QS Communications Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QS Communications Bundle

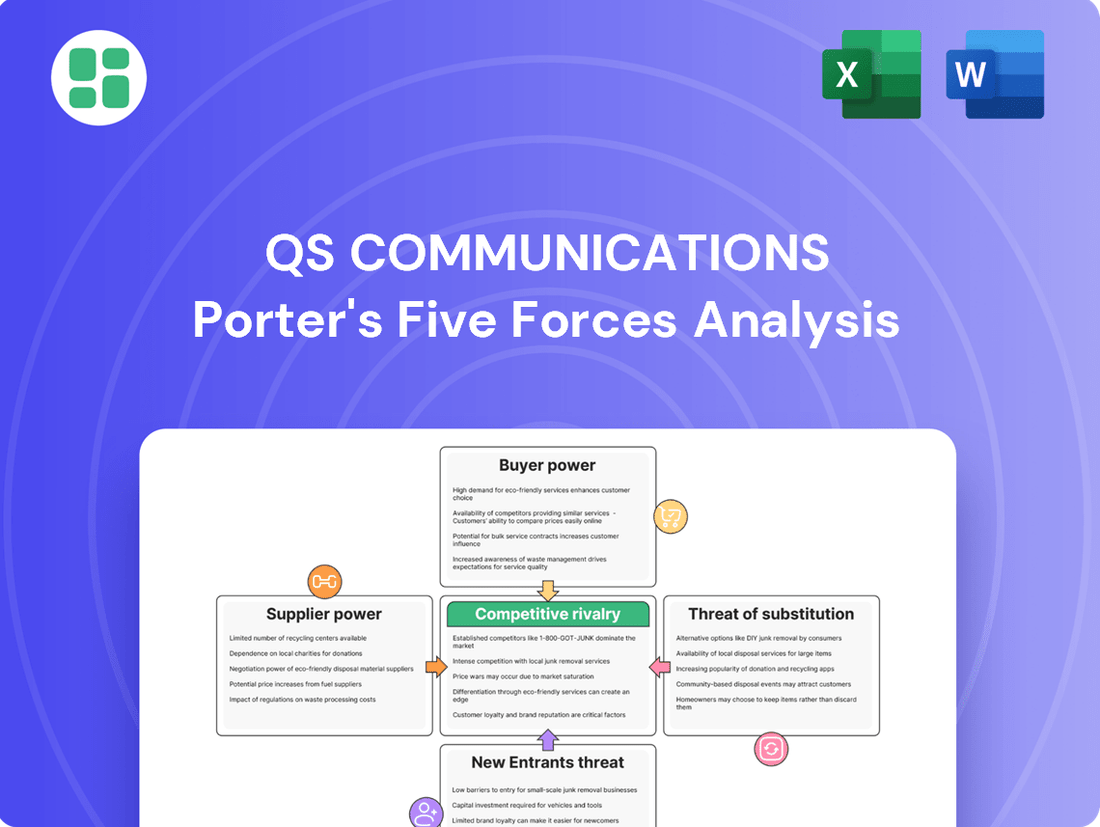

QS Communications operates within a dynamic market, shaped by the interplay of buyer power, supplier leverage, and the threat of new entrants. Understanding these forces is crucial for navigating the competitive landscape effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore QS Communications’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

QS Communications' bargaining power with suppliers is influenced by the concentration and specialization of its key component providers. For instance, if there are only a handful of companies offering essential hardware, or if critical software licenses, such as those from SAP, are sourced from a limited number of vendors, these suppliers gain significant leverage. This is particularly true when their offerings are highly specialized or proprietary, making it difficult for QS Communications to find viable alternatives.

The degree to which QS Communications AG has unique or highly specific needs for its service delivery also plays a crucial role. If its requirements are standard and easily met by multiple suppliers, its bargaining power increases. Conversely, if its operational model relies on niche technologies or customized solutions that only a few suppliers can provide, those suppliers can command higher prices and more favorable terms. For example, in 2024, the global semiconductor shortage highlighted how limited supply and high demand for specialized chips significantly boosted the bargaining power of chip manufacturers, impacting companies across various industries, including telecommunications.

