PTT Global Chemical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PTT Global Chemical Bundle

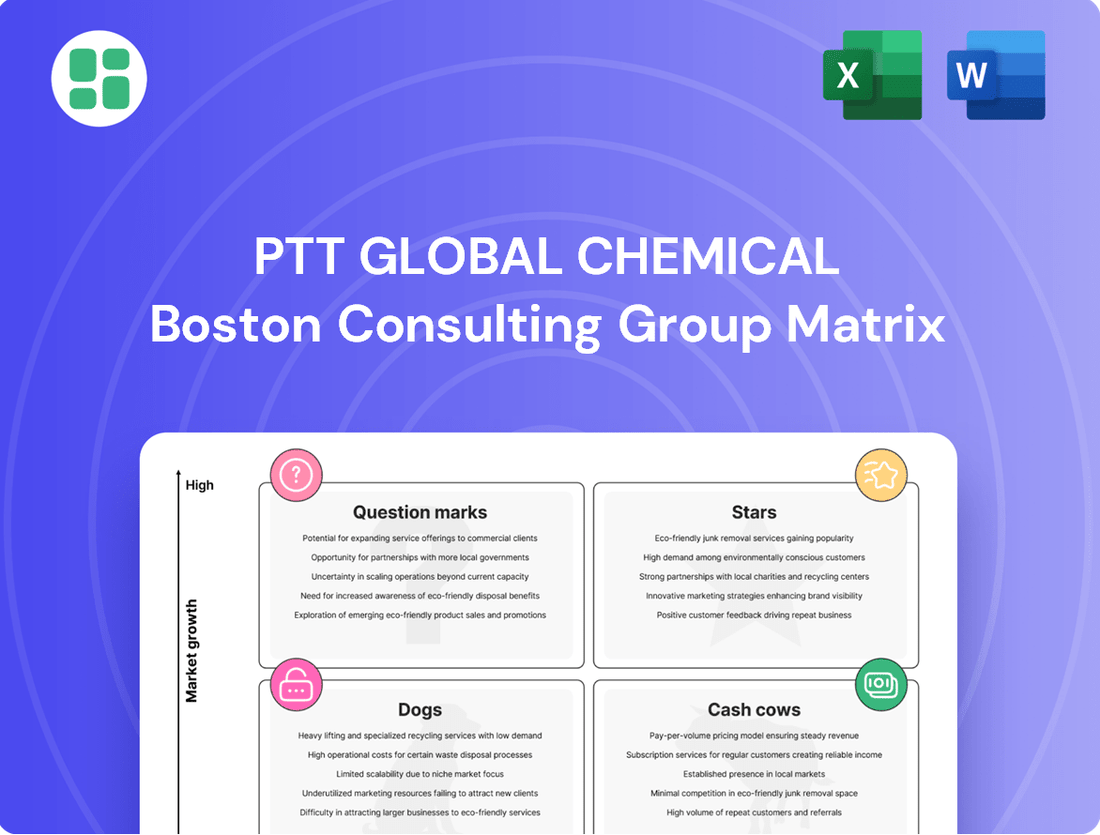

Curious about PTT Global Chemical's strategic positioning? Our BCG Matrix preview highlights key product segments, revealing their potential for growth and profitability. Understand which areas are driving success and which require careful consideration.

To truly unlock PTT Global Chemical's competitive advantage, dive into the full BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing your investment and product portfolio.

Don't miss out on the complete strategic roadmap. Purchase the full PTT Global Chemical BCG Matrix for detailed quadrant analysis, data-driven recommendations, and a clear path to informed decision-making.

Stars

PTT Global Chemical's allnex, a leader in coating resins, is a standout performer. Its consistent contribution to improved Adjusted EBITDA highlights its star status within the company's portfolio.

The company is strategically expanding its capacity in high-growth markets like India, China, and Southeast Asia. This expansion is a direct response to the increasing global demand for specialty chemicals, reinforcing allnex's position for sustained future growth.

