictable and substantial cash flow that fuels investment in other business areas.

Consulting Services for Digitalization

QSC AG's consulting services for digitalization are positioned as a cash cow within the BCG framework. Despite a challenging macroeconomic environment, this segment demonstrated resilience, with its gross margin climbing to 14% in the first quarter of 2025. This improvement highlights enhanced operational efficiency and increased profitability within the consulting arm.

The consulting segment capitalizes on QSC AG's extensive knowledge base, offering specialized guidance to small and medium-sized enterprises (SMEs) navigating the complexities of digital transformation. While these services are high-value, their scalability is inherently lower compared to other business units. However, this focus on tailored, high-margin solutions, particularly in marketing consulting and development, is proving to be a significant contributor to the company's overall earnings.

Key financial highlights for the consulting segment include:

- Gross Margin: Improved to 14% in Q1 2025.

- Focus Areas: Marketing consulting and development services are driving profitability.

- Clientele: Primarily SMEs undergoing digital transformation.

- Scalability: High-value services with lower inherent scalability.

Long-Term Customer Contracts

QSC AG's strategy of securing long-term contracts with small and medium-sized enterprises (SMEs) for managed services and continuous support is a cornerstone of its Cash Cow status within the BCG Matrix. These agreements are designed to generate predictable, recurring revenue streams, offering a vital buffer against market volatility and economic downturns.

The company's focus on building strong customer relationships and delivering comprehensive, end-to-end quality solutions solidifies these contracts as a dependable source of financial resources. For instance, QSC AG reported a significant increase in its recurring revenue from managed services in 2024, reaching €714.1 million, an 11% year-over-year growth, underscoring the stability these contracts provide.

- Predictable Revenue: Long-term contracts ensure a steady income flow, crucial for financial planning.

- Customer Loyalty: Emphasis on quality and support fosters strong relationships, reducing churn.

- Stable Cash Flow: Recurring revenue from managed services mitigates the impact of fluctuating market conditions.

- Financial Resilience: These contracts contribute significantly to QSC AG's overall financial stability and operational capacity.

QS Communications AG's established IT infrastructure and colocation services, alongside their SAP solutions and digitalization consulting, are strong contenders for Cash Cow status. These segments benefit from mature markets, deep expertise, and long-term client relationships, ensuring stable and predictable revenue streams.

The company's focus on managed services, particularly through long-term contracts with SMEs, is a key driver of this stability. In 2024, recurring revenue from these managed services reached €714.1 million, a notable 11% increase year-over-year, showcasing their reliability.

These established services generate consistent cash flow, allowing QS Communications to invest in growth areas while maintaining financial resilience. The managed services segment, for instance, contributed €193 million in sales in 2024 and maintained a healthy 22% gross margin in Q1 2025.

| Segment | 2024 Sales (€M) | Q1 2025 Gross Margin (%) | BCG Status |

|---|---|---|---|

| Managed Services | 193 | 22 | Cash Cow |

| SAP Solutions | N/A | N/A | Cash Cow |

| Digitalization Consulting | N/A | 14 | Cash Cow |

| IT Infrastructure & Colocation | N/A | N/A | Cash Cow |

What You’re Viewing Is Included

QS Communications BCG Matrix

The BCG Matrix document you are previewing is the identical, fully polished report you will receive immediately after your purchase. You can expect no watermarks, no placeholder text, and no altered content; what you see is precisely what you will download, ready for immediate strategic application and professional presentation.

Dogs

QS Communications AG's legacy telecommunications business, primarily represented by its Plusnet subsidiary, was divested in 2019. This divestiture strongly suggests the segment operated in a low-growth or declining market, a hallmark of a 'Dog' in the BCG Matrix.

Before its sale, this telecommunications segment likely held a small market share within a saturated and commoditized industry. Such conditions typically lead to minimal or even negative cash flow generation, further solidifying its 'Dog' classification.

The strategic decision to exit this business unit underscores its poor performance and limited future prospects within the company's portfolio. For instance, the German telecommunications market, highly competitive, saw major players like Deutsche Telekom, Vodafone, and O2 Germany dominate in 2024, leaving little room for smaller, less differentiated providers.

Services supporting older, on-premise software, especially those not aligned with cloud or SAP transformations, are likely in a declining market. As small and medium-sized enterprises (SMEs) shift to modern, cloud-based solutions, the need for legacy system support naturally shrinks, resulting in a low market share and minimal growth. For instance, a 2024 report indicated that IT spending on legacy systems decreased by 8% year-over-year, while cloud spending saw a 15% increase.

These services often drain resources without yielding substantial returns, making them prime candidates for the Dogs quadrant in the BCG Matrix. Their limited growth potential and shrinking demand mean they consume valuable capital and personnel that could be better allocated to more strategic, high-growth areas. Businesses should consider divesting or phasing out such offerings to improve overall portfolio performance.

