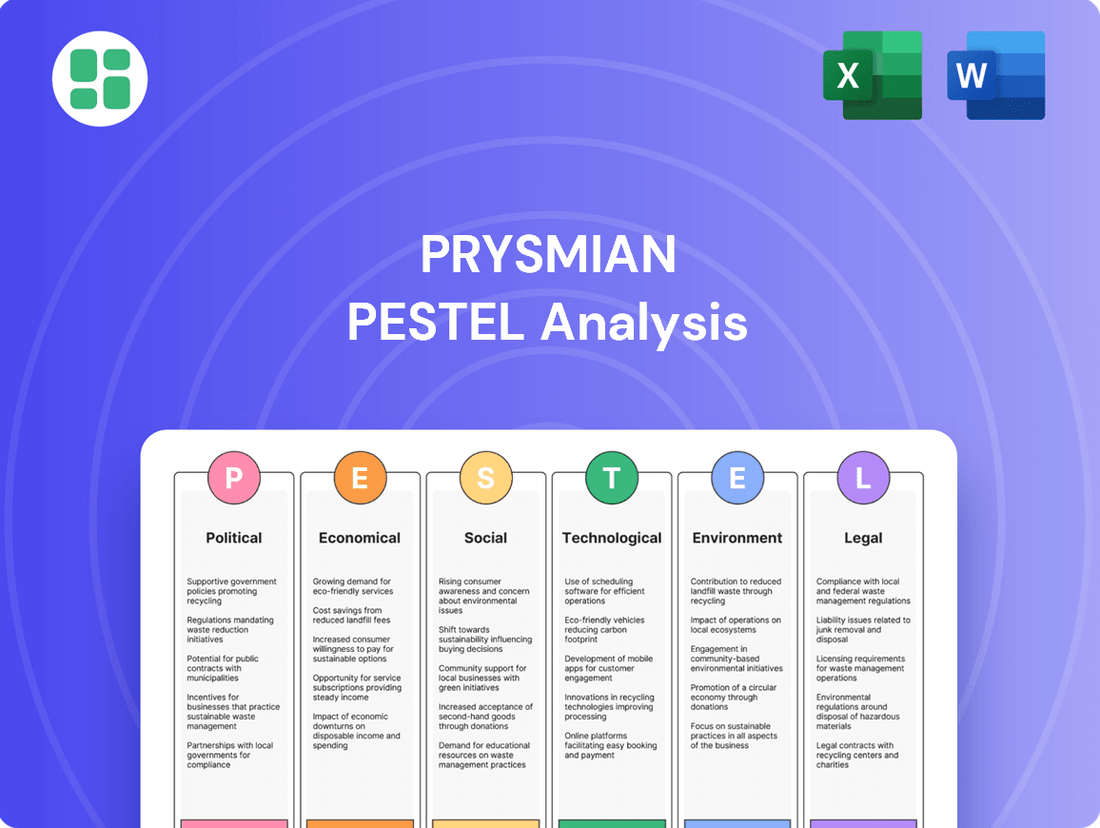

Prysmian PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

Understand how political, economic, and technological forces impact Prysmian's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Governments worldwide are significantly increasing infrastructure spending, with a focus on modernizing energy grids and expanding digital connectivity. For instance, the European Union's NextGenerationEU recovery plan allocates substantial funds to green and digital transitions, directly benefiting companies like Prysmian that supply cables for smart grids and renewable energy projects. In the United States, the Bipartisan Infrastructure Law, passed in 2021, earmarks billions for grid modernization and broadband deployment, creating a robust demand environment.

Global trade policies and tariffs directly influence Prysmian's operational costs and market positioning. For example, the US International Trade Commission's investigations into steel and aluminum imports in 2024 could lead to new tariffs, potentially increasing Prysmian's raw material expenses for copper and aluminum, critical components in its cable manufacturing.

The imposition of trade barriers, such as those seen in recent US-China trade disputes, can disrupt supply chains and affect the price competitiveness of Prysmian's finished goods in key international markets. While Prysmian's diversified manufacturing footprint, including significant operations in North America, can help buffer some impacts, ongoing vigilance regarding trade agreements and potential protectionist measures remains crucial for supply chain resilience and market access.

Geopolitical stability is a significant concern for Prysmian. For instance, the ongoing conflicts in Ukraine and Israel, as highlighted in their market outlook, directly impact project timelines and the cost of essential materials, creating considerable uncertainty.

Prysmian's extensive global operations mean they must constantly adapt to a wide array of political environments. This requires meticulous planning to ensure project continuity and supply chain integrity across diverse regions.

