PTT Global Chemical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PTT Global Chemical Bundle

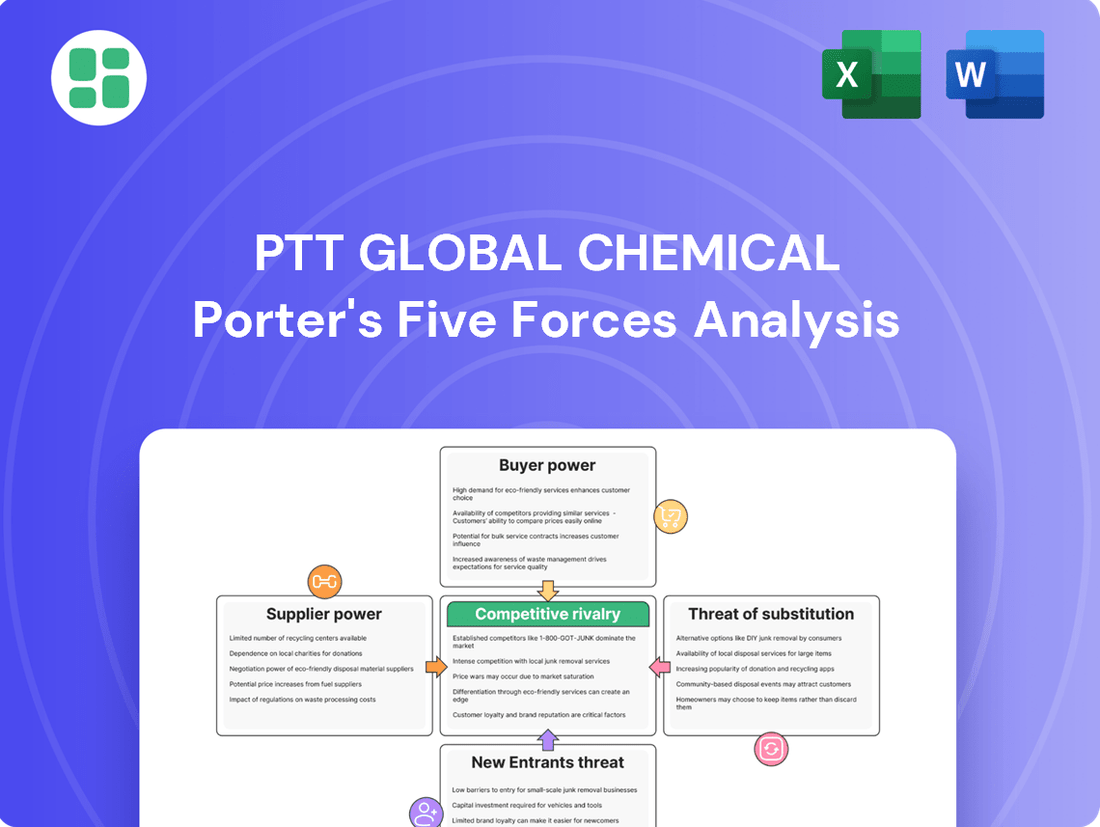

PTT Global Chemical's competitive landscape is shaped by several key forces, including the bargaining power of its buyers and the intensity of rivalry within the petrochemical industry. Understanding these dynamics is crucial for navigating the market effectively.

The full Porter's Five Forces Analysis reveals the strength and intensity of each market force affecting PTT Global Chemical, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

PTT Global Chemical's (PTTGC) dependence on crude oil, natural gas, and naphtha as key feedstocks positions suppliers of these commodities with considerable influence. The upstream energy sector's concentrated structure, dominated by national oil companies and global energy giants, amplifies this supplier bargaining power.

This reliance makes PTTGC vulnerable to price volatility in global energy markets. For instance, in 2024, the company experienced compressed Gross Refining Margins (GRM) partly due to widening diesel crack spreads and rising ethylene feedstock costs, directly illustrating the impact of raw material price fluctuations on profitability.