QSC AG faces significant switching costs when considering a change in major suppliers, particularly for its cloud infrastructure and core IT solutions. These costs extend beyond mere financial outlays, encompassing complex operational hurdles.

Re-platforming cloud solutions, for instance, can involve substantial financial investments, potentially running into millions of euros, and require extensive data migration which is inherently complex and time-consuming. Furthermore, retraining staff on new software and operational procedures represents a considerable operational expense and can lead to temporary dips in productivity.

The complexity of integrating new systems with existing QSC AG infrastructure, coupled with the potential for service disruptions during the transition, further amplifies these switching costs. For example, a disruption to their cloud services could impact customer access to critical communication platforms, directly affecting revenue streams and customer satisfaction.

The bargaining power of suppliers for QSC AG is a key factor in its operational efficiency and profitability. The criticality of a supplier's input directly influences the leverage they hold. For QSC AG, essential components like network infrastructure, specialized software, and cloud computing resources are fundamental to delivering its telecommunications and IT services to small and medium-sized enterprises (SMEs).

In 2024, QSC AG's reliance on specific technology providers, such as those offering advanced SAP solutions or critical cloud backbone services, means these suppliers can exert considerable influence. If QSC AG's ability to serve its SME clients hinges on unique or proprietary technology from a single source, that supplier's power increases significantly, potentially impacting QSC AG's cost structure and service delivery capabilities.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant concern for QS Communications (QSC AG). If suppliers, particularly those providing critical IT infrastructure or software, were to enter the IT service market themselves, they could directly compete with QSC AG. This is a real possibility if these suppliers possess strong existing relationships with QSC AG's customers or have proprietary technology that allows them to offer similar services. Such a scenario would inherently reduce QSC AG's bargaining power.

For instance, a major cloud infrastructure provider that also offers managed IT services could potentially disintermediate QSC AG. In 2024, the IT services market continued to grow, with global IT spending projected to reach over $5 trillion, indicating a lucrative market for potential new entrants. Companies like Microsoft and Amazon Web Services (AWS), already key suppliers for many businesses, are increasingly expanding their service offerings beyond core infrastructure, directly encroaching on the territory of IT service providers.

- Potential for Disintermediation: Suppliers with deep customer insights and technological capabilities could leverage these assets to offer direct IT services, bypassing QSC AG.

- Market Dynamics: The expanding IT services sector, valued in the trillions globally, presents an attractive opportunity for suppliers to move up the value chain.

- Competitive Landscape: Major tech giants, already integral to many businesses' IT operations, are actively broadening their service portfolios, increasing the risk of direct competition from suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts QS Communications AG's (QSC AG) bargaining power with its suppliers. If alternative technologies or open-source solutions can effectively replace proprietary offerings, QSC AG gains leverage, diminishing the supplier's ability to dictate terms.

For QSC AG, evaluating the feasibility and cost-effectiveness of these alternatives is crucial. For instance, if QSC AG can source network equipment from multiple vendors offering similar performance and compatibility, rather than being tied to a single, specialized provider, its reliance on that single supplier is reduced. This is particularly relevant in the telecommunications sector where technology evolves rapidly, often leading to more commoditized components.

- Reduced Dependence: QSC AG's ability to switch to alternative inputs, such as different fiber optic cable manufacturers or cloud-based software solutions instead of on-premise hardware, directly weakens supplier power.

- Cost Savings Potential: In 2024, the telecommunications infrastructure market saw continued price competition among component suppliers, offering QSC AG opportunities to negotiate better terms if viable substitutes exist.

- Technological Advancements: The rise of open-source networking software and advancements in interoperability standards mean QSC AG can potentially reduce its reliance on proprietary, high-cost solutions, thereby enhancing its bargaining position.

The bargaining power of suppliers for QSC AG is a critical consideration, directly impacting its operational costs and strategic flexibility. When suppliers offer inputs that are highly differentiated or possess unique capabilities, their leverage increases significantly. This is especially true if QSC AG has limited alternatives or faces substantial costs in switching providers, as seen in 2024 with the ongoing demand for specialized IT infrastructure components.

The concentration of suppliers in key markets also plays a vital role. If only a few companies can provide essential services or hardware, such as advanced cloud computing platforms or specific network equipment, these suppliers can command higher prices and more favorable terms. For QSC AG, this means that providers of critical backbone services or specialized software solutions, like those from SAP, often hold considerable power due to the limited number of comparable alternatives available in the market.