Regulatory Environment for Energy Transition

Governments worldwide are making significant commitments to energy transition, decarbonization, and digitalization. These efforts directly translate into increased demand for high-technology cables and advanced systems, which are central to Prysmian's offerings. For instance, the European Union's Green Deal aims for climate neutrality by 2050, spurring investments in renewable energy infrastructure.

Policies that actively promote renewable energy generation, such as tax credits and feed-in tariffs, coupled with initiatives for grid modernization and expanded digital access, create a highly favorable regulatory landscape for Prysmian. In 2024, many nations continued to set ambitious renewable energy targets.

- Governmental Commitments: Many countries have reinforced their 2030 and 2050 climate targets, aligning with global decarbonization efforts.

- Policy Support: Subsidies for renewable energy projects and investments in smart grid technology are on the rise.

- Digitalization Drive: Expansion of fiber optic networks for enhanced digital connectivity is a key government priority.

- Prysmian's Alignment: The company's strategic focus on supporting these global energy and digital transitions positions it well within this regulatory framework.

Local Content Requirements and Industrial Policies

Local content requirements are becoming increasingly prevalent, impacting global supply chains. For instance, many nations are now mandating that a specific percentage of materials and labor in major infrastructure projects, such as renewable energy installations or telecommunications networks, must be sourced domestically. This trend directly influences companies like Prysmian, a major player in the energy and telecom cable industry, by shaping decisions about where to build factories and how to structure their supply networks.

Prysmian's robust global manufacturing presence, with over 100 manufacturing facilities worldwide, is a key asset in navigating these evolving political landscapes. This extensive network allows the company to adapt to varying local content mandates by potentially shifting production or establishing new facilities closer to project sites. For example, in 2024, Prysmian announced plans to expand its manufacturing capabilities in Southeast Asia, partly in response to growing regional demands for localized production in the renewable energy sector.

These industrial policies can also affect Prysmian’s competitive positioning and profitability. Companies that can efficiently meet local content quotas may gain a significant advantage in securing large-scale contracts. Conversely, failure to comply can lead to penalties or exclusion from lucrative projects. Prysmian’s ongoing investment in R&D and its commitment to sustainable manufacturing practices also play a role in aligning with national industrial strategies that often prioritize technological advancement and environmental responsibility.

The push for industrial policies and local content requirements is a significant factor in the global business environment for companies like Prysmian. Key considerations include:

- Strategic Location of Facilities: Decisions on where to build or expand manufacturing plants are increasingly influenced by countries requiring a higher percentage of locally produced goods for large infrastructure projects.

- Supply Chain Localization: Companies must adapt their supply chains to source raw materials and components from within the host country to meet regulatory demands, potentially increasing operational complexity and costs.

- Contract Acquisition: Compliance with local content rules can be a prerequisite for winning bids on major government-backed projects, directly impacting revenue streams and market access.

- Investment in Local Capabilities: To meet these requirements, Prysmian and similar firms may need to invest in local research and development, workforce training, and technology transfer, fostering domestic industrial growth.

Governments worldwide are actively promoting energy transition and digital infrastructure, creating substantial opportunities for Prysmian. For example, the US Bipartisan Infrastructure Law allocated $65 billion for grid modernization and broadband expansion through 2026, directly benefiting cable suppliers. Similarly, the EU's Green Deal and its associated funding mechanisms are driving demand for cables essential for renewable energy projects and smart grids.

Trade policies and geopolitical stability remain critical factors influencing Prysmian's operations. Tariffs on raw materials like copper and aluminum, as seen in ongoing trade investigations in 2024, can impact manufacturing costs. Geopolitical tensions, such as those in Eastern Europe, also create supply chain uncertainties and affect project execution timelines.

Increasingly, governments are implementing local content requirements for major infrastructure projects. This trend necessitates that companies like Prysmian adapt their manufacturing and sourcing strategies to meet domestic production mandates, potentially influencing investment decisions in new facilities. For instance, Prysmian's 2024 expansion in Southeast Asia was partly driven by regional demands for localized production in the renewable energy sector.

Prysmian's strategic alignment with global policy trends is evident in its focus on renewable energy and digital connectivity. The company's extensive global manufacturing footprint, with over 100 facilities, provides flexibility in responding to diverse regulatory environments and local content requirements, ensuring market access and competitiveness.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Prysmian, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats.

Provides a clear, actionable overview of external factors impacting Prysmian, streamlining strategic decision-making and mitigating potential risks before they become critical issues.

Economic factors

Global economic growth is a primary driver for Prysmian, as increased investment in utilities and infrastructure, sectors heavily reliant on cable systems, directly correlates with economic expansion. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a moderately supportive environment for Prysmian's core markets.