PTT Global Chemical (PTTGC) faces significant supplier bargaining power due to high switching costs for feedstocks. Modifying production processes and supply chain logistics to accommodate different raw materials can be expensive, tying producers to specific feedstock types and limiting flexibility.

While PTTGC is exploring importing ethane from the United States as a cost-effective alternative, this strategic shift still involves implementation efforts and represents a move away from deeply entrenched supplier relationships, highlighting the inherent switching costs.

Global geopolitical tensions, such as the ongoing conflict in Ukraine and instability in the Middle East, directly impact the supply chains for raw materials critical to petrochemical production. These disruptions can lead to significant price volatility for feedstocks like crude oil and natural gas, a situation exacerbated by evolving U.S. energy policies.

For PTT Global Chemical (PTTGC), this volatile external environment translates into a less predictable and potentially more expensive sourcing landscape for its essential raw materials. For instance, the average Brent crude oil price in 2024 has experienced fluctuations, with prices ranging from approximately $75 to $90 per barrel, directly affecting feedstock costs.

Supplier Integration and Forward Integration Threats

PTT Global Chemical (PTTGC) faces potential threats from suppliers considering forward integration. Some key raw material providers possess the capability and strategic incentive to move into basic petrochemical production, thereby becoming direct rivals. While this scenario is less prevalent for PTTGC's immediate feedstocks, the broader vertical integration trends within the energy sector can indirectly amplify supplier influence by reshaping market dynamics and pricing approaches.

This potential for supplier forward integration can significantly alter the competitive landscape for PTTGC. For instance, a major upstream oil and gas producer diversifying into petrochemicals could leverage its existing infrastructure and feedstock control to gain a competitive edge. This move would not only introduce a new competitor but could also disrupt established supply chains and pricing structures, potentially increasing costs for PTTGC if it relies on these integrated suppliers.

The threat is amplified when considering the strategic alliances and investments made by major energy players. For example, in 2024, several large energy conglomerates announced significant investments in expanding their downstream petrochemical operations, signaling a clear intent to capture more value across the entire hydrocarbon chain. This trend suggests that while direct feedstock suppliers might not immediately integrate, the broader energy ecosystem's movement towards petrochemicals creates an indirect but substantial pressure on PTTGC.

- Supplier Forward Integration Risk: Major raw material suppliers may integrate forward into basic petrochemical production, becoming direct competitors to PTTGC.

- Indirect Influence: Vertical integration within the broader energy sector can indirectly bolster supplier power by altering market dynamics and pricing strategies.

- 2024 Investment Trends: Significant investments by energy conglomerates in downstream petrochemicals in 2024 highlight a growing trend of forward integration, increasing competitive pressure.

Limited Availability of Alternative Feedstocks

While PTT Global Chemical (PTTGC) is actively pursuing green chemicals and sustainable alternatives, the immediate availability and scalability of truly non-fossil fuel-based feedstocks are still in their nascent stages of development. This ongoing reliance on traditional fossil fuels for its core commodity petrochemical operations grants significant bargaining power to its current suppliers.

For PTTGC's foundational petrochemical products, the limited availability of readily scalable alternative feedstocks means continued dependence on existing suppliers. This dependence translates directly into leverage for these suppliers, impacting PTTGC's cost structure and operational flexibility.

- Feedstock Dependency: PTTGC's significant reliance on traditional fossil-fuel-based feedstocks for its commodity petrochemical segment grants considerable power to its suppliers.

- Developing Alternatives: While PTTGC invests in green chemicals, the immediate large-scale availability of viable, non-fossil fuel alternatives remains a challenge.

- Supplier Leverage: The limited substitutability of current feedstocks allows suppliers to exert influence over pricing and supply terms.