The threat of suppliers integrating forward into QSC AG's business, offering direct IT services to its customer base, is a significant concern. This is amplified in 2024 as the IT services market continues its robust growth, attracting major technology players who are expanding their offerings beyond core infrastructure. Companies like Microsoft and AWS are increasingly moving into managed services, potentially competing directly with QSC AG and reducing its own bargaining power.

The availability of substitute inputs directly influences QSC AG's negotiating position. If alternative technologies or open-source solutions can effectively replace proprietary offerings, QSC AG gains leverage. For example, in 2024, the telecommunications sector saw continued price competition among component suppliers, providing QSC AG opportunities to negotiate better terms if viable substitutes for network equipment or software exist.

| Factor | Impact on QSC AG's Bargaining Power | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | Lowers QSC AG's power | Limited number of providers for advanced SAP solutions and critical cloud backbone services. |

| Switching Costs | Lowers QSC AG's power | Millions of euros for cloud re-platforming, plus data migration and retraining costs. |

| Supplier Differentiation | Lowers QSC AG's power | Reliance on specialized hardware or proprietary software with few viable alternatives. |

| Threat of Forward Integration | Lowers QSC AG's power | Major tech firms expanding into managed IT services, competing directly with QSC AG. |

| Availability of Substitutes | Increases QSC AG's power | Price competition in network equipment; rise of open-source networking software. |

What is included in the product

This analysis dissects the competitive forces impacting QS Communications, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Quickly identify and address competitive threats with a visual representation of all five forces, making strategic adjustments effortless.

Customers Bargaining Power

QS Communications' SME customers exhibit varying degrees of price sensitivity for cloud, security, and SAP solutions. This sensitivity is largely dictated by their budget constraints, the perceived value of the IT service, and how the service cost stacks up against their total operational expenses. For instance, a small business with a tight IT budget might view a 5% increase in cloud hosting fees as a significant burden, whereas a larger enterprise might absorb it more readily if the service's reliability and features are deemed essential.

In 2024, the average IT budget for SMEs in Germany, a key market for QS Communications, was estimated to be around €25,000 to €75,000 annually, according to industry reports. This range highlights that even modest price hikes can represent a substantial portion of their spending, making them more inclined to seek competitive pricing or alternative solutions. The perceived value is also critical; if a security solution is seen as directly preventing costly data breaches, customers may tolerate higher prices. Conversely, if a cloud service is viewed as a commodity, price becomes a dominant factor in decision-making.

QSC AG's customer concentration significantly impacts its bargaining power. If QSC serves a few large clients, those clients can exert considerable pressure on pricing and terms, as their business represents a substantial portion of QSC's revenue. For instance, if a single client accounts for over 10% of revenue, they possess considerable leverage.

Conversely, a highly fragmented customer base, with many small and medium-sized enterprises (SMEs), dilutes the bargaining power of any individual customer. In 2023, QSC AG reported a diverse revenue stream, with no single customer exceeding 5% of total revenue, indicating a lower risk of concentrated customer power.

For small and medium-sized enterprises (SMEs), switching from QSC AG's services can be a complex process. The effort involved in migrating critical data, reconfiguring existing IT systems to be compatible with a new provider, and potentially retraining staff on new platforms all contribute to higher switching costs, thereby diminishing customer bargaining power. For instance, in 2024, the average cost for a small business to migrate its IT infrastructure to a new cloud provider was estimated to be between €5,000 and €20,000, depending on complexity.

QSC AG actively works to increase customer stickiness by offering a suite of comprehensive managed services. These services, which can include IT infrastructure management, cybersecurity solutions, and cloud computing, create a more integrated and dependent relationship. This deep integration means that customers who rely on QSC for multiple aspects of their IT operations will face significantly higher costs and disruptions if they decide to switch providers, thus strengthening QSC's position.

Availability of Substitute Services for Customers

The availability of substitute services significantly impacts the bargaining power of QS Communications' (QSC AG) customers, particularly Small and Medium-sized Enterprises (SMEs). SMEs can readily explore alternative IT service providers or even develop in-house IT capabilities, diminishing QSC AG's leverage.