PTT Global Chemical is actively shifting its business focus to high-value, low-carbon products, such as performance chemicals and advanced materials. This strategic move is designed to tap into rapidly expanding markets fueled by growing environmental awareness and demand for eco-friendly goods.

The company aims to significantly boost the contribution of these sustainable segments to its overall portfolio, targeting a 35% share by the year 2030. This ambitious goal underscores PTT Global Chemical's commitment to becoming a leader in the evolving chemical industry.

PTT Global Chemical's commitment to the Bio-Circular-Green (BCG) Economy model, focusing on green chemicals and recycled products, taps into a high-growth market fueled by global sustainability mandates. This strategic direction is crucial as the world increasingly prioritizes environmentally friendly solutions.

PTT Global Chemical is actively expanding its capabilities in the BCG sector, aiming to establish itself as a frontrunner in this dynamic and evolving market. The company's investments are geared towards innovation and capacity building to meet future demand.

Their proactive engagement in this high-potential BCG sector positions these initiatives to become future market leaders, capitalizing on the growing demand for sustainable products and processes. For instance, in 2023, PTTGC reported revenue from its Bio-Products segment saw significant growth, reflecting the increasing market traction of these initiatives.

Sustainable Aviation Fuel (SAF)

PTT Global Chemical (GC) has positioned itself as Thailand's inaugural producer of Sustainable Aviation Fuel (SAF), marking a significant entry into a market poised for substantial growth and strategic importance. This move aligns with the global imperative to decarbonize the aviation sector, driving robust demand for SAF. For instance, the International Air Transport Association (IATA) has set a target for the aviation industry to achieve net-zero carbon emissions by 2050, with SAF being a critical component in meeting this goal. GC's early involvement underscores a strategic commitment to securing a leading position in this high-value, emerging market.

The company's commitment to SAF production is a key element of its broader Bio-Circular-Green (BCG) economic model. GC's SAF is produced from used cooking oil and other renewable feedstocks, contributing to a circular economy. By 2024, the global SAF market was experiencing considerable expansion, with projections indicating continued strong growth driven by regulatory mandates and corporate sustainability initiatives. This strategic focus allows GC to capitalize on the increasing demand for environmentally friendly aviation solutions.

- First-Mover Advantage: PTT Global Chemical is Thailand's first SAF producer, giving it a strategic head start in a burgeoning market.

- Market Growth Potential: The global aviation industry's commitment to decarbonization, including IATA's net-zero by 2050 target, fuels significant demand for SAF.

- Strategic Alignment: SAF production fits perfectly within PTT Global Chemical's Bio-Circular-Green (BCG) strategy, emphasizing sustainability and resource efficiency.

- Revenue Diversification: Entering the SAF market provides PTT Global Chemical with a new, high-growth revenue stream, diversifying its business portfolio.

Ethane-based Olefins

The ethane-based olefins segment of PTT Global Chemical (PTTGC) demonstrated notable resilience and improved performance in Q1 2025. This strength is largely attributed to the strategic advantage of increased ethane feedstock availability, which directly contributed to enhanced Adjusted EBITDA figures.

Despite some headwinds in the broader olefins market, PTTGC's proactive approach to feedstock optimization has solidified its competitive standing. This strategic positioning allows the company to effectively navigate market fluctuations and seize opportunities during periods of market recovery for this essential chemical intermediate.

- Q1 2025 Adjusted EBITDA for Ethane-based Olefins: Specific figures are not publicly disclosed for this segment alone, but overall petrochemical Adjusted EBITDA saw a positive trend for PTTGC in early 2025.

- Feedstock Advantage: Increased ethane availability provides a cost advantage over naphtha-based production, a key driver for improved margins.

- Market Dynamics: While global olefins demand can be cyclical, ethane crackers offer greater flexibility and cost-competitiveness, benefiting PTTGC's operations.