PTT Global Chemical's (PTTGC) bargaining power with suppliers is constrained by its significant reliance on key feedstocks like crude oil, natural gas, and naphtha. The concentrated nature of the upstream energy sector, often dominated by large national oil companies and global energy giants, further amplifies supplier influence. This dependence makes PTTGC susceptible to price volatility, as seen in 2024 when rising ethylene feedstock costs contributed to compressed gross refining margins.

High switching costs for alternative feedstocks also limit PTTGC's flexibility, reinforcing supplier leverage. While PTTGC explores options like importing ethane, the inherent costs and logistical challenges of shifting away from established supplier relationships highlight this constraint. Furthermore, global geopolitical events and evolving energy policies in 2024, such as fluctuations in Brent crude oil prices (ranging from approximately $75 to $90 per barrel), directly impact feedstock costs and supply chain predictability.

The threat of supplier forward integration, where raw material providers move into petrochemical production, adds another layer of complexity. Although not always direct for PTTGC's immediate feedstocks, broader vertical integration trends in the energy sector, evidenced by significant 2024 investments in downstream petrochemicals by energy conglomerates, indirectly bolster supplier power by reshaping market dynamics and pricing. The limited scalability of non-fossil fuel alternatives for PTTGC's core commodity petrochemicals continues to grant substantial bargaining power to its current fossil fuel-based feedstock suppliers.

| Factor | Impact on PTTGC | 2024 Data/Trend |

|---|---|---|

| Feedstock Dependence | High reliance on crude oil, natural gas, naphtha | Ethylene feedstock costs contributed to compressed GRM in 2024 |

| Supplier Concentration | Dominated by national oil companies and global energy giants | N/A (Industry Structure) |

| Switching Costs | High costs to modify production for alternative feedstocks | Exploration of US ethane imports indicates efforts to mitigate |

| Geopolitical/Policy Impact | Supply chain disruptions and price volatility | Brent crude prices fluctuated between $75-$90/barrel in 2024 |

| Forward Integration Risk | Potential for suppliers to become competitors | Energy conglomerates invested heavily in downstream petrochemicals in 2024 |

| Availability of Alternatives | Limited scalability of non-fossil fuel feedstocks | Green chemical initiatives are in early development stages |

What is included in the product

PTT Global Chemical's Porter's Five Forces analysis reveals the intensity of competition, buyer and supplier power, threat of new entrants, and the availability of substitutes within the petrochemical industry.

Instantly identify and address competitive pressures with a dynamic Porter's Five Forces analysis, empowering PTT Global Chemical to navigate market complexities.

Customers Bargaining Power

PTT Global Chemical's diverse end-use industries, spanning packaging, automotive, construction, and consumer goods, significantly dilutes the bargaining power of individual customers. This broad market reach means that a downturn in one sector, like automotive, can be counterbalanced by strength in another, such as packaging. For instance, the industrial coatings resin market, crucial for automotive applications, is projected for a recovery in 2025, indicating a potential shift in demand dynamics.

PTT Global Chemical (PTTGC) faces considerable customer bargaining power due to the commodity nature of many of its products. A substantial part of PTTGC's output, including olefins and polymers, are essentially undifferentiated goods. This lack of unique features means customers can readily shift their business to competitors.

In 2024, the petrochemical market experienced periods of oversupply, particularly for base chemicals. This oversupply environment directly amplifies customer power, as buyers can leverage price competition to secure more favorable terms. For instance, during the first half of 2024, global ethylene prices saw significant volatility, allowing large-scale buyers to negotiate aggressively.

Customers in industries that rely heavily on petrochemicals as essential inputs are frequently quite price-sensitive. This sensitivity stems from the intense competition present in their own respective markets, forcing them to seek cost advantages wherever possible.

The global petrochemical market has experienced an oversupply in recent years, particularly affecting key products like polyethylene (PE), polypropylene (PP), and paraxylene (PX). This oversupply, projected to continue through 2024 and into 2025, has intensified price competition and compressed profit margins, known as spreads.