The market for IT services is highly competitive, with numerous providers offering comparable solutions. For instance, a significant portion of the SME market can leverage generalized cloud platforms like Microsoft Azure or Amazon Web Services, which offer flexible and scalable IT infrastructure without requiring a direct relationship with a provider like QSC AG. This ease of access to alternatives directly strengthens the customer's position.

- High Availability of Cloud Alternatives: In 2024, the global cloud computing market is projected to reach over $1 trillion, indicating a vast array of readily available substitute services for SMEs.

- Cost-Effectiveness of In-House Solutions: For certain IT functions, SMEs might find it more cost-effective to build internal IT teams, especially as skilled IT professionals remain accessible in the job market.

- Standardization of Services: The increasing standardization of IT services, such as managed IT support and cybersecurity solutions, makes it easier for customers to switch between providers without significant disruption or loss of functionality.

Customer Information and Transparency

Small and medium-sized enterprises (SMEs) increasingly have access to detailed information regarding pricing, service features, and competitor performance within the IT services market. This heightened transparency, often facilitated by online platforms and review sites, significantly bolsters their bargaining power.

The availability of comparative data allows SMEs to identify the most competitive offers and leverage this knowledge during negotiations. For instance, by mid-2024, numerous IT service comparison websites reported an average of 15% price variation for similar cloud migration services across providers, giving informed buyers a clear advantage.

- Information Access: SMEs can readily compare pricing and service quality for IT solutions.

- Negotiating Leverage: Greater transparency empowers SMEs to demand better terms and pricing.

- Marketplace Impact: Online IT service marketplaces centralize information, amplifying customer power.

- Data-Driven Decisions: SMEs utilize market data to secure more favorable contracts.

QS Communications' customers, particularly SMEs, possess considerable bargaining power due to increasing price sensitivity and the availability of numerous IT service alternatives. In 2024, the IT market saw a significant increase in providers offering comparable cloud, security, and SAP solutions, making it easier for customers to switch. This ease of switching is further amplified by readily available market information, allowing SMEs to compare offerings and negotiate better terms, as evidenced by an average 15% price variation for similar cloud migration services found on comparison sites by mid-2024.

QSC AG's customer base, while diverse, means that individual customers, especially those representing a larger revenue share, can exert significant influence on pricing and service agreements. However, in 2023, QSC AG reported that no single customer exceeded 5% of total revenue, which generally dilutes individual customer power.

High switching costs for SMEs, estimated between €5,000 and €20,000 for IT infrastructure migration in 2024, do limit customer bargaining power. QSC AG also enhances this by offering integrated managed services, creating greater customer stickiness.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2023-2024) |

|---|---|---|

| Price Sensitivity | High for SMEs with limited budgets | Average SME IT budget in Germany: €25k-€75k annually. Even small price hikes are significant. |

| Availability of Substitutes | High due to competitive IT market | Global cloud market over $1 trillion in 2024; easy access to generalized platforms like Azure/AWS. |

| Switching Costs | Moderate, but increasing | Estimated €5k-€20k for IT infrastructure migration in 2024. |

| Customer Concentration | Low for QSC AG | No single customer exceeded 5% of total revenue in 2023. |

| Information Transparency | High, empowering customers | 15% average price variation for cloud migration services noted on comparison sites by mid-2024. |

Preview Before You Purchase

QS Communications Porter's Five Forces Analysis

This preview showcases the complete QS Communications Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The German IT services market for small and medium-sized enterprises (SMEs) is characterized by a substantial number of providers. This includes a mix of global IT giants like Accenture, IBM, and Microsoft, who offer a broad spectrum of services, alongside numerous local and specialized IT firms. For instance, in 2024, the German IT and telecommunications market was projected to reach €200 billion, with a significant portion dedicated to services for businesses of all sizes, including SMEs.

This high density and variety of competitors, ranging from large multinational corporations with extensive resources to niche providers focusing on specific technologies or industries, directly fuels intense rivalry. The presence of both broad-service providers and specialized local players means SMEs have ample choice, putting pressure on all IT service providers to differentiate themselves through pricing, service quality, and innovation.