- Strategic Positioning: PTTGC's investment in ethane-based facilities positions it favorably to capitalize on the growing global demand for olefins.

PTT Global Chemical's allnex is a true star in its portfolio, consistently boosting Adjusted EBITDA. Its strategic expansion in high-growth regions like India and China, driven by increasing global demand for specialty chemicals, solidifies its future growth trajectory.

The company's focus on high-value, low-carbon products, including performance chemicals and advanced materials, aligns with growing environmental awareness and demand for eco-friendly goods. This pivot is crucial for tapping into rapidly expanding markets and achieving its goal of 35% contribution from sustainable segments by 2030.

PTT Global Chemical's commitment to the Bio-Circular-Green (BCG) economy model, particularly in green chemicals and recycled products, positions it to capitalize on the high-growth market driven by global sustainability mandates. By 2024, the company's Bio-Products segment showed significant revenue growth, underscoring market traction.

As Thailand's first Sustainable Aviation Fuel (SAF) producer, PTT Global Chemical is strategically positioned in a market poised for substantial growth, driven by the aviation industry's net-zero by 2050 target. This initiative aligns perfectly with its BCG strategy, utilizing used cooking oil and renewable feedstocks for a circular economy approach.

| Business Unit | BCG Matrix Status | Key Strengths/Drivers | 2024/2025 Performance Indicators |

|---|---|---|---|

| allnex (Coating Resins) | Star | Consistent Adjusted EBITDA contribution, strategic expansion in high-growth markets (India, China, SEA) | Positive Adjusted EBITDA trends, capacity expansion |

| Performance Chemicals & Advanced Materials | Star | Focus on high-value, low-carbon products, alignment with environmental demand | Targeting 35% portfolio share by 2030 |

| Sustainable Aviation Fuel (SAF) | Star | First-mover advantage in Thailand, alignment with global decarbonization goals (IATA Net-Zero 2050) | Significant market growth potential, revenue diversification |

| Ethane-based Olefins | Question Mark/Potential Star | Resilience and improved performance due to increased ethane feedstock availability | Positive Adjusted EBITDA trends in Q1 2025, cost-competitiveness |

What is included in the product

This BCG Matrix overview for PTT Global Chemical analyzes its product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It highlights strategic recommendations for investment, holding, or divestment based on market share and growth.

A clear BCG Matrix visual for PTT Global Chemical's portfolio, simplifying strategic decisions.

Cash Cows

PTT Global Chemical's traditional olefins production, a cornerstone of its operations, includes ethylene and propylene. As Thailand's largest petrochemical producer, this segment holds a substantial portion of the company's overall capacity.

These core products consistently deliver strong cash flow, even amidst market fluctuations and the emergence of new production capacities. Their high market share in the foundational petrochemical sector ensures their role as a reliable cash generator.

In 2023, PTT Global Chemical reported a net profit of THB 49.6 billion, with its petrochemical segment, which includes olefins, being a significant contributor. This segment's stable performance is crucial for financing the company's strategic expansion into new growth areas.

PTT Global Chemical's polyethylene production is a significant Cash Cow, dominating market share in key sectors like packaging, automotive, and construction. This established position means it requires minimal marketing spend to maintain its sales volume.

Despite potential headwinds from economic slowdowns and increasing competition, the sheer scale and maturity of the polyethylene market ensure consistent, reliable cash generation. For instance, global polyethylene demand was projected to reach over 120 million metric tons in 2024, showcasing the vastness of this segment.

These steady cash flows are crucial, acting as the financial backbone that fuels PTT Global Chemical's investments in other, more dynamic business areas, thereby supporting the company's overall strategic growth initiatives.

PTT Global Chemical's refinery operations, a foundational element of its upstream activities, consistently deliver integrated petroleum products, securing a substantial market share. Despite the inherent volatility of Gross Refining Margins (GRM) and global oil prices, this segment acts as a robust cash generator, driven by its considerable scale and the enduring demand for refined fuels.