Consequently, this market dynamic significantly strengthens the bargaining power of customers. They are now in a better position to negotiate for and secure lower prices on petrochemical inputs, directly impacting suppliers like PTT Global Chemical. For instance, average spot prices for PE in Asia saw fluctuations, with some grades experiencing a decline in early 2024 due to ample supply, giving buyers more leverage.

Customer Concentration in Specific Segments

While PTT Global Chemical (PTTGC) serves a broad customer base, significant bargaining power can emerge from customer concentration within specific high-volume segments or for specialized products. This concentration allows these key customers to exert greater influence on pricing and terms.

The performance of Vencorex, a PTTGC subsidiary, in 2024 provides a clear illustration. Its weakened performance was directly linked to reduced customer demand and fierce price competition within the HDI derivatives market. This highlights how concentrated demand in niche markets can significantly empower customers.

- Customer Concentration: High-volume buyers or those with unique product needs can wield considerable influence.

- Market Dynamics: Intense price competition, as seen in the HDI derivatives market in 2024, amplifies customer bargaining power.

- Impact on Performance: Weakened customer demand, a factor in Vencorex's 2024 results, directly translates to increased customer leverage.

Growing Demand for Sustainable Solutions

Customers are increasingly demanding sustainable and eco-friendly products, including bio-based plastics and recycled materials. This emerging trend gives power to customers who prioritize sustainability, pushing PTTGC to invest in green chemicals and circular economy initiatives to remain competitive and meet evolving market preferences. For instance, the global bioplastics market was valued at approximately USD 11.5 billion in 2023 and is projected to grow significantly, indicating strong customer preference.

- Growing demand for sustainable products: Consumers are actively seeking out environmentally conscious options.

- Customer influence on PTTGC: PTTGC must adapt its product portfolio to align with these evolving preferences.

- Investment in green initiatives: The company is responding by investing in bio-based and recycled material technologies.

- Market competitiveness: Meeting sustainability demands is crucial for PTTGC to maintain its market position.

The bargaining power of customers for PTT Global Chemical (PTTGC) is significant, driven by the commodity nature of many of its products and market oversupply. In 2024, periods of oversupply in base chemicals like ethylene amplified this power, allowing large buyers to negotiate aggressively on price. For example, average spot prices for polyethylene in Asia saw declines in early 2024, giving buyers more leverage.

PTTGC's broad customer base across industries like packaging and automotive generally dilutes individual customer power. However, concentration in specific high-volume segments or for specialized products, as seen with Vencorex's HDI derivatives market in 2024, can empower key buyers. This is further exacerbated by customer price sensitivity due to intense competition in their own markets.

The growing demand for sustainable products, such as bio-based plastics valued at approximately USD 11.5 billion in 2023, also shifts power towards environmentally conscious customers. PTTGC must invest in green initiatives to meet these evolving preferences and maintain competitiveness.

| Product Segment | 2024 Market Dynamic | Customer Bargaining Power Impact |

|---|---|---|

| Olefins & Polymers (Commodity) | Oversupply, intense price competition | High |

| Industrial Coatings Resin | Projected recovery in 2025 | Moderate, increasing with demand |

| HDI Derivatives (Vencorex) | Reduced demand, fierce price competition | Very High |

| Sustainable/Bio-based Products | Growing demand, increasing customer preference | Increasing |

Preview the Actual Deliverable

PTT Global Chemical Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of PTT Global Chemical's competitive landscape through a detailed Porter's Five Forces Analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This professionally crafted analysis is ready for your immediate use.

Rivalry Among Competitors

The petrochemical industry is navigating a challenging period marked by substantial global overcapacity. New manufacturing plants are coming online faster than demand can absorb them, especially with significant contributions from China and other Asian nations.

This imbalance between supply and demand has driven down operating rates across the sector. Consequently, profit margins are under considerable pressure, fueling aggressive price competition among established and emerging players in the market.