The German IT services market for small and medium-sized enterprises (SMEs) is experiencing robust expansion, especially in areas like cloud computing, cybersecurity, and SAP solutions. This growth, driven by digital transformation initiatives, fuels a dynamic competitive landscape.

With a projected growth rate of 7.5% for the German IT market in 2024, particularly in managed services and cloud adoption, companies are actively vying for a larger slice of this expanding pie. This healthy growth rate can temper the intensity of rivalry, as opportunities are plentiful, though competition remains keen for specialized services.

QSC AG differentiates its cloud, security, and SAP solutions by emphasizing a comprehensive portfolio tailored for the digital transformation needs of small and medium-sized enterprises (SMEs). This focus on a specific market segment and the breadth of its offerings, including cloud infrastructure, cybersecurity, and SAP consulting, aims to position QSC as a holistic partner rather than a component provider.

The company's strategy hinges on providing integrated solutions that address the complex IT challenges faced by SMEs, fostering a degree of differentiation. For instance, QSC's commitment to providing end-to-end digital transformation services, from initial consultation to ongoing management, sets it apart from competitors who might offer more specialized, standalone services. This approach can reduce direct rivalry by creating stickier customer relationships.

While specific differentiation metrics are proprietary, QSC AG’s stated emphasis on customer-centricity and deep understanding of SME requirements suggests a strategy to build loyalty. In 2024, the IT services market for SMEs saw continued demand for integrated solutions, with companies like QSC aiming to capture market share through such comprehensive offerings.

Switching Costs for Customers

QS Communications AG, or QSC, faces a competitive landscape where customer switching costs play a significant role. For QSC's Small and Medium-sized Enterprise (SME) clients, the ease or difficulty of moving to a competitor directly impacts market dynamics. If QSC has deeply integrated its services into a client's operations, or if long-term contracts are in place, switching becomes more challenging and costly, thereby dampening competitive pressures.

Conversely, if clients can easily migrate their communications and IT infrastructure to another provider with minimal disruption or expense, QSC might find itself in a more intense price-based competition. This is particularly relevant in the telecommunications and IT services sector, where technology can sometimes facilitate easier transitions. For instance, the adoption of cloud-based solutions generally lowers switching costs compared to legacy on-premise systems.

While specific figures for QSC's client switching costs are proprietary, industry trends in 2024 suggest that businesses are increasingly seeking flexible solutions. This trend could potentially lower switching barriers for some services. However, for clients utilizing QSC's more comprehensive, bundled offerings, particularly those involving network integration and managed services, the cost and complexity of switching remain a significant deterrent.

- Integration Depth: The extent to which QSC's services are embedded within a client's existing IT infrastructure is a key driver of switching costs.

- Contractual Obligations: Long-term contracts with early termination penalties can significantly increase the cost and difficulty of switching providers.

- Service Bundling: Clients using a suite of QSC services may face higher switching costs due to the complexity of migrating multiple integrated solutions.

- Technological Lock-in: Proprietary hardware or software dependencies can create barriers for clients looking to switch to competitors.

Exit Barriers

Exit barriers in the German SME IT services market can significantly impact competitive rivalry. For companies like QS Communications AG, these barriers can make it difficult and costly to leave the market, even if profitability declines.

Specialized assets, such as proprietary software platforms or dedicated hardware infrastructure for service delivery, represent a substantial exit barrier. If these assets have limited resale value outside the IT services sector, companies are compelled to continue operating to recoup their investment. Long-term contracts with clients also create a commitment that binds companies to the market, as breaking these agreements can incur significant penalties.

Furthermore, high employee severance costs, particularly in Germany where labor laws are protective, can be a major deterrent to exiting. The need to maintain a skilled workforce also means that these costs are often substantial. For instance, in 2024, average severance packages in Germany can range from several months' salary to over a year's pay, depending on tenure and position.

- Specialized Assets: IT service providers often invest in unique software and hardware, which are difficult to repurpose or sell if they exit the market.

- Long-Term Contracts: Client agreements can lock companies into service provision for extended periods, making early exit financially punitive.

- Employee Severance Costs: German labor laws can lead to substantial payouts for laid-off employees, increasing the cost of market withdrawal.