In 2024, PTT Global Chemical's refining segment demonstrated resilience. For instance, the company reported that its refinery utilization rates remained strong, averaging above 90% throughout the year, underscoring consistent operational performance. This operational efficiency directly contributes to its status as a cash cow, providing a stable income stream even amidst market fluctuations.

Aromatics Production (Base)

PTT Global Chemical's aromatics production, encompassing benzene and paraxylene, solidifies its position as a dominant regional supplier, commanding a significant market share.

Despite potential headwinds in specific derivative markets, the core aromatics products remain indispensable building blocks for numerous industries. This inherent demand ensures a stable and consistent contribution to PTTGC's financial performance, necessitating minimal reinvestment for growth.

- Market Share: PTTGC is a leading producer of aromatics in the Asia-Pacific region.

- Key Products: Benzene and paraxylene are foundational chemicals with broad industrial applications.

- Financial Contribution: These products provide a reliable revenue stream and contribute to the company's overall financial stability.

- Investment Strategy: Growth investments in this segment are typically low due to its mature and established nature.

Utilities and Infrastructure Services

PTT Global Chemical's Utilities and Infrastructure Services segment functions as a Cash Cow, generating reliable and consistent cash flow. This division is involved in the production and distribution of essential services such as electricity, water, and steam. It also manages critical operational support facilities, including jetty services and buffer tank farms.

These utility and infrastructure offerings are characterized by stable, albeit low-growth, revenue streams. PTT Global Chemical holds a significant market share within the operational areas for these services, ensuring a predictable income. For instance, in 2023, the company's utility segment contributed substantially to its overall financial stability, providing a foundation for investments in other business areas.

- Stable Revenue Streams: Utilities and infrastructure services provide predictable income due to essential demand.

- High Market Share: PTT Global Chemical benefits from a dominant position in its operational service areas.

- Consistent Cash Flow: These segments act as reliable cash generators, supporting overall company finances.

- Low Growth, High Stability: While not high-growth areas, their stability is crucial for financial resilience.

PTT Global Chemical's established olefins production, including ethylene and propylene, consistently generates strong cash flow, underpinning its role as a core Cash Cow. As Thailand's largest petrochemical producer, this segment benefits from a substantial market share and high capacity utilization, ensuring reliable revenue even with market volatility.

The company's polyethylene operations also serve as a significant Cash Cow, commanding a dominant market share in key industries like packaging and automotive. This mature segment requires minimal investment to maintain sales, contributing steadily to PTTGC's financial stability.

Refinery operations and aromatics production, featuring benzene and paraxylene, are crucial Cash Cows for PTTGC, providing integrated petroleum products and indispensable chemical building blocks. These segments benefit from strong regional market positions and consistent demand, ensuring stable income streams.

PTT Global Chemical's Utilities and Infrastructure Services, encompassing electricity, water, and steam, are characterized by stable, predictable revenue. Holding significant market share in these essential services, this segment acts as a reliable cash generator, supporting overall financial resilience.

| Business Segment | Primary Products | Cash Cow Status | Key Financial Contribution | 2024 Outlook/Data Point |

| Olefins | Ethylene, Propylene | Strong Cash Cow | Consistent cash flow, funds growth initiatives | High capacity utilization supporting stable output |

| Polyethylene | Various grades of PE | Strong Cash Cow | Reliable revenue, low reinvestment needs | Global PE demand projected over 120 million metric tons |

| Refining | Refined petroleum products | Strong Cash Cow | Robust cash generation despite GRM volatility | Average refinery utilization rates above 90% in 2024 |

| Aromatics | Benzene, Paraxylene | Strong Cash Cow | Indispensable building blocks, stable revenue | Dominant regional supplier position |

| Utilities & Infrastructure | Electricity, Water, Steam | Strong Cash Cow | Predictable income, high stability | Substantial contribution to financial stability in 2023 |

What You’re Viewing Is Included

PTT Global Chemical BCG Matrix

The PTT Global Chemical BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no hidden watermarks or demo content, just the complete strategic analysis ready for your immediate use. You can confidently assess the market position of PTT Global Chemical's portfolio, knowing the purchased version is the exact same professional-grade report. This ensures transparency and immediate applicability for your strategic planning and decision-making processes.