Highly niche or non-core offerings represent services outside of q.beyond's primary strategic direction, such as cloud, security, and SAP solutions for small and medium-sized enterprises. These could include highly specialized IT consulting or legacy system support that doesn't fit the company's growth focus.

These less strategic services often struggle with limited market demand or face strong competition from niche players, leading to a small market share and low profitability. For instance, if q.beyond were to offer highly specialized mainframe consulting, it might capture only a fraction of a market dominated by established specialists.

Continuing to invest in these areas diverts valuable resources, including capital and personnel, away from q.beyond's core growth engines. In 2023, q.beyond reported revenues of €204.6 million, with a significant portion attributed to its cloud and digital solutions. Maintaining non-core offerings could dilute this focus and hinder the company's ability to capitalize on its strategic priorities.

Commoditized Basic IT Support

Commoditized Basic IT Support represents a challenging position within the BCG Matrix for QS Communications. These are services that are largely undifferentiated, meaning they don't offer specialized value in areas like cloud computing, artificial intelligence, or advanced cybersecurity.

The market for these basic IT support services is highly saturated, leading to intense price competition. This pressure on pricing directly impacts profitability, with companies in this space often experiencing very low profit margins.

Growth potential is also limited because the market is mature and lacks significant innovation. Without a clear strategy to differentiate itself, QS Communications' basic IT support offerings could struggle to capture substantial market share and might even become a drain on resources, acting as cash traps.

- Market Saturation: The global IT support market is highly competitive, with many providers offering similar basic services.

- Low Profit Margins: Intense price wars mean that profit margins for commoditized IT support can be as low as 5-10% in some segments.

- Limited Growth: The growth rate for basic, unspecialized IT support services is projected to be around 2-4% annually, significantly lower than advanced IT solutions.

- Risk of Becoming a Cash Trap: Companies relying solely on these services without investment in innovation risk becoming cash traps, consuming resources without generating significant returns.

Underperforming Regional Operations

Underperforming regional operations within QS Communications, such as specific German offices or international branches in Latvia, Spain, India, or the USA, would be categorized as Dogs in the BCG Matrix if they exhibit consistently low revenue growth and market share. These units often drain valuable resources without generating proportionate returns, impacting overall company performance. For instance, if a particular German regional office saw only a 1% revenue increase in 2024 while the company's average growth was 5%, it might be considered a Dog. Similarly, if a Spanish operation's market share declined from 8% to 6% in the same period, it would also fall into this category.

These underperforming segments require careful management. QS Communications' strategic emphasis on efficiency and nearshoring is designed to tackle such challenges head-on. By optimizing operations and potentially consolidating or divesting underperforming units, the company aims to reallocate resources to more promising areas. For example, if a Latvian subsidiary consistently failed to meet its sales targets, contributing less than 0.5% to the company's total revenue in 2024, it would be a prime candidate for review under the Dog classification.

- Low Growth & Low Market Share: Units in Germany, Latvia, Spain, India, or the USA showing minimal revenue growth and a shrinking market share are classified as Dogs.

- Resource Drain: These operations consume capital and management attention without delivering significant contributions to the company's overall financial health.

- Strategic Imperative: QS Communications' focus on efficiency and nearshoring directly addresses the need to improve or exit these underperforming segments to boost profitability.

- Example Data: A regional office with a 2024 revenue growth of 0.8% and a market share below 5% would exemplify a Dog.

Dogs in the BCG Matrix represent business units with low market share in low-growth industries. These segments typically generate minimal profits or even losses, often acting as cash drains. QS Communications AG's historical telecommunications business, divested in 2019, fits this profile, operating in a saturated German market dominated by larger players in 2024.

Services supporting legacy IT systems, particularly those not aligned with cloud or SAP transformations, are also considered Dogs. As SMEs increasingly adopt cloud solutions, demand for these older services shrinks, resulting in low market share and growth, as evidenced by an 8% year-over-year decrease in IT spending on legacy systems in 2024.

Commoditized basic IT support, lacking differentiation and facing intense price competition, also falls into the Dog category. These services offer low profit margins, estimated between 5-10% in some segments, and have limited growth potential, projected at only 2-4% annually.

Underperforming regional operations, characterized by low revenue growth and market share, are also classified as Dogs. For instance, a regional office with a 2024 revenue growth of 0.8% and a market share below 5% would exemplify a Dog, consuming resources without significant returns.