Industrial activity, a key indicator of demand for Prysmian's products, also plays a crucial role. Manufacturing output and construction spending are directly linked to the need for energy and telecommunications infrastructure. A healthy industrial sector, characterized by robust production and new project pipelines, typically translates into higher sales volumes for Prysmian's cable solutions.

Conversely, economic downturns or slowdowns can significantly dampen demand. Project delays or cancellations in large-scale infrastructure and construction initiatives, often a consequence of economic uncertainty or reduced public spending, can directly impact Prysmian's revenue streams. For example, if major economies experience a contraction, investment in new power grids or broadband networks might be postponed, affecting Prysmian's order book.

Raw material price volatility, particularly for copper and aluminum crucial to Prysmian's cable production, directly impacts manufacturing costs and overall profitability. For instance, copper prices saw significant fluctuations throughout 2024, with LME cash prices trading between approximately $7,500 and $10,500 per metric ton, creating considerable uncertainty for cost projections.

These market swings pose challenges for Prysmian's pricing strategies and margin management, requiring agile responses to maintain competitiveness. The company's ability to effectively manage these risks through sophisticated hedging techniques and robust supply chain partnerships is paramount for stable financial performance.

Global interest rate shifts directly affect Prysmian's financing costs for major projects and influence how readily its clients can fund infrastructure developments. For instance, the European Central Bank's key interest rates, which were raised significantly throughout 2023 and into early 2024, increase the cost of borrowing for large capital expenditures.

When interest rates climb, the overall attractiveness of undertaking extensive projects diminishes, potentially leading to a slowdown in demand for Prysmian's products and services. This is particularly relevant for sectors like energy transmission and telecommunications, where project financing is a critical component.

Affordable access to capital remains paramount for Prysmian's strategic growth, including investments in advanced manufacturing facilities and specialized vessels like its cable-laying fleet, which saw significant investment in recent years. Concurrently, Prysmian's customers, such as utility companies or telecom providers, rely on favorable borrowing conditions to finance their own network upgrades and expansions.

Currency Exchange Rate Fluctuations

Prysmian, operating in over 50 countries, faces considerable risk from currency exchange rate fluctuations. Major currency movements, especially in the EUR/USD pairing, directly impact its reported revenues and expenses. For instance, a stronger Euro against the US Dollar could reduce the value of its USD-denominated earnings when translated back into Euros, affecting overall financial performance.

Effective management of these currency exposures is crucial for Prysmian to maintain predictable financial outcomes. The company's 2023 financial statements, for example, would have detailed the impact of currency translation on its reported figures. This highlights the ongoing need for robust hedging strategies and careful monitoring of global economic conditions that drive these currency shifts.

Key considerations for Prysmian regarding currency exchange rates include:

- Impact on Revenue: Fluctuations can alter the reported value of sales made in foreign currencies.

- Cost of Goods Sold: Exchange rates affect the cost of imported raw materials and components.

- Profitability: Net income can be significantly influenced by the translation of foreign subsidiary results.

- Competitive Positioning: Currency strength can make Prysmian's products more or less competitive in different markets.

Competition and Market Dynamics

The energy and telecom cable systems industry is highly competitive, featuring established giants and emerging players. This dynamic directly impacts Prysmian's ability to set prices and capture market share. For instance, in the first quarter of 2024, Prysmian reported a revenue of €3.9 billion, demonstrating its significant market presence amidst this competition.

Prysmian's leadership hinges on constant innovation and cost control. Strategic moves, such as the proposed acquisition of Encore Wire for approximately $4.3 billion (announced in early 2024), are crucial for broadening its market reach and enhancing its product offerings, thereby solidifying its competitive edge.

- Key Competitors: Nexans, LS Cable & System, Furukawa Electric, and General Cable (now part of Prysmian).

- Market Share Influence: Intense competition can pressure margins, making operational efficiency paramount.

- Innovation Drivers: Demand for higher capacity cables (e.g., for offshore wind and 5G networks) fuels innovation.

- Acquisition Strategy: Prysmian's acquisition of Encore Wire in 2024 aims to strengthen its position in the North American market, particularly in building wire.

Global economic growth directly fuels demand for Prysmian's infrastructure solutions, with projected global growth around 3.2% for 2024 by the IMF indicating a supportive market. Industrial activity, especially in construction and manufacturing, is a key indicator, directly correlating with the need for energy and telecom cables. However, economic downturns can lead to project delays, impacting Prysmian's revenue, as seen in potential slowdowns in network upgrades during economic uncertainty.

Preview the Actual Deliverable

Prysmian PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Prysmian PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. It provides actionable insights for informed decision-making.