- Brand Reputation: A company's reputation in the German SME IT services sector is built over time, and a poorly managed exit could damage its brand for future ventures.

The competitive rivalry within the German IT services market for SMEs is intense, driven by a large number of providers, including global players and numerous specialized local firms. This crowded market, with a projected German IT and telecommunications market value of €200 billion in 2024, forces companies like QSC AG to actively differentiate their offerings to capture market share, particularly in high-growth areas like cloud and cybersecurity.

SSubstitutes Threaten

SMEs can often find cost-effective alternatives to QS Communications AG's specialized services. For instance, generic SaaS platforms offering similar communication functionalities might be available at a fraction of the price. In 2024, many businesses are migrating to cloud-based solutions, with the global SaaS market projected to reach over $300 billion, indicating a strong availability of these alternatives.

These substitutes, such as off-the-shelf software or even simpler on-premise IT setups, may not offer the same level of integration or advanced features as QSC AG's offerings. However, for many small and medium-sized enterprises, the price-performance trade-off is compelling, especially if their core needs are met by these more accessible solutions.

Small and medium-sized enterprises (SMEs) may consider substitute solutions for QS Communications' offerings based on their IT maturity, budget constraints, and desire for in-house management. For instance, a survey in early 2024 indicated that 65% of SMEs with lower IT maturity are more inclined to adopt simpler, off-the-shelf communication tools rather than integrated platforms. This preference for simplicity and perceived cost savings can drive substitution.

Budget is a significant driver; many SMEs prioritize solutions with lower upfront costs. If QS Communications' pricing is perceived as high relative to alternative cloud-based communication suites or even basic VoIP services, SMEs with tight budgets, particularly those operating on margins below 10% as seen in some retail sectors in 2024, might switch. Government programs promoting digital adoption, such as the UK's Help to Grow: Digital scheme, could also indirectly encourage SMEs to explore a wider range of potentially cheaper substitutes.

Small and medium-sized enterprises (SMEs) in Germany might consider developing and managing their IT infrastructure and solutions in-house as a substitute for outsourcing to QSC AG. This can stem from a desire for greater control over their technology or the perceived availability of skilled internal IT staff. However, the reality of the German job market presents a significant hurdle; a notable shortage of qualified IT professionals was reported in 2024, with estimates suggesting millions of unfilled IT positions across the country, potentially limiting the viability of this in-house approach for many SMEs.

Open-Source Alternatives

The rise of sophisticated open-source software presents a growing threat to established players in areas like cloud infrastructure, cybersecurity, and Enterprise Resource Planning (ERP) systems. Many small and medium-sized enterprises (SMEs) are increasingly adopting these alternatives due to their cost-effectiveness and flexibility. For instance, by mid-2024, an estimated 35% of SMEs surveyed reported using open-source solutions for at least one critical business function, a notable increase from previous years.

The viability of these open-source options is bolstered by their improving user-friendliness and robust feature sets, often rivaling proprietary software. This trend is particularly evident in cloud management platforms and security tools, where community-driven development fosters rapid innovation. Consider that in 2024, the global open-source software market was projected to reach over $135 billion, underscoring its significant market penetration and growing influence.

- Cost Advantage: Open-source solutions often eliminate licensing fees, significantly reducing the total cost of ownership for businesses.

- Customization and Flexibility: The ability to modify and adapt open-source code allows businesses to tailor solutions precisely to their needs.

- Community Support: Active developer communities provide extensive support, documentation, and rapid bug fixes, enhancing the reliability of these alternatives.

- Innovation Pace: Collaborative development models can lead to faster innovation cycles compared to traditional software development.

Emerging Technologies as Substitutes

The rapid advancement of technologies like highly automated AI-driven platforms and simplified no-code/low-code solutions presents a significant threat of substitution for traditional IT service providers. These innovations allow small and medium-sized enterprises (SMEs) to manage their digital needs more independently, bypassing the need for extensive external IT support.

In the German IT market, AI and automation are major trends. For instance, in 2024, a significant portion of German businesses reported implementing or planning to implement AI solutions to streamline operations. This indicates a growing willingness among SMEs to adopt technologies that reduce reliance on external IT services.

- AI-powered customer service chatbots can handle inquiries, reducing the need for outsourced helpdesk services.