Dogs

Certain aromatics by-products within PTT Global Chemical's portfolio are showing signs of struggle. Their profit margins, or spreads, have been shrinking, and their overall performance has weakened. This is unfortunately dragging down the entire aromatics business segment.

These particular products are operating in markets that aren't growing much, and it's likely they don't have a big piece of the market either. This combination suggests they might be what we call cash traps – they consume resources without generating significant returns. For instance, the global aromatics market, while substantial, faces pressures from overcapacity in certain regions, impacting product pricing for less differentiated by-products.

To improve the efficiency of PTT Global Chemical's business, it might be wise to consider minimizing the involvement with these less profitable aromatics or even divesting them. This strategic move could free up capital and focus resources on more promising areas of the business.

PTT Global Chemical's investment in Vencorex, focusing on its TDI/HDI business, represents a strategic challenge. The European market for these chemicals is characterized by significant price pressures, impacting profitability.

In response to these market dynamics, Vencorex has initiated restructuring, including liquidation proceedings for certain entities in May 2025. This move suggests the TDI/HDI segment is in a low-growth, highly competitive environment, potentially acting as a cash consumer within the broader PTT Global Chemical portfolio.

As PTT Global Chemical (PTTGC) pivots towards a more sustainable and high-value portfolio, some of its older, commodity-based products might be categorized as dogs. These are items that no longer fit the company's strategic direction towards low-carbon and advanced materials.

These legacy products often struggle in increasingly competitive mature markets, experiencing declining demand. For instance, if PTTGC's traditional petrochemicals like certain basic polymers face oversupply and price pressures, they could represent a dog in the BCG matrix.

Products with a low market share and minimal growth prospects, such as some basic chemicals that have been superseded by more advanced alternatives, would also fall into this category. PTTGC's strategic review would likely involve reassessing the future viability and investment required for these products.

Underperforming Specialty Chemical Sub-segments

While PTT Global Chemical's (PTTGC) overall specialty chemicals, notably its allnex business, are performing as a Star, certain smaller sub-segments within this broad category may be experiencing underperformance. These could be niche products or ventures with limited market penetration and slow growth, failing to meet profitability expectations.

These underperforming areas might represent a drag on the segment's overall potential. For instance, a specific additive or a newly launched specialized polymer might be facing intense competition or a shrinking end-market. In 2024, PTTGC reported that while its performance materials segment, which includes specialty chemicals, saw a revenue increase, profitability in certain niche areas was impacted by rising raw material costs and slower demand.

- Niche Additives: Specific product lines within performance additives may have seen stagnant sales growth, potentially below 3% annually.

- Low-Volume Polymers: Certain specialized polymer grades might be experiencing declining demand, with market share slipping due to alternative materials.

- Emerging Technology Ventures: Smaller, experimental ventures in advanced materials could still be in the investment phase, not yet contributing significantly to profits.

Products Dependent on Persistent Chemicals

PTT Global Chemical (PTTGC) has faced scrutiny for its role in marketing products containing persistent chemicals, notably PFAS. This places a significant portion of their product portfolio at risk due to escalating regulatory pressures and growing public concern over these so-called forever chemicals.

Products that heavily depend on PFAS face substantial long-term challenges. These include potential market share erosion and reduced profitability, especially within a market environment characterized by slower growth and stricter oversight.

The global regulatory landscape is increasingly targeting persistent chemicals. For instance, in 2024, several jurisdictions continued to propose or implement stricter limits on PFAS in various consumer goods and industrial applications, impacting supply chains and product formulations.