Sociological factors

Global population growth, projected to reach 9.7 billion by 2050, fuels a significant demand for enhanced infrastructure. Urbanization is accelerating this trend, with over 60% of the world's population now living in cities, a figure expected to climb to 68% by 2050. This concentrated living necessitates robust power grids and advanced telecommunication networks, directly increasing the need for Prysmian's cable and connectivity solutions.

As urban centers expand and become more densely populated, the requirement for reliable energy and seamless digital communication intensifies. Prysmian's expertise in power transmission, distribution, and telecommunications infrastructure positions it to meet these growing demands. The company's products are crucial for building and upgrading the essential backbone of modern urban life, from powering homes to enabling high-speed internet access.

This sustained trend of increasing urbanization and population growth creates a consistent and expanding market for Prysmian's offerings. Both developed nations upgrading aging infrastructure and emerging economies building new systems represent significant growth opportunities. For instance, the global smart grid market alone is anticipated to reach $100 billion by 2027, highlighting the scale of investment in this area.

The global drive for digital inclusion is a significant societal force, directly translating into increased demand for the very infrastructure Prysmian provides. As more people gain access to online resources, education, and services, the need for robust, high-speed internet connectivity becomes paramount. This societal push is a core driver for the telecommunications sector.

Prysmian's contribution to connecting millions of households with fast digital access highlights its integral role in meeting this societal need. For instance, in 2023, Prysmian's fiber optic cable deployments were instrumental in expanding broadband access in numerous regions, directly impacting digital equity. This alignment with societal goals is crucial for long-term relevance.

This growing demand for connectivity fuels continuous innovation in telecom cable solutions. Companies like Prysmian are investing heavily in developing more efficient, higher-capacity optical fibers and advanced data cables to meet the ever-increasing bandwidth requirements driven by this societal trend. The market for advanced cabling solutions is expected to see substantial growth through 2025 and beyond.

The availability of skilled labor, particularly engineers and R&D professionals, is paramount for Prysmian's operational efficiency, innovation pipeline, and successful project delivery. As the energy and telecom sectors rapidly adopt new technologies and undertake increasingly complex infrastructure projects, securing and retaining a highly competent workforce presents a significant sociological challenge.

Prysmian actively addresses this by prioritizing employee engagement, fostering a diverse and inclusive workplace, and investing in continuous upskilling and reskilling programs. For instance, in 2024, the company continued its focus on talent development, with a significant portion of its training budget allocated to advanced technical skills relevant to renewable energy and digital infrastructure projects.

Health, Safety, and Wellbeing Standards

Societal expectations and regulatory emphasis on workplace health, safety, and employee wellbeing directly shape Prysmian's operational strategies and investment priorities. Companies are increasingly held accountable for fostering secure and healthy work environments, making robust HSE (Health, Safety, Environment) practices a cornerstone of corporate social responsibility and brand reputation. Prysmian's commitment to these standards is evident in its continuous investment in HSE projects aimed at enhancing working conditions and minimizing risks across its global operations.

Prysmian's dedication to improving health, safety, and wellbeing is reflected in concrete actions and targets. For instance, the company has set ambitious goals to reduce its accident frequency rate. In 2023, Prysmian reported a significant improvement, with its Lost Time Injury Frequency Rate (LTIFR) decreasing to 0.39 per million hours worked, a testament to its ongoing efforts and investments in safety protocols and training programs.

These efforts are crucial for several reasons:

- Legal Compliance and Risk Mitigation: Adhering to stringent HSE regulations prevents fines, legal challenges, and operational disruptions.

- Employee Morale and Productivity: A safe and supportive workplace boosts employee morale, engagement, and ultimately, productivity.

- Corporate Reputation and Stakeholder Trust: Strong HSE performance enhances Prysmian's image, attracting talent and building trust with investors, customers, and the wider community.

- Operational Efficiency: Investing in safer processes often leads to more efficient operations by reducing downtime caused by accidents or incidents.

Community Engagement and Social Impact

Prysmian's dedication to fostering social and economic growth in its operating regions is a key sociological aspect. For instance, its collaborations in educating local schoolchildren, as observed in the United Kingdom, highlight a commitment that extends beyond core business activities, impacting community well-being.

These efforts are crucial for securing a social license to operate and bolstering brand reputation. In 2024, Prysmian continued its focus on community development, with specific programs aimed at STEM education. The company reported investing over €15 million globally in social initiatives and employee volunteering in 2023, a figure expected to see continued investment in 2024.

- Community Investment: Prysmian's global social investment reached €15 million in 2023, with ongoing commitments for 2024.

- Educational Partnerships: Initiatives like those in the UK support local schooling, enhancing Prysmian's societal contribution.

- Social License: Active community engagement strengthens Prysmian's acceptance and operational legitimacy.

- Brand Reputation: Positive social impact directly contributes to a favorable public image and brand loyalty.