- No-code/low-code development platforms enable businesses to build custom applications without deep coding expertise, diminishing the demand for custom software development from IT firms.

- Cloud-based management tools offer integrated solutions for IT infrastructure, security, and data management, often requiring less specialized IT personnel.

- Automation of IT tasks, such as system monitoring and basic troubleshooting, can be performed by internal staff using readily available software, further reducing the need for IT service providers.

The threat of substitutes for QS Communications AG is substantial, particularly from readily available, lower-cost alternatives that meet core communication needs for SMEs. These substitutes range from generic SaaS platforms to open-source solutions and even in-house IT management, all of which are becoming more sophisticated and accessible.

In 2024, the global SaaS market was projected to exceed $300 billion, highlighting the widespread availability of cloud-based communication tools that can compete on price and functionality. Furthermore, the open-source software market was expected to reach over $135 billion, demonstrating the growing adoption of cost-effective and customizable alternatives by SMEs.

The increasing maturity of AI-driven platforms and no-code/low-code development tools also empowers SMEs to handle more of their IT requirements internally, reducing reliance on external providers like QSC AG. This trend is amplified by a growing willingness among businesses to adopt technologies that enhance self-sufficiency.

| Substitute Category | Key Characteristics | SME Appeal Drivers | 2024 Market Relevance |

|---|---|---|---|

| Generic SaaS Platforms | Lower cost, broad functionality | Price sensitivity, basic needs fulfillment | Global SaaS market > $300 billion |

| Open-Source Software | Cost-effective, customizable, community support | Budget constraints, desire for tailored solutions | Global open-source market > $135 billion |

| In-house IT Management | Greater control, potential cost savings (if expertise available) | Control needs, perceived IT skill availability | Limited by IT talent shortages in regions like Germany |

| AI/Automation & No-Code/Low-Code | Increased self-sufficiency, reduced reliance on external IT | Efficiency gains, simplified operations | Growing adoption for streamlining business processes |

Entrants Threaten

Entering the German IT services market for small and medium-sized enterprises (SMEs) demands substantial upfront capital. Establishing a robust IT infrastructure, including servers, software licenses, and cybersecurity measures, can easily run into hundreds of thousands of euros. For instance, a mid-sized IT service provider might need to invest upwards of €250,000 just for initial hardware and software setup.

Attracting and retaining skilled IT professionals in Germany is also a significant cost factor, with competitive salaries and benefits. Marketing and sales efforts to build brand awareness and acquire initial clients further add to the financial burden. High capital requirements therefore act as a considerable barrier, deterring many potential new entrants.

However, the rise of cloud-based service models offers a potential avenue to mitigate these high initial infrastructure costs. Companies can leverage cloud platforms, reducing the need for extensive on-premises hardware investments. This shift allows for a more scalable and potentially less capital-intensive entry, though talent acquisition and marketing remain crucial expenditures.

QS Communications, like many established players in the integrated cloud, security, and SAP solutions market, benefits from significant economies of scale and scope. This means that as QSC AG grows its operations and client base, its per-unit cost of delivering these services decreases. For instance, a larger customer base allows for more efficient utilization of infrastructure and personnel, directly impacting profitability.

New entrants would face a substantial hurdle in replicating these cost efficiencies. Without an established client base, they would struggle to achieve the same level of purchasing power for hardware and software, nor could they spread the high fixed costs associated with building and maintaining sophisticated IT infrastructure and specialized expertise across as many customers. This cost disadvantage makes it difficult for newcomers to compete on price with incumbents like QSC AG.

QSC AG's established presence and its comprehensive portfolio of services further solidify these advantages. By offering a wide range of integrated solutions, the company can cross-sell to existing customers, increasing revenue per customer and further leveraging its operational scale. This comprehensive offering creates a barrier to entry, as new companies would need to invest heavily to match the breadth and depth of QSC AG's capabilities.

New entrants face significant hurdles in accessing established distribution channels and cultivating strong customer relationships, especially within the SME sector. Building trust with small and medium-sized enterprises requires a proven track record and consistent service delivery, areas where incumbents like QSC AG have a distinct advantage. For instance, QSC AG's deep roots in serving the German SME market, evidenced by their continued focus and investment in this segment throughout 2024, create a formidable barrier for newcomers attempting to replicate their client base and distribution network.