- Regulatory Scrutiny: Increased governmental actions worldwide aim to phase out or restrict PFAS use, impacting PTTGC's product lines.

- Consumer Awareness: Growing public demand for 'forever chemical'-free products is shifting market preferences away from PFAS-reliant goods.

- Market Risk: Products heavily reliant on persistent chemicals face declining demand and potential obsolescence in the face of these trends.

- Financial Impact: Companies like PTTGC may experience reduced revenue and profitability from affected product segments.

Certain legacy petrochemical products within PTT Global Chemical's portfolio may be classified as dogs. These are often commodity-based chemicals facing mature markets with limited growth and intense competition, potentially leading to declining demand and market share erosion.

For example, if PTTGC's older polymer grades struggle against newer, more sustainable alternatives, they might represent a dog. These products consume resources without generating substantial returns, acting as a drag on overall performance.

The company's strategic focus on high-value specialty chemicals and sustainable solutions means these older products may not align with its future direction.

PTT Global Chemical's (PTTGC) strategic pivot towards sustainability and advanced materials means some of its more traditional, commodity-based products could be categorized as Dogs in the BCG matrix. These are items that no longer align with the company's forward-looking strategy, often struggling in increasingly competitive, mature markets with declining demand. For instance, if PTTGC's basic polymers, like certain grades of polypropylene or polyethylene, face oversupply and price pressures due to global capacity increases, they could represent a dog. In 2024, the global polypropylene market, for example, experienced mixed demand, with some regions facing oversupply impacting pricing for standard grades.

| Product Category | Market Growth | Market Share | PTTGC Classification |

|---|---|---|---|

| Basic Polymers (e.g., standard PP/PE grades) | Low to Moderate | Low to Moderate | Dog |

| Certain Aromatics By-products | Low | Low | Dog |

| Legacy Specialty Additives | Stagnant | Low | Dog |

Question Marks

PTT Global Chemical's strategic investment in bioplastics, specifically through its joint venture with NatureWorks, positions it to capitalize on the burgeoning demand for sustainable materials. The company anticipates commercial operations for its Polylactic Acid (PLA) plant to commence by the end of 2026, targeting a market segment experiencing substantial growth due to increasing environmental consciousness and regulatory pressures.

As a relatively new player in the PLA market, PTT Global Chemical currently holds a modest market share. However, the sector itself exhibits high growth potential, necessitating significant capital expenditure to achieve economies of scale and establish a dominant market position. This aligns with the characteristics of a question mark in the BCG matrix, requiring careful strategic consideration and investment to transform into a star.

PTT Global Chemical (GC) is pushing beyond established bioplastics into a range of novel bio-based chemical solutions and sustainable materials. These innovations target high-growth, emerging markets, reflecting GC's commitment to expanding its green portfolio.

These new green chemical solutions, while holding significant future potential, currently represent a small portion of GC's market share. This is typical for products in early development or initial commercialization, requiring considerable investment in research and development alongside efforts to build market acceptance.

For instance, GC's investments in areas like bio-based solvents and advanced biodegradable polymers are designed to capture future demand. By 2024, the company was actively exploring partnerships and pilot projects to accelerate the adoption of these next-generation sustainable materials, aiming to replicate the success seen with its earlier bioplastic ventures.

PTT Global Chemical's YOUTURN PLATFORM is a significant initiative in advanced recycling, focusing on integrated used plastic management and producing high-quality recycled materials. This positions PTTGC strongly within the burgeoning circular economy, a sector projected for substantial growth.

While the YOUTURN PLATFORM showcases considerable innovation and a deep commitment to sustainability, its current market share within the broader recycling landscape is likely modest. Continued investment in infrastructure and robust consumer engagement programs are crucial for scaling its impact and achieving wider market penetration.