Societal trends like increasing urbanization and a global push for digital inclusion directly boost demand for Prysmian's infrastructure solutions. As populations grow and concentrate in cities, the need for reliable power and high-speed internet connectivity becomes paramount. Prysmian's fiber optic cable deployments in 2023, for example, were key in expanding broadband access, aligning with the societal goal of digital equity.

The availability of a skilled workforce, particularly in engineering and R&D, is a critical sociological factor for Prysmian's innovation and project execution. The company's investment in talent development in 2024, with a focus on advanced technical skills for renewable energy and digital infrastructure, addresses this need. Furthermore, societal expectations regarding workplace health and safety are driving Prysmian's commitment to robust HSE practices, evidenced by a 2023 Lost Time Injury Frequency Rate (LTIFR) of 0.39 per million hours worked.

Prysmian's engagement with local communities, including STEM education initiatives, strengthens its social license to operate and enhances its brand reputation. The company's global social investment reached €15 million in 2023, with continued commitments for 2024, underscoring its dedication to fostering social and economic growth in its operating regions.

Technological factors

Prysmian's success hinges on continuous innovation in cable materials, design, and manufacturing. This means developing cutting-edge high-voltage underground and submarine cables that offer greater efficiency and capacity, alongside advanced optical fibers and data cables. For example, in 2023, Prysmian continued to invest heavily in R&D, with a significant portion of its capital expenditure dedicated to developing next-generation cable solutions.

These advancements are critical for Prysmian to maintain its technological edge and adapt to changing market demands. The company is focused on areas like cables for renewable energy integration, which require specialized designs for higher power transmission and greater durability. This commitment to R&D ensures Prysmian stays ahead in a competitive landscape, anticipating future needs for power and data infrastructure.

The ongoing development of smart grids and the widespread digitalization of energy and telecommunications networks represent substantial technological advancements. Prysmian is well-positioned to leverage these trends through its innovative smart cable systems, advanced fault location sensing technologies, and digital solutions designed for effective power grid management and monitoring.

By integrating Internet of Things (IoT) capabilities and Artificial Intelligence (AI) into its product offerings and operational workflows, Prysmian aims to enhance grid efficiency and reliability. For instance, the global smart grid market was valued at approximately $70 billion in 2023 and is projected to grow, indicating a strong demand for the digital solutions Prysmian is developing.

The growing demand for renewable energy, particularly offshore wind, is driving the need for advanced cable technologies. Prysmian is actively responding to this trend by developing specialized dynamic cables for these demanding offshore environments. In 2023, global investment in renewable energy reached a record $644 billion, underscoring the market's rapid expansion and the critical role of reliable transmission infrastructure.

Prysmian's strategic investments in new, state-of-the-art cable-laying vessels are crucial for supporting the installation of these complex submarine cable systems. These advancements are essential for connecting offshore wind farms to the grid, enabling the efficient transmission of clean energy. The company's commitment to this technological frontier positions it to capitalize on the ongoing energy transition.

Fiber Optic Innovation and Data Center Demand

The relentless surge in global data traffic, projected to grow significantly in the coming years, directly fuels the demand for advanced fiber optic cables. This escalating data consumption necessitates more robust and faster connectivity solutions, particularly for the burgeoning data center industry. By 2025, the number of connected devices worldwide is expected to exceed 75 billion, underscoring the immense pressure on existing infrastructure.

Prysmian is strategically positioning itself to capitalize on this trend through substantial investments in cutting-edge fiber optic technologies. Their development of next-generation solutions, including pioneering work with hollow-core optical fiber, aims to deliver unparalleled data transmission speeds and capacity. This focus on innovation is crucial for meeting the evolving needs of hyperscale data centers and cloud service providers.

The company's proactive expansion of its product portfolio specifically tailored for data center applications is a key driver for its digital solutions segment. This includes a comprehensive range of cables, connectivity components, and services designed to support the high-density, high-performance requirements of modern data infrastructure. Prysmian's commitment to R&D in this area is evident, with significant capital expenditure allocated to advancing fiber optic capabilities.

Key technological advancements and market drivers include:

- Exponential Data Growth: Global IP traffic is expected to nearly triple between 2022 and 2027, reaching approximately 628 exabytes per month by 2027, according to Cisco's Annual Internet Report.

- Data Center Expansion: The global data center market size was valued at USD 242.14 billion in 2023 and is projected to grow, driven by AI, IoT, and cloud computing.

- Hollow-Core Fiber Innovation: This technology promises to significantly increase data transmission speeds, potentially by a factor of ten or more compared to traditional optical fibers.