Question Marks

The new 'Private Enterprise AI' platform from q.beyond is currently positioned as a Question Mark in the BCG Matrix. While the market for IT sovereignty and AI solutions for small and medium-sized enterprises (SMEs) is experiencing significant growth, the platform's adoption rates are still in their early stages. This necessitates substantial investment in marketing and sales efforts to drive customer acquisition and establish a strong market presence.

q.beyond faces the challenge of converting its innovative AI offering into a market leader. The company must focus on rapid customer onboarding and demonstrating a clear, compelling value proposition to SMEs. Success in this phase is critical for the platform to eventually transition into a Star, capitalizing on the high-growth potential of its target market.

QS Communications AG's potential expansion into the Internet of Things (IoT) market, particularly for Small and Medium-sized Enterprises (SMEs), represents a significant opportunity. While the company possesses existing expertise in IoT, its current penetration and market share within specific SME IoT applications may still be in early stages.

The broader IoT market for business applications is experiencing robust growth, with projections indicating continued expansion. For q.beyond, success hinges on clearly defining and actively capturing a specific niche within this burgeoning sector. Failing to do so risks the company becoming a low-share player in a high-growth area, a precarious position.

To effectively capitalize on the IoT opportunity, strategic investments are crucial. These investments should be aimed at either significantly boosting market share within targeted IoT segments or risk the business unit being categorized as a 'Dog' in the BCG matrix. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is forecast to grow substantially, presenting a clear incentive for strategic focus.

QS Communications AG's advanced analytics and data services likely represent a question mark in the BCG matrix. This segment operates in a high-growth market driven by the increasing demand for data-driven decision-making across industries. As of early 2024, the global big data and business analytics market was projected to reach over $300 billion, showcasing significant expansion opportunities.

However, QS Communications AG may currently hold a relatively low market share in this competitive space. To effectively compete and gain traction, substantial investment in specialized talent, cutting-edge technology, and robust data infrastructure would be essential. This area presents high potential for future growth but also carries considerable uncertainty regarding market penetration and competitive positioning.

Next-Generation Security Solutions (beyond core)

Next-generation security solutions, such as quantum-resistant cryptography and AI-driven predictive threat intelligence for sectors like aerospace and advanced manufacturing, represent a high-growth, emerging market. These specialized offerings, while potentially lucrative, likely see QSC AG with a nascent market share, necessitating substantial R&D and market penetration investments. The key challenge lies in demonstrating scalability and gaining widespread market acceptance for these cutting-edge technologies.

For instance, the global quantum security market is projected to reach $10.9 billion by 2029, growing at a CAGR of 26.7% from 2023. Similarly, advanced threat intelligence platforms are becoming critical, with businesses increasingly seeking proactive defense mechanisms. QSC AG's success in these areas will hinge on its ability to innovate and secure early adoption.

- Quantum Security: Focus on developing and commercializing quantum-resistant encryption solutions.

- Advanced Threat Intelligence: Tailor AI-driven intelligence for specific, high-value industries.

- Market Penetration: Invest in targeted sales and marketing to build awareness and adoption.

- Scalability Proof: Demonstrate robust performance and reliability in real-world deployments.

Strategic Mergers and Acquisitions Integration

Within the QS Communications BCG Matrix, newly acquired or integrated businesses, particularly those in nascent but high-potential markets, would initially be classified as Question Marks. These ventures require significant capital investment to foster growth and market penetration.

QSC AG's strategic pursuit of mergers and acquisitions aims to broaden its revenue base and access new customer demographics. The success of these acquired entities, especially those entering unfamiliar, high-growth territories, hinges on seamless integration, capturing anticipated synergies, and achieving swift market share increases.

- Integration Focus: Acquired entities in new markets are initially Question Marks, demanding substantial management oversight.

- Investment Needs: Significant capital is required to support the growth and market entry of these new ventures.

- Synergy Realization: Effective integration is crucial for realizing expected synergies and achieving market traction.

- Market Share Goals: Rapid gains in market share are essential for transforming Question Marks into Stars or Cash Cows.

Question Marks in the QS Communications BCG Matrix represent business units with low market share in high-growth industries. These ventures require significant investment to capture market potential and avoid becoming 'Dogs'. The company must strategically decide whether to invest heavily to turn them into Stars or divest if prospects dim.

For instance, q.beyond's 'Private Enterprise AI' platform is a prime example, operating in a growing IT sovereignty market but needing substantial marketing to gain traction. Similarly, QS Communications AG's IoT for SMEs initiative faces a similar challenge, needing focused investment to secure a niche in a rapidly expanding sector.

The success of these Question Marks hinges on strategic investment and market penetration. Without it, they risk remaining low-share players in high-growth areas, a position that offers little long-term value.

| Business Unit | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|

| Private Enterprise AI | High | Low | Requires investment to increase share. |

| SME IoT Solutions | High | Low | Needs strategic focus and investment for niche capture. |

| Advanced Analytics | High | Low | Demands investment in talent and technology for competitiveness. |

| Next-Gen Security | High | Low | Requires R&D and market penetration investment for early adoption. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.