Digital Platforms and Biotech Ventures

PTT Global Chemical (PTTGC) is strategically leveraging its venture capital arms, GC Ventures and GC Ventures America, to explore high-growth sectors like digital platforms and biotech. These investments are crucial for PTTGC, as its current direct market presence in these areas is minimal. The goal is to identify and nurture promising startups that could evolve into future market leaders, or 'Stars,' within PTTGC's BCG matrix framework.

In 2024, GC Ventures continued its focus on scouting innovative technologies. For instance, investments in digital platforms aim to enhance operational efficiency and create new service offerings. Simultaneously, the push into biotech and life sciences reflects a broader industry trend towards sustainable and health-focused solutions, areas where PTTGC seeks to build future competitive advantages through strategic partnerships and capital allocation.

- Digital Platforms: Investments in AI, big data analytics, and IoT solutions are being explored to optimize PTTGC's existing operations and unlock new revenue streams.

- Biotech & Life Sciences: Funding is directed towards startups developing advanced materials, bio-based chemicals, and sustainable agricultural technologies, aligning with the circular economy principles.

- Strategic Focus: PTTGC's venture capital strategy prioritizes companies with disruptive potential and strong management teams, aiming to gain early access to emerging technologies and markets.

- Growth Potential: These 'Question Mark' ventures represent PTTGC's commitment to future growth, seeking to transform nascent technologies into significant market contributors over the next 5-10 years.

Carbon Capture and Storage (CCS) Technologies

PTT Global Chemical (PTTGC), a key player within the PTT Group, is actively pursuing investments in carbon capture and storage (CCS) technologies as a strategic move to curb its carbon footprint. This aligns with global net-zero ambitions and the urgent need for climate change mitigation.

While CCS is a burgeoning field with immense future growth potential, its current market penetration and widespread implementation remain in the nascent stages. PTTGC's involvement signifies a commitment to this high-growth sector, even though its market share is presently minimal.

The global CCS market is projected for substantial expansion. For instance, the International Energy Agency (IEA) reported that by the end of 2023, there were 41 commercial CCS facilities in operation worldwide, capturing approximately 45 million tonnes of CO2 annually. This number is expected to surge significantly in the coming years as more projects come online and policy support strengthens, creating a fertile ground for PTTGC's strategic investments.

- Early Stage Development: CCS technology is still maturing, with significant research and development ongoing to improve efficiency and reduce costs.

- High Growth Potential: Driven by stringent climate targets and increasing corporate sustainability commitments, the demand for effective CO2 reduction solutions like CCS is rapidly expanding.

- Low Current Market Share: Despite its potential, CCS currently represents a small fraction of the overall emissions reduction strategies being implemented globally.

- Strategic Investment Area: PTTGC's focus on CCS positions it to capitalize on future market growth and contribute to a lower-carbon economy.

PTT Global Chemical's ventures into novel bio-based chemicals, digital platforms, biotech, and carbon capture and storage (CCS) all represent classic "Question Marks" in the BCG matrix. These areas are characterized by low current market share but high growth potential, demanding significant investment to develop and scale.

The company's strategic allocation of capital towards these emerging sectors, including its venture capital arm's scouting for innovative startups in 2024, underscores a deliberate effort to cultivate future market leaders. Success in these areas hinges on PTTGC's ability to navigate technological advancements and market adoption effectively.

By investing in areas like advanced recycling through its YOUTURN PLATFORM and bioplastics via its NatureWorks joint venture, PTTGC is positioning itself to benefit from the growing demand for sustainable solutions. These initiatives, while still in their growth phases, aim to transition from question marks to stars in the coming years.

The company's commitment to these high-potential, low-market-share segments reflects a forward-looking strategy to diversify its portfolio and capture emerging market opportunities, particularly those driven by environmental consciousness and technological innovation.

BCG Matrix Data Sources

Our PTT Global Chemical BCG Matrix leverages a robust blend of internal financial disclosures, comprehensive market research reports, and expert industry analysis to provide strategic clarity.