- Prysmian's Portfolio Development: Investments in high-bandwidth cables and advanced connectivity solutions are vital for capturing market share in this rapidly expanding sector.

Automation and Industry 4.0 in Manufacturing

The manufacturing sector, including Prysmian's operations, is increasingly embracing automation and Industry 4.0 principles. This integration of advanced technologies like machine learning and artificial intelligence promises significant gains in operational efficiency, product quality, and even a reduction in environmental footprint. For instance, AI can optimize complex cable manufacturing processes, leading to fewer defects and less material waste. Prysmian’s own investments in digital solutions for remote monitoring and control exemplify this trend, enabling more agile and responsive production environments.

The impact of these technological shifts is substantial. By 2024, the global industrial automation market was projected to reach over $250 billion, highlighting the widespread adoption. Prysmian's strategic focus on these areas positions it to capitalize on these advancements.

- Enhanced Efficiency: Automation reduces manual labor, speeds up production cycles, and minimizes errors.

- Improved Quality Control: AI-driven systems can detect defects with greater precision than human inspection.

- Sustainability Gains: Optimized processes and reduced waste contribute to a smaller environmental impact.

- Remote Operations: Industry 4.0 enables real-time monitoring and management of manufacturing facilities from anywhere.

Technological advancements are reshaping the cable industry, with Prysmian at the forefront of innovation. The company's focus on developing high-voltage, submarine, and optical fiber cables is driven by the increasing demand for efficient power transmission and faster data connectivity. For example, Prysmian's investment in R&D in 2023 aimed at next-generation cable solutions, critical for maintaining its competitive edge.

The growth of smart grids and digitalization fuels the need for Prysmian's smart cable systems and fault location technologies. With the global smart grid market valued around $70 billion in 2023, Prysmian's digital solutions are well-positioned to meet this demand. Furthermore, the company's work with hollow-core optical fiber promises significant increases in data transmission speeds.

Prysmian is also leveraging Industry 4.0 principles in its manufacturing operations, integrating AI and automation to boost efficiency and quality. The global industrial automation market's projected growth beyond $250 billion by 2024 underscores the widespread adoption of these technologies, which Prysmian is actively embracing to optimize its production processes and reduce waste.

| Technology Area | Key Developments | Market Impact/Data |

|---|---|---|

| High-Voltage Cables | Submarine and underground cables for renewable energy integration | Global renewable energy investment reached $644 billion in 2023. |

| Optical Fiber | Next-generation solutions, hollow-core fiber | Global IP traffic projected to nearly triple by 2027 (Cisco). |

| Smart Grids | Smart cable systems, fault location sensing | Smart grid market valued at approx. $70 billion in 2023. |

| Manufacturing Automation | AI, machine learning, Industry 4.0 integration | Industrial automation market projected over $250 billion by 2024. |

Legal factors

Prysmian, operating globally, faces intricate international trade laws. These include import/export rules, sanctions, and anti-dumping duties. For instance, in 2024, the European Union continued to implement trade defense measures, impacting various imported goods. Navigating these diverse regulations across numerous countries is crucial for Prysmian to avoid penalties and maintain seamless operations.

Compliance with these evolving trade frameworks is paramount. Changes in tariffs or trade agreements can significantly alter supply chain costs and market accessibility for Prysmian's products. For example, a shift in trade policy in a key market could necessitate adjustments to sourcing strategies or pricing models, directly affecting profitability and competitive positioning.

Prysmian operates in a highly competitive global market, necessitating strict adherence to antitrust and competition laws across numerous jurisdictions. These regulations are crucial for maintaining fair market practices and preventing monopolistic tendencies.

Significant transactions, like Prysmian's acquisition of Encore Wire in late 2023 for approximately $4.3 billion, undergo rigorous scrutiny by regulatory bodies. This review process aims to ensure such deals do not unduly concentrate market power, potentially impacting pricing and consumer choice.

Failure to comply with antitrust regulations can result in substantial financial penalties, with fines potentially reaching billions of dollars for major infringements. Beyond financial repercussions, antitrust violations can severely damage a company's reputation and hinder future business operations.

The cable industry operates under stringent legal frameworks governing product safety, quality, and performance. These regulations are particularly vital for high-voltage and telecommunication cables, where failure can have severe consequences. Compliance with international benchmarks like IEC and ASTM standards is not just a legal necessity but a core tenet for ensuring reliability, mitigating liability risks, and fostering enduring customer confidence.

Environmental Regulations and Compliance

Prysmian operates under an increasingly complex web of environmental regulations. These laws, covering everything from air emissions and water discharge to waste disposal and the phase-out of hazardous materials, directly influence manufacturing operations and product development. For instance, the European Union's stringent rules on greenhouse gas emissions and its push for a circular economy necessitate ongoing investment in cleaner technologies and sustainable material sourcing.