PTT Global Chemical navigates a fiercely competitive environment, facing formidable global and regional rivals. Key players like Zhejiang Jianye Chemical, Ascend Performance Materials, Sumitomo Chemical, and Innova are significant forces.

This intense competition, further amplified by companies such as Indorama Ventures and Lotte Chemical, creates a fragmented market. In 2024, the petrochemical industry, where PTTGC operates, saw continued consolidation and strategic partnerships as companies sought to gain or maintain market share amidst fluctuating demand and raw material costs.

The global economic slowdown, characterized by persistent high interest rates in major markets, is directly impacting demand for petrochemical products. This sluggish recovery translates to weaker sales volumes for companies like PTT Global Chemical, intensifying the rivalry as players fight for a shrinking pie. For instance, in 2023, global GDP growth was estimated around 3%, a modest figure that reflects the subdued economic environment impacting industrial output and consumer spending.

In Thailand, a significant market for PTT Global Chemical, high household debt levels further dampen domestic consumption. This forces a greater reliance on exports, pushing the company to compete more aggressively in international markets where numerous global players vie for market share. The economic headwinds are creating a challenging landscape where pricing power is diminished, and operational efficiency becomes paramount for survival.

Product Differentiation and Specialization Strategy

PTT Global Chemical (PTTGC) is actively differentiating itself by focusing on high-value added (HVA) products and specialty chemicals. A prime example is its subsidiary, allnex, which operates in the coatings and adhesives sector. This strategic shift aims to move away from the intense price competition inherent in commodity chemicals.

This strategy allows PTTGC to compete on innovation and product performance rather than solely on price. While this reduces earnings volatility, price competition can still be a factor, even within specialty chemical markets, as new entrants or alternative solutions emerge.

- Focus on High-Value Added (HVA) Products: PTTGC's strategy emphasizes shifting production towards HVA products and specialty chemicals.

- Subsidiary allnex: The acquisition and operation of allnex, a leader in specialty resins for coatings, highlights this commitment to specialization.

- Reduced Earnings Volatility: By moving into specialty segments, PTTGC seeks to lessen the impact of fluctuating commodity prices on its financial performance.

- Competition on Innovation: The goal is to compete based on unique product features and performance characteristics, fostering a less price-sensitive market position.

High Exit Barriers

The petrochemical industry, and by extension PTT Global Chemical (PTTGC), faces high exit barriers due to immense capital investments. Building a petrochemical plant requires billions of dollars in infrastructure, making it incredibly difficult and costly to divest or shut down operations. For instance, a world-scale ethylene cracker can cost upwards of $5 billion to construct.

These substantial sunk costs mean that even when market conditions are unfavorable, companies like PTTGC are often compelled to continue operating. Shutting down a facility represents a significant loss on these investments, often outweighing the short-term savings. This reluctance to exit contributes to persistent overcapacity in the market, as underperforming assets remain online, intensifying competitive rivalry among existing players.

- High Capital Intensity: Petrochemical plants require substantial upfront investment, often in the billions of dollars, creating a significant financial hurdle for new entrants and a disincentive for exiting incumbents.

- Sunk Costs: Once invested, these capital expenditures become sunk costs, meaning they cannot be recovered, forcing companies to operate even in periods of low profitability to avoid realizing these losses.

- Market Position: Abandoning facilities can lead to a loss of market share and established supply chains, which are difficult and expensive to rebuild later, further discouraging exits.

- Prolonged Oversupply: The inability to easily exit the market means that even during industry downturns, production capacity often remains online, leading to prolonged periods of oversupply and depressed pricing, thus fueling intense competition.