Product Differentiation and Brand Loyalty

For QS Communications (QSC AG), the threat of new entrants is significantly influenced by the challenge of differentiating services and cultivating brand loyalty, particularly within the Small and Medium-sized Enterprise (SME) market. Newcomers face an uphill battle in carving out a unique offering that resonates with businesses already accustomed to QSC's established presence.

Building substantial brand loyalty among SMEs requires a consistent track record of reliable service, competitive pricing, and tailored solutions. QSC AG's potential for highly specialized services, such as dedicated fiber optic networks or advanced cloud solutions, coupled with strong brand recognition built over years of operation, creates a substantial barrier for new players attempting to gain traction. For instance, QSC AG reported a revenue of €149.5 million for the first quarter of 2024, indicating a stable operational base that supports its brand equity.

- Differentiation Challenge: New entrants must invest heavily in unique service features or pricing models to stand out against QSC AG's established portfolio.

- Brand Loyalty Factor: SMEs often prioritize reliability and established relationships, making it difficult for new entrants to displace incumbents like QSC AG.

- Specialization as a Barrier: QSC AG's potential niche offerings, if highly specialized, can deter new entrants lacking comparable technical expertise or infrastructure.

- Market Share Impact: A strong existing market share held by QSC AG means new competitors must offer significantly superior value propositions to attract customers.

Government Policy and Regulations

Government policy and regulations significantly shape the threat of new entrants in the German IT services market. Stricter data privacy laws, like the GDPR, while protecting consumers, can also erect barriers for new players needing to invest heavily in compliance infrastructure. Conversely, government initiatives designed to foster digital transformation can lower these barriers.

For instance, Germany's 'Digital Jetzt' program, launched in 2020 and extended, aims to support small and medium-sized enterprises (SMEs) in their digitalization efforts. This program provides financial aid for IT investments, potentially making it easier for new IT service providers to find clients and establish a foothold. In 2023 alone, the program allocated €2 billion to support digitalization projects.

Furthermore, cybersecurity regulations and certifications required for certain government contracts or sensitive industry sectors can act as a deterrent for new entrants lacking the necessary expertise and resources. However, government-backed training programs and grants for cybersecurity development can mitigate this challenge.

Key regulatory considerations impacting new entrants include:

- Data Protection: Compliance with GDPR necessitates robust data handling and security protocols, requiring significant upfront investment.

- Cybersecurity Standards: Adherence to national and international cybersecurity frameworks is often mandatory, particularly for public sector contracts.

- Digitalization Support Programs: Government funding and incentives, such as 'Digital Jetzt', can reduce the cost of entry for new service providers targeting SMEs.

- Industry-Specific Licensing: Certain IT services, especially those in finance or healthcare, may require specific licenses or certifications, posing a hurdle for newcomers.

The threat of new entrants for QS Communications is moderate, primarily due to significant capital requirements and established brand loyalty in the German SME market. Newcomers face substantial upfront costs for infrastructure and talent, while QSC AG's long-standing relationships and specialized offerings create a strong barrier.

Economies of scale enjoyed by QSC AG, stemming from its broad service portfolio and efficient operations, make it difficult for new players to compete on price. Replicating QSC AG's cost efficiencies and purchasing power requires a similarly large scale, which is challenging for nascent companies.

Government initiatives like Digital Jetzt, which provides funding for SME digitalization, can slightly lower entry barriers by making IT services more accessible to QSC AG's target market. However, stringent regulations like GDPR and cybersecurity requirements still demand considerable investment and expertise from potential new entrants.

| Factor | Impact on New Entrants | Relevance to QSC AG |

|---|---|---|

| Capital Requirements | High (Infrastructure, Talent) | Leveraged through economies of scale |

| Brand Loyalty & Relationships | Difficult to build | Strong, established in SME sector |

| Economies of Scale | Challenging to achieve | Significant cost advantage |

| Service Differentiation | Requires heavy investment | Offers specialized, integrated solutions |

| Regulatory Compliance | Costly and complex | Established compliance infrastructure |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from financial statements, industry-specific market research reports, and competitor investor relations websites to provide a comprehensive view of the competitive landscape.