Compliance is not just a legal obligation but a cornerstone of Prysmian's sustainability strategy. The company's 2023 sustainability report highlights a continued focus on reducing its environmental footprint. This includes targets for reducing Scope 1 and Scope 2 greenhouse gas emissions, with specific goals set for improvement year-on-year. The company is also investing in waste reduction initiatives across its global facilities, aiming to increase recycling rates and minimize landfill waste.

- Emissions Control: Prysmian must adhere to evolving standards on volatile organic compounds (VOCs) and particulate matter, impacting cable insulation and sheathing processes.

- Circular Economy Mandates: Regulations promoting recycled content and product end-of-life management, such as those in the EU, require Prysmian to innovate in material selection and product design.

- Chemical Substance Restrictions: Compliance with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) impacts the chemicals used in cable manufacturing, potentially requiring the substitution of certain substances.

- Energy Efficiency Standards: Increasingly strict energy efficiency requirements for manufacturing facilities and the products themselves drive investments in more efficient machinery and energy-saving product designs.

Labor Laws and Employment Regulations

Prysmian navigates a complex web of labor laws across its global operations, impacting everything from minimum wages and working hours to employee rights and union negotiations. For instance, in 2024, European Union directives continue to shape regulations around worker safety and fair compensation, requiring constant vigilance. Adhering to these diverse legal frameworks is paramount for Prysmian's over 33,000 employees worldwide to ensure ethical operations and avoid costly legal disputes.

The company's commitment to diversity, equity, and inclusion (DEI) is increasingly intertwined with labor regulations, as many jurisdictions are enacting or strengthening laws that promote equal opportunities and prohibit discrimination. This proactive approach to DEI, which Prysmian has emphasized in its 2024 and 2025 strategic outlooks, helps align its employment practices with evolving societal expectations and legal mandates.

- Global Compliance Burden: Prysmian must ensure adherence to varying labor laws in each of the 50+ countries it operates in, covering aspects like wages, benefits, and termination procedures.

- Employee Relations and Collective Bargaining: The company engages with numerous trade unions and works councils globally, necessitating strong negotiation skills and compliance with collective bargaining agreements.

- DEI Legislation: Evolving legal frameworks in key markets, such as the US and EU, increasingly mandate diversity targets and anti-discrimination measures, influencing Prysmian's HR policies.

- Workplace Safety Standards: Strict occupational health and safety regulations, enforced by bodies like OSHA in the US and similar agencies internationally, require continuous investment in safe working environments for Prysmian's workforce.

Prysmian's global operations are significantly shaped by intellectual property laws, including patent, trademark, and copyright protections. Protecting its innovations, particularly in areas like advanced cable technology and manufacturing processes, is crucial for maintaining a competitive edge. The company's significant investment in research and development, evident in its numerous patents filed annually, underscores the importance of robust IP strategies to prevent infringement and secure market exclusivity.

The company must also navigate complex data privacy regulations, such as GDPR in Europe and similar laws in other regions, affecting how it collects, stores, and uses customer and employee data. Ensuring compliance is vital for maintaining trust and avoiding substantial penalties. For instance, the increasing focus on cybersecurity in 2024 and 2025 means Prysmian must invest in secure data management practices to safeguard sensitive information.

Contract law is fundamental to Prysmian's business, governing agreements with suppliers, customers, and partners. Ensuring all contracts are legally sound and clearly define terms, responsibilities, and liabilities is critical for mitigating risks and fostering stable business relationships. The company's extensive global supply chain and diverse customer base necessitate meticulous contract management across various legal systems.

Prysmian's legal landscape also includes regulations concerning corporate governance and financial reporting. Adherence to accounting standards, disclosure requirements, and ethical business practices is essential for maintaining investor confidence and complying with securities laws in the markets where it operates. The company's commitment to transparency, as demonstrated in its annual financial reports, reflects the importance of these legal obligations.

Environmental factors

Global efforts to combat climate change, such as the European Union's Fit for 55 package aiming for a 55% emissions reduction by 2030, directly impact Prysmian. The increasing demand for renewable energy infrastructure, a core area for Prysmian's cable solutions, presents significant growth opportunities.

However, this transition also brings pressure for Prysmian to decarbonize its own operations. The company has committed to ambitious greenhouse gas emission reduction targets, aiming for a 40% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline, alongside a 20% reduction in Scope 3 emissions over the same period.

Prysmian faces increasing pressure from resource scarcity, driving a focus on circular economy principles in its operations. The company is actively working to extend the lifespan and reuse of materials, such as its cable drums, and incorporate recycled content like polyethylene into its products.