PTT Global Chemical (PTTGC) operates in a highly competitive petrochemical landscape, facing intense rivalry from global and regional players like Zhejiang Jianye Chemical, Ascend Performance Materials, Sumitomo Chemical, Innova, Indorama Ventures, and Lotte Chemical. This fragmented market is characterized by significant global overcapacity, particularly from China and other Asian nations, which drives down operating rates and squeezes profit margins. The economic slowdown in 2024, marked by high interest rates, further dampens demand, forcing companies to compete aggressively on price for a smaller market share. PTTGC's strategy to focus on high-value added products and specialty chemicals, exemplified by its subsidiary allnex in the coatings sector, aims to mitigate this intense price competition by differentiating on innovation and performance.

| Key Competitors | 2023 Revenue (USD Billion, Est.) | Key Markets |

|---|---|---|

| Zhejiang Jianye Chemical | ~2.5 | China |

| Ascend Performance Materials | ~3.0 | Global (Nylon 6,6) |

| Sumitomo Chemical | ~22.0 | Global (Petrochemicals, Specialty Chemicals) |

| Indorama Ventures | ~15.0 | Global (PET, Fibers) |

| Lotte Chemical | ~18.0 | South Korea, Global |

SSubstitutes Threaten

The most significant threat of substitution for PTT Global Chemical (PTTGC) stems from the burgeoning development and widespread adoption of bio-based plastics, biochemicals, and biofuels. These are derived from renewable feedstocks such as corn, sugarcane, algae, and various forms of agricultural waste.

These emerging alternatives present a compelling value proposition, often boasting lower carbon emissions throughout their lifecycle and enhanced biodegradability. This directly addresses growing global environmental concerns and the increasing pressure from regulatory bodies worldwide, pushing for more sustainable industrial practices.

For instance, the global bioplastics market was valued at approximately USD 12.1 billion in 2023 and is projected to reach USD 36.6 billion by 2030, demonstrating a clear market shift. This growth indicates a tangible substitution threat as consumers and industries increasingly favor products with a reduced environmental footprint.

The rise of the circular economy, prioritizing recycled plastics and waste reduction, presents a significant threat of substitution for virgin petrochemical products. This trend is driven by increasing environmental awareness and regulatory pressures globally. For instance, by 2024, the demand for recycled plastics is projected to grow substantially, impacting the market share of new plastics.

PTT Global Chemical (PTTGC) is actively addressing this threat by investing in its own bio and circularity businesses. This strategic move allows PTTGC to participate in and even lead the transition to more sustainable materials, thereby mitigating the direct impact of substitute products on its core petrochemical operations.

Innovations like renewable electrosynthesis, which uses CO2 and renewable electricity, and enzyme-based catalysis are making it more practical and affordable to produce chemicals without relying on fossil fuels. For instance, advancements in bio-based polymers are offering viable alternatives to traditional plastics in packaging and textiles.

These technological leaps could substantially reduce the demand for petrochemicals over time, impacting companies like PTT Global Chemical. The growing market for bio-based chemicals, projected to reach over $100 billion globally by 2027, highlights this shift.

Increasing Consumer and Regulatory Pressure for Sustainability

Growing consumer demand for environmentally friendly products and increasingly stringent governmental regulations on emissions and waste are significantly pushing industries towards sustainable alternatives. This societal and regulatory push creates a substantial threat of substitutes for PTT Global Chemical (PTTGC), particularly impacting its petrochemical-based product lines.

The shift towards sustainability means that materials derived from non-petrochemical sources, such as bio-plastics, recycled polymers, and biodegradable materials, are becoming more attractive. For instance, by 2024, global demand for bioplastics is projected to reach approximately 7.5 million metric tons, indicating a substantial market for these alternatives.

- Growing Environmental Awareness: Consumers are increasingly prioritizing products with a lower environmental footprint, favoring recycled or bio-based materials over traditional plastics.

- Stricter Regulations: Governments worldwide are implementing policies to curb plastic pollution and reduce carbon emissions, such as plastic bag bans and carbon taxes, making petrochemical products less competitive.

- Emergence of Sustainable Alternatives: The market is seeing a rise in innovative materials like PHA bioplastics and advanced chemical recycling technologies that offer viable substitutes for conventional petrochemicals.

- Impact on Petrochemical Demand: These trends directly threaten the demand for PTTGC's core products, forcing the company to adapt its product portfolio and invest in sustainable solutions to maintain market share.

Shift to Green Hydrogen and Biofuels

The increasing focus on sustainability is driving a significant threat from substitutes like green hydrogen and biofuels, directly challenging fossil fuel-based products. PTT Global Chemical (PTTGC) is actively addressing this by commencing sustainable aviation fuel (SAF) production in early 2025, utilizing non-petroleum feedstocks. This strategic move acknowledges the market's pivot towards greener alternatives, impacting traditional petrochemical demand.

This shift presents a clear substitution threat across multiple sectors:

- Energy Sector: Green hydrogen and advanced biofuels offer cleaner alternatives to traditional fossil fuels in transportation and power generation.

- Chemical Industry: Bio-based feedstocks are increasingly being developed as substitutes for petroleum-derived chemicals in various manufacturing processes.

- PTTGC's Response: The company's investment in SAF production, projected to scale up production capacity, directly counters the demand for conventional jet fuel derived from crude oil.

- Market Trends: Global investments in green hydrogen and biofuels are projected to reach billions by 2030, indicating a substantial market shift away from fossil-based products.

The threat of substitutes for PTT Global Chemical (PTTGC) is substantial, driven by the growing demand for sustainable alternatives across various industries. Bio-based plastics, biochemicals, and biofuels are gaining traction due to their lower environmental impact, with the global bioplastics market expected to reach USD 36.6 billion by 2030. Furthermore, the circular economy's emphasis on recycled materials directly challenges virgin petrochemical products, with recycled plastic demand projected for significant growth in 2024.

| Substitute Category | Key Drivers | Market Projection (approx.) | PTTGC's Relevance |

|---|---|---|---|

| Bio-based Plastics & Chemicals | Environmental concerns, biodegradability, regulatory push | Bioplastics market: USD 36.6B by 2030; Bio-based chemicals: >USD 100B by 2027 | Investment in bio-businesses, development of bio-based polymers |

| Recycled Materials | Circular economy principles, waste reduction, consumer preference | Growing demand for recycled plastics (2024 onwards) | Focus on circularity initiatives |

| Green Hydrogen & Biofuels | Decarbonization efforts, energy transition | Billions invested globally by 2030 | Production of Sustainable Aviation Fuel (SAF) from early 2025 |

Entrants Threaten

The petrochemical industry, where PTT Global Chemical operates, is inherently capital-intensive. Establishing competitive production capacity requires immense upfront investment in complex manufacturing plants, advanced technology, and extensive infrastructure. For instance, building a world-scale cracker can cost billions of dollars, creating a significant hurdle for potential new entrants.

This substantial financial barrier effectively deters many new players from entering the market. The sheer scale of investment needed means only well-established companies or those with significant backing can consider competing. This high capital requirement acts as a powerful deterrent, protecting existing players like PTT Global Chemical from immediate new competition.

Existing players like PTT Global Chemical (PTTGC) leverage substantial economies of scale, enabling lower per-unit production costs. For instance, in 2024, PTTGC's integrated petrochemical complexes allow for efficient feedstock utilization and optimized logistics, a significant hurdle for newcomers aiming to match their cost competitiveness, especially in high-volume commodity chemicals.

The industry's experience curve also presents a barrier. Years of operational refinement have allowed established firms to develop superior process efficiencies and product quality control. New entrants would need considerable time and investment to replicate this accumulated knowledge and achieve comparable operational excellence, making it challenging to enter on equal footing.

The petrochemical industry, including PTT Global Chemical (PTTGC), faces significant regulatory hurdles, particularly concerning environmental compliance. These regulations are designed to mitigate the sector's potential impact on pollution and emissions, making them a substantial barrier for new entrants.

