PTT Global Chemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PTT Global Chemical Bundle

Navigate the complex external forces impacting PTT Global Chemical with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its strategic landscape. Gain a competitive advantage by leveraging these critical insights. Download the full analysis now for actionable intelligence to inform your decisions.

Political factors

PTT Global Chemical's operations are heavily influenced by Thailand's political landscape. The country's political stability directly impacts investor confidence and the predictability of government policies affecting the petrochemical sector. For instance, any shifts in government could lead to revisions in energy regulations or environmental standards, creating uncertainty for PTTGC's long-term strategic planning and capital investments.

Supportive government policies are vital for PTTGC's growth and operational efficiency. Thailand's commitment to developing its industrial base, particularly in advanced materials and the circular economy, can provide a favorable environment. In 2024, the Thai government continued to emphasize sustainable development and investment in high-value industries, aiming to attract foreign direct investment and foster innovation within sectors like petrochemicals, which directly benefits companies like PTTGC.

Global trade policies, such as import/export tariffs and trade agreements, significantly influence PTT Global Chemical's (PTTGC) ability to access international markets and remain competitive. For example, the US imposition of high tariffs on Chinese petrochemical products in recent years has contributed to an oversupply in Asian markets, impacting PTTGC's sales volumes and overall profitability.

The petrochemical sector, including PTT Global Chemical, operates under stringent regulations governing production processes, safety protocols, and environmental impact. These rules are crucial for managing risks and ensuring sustainable operations. For instance, Thailand’s Department of Industrial Works sets specific standards for chemical plant emissions and waste disposal, directly affecting PTTGC's operational expenditures and investment in compliance technologies.

International Relations and Geopolitics

Geopolitical uncertainties, particularly ongoing trade tensions between major economic blocs like the US and China, pose significant risks to PTT Global Chemical (PTTGC). These frictions can disrupt established global supply chains for petrochemical products, affecting the availability and cost of raw materials. For instance, the International Monetary Fund (IMF) projected global trade growth to slow to 2.9% in 2024, down from 3.5% in 2023, partly due to these trade disputes.

These international relations can directly impact PTTGC's profitability. Increased tariffs or trade barriers can inflate operational costs and weaken consumer sentiment, leading to reduced demand for petrochemical derivatives. In 2023, global economic growth forecasts were revised downwards, reflecting these persistent geopolitical headwinds, which can directly translate to a less favorable market outlook for companies like PTTGC.

- Trade Tensions: US-China trade disputes continue to create volatility in global commodity markets.

- Supply Chain Disruptions: Geopolitical events can interrupt the flow of essential feedstocks and finished goods.

- Economic Impact: Weakened consumer confidence due to geopolitical instability can reduce demand for PTTGC's products.

- Cost Pressures: Tariffs and trade restrictions can increase the cost of doing business, impacting profit margins.

Government Support for Green Initiatives

The Thai government's strong push for its Bio-Circular-Green (BCG) economic model is a significant political factor for PTT Global Chemical (GC). This policy actively encourages businesses, including chemical manufacturers, to invest in technologies that boost product value and reduce environmental footprints.

GC's strategic alignment with these government priorities is evident in its focus on green chemicals, sustainable solutions, and emerging areas like Sustainable Aviation Fuel (SAF) production. This alignment could translate into tangible benefits such as government incentives, grants, or preferential treatment, enhancing GC's competitive edge in the evolving market.

- BCG Model Focus: Thailand's BCG economic model prioritizes sustainable development and value addition, directly influencing industries like petrochemicals.

- GC's Green Strategy: PTT Global Chemical's investment in green chemicals and circular economy solutions aligns with these national objectives.

- Potential Incentives: Government support for BCG initiatives may include tax breaks, subsidies, or R&D funding for companies like GC.

- Market Advantage: Adherence to and leadership in green initiatives can provide GC with a competitive advantage and improved public perception.

Government stability in Thailand directly impacts PTT Global Chemical's (PTTGC) operational environment and investment decisions. Policy continuity ensures a predictable framework for the petrochemical sector, crucial for long-term capital allocation. For instance, the Thai government's continued focus on attracting foreign direct investment in high-value industries, including petrochemicals, as seen in 2024, provides a supportive backdrop for PTTGC's growth initiatives.

PTTGC benefits from Thailand's commitment to its Bio-Circular-Green (BCG) economic model, which encourages sustainable practices and innovation in the chemical industry. This national strategy, actively promoted by the government, aligns with PTTGC's investments in green chemicals and circular economy solutions, potentially unlocking government incentives and R&D support.

Global trade policies and geopolitical tensions remain significant political factors for PTTGC. For example, the IMF's projection of a slowdown in global trade growth to 2.9% in 2024, partly due to trade disputes, highlights the potential for increased costs and reduced market access for petrochemical products.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing PTT Global Chemical's operations and strategic positioning.

It provides a comprehensive overview of external forces, highlighting potential challenges and opportunities for the company within its operating landscape.

Provides a concise version of the PTT Global Chemical PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global economic health is a major driver for PTT Global Chemical (PTTGC), as demand for its petrochemical products is tied to sectors like packaging, automotive, and construction. A slower global economic recovery in 2024 has resulted in weaker demand and a surplus of petrochemicals, which has affected PTTGC's financial results.

Analysts are watching China's economic stimulus efforts closely, as these could provide a much-needed boost to the petrochemical market. For instance, China's manufacturing output, a key indicator for petrochemical demand, saw a modest expansion in early 2024, but the pace of recovery remains a concern for sustained demand growth.

Volatility in crude oil prices and the spreads of key petrochemical products, such as aromatics, olefins, and polymers, directly impact PTT Global Chemical's financial performance. In 2024, the company saw its refinery operations hampered by a lower Gross Refining Margin (GRM) and tighter diesel spreads. This was compounded by weakening polymer spreads, creating a challenging revenue environment.

To navigate these pressures, PTT Global Chemical focuses on efficient cost management and strategic sourcing of raw materials. For instance, importing ethane from the United States is a key initiative aimed at securing competitive feedstock and mitigating the adverse effects of fluctuating commodity prices.

Rising inflation and interest rates present significant challenges for PTT Global Chemical. Higher inflation directly increases the cost of essential inputs like petrochemical feedstocks and energy, impacting production expenses. For instance, global energy prices, a key driver of inflation, saw significant volatility through 2024, directly affecting PTTGC's cost structure.

Furthermore, increased interest rates, as seen with central bank policy adjustments throughout 2024 and anticipated into 2025, raise the cost of borrowing for PTTGC. This impacts the affordability of capital for expansion projects and increases the financial burden of existing debt, potentially squeezing profit margins.

These macroeconomic shifts also indirectly influence demand. Elevated inflation can curb consumer spending on durable goods, while higher interest rates can dampen industrial investment, both of which are critical for PTTGC's diverse product portfolio, from plastics to specialty chemicals.

Currency Exchange Rates

Currency exchange rates significantly influence PTT Global Chemical's (PTTGC) profitability. Fluctuations directly affect the cost of imported raw materials and machinery, as well as the revenue generated from international sales. For instance, a strengthening Thai Baht can make PTTGC's products less competitive in overseas markets, potentially reducing export volumes.

Conversely, a weaker Baht can increase the expense of key imported feedstocks, squeezing profit margins. In 2024, the Thai Baht experienced volatility against major currencies, with the USD/THB rate fluctuating. For example, the Baht weakened against the US dollar in early 2024, which would have increased PTTGC's costs for dollar-denominated raw materials.

- Impact on Imports: A stronger Baht increases the cost of imported raw materials and equipment, impacting PTTGC's cost of goods sold.

- Impact on Exports: A weaker Baht makes PTTGC's exports more expensive for foreign buyers, potentially reducing sales volume and revenue.

- 2024/2025 Trends: Currency markets in 2024 saw the Thai Baht fluctuate against major trading partners' currencies, directly affecting PTTGC's import expenses and export competitiveness.

Supply-Demand Imbalance in Petrochemicals

The petrochemical sector is grappling with a significant supply-demand imbalance, largely driven by substantial capacity expansions. China, in particular, has been a major contributor to this increased production, creating a global oversupply situation.

This oversupply has directly translated into downward pressure on petrochemical product prices and a shrinking of profit margins, known as spreads. For companies like PTT Global Chemical (PTTGC), this intensified competition directly impacts their profitability.

For instance, in early 2024, benchmark prices for key olefins like ethylene saw declines, impacting the revenue streams of major producers. The average ethylene price in Asia hovered around $900-$1000 per metric ton in Q1 2024, down from peaks seen in previous years, reflecting the oversupply.

- Oversupply Pressure: Increased petrochemical production capacity, especially from China, has led to a glut in the market.

- Price Erosion: The supply glut has driven down product prices across various petrochemical segments.

- Margin Squeeze: Narrower spreads between feedstock costs and product selling prices are impacting profitability for companies like PTTGC.

- Intensified Competition: Lower prices and tighter margins are fueling fiercer competition among global petrochemical players.

The global economic slowdown in 2024 has significantly impacted petrochemical demand, affecting PTT Global Chemical (PTTGC) through weaker sales in key sectors like automotive and construction. This trend, coupled with substantial capacity expansions, particularly from China, has created a petrochemical oversupply, leading to reduced product prices and tighter profit margins for producers like PTTGC.

Volatility in crude oil prices and petrochemical spreads, such as those for olefins and polymers, directly influences PTTGC's financial performance. In 2024, the company experienced lower Gross Refining Margins (GRM) and weaker polymer spreads, creating a challenging revenue environment.

Rising inflation and interest rates in 2024 and projected into 2025 are increasing PTTGC's operational costs and the expense of borrowing, potentially impacting profitability and investment in new projects.

Currency fluctuations, particularly the Thai Baht's movement against major currencies in 2024, affect PTTGC's import costs for raw materials and the competitiveness of its exports.

| Economic Factor | Impact on PTTGC | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for petrochemicals; slowdown reduces demand. | Modest global GDP growth forecast for 2024, with varied regional performance impacting demand. |

| Petrochemical Supply/Demand Balance | Oversupply leads to price pressure and reduced margins. | Significant new capacity, especially in Asia, has widened the supply gap in 2024. |

| Commodity Prices (Crude Oil, Feedstocks) | Affects production costs and profitability. | Crude oil prices saw volatility in 2024, with Brent crude averaging around $80-$85/barrel. |

| Inflation & Interest Rates | Increases operating costs and borrowing expenses. | Global inflation remained elevated in 2024, with central banks maintaining higher interest rates. |

| Currency Exchange Rates (THB) | Impacts cost of imports and revenue from exports. | USD/THB rate fluctuated in 2024, with periods of Baht weakening, increasing import costs. |

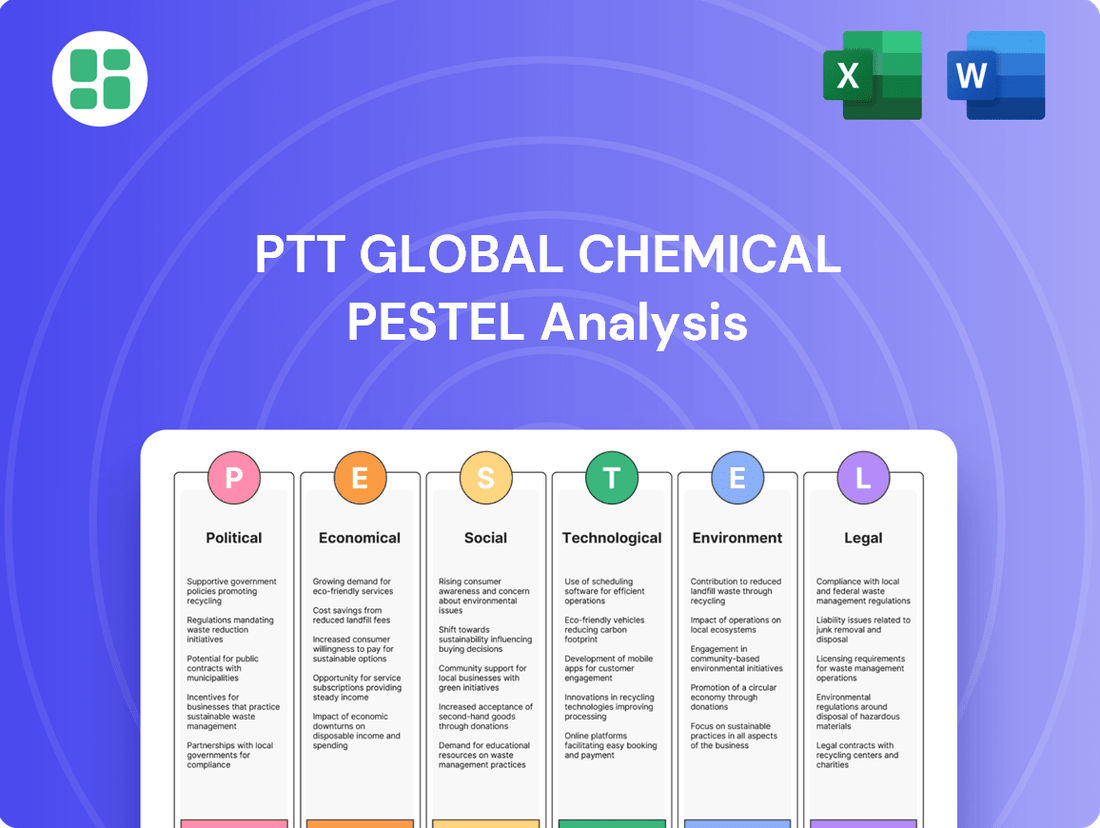

Preview the Actual Deliverable

PTT Global Chemical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of PTT Global Chemical.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting PTT Global Chemical.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning related to PTT Global Chemical.

Sociological factors

Consumers and industries worldwide are increasingly favoring eco-friendly and sustainable goods, such as bioplastics and recycled materials. This shift is a significant sociological factor influencing market demand.

PTT Global Chemical is well-positioned to capitalize on this trend. Their strategic investments in green chemicals, sustainable aviation fuel (SAF), and polylactic acid (PLA) directly address this growing preference, opening up new avenues for market capture.

For instance, the global bioplastics market was valued at approximately USD 11.5 billion in 2023 and is projected to reach over USD 25 billion by 2030, demonstrating a clear and substantial demand that PTT Global Chemical can leverage.

Stakeholders, from investors to local communities, are increasingly scrutinizing corporate social responsibility (CSR) efforts. PTT Global Chemical recognizes this, actively investing in social development and community engagement programs. For instance, in 2023, the company reported a significant portion of its sustainability investments directed towards community projects, aiming to foster local well-being and build enduring trust.

The availability of skilled labor is paramount for PTT Global Chemical. In 2024, the global chemical industry faces a growing demand for specialized roles in areas like sustainable chemistry and advanced materials, creating potential talent shortages.

PTT Global Chemical's strategy must include robust investment in training and development programs. This focus is essential to cultivate expertise in green chemical innovation and digital manufacturing, ensuring the workforce can support the company's forward-looking objectives and maintain a competitive edge.

Public Perception of Plastics and Petrochemicals

The petrochemical industry, including companies like PTT Global Chemical, is under increasing public scrutiny due to concerns about plastic waste and its environmental consequences. This perception directly impacts market trust and regulatory pressures. For instance, a 2023 survey indicated that over 70% of consumers worldwide are concerned about plastic pollution and its effects on marine life.

To navigate this, PTT Global Chemical must actively shape public perception by championing circular economy principles. This involves transparently communicating investments in advanced recycling technologies, such as chemical recycling, which aims to break down plastics into their original building blocks. By showcasing a tangible commitment to these solutions, the company can begin to rebuild public confidence.

Furthermore, developing and promoting bio-based alternatives to traditional petrochemicals is crucial. These alternatives, derived from renewable resources, offer a pathway to reduce reliance on fossil fuels and mitigate the environmental footprint of plastic production. PTT Global Chemical's investment in bio-plastics, for example, signals a forward-looking approach to sustainability.

- Growing public demand for sustainable products: A significant portion of consumers now actively seek out products with minimal environmental impact.

- Increased regulatory focus on plastic waste: Governments globally are implementing stricter regulations on single-use plastics and waste management.

- Industry-wide push for circularity: Companies are being pressured to adopt circular economy models, moving away from linear production and disposal.

- Impact on brand reputation: Negative public perception regarding environmental practices can severely damage a company's brand image and market share.

Health and Safety Standards

Societal expectations for rigorous health and safety standards in industrial operations are increasingly paramount. PTT Global Chemical (PTTGC) must not only comply with but exceed these expectations, ensuring the well-being of its workforce and the communities in which it operates. This commitment is deeply embedded in their Quality, Safety, Health, Environment, and Security (QSHEB) policy and their overarching sustainability management policy.

The company's dedication to safety is reflected in its performance metrics. For instance, in 2023, PTTGC reported a Lost Time Injury Frequency Rate (LTIFR) of 0.05, significantly below industry averages and a testament to their proactive safety culture. This focus extends to environmental stewardship, with ongoing investments in advanced emission control technologies and waste reduction programs, aligning with global sustainability goals and public demand for responsible corporate citizenship.

- Zero Harm Culture: PTTGC actively promotes a zero harm philosophy, aiming for no injuries or incidents across all its operations.

- Community Engagement: The company engages with local communities to address safety concerns and build trust through transparent communication and shared responsibility.

- Regulatory Compliance: PTTGC adheres to all national and international health and safety regulations, often implementing internal standards that surpass legal requirements.

- Continuous Improvement: Regular audits, risk assessments, and employee training programs are central to PTTGC's strategy for continuously enhancing its health and safety performance.

Societal expectations are a powerful force, driving demand for sustainable products and influencing consumer choices. PTT Global Chemical's focus on bioplastics and recycled materials directly addresses this, tapping into a market that valued bioplastics at approximately USD 11.5 billion in 2023.

Public perception of the petrochemical industry, particularly concerning plastic waste, necessitates a proactive approach. PTT Global Chemical's commitment to circular economy principles and transparent communication about investments in advanced recycling technologies is crucial for building trust. For example, a 2023 survey revealed over 70% of global consumers are concerned about plastic pollution.

The company's emphasis on rigorous health and safety standards, underscored by a 2023 LTIFR of 0.05, demonstrates a commitment to operational excellence. This focus, combined with community engagement and a dedication to exceeding regulatory requirements, strengthens its social license to operate.

Technological factors

Technological breakthroughs in green chemicals and bio-based polymers are significantly reshaping the chemical industry. These advancements offer pathways to more sustainable production methods and novel materials.

PTT Global Chemical (PTTGC) is actively embracing these innovations. The company is investing in key projects such as the production of Sustainable Aviation Fuel (SAF) derived from used cooking oil and polylactic acid (PLA) from sugarcane.

These strategic investments highlight PTTGC's commitment to leveraging green chemical technologies for future growth. The company aims to reduce its carbon footprint by adopting these bio-based alternatives.

PTT Global Chemical (PTTGC) is actively embracing advanced recycling technologies as a cornerstone of its circular economy strategy. This includes significant investment in innovations like chemical recycling, which can break down plastic waste into its original building blocks. For instance, by 2024, PTTGC aims to increase its plastic recycling capacity, focusing on advanced methods that can handle mixed plastic streams, a significant challenge in traditional mechanical recycling.

The company is co-developing proprietary technologies, such as advanced catalyst recycling, to transform previously unusable industrial waste into valuable feedstock. This approach not only tackles plastic waste but also creates a more sustainable supply chain. PTTGC's commitment is reflected in its 2025 targets, which include diverting a substantial percentage of its operational waste from landfills through these innovative recycling processes.

PTT Global Chemical is actively embracing automation and digitalization to sharpen its operational edge. By integrating artificial intelligence and advanced digital tools, the company aims to boost efficiency across its production lines and streamline its supply chain. This strategic move is central to their 'Holistic Optimization' approach, designed to refine processes and cut costs through technology.

In 2023, PTTGC reported a significant increase in digital investment, focusing on areas like AI-driven predictive maintenance and advanced analytics for process control. This investment is expected to yield tangible results, with projections indicating a 5-7% improvement in operational efficiency in key business units by the end of 2024, contributing to a more agile and cost-effective operational framework.

Research and Development (R&D) Capabilities

PTT Global Chemical (GC) recognizes that robust Research and Development (R&D) capabilities are crucial for innovation, enabling the creation of new products, enhancing current offerings, and pioneering more environmentally friendly production processes. The company strategically directs its R&D efforts towards expanding its product range within high-value and sustainable segments.

GC's commitment to R&D is further demonstrated through its investments in corporate venture capital. These investments are specifically targeted at emerging fields such as advanced materials, renewable energy and circular economy solutions, net-zero technologies, and industrial digitalization. This forward-looking approach ensures GC remains at the forefront of technological advancements in the chemical industry.

- Focus on High-Value & Sustainable Products: GC is actively broadening its portfolio to include chemicals and materials that offer enhanced performance and reduced environmental impact.

- Corporate Venture Capital Investments: The company allocates capital to startups and innovative projects in critical areas like advanced materials, circularity, and net-zero initiatives.

- Digitalization in Industry: GC is exploring and investing in digital technologies to optimize its operations, supply chains, and R&D processes.

- Sustainability as a Driver: R&D is a key enabler for GC's sustainability goals, driving the development of greener chemistries and production methods.

Process Innovation and Efficiency Enhancement

PTT Global Chemical (PTTGC) is keenly focused on process innovation to drive efficiency. By continuously refining their production methods, they aim to achieve substantial cost reductions and bolster their market position. A key strategy involves optimizing the use of existing assets and securing more economical raw material sources, like the advantageous ethane supplies sourced from the United States.

This commitment to operational excellence is reflected in their financial performance and strategic investments. For instance, PTTGC's investment in advanced process technologies is designed to yield higher output with lower input costs, directly impacting their bottom line. Their ongoing efforts to integrate digital solutions and automation across their manufacturing facilities are projected to further enhance productivity and reduce operational expenditures throughout 2024 and into 2025.

- Asset Utilization Optimization: PTTGC actively works to maximize the output from its existing plant infrastructure, reducing idle capacity and improving overall efficiency.

- Cost-Effective Raw Material Sourcing: Securing competitive pricing for key inputs, such as ethane from the US, directly lowers production costs.

- Digitalization and Automation: Implementing advanced technologies in manufacturing processes aims to streamline operations and cut down on manual labor and associated expenses.

- Continuous Improvement Initiatives: Ongoing programs focus on identifying and implementing incremental process enhancements that collectively lead to significant cost savings and efficiency gains.

PTT Global Chemical (PTTGC) is heavily investing in green chemical technologies and advanced recycling to drive sustainability and innovation. The company is actively pursuing projects like Sustainable Aviation Fuel (SAF) production and the development of bio-based polymers such as polylactic acid (PLA). These initiatives are central to PTTGC's strategy to reduce its environmental impact and tap into growing markets for eco-friendly products.

PTTGC's commitment to a circular economy is evident in its adoption of advanced recycling technologies, including chemical recycling, to process plastic waste. By 2024, the company is set to significantly boost its plastic recycling capacity, focusing on methods capable of handling mixed plastic streams. This technological push is designed to transform waste into valuable resources, aligning with their 2025 targets for waste diversion.

Furthermore, PTTGC is embracing digitalization and automation, integrating AI and advanced analytics to enhance operational efficiency and supply chain management. This strategic investment, which saw a notable increase in 2023, aims to achieve substantial improvements in productivity, with projections of a 5-7% efficiency boost in key units by the end of 2024.

PTTGC's R&D focus is on high-value, sustainable products and net-zero technologies, supported by corporate venture capital investments in emerging fields. This forward-thinking approach, coupled with process innovation and cost-effective raw material sourcing, positions PTTGC for continued growth and leadership in the evolving chemical industry landscape.

Legal factors

PTT Global Chemical operates under stringent environmental regulations, impacting its operations from emissions control to hazardous waste management. For instance, Thailand's National Environmental Quality Act mandates strict limits on industrial emissions and waste discharge, directly affecting PTTGC's petrochemical facilities. Failure to adhere to these, including evolving standards for greenhouse gas reduction, can lead to significant penalties, such as the 2023 fines imposed on several industrial plants in Thailand for exceeding air quality standards.

PTT Global Chemical (GC) operates within a stringent legal landscape where product safety and quality are non-negotiable. Adherence to regulations like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and national standards is crucial for market access and consumer trust. For instance, in 2023, the global petrochemical industry saw increased scrutiny on chemical safety, impacting production processes and requiring robust quality control measures.

Meeting these evolving legal frameworks, from chemical handling to end-product specifications, is vital for GC's diverse product portfolio, which includes polymers and specialty chemicals. Failure to comply can lead to significant fines, product recalls, and reputational damage. GC's commitment to international quality certifications, such as ISO 9001, underscores its dedication to meeting these legal obligations and maintaining its competitive edge in the global market.

PTT Global Chemical's operations are heavily influenced by labor laws, encompassing everything from minimum wages and working hours to workplace safety standards and employee benefits. Compliance with these regulations is paramount to prevent costly legal battles and maintain a positive employer reputation.

In 2024, Thailand's labor ministry continued to emphasize enforcement of existing labor protection acts, with particular attention on fair wages and preventing unfair dismissal. For instance, the minimum wage across Thailand saw adjustments in early 2024, impacting PTT Global Chemical's payroll costs and necessitating careful budgeting to remain compliant.

Competition Laws and Anti-Trust Regulations

As a major player in the petrochemical sector, PTT Global Chemical (GC) operates under stringent competition laws and anti-trust regulations globally. These rules are in place to prevent monopolistic practices and ensure a level playing field for all market participants. GC's strategic decisions, including potential mergers and acquisitions, are carefully scrutinized to ensure compliance, avoiding hefty fines and legal disputes that could disrupt operations. For instance, in 2023, the European Union's competition authorities continued to monitor significant market consolidations within the chemical industry, a trend that GC must navigate.

Compliance with these regulations is paramount for PTT Global Chemical's sustained growth and market access. Failure to adhere to anti-trust provisions can result in substantial penalties and reputational damage. The company actively engages with regulatory bodies to understand and implement evolving competition frameworks, ensuring its business practices align with fair market principles.

- Regulatory Scrutiny: PTT Global Chemical's market share and pricing strategies are subject to ongoing review by competition authorities in key operating regions.

- Merger & Acquisition Compliance: Any proposed mergers or acquisitions by GC must undergo rigorous review to ensure they do not stifle competition, as seen in past industry consolidations requiring divestitures.

- Fair Market Practices: The company is obligated to uphold fair competition, preventing anti-competitive agreements or abuses of dominant market positions.

Intellectual Property Rights

Intellectual property rights are crucial for PTT Global Chemical (PTTGC), especially concerning its advancements in green chemicals, specialty chemicals, and proprietary production methods. Protecting these innovations through patents and trade secrets is vital for maintaining its competitive edge and ensuring a return on its significant research and development expenditures.

In 2024, PTTGC continued to emphasize the protection of its intellectual assets. For instance, its focus on developing bio-based polymers and advanced materials relies heavily on patent filings to secure market exclusivity. The company's investment in R&D, which reached approximately THB 2.5 billion in 2023, underscores the importance of safeguarding these discoveries.

- Patent Protection: PTTGC actively pursues patents for its novel chemical formulations and manufacturing processes, particularly in high-growth areas like bioplastics and performance polymers.

- Trade Secrets: Key operational know-how and proprietary formulas are maintained as trade secrets, providing a confidential advantage in the competitive chemical landscape.

- R&D Investment: The company's ongoing commitment to innovation, backed by substantial R&D budgets, necessitates robust legal frameworks to protect its intellectual property investments.

- Global Filings: PTTGC strategically files for intellectual property protection in key global markets to prevent infringement and capitalize on its technological advancements worldwide.

PTT Global Chemical's operations are significantly shaped by contract law, governing agreements with suppliers, customers, and joint venture partners. Ensuring these contracts are legally sound and enforceable is critical for supply chain stability and revenue generation.

In 2024, PTTGC's international trade activities necessitate strict adherence to import/export regulations and trade agreements, impacting cross-border transactions and market access. For example, compliance with the ASEAN Free Trade Area (AFTA) provisions facilitates smoother trade within the region, while navigating differing regulations in markets like China or Europe requires diligent legal oversight.

The company's financial dealings, including borrowing and investment, are governed by financial regulations and corporate governance laws. Adherence to these ensures transparency and stakeholder confidence.

Environmental factors

Global pressure to address climate change is intensifying, leading to stricter carbon emission reduction targets worldwide. PTT Global Chemical is actively responding to this by setting ambitious goals, including a 20% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, measured against a 2025 peak.

This commitment extends to achieving net-zero emissions by 2050. To meet these targets, the company anticipates substantial investments in cleaner energy sources and advanced decarbonization technologies, reflecting a strategic shift towards sustainability in its operations.

The growing global concern over plastic waste is a significant environmental factor, directly boosting the market for circular economy solutions. PTT Global Chemical is responding by investing in technologies that improve resource efficiency and reduce waste, aiming to transform post-consumer plastics into higher-value materials.

In 2023, the global plastic waste generation was estimated to be around 240 million tonnes, highlighting the urgency for effective management strategies. PTT Global Chemical’s commitment to recycling and upcycling initiatives, such as their collaboration with local partners to collect and process plastic waste, directly addresses this challenge and aligns with the principles of a circular economy, potentially creating new revenue streams from recycled content.

Growing global awareness of resource limitations, especially concerning fossil fuels, is compelling chemical companies to prioritize sustainable sourcing and explore alternative feedstocks. This shift is driven by both environmental concerns and the long-term economic viability of traditional resources.

PTT Global Chemical (PTTGC) is actively addressing this by investing in bio-based chemical production. For instance, their commitment to producing Polylactic Acid (PLA) from sugarcane highlights a strategic move to diversify raw material dependency away from petrochemicals. This initiative aligns with global trends aiming for a circular economy.

Furthermore, PTTGC's development of Sustainable Aviation Fuel (SAF) from used cooking oil showcases another facet of their sustainability strategy. This not only diversifies their feedstock but also contributes to reducing waste and carbon emissions in the aviation sector, a key area for environmental improvement.

Water Management and Security

Water scarcity and quality are increasingly critical environmental issues impacting industrial operations globally. PTT Global Chemical (PTTGC) actively addresses these challenges through its commitment to sustainable water management. This dedication is evidenced by its consistent achievement of a leadership level 'A' rating for water security management from CDP for five consecutive years, underscoring its focus on efficient water usage and risk mitigation.

PTTGC's proactive approach to water management is crucial for maintaining operational resilience and minimizing environmental impact. The company's sustained high rating from CDP highlights its robust strategies for water conservation, wastewater treatment, and responsible sourcing, ensuring a stable supply of water essential for its chemical production processes.

- CDP Water Security Rating: Achieved Leadership Level 'A' for five consecutive years (as of 2024 reporting).

- Focus Areas: Efficient water use, wastewater treatment, and responsible water sourcing.

- Impact: Enhances operational resilience and minimizes environmental footprint in water-stressed regions.

Biodiversity Protection and Ecosystem Impact

PTT Global Chemical (GC) acknowledges that its industrial activities can affect local ecosystems and biodiversity. The company's commitment to sustainability means it actively considers and works to reduce these potential impacts in the areas where it operates.

GC's environmental management strategies are designed to align with its overarching sustainability framework and policies, ensuring that biodiversity protection is a key consideration in its operational planning and execution. This approach is crucial for maintaining ecological balance and supporting long-term environmental health.

For instance, in 2023, GC reported progress on its biodiversity initiatives, including efforts to restore mangrove forests in coastal areas adjacent to its operations. The company aims to achieve a net positive impact on biodiversity by 2030, a target that guides its conservation and restoration projects.

- Biodiversity Impact Assessment: GC conducts regular assessments to understand and quantify the potential impacts of its operations on local flora and fauna.

- Habitat Restoration Projects: The company engages in projects such as mangrove replanting and the creation of green spaces around its facilities to enhance local biodiversity.

- Sustainable Sourcing: GC is increasingly focusing on sourcing raw materials from suppliers who adhere to strict environmental and biodiversity protection standards.

- Stakeholder Engagement: Collaboration with local communities and environmental organizations is a key part of GC's strategy to ensure its operations are in harmony with the surrounding ecosystems.

Global pressure for decarbonization is intensifying, with many nations setting ambitious emission reduction targets. PTT Global Chemical (PTTGC) has responded by aiming for a 20% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, based on a 2025 peak, and achieving net-zero by 2050. This necessitates significant investment in cleaner energy and advanced decarbonization technologies, signaling a strategic pivot towards sustainability.

The escalating global concern over plastic waste is a major environmental driver, fueling demand for circular economy solutions. PTTGC is investing in technologies to enhance resource efficiency and waste reduction, with the goal of transforming post-consumer plastics into higher-value products. In 2023, global plastic waste generation was approximately 240 million tonnes, underscoring the critical need for effective management strategies.

Growing awareness of resource limitations, particularly concerning fossil fuels, is prompting chemical companies to prioritize sustainable sourcing and explore alternative feedstocks. PTTGC is actively investing in bio-based chemicals, such as Polylactic Acid (PLA) from sugarcane, and developing Sustainable Aviation Fuel (SAF) from used cooking oil, diversifying its raw material base and contributing to waste reduction and emission cuts.

Water scarcity and quality are increasingly critical environmental issues impacting industrial operations worldwide. PTTGC demonstrates a strong commitment to sustainable water management, evidenced by its consistent achievement of a Leadership Level 'A' rating from CDP for water security management for five consecutive years (as of 2024 reporting), highlighting its focus on efficient water use and risk mitigation.

| Environmental Factor | PTTGC's Response/Initiatives | Key Data/Targets |

|---|---|---|

| Climate Change & Emissions | Reducing Scope 1 & 2 GHG emissions, Net-zero target | 20% reduction by 2030 (vs. 2025 peak); Net-zero by 2050 |

| Plastic Waste & Circular Economy | Investing in recycling & upcycling technologies | Global plastic waste ~240 million tonnes (2023) |

| Resource Scarcity & Feedstocks | Developing bio-based chemicals & SAF | PLA from sugarcane, SAF from used cooking oil |

| Water Management | Sustainable water use, wastewater treatment | CDP Water Security: 'A' rating for 5 consecutive years (as of 2024) |

| Biodiversity & Ecosystem Impact | Biodiversity impact assessment, habitat restoration | Net positive impact on biodiversity by 2030 |

PESTLE Analysis Data Sources

Our PTT Global Chemical PESTLE Analysis is meticulously constructed using data from reputable sources including the International Energy Agency (IEA), national environmental protection agencies, and leading chemical industry market research firms. We incorporate regulatory updates, economic forecasts, and technological advancements to provide a comprehensive view.