This strategic shift aims to reduce reliance on virgin resources and minimize waste. For instance, Prysmian's commitment to sustainability includes targets for increasing the use of recycled materials, directly addressing the environmental factor of resource depletion.

Prysmian's manufacturing operations are inherently energy-intensive, making energy consumption a critical environmental factor. The company is actively pursuing enhanced energy efficiency across its global facilities, a move that directly supports its climate objectives. For instance, the installation of photovoltaic systems at several of its plants, including facilities in Italy and Brazil, demonstrates a commitment to reducing reliance on fossil fuels and lowering operational costs.

Waste Management and Pollution Control

Effective waste management, encompassing waste reduction and responsible disposal, is a critical environmental consideration for cable manufacturers like Prysmian. The company actively pursues initiatives to optimize its waste management processes and integrate circular economy principles, aiming to significantly shrink its environmental impact. For instance, in 2023, Prysmian reported a reduction in waste sent to landfill by 5% compared to the previous year, a testament to their ongoing efforts.

Prysmian's commitment extends to robust pollution control measures, which are vital for both regulatory adherence and upholding its corporate responsibility. These measures ensure that manufacturing processes minimize harmful emissions and discharges into the environment. The company's 2024 sustainability report highlights a 10% decrease in specific air pollutant emissions across its key European production sites.

- Waste Reduction Targets: Prysmian aims to reduce total waste generated per ton of product by 15% by 2026.

- Circularity Initiatives: The company is investing in technologies to increase the use of recycled materials in its cable production, targeting a 20% increase in recycled content by 2025.

- Pollution Control Investments: In 2024, Prysmian allocated €15 million towards upgrading pollution control equipment at its manufacturing facilities.

- Compliance Metrics: Prysmian maintained a 99.8% compliance rate with environmental regulations across all its operational sites in 2023.

Biodiversity and Ecosystem Protection

Prysmian is actively incorporating biodiversity and ecosystem protection into its business strategy. This includes conducting thorough assessments of potential impacts on habitats and identifying associated risks and opportunities. For instance, the company utilizes tools such as the WWF Biodiversity Risk Filter to inform its decision-making processes.

A key area of focus for Prysmian is minimizing the environmental footprint of its large-scale installation projects, particularly those in marine environments. This commitment is crucial given the sensitive nature of these ecosystems. In 2023, Prysmian reported that its sustainability initiatives, including those related to biodiversity, contributed to a 10% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2019 levels, demonstrating a tangible step towards environmental stewardship.

The company's approach involves:

- Integrating biodiversity considerations into project planning and execution.

- Utilizing risk assessment tools to understand and mitigate ecosystem impacts.

- Prioritizing the protection of marine habitats during offshore cable laying operations.

- Seeking to align its practices with global conservation efforts.

Prysmian's environmental strategy is deeply intertwined with global climate action, particularly the push for renewable energy infrastructure which drives demand for its cable solutions.

The company is actively working to reduce its own carbon footprint, setting targets for Scope 1, 2, and 3 emissions reductions by 2030, demonstrating a commitment to operational sustainability.

Resource scarcity is a growing concern, prompting Prysmian to embrace circular economy principles, focusing on material reuse and incorporating recycled content into its products to minimize reliance on virgin resources.

Prysmian is also investing in energy efficiency and pollution control across its manufacturing sites, with specific targets for waste reduction and emission improvements, exemplified by a 5% reduction in waste sent to landfill in 2023 and a 10% decrease in specific air pollutant emissions at key European sites in 2024.

| Environmental Factor | Prysmian's Action/Target | 2023/2024 Data/Commitment |

|---|---|---|

| Climate Change & Renewables | Demand for renewable energy infrastructure | Core growth area for Prysmian |

| Emissions Reduction | Scope 1 & 2 reduction target | 40% by 2030 (vs. 2019 baseline) |

| Emissions Reduction | Scope 3 reduction target | 20% by 2030 (vs. 2019 baseline) |

| Circular Economy | Increase recycled material use | Targeting 20% increase by 2025 |

| Waste Management | Reduce total waste generated per ton | Targeting 15% reduction by 2026 |

| Pollution Control | Investment in equipment upgrades | €15 million allocated in 2024 |

| Regulatory Compliance | Compliance rate with environmental regulations | 99.8% in 2023 |

| Biodiversity | Minimizing impact on marine habitats | Utilizes WWF Biodiversity Risk Filter |

PESTLE Analysis Data Sources

Our Prysmian PESTLE Analysis is informed by a comprehensive review of global economic indicators, energy market trends, technological advancements, environmental regulations, and geopolitical developments. We draw from reports by international organizations, industry associations, and reputable financial news outlets to ensure a robust understanding of the macro-environment.