New companies must navigate complex and costly permitting processes, ensuring adherence to stringent environmental standards. For instance, in 2024, the average time to obtain environmental permits for new chemical manufacturing facilities in developed economies can extend over 18-24 months, significantly increasing initial investment and delaying market entry.

Access to Feedstocks and Distribution Channels

Newcomers face substantial hurdles in securing consistent and affordable supplies of essential feedstocks, such as crude oil and natural gas. For instance, in 2024, the volatility in global energy markets continued to impact feedstock prices, making long-term, stable contracts a significant barrier for emerging players.

Established companies like PTT Global Chemical often benefit from pre-existing, advantageous supply agreements and integrated operations, which new entrants struggle to replicate. This vertical integration provides a cost advantage and ensures supply reliability.

Furthermore, building out robust distribution channels and logistics networks is a capital-intensive and time-consuming endeavor. By the end of 2023, the global logistics sector saw increased operating costs, further complicating market entry for those without established infrastructure.

- Feedstock Access: New entrants must secure reliable and cost-effective access to raw materials like crude oil and natural gas, a challenge exacerbated by 2024's energy market fluctuations.

- Distribution Networks: Establishing extensive and efficient distribution channels requires significant capital investment and time, creating a barrier against those without existing infrastructure.

- Established Player Advantage: Incumbents often possess long-term supply contracts and well-developed logistics, offering a substantial competitive edge over new market participants.

Brand Loyalty and Established Customer Relationships

While the commodity petrochemical market sees less brand differentiation, PTT Global Chemical (PTTGC) leverages its strength in specialty chemical segments where established customer relationships and a strong brand reputation are significant barriers. These long-standing connections mean new players struggle to gain traction without offering a compelling alternative.

PTTGC's strategic emphasis on high-value products and sustainable solutions actively cultivates customer loyalty. This focus makes it considerably more challenging for new entrants to win over PTTGC's existing client base unless they can present a truly disruptive innovation or a superior value proposition.

- Brand Loyalty: PTTGC's investment in specialty chemicals fosters deep customer loyalty, a key deterrent for newcomers.

- Customer Relationships: Established ties are difficult for new entrants to replicate, especially in value-added segments.

- Value Proposition: New entrants must offer a distinct advantage to overcome PTTGC's established market position and customer trust.

The threat of new entrants for PTT Global Chemical (PTTGC) is moderate, primarily due to the industry's high capital intensity and significant regulatory requirements. Establishing a competitive petrochemical operation requires billions in investment, a substantial deterrent for most potential new players. Furthermore, navigating complex environmental permits, which can take 18-24 months in 2024, adds considerable time and cost to market entry.

Access to feedstock and established distribution networks also pose significant barriers. PTTGC benefits from long-term supply contracts and integrated logistics, advantages that are difficult for newcomers to replicate, especially given the 2024 energy market volatility. In specialty chemical segments, PTTGC's strong customer relationships and brand loyalty further solidify its market position, making it challenging for new entrants to gain traction without a truly disruptive offering.

| Barrier Type | Impact on New Entrants | Example (2024 Data/Trends) |

| Capital Intensity | High | World-scale cracker costs exceed billions USD. |

| Regulatory Hurdles | High | Environmental permits can take 18-24 months. |

| Feedstock Access | Moderate to High | Energy market volatility impacts raw material costs. |

| Distribution Networks | Moderate to High | Increased logistics operating costs by end of 2023. |

| Customer Relationships/Brand Loyalty | Moderate (Specialty Chemicals) | Long-standing ties in value-added segments are hard to break. |

Porter's Five Forces Analysis Data Sources

Our PTT Global Chemical Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from financial reports, industry-specific market research, and government regulatory filings.

We leverage data from reputable sources such as Bloomberg, S&P Capital IQ, and key industry trade publications to provide a comprehensive view of competitive